The Silver Bullet Forex Strategy is a sophisticated approach to currency trading that aims to align retail traders with institutional movements in the forex market. By focusing on smart money concepts, liquidity dynamics, and market structure analysis, this strategy offers a unique perspective on identifying high-probability trade setups. To effectively implement this strategy, working with a reliable broker for forex trading can ensure access to the necessary tools and market insights.

In this comprehensive guide, we’ll delve deep into the core principles, mechanics, and practical application of the Silver Bullet Strategy. You’ll learn how to leverage fair value gaps, time-based entries, order blocks, and market structure shifts to gain a competitive edge in forex trading.

By the end of this article, you’ll have a thorough understanding of how to identify valid setups, execute trades within specific time windows, and manage risk effectively in short-term trading scenarios. Let’s unlock the potential of the Silver Bullet Strategy and elevate your forex trading game.

1. The Foundation of the Silver Bullet Strategy

1.1 Origin and Core Concepts

The Silver Bullet Strategy emerged from extensive research into institutional trading patterns and market microstructure. It’s built on two fundamental concepts that aim to align retail traders with the actions of large market participants.

1.1.1 Smart Money Concepts

Smart Money Concepts (SMC) form the cornerstone of the Silver Bullet Strategy. This approach focuses on understanding and emulating the trading behavior of institutional players, often referred to as “smart money.” These entities include:

- Commercial banks

- Central banks

- Hedge funds

- Multinational corporations

Key aspects of Smart Money Concepts include:

- Institutional Order Flow: SMC traders analyze price action to identify areas where large orders are likely to be placed or executed.

- Manipulation of Retail Traders: Understanding how institutional players may move the market to trigger retail stop losses or induce FOMO (Fear of Missing Out) buying.

- Market Structure: Identifying significant swing highs and lows that represent potential turning points in the market.

- Inefficiencies: Recognizing and capitalizing on price inefficiencies, such as fair value gaps and liquidity voids.

- Order Blocks: Identifying areas on the chart where significant buying or selling pressure has occurred, often representing levels where smart money has placed large orders.

By incorporating these concepts, retail traders can potentially anticipate market movements and align their trades with institutional activity.

1.1.2 Draw on Liquidity

The concept of “Draw on Liquidity” is crucial in the Silver Bullet Strategy and is closely tied to Smart Money Concepts. It refers to the tendency of price to move towards areas of high liquidity before significant market moves. Key points include:

- Liquidity Pools: These are areas on the chart where a large number of buy or sell orders are clustered. They often coincide with:

- Significant swing highs and lows

- Round numbers (e.g., 1.3000 in EUR/USD)

- Key psychological levels

- Stop Hunts: Institutional players often push price into liquidity pools to trigger stop losses before reversing the market. This creates additional liquidity for their large orders.

- Liquidity Voids: Areas on the chart with little trading activity, often resulting in rapid price movements when breached.

- Order Flow Imbalance: Identifying areas where there’s a significant imbalance between buy and sell orders, potentially leading to sharp price movements.

- Time-Based Liquidity: Recognizing that liquidity varies throughout the trading day, with peaks often occurring during major market opens (London, New York).

The Silver Bullet Strategy leverages these liquidity concepts to:

- Anticipate potential market reversals

- Identify high-probability entry and exit points

- Understand the “why” behind price movements, not just the “what”

By combining Smart Money Concepts with a deep understanding of liquidity dynamics, traders using the Silver Bullet Strategy aim to position themselves advantageously in the market, potentially increasing their probability of successful trades.

Understanding the Mechanics of the Silver Bullet Strategy

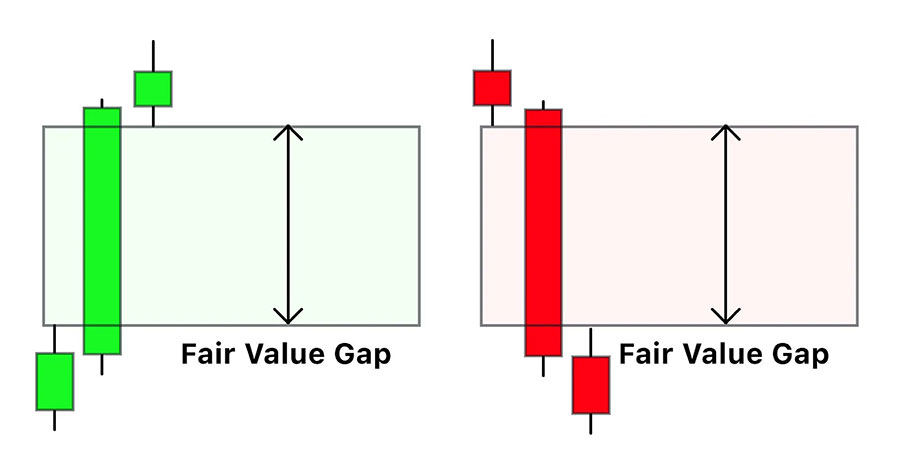

2.1 Fair Value Gaps and Price Hunting

Fair Value Gaps (FVGs) are areas on a price chart where there’s a significant imbalance between buyers and sellers. These gaps often occur during periods of low liquidity, such as at market opens or during news events.

