Have you ever wondered how top traders consistently make profitable decisions in the ever-fluctuating financial markets? Imagine having a strategy that not only deciphers the current market trends but also predicts future movements with remarkable accuracy. In the fast-paced world of trading, technical analysis serves as your compass, guiding you through the unpredictable waves of the financial markets. Among the myriad of strategies available, Price Action and Elliott Wave Theory stand out as two of the most powerful tools in a trader’s arsenal. Whether you’re a seasoned trader or just embarking on your trading journey, mastering the price action vs Elliott wave debate can significantly enhance your trading performance.

This comprehensive guide delves deep into these methodologies, comparing their effectiveness, applicability, and how they can be integrated to optimize your trading outcomes. Additionally, discover why choosing a regulated forex broker like Opofinance can elevate your trading experience. Let’s embark on this journey to decode the ultimate trading strategies that can transform your approach to the markets.

Understanding Price Action

Before diving into the comparison, it’s essential to grasp what Price Action entails and why it’s a favored method among traders.

Read More: Price Action vs ICT

Definition and Core Principles

Price Action refers to the movement of a security’s price plotted over time. Unlike other trading strategies that rely heavily on technical indicators, Price Action focuses solely on the price itself, making it a purist’s approach to trading. This method emphasizes reading and interpreting raw price movements to make informed trading decisions.

At its core, Price Action is about understanding the market’s current behavior and anticipating future movements based on historical price data. By observing patterns, trends, and key price levels, traders can make strategic decisions without the clutter of additional indicators.

Key Features

Price Action boasts several key features that make it a versatile and effective trading strategy:

Simplicity: One of the most significant advantages of Price Action is its simplicity. By eliminating the need for complex indicators, traders can focus on the raw price movements, allowing for a more straightforward analysis. This minimalist approach helps in reducing the clutter on the charts, making it easier to identify key levels of support and resistance.

Flexibility: Price Action is highly adaptable, making it suitable for various timeframes—from minute charts for day trading to daily or weekly charts for long-term investments. This flexibility extends to multiple markets, including forex, stocks, commodities, and cryptocurrencies. Whether you’re trading EUR/USD or Bitcoin, Price Action remains a reliable strategy.

Real-Time Analysis: Price Action provides real-time insights, enabling traders to make swift decisions based on the latest market movements. This immediacy is crucial for capitalizing on short-term opportunities and reacting promptly to market changes. For instance, a sudden spike in price can signal a breakout, allowing traders to enter or exit positions swiftly.

Advantages and Potential Drawbacks

Advantages:

- Clarity: Offers a clear view of market sentiment and trends.

- Cost-Effective: Eliminates the need for expensive indicators or software.

- Versatile: Suitable for various trading styles and markets.

Drawbacks:

- Subjectivity: Interpretation can vary between traders, leading to inconsistent results.

- Requires Experience: Demands a keen understanding of market behavior and patterns.

- Limited Predictive Power: Relies heavily on trader intuition and experience.

Price Action is a powerful tool, but its effectiveness hinges on the trader’s ability to accurately interpret price movements.

Understanding Elliott Wave Theory

Now, let’s explore the Elliott Wave Theory, a method that brings a structured approach to market analysis.

Definition and Historical Background

Developed by Ralph Nelson Elliott in the 1930s, Elliott Wave Theory posits that market prices unfold in specific patterns, known as waves, reflecting the collective psychology of investors. This theory integrates elements of technical analysis and behavioral finance, suggesting that markets move in predictable cycles based on investor sentiment.

Elliott observed that market movements are not random but follow repetitive cycles driven by the emotions and behaviors of market participants. This observation led to the formulation of the wave principle, which has since become a cornerstone in technical analysis.

