Are you searching for a powerful forex trading strategy that can generate quick profits? Look no further than the reversal scalping strategy. This dynamic technique allows forex traders to capitalize on rapid price reversals in the market, potentially boosting profits in a matter of minutes. Reversal scalping is a short-term trading method where traders identify and exploit brief price reversals, entering trades at key turning points to maximize gains from quick market movements.

Whether you’re a seasoned forex trading veteran or just starting your journey with an online forex broker, understanding and implementing this strategy can significantly enhance your trading success. In this comprehensive guide, we’ll delve deep into the world of reversal scalping, equipping you with the knowledge, tools, and techniques needed to excel in the fast-paced forex market. By mastering reversal scalping, you’ll be better positioned to take advantage of market volatility and potentially increase your trading profits.

What is Reversal Scalping?

Reversal scalping is a short-term trading strategy that aims to profit from sudden changes in price direction within the forex market. Unlike traditional scalping methods that focus on small, frequent gains in the direction of the trend, reversal scalping capitalizes on price reversals or “turning points” in the market.

Key Characteristics of Reversal Scalping:

- Quick Trades: Positions are typically held for a few minutes to an hour at most.

- Tight Stop Losses: Traders use narrow stop-loss orders to minimize risk.

- High Frequency: Multiple trades may be executed throughout a single trading session.

- Technical Analysis: Heavy reliance on technical indicators and chart patterns to identify potential reversals.

The primary goal of reversal scalping is to catch the beginning of a new price movement, entering at the point where the previous trend is exhausted and a new one is about to begin.

The Psychology Behind Reversal Scalping

Understanding the psychological aspects of reversal scalping is crucial for success in this high-intensity trading style. Traders must:

- Remain Calm Under Pressure: Quick decision-making is essential, but it must be done with a clear mind.

- Control Emotions: Greed and fear can lead to poor trade management.

- Accept Losses: Not every trade will be profitable; accepting small losses is part of the strategy.

- Stay Disciplined: Stick to predetermined entry and exit points.

Successful reversal scalpers develop a keen sense of market sentiment and learn to “feel” the rhythm of price movements.

Technical Indicators for Reversal Scalping

To effectively implement a reversal scalping strategy, traders rely on various technical indicators. Here are some of the most popular:

1. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It’s particularly useful for identifying overbought or oversold conditions, which can signal potential reversals.

- Overbought: RSI above 70

- Oversold: RSI below 30

2. Bollinger Bands

Bollinger Bands consist of a middle moving average with upper and lower bands. They help traders identify:

- Potential reversals when price touches or exceeds the outer bands

- Volatility contractions that may precede significant moves

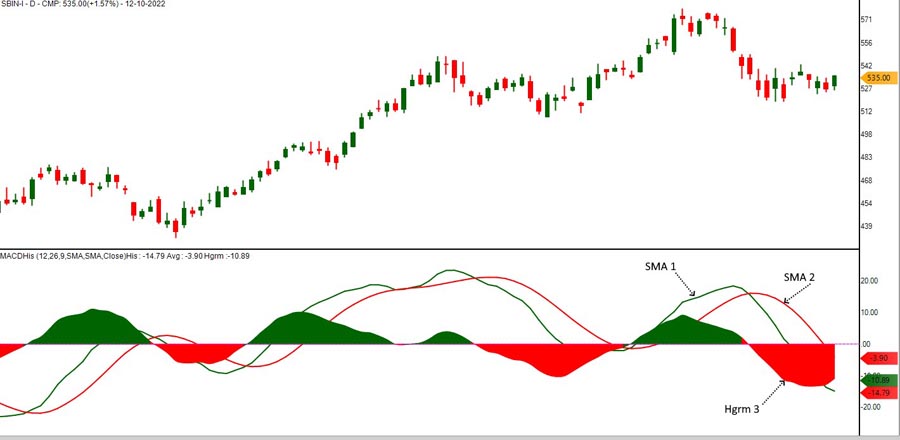

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Bullish Signal: MACD line crosses above the signal line

- Bearish Signal: MACD line crosses below the signal line

4. Stochastic Oscillator

This momentum indicator compares a closing price to its price range over a specific period. It’s useful for identifying potential reversal points when:

- The oscillator moves out of overbought (above 80) or oversold (below 20) territories

- There’s a divergence between the oscillator and price action

Read More: usd jpy scalping strategy

Chart Patterns for Reversal Scalping

In addition to technical indicators, reversal scalpers often rely on specific chart patterns to confirm potential trade setups:

