Have you ever felt like the market has a personal vendetta against you? You spot the perfect trade, follow all the rules you learned, place your stop loss exactly where the textbook says, and then watch in frustration as the price nosedives, clips your stop by a single tick, and then skyrockets in the direction you originally predicted. If that sounds familiar, I want you to know you’re not alone, and it’s not your fault. What you’ve experienced is the invisible war that defines the market: the constant clash of smart money concepts vs retail traders.

The truth that took me years to learn is that the market isn’t random; it’s engineered. The key to flipping the switch on your trading results is to stop thinking like everyone else and start seeing the game for what it is. This guide is my attempt to share that perspective with you. We’re going to pull back the curtain on why your strategies might be failing and how the market’s biggest players—the “smart money”—really operate. Finding a great online forex broker is a good start, but understanding the smart money vs retail traders dynamic is what will truly change your journey.

Key Takeaways

- The Real Conflict: The market isn’t about patterns; it’s a battle for liquidity. Smart money needs to trigger retail stop losses to fill their huge orders, creating the core conflict between smart money concepts vs retail traders.

- The Retail Trap: Most common trading tools like trend lines, RSI, and classic support/resistance are predictable. They lead traders into placing stops in concentrated areas, which become targets.

- Follow the Footprints: Institutions leave clues. Concepts like Order Blocks (OB), Fair Value Gaps (FVG), and Market Structure Shifts (MSS) are the footprints you can learn to follow.

- Liquidity is King: The most vital shift in thinking is understanding that the market is designed to move toward pools of stop-loss orders (liquidity). Price doesn’t just randomly turn at a line; it’s drawn to these zones.

- A New Game Plan: A simple SMC strategy involves waiting for the market to raid a liquidity zone, confirming a reversal with a Market Structure Shift, and entering on a pullback to an institutional reference point like an Order Block.

- Trade Like a Machine: The biggest edge smart money has is psychological. They are patient and unemotional. Learning to adopt this mindset is just as critical as the technicals.

The Core Conflict: Smart Money vs. Retail Traders

At its core, the financial market is a zero-sum game. For someone to win, someone else has to lose. This game is dominated by a fundamental conflict between two opposing sides: the institutional “smart money” and the individual “retail traders.” It’s less of a fair fight and more of a predator-and-prey dynamic, where one group’s massive influence shapes the environment for everyone else.

Why This Insight Is Your Ultimate Trading Edge

That feeling of the market being “rigged” isn’t just a feeling; it’s a reflection of a deeper truth. When your stop loss gets hunted, it’s because your actions, and the actions of millions of other retail traders, were predictable. We are all taught the same things, and that makes us easy targets.

When I finally understood the real nature of the smart money concepts vs retail traders battle, everything changed for me. I stopped being the victim and started to see the logic behind the moves that once confused me. This understanding is the only real edge in trading. It allows you to anticipate where the market is likely to go by figuring out who it’s targeting next.

What We’ll Uncover in This Guide

Think of this guide as a new playbook. First, we’ll take an honest look at the typical retail trader—the tools we use, the strategies we’re taught, and the emotional traps we all fall into. Then, we’ll expose “smart money,” showing you who they are and what they’re really after. We’ll put these two approaches side-by-side to highlight the stark differences. Most importantly, I’ll break down the core Smart Money Concepts in plain English and give you a simple, step-by-step way to start using this powerful lens to analyze the markets.

The Retail Trader’s Playbook and Its Traps

If you’re trading your own money through a broker, you’re a retail trader. We are the millions of individuals trying to carve out our own success in the markets. We come from all walks of life, but we often enter the arena armed with the same, flawed map, wondering why it keeps leading us off a cliff.

Who Are We, the Retail Traders?

We’re the ambitious ones. We spend hours learning, watching videos, and reading books. We’re taught to find the “holy grail” indicator or the perfect chart pattern. We diligently draw our trend lines, identify what we believe are “strong” support and resistance zones, and look for textbook signals. I remember my early charts were a spaghetti-like mess of moving averages and oscillators. I believed success was just one more indicator away. The problem is, this entire approach is built on a misunderstanding of what actually drives price.

Our Common Toolkit: A Recipe for Failure?

The tools given to retail traders almost seem designed to make us lose. They are all based on old price data, meaning they are always late to the party.

