In the ever-evolving world of trading, two analytical frameworks have captured the attention of both retail and macro traders: the Smart Money Concept (SMC) and Supply and Demand (S&D) trading. Both analytical frameworks claim to decipher the invisible hand that guides the markets, but differ in their implementation and philosophy. Supply and demand trading focuses on identifying areas on the chart where the price is likely to react due to an imbalance between buyers and sellers. Smart money concepts, however, are more focused on tracking the behavior and strategies of institutional traders. As institutional trading strategies become more accessible to retail traders through various platforms and educational institutions, understanding which approach offers the greatest advantage has become increasingly important.

Without any bias towards the use of the approaches, this article will examine the concept of Smart Money Supply and Demand, highlighting the origins, principles, practical applications, and how using which concept in different market situations can help traders achieve their goals, and how combining smart money concept vs supply and demand can create more strategic trading opportunities.

What Is the Smart Money Concept (SMC)?

The Smart Money Concept (SMC) strategy is based on tracking the behavior of major market players who manipulate price movements to accumulate liquidity. The primary goal is to follow Smart Money, utilizing their algorithmic patterns based on price shifts between liquidity zones. The SMC approach emphasizes:

- Order Blocks: Price areas where powerful institutions and banks have placed large orders, which often lead to price changes or changes in the direction of the market trend.

- Fair Value Gaps (FVGs): A price range with little trading due to sudden moves. Traders use FVGs for entry, exit, and support/resistance, but should combine them with other indicators for accuracy.

- Liquidity Pools: Zones where stop-loss orders accumulate and institutions or banks may target them to fill their positions. One of the most frequent times when liquidity pools fill up is when important economic data is released, especially speeches by influential figures in the world economy, which sometimes accelerate the process of filling these pools and reaching the desired price.

- Break of Structure (BOS) & Change of Character (CHoCH): A break of structure (BOS) is a phenomenon that confirms trend continuation. Meanwhile, a change of character (CHoCH) is an indication of trend shifts or momentum changes that signals a potential reversal in the trend.

The concept stems from Wyckoff’s accumulation/distribution model and was recently refined by Inner Circle Trader (ICT) and other institutional trading educators. It’s more than price-action—it’s psychology, intention, and execution strategy wrapped into one.

Read More:Identify Order Blocks in Forex

Understanding Supply and Demand Trading

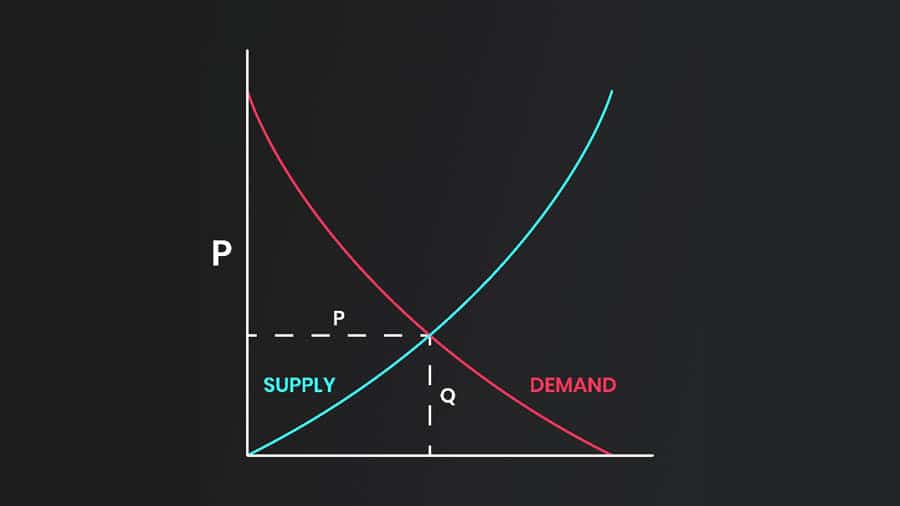

Supply and demand (S&D) trading is a price action-based trading strategy that is similar to horizontal support and resistance. It is based on the fundamental dynamics of supply and demand, which influence financial markets just as they do in the broader economy. It works on a core economic principle:

- When demand exceeds supply, prices rise; when supply exceeds demand, prices fall.

Smart Money Concept vs Supply and Demand trading is often seen as more complex and less visual. supply and demand focus less on manipulation and more on volume and balance. Supply and demand zones are usually formed when the price rallies or drops sharply from a consolidation area. Traders aim to:

- Identify fresh zones: To identify supply and demand zones, you have to look at consolidations before the large expansions. The demand zones are found in consolidations before a large move up. The supply zones are found in consolidations before the large move down. The larger and more aggressive the move, the more significant the Supply or Demand zone is.

- Anticipate bounces or breaks: As a smart trader, always anticipate bounces or breakouts when these zones are touched, and don’t be surprised. When price returns to these zones, it often responds by continuing or reversing.

- Use confluences: Trend lines, candlestick patterns, and different time frames all increase the accuracy of the analysis, allowing for more accurate identification of supply and demand zones, and are also very effective in providing safe entry prices.