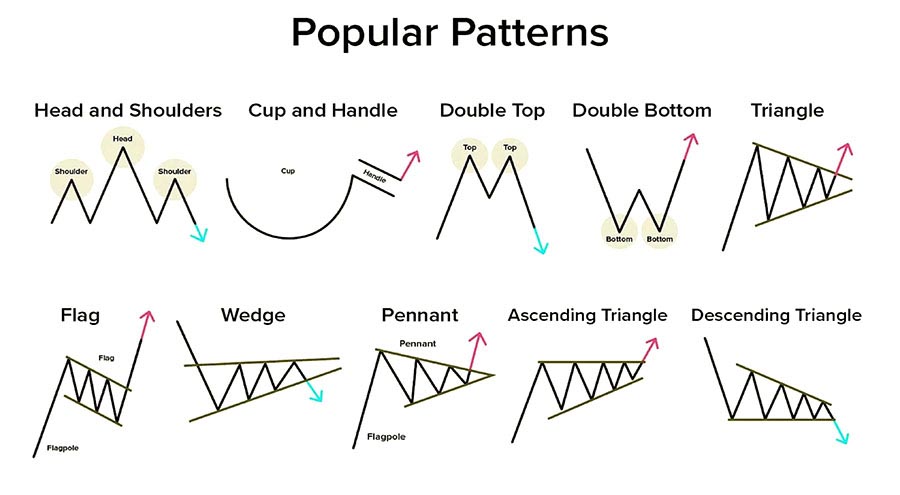

- Double Tops and Bottoms: These patterns signal a potential trend reversal after a prolonged move.

- Head and Shoulders: A reliable reversal pattern that forms after an uptrend, signaling a potential bearish reversal.

- Engulfing Candles: Bullish or bearish engulfing patterns can indicate a short-term reversal in price direction.

- Pin Bars: These candles have long wicks and small bodies, often signaling rejection of a certain price level and a potential reversal.

- Fibonacci Retracements: Used to identify potential support and resistance levels where reversals may occur.

Combining multiple chart patterns with technical indicators can significantly increase the probability of successful reversal scalping trades.

Implementing a Reversal Scalping Strategy

Now that we’ve covered the basics, let’s dive into how to implement a reversal scalping strategy:

Step 1: Choose Your Timeframe

Most reversal scalpers focus on short timeframes, typically 1-minute to 15-minute charts. However, it’s essential to:

- Monitor higher timeframes for overall trend direction

- Use multiple timeframe analysis to confirm potential reversals

Read More: gbpusd scalping strategy

Step 2: Identify Key Support and Resistance Levels

Mark important price levels where reversals are likely to occur:

- Previous day’s high and low

- Round numbers (e.g., 1.3000, 1.3500)

- Fibonacci retracement levels

Step 3: Wait for Confirmation

Don’t rush into trades at the first sign of a potential reversal. Look for:

- Candlestick patterns confirming the reversal

- Technical indicator signals aligning with price action

- Volume spikes indicating strong market participation

Step 4: Set Entry and Exit Points

Determine your:

- Entry point: Slightly after the confirmation of the reversal

- Stop loss: Just beyond the recent swing high/low

- Take profit: Based on the average true range (ATR) or a fixed risk-reward ratio

Step 5: Manage Your Risk

Reversal scalping can be risky due to its fast-paced nature. Always:

- Use proper position sizing (risk no more than 1-2% of your account per trade)

- Implement a trailing stop to lock in profits as the trade moves in your favor

- Be prepared to exit quickly if the market doesn’t move as expected

Backtesting Your Reversal Scalping Strategy

Backtesting is a crucial step in developing a successful reversal scalping strategy. It allows you to evaluate the effectiveness of your approach using historical data before risking real capital. Here’s how to backtest your reversal scalping strategy:

- Choose a Testing Platform: Use trading software that allows for historical data analysis and strategy testing.

- Define Your Parameters: Set clear rules for entries, exits, and risk management based on your reversal scalping strategy.

- Select a Time Period: Test your strategy across different market conditions and timeframes to ensure robustness.

- Run the Test: Apply your strategy to historical data and record the results.

- Analyze the Results: Evaluate key metrics such as win rate, profit factor, and maximum drawdown.

- Refine Your Strategy: Based on the results, make adjustments to improve performance.

- Forward Test: After backtesting, run your strategy on a demo account to validate its performance in real-time market conditions.

Remember, past performance doesn’t guarantee future results, but backtesting can provide valuable insights into your strategy’s potential effectiveness.

Pros and Cons of Reversal Scalping

Understanding the advantages and disadvantages of reversal scalping is essential for determining if this strategy aligns with your trading goals and risk tolerance.

Pros:

- High Profit Potential: Capitalizing on price reversals can lead to significant gains in short periods.

- Frequent Trading Opportunities: Market reversals occur regularly, providing multiple trading chances throughout the day.

- Limited Market Exposure: Short holding periods reduce the risk of overnight gaps or unexpected news impacts.

- Skill Development: Enhances a trader’s ability to read charts and react quickly to market changes.

Cons:

- High Stress: The fast-paced nature of reversal scalping can be mentally taxing.

- Increased Transaction Costs: Frequent trading can lead to higher commission fees, impacting overall profitability.

- Requires Constant Attention: Traders must monitor the markets closely, which can be time-consuming.

- Higher Risk of False Signals: Short-term price movements can be noisy, leading to potential false reversal signals.

Read More: Range Scalping Strategy

Weighing these pros and cons can help you decide if reversal scalping aligns with your trading style and goals.