Read More: Price Action in Forex Trading

Key Features

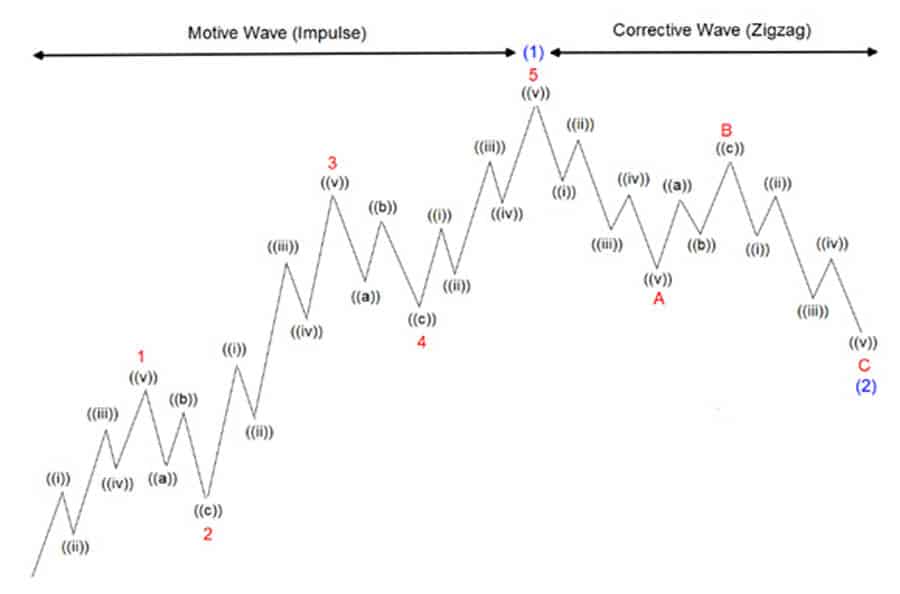

Wave Patterns: Elliott Wave Theory identifies a repetitive five-wave structure in the direction of the trend, followed by a three-wave corrective phase. This cyclical pattern helps in forecasting future market movements. For example, in a bull market, five waves typically drive the price upward, while three waves correct the movement.

Fractal Nature: The theory’s fractal nature means that wave patterns repeat across different timeframes, allowing traders to analyze markets on multiple levels simultaneously. This characteristic makes Elliott Wave applicable to any time frame, from minutes to decades, providing a versatile tool for traders.

Predictive Power: By identifying wave patterns, traders can predict potential market turns and significant price movements, enhancing their ability to enter or exit trades at optimal points. For instance, recognizing the completion of an impulse wave can signal a forthcoming corrective phase, allowing traders to adjust their positions accordingly.

Advantages and Potential Drawbacks

Advantages:

- Predictive Insights: Offers a structured framework for anticipating market trends.

- Structured Approach: Provides clear guidelines for analyzing market cycles.

- Integrative: Can be combined with other technical analysis tools for enhanced accuracy.

Drawbacks:

- Complexity: Requires extensive study and practice to master.

- Subjectivity: Wave interpretation can vary, leading to differing conclusions.

- Overcomplication: The intricate nature of wave patterns may overwhelm novice traders.

Elliott Wave Theory provides depth and structure, but its complexity can be a barrier for many traders.

Comparative Analysis: Price Action vs Elliott Wave Theory

Now that we’ve explored both strategies individually, let’s compare price action vs Elliott wave to understand their strengths and limitations.

Accuracy and Predictability

Price Action: Relies on real-time price movements and patterns, offering immediate insights but can be less predictive in nature. It excels in identifying current trends but may not always forecast future movements accurately.

Elliott Wave Theory: Provides a more structured and predictive framework, allowing traders to anticipate future market movements based on wave patterns. This predictive capability can offer a strategic advantage, especially in trending markets.

While both methods offer valuable insights, their accuracy often depends on the trader’s expertise and the market conditions.

Subjectivity in Interpretation

Both Price Action and Elliott Wave Theory involve a degree of subjectivity. However, Elliott Wave tends to be more complex, leading to greater variation in interpretation among traders. Price Action, while also subjective, often relies on more straightforward price patterns, making it slightly less prone to varied interpretations.

For example, identifying the exact start and end of a wave in Elliott Wave Theory can vary between traders, whereas Price Action might involve clearer support and resistance levels.

