Ever felt like the market just outplayed you? You might have stumbled into a Smart Money Trap. So, to answer the common question, ‘what is a smart money trap in forex?’, it’s a calculated price move by large financial institutions—the ‘smart money’—designed to mislead retail traders. This allows them to secure better positions. While a good online forex broker provides tools, understanding this market dynamic is your primary shield. This article will explore the Smart Money Trap, how these entities operate, common examples, and how you can learn to identify and navigate these tricky situations.

How Smart Money Influences Forex

To really get a handle on the Smart Money Trap, it’s vital to know who we mean by “smart money” and how they make waves in the forex market. These aren’t your everyday traders; they’re the financial world’s heavy hitters.

Who Exactly is “Smart Money”?

“Smart money” is the term for the big players: institutional investors, major banks, massive hedge funds, and other financial giants with deep pockets. Their trading volumes are so huge they can literally steer the market. They’ve got access to top-tier research, super-advanced tech, and an understanding of market dynamics that most retail traders can only dream of. Their main goal? Profit. And sometimes, that involves setting up scenarios where smaller traders might get caught out, often leading to a Smart Money Trap.

Creating Market Moves and Traps

Smart money doesn’t just randomly buy or sell. Their moves are highly strategic, designed to build up their positions at the best prices or to cause specific market reactions. A Smart Money Trap is often a carefully orchestrated part of this process. For example, they might push prices towards an area where they know lots of retail stop-loss orders are sitting, or engineer a convincing but ultimately false breakout to lure traders in before yanking the price back. It’s less about being malicious, and more about them needing to get their huge orders filled without disrupting their own entry prices too much, a common tactic in forming a Smart Money Trap.

Common Types of Smart Money Traps

Smart money has a playbook of common tactics to set up these market deceptions. Getting familiar with these patterns is your first big step in learning to dodge them. These traps often play on typical retail trader psychology and reactions. Recognizing a Smart Money Trap in its various forms is a key skill.

Read More:what is stop hunt in forex

Stop Hunts: The Stop-Loss Raid

A stop hunt is a textbook Smart Money Trap. Institutions have a pretty good idea where retail traders, perhaps like yourself, tend to place stop-loss orders – usually just above key resistance or below key support. They might intentionally nudge the price to these exact levels to trigger those stops. This gives them the liquidity they need to fill their own large orders and also clears out traders who were betting against them. Once the stops are hit, the price often snaps back in the direction they wanted all along, leaving the “hunted” traders with a loss from this particular Smart Money Trap.

Chart Example: price dipping sharply below a known support level, triggering a wave of stop-losses, then quickly reversing upwards. This quick stab and reversal is a hallmark of a stop hunt, a classic Smart Money Trap.

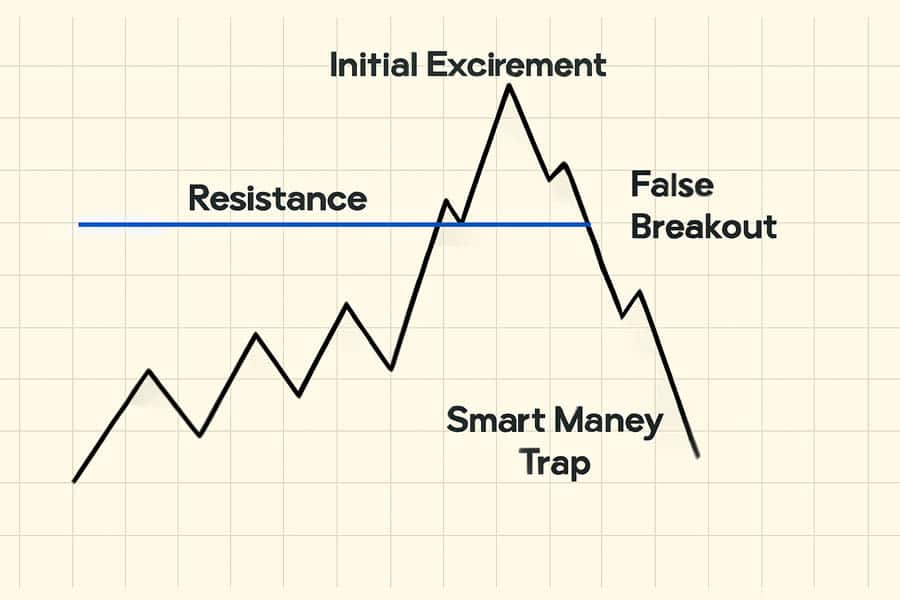

False Breakouts: The Head Fake

False breakouts are super deceptive. The price looks like it’s decisively breaking above resistance or below support, signaling the start of a strong new trend. Retail traders, often driven by the fear of missing out (FOMO), pile into the trade. But, surprise! The smart money engineered this move only to reverse it soon after, trapping those breakout traders. Learning how to identify these fake-outs is crucial to sidestep a potentially costly Smart Money Trap. A big clue is often a lack of follow-through volume or an immediate price rejection after the supposed break.

