Lots of talented traders hit a wall. You’ve sharpened your skills and maybe even have a winning strategy, but you don’t have the big bucks needed to make serious returns. Trading your own small account feels like spinning your wheels, and the dream of trading full-time seems miles away. Finding a solid broker for forex trading helps, but getting your hands on significant capital is a whole different challenge.

This lack of funding means you’re either forced to risk too much of your own money or settle for tiny profits. You can see the potential in the markets, but your account size holds you back like an anchor. The question keeps popping up: how can you use your trading smarts without betting the farm?

Proprietary (prop) trading firms offer one possible answer. They give skilled traders access to large amounts of capital, letting them boost their profit potential significantly. But before jumping in, you really need to understand how it works and seriously ask yourself: should I trade with a prop firm?

Understanding Prop Trading

Proprietary trading, or “prop trading” for short, is a different beast in the financial world compared to regular brokerages that handle trades for clients. Prop firms are in the game for themselves, using their own cash to make trades. Let’s dive into what that really means and how these firms usually operate.

What is Proprietary (Prop) Trading?

Basically, prop trading is when a financial firm – could be a bank, a brokerage, or a company set up just for this purpose – trades things like stocks, bonds, currencies, commodities, or derivatives using its own money, not customers’ money. The goal is simple: make money for the firm. They hire traders or partner with independent traders who use the firm’s capital to execute strategies and try to profit from market movements.

How do Prop Firms Work?

Many modern online prop firms, especially those accessible to everyday traders, use an evaluation or challenge system. Here’s how it typically goes:

- Evaluation/Challenge: First off, traders pay a fee to take a test drive, known as an evaluation or challenge. During this period (which might last a month or more, sometimes with no time limit), you have to prove you can trade profitably while sticking to very strict risk rules – like limits on how much you can lose in a day or overall – usually on a demo or simulated account.

- Funding: If you pass the evaluation by hitting the profit goals without breaking the rules, the firm offers you a funded account. This account is loaded with the firm’s money (anywhere from $10,000 to potentially over $1 million, depending on the program). You then use this capital to trade in the real markets.

- Profit Split: When you make profits using the funded account, you share them with the firm based on an agreement made beforehand. It’s common for traders to keep a large chunk, like 70%, 80%, or even 90% or more. The firm eats the losses (remember, your risk was mainly the evaluation fee), while you get the lion’s share of the profits.

Keep in mind, not all prop firms work this way. Some traditional ones hire traders as employees with salaries and bonuses, often requiring serious experience. But the evaluation model has become super popular because it opens doors for more retail traders.

Why Consider a Prop Firm?

The biggest draw for most traders is getting access to a hefty amount of trading capital. Let’s say your strategy makes 5% a month. On your own $5,000 account, that’s $250. But on a $100,000 prop firm account, that’s $5,000 in profit. Even after the split (say you get 80%), you could pocket $4,000. This leverage lets skilled traders potentially earn a real income without putting their own savings on the line (apart from that initial evaluation fee). For many, answering “should I trade with a prop firm?” comes down to this access to capital.

Read More: Prop Firm vs Personal Trading Accounts

Key Benefits of Trading with a Prop Firm (Pros)