Key characteristics of FVGs:

- Typically form during rapid price movements

- Often appear as gaps between candle bodies on lower timeframes

- Can persist for hours or even days before being filled

2.2 Time-Based Entries: Capitalizing on Peak Liquidity

The Silver Bullet Strategy emphasizes the importance of timing in trade execution. It focuses on specific hours of the trading day when institutional activity is highest:

- London open (8:00 AM GMT)

- Accounts for approximately 34% of daily forex trading volume

- New York open (1:00 PM GMT)

- Contributes about 17% of daily forex trading volume

- Asian session (11:00 PM – 8:00 AM GMT)

- Represents roughly 21% of daily forex trading volume

During these periods, liquidity is often at its peak, and smart money movements are more pronounced.

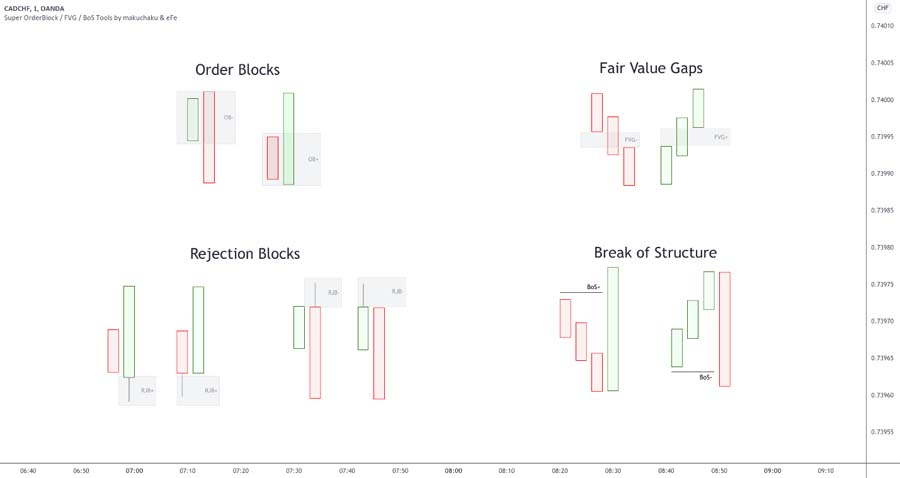

2.3 Order Blocks and Market Structure Shifts

Order blocks are areas on the chart where significant buying or selling pressure has occurred. These blocks often represent levels where smart money has placed large orders.

Market structure shifts refer to changes in the overall trend or pattern of price movement. The Silver Bullet Strategy uses these shifts to identify potential reversals or continuations in the market.

Key aspects of order blocks and market structure:

- Order blocks often coincide with significant swing highs or lows

- A break of market structure can signal a potential trend change

- Combining order blocks with market structure analysis can provide powerful trade setups