- Moving Averages: The classic “golden cross” or “death cross” is a signal that so many traders wait for. In my experience, by the time that signal prints, the real move is often halfway done, and you’re being invited in just as the smart money is looking to exit.

- RSI and Oscillators: We’re told to sell when the RSI is “overbought” (above 70) and buy when it’s “oversold” (below 30). But how many times have you sold in an overbought market only to watch it climb another 200 pips? These conditions can persist for a long time in a strong trend, and trading against them is a quick way to drain your account.

- Support and Resistance: This is the biggest trap of all. We’re taught to buy at support and sell at resistance. The issue is, these obvious levels are where everyone else is placing their orders and, crucially, their stop losses. These zones become giant pools of liquidity, and as we’ll see, they are the primary target for institutional players. The whole dynamic of smart money vs retail traders hinges on this fact.

The Emotional Game: Fear, Greed, and FOMO

More than any flawed tool, our own psychology is our worst enemy. The retail trading experience is an emotional storm. First, there’s the Fear of Missing Out (FOMO). We see a candle rocketing up, and we jump in at the top, afraid of missing the ride. This is often the exact moment smart money is selling their positions to us.

Then, after a few painful losses, the fear of being wrong kicks in. We get into a good trade, but we snatch our profits at the first sign of a pullback, leaving a huge move on the table. Or worse, we hesitate and miss the entry altogether. This emotional decision-making is a direct result of not understanding the market’s true intentions. The psychological aspect of the smart money concepts vs retail traders debate cannot be overstated.

Read More: The Smart Money Concept

Unmasking “Smart Money”: The Market’s Giants

On the other side of your trade is “smart money.” This isn’t some secret society, but rather the market’s largest players: the big banks, hedge funds, and financial institutions that move colossal amounts of capital. They don’t play by our rules; they create the rules. Their actions are the cause, and the price charts we see are simply the effect.

Who Exactly Are the “Smart Money” Players?

Think of the giants of the financial world: J.P. Morgan, Goldman Sachs, major central banks, and massive hedge funds. These institutions are executing orders worth hundreds of millions or even billions of dollars. They can’t just press a “buy” button like we do. If they did, their own order would spike the price against them, resulting in a terrible entry. This simple operational problem is the key to everything. It forces them to be clever, and their “clever” tactics are what we can learn to spot.

The Ultimate Goal of Smart Money: Finding Liquidity

If you remember one thing from this article, let it be this: the primary goal of smart money is to find liquidity. Liquidity is just a fancy word for a large number of orders available to trade against. Since they need to buy or sell massive positions, they have to find an equally massive number of people willing to take the other side of their trade.

And where is the easiest, most predictable place to find a huge pool of orders? It’s right where retail traders are told to place their stop losses. A stop loss on a buy trade is a market sell order. A stop loss on a sell trade is a market buy order.

Imagine smart money wants to buy 100,000 lots of EUR/USD. To do that, they need people to sell 100,000 lots to them. So, they will engineer price to look weak, push it below a “key support level,” and trigger the thousands of retail sell-stop orders waiting there. As all these sell orders flood the market, smart money quietly buys them all up, accumulating their huge position at a great price before they reveal their true intention and send the price flying upwards.

How Smart Money Engineers the Market

Smart money moves the market in a deliberate, two-phase cycle. This cycle is designed to mislead the retail crowd and build up the liquidity they need.

- Accumulation (Loading Up): In this phase, smart money wants to buy. To get a good price, they need to make the market look weak. They might create a “head and shoulders” pattern or break a trend line, tricking retail traders into selling. As the retail herd sells in panic, smart money is on the other side of the trade, quietly absorbing all those sell orders and building their long position.

- Distribution (Unloading): After accumulating their position and driving the price way up, it’s time to take profit. To do this, they need to sell their massive holdings. Now, they need to make the market look incredibly bullish. They’ll engineer a powerful breakout above a “key resistance level.” This creates intense FOMO, and retail traders rush in to buy the breakout. As the retail crowd is enthusiastically buying, smart money is selling their positions to them at the top. This is the essence of the smart money vs retail traders game.

This cycle of accumulation, manipulation, and distribution is the engine of the market. Your job is to learn to see it happening.

Read More: Market Makers in Forex Market

Key Differences: Smart Money vs. Retail Traders

To truly shift your perspective, let’s put the two approaches side-by-side. The way a retail trader and an institutional trader see the market are worlds apart. Grasping these differences is how you begin to move from one column to the other. The entire framework of smart money concepts vs retail traders is built on these opposing views.