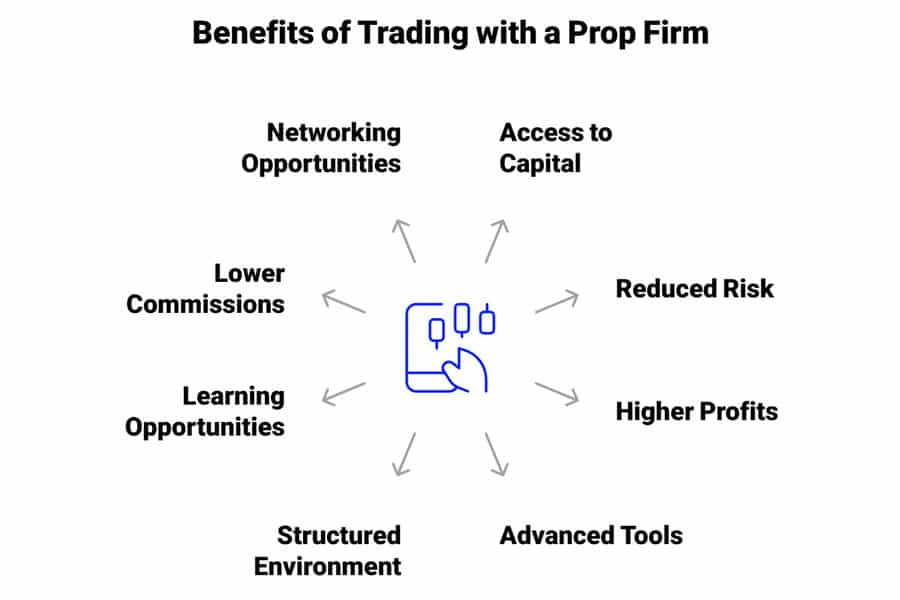

Partnering with a prop firm can bring some really attractive perks, especially if you’ve got the skills but not the cash. These benefits can seriously speed up your trading journey and income potential, making the decision of whether you should trade with a prop firm seem like a great idea for the right person.

- Access to Significant Trading Capital: This is the big one. Prop firms let you trade account sizes much larger than most people could fund themselves. This naturally ramps up the potential rewards from your winning trades.

- Reduced Personal Financial Risk: Once you’re funded, you’re playing with the house’s money. Your main financial exposure is usually just the fee you paid for the evaluation. If trades go south, the firm takes the hit, not your personal bank account.

- Potential for Higher Profits/Income: Because you’re trading more capital, even small percentage wins can turn into significant cash. This can mean earning way more than you could with a small personal account.

- Access to Advanced Trading Tools and Technology: Many firms provide top-tier trading platforms (like MT4, MT5, cTrader), fancy analytical tools, fast execution, and quality market data – stuff that can be expensive for individual traders.

- Structured Trading Environment & Discipline: The firm’s rules (like drawdown limits) force you to be disciplined about risk. While it might feel restrictive sometimes, this structure builds good habits essential for long-term success.

- Learning Opportunities: Some firms offer training materials, coaching, access to experienced traders, or active online communities. This support system can help you learn faster and get valuable feedback.

- Possible Lower Commission Rates: Because they trade in large volumes, prop firms often get better deals on commissions and spreads from brokers. These savings can be passed on to you, lowering your trading costs.

- Networking Opportunities: Being part of a prop firm connects you with fellow traders. This can lead to sharing ideas, improving strategies, and building professional connections.

Significant Risks and Drawbacks (Cons)

While trading big money sounds great, you need to go into prop trading with your eyes wide open to the downsides and challenges. These factors are super important when weighing if you should trade with a prop firm, as they can really affect your experience and whether you succeed.

- Strict Rules and Restrictions: This is the flip side of that structured environment. Prop firms have tight rules about maximum daily loss, maximum total loss (drawdown), profit targets (especially during the test), holding trades over weekends or major news, and sometimes even limit the strategies or assets you can trade. Break a rule, and you often lose the account.

- Profit Sharing Agreements: You don’t get to keep all the profits. While the split usually favors the trader heavily, the firm always gets a cut. This means your take-home pay is less than if you made the same profit on an equally large personal account (though getting that large personal account is the main challenge).

- Evaluation Challenges: Passing the evaluation is often tough. You need to be consistently profitable under pressure, stick to the risk limits, and sometimes do it within a specific time frame. Many traders fail and lose their evaluation fee. The fee itself is an upfront cost.

- Risk of Losing the Funded Account: Even after you pass, breaking any rule (like hitting your daily loss limit) on the funded account usually means they close it immediately. You lose your funded status and might have to pay for another evaluation to try again.

- High Pressure and Psychological Stress: Trading large amounts (even if it’s not yours) and knowing that one mistake can cost you the account can be incredibly stressful. The pressure to pass the evaluation and keep performing on the funded account is intense.

- Lack of Guaranteed Income / Performance-Based Opportunities: Your income from a prop firm depends entirely on your trading results. No profits mean no pay. This can be tough if you need a steady paycheck.

