Imagine being able to anticipate the next move in the forex market with remarkable precision, relying solely on the natural movements of currency prices without the clutter of complex indicators. Price action in forex trading offers just that—a streamlined, effective approach that has empowered countless traders to achieve consistent success. In the ever-evolving and fast-paced world of forex, mastering price action can be your key to unlocking profitable trading opportunities.

In this comprehensive guide, we will delve deep into the essence of price action, comparing it with other trading methodologies, and providing actionable insights to enhance your trading strategies. Whether you’re a novice seeking to understand the basics or an experienced trader looking to refine your techniques, this article will equip you with the knowledge and tools necessary to excel in forex trading. Additionally, we’ll explore the benefits of partnering with a regulated forex broker, ensuring your trading journey is both secure and prosperous.

Fundamentals of Price Action Trading

Price action trading is a methodology that relies on analyzing the price movements of currency pairs to make informed trading decisions. Unlike strategies that depend heavily on technical indicators or fundamental analysis, price action focuses solely on the raw price data, making it a purer form of trading. By interpreting the natural ebb and flow of the market, traders can identify patterns and trends that signal potential trading opportunities.

Price action trading operates on the premise that all relevant information is already reflected in the price, eliminating the need for external indicators. This approach provides a clear and unambiguous view of the market, allowing traders to react swiftly to changing conditions. For instance, seasoned traders often refer to the work of Al Brooks, a renowned expert in price action, who emphasizes that understanding the market’s narrative through price movements is crucial for successful trading (Investopedia).

Read More: Price Action vs ICT

Key Principles and Assumptions

Price action trading is grounded in several fundamental principles and assumptions that guide traders in their decision-making process:

- Market Price Reflects All Information: Price action traders believe that the current price encapsulates all available information, including fundamental and technical factors. This means that by analyzing price movements, traders can infer market sentiment and potential future movements without relying on additional data.

- Price Moves in Trends: Prices tend to move in identifiable trends—upward, downward, or sideways. Recognizing these trends is crucial for aligning trades with the prevailing market direction, enhancing the probability of success.

- Support and Resistance Levels: These are key price levels where the market tends to pause or reverse. Identifying support (a price level where buying interest is strong enough to prevent the price from declining further) and resistance (a price level where selling interest is strong enough to prevent the price from rising further) provides strategic entry and exit points.

- Price Patterns Signal Future Movements: Repeating price patterns, such as double tops or trend channels, can indicate the direction of future price movements. Recognizing these patterns allows traders to anticipate potential market shifts and position themselves accordingly.

These foundational principles guide price action traders in interpreting market behavior and making strategic trading decisions.

Common Price Action Patterns in Forex

Understanding and recognizing common price action patterns is essential for successful forex trading. These patterns provide valuable insights into market sentiment and potential price movements.

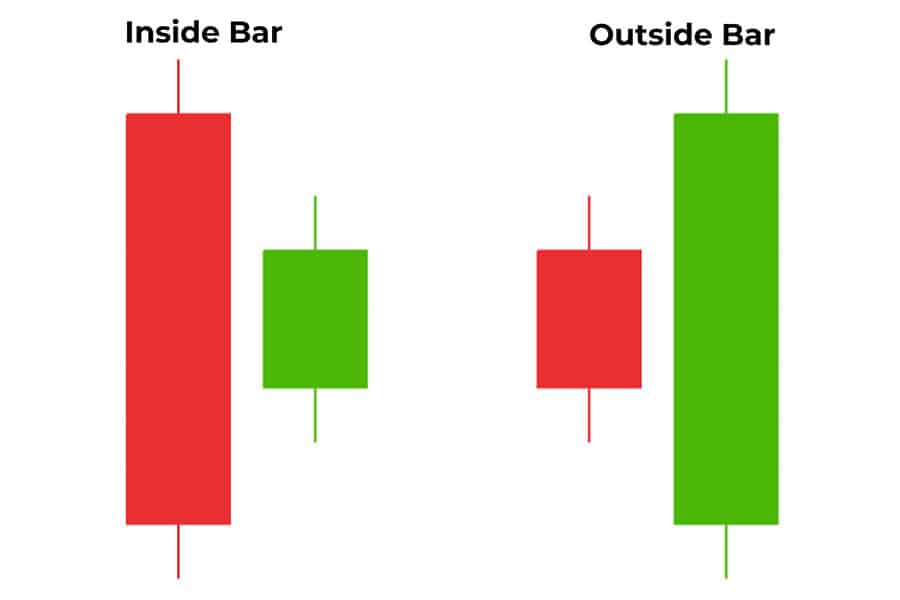

Inside and Outside Bars

Inside and outside bars are fundamental price action patterns that indicate potential market movements.