Market View: Static Lines vs. Pools of Money

- Retail Trader: I used to see the chart as a roadmap of lines. A support level was a floor, a resistance level was a ceiling. I thought these lines had some magical power to hold the price. My strategy was based on these static points.

- Smart Money: They see these lines completely differently. A support level isn’t a floor; it’s a giant pool of sell-stop orders sitting just below it. A resistance level isn’t a ceiling; it’s a magnet for price because of all the buy-stop orders above it. Their entire strategy is about driving price to these “liquidity pools” to fuel their next move.

Primary Tools: Lagging Indicators vs. Raw Price Action

- Retail Trader: We are taught to rely on lagging indicators. The RSI, MACD, and Stochastics are all just different ways of looking at what price has already done. By the time an indicator gives you a signal, you are often the last person to the party.

- Smart Money: They don’t need indicators because they are the ones creating the price move. They study pure price action and order flow. Their “tools” are the footprints they leave behind—the concepts we’re about to cover. This is a critical distinction in the smart money concepts vs retail traders debate.

Entry Tactic: Chasing Breakouts vs. Engineering Entries

- Retail Trader: Our natural instinct, amplified by most trading education, is to chase breakouts. When price smashes through a resistance level, the FOMO is overwhelming, and we jump in. I can’t count how many times I bought a “breakout” only to be immediately reversed on. I was providing the exit liquidity for the institutions.

- Smart Money: They don’t chase price; they wait for price to come to them. They often engineer the breakout themselves to induce retail traders into the market. Once that liquidity is grabbed and the trap is set, they enter on the pullback to a specific, strategic price point they created earlier.

Trading Mindset: Emotional vs. Mechanical & Patient

- Retail Trader: Our trading is often driven by a storm of emotions. We feel invincible after a win and crushed after a loss. We revenge-trade, we get greedy, we get scared. Our decisions are impulsive and reactive. The psychological edge is perhaps the biggest factor in the lopsided smart money vs retail traders battle.

- Smart Money: Their operations are planned weeks, sometimes months, in advance. Their execution is mechanical, patient, and precise. They wait for the perfect setup, where liquidity is ripe for the taking. They operate like a casino, knowing they have a statistical and psychological edge, and they execute their plan without emotion.

Core Smart Money Concepts in Plain English

To start thinking like smart money, you have to learn their language. Smart Money Concepts (SMC) are the set of tools that allow us to read their footprints on the chart. This is where the smart money concepts vs retail traders theory becomes a practical, actionable strategy that you can use.

Liquidity: The Market’s Fuel

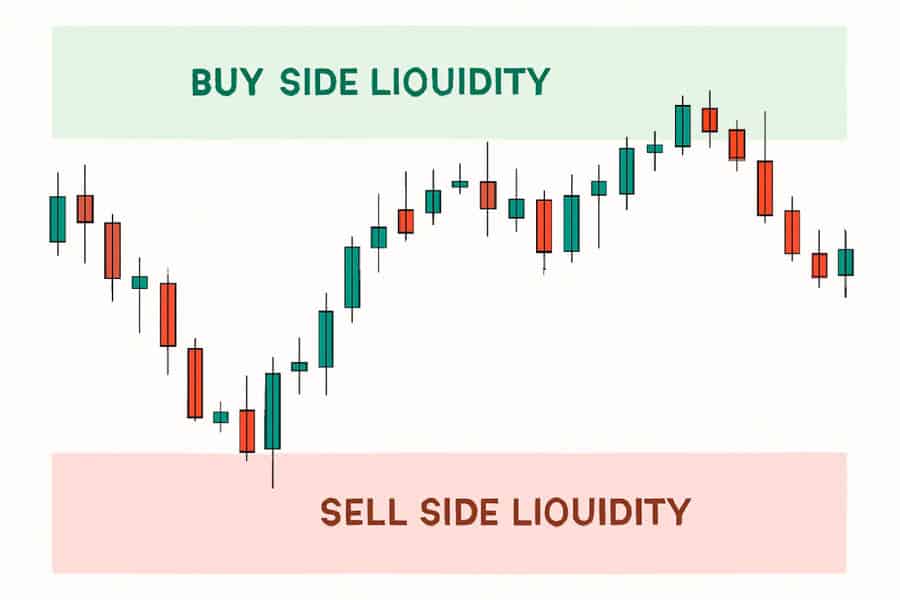

This is the most important concept. Liquidity is where the money is. On a chart, it’s where large groups of traders have placed their stop-loss orders. The market is like a heat-seeking missile, and these pools of liquidity are its target.