- Potential Fees: Besides the evaluation fee, watch out for other potential costs some firms might charge: monthly platform fees, data fees, withdrawal fees, or fees to reset your evaluation if you break a minor rule. Make sure you know all the potential costs upfront.

- Regulatory Concerns and Firm Legitimacy: The online prop firm world is newer and less regulated than traditional finance. You must do your homework to make sure a firm is legit, actually pays its traders, and is transparent. Some firms might make most of their money from failed evaluation fees rather than successful traders.

- Market Risk and Volatility Exposure: The usual risks of trading still apply. The market can move against you quickly, and hitting a drawdown limit means losing the account, regardless of whether it was the firm’s capital.

- Operational Risks: There’s always a small risk related to the firm itself – maybe they have technical issues, payout delays, or even financial trouble (though rare for reputable firms).

- Limited Control Compared to Personal Accounts: You have to play by their rules. This might mean you can’t use certain strategies or trade exactly how you’d prefer. You give up some freedom for the capital access. Deciding should I trade with a prop firm means accepting these trade-offs.

Prop Firm Trading vs. Trading Your Own Account

Choosing between a prop firm and using your own money involves balancing access to capital against risk, freedom, and how much profit you keep. Understanding these key differences is crucial to figure out which route fits you and your goals best. Looking at these points helps clarify whether you should trade with a prop firm.

Capital Requirements

- Prop Firm: Small personal outlay needed (usually just the evaluation fee). Access to large amounts of firm capital ($10k – $2M+ isn’t uncommon).

- Own Account: Need a lot of your own money to make decent income. Growth is often slow.

Risk Exposure

- Prop Firm: Personal financial risk is mostly limited to the evaluation fee. The firm covers trading losses on the funded account.

- Own Account: You bear 100% of the trading losses directly from your own pocket. Potential for significant personal financial loss is higher.

Profit Retention

- Prop Firm: Profits are shared – you might keep 70-90%, the firm gets the rest.

- Own Account: You keep 100% of every dollar you make.

Rules and Flexibility

- Prop Firm: Strict rules on losses, risk, sometimes trading style or when you can trade. Less freedom.

- Own Account: Total freedom over strategy, risk levels, timing, and what you trade (within your broker’s limits).

Psychological Factors

- Prop Firm: Pressure to pass tests, follow rules strictly, and perform consistently to keep the account and get paid. Can be stressful knowing you’re constantly watched.

- Own Account: Pressure comes from risking your own hard-earned money. Freedom can lead to undisciplined decisions if you’re not careful.

Tools and Support Access

- Prop Firm: Often includes good platforms, tools, maybe lower trading costs, learning resources, and a community.

- Own Account: You have to find and pay for your own tools, platforms, data, and education. Trading costs might be higher.

Strategy Application

- Prop Firm: Your strategy must work within their rules (especially drawdown limits). Some strategies (like high-risk Martingale or very long-term holds) might not be allowed.

- Own Account: You can use any strategy you want, as long as you accept the risks involved.

Often, the debate around `is prop trading worth it` boils down to whether the huge advantage of trading large capital outweighs the limitations the firm puts on you.

Read More: What Is Prop Firm in Forex?

Who Should Consider Trading with a Prop Firm?

Prop trading isn’t for everyone. It’s best suited for traders with a certain profile and in specific situations. Figuring out if you fit that profile is key before you decide to take on a prop firm challenge. Thinking honestly about your skills and circumstances is vital when asking, “should I trade with a prop firm?”

Traits of Potentially Suitable Traders

Traders who tend to do well with prop firms often share these qualities:

- Proven Profitability: You need a trading strategy that has already shown it can make money consistently over time. Having a track record (even on a small or demo account) is a big plus.

- Strong Risk Management Skills: Being able to stick religiously to risk rules (like maximum drawdown) is absolutely essential. Prop firms don’t bend these rules.

- Discipline and Rule-Following: Success means following the firm’s playbook to the letter, even if it cramps your style a bit. Emotional control is key.

- Consistency Over High-Risk Gambling: Firms want traders who can grind out steady profits within risk limits, not shoot for the moon with risky bets.