Inside Bars: An inside bar occurs when the current bar’s high and low are entirely within the range of the previous bar. This pattern signifies consolidation and often precedes a breakout in either direction. For example, if a currency pair forms an inside bar after a strong uptrend, it may indicate a potential reversal or continuation once the breakout occurs.

Outside Bars: An outside bar engulfs the previous bar, with its high higher and low lower than the preceding bar. This indicates strong momentum and can signal the continuation of the current trend. Traders often view outside bars as confirmation of a trend’s strength, providing a clear signal for entry.

Recognizing inside and outside bars helps traders anticipate potential breakouts or reversals, allowing for timely and informed trading decisions.

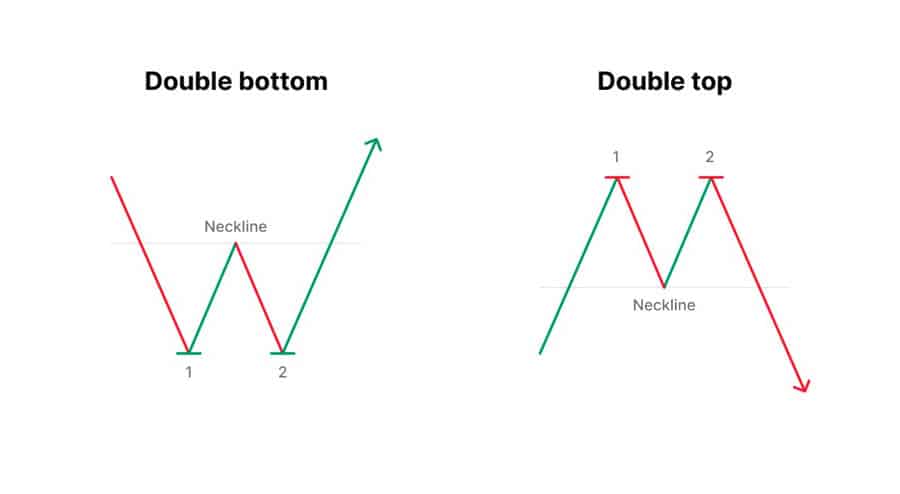

Double Tops and Double Bottoms

Double tops and double bottoms are classic reversal patterns that signal a potential change in market direction.

Double Tops: This bearish reversal pattern forms after two peaks at approximately the same price level, indicating that the upward momentum is weakening. For instance, if the EUR/USD pair hits a high, retraces, and then hits the same high again without breaking through, it may signal a forthcoming downward trend.

Double Bottoms: Conversely, this bullish reversal pattern occurs after two troughs at roughly the same price level, suggesting that the downward momentum is fading. An example would be the USD/JPY pair dipping to a support level, rebounding, and then dipping again to the same level before reversing upwards.

These patterns are pivotal in identifying trend reversals, enabling traders to capitalize on changing market conditions.

Read More: price action vs Elliott wave

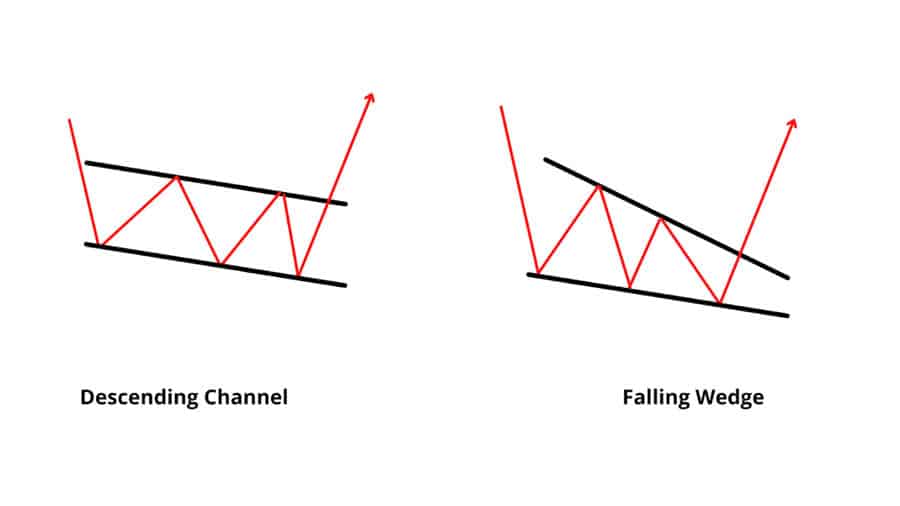

Trend Channels and Wedges

Trend channels and wedges are continuation patterns that help traders identify the strength and direction of a trend.