- Buy-Side Liquidity: Think of any obvious high on the chart, especially a “double top.” Above that high sits a massive pool of buy-stop orders (from people shorting the market) and breakout buy orders. Smart money will often push price to that level specifically to trigger those orders.

- Sell-Side Liquidity: Now, think of any obvious low, especially a “double bottom” or a clear support level. Below that low is a huge cluster of sell-stop orders (from people in buy trades). Price is drawn to these zones like a magnet.

- The Big Shift: From now on, when you see a clear high or low, don’t think “ceiling” or “floor.” Think “target.”

Order Blocks (OB): The Institutional Footprint

An Order Block is the clearest evidence of smart money’s involvement. It’s a specific candle that shows where a big institution likely placed a massive order, kickstarting a powerful move.

- Bullish Order Block: This is the last down-close candle right before a strong, explosive move to the upside. In that little down candle, smart money was likely absorbing all the selling pressure to load up on their buy positions before sending it higher. Price loves to come back and re-test this zone before continuing up.

- Bearish Order Block: This is the last up-close candle right before a huge, aggressive drop in price. This is a spot where institutions were likely distributing their long positions or loading up on shorts. Price will often pull back to this zone before continuing its fall.

- Why They’re Your New Best Friend: Order Blocks become your high-probability entry zones. Instead of chasing a move, you patiently wait for price to return to this institutional footprint.

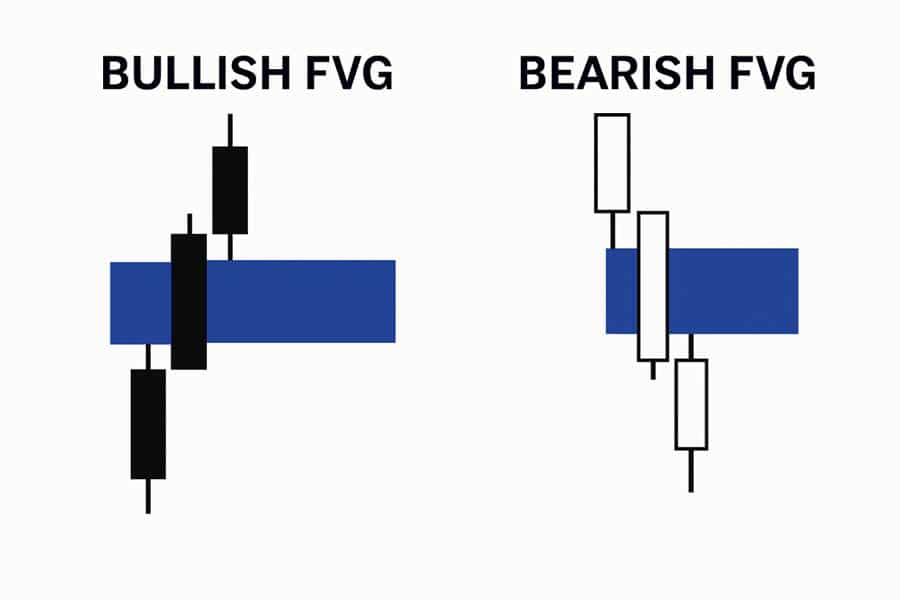

Fair Value Gaps (FVG): Signs of an Aggressive Move

A Fair Value Gap (or Imbalance) is another key footprint. It’s a 3-candle pattern that shows price moved so fast and so aggressively that it left a “gap” or an inefficiency in the market.

- How to Spot It: Look at three candles in a row. If there’s a space between the top of the first candle’s wick and the bottom of the third candle’s wick, that space in the middle candle is the FVG.

- What It Tells You: This gap screams institutional activity. It shows smart money shoved the market in one direction with extreme force.

- How to Use It: The market likes to be efficient, so it often comes back to “fill” these gaps. Just like an Order Block, an FVG can act as a powerful magnet and a precise entry point for your trade.