- Ability to Handle Pressure: Trading under evaluation conditions and managing a large account takes mental toughness.

- Adaptability: It helps if you can tweak your strategy slightly to fit the prop firm’s rules (like managing daily loss limits).

Ideal Scenarios

Prop trading could be a really good option if:

- You have a trading strategy you know works, but you just don’t have enough personal cash to make a real living from it.

- You’re confident you can hit the specific profit targets and stay within the risk limits of an evaluation.

- You actually like having clear rules and structure, seeing them as helpful boundaries rather than annoying restrictions.

- You want to boost your trading income potential without risking your life savings. This is often the main reason the answer to “should I trade with a prop firm?” becomes a yes.

Scenarios Where It Might Not Be Suitable

On the flip side, prop trading probably isn’t the best route if:

- You’re totally new to trading and still figuring out the basics. Prop firms usually aren’t schools for beginners.

- You need a steady, reliable income. Prop firm payouts depend entirely on performance and aren’t guaranteed.

- You have trouble with discipline or sticking to strict rules and loss limits.

- Your trading strategy naturally involves big swings in your account balance (high drawdowns) or uses methods most firms don’t allow (like certain news trading tactics or Martingale).

- You find that trading under pressure or being monitored makes your performance worse.

- You value having complete control and flexibility more than having access to more capital.

Ultimately, the question `is prop trading worth it` really depends on the individual trader’s skills, mindset, and readiness.

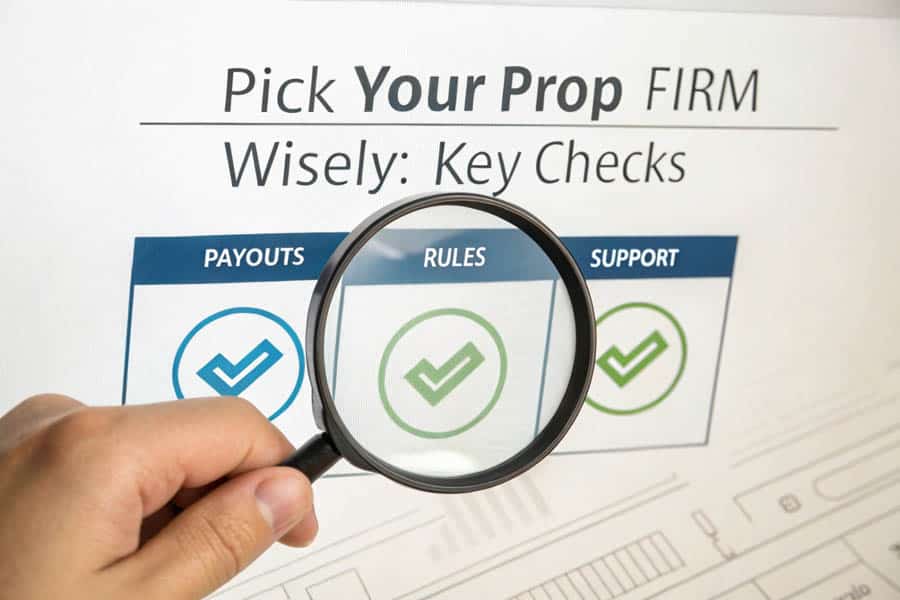

How to Choose the Right Prop Trading Firm

The prop firm scene has blown up, meaning there are tons of choices out there – and not all of them are good. Picking a reliable and suitable firm is critical if you want to have a good experience and actually get paid your share of the profits. Doing your homework is non-negotiable when deciding if you should trade with a prop firm and which one to go with.

Reputation and Track Record

Look for firms that have been around for a while and generally get good feedback from traders, especially about getting paid. Check out independent review sites (like Trustpilot), forums (Reddit can be useful), and social media, but be smart about spotting fake or overly biased reviews. A solid history usually means more stability.

Transparency and Legitimacy

The firm should have its rules, terms, profit split details, and fees laid out clearly and easy to find on its website. Steer clear of firms with fuzzy rules, super-hyped marketing, or promises that sound too good to be true (“Get rich overnight!”). Good firms are honest about the fact that trading is hard.