Trend Channels: Defined by two parallel trendlines that encapsulate the price movement, trend channels indicate a strong and sustained trend. For example, an uptrend channel formed by drawing a line along the higher highs and another along the higher lows provides a framework within which traders can operate.

Wedges: Converging trendlines that signal a potential breakout or reversal, often preceding significant price movements. A rising wedge in an uptrend may indicate a potential reversal, while a falling wedge in a downtrend might suggest a bullish reversal.

Understanding these formations allows traders to predict future price actions and execute strategic trades within the established trend.

Implementing Price Action Strategies in Forex

Implementing price action strategies effectively requires a systematic approach. Here’s how you can build a robust forex trading model based on price action.

Steps to Build a Forex Trading Model

Building a forex trading model centered around price action involves several critical steps:

- Identify the Market Structure: Determine whether the market is trending or ranging. This foundational step influences the choice of trading strategies, whether you opt for trend-following or range-bound approaches.

- Recognize Key Levels: Spot support and resistance zones that influence price movements. These levels serve as potential entry and exit points, helping you make informed trading decisions.

- Analyze Price Patterns: Look for recurring patterns such as inside bars, double tops/bottoms, and trend channels that indicate potential trading opportunities. Pattern recognition is crucial for predicting future price movements.

- Determine Entry and Exit Points: Based on identified patterns and key levels, decide where to enter and exit trades to maximize profits and minimize losses. For example, entering a trade at a breakout from an inside bar can be a strategic move.

- Manage Risk: Implement risk management techniques, such as setting stop-loss orders and managing position sizes, to protect your capital. Effective risk management ensures that no single trade can significantly impact your overall portfolio.

Building a systematic trading model ensures that your trading decisions are based on objective analysis and reduces the influence of emotions.

Identifying Trends and Trading Ranges

Accurately identifying whether the market is trending or ranging is crucial for applying the right trading strategies.

Trends: Use higher highs and higher lows for uptrends, and lower highs and lower lows for downtrends. Recognizing these patterns helps in aligning trades with the prevailing market direction. For example, in an uptrend, you might look for buying opportunities on pullbacks to support levels.

Trading Ranges: Identify periods where the price oscillates between support and resistance without a clear trend. In ranging markets, strategies such as range trading or breakout trading can be effective. For instance, selling near resistance and buying near support within a range can yield consistent profits.

Understanding the current market condition allows traders to apply the most suitable strategies, enhancing their chances of success.

Entry and Exit Strategies Based on Price Action

Effective entry and exit strategies are essential for maximizing profits and minimizing losses in price action trading.

Entry Strategies:

- Breakout Trading: Entering a trade when the price breaks through a key support or resistance level, indicating a potential continuation of the trend. For example, buying the GBP/USD pair when it breaks above a significant resistance level can signal a strong upward movement.

- Pullback Trading: Entering after a price retraces to a support or resistance level within a trend, providing a favorable risk-reward ratio. This strategy allows traders to enter the market at a better price point within an ongoing trend.

Exit Strategies:

- Target Setting: Setting profit targets based on previous support/resistance levels or measured moves from price patterns. For instance, setting a profit target at the next resistance level after entering a trade at a support breakout.

- Trailing Stops: Adjusting stop-loss orders as the price moves in your favor to lock in profits while allowing for continued gains. This method helps in capturing maximum profit from a trending move while protecting against reversals.

Implementing these strategies ensures disciplined trading and helps in capturing significant price movements.

Advantages and Limitations of Price Action Trading

Benefits of Using Price Action in Forex Trading

Price action trading offers several advantages that make it a preferred choice for many forex traders:

- Simplicity: Eliminates the complexity of numerous indicators, making it easier to understand and apply. This straightforward approach allows traders to focus on price movements without getting overwhelmed by technical analysis tools.

- Flexibility: Can be applied to any time frame and currency pair, offering versatility in trading. Whether you’re trading on a 5-minute chart or a daily chart, price action strategies remain effective.

- Timeliness: Allows for quicker decision-making based on real-time price movements, enabling traders to react swiftly to market changes. This is crucial in the fast-paced forex market where opportunities can arise and disappear within minutes.