Chart Example: Price punches through a resistance level with some initial excitement, only to slump back below it shortly after. This is a typical false breakout, a kind of Smart Money Trap designed to catch eager buyers.

Liquidity Grabs: The Quick Snatch

A liquidity grab is a sharp, fast price spike into an area where lots of buy or sell orders (liquidity) are likely sitting – think above recent highs or below recent lows. Smart money uses these quick spikes to fill their large orders at prices they like, right before the market turns around. Those long “wicks” or “shadows” you see on candlestick charts at key levels? They’re often tell-tale signs of a liquidity grab, a sneaky form of Smart Money Trap.

Bull & Bear Traps: The Trend Reversal Trick

Bull traps happen during what looks like a solid uptrend. The price pokes to a new high, encouraging more buyers to jump in, then boom – it reverses sharply, trapping these latecomers. Bear traps are the opposite, occurring in a downtrend. The price dips to a new low, tempting sellers to get short, then suddenly rallies, catching the bears off guard. Both are classic examples of a Smart Money Trap, set to catch traders on the wrong side just before a significant trend change.

How to Identify Smart Money Traps

Spotting a Smart Money Trap before it springs on you takes a bit of detective work, patience, and a clear plan. It’s all about reading the subtle hints the market leaves behind. This is a core skill in developing a robust trading approach against such maneuvers.

Step 1: Pinpoint Key Market Zones

Start by carefully marking out the major support and resistance levels on your charts. Also, identify significant supply and demand zones, and areas where liquidity is likely to pool (like previous daily highs and lows, or session extremes). These are the prime hunting grounds for smart money, where a Smart Money Trap might be initiated.

Step 2: Look for Unusual Volume Activity

Keep an eye out for sudden spikes in trading volume, especially when they happen near these key levels without a strong, sustained price move. If you see super high volume on a breakout that then quickly fizzles out, that’s a big red flag for a potential Smart Money Trap. Conversely, a breakout on very thin volume might also suggest it’s not a genuine move.

Step 3: Watch for Long Wicks and Shadows

Those long wicks or shadows on candlesticks, particularly when they appear at important price levels, often scream “liquidity grab!” They show that price was pushed to an extreme but then got rejected fast. This suggests smart money grabbed the available orders and the market might be about to head the other way. It’s a visual clue of a Smart Money Trap in action.

Step 4: Confirm with Market Structure Clues

Don’t hang your hat on just one signal. Always look for confirmation from the overall market structure. For example, if you suspect a false breakout to the upside (a common Smart Money Trap), wait to see if the price then breaks a recent low. This “break of structure” (BOS) or “change of character” (CHoCH) in the opposite direction can confirm that the initial move was indeed a fake-out.

Step 5: Use Multi-Timeframe Analysis

What looks like a confusing trap on a short-term chart (say, the 15-minute) can often make more sense when you zoom out to a higher timeframe (like the 4-hour or daily chart). Higher timeframes give you the bigger picture of the main trend and significant levels, helping you filter out the noise and get better confirmation on a potential Smart Money Trap. This broader view is crucial for effectively applying any sound trading strategy.

Smart Money Concept Trading Strategy

A smart money concept trading strategy is all about understanding how the big institutions trade and trying to align your own trades with their likely actions. It involves recognizing their patterns, including how they set up a Smart Money Trap, and using that insight.

Read More:Market Structure Break (MSB)

Entry Criteria: When to Jump In

With these concepts, you’re not chasing fast moves. You’re waiting patiently for specific conditions after smart money has hinted at its intentions. Key entry signals include:

- Liquidity Sweep: Price moves to take out orders (liquidity) resting above an old high or below an old low. This can be the setup for a Smart Money Trap.

- Market Structure Shift (BOS/CHoCH): After the liquidity sweep, the price breaks a key structural point in the direction opposite to the sweep. This is your confirmation that momentum might be changing.

- Return to an Area of Interest: Price then pulls back to an institutional “order block” (an area where smart money previously placed a lot of orders) or fills a “Fair Value Gap” (FVG – an imbalance in price). This is often where you’d look for an entry.

Confirmation Tools: What to Look For

Several tools and ideas are central to confirming trades in a trading strategy that considers smart money actions:

- Order Blocks: These are specific candles or price zones that show where institutions likely initiated large buy or sell programs. Price often revisits these important areas.

- Fair Value Gaps (FVGs) or Imbalances: Think of these as momentary inefficiencies or “gaps” in the market, often shown by a three-candle pattern where the wicks of the first and third candles don’t meet. Price has a tendency to come back and “fill” these gaps.

