Passing a proprietary trading firm challenge is your direct ticket to trading significant capital without risking your own, yet with success rates lingering at a slim 15%, most traders fail. This guide provides a proven, step-by-step playbook to navigate the evaluation process, master risk, and become one of the few who get funded. Whether you’re a novice or an experienced trader looking for the best online forex broker to support your journey, understanding how to pass a prop firm challenge is the first critical step toward scaling your trading career.

Key Takeaways

- Understand the Rules: Success starts with a deep understanding of your firm’s specific rules, including profit targets, drawdown limits (static vs. trailing), and trading restrictions.

- Risk Management is Paramount: The core of passing any evaluation is strict risk management. Never risk more than 1-2% per trade and adhere to daily loss limits religiously.

- Develop a Challenge-Specific Plan: A generic trading plan won’t work. You need a back-tested strategy with a proven edge that is tailored to the challenge’s unique parameters.

- Discipline Overrides Emotion: Emotional decisions, like revenge trading or oversizing, are the primary reasons for failure. Execute your plan with mechanical discipline.

- Lock in Profits Strategically: As you approach the profit target, reduce your risk to protect your gains and avoid last-minute mistakes that could disqualify you.

30-Second Cheat Sheet

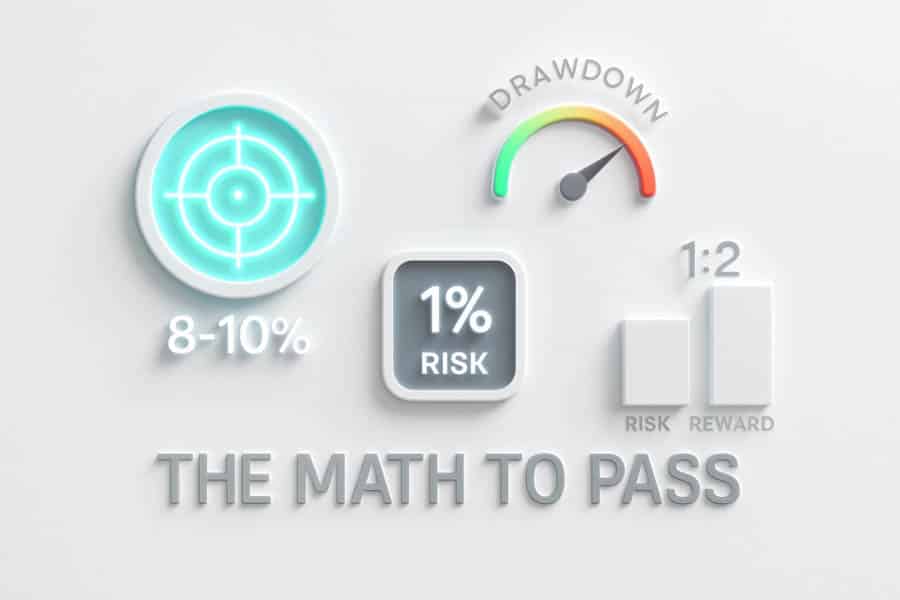

Here’s the bare-bones math and logic for passing a typical $100,000 prop firm challenge. This is the core framework you need to internalize.

- Profit Target: Usually 8-10% ($8,000-$10,000).

- Max Drawdown: Typically 8-12% ($8,000-$12,000). This is your total buffer.

- Daily Risk %: Your risk per trade should not exceed 1% ($1,000). This allows you to survive a losing streak without breaching the daily loss limit (often 4-5%).

- Win-Rate Math: With a 1:2 risk-to-reward ratio, you only need a 35-40% win rate to be profitable. Risking $1,000 to make $2,000 per trade is a common and effective model.

- Time Needed: With a solid strategy and no time limits (a key 2025 trend), it could take 15-25 focused trading days. Don’t rush it.

Ready for the full strategy? Scroll for the step-by-step playbook.