- Clarity: Provides clear signals without the noise of conflicting indicators, enhancing the precision of trading decisions. Clear price signals help in reducing the ambiguity that often plagues indicator-based strategies.

These benefits make price action trading a powerful tool for traders seeking a straightforward and effective approach to the forex market.

Potential Challenges and Limitations

Despite its advantages, price action trading also comes with certain challenges and limitations:

- Subjectivity: Interpretation of price patterns can vary between traders, leading to inconsistent trading decisions. What one trader sees as a valid pattern, another might dismiss, affecting the reliability of signals.

- Requires Skill and Experience: Effective price action trading demands a deep understanding and extensive practice to accurately identify patterns and trends. Beginners might struggle initially, making it essential to invest time in learning and practicing.

- No Guarantees: Like all trading strategies, it does not ensure profits and carries inherent risks, especially in volatile markets. Market unpredictability means that even well-analyzed trades can result in losses.

Being aware of these limitations is essential for developing a realistic and effective trading approach.

Integrating Price Action with Technical Analysis Tools

Combining Price Action with Indicators

While price action trading primarily relies on price movements, integrating it with technical indicators can enhance decision-making. Common indicators used alongside price action include:

- Moving Averages: Help identify trend direction and potential support/resistance levels by smoothing out price data. For instance, a 50-day moving average can act as a dynamic support in an uptrend.

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions that can signal potential reversals. An RSI above 70 might indicate overbought conditions, complementing price action signals for a possible downward reversal.

Combining price action with these tools provides a more comprehensive analysis, improving the accuracy of trade signals.

Enhancing Decision-Making with Additional Tools

In addition to technical indicators, other tools can complement price action strategies:

- Volume Analysis: Understanding trading volume can confirm the strength of a price movement, providing additional validation for trade entries and exits. For example, a price breakout accompanied by high volume is more likely to sustain the move.

- Fibonacci Retracements: Identifies potential support and resistance levels based on key Fibonacci ratios, aiding in the prediction of price reversals. Traders often use Fibonacci levels to set target prices or stop-loss orders.

These additional tools offer deeper insights into market dynamics, allowing traders to make more informed and strategic decisions.

Read More: Price Action vs SMC

Developing a Price Action Trading Plan

Importance of a Structured Trading Plan

A well-defined trading plan is essential for consistent success in forex trading. It outlines your trading strategies, risk management rules, and personal goals, ensuring disciplined and objective trading. Having a structured plan minimizes emotional trading and enhances decision-making, leading to more consistent and profitable trading outcomes.

A structured trading plan serves as a roadmap, guiding you through various market conditions and helping you stay focused on your trading objectives. It prevents impulsive decisions driven by emotions, which can often lead to significant losses.

Key Components to Include

A comprehensive trading plan should encompass the following key components:

- Trading Goals: Define your financial objectives and timeframes to stay focused and motivated. Whether it’s achieving a specific monthly profit or building long-term wealth, clear goals provide direction.

- Risk Management: Set rules for position sizing, stop-loss orders, and risk-reward ratios to protect your capital. For example, limiting each trade to 2% of your trading account can prevent substantial losses.

- Trading Strategies: Detail the price action patterns and indicators you will use, ensuring a clear and consistent approach. This includes specifying which patterns to trade and under what conditions.

- Evaluation Criteria: Establish how you will assess the performance of your trades, enabling continuous improvement. Regularly reviewing your trading performance helps identify strengths and areas for improvement.

- Psychological Preparation: Develop strategies to manage emotions and maintain discipline, crucial for long-term success. Techniques like meditation or maintaining a trading journal can help in managing stress and staying disciplined.

Incorporating these components into your trading plan ensures a comprehensive and disciplined approach to price action trading.

Pro Tips for Advanced Traders

For those looking to elevate their trading skills, here are some pro tips that can enhance your price action trading strategies:

Refine Your Pattern Recognition

Continuous practice in identifying and interpreting complex price patterns can significantly enhance your trading accuracy. Advanced traders should focus on recognizing nuanced patterns and understanding their implications in different market conditions. Utilizing tools like pattern recognition software can aid in this process, ensuring that you don’t miss critical signals.

Optimize Risk Management

Implementing advanced risk management techniques, such as dynamic position sizing and multi-layered stop-loss orders, can protect your capital and maximize your trading potential. Effective risk management ensures that no single trade can significantly impact your overall portfolio. For example, adjusting your position size based on market volatility can help manage risk more effectively.