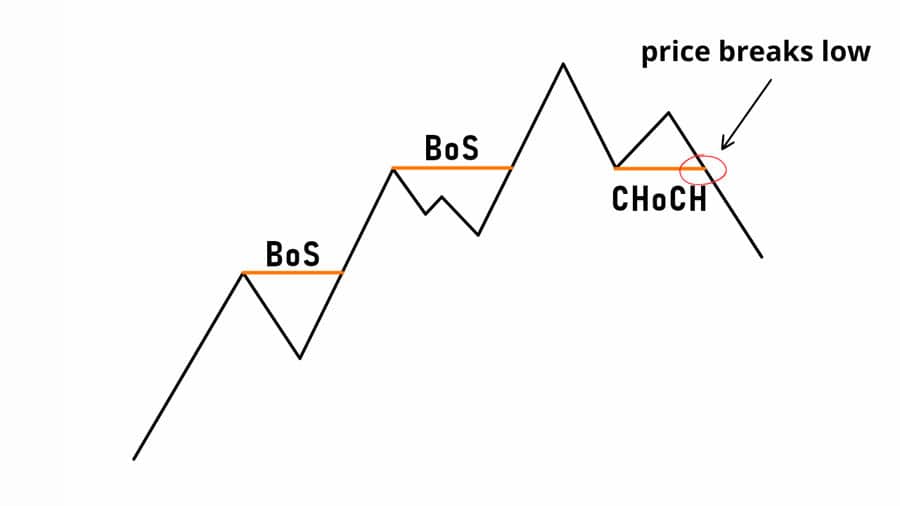

Market Structure Shift (MSS): Your Confirmation Signal

This is your go-ahead signal. A Market Structure Shift (also called a Change of Character or CHoCH) tells you that the power has officially shifted from buyers to sellers, or vice-versa, usually right after a liquidity grab.

- Seeing the Shift: Imagine a market making higher highs and higher lows (an uptrend). Smart money pushes the price up one last time to grab liquidity above an old high. Then, price aggressively reverses and breaks below the most recent swing low. That break is the Market Structure Shift. It’s your first clear sign that the uptrend is over and sellers are now in control.

- The Confirmation: An MSS isn’t a signal to jump in immediately. It’s the confirmation that your analysis was right. The trap has been set and sprung. Now, you can confidently look for an entry on the pullback. This concept is the key to actively trading the smart money concepts vs retail traders dynamic.

Read More: Dumb Money vs Smart Money

Your New Game Plan: How to Use Smart Money Concepts

Theory is great, but let’s make this real. Moving from a retail mindset to an SMC approach is a process. It’s about building a logical story for every trade. The smart money concepts vs retail traders game is won by having a better plan. Here is a simple, step-by-step framework you can start using today.

Step 1: Find the Obvious Liquidity

Before you do anything else, zoom out to a higher timeframe like the 4-hour or daily chart. Your first job is to play detective and find where the retail crowd has likely placed their stops.

- Where’s the money? Mark the obvious old highs (buy-side liquidity) and the clean, obvious old lows (sell-side liquidity). These are your targets.

- What’s the bigger story? Is the overall market trending up? If so, any move down is likely a hunt for sell-side liquidity before the main trend continues. This high-level view gives you your directional bias. You’re no longer just reacting; you’re anticipating.

Step 2: Identify the Institutional Footprints (Order Blocks)

Now that you know where price is likely headed, you need to find the launchpads—the zones from which smart money might initiate their move.

- Find the origin: Look for clear Order Blocks (that last opposing candle before a big move) that are located in strategic areas. For example, a Bullish Order Block sitting just below a major pool of sell-side liquidity is a very high-probability zone.

- Mark your zones: Draw a box around these Order Blocks on your chart. These are your points of interest. You will patiently wait for the price to reach one of these zones. This patient approach is a core difference in the smart money vs retail traders matchup.

Step 3: Wait for the Confirmation (Market Structure Shift)

This is where your patience pays off. You’ve done your homework. Now you wait for the market to prove you right.

- Let the raid happen: Watch price trade into your targeted liquidity zone. For example, let it run below that clean low and trigger all the sell-stops. You’ll see retail traders panic-selling or getting stopped out. This is the stop hunt.

- Watch for the reversal: After the liquidity is grabbed, look for a powerful and aggressive move in the opposite direction. You need to see price break the most recent swing structure. If it just swept a low, you need to see it break the last swing high. This is your Market Structure Shift (MSS).