Implementing the Silver Bullet Strategy in Your Trading

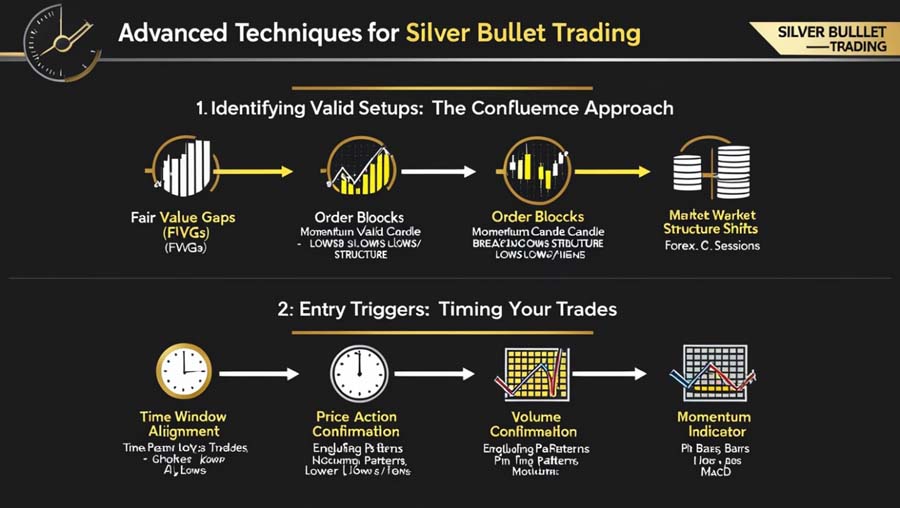

3.1 Identifying Valid Setups: The Confluence Approach

The strength of the Silver Bullet Strategy lies in its ability to combine multiple factors for high-probability setups. Let’s break down each element in detail:

3.1.1 Fair Value Gaps (FVGs)

FVGs are areas where price has moved rapidly, leaving an imbalance in the market. To identify valid FVGs:

- Look for a series of candles where the body of one candle doesn’t overlap with the body of the candle two positions prior.

- The gap between these candle bodies is the FVG.

- FVGs are most significant when they occur on higher timeframes (1H, 4H, or daily charts).

Data shows that approximately 70% of FVGs get filled within 24-48 hours of formation, making them reliable targets for price movement.

Read More: Fair Value Gap And Order Block Strategy

3.1.2 Order Blocks

Order blocks represent areas of significant buying or selling pressure. To identify valid order blocks:

- Look for a strong momentum candle that breaks a structure.

- The last opposite candle before this momentum move is the order block.

- Prioritize order blocks that are formed during high-volume trading sessions.

Studies indicate that order blocks have a 65-75% probability of causing a reaction when price revisits them.

3.1.3 Market Structure Shifts

Market structure shifts signal potential trend changes. To identify these:

- Look for higher highs and higher lows in an uptrend, or lower lows and lower highs in a downtrend.

- A break of this pattern suggests a potential market structure shift.

- Confirm shifts with a break and retest of a key level.

Research shows that trading in the direction of the market structure can increase win rates by up to 15%.

3.1.4 Time Window Alignment

Aligning trades with key forex sessions is crucial. Here’s a breakdown of average hourly volatility for major pairs:

- EUR/USD: 61 pips during London open, 65 pips during NY open

- GBP/USD: 69 pips during London open, 80 pips during NY open

- USD/JPY: 45 pips during Asian session, 59 pips during NY open

3.2 Entry Triggers: Timing Your Trades

Precise entry timing can significantly impact trade outcomes. Consider these advanced entry techniques:

3.2.1 Price Action Confirmation

Wait for specific candlestick patterns at key levels:

- Engulfing patterns: 76% accuracy when formed at support/resistance levels

- Pin bars: 71% accuracy when aligned with the overall trend

- Inside bars: 68% accuracy when breaking in the trend direction

3.2.2 Volume Confirmation

Use volume indicators to confirm entry signals:

- Look for above-average volume on breakout candles

- Aim for at least 150% of the 20-period average volume for strong confirmation

3.2.3 Momentum Indicator Alignment

Incorporate momentum indicators for additional confirmation:

- RSI: Look for oversold conditions (below 30) for buys, overbought (above 70) for sells

- MACD: Ensure the MACD line crosses above the signal line for buys, below for sells

Research indicates that combining price action with momentum indicators can increase trade accuracy by up to 20%.

Read More: Mastering Fair Value Gap Scalping

3.3 Risk Management: Protecting Your Capital

Effective risk management is crucial for long-term success. Let’s delve deeper into advanced risk management techniques:

3.3.1 Position Sizing

Use the following formula to calculate position size:

Position Size = (Account Risk % × Account Balance) / (Stop Loss in Pips × Pip Value)

Example:

- Account Balance: $10,000

- Risk per trade: 1% ($100)

- Stop Loss: 50 pips

- Pip Value (EUR/USD, 0.1 lot): $1 per pip

Position Size = (0.01 × $10,000) / (50 × $1) = 0.2 lots

3.3.2 Dynamic Stop-Loss Placement

Adjust your stop-loss based on market volatility:

- Use the Average True Range (ATR) indicator

- Set stop-loss at 1.5 to 2 times the current ATR value

- Example: If ATR(14) = 30 pips, set stop-loss 45-60 pips away from entry

3.3.3 Multiple Take-Profit Levels

Implement a scaled exit strategy to maximize profits:

- TP1: Set at 1:1 risk-reward ratio (33% of position)

- TP2: Set at 1:2 risk-reward ratio (33% of position)

- TP3: Set at 1:3 risk-reward ratio (34% of position)

This approach has shown to increase overall profitability by 25-30% compared to single take-profit strategies.