- Price Action Signals: Classic candlestick patterns like pin bars or engulfing candles, when they appear at these zones of interest, can give you extra confidence.

Stop Loss Placement: Protecting Your Capital

To avoid getting caught by a stop hunt (a type of Smart Money Trap), stop losses in such strategies are usually placed logically:

- Just beyond the high or low of the structure that caused the initial liquidity sweep.

- A bit beyond the order block or FVG you’re trading from, making sure it’s protected by a structural point.

The goal is to place your stop where, if it gets hit, your entire trade idea is clearly proven wrong by the market, not just by a random price spike which could be another Smart Money Trap.

Take Profit Targets: Where to Aim

Take profit targets are generally set towards areas where smart money is likely to push the price next. Think about:

- Pools of liquidity on the other side of the current move (e.g., old highs if you’re short, or old lows if you’re long).

- Significant opposing order blocks or FVGs on higher timeframes.

- Always aiming for a good risk-to-reward ratio, like 1:2 or better. This principle is vital when dealing with the possibility of a Smart Money Trap.

How to Avoid Falling Into Traps

Steering clear of the Smart Money Trap isn’t about having a crystal ball. It’s more about disciplined trading habits and being able to tell a genuine opportunity from a deceptive one. Being aware of what is a smart money trap in forex is the first step.

- Don’t Chase Breakouts Without Proof: Breakouts look tempting, but so many are fakes. Always wait for some kind of confirmation. This could be a retest of the breakout level that holds strong, or a clear shift in market structure on a shorter timeframe after the breakout. Patience here can save you from many a Smart Money Trap.

- Avoid Obvious Stop-Loss Levels: If your stop-loss spot seems super obvious (like right on a round number or a very clear previous high/low), think twice. Smart money knows these spots too. Maybe give your trade a little more breathing room or use structural points that are less apparent.

- Use Price Alerts, Not Just Pending Orders: Instead of placing pending orders right at key levels where traps often happen, try setting alerts. When the price hits your level, you can then watch the live price action for any signs of manipulation or, conversely, genuine confirmation before you commit. This helps you actively sidestep a Smart Money Trap.

- Wait for Clear Market Structure Shifts: Before jumping into a trade, especially if it’s against the short-term momentum, wait for a confirmed Break of Structure (BOS) or Change of Character (CHoCH). This is a sign that the underlying market force might genuinely be shifting, rather than it just being a temporary fake-out. This helps differentiate a real move from a Smart Money Trap.

Risk Management for Dealing with Traps

Even with the sharpest analysis, you might sometimes get caught in a Smart Money Trap. That’s where solid risk management becomes your best friend and ultimate safety net.

Smart Position Sizing

This is Trading 101, but it’s extra important here: never risk more than a tiny fraction of your trading capital on any single trade (most pros stick to 1-2%). With proper position sizing, even if a Smart Money Trap gets you, the loss will be a small, manageable dent, not a catastrophe for your account.

Using Trailing Stops Carefully

Once your trade is in profit and seems to be moving your way (like after a confirmed market structure shift post-entry), a trailing stop can be useful to lock in gains. But don’t trail it too close to the price! That can get you stopped out by minor, normal pullbacks that aren’t actually traps. It’s often better to trail your stop based on market structure, like just behind recent swing lows in an uptrend. This helps protect profits without falling for a minor Smart Money Trap.

The Power of a Trading Journal

Keep a detailed trading journal. Seriously. Write down your entries, exits, why you took the trade, and especially, any times you suspected or actually fell into a Smart Money Trap. Reviewing your journal regularly will help you spot patterns in how these traps tend to show up in the markets you trade and how you usually react. This is invaluable for refining your strategies to avoid them next time.

Helpful Tools for Spotting Activity

While a lot of identifying a Smart Money Trap comes down to understanding price action and market structure, some tools can offer an extra edge. Knowing how to identify these market maneuvers can be enhanced with these aids.

Useful Indicators

- Volume Profile: This isn’t your standard volume bar at the bottom. It shows how much trading happened at specific price levels over a period. It can highlight areas of intense institutional interest and potential support/resistance where a Smart Money Trap might be set.

- Liquidity Heatmaps: These are often third-party tools or features on advanced platforms. They try to visualize where large clusters of limit orders are sitting, which can give you a clue about where liquidity pools (and therefore, potential targets for grabs) might be.

- Standard Volume Indicator: Don’t underestimate the simple volume bars! Unusual spikes in volume around key price levels can be your first warning sign of institutional games that could lead to a Smart Money Trap.

Charting Platforms with SMC Tools

Many charting platforms give you the drawing tools and indicators you need for analysis and spotting traps:

- TradingView: Super popular for a reason. It has great charting tools, a huge library of indicators (including many community-made ones for these concepts), and makes multi-timeframe analysis easy.