Why 85% Fail Prop Challenges

The high failure rate in prop firm evaluations isn’t random; it’s a result of a few repeating, predictable mistakes. Understanding these pitfalls is the first step toward avoiding them. Traders who know what to watch for are already ahead of the curve and have a better chance of mastering the process of how to pass a prop trading challenge.

- Rule Ignorance: Many traders skim the rules, only to be disqualified for a violation they didn’t know existed, like holding a trade over the weekend or trading during a restricted news event. The fine print matters.

- Oversizing and Revenge Trading: After a few losses, traders often double down, hoping for a quick comeback. This emotional “revenge trading” is a direct path to hitting the maximum drawdown limit.

- Psychology Lapses: The pressure of a challenge can expose every psychological weakness. Greed, fear, and impatience lead to impulsive decisions that deviate from a sound trading plan. Success requires a calm, robotic mindset.

Micro-Case Study: The Consistency Rule Trap

A trader took on a $50,000 challenge and had a phenomenal start, making a 6% profit in a single day. Feeling confident, he continued his aggressive strategy. However, the firm had a 30% consistency rule, stating that no single trading day could account for more than 30% of the total profits. His one great day instantly put him in violation. Despite being profitable, his account was terminated. This is a classic example of how not knowing one specific rule can nullify all your hard work.

Read More: How to Manage a Funded Account

Step 1 – Decode Your Firm’s Rules

Before you place a single trade, you must become an expert on the firm’s rulebook. Think of it as the game’s instruction manual; you can’t win if you don’t know how to play. Failing to understand these parameters is the most common reason aspiring traders are disqualified. A successful approach to any prop firm challenge begins here.

Profit Target Ranges

The profit target is the most straightforward rule. It’s typically between 8% and 10% for Phase 1 and around 5% for Phase 2. While a lower target seems easier, always check it in context with the drawdown limit. A firm offering an 8% target with a 12% drawdown is generally more favorable than one with a 10% target and a 10% drawdown, as it gives you more breathing room for mistakes.

Static vs. Trailing Drawdown

This is arguably the most critical rule to understand. A misunderstanding here can end your challenge instantly.

- Static Drawdown: This is a fixed amount calculated from your initial balance. If you have a $100,000 account with a 10% static drawdown, your account is breached only if your equity drops below $90,000. It never changes, which is simpler and often preferred by traders.

- Trailing Drawdown: This is more complex and dangerous. The drawdown limit “trails” your highest account balance (your high-water mark). For example, with a 5% trailing drawdown on a $100,000 account, your breach level starts at $95,000. If your account balance rises to $102,000, your new breach level is $96,900 ($102,000 – 5%). A popular trend for 2025 is the end-of-day (EOD) trailing drawdown, which only updates your breach level based on the closing balance of each day, offering a slight advantage over live trailing systems.

News-Trading Bans

Many firms restrict trading around major news events (like NFP or CPI announcements). This rule can be tricky. Some firms prohibit opening or closing trades within a window of 2-5 minutes before and after the release. Others might not have this restriction. Always check the list of restricted news events and the specific rules. Violating this often leads to immediate disqualification. This is a crucial element in learning how to pass a prop firm challenge.