Complexity and Learning Curve

Price Action: Easier to grasp for beginners due to its straightforward approach but requires experience to interpret effectively. Traders can start applying Price Action techniques relatively quickly, focusing on key price levels and simple patterns.

Elliott Wave Theory: Steeper learning curve with its intricate wave patterns and principles, making it more challenging for newcomers. Mastering Elliott Wave requires a deep understanding of wave structures, Fibonacci ratios, and the ability to identify wave counts accurately.

The complexity of Elliott Wave Theory can be daunting, but with dedication, it offers profound insights into market behavior.

Flexibility in Different Markets

Both strategies are versatile across various markets:

- Forex: Highly applicable due to the continuous nature of forex trading.

- Stocks: Effective in analyzing trends and market sentiment.

- Commodities: Useful for predicting cyclical movements.

- Cryptocurrencies: Beneficial in volatile markets where rapid price changes occur.

Whether you’re trading major currency pairs or emerging cryptocurrencies, both Price Action and Elliott Wave can be adapted to fit your market of choice.

Suitability Across Timeframes

Price Action: Equally effective across short-term, medium-term, and long-term trading. Its adaptability allows traders to apply it to any timeframe, from scalping to swing trading.

Elliott Wave Theory: More suited for medium to long-term trading due to its reliance on identifying broader market cycles. While it can be applied to shorter timeframes, the complexity increases, making it less practical for very short-term trades.

Choosing the right timeframe is crucial, and understanding how each strategy performs across different periods can enhance your trading effectiveness.

Risk Management Considerations

Price Action: Emphasizes real-time risk assessment and dynamic stop-loss placement based on current price behavior. Traders using Price Action often adjust their stops as the market moves, allowing for flexible risk management.

Elliott Wave Theory: Utilizes wave patterns to determine strategic stop-loss levels and assess overall market risk. By identifying key wave boundaries, traders can place stops in a manner that aligns with the expected wave completion points.

Effective risk management is pivotal in both strategies, ensuring traders can protect their capital while maximizing potential gains.

Read More: Price Action vs SMC

Integrating Price Action and Elliott Wave Theory in Trading

Combining Price Action with Elliott Wave Theory can create a more robust trading strategy, leveraging the strengths of both methods.

Benefits of Combining Both Methods

Integrating Price Action with Elliott Wave Theory provides a comprehensive analysis framework. While Elliott Wave offers a predictive structure, Price Action adds real-time confirmation, enhancing overall trading accuracy. This synergy allows traders to validate wave patterns with actual price movements, reducing the reliance on subjective interpretations.

For instance, using Elliott Wave to identify potential wave counts and then applying Price Action to confirm entry and exit points can lead to more precise and profitable trades.

Practical Examples of Integration

Consider a trader who identifies a five-wave impulse pattern using Elliott Wave Theory, signaling a continuation of the current trend. By applying Price Action techniques, the trader can confirm entry points based on price levels, such as support and resistance zones identified through candlestick patterns. This dual approach increases the likelihood of successful trades by combining long-term predictions with short-term confirmations.

A real-world example can be seen in the EUR/USD currency pair. Suppose Elliott Wave analysis suggests the completion of an impulse wave. The trader then looks for Price Action signals, such as a pin bar reversal at a key resistance level, to confirm the wave count and decide on the optimal entry point.

Tips for Traders on Using Both Strategies Effectively

- Educate Thoroughly: Understand the fundamentals of both methods before combining them. Invest time in learning the intricacies of wave patterns and price action signals.

- Practice Consistently: Use demo accounts to refine integration techniques without financial risk. Practice identifying wave counts and price action patterns simultaneously.

- Stay Disciplined: Maintain a structured approach, avoiding emotional decisions based on market fluctuations. Adhere to your trading plan and integrate both strategies systematically.

- Seek Expert Insights: Engage with trading communities and seek mentorship from experienced traders who successfully combine both methods.

- Utilize Technology: Employ trading platforms that support advanced charting and analysis tools, facilitating the integration of Price Action and Elliott Wave Theory.