Stay Updated with Market News

While price action focuses on price movements, being aware of fundamental events and economic indicators can provide valuable context. Understanding the broader market environment allows you to interpret price action more accurately and anticipate potential market shifts. Subscribing to financial news platforms like Bloomberg or Reuters can keep you informed about events that may influence currency movements.

Backtest Your Strategies

Rigorously testing your price action strategies on historical data helps validate their effectiveness and identify areas for improvement. Backtesting provides confidence in your strategies and ensures they are robust across different market conditions. Utilizing platforms like MetaTrader for backtesting can help you refine your strategies before applying them in live trading.

Embrace Continuous Learning

Staying abreast of new developments in price action trading and adapting your strategies accordingly can keep you ahead of the curve. Advanced traders should seek out new resources, attend seminars, and engage with the trading community to enhance their knowledge and skills. Joining forums like Forex Factory or attending webinars hosted by trading experts can provide valuable insights and foster continuous improvement.

These pro tips can elevate your trading skills, helping you navigate the forex market with greater confidence and precision.

Opofinance Services

Choosing the right broker is pivotal for successful forex trading. Opofinance, an ASIC regulated broker, offers a suite of services tailored to meet traders’ needs:

- Social Trading Service: Connect with and copy the strategies of experienced traders, enhancing your trading potential.

- Featured on MT5 Brokers List: Gain access to the advanced MT5 trading platform, renowned for its reliability and comprehensive features.

- Safe and Convenient Deposits and Withdrawals: Enjoy a variety of secure and efficient methods for managing your funds.

Partnering with Opofinance ensures a seamless and secure trading experience.

Why Choose Opofinance?

- ASIC Regulated: Ensures compliance with strict regulatory standards for trader protection.

- Advanced Trading Tools: Access to the MT5 platform and social trading features.

- Reliable Customer Support: Dedicated support team available to assist you.

- Flexible Account Options: Suitable for both beginners and advanced traders.

Conclusion

Price action in forex trading is a powerful and versatile strategy that can significantly enhance your trading performance. By focusing on price movements, identifying key patterns, and integrating technical analysis tools, traders can make informed and timely decisions. While it offers numerous advantages, it’s essential to be aware of its limitations and continuously refine your strategies. Developing a structured trading plan and leveraging advanced tips can further boost your success in the forex market. Additionally, partnering with a reputable broker like Opofinance can provide the necessary tools and support to maximize your trading potential. Embrace price action trading, practice diligently, and watch your trading skills soar.

Key Takeaways

- Price Action Trading: A strategy focused on analyzing price movements without relying on indicators.

- Common Patterns: Understanding inside bars, double tops/bottoms, and trend channels is crucial.

- Strategic Implementation: Building a trading model involves identifying market structures, key levels, and effective entry/exit points.

- Advantages & Limitations: While simple and flexible, price action trading requires skill and can be subjective.

- Integration with Tools: Combining price action with indicators like moving averages and RSI enhances analysis.

- Structured Trading Plan: Essential for consistent success, encompassing goals, risk management, and evaluation criteria.

- Advanced Strategies: Pro tips for refining your approach and maximizing trading efficiency.

- Reliable Broker: Opofinance offers regulated, secure, and feature-rich services to support your trading journey.

How can price action trading be combined with fundamental analysis in forex?

Integrating fundamental analysis with price action trading involves using economic indicators and news events to contextualize price movements, allowing for more informed trading decisions. For instance, understanding how interest rate changes by central banks affect currency pairs can enhance the interpretation of price action signals. By aligning fundamental insights with price patterns, traders can validate their strategies and anticipate market shifts more effectively (Investopedia).

What are the best time frames for implementing price action strategies?

While price action can be applied to any time frame, many traders find that medium to higher time frames, such as 1-hour or 4-hour charts, provide more reliable signals and reduce market noise. These time frames strike a balance between capturing significant price movements and maintaining manageable levels of volatility. For example, swing traders often prefer the 4-hour chart to identify major trends and key reversal points, while day traders might use the 15-minute chart for more frequent trading opportunities (BabyPips).

Can price action trading be automated using trading algorithms?

Yes, price action trading principles can be incorporated into automated trading systems, although the subjective nature of pattern recognition may require advanced algorithmic strategies to mimic human interpretation effectively. Traders often use machine learning and artificial intelligence to enhance the accuracy of automated price action systems. For example, algorithms can be trained to recognize specific price patterns and execute trades based on predefined rules, but continuous monitoring and optimization are essential to adapt to changing market conditions (DailyFX).