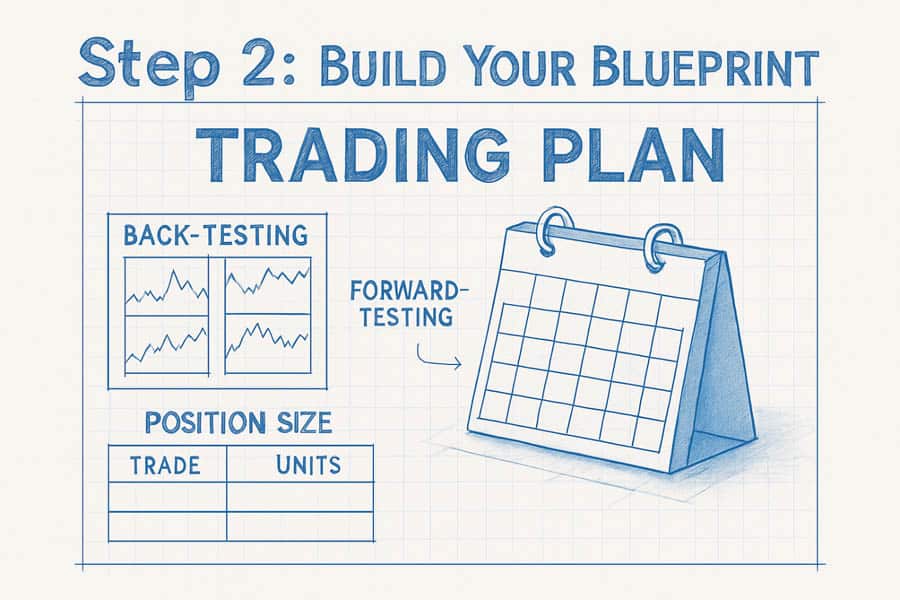

Step 2 – Build a Challenge-Specific Plan

Once you’ve mastered the rules, it’s time to build a trading plan specifically designed to beat the challenge. Your personal trading style is a good starting point, but it must be adapted to operate within the firm’s constraints. This is not the time for improvisation; it’s a time for a clear, data-driven strategy.

Back-test for 6-12 Months

Your strategy must have a proven, positive expectancy. Go back through at least six months of historical data (twelve is better) and simulate your trading strategy. The goal isn’t just to see if it’s profitable but to understand its characteristics. What is its average win rate? What is the longest losing streak? Does it perform well in the current market conditions? This data builds the statistical confidence needed to execute flawlessly under pressure.

Forward-test on a 30-Day Demo

After successful back-testing, open a demo account with the same parameters as the prop firm challenge (e.g., same leverage, account size, and platform). Trade your plan for at least 30 days in live market conditions. This step is non-negotiable. It bridges the gap between theory (back-testing) and real-world execution, helping you iron out any practical issues and building the psychological fortitude required.

Create a Position-Size Table

To avoid emotional sizing errors, create a simple table that dictates your position size based on your stop-loss distance. For a $100,000 account with a 1% risk rule ($1,000 per trade), your table might look like this:

- 20-pip stop loss = 5 lots

- 25-pip stop loss = 4 lots

- 50-pip stop loss = 2 lots

This mechanical approach removes guesswork and ensures you are always adhering to your risk management plan, a cornerstone of any guide on how to pass a prop trading challenge.

Read More: What Is Prop Firm in Forex

Step 3 – Master Risk Management

If there is one secret on how to pass a prop firm challenge, it is this: risk management is not just a part of the game; it is the whole game. You can have a mediocre strategy and still pass with excellent risk management. Conversely, you can have a brilliant strategy and fail with poor risk management. This is the discipline that separates the funded traders from the 85% who fail.

The 1-2% Per Trade Cap

This is the golden rule. Never, under any circumstances, risk more than 1% of your account on a single trade. Some conservative traders even advocate for 0.5%. On a $100,000 challenge, 1% is $1,000. This feels small, but it’s your armor. It ensures that a string of losses—which is inevitable—won’t cripple your account. A 5-trade losing streak costs you only 5%, which is easily recoverable. Mastering pass prop firm challenge risk management is about survival first, profits second.

The 40% of Daily Drawdown Rule

A smart way to stay far from the daily loss limit (usually 4-5%) is to cap your risk per trade at a fraction of that limit. A good mental model is to ensure your risk per trade doesn’t exceed 40% of your daily drawdown. If your daily loss limit is $4,000, risking a maximum of $1,000 per trade means you would need to lose four consecutive trades in a day to get into trouble, which is unlikely with a solid plan.

Automate Your Stop-Loss

Your stop-loss is your safety net, and it should be non-negotiable. Set it the moment you enter a trade and never widen it. The temptation to give a losing trade “more room to breathe” is a classic emotional trap that leads to disaster. Use your platform’s features to set your stop-loss automatically. Treat it as an unbreakable rule. This discipline is essential for anyone serious about understanding how to pass a prop firm challenge.