- MetaTrader 4/5 (MT4/MT5): These are the workhorses offered by most forex brokers. You can get custom indicators for them that can help highlight elements of a Smart Money Trap.

- cTrader: Known for its Depth of Market (DOM) features. While DOM can give some clues about order flow, using it to spot retail trapping takes quite a bit of experience.

Just remember, tools are there to help, not to make decisions for you. They should back up your understanding of price action and smart money concepts, not replace your own analysis. Your best tool is always a well-trained eye for the patterns linked to the Smart Money Trap.

Read More: Buy Side Liquidity vs Sell Side Liquidity Explained

Opofinance Services: Trade Smarter, Not Harder

When you’re trying to navigate something as tricky as a Smart Money Trap, having a top-notch and tech-savvy forex trading broker by your side can make a real difference. Opofinance, which is regulated by ASIC, offers a fantastic range of services built to help traders like you succeed:

- Advanced Trading Platforms: Take your pick from the best in the business: MT4, MT5, cTrader, and our very own OpoTrade platform. They’re all packed with tools to help you analyze market moves and make informed decisions.

- Innovative AI Tools: Get an edge with our AI Market Analyzer, AI Coach, and AI Support. These tools use artificial intelligence to give you deeper market insights and help you sharpen your trading strategies, which can be a game-changer when trying to spot and avoid the Smart Money Trap.

- Social & Prop Trading: Want to learn from others or test your skills with funded accounts? Explore our social trading features and proprietary trading opportunities.

- Secure & Flexible Transactions: We make managing your money easy and safe. Enjoy convenient deposit and withdrawal methods, including cryptocurrency payments, with absolutely zero fees from Opofinance. This means more of your money stays yours.

Ready to upgrade your trading experience and tackle the markets with more confidence, even when faced with a potential Smart Money Trap?

Conclusion: Outsmarting the Traps

The Smart Money Trap is an undeniable aspect of markets influenced by large institutions, including forex. While initially seeming complex, understanding its mechanics, recognizing common forms, and learning to spot the warning signs transforms it from a hidden danger into a manageable market feature. By learning to see these institutional plays, traders can sidestep being caught and use this knowledge to refine their own approaches. Remember patience, the need for confirmation, and robust risk management. Navigating the Smart Money Trap effectively is a significant step towards more informed and potentially consistent trading outcomes.

- Defining the Trap: A Smart Money Trap is a deceptive market move by large institutions to mislead retail traders.

- Smart Money Players: Primarily banks, hedge funds, and other large financial institutions with market-moving capacity.

- Common Trap Types: Watch out for stop hunts, false breakouts, liquidity grabs, and classic bull/bear traps, all forms of a Smart Money Trap.

- Spotting Traps: Learn how to identify these traps by marking key zones, monitoring volume, analyzing wicks, confirming with market structure, and using multi-timeframe analysis.

- SMC Strategy Basics: A trading strategy considering smart money involves looking for liquidity sweeps, structure breaks (BOS/CHoCH), and entries at order blocks or FVGs, often in response to a Smart Money Trap.

- Avoiding Traps: Be patient with breakouts, place stops strategically, use alerts, and wait for clear market shifts.

- Risk Management is Key: Essential for survival, focusing on appropriate position sizing and diligent trade journaling, especially when dealing with the Smart Money Trap.

Are Smart Money Concepts (SMC) a guaranteed way to profit?

No trading strategy, including those based on Smart Money Concepts, offers a guarantee of profit. SMC provides a logical framework for interpreting market behavior based on perceived institutional actions, which can help in identifying a potential Smart Money Trap. While this can provide high-probability trading setups, the market’s complexity means false signals can still occur. Robust risk management is always essential. Success with any approach, including understanding the Smart Money Trap, comes from consistent practice, discipline, and adapting to the ever-changing market landscape.

Can Smart Money Traps occur in markets besides forex?

Absolutely! The underlying principles of a Smart Money Trap apply to any market where large institutional players are active and where liquidity dynamics are significant. This includes markets for stocks, commodities, indices, and even cryptocurrencies. Essentially, wherever “smart money” trades in large volumes, the potential exists for them to create conditions that might trap smaller or less informed participants. Answering ‘what is a smart money trap in forex’ also helps understand its manifestation in other assets.

How much time does it typically take to get good at spotting Smart Money Traps?

The learning curve for effectively spotting a Smart Money Trap really varies from one trader to another. It depends heavily on your dedication, any previous trading experience you have, and how quickly you can recognize complex patterns. Consistently identifying these traps with a good degree of accuracy can take anywhere from several months to a year or more of focused study, intensive chart analysis, and dedicated practice—ideally starting on a demo account. It’s an ongoing journey of refining your grasp of price action, market structure, and institutional behavior when trying to understand and avoid a Smart Money Trap.