Evaluation Process and Rules

Dig into the evaluation details:

Profit Target: Can you realistically hit it in the time allowed without taking crazy risks?

Drawdown Limits (Daily and Overall): Are the percentages fair (e.g., 5% daily, 10% overall are pretty standard)? Make sure you understand exactly how they calculate drawdown (is it based on balance or equity? Does it reset daily?).

Time Limits: Are there minimum trading days or a maximum time to pass? Some firms now offer unlimited time, which takes off some pressure.

Other Rules: Check for any rules about trading during news, holding trades over the weekend, using automated strategies (EAs), maximum position sizes, etc.

Profit Split and Payout Structure

Know the profit split percentage (higher is generally better, but make sure the firm seems sustainable). Most importantly, check out the payout process:

Frequency: How often can you cash out (e.g., every two weeks, monthly)?

Methods: How do they pay you (bank transfer, crypto, PayPal, etc.)?

Reliability: This is HUGE. Look for real proof (reviews, trader testimonials, payout certificates if offered) that the firm actually pays traders consistently and without hassle. Proof of payment is way more important than just a high percentage split.

Fees and Costs

Get a clear picture of every possible cost:

Evaluation Fee: The upfront cost for the test.

Reset Fees: What it costs to try the evaluation again if you break a rule (but don’t fail completely).

Monthly Fees: Some firms might charge ongoing fees for platform access or data on funded accounts (less common now, but check).

Withdrawal Fees: Do they charge you to take your money out? Knowing all this avoids nasty surprises.

Trading Platform and Tools Offered

Make sure they offer platforms you like and know how to use (MT4, MT5, cTrader are popular) and that their trade execution is reliable. See if they offer any extra helpful tools or resources.

Allowed Trading Styles and Instruments

Double-check that your way of trading (like scalping, swing trading, using algorithms) and the things you trade (forex, indices, commodities, crypto) are allowed.

Customer Support and Community Resources

Good support that’s quick and helpful is important when problems pop up. An active community (like on Discord) can be a great place for support and sharing ideas with other traders.

Scaling Plan/Growth Potential

Does the firm have a clear way for successful traders to get more capital to manage over time? A good scaling plan rewards consistency and is a sign the firm wants long-term relationships.

Understanding the Firm’s Business Model

Try to get a sense of whether the firm makes most of its money from people failing evaluations (which might mean the challenge is designed to be extremely difficult) or from sharing profits with genuinely successful traders (which is a healthier sign). Firms that focus on support, realistic rules, and celebrating trader success stories usually have a better, more sustainable approach. Thinking through these points will help you answer “should I trade with a prop firm?” more wisely.

The Verdict: Is Prop Trading Worth It?

So, let’s circle back to the big questions: should I trade with a prop firm? And when it comes down to it, is prop trading worth it? Honestly, there’s no single right answer for everyone. It really hinges on you as a trader – your skills, your discipline, your mindset, and what you’re looking for.

Prop trading definitely offers a huge opportunity, mainly by giving you access to capital that can seriously multiply your earning potential if you have the skills. It lets you turn your trading ability into potentially significant income without risking your own nest egg (beyond the evaluation fee). Plus, the structure can force good habits, and access to better tools or a community can be a plus.

But, it’s also packed with challenges. The evaluations are tough, the rules are strict, the pressure is real, and failure is common. There’s the upfront cost of the evaluation fee, and the constant risk of losing your funded account if you slip up. On top of that, you have to navigate the industry carefully to find firms that are legitimate and actually treat their successful traders well.

So, prop trading `is worth it` for traders who:

- Have a trading strategy that consistently makes money and has been tested.

- Are masters of disciplined risk management and following rules.

- Can handle the mental pressure of performing under scrutiny.

- Lack personal capital but have the proven ability to manage larger sums effectively.

- Do their homework and choose a reputable firm with fair conditions.

It’s probably not worth it for:

- Total beginners who are still learning the ropes.

- Traders who struggle with discipline or impulsive decisions.

- People who need a guaranteed paycheck or hate being restricted.

- Anyone not willing to put in the effort to research firms thoroughly.