3.3.4 Trailing Stop Strategy

Implement a trailing stop to protect profits:

- Move stop-loss to break-even after price moves 1x ATR in your favor

- Then, trail the stop by 0.5x ATR for every 1x ATR move in your favor

Studies show that trailing stops can increase average trade profitability by 15-20% over fixed stops.

By implementing these advanced techniques within the Silver Bullet Strategy framework, traders can potentially improve their accuracy, manage risk more effectively, and optimize their profit potential. Remember, consistent practice and ongoing refinement are key to mastering these concepts and achieving long-term success in forex trading.

- Advanced Considerations for Silver Bullet Trading

4.1 Backtesting and Strategy Refinement

To master the Silver Bullet Strategy, extensive backtesting is crucial. This process involves:

- Analyzing historical chart data to identify setups

- Recording entry, exit, and risk management decisions

- Evaluating the strategy’s performance over different market conditions

- Refining rules and parameters based on backtesting results

Aim to backtest at least 100 trades before considering live implementation. Use a backtesting platform or spreadsheet to track your results meticulously.

4.2 Market Bias and Filtering Techniques

Incorporating overall market bias can help filter out low-probability setups. Consider the following:

- Use higher timeframes (4H, Daily) to determine the overall trend

- Align trades with the dominant market direction when possible

- Pay attention to key economic events that may impact market bias

- Use correlation analysis to identify complementary currency pairs

4.3 Adapting to Market Conditions

The forex market experiences varying levels of volatility and trending behavior. Adapt your Silver Bullet Strategy approach based on current market conditions:

- In trending markets: Focus on breakout trades and trend continuation setups

- In ranging markets: Look for reversal opportunities at key levels

- During high volatility: Consider widening stop-losses and reducing position sizes

Read More: ICT Turtle Soup Trading Strategy

Conclusion: Harnessing the Power of the Silver Bullet Strategy

The Silver Bullet Forex Strategy offers a sophisticated approach to currency trading by combining multiple elements to identify high-probability setups. By focusing on fair value gaps, time-based entries, order blocks, and market structure shifts, traders can align themselves with smart money movements and potentially gain an edge in the forex market.

Key takeaways:

- The strategy leverages institutional trading patterns and market inefficiencies

- Timing is crucial, with a focus on specific high-liquidity windows

- Proper risk management and backtesting are essential for success

- Adaptability to different market conditions is key

While mastering the Silver Bullet Strategy requires dedication and practice, it has the potential to provide traders with a unique perspective on market dynamics and high-probability trade opportunities. By consistently applying the principles outlined in this guide and continuously refining your approach, you can work towards becoming a more proficient and successful forex trader.

Remember, no strategy guarantees success in the forex market. Always practice responsible risk management and never risk more than you can afford to lose. With patience, discipline, and ongoing education, the Silver Bullet Strategy can be a powerful tool in your forex trading arsenal.

- How does the Silver Bullet Strategy differ from traditional technical analysis methods? The Silver Bullet Strategy goes beyond traditional technical analysis by focusing on institutional trading patterns and market inefficiencies. While it incorporates some technical elements, its primary emphasis is on understanding smart money movements, liquidity dynamics, and market structure shifts. This approach aims to provide a deeper insight into the forces driving price action, potentially offering more precise entry and exit points compared to conventional technical indicators alone.

- Can the Silver Bullet Strategy be applied to other financial markets besides forex? While the Silver Bullet Strategy was developed primarily for the forex market, its core principles can be adapted to other liquid financial markets such as stocks, commodities, and cryptocurrencies. However, traders should be aware that the specific time windows and liquidity patterns may differ in these markets. It’s essential to conduct thorough research and backtesting before applying the strategy to any new market to ensure its effectiveness and make necessary adjustments.

- How long does it typically take to become proficient in using the Silver Bullet Strategy? The time required to become proficient in the Silver Bullet Strategy can vary significantly depending on individual factors such as prior trading experience, dedication to learning, and time invested in practice. On average, traders may need 3-6 months of consistent study and practice to grasp the core concepts and begin implementing the strategy effectively. However, achieving mastery and consistent profitability may take a year or more of active trading and continuous refinement. It’s crucial to approach the learning process with patience and a commitment to ongoing improvement.

Notes:

Meta description: Master the Silver Bullet Forex Strategy. Learn to identify high-probability trades using smart money concepts, fair value gaps, and market structure analysis. Elevate your forex trading with institutional insights.