By thoughtfully combining these strategies, traders can achieve a balanced approach that leverages both predictive insights and real-time analysis.

Pro Tips for Advanced Traders

Elevate your trading strategies with these advanced tips:

- Combine Multiple Timeframes: Analyze price action and Elliott Wave patterns across different timeframes to gain a holistic market view. For example, use a higher timeframe to identify the primary wave structure and a lower timeframe for precise entry points.

- Leverage Advanced Indicators: While Price Action focuses on price, integrating indicators like Fibonacci retracements can enhance wave predictions. Fibonacci levels often align with wave corrections, providing additional confirmation.

- Stay Updated with Market News: Incorporate fundamental analysis to complement technical strategies, ensuring informed trading decisions. Economic events can influence wave patterns and price movements significantly.

- Backtest Strategies: Rigorously test combined strategies using historical data to validate their effectiveness before live trading. Analyze past market conditions to understand how your integrated approach performs under different scenarios.

- Maintain a Trading Journal: Document trades, strategies, and outcomes to continuously refine your approach and learn from past experiences. A detailed journal helps in identifying patterns, strengths, and areas for improvement.

Advanced traders can significantly benefit from integrating these pro tips, enhancing their ability to navigate complex market conditions.

Opofinance Services: Your Partner in Trading Excellence

Enhance your trading journey with Opofinance, a trusted and ASIC regulated forex broker. Here’s why Opofinance stands out:

- Social Trading Service: Connect with top traders and replicate their strategies effortlessly. This feature allows you to learn from seasoned traders and implement proven strategies without extensive research.

- Featured on MT5 Brokers List: Access advanced trading platforms with robust features. The MetaTrader 5 platform offers comprehensive tools for technical analysis, automated trading, and real-time data.

- Safe and Convenient Deposits and Withdrawals: Enjoy seamless transactions with multiple secure methods. Whether you prefer bank transfers, credit cards, or e-wallets, Opofinance ensures your funds are handled safely and efficiently.

- Proven Reliability: Benefit from a broker committed to transparency and client success. Opofinance prides itself on providing exceptional customer support and maintaining a trustworthy trading environment.

Take your trading to the next level with Opofinance—Join Now and experience unparalleled support and services.

Conclusion

Navigating the complexities of the trading world requires a deep understanding of various technical analysis methods. Price Action offers simplicity and real-time insights, making it a favorite among many traders, while Elliott Wave Theory provides a structured, predictive framework ideal for anticipating market movements. By comprehensively understanding price action vs Elliott wave, traders can leverage the strengths of both strategies to enhance their trading performance. Ultimately, the choice between the two—or the decision to integrate them—should align with individual trading styles, goals, and the specific demands of the markets they engage with.

Embracing both methods can lead to a more nuanced and effective trading approach, empowering traders to make informed decisions with confidence and precision.

Key Takeaways

- Price Action emphasizes pure price movements, offering simplicity and real-time analysis.

- Elliott Wave Theory provides a predictive framework based on recurring wave patterns.

- Both methods have their unique advantages and can be effectively integrated for enhanced trading strategies.

- Understanding and mastering these strategies can lead to more informed and profitable trading decisions.

- Choosing the right approach depends on individual trading styles, market preferences, and risk tolerance.

References: +

How do Price Action and Elliott Wave Theory complement each other in volatile markets?

Price Action provides immediate insights into current market movements, while Elliott Wave Theory offers a structured prediction of future trends. Together, they allow traders to react swiftly to volatility while maintaining a strategic outlook.

Can beginners effectively use both Price Action and Elliott Wave Theory simultaneously?

While both methods offer valuable insights, beginners might find it challenging to master both simultaneously. It’s advisable to first gain proficiency in one strategy before integrating the other for more comprehensive analysis.

What role does trader psychology play in the effectiveness of Price Action and Elliott Wave strategies?

Trader psychology is pivotal in both strategies. Price Action relies on interpreting market sentiment through price movements, while Elliott Wave Theory is grounded in the collective psychology of market participants. Understanding emotional triggers can enhance the accuracy and effectiveness of both methods.