Step 4 – Execute with Surgical Discipline

With rules understood, a plan built, and risk defined, the final piece is execution. This stage is about quiet, boring, and repetitive discipline. The goal is not to have an exciting trading journey but a profitable one. It’s about showing up, following the plan, and protecting your capital with relentless focus.

Focus on London–NY Overlap Hours

Unless your strategy is specifically designed for Asian session ranges, the highest probability for setups in Forex typically occurs during the London-New York session overlap (approximately 8 AM to 12 PM EST). This four-hour window offers the highest liquidity and volatility. Focusing your energy here prevents over-trading and keeps you engaged when the market is most likely to move decisively.

Set a 5-Trade/Day Maximum

Impose a hard limit on the number of trades you take per day. A good number is five. This prevents over-trading and “revenge trading” after a loss. If your first few trades are losers, this rule forces you to step away, reset, and come back fresh the next day. If your first trade is a big winner, it helps you lock in those gains without giving them back. This simple rule is one of the best tips to pass prop firm challenge fast because it prioritizes capital preservation.

Maintain a Trade Journaling Template

Every trade must be logged. Your journal is your data-driven coach. It should include the setup, entry, exit, your reasoning, and a screenshot of the chart. At the end of each week, review your journal. What worked? What didn’t? Were there any emotional mistakes? A journal turns your experience into a feedback loop for continuous improvement and is a non-negotiable tool for anyone learning how to pass a prop trading challenge.

A firsthand tip: Always set your trading platform’s clock to UTC or the server time specified by the prop firm. Time-zone errors are a silly but common reason for accidentally violating news trading or end-of-day rules. Don’t let a simple clock setting error disqualify you.

Step 5 – Lock Profits & Finish

You’ve done the hard work, navigated the market, and your profit target is within sight. This is one of the most dangerous phases of the challenge. Overconfidence or anxiety can lead to unforced errors right at the finish line. The goal now is to switch from offense to defense, protecting your gains and closing out the challenge professionally.

Scale Down When ≤10% to Target

When you are close to your goal, it’s time to reduce risk. If you are 1-2% away from your profit target, cut your standard position size in half. Instead of risking 1%, risk 0.5%. The objective is no longer to hit home runs but to hit singles. This defensive mindset protects you from a sudden, unexpected loss that could cause a significant psychological setback.

Utilize Partial Closes

Partial profit-taking is an excellent way to secure gains while still allowing a trade to run. If your trade moves in your favor by a 1:1 risk-to-reward ratio, consider closing half of your position and moving your stop-loss to breakeven. This locks in some profit, makes the trade “risk-free,” and allows you to participate in any further upside without the stress.

Avoid Last-Day FOMO

If you’re approaching the end of a time-limited challenge (though many firms in 2025 have removed these limits) and are still short of the target, avoid the fear of missing out (FOMO). Do not take low-probability trades out of desperation. Many firms offer a free retry if you end the period in profit but haven’t hit the target. It is always better to take a free retry than to blow up your account by gambling on the last day.

Read More: should i trade with a prop firm

Pro Tactics the Funded Traders Use

Beyond the fundamentals, elite traders employ advanced techniques to gain an edge. These professional tactics can improve your probability of success and help you approach the challenge with the mindset of a portfolio manager, not just a trader.

| Tactic | Description | How to Apply It |

| Monte Carlo Streak Math | This involves using statistical models to understand the probability of losing streaks. A trader with a 50% win rate has a surprisingly high chance of experiencing a 5-6 trade losing streak. Knowing this prepares you mentally and prevents panic. | Run a Monte Carlo simulation on your back-tested results. Seeing that a 7-loss streak is a statistical possibility makes it less terrifying when you’re in one. It reinforces the need for low (0.5-1%) risk per trade. |

| Order-Flow Confluence | This goes beyond simple technical analysis. It involves analyzing the flow of buy and sell orders, often using Level 2 data or volume profiles, to confirm a trade setup. It helps you identify where institutional traders are positioned. | Add a volume profile indicator to your charts. Look for trade entries at high-volume nodes or rejection at low-volume areas. This adds a powerful layer of confirmation to your existing strategy. |