- The MSS is your green light. It confirms the institutional reversal. The trap has been sprung, the amateurs have been shaken out, and control has shifted.

Step 4: A Simple SMC Trade Example Walkthrough

Let’s walk through a simple buy setup together:

- Bias (4H Chart): You see the overall trend is bullish. You identify a clean, obvious “double bottom” that formed last week. This is your target pool of sell-side liquidity.

- Point of Interest (4H Chart): Below those lows, you spot a clear Bullish Order Block from a month ago that has not yet been re-tested.

- The Trap (15M Chart): You switch to a 15-minute chart and watch as price sells off into the New York session. It pushes aggressively below the double bottom, grabbing the liquidity. Breakout sellers are jumping in, thinking the trend is now down.

- Confirmation (15M Chart): After sweeping the low, price violently reverses and rallies, breaking above the most recent swing high on the 15-minute chart. You have your Market Structure Shift (MSS). The reversal is now confirmed.

- Entry (15M Chart): You don’t chase the rally. You patiently wait for price to pull back into the zone that caused the rally. This could be a new, small Order Block or a Fair Value Gap (FVG) that was created during the aggressive up-move. You set a limit order to buy in this zone, placing your stop loss safely below the low that was created during the liquidity grab.

- Target: Your primary target is the next major pool of buy-side liquidity—perhaps a clean high that was formed earlier in the week.

This methodical process—narrative, liquidity, confirmation, and precise entry—is how you trade alongside smart money, and it’s a world away from the guesswork of retail strategies. It’s how you win the smart money concepts vs retail traders game.

Opofinance Services

As you evolve your trading and adopt a more professional approach like Smart Money Concepts, the broker you use becomes a critical part of your toolkit. You need a platform that delivers precision, advanced features, and unwavering reliability. Opofinance, an ASIC-regulated forex broker, is built for the modern trader who demands an edge.

- Advanced Trading Platforms: Execute your SMC strategy with the speed and accuracy it deserves. Opofinance provides access to the industry’s best: MT4, MT5, cTrader, and their own OpoTrade platform. This ensures you have the powerful charting tools needed to spot institutional moves.

- Innovative AI Tools: Gain a technological advantage with cutting-edge AI. Use the AI Market Analyzer to spot high-probability trends, get feedback from the AI Coach to refine your technique, and receive instant help from AI Support.

- Social & Prop Trading: You don’t have to trade alone. Opofinance’s social trading features let you connect with and learn from a community, while their prop trading program offers a direct path to trading with firm capital.

- Secure & Flexible Transactions: Move your money with ease and peace of mind. Opofinance supports safe and convenient deposit and withdrawal options, including crypto payments. Best of all, they charge zero fees on transactions, so more of your money stays where it belongs—in your account.

For any trader committed to mastering professional strategies, partnering with the right broker is a non-negotiable step.

Start trading with a professional edge at Opofinance today!

Conclusion: Playing a New Game

The journey from being a typical retail trader to thinking like an institution is the most important one you can make. It’s about a fundamental shift in how you see the chart—from a confusing mess of wicks and lines to a clear story of liquidity being sought and captured. The entire smart money concepts vs retail traders dynamic boils down to this singular focus. By learning to see the targets, read the institutional footprints, and wait for confirmation, you stop being the fuel for the market’s fire. You learn to ride the powerful waves they create. This path demands more patience and discipline than you’re used to, but it leads to a place of clarity and confidence that retail strategies can never offer.

Is smart money concepts trading profitable?

Yes, many traders find Smart Money Concepts to be a highly profitable methodology. However, its success is not automatic. It requires deep study, disciplined application, strict risk management, and mastering the psychological patience to wait for high-probability setups, rather than chasing every market movement.

Are smart money concepts real?

Yes, Smart Money Concepts are very real because they are based on the logical mechanics of how large institutions must operate in the market. The need to acquire massive amounts of liquidity to fill orders without moving the price against themselves forces them to engage in behaviors that leave behind detectable footprints like Order Blocks and Fair Value Gaps.

Does smart money ever lose?

Absolutely. No trading strategy is infallible, and smart money institutions do take losses. However, their strategies are built on a probabilistic edge. They may lose on several individual trades, but their overall plan, capitalization, and understanding of liquidity flow allow them to be highly profitable over the long term. They play a game of averages, not a game of being right every single time.