Smart Money Concept vs Supply and Demand: Key Differences & Overlaps

Smart Money Concepts is a trading approach that focuses on understanding the behavior of institutional traders. SMC traders believe that large financial institutions control the market and that their buying and selling activities create supply and demand zones. Though many traders treat them separately, the smart money concept vs supply and demand trading overlap significantly:

| Concept | Smart Money Concept | Supply & Demand |

| Focus | Institutional manipulation & intent | Order imbalances |

| Factors | Order blocks, FVGs, BOS, CHoCH | Zones of rapid price movement |

| Liquidity Theory | Core to strategy | Less emphasized |

| Visual Simplicity | More complex | Easier to identify |

| Zone Identification | Based on institutional footprints | Based on historical price action |

| Reaction to Price | Including fake breakouts and stop hunts | Traditional support/resistance principles |

Order blocks, often used in SMC, are essentially refined supply/demand zones, enhanced with context of liquidity grabs, where price purposely sweeps highs/lows—often occur right before reacting to these zones.

Institutions, banks, or market makers may push the price through a demand zone to collect liquidity and then reverse. This is where SMC adds psychological depth to the more mechanical S&D method.

Read More:Identify liquidity in forex

Integration: Tools, Techniques & Chart Examples

In practical terms, many successful traders do not restrict themselves to only one method and integrate both strategies to enhance their edge. This hybrid approach helps filter out noise, enhances accuracy, and increases the probability of high R/R trades. Here’s how:

- Use Supply/Demand to Set Context: Start with macro zones.

- Refine Entries with SMC: Identify order blocks, BOS/CHoCH within those zones.

- Track Liquidity: Look for recent highs/lows near your zones.

- Incorporate Fair Value Gaps: These act as magnets for price action.

Pros and Cons of Each Approach

Although success in the financial markets using a framework or strategy does not necessarily mean endorsing every aspect of that strategy and recommending it to all traders, the undisputed secret to success in using strategies is personalizing these methods. Both approaches, the smart money concept vs supply and demand, have strengths. Combining them can yield better results than using either in isolation. In this section, we will examine the advantages and disadvantages of the Smart Money Concept vs Supply and Demand:

| Approach | Pros | Cons |

| Smart Money Concept | Follows institutional footprints | Steeper learning curve |

| Offers deeper market insight | Requires more chart time and backtesting | |

| Useful for precision entries | Heavily reliant on subjective zone marking | |

| Supply and Demand | Simple, visual, and fast to apply | Zones can sometimes be ambiguous or inconsistent |

| Effective for all timeframes | Lack of psychological depth | |

| Easier for beginners | Higher chance of false signals |

Practical Tips for Traders

As mentioned earlier, strategies and frameworks in financial markets, especially Smart Money Concept vs Supply and Demand, do not have significant advantages over each other except in the process of personalization, which differentiates the performance of one trader from another. Here are some practical tips that will improve trader performance in order to achieve better results:

- Master one method first. Most traders start with price action principles to gain a basic understanding of the market. They identify and learn supply and demand zones well, and then move on to SMC.

- Use multi-timeframe analysis. Just following and analyzing only one trading time frame cannot guarantee the accuracy of the analysis at all. Moreover, most institutional moves often start on higher time frames. So, the most reliable method is multi-time frame market analysis.

- Apply strict risk management. Never forget that the first principle of survival in the financial markets is to preserve capital with careful risk management. Regardless of using the best trading strategies, risk management and calculating a logical risk/reward ratio come before anything else.

- Demo and backtest. Although demo trading cannot replicate the feel of real trading in terms of controlling emotions for the trader, undoubtedly, nothing can improve your experience and confidence like backtesting your trading strategy and method by analyzing historical data.

- Avoid overtrading. Any method or strategy in the financial markets, like the smart money concept vs supply and demand, can become exhausting and exhausting for you after a while, so be careful not to fall into the over-trading trap. Always prefer quality over quantity in trading.

Read More: Multiple Timeframe Strategy

Conclusion

It is important to remember that no strategy is 100% in the trading market. In the battle of Smart Money Concept vs Supply and Demand, there’s no universal winner. The real winner is the trader who tries to achieve a unique way of making money by personalizing each of these two strategies. SMC offers a psychological advantage by understanding institutional intent, while S&D trading can be more helpful to novice or less experienced traders with its simplicity and clarity. For serious traders, the best approach is often a combination of both – aligning institutional areas with basic economic principles.

Master the core of smart money supply and demand, layer them thoughtfully, and you’ll begin to see the markets not as chaotic, but as strategic games played by the biggest players. Let your strategy reflect their footprints.

Can retail traders consistently profit using Smart Money Concepts?

Yes—but with caveats. SMC requires a strong understanding of price action, liquidity dynamics, and patience. Without sufficient practice and psychological discipline, this strategy can’t work effectively and can lead to over-trading or erroneous entries. However, once you gain the necessary experience, it can provide extraordinary accuracy once you master it.

Is Supply and Demand trading suitable for both intraday and swing trading?

Absolutely. This strategy scales well. Day traders use smaller areas and faster confirmations, while swing traders scrutinize major daily/weekly and even monthly areas. The key is to align your entries with the overall trend and market structure.

Do I need volume or Level II data to use Smart Money Concepts effectively?

Not necessarily. While advanced tools help, most SMC strategies rely on price action and structure alone. Many ICT-based traders work with standard charts. That said, order flow and footprint charts can offer additional confirmation.