| Multi-Account Hedging | An advanced (and sometimes controversial) strategy where a trader buys a challenge account and simultaneously trades in the opposite direction on a separate, personal “hedge” account. The goal is to recoup the challenge fee on the hedge account if the challenge is failed. | This is a high-level tactic. For example, if you go long on EUR/USD on the challenge account, you go short on your personal account. It essentially provides a discount on challenge attempts, allowing you to try multiple times at a lower net cost. Be aware of firm rules on this. |

Free Simulators & AI Helpers

In 2025, technology offers a significant edge. The right tools can help you back-test more effectively, analyze market data more deeply, and maintain discipline more easily. Here are some resources that can help you on your journey to pass a prop firm challenge.

- Forex Tester Software: This is the gold standard for back-testing. It allows you to simulate trading over years of historical data with incredible detail, helping you refine your strategy and build confidence before risking a challenge fee. Many consider it essential for serious preparation.

- Rithmic or ATAS for Depth-of-Market: For traders looking to incorporate order flow, platforms like Rithmic (for futures) or ATAS provide detailed depth-of-market (DOM) and order flow data. This allows you to see the underlying buying and selling pressure, providing an edge over those using standard charts alone.

- Journaling APIs (e.g., Tradervue, EdgeWonk): Automated journaling tools can sync with your trading platform to log trades automatically. They provide advanced analytics on your performance, helping you spot weaknesses and patterns in your trading that you might otherwise miss.

Paid vs. Free Challenges: Which Is Worth It?

The prop firm industry offers both paid evaluation challenges and a few free-to-enter programs. While “free” is always tempting, it’s crucial to understand the trade-offs. The best path often depends on your confidence, experience, and capital. Here is a comparison to help you decide which route is better for your quest on how to pass a prop firm challenge.

| Feature | Paid Challenges | Free Challenges |

| 1. Fees | Requires an upfront, refundable fee (e.g., $500 for a $100K account). | No upfront cost. |

| 2. Pass Rates | Generally higher as the fee acts as a filter for serious traders. Firms have a vested interest in your success. | Extremely low. The barrier to entry is zero, leading to a high volume of unprepared applicants. |

| 3. Capital Offered | Typically offers larger account sizes from the start (e.g., $50K – $200K). | Often starts with a very small live account (e.g., $1K – $5K) that you must scale up over a long period. |

| 4. Support & Community | Usually provides better customer support, community access, and educational resources. | Support is often limited or non-existent. You are largely on your own. |

For most serious traders, a paid challenge from a reputable firm is the more efficient path to significant funding.

7 Pitfalls That Kill Your Evaluation

Even with a solid plan, certain traps can derail your progress. Being aware of these common evaluation killers is crucial for anyone wondering how to pass a prop trading challenge. Here are seven of the most lethal pitfalls and how to fix them.

- Over-leveraging After a Win: Getting overconfident after a winning streak and increasing your risk.

- Fix: Strictly adhere to your 1% risk rule, no matter how confident you feel. Confidence is not an edge.

- Ignoring News Spike Volatility: Placing a trade right before a major news release, thinking you can predict the outcome.

- Fix: Have a hard rule to stay out of the market 5 minutes before and after high-impact news. Check the economic calendar daily.

- Platform Time-Zone Errors: Miscalculating the end of the trading day due to time zone differences and violating an “overnight holding” rule.

- Fix: Set your platform’s clock to the firm’s server time (often UTC) from day one.

- Strategy Hopping: Ditching your plan after two or three losses and trying a new, untested strategy.

- Fix: Trust your back-tested data. Remind yourself that losing streaks are a normal part of your strategy’s performance.

- Letting a Small Loss Become a Big One: Widening your stop-loss because you “feel” the market will turn around.

- Fix: Treat your initial stop-loss as sacred. Once it’s set, it should only be moved in your favor (trailing stop), never against you.