Expert Quotes on Reversal Scalping

To provide additional insights and authority to our discussion on reversal scalping, let’s consider the perspectives of recognized forex trading experts:

“Reversal scalping requires a unique blend of technical analysis skills and psychological fortitude. It’s not for everyone, but for those who master it, it can be an incredibly rewarding strategy.” – Michael Conner, Professional Forex Trader and Author of “Mastering Short-Term Trading”

“The key to successful reversal scalping lies in identifying high-probability setups and managing risk effectively. It’s not about being right all the time, but about capitalizing on those moments when the market is most likely to change direction.” – Reza Bagheri, Forex Market Analyst

“RSI is a powerful tool for reversal scalpers, but it should never be used in isolation. Combining RSI with other indicators and price action analysis significantly increases the probability of successful trades.” – Michael Brown, Head of Trading Education at Abaqus Forex Academy

These expert perspectives underscore the importance of thorough preparation, risk management, and a multi-faceted approach to reversal scalping.

Common Mistakes to Avoid in Reversal Scalping

Even experienced traders can fall prey to these pitfalls:

- Overtrading: Don’t force trades; wait for high-probability setups.

- Ignoring the broader market context: Always consider the larger trend and economic factors.

- Failing to adapt: Markets change; be prepared to adjust your strategy.

- Neglecting risk management: Proper risk control is crucial for long-term success.

- Emotional trading: Don’t let fear or greed dictate your decisions.

Remember, consistency and discipline are key to mastering the reversal scalping strategy.

Advanced Techniques for Reversal Scalping

As you become more comfortable with basic reversal scalping, consider incorporating these advanced techniques:

1. Multi-Pair Scalping

Trade reversals across multiple currency pairs simultaneously to increase opportunities and diversify risk.

2. News-Based Scalping

Capitalize on sharp reversals that often occur immediately after major economic news releases.

3. Order Flow Analysis

Use order flow data to gain deeper insights into market sentiment and potential reversal points.

4. Algorithmic Scalping

Develop or use automated trading systems to execute reversal scalping strategies with precision and speed.

OpoFinance Services: Your Partner in Reversal Scalping Success

When it comes to implementing your reversal scalping strategy, choosing the right broker can make all the difference. OpoFinance, an ASIC-regulated forex broker, offers a comprehensive suite of services tailored to meet the needs of scalpers and day traders alike.

Why Choose OpoFinance for Your Reversal Scalping Endeavors?

- Lightning-Fast Execution: OpoFinance’s advanced trading infrastructure ensures rapid order execution, crucial for successful scalping.

- Tight Spreads: Benefit from competitive spreads that minimize trading costs, maximizing your potential profits.

- Robust Trading Platforms: Access state-of-the-art platforms equipped with advanced charting tools and technical indicators essential for reversal scalping.

- Social Trading Feature: For those new to reversal scalping or looking to diversify their strategies, OpoFinance’s social trading service allows you to follow and copy trades from experienced scalpers.

- Educational Resources: Take advantage of comprehensive educational materials to enhance your reversal scalping skills and stay updated on market trends.

- 24/7 Customer Support: Get assistance whenever you need it, ensuring uninterrupted trading during market hours.

By partnering with OpoFinance, you’re not just getting a broker – you’re gaining a valuable ally in your reversal scalping journey, backed by the security of ASIC regulation and a commitment to trader success.

Conclusion

Reversal scalping is a powerful strategy that can lead to significant profits when executed correctly. By understanding market psychology, mastering technical analysis, and implementing proper risk management, traders can capitalize on short-term price reversals in the forex market.

Remember, success in reversal scalping requires:

- Continuous learning and adaptation

- Strict discipline in trade execution

- Emotional control and patience

- Proper use of technical tools and indicators

- A reliable forex broker with fast execution and tight spreads

As you embark on your reversal scalping journey, stay committed to refining your skills and always prioritize risk management. With dedication, practice, and the right tools at your disposal, you can master this exciting and potentially lucrative trading strategy.

How does reversal scalping differ from trend scalping?

Reversal scalping focuses on identifying and profiting from short-term price reversals, often going against the prevailing trend. In contrast, trend scalping aims to capture small profits in the direction of the overall trend. Reversal scalpers look for exhaustion points in the current trend, while trend scalpers seek to enter during pullbacks or continuations of the established trend.

Can reversal scalping be combined with other trading strategies?

Yes, reversal scalping can be effectively combined with other trading strategies to enhance overall performance. For example, traders might use longer-term trend analysis to identify potential reversal zones, then apply reversal scalping techniques within these areas. Additionally, some traders incorporate elements of price action trading or order flow analysis to confirm reversal signals, increasing the probability of successful trades.

What are the best currency pairs for reversal scalping?

The most suitable currency pairs for reversal scalping typically have high liquidity and moderate to high volatility. Some popular choices include:

EUR/USD: The most traded pair, offering tight spreads and consistent liquidity.

GBP/USD: Known for its volatility, providing numerous reversal opportunities.

USD/JPY: Often exhibits clear support and resistance levels, ideal for reversal scalping.

AUD/USD: Influenced by commodity prices, offering unique reversal setups.

It’s important to note that the best pairs may vary depending on market conditions and individual trading style. Traders should analyze multiple pairs to find those that best suit their reversal scalping strategy.