Prop trading isn’t a magic bullet or a quick path to riches. It takes real skill, hard work, discipline, and smart choices. The industry is also changing fast, so you need to stay informed. The decision on whether you should trade with a prop firm boils down to an honest look at yourself and careful research.

Read More: How Much Do Prop Firm Traders Make?

Opofinance Services: Enhance Your Trading

Whether you choose the prop firm route or trade your own account, having a reliable forex broker behind you makes a difference. Opofinance, regulated by ASIC, provides a strong platform designed to help traders at every stage.

Here’s what makes Opofinance stand out:

- Advanced Trading Platforms: Take your pick from top platforms like MT4, MT5, cTrader, and the easy-to-use OpoTrade.

- Innovative AI Tools: Get an edge with smart tools like the AI Market Analyzer for insights, an AI Coach to help improve your trading, and AI Support for fast help.

- Social & Prop Trading Integration: Connect with other traders and explore options that might link with prop trading opportunities (always check the specifics with the prop firm).

- Secure & Flexible Transactions: Easily deposit and withdraw funds using safe and convenient methods, including popular cryptocurrencies.

- Zero Fees from Opofinance: Make deposits and withdrawals without Opofinance charging you any fees, letting you keep more of your money.

Opofinance offers a trading environment that’s secure, uses modern tech, and gives you flexibility. If you’re searching for a dependable broker to support your trading, check out what Opofinance brings to the table.

Conclusion

Deciding “should I trade with a prop firm?” is a major crossroads for any trader. It presents a very attractive way to trade with significant capital and aim for higher income, skipping the often slow process of growing a small personal account. The upsides, like less personal risk and access to better resources, are definitely appealing. But, the strict rules, the pressure of evaluations, sharing profits, and the critical task of finding a trustworthy firm are serious challenges.

Success really comes down to having proven skills, iron discipline, mental toughness, and choosing your firm wisely. It’s not a guaranteed win, but it’s a real opportunity for the right trader who’s ready for the demands. Weigh the good against the bad honestly, considering your own situation, before taking the plunge.

Key Takeaways

- Prop Trading in a Nutshell: Firms give you capital to trade; you pass a test first, then share the profits.

- Biggest Pro: Trade large sums without risking your own cash (besides the test fee).

- Biggest Cons: Tight rules (especially on losses), tough evaluations, profit sharing, and high pressure.

- Who Is It For?: Best for skilled, disciplined traders who lack capital; not great for beginners or those needing steady income.

- Choosing a Firm is Key: Look for good reputation, clear rules, fair terms, reliable payouts, and transparent fees.

- The Bottom Line: “Is prop trading worth it?” It can be, but it depends heavily on your skill, discipline, risk tolerance, and picking the right firm. It’s a chance to level up, not a shortcut. Asking yourself “should I trade with a prop firm?” requires serious self-reflection.

Can absolute beginners trade with a prop firm?

Generally, it’s not recommended. Prop firms are typically looking for traders who already have a working strategy that makes money consistently and who understand risk management inside out. The evaluation process itself is designed to weed out those who aren’t ready. If you’re just starting, you’re much better off practicing on a demo account or trading very small amounts of your own money to gain experience before trying the high-stakes environment of a prop firm challenge. Jumping in too early likely just means losing the evaluation fee.

What happens if my prop firm goes bankrupt?

This is a real risk you take when dealing with prop firms, particularly ones that are newer or less established. If the firm goes bust, there’s a strong chance you might not get paid any profit split you’re owed. Unlike traditional brokers who usually keep client money separate, the capital you trade belongs to the prop firm, and your profit share is essentially like being an unsecured creditor. This really highlights why it’s so important to pick reputable, well-established firms and maybe think about taking out your profits regularly instead of letting them build up too high.

Are profits earned from a prop firm taxed differently?

How your prop firm earnings are taxed really depends on where you live and your personal financial situation. In many places, the money you get from a prop firm (your profit split) is treated as income from self-employment or contract work, not as capital gains from personal investments. This usually means it’s taxed at your regular income tax rate and you might also have to pay self-employment taxes. It’s super important to talk to a qualified tax advisor in your country to figure out exactly what you owe, because the rules can be very different from one place to another.