- Failing to Review Trades: Closing the laptop after a trading session without logging or analyzing your trades.

- Fix: Dedicate 20 minutes at the end of each day to update your journal. This is non-negotiable work.

- Gambling on Low-Quality Setups: Taking trades out of boredom when there are no high-probability setups matching your plan.

- Fix: Adopt the mindset that you are paid to wait for perfect setups, not to trade. No setup means no trade.

Data-Backed Success Benchmarks

Success in a prop firm challenge is a game of probabilities, not certainties. Understanding the math behind a successful trading system is crucial. The data suggests you don’t need a sky-high win rate to pass; you need a positive risk-to-reward ratio and the discipline to let it play out. For example, extensive data from trading simulations shows that a strategy with at least a 1:3 risk-to-reward ratio and a 50% win rate gives a trader a 64% probability of passing a challenge within just 20 trades. This benchmark highlights that profitability is driven by the size of your wins, not just the frequency of them. Focusing on high-quality setups with significant upside potential is statistically more robust than trying to win every single trade. This is the mathematical core of how to pass a prop firm challenge.

Your Partner in Trading: Opofinance

As you prepare to conquer your prop firm challenge, having a reliable and ASIC-regulated broker is key. Opofinance provides the tools and environment built for success.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the intuitive OpoTrade app.

- Innovative AI Tools: Gain an edge with an AI Market Analyzer, an AI Coach for performance insights, and 24/7 AI Support.

- Social & Prop Trading: Join a community of traders and explore pathways to professional funding.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Elevate your trading journey today. Explore Opofinance.

Ready to Try? Checklist Before You Click “Buy Challenge”

You’ve done the research and feel prepared. Before you commit your capital to a challenge fee, run through this final pre-flight checklist. This ensures you are not just mentally ready, but practically set up for success. Answering “yes” to these questions dramatically increases your odds of joining the 15% who pass.

- Have I read and understood every single rule in the firm’s FAQ?

- Do I know for certain if the drawdown is static or trailing?

- Is my trading plan written down, with clear entry, exit, and risk rules?

- Has my strategy been back-tested over at least 6 months of data?

- Have I successfully traded my plan on a demo account for 30 days?

- Have I created a position-sizing table to avoid calculation errors?

- Do I have a trade journaling system ready to go from the first trade?

- Am I mentally prepared to follow my plan with 100% discipline?

- Do I understand that losing streaks are inevitable and part of the process?

- Do I know exactly which news events to avoid and when they occur?

If you can confidently check all these boxes, you are ready to take on the challenge.

Conclusion

Ultimately, learning how to pass a prop firm challenge is less about finding a secret strategy and more about mastering yourself. It’s a test of discipline, patience, and unwavering adherence to a well-defined plan. By decoding the rules, building a challenge-specific strategy, mastering risk management, and executing with robotic discipline, you shift the odds dramatically in your favor. Treat the challenge not as a sprint to get rich, but as a professional job interview where your consistency and risk protocols are being evaluated.

References: +

Can you use trading bots or EAs in prop firm challenges?

It depends entirely on the firm. Some firms allow EAs as long as they are not used for high-frequency trading or copy trading from another user. Always check the firm’s specific rules on automated trading before proceeding.

What happens if I finish the challenge in profit but don’t hit the target?

Most reputable prop firms will offer a free retry for your next challenge attempt, provided your account ends with a positive balance and you have not violated any drawdown rules.

How long does it take to receive the funded account after passing?

Typically, after you successfully pass both phases of the challenge, your account is reviewed and a funded account is issued within 24-72 business hours.

Are there any restrictions on what pairs or instruments I can trade?

Generally, firms allow trading on all major and minor forex pairs, as well as many indices and commodities. However, some may have restrictions on certain exotic pairs or assets, so it’s best to confirm on their website.

What is the profit split on a funded account?

Profit splits typically start at 80/20 (80% for the trader) and can scale up to 90/10 or even 100% for traders who demonstrate consistent profitability over time.