Are you looking to capitalize on quick market movements and potentially increase your trading profits? The S&P 500 scalping strategy might be the answer you’re seeking. S&P 500 scalping is a high-frequency trading technique that aims to profit from small price fluctuations in the US500 market, typically within minutes or even seconds. This approach allows traders to take advantage of the index’s liquidity and volatility to generate multiple small gains throughout the trading day.

In this comprehensive guide, we’ll explore the ins and outs of the S&P 500 scalping strategy, also known as the US500 scalping strategy. You’ll learn how to identify profitable setups, manage risks effectively, and implement various scalping techniques suitable for both novice and experienced traders. We’ll cover everything from basic price action analysis to advanced order flow interpretation, equipping you with the knowledge to potentially enhance your trading performance in the fast-paced world of S&P 500 scalping.

Whether you’re a seasoned forex trading broker looking to expand your skillset or a curious beginner eager to explore this dynamic trading style, this article will provide valuable insights into mastering the art of S&P 500 scalping. By the end, you’ll have a solid foundation to develop and refine your own US500 scalping strategy, potentially unlocking new opportunities in one of the world’s most popular financial markets.

Understanding S&P 500 Scalping

What is S&P 500 Scalping?

S&P 500 scalping, also known as US500 scalping strategy, is a short-term trading method that involves making numerous trades within a single day to profit from small price fluctuations in the S&P 500 index. Scalpers aim to enter and exit positions quickly, often holding trades for just a few minutes or even seconds.

Why Choose S&P 500 Scalping?

- High liquidity: The S&P 500 is one of the most liquid markets in the world, ensuring smooth entry and exit of positions.

- Frequent opportunities: With constant price movements, scalpers can find multiple trading opportunities throughout the day.

- Reduced overnight risk: By closing all positions before the market closes, scalpers minimize exposure to overnight gaps and news events.

- Potential for consistent profits: Successful scalpers can accumulate small gains that add up to significant profits over time.

Essential Tools for S&P 500 Scalping

To excel in S&P 500 scalping, you’ll need the right tools and resources:

- Advanced charting software: Look for platforms with real-time data, multiple timeframes, and customizable indicators.

- Low-latency trading execution: Every millisecond counts in scalping, so choose a broker with fast order execution.

- Reliable internet connection: A stable, high-speed internet connection is crucial to avoid costly delays.

- Risk management tools: Use stop-loss orders and position sizing calculators to protect your capital.

Key Strategies for S&P 500 Scalping

Strategies for Novice Traders

- Support and Resistance Scalping

Support and resistance levels are crucial concepts in price action trading. For novice S&P 500 scalpers, identifying these levels can provide high-probability entry and exit points.

Key steps:

- Identify clear support and resistance levels on shorter timeframes (1-minute or 5-minute charts)

- Enter long positions near support levels when price shows signs of bouncing

- Enter short positions near resistance levels when price shows signs of rejection

- Place tight stop-losses just beyond the support or resistance level

- Set profit targets at the next significant support or resistance level

- Trend Following with Price Action

Riding the trend is a fundamental strategy that even novice traders can employ effectively in S&P 500 scalping.

Key steps:

- Identify the overall trend on a higher timeframe (15-minute or 30-minute chart)

- Look for pullbacks on lower timeframes (1-minute or 5-minute charts)

- Enter trades in the direction of the main trend when price action indicates a potential reversal from the pullback

- Use candle patterns such as pin bars, engulfing patterns, or dojis to confirm entry points

- Place stop-losses beyond the recent swing high/low

- Set profit targets at previous swing highs/lows in the trend direction

- Break and Retest Scalping

Read More: dow jones scalping strategy

This strategy capitalizes on price breaks of significant levels and their subsequent retests, offering novice traders a clear structure for entries and exits.

Key steps:

- Identify key support or resistance levels

- Wait for a clear break of these levels

- Look for a retest of the broken level (former support becomes resistance, former resistance becomes support)

- Enter the trade if price action confirms the level holds (e.g., rejection candles)

- Place stop-loss orders beyond the retest point

- Set profit targets at the next significant support or resistance level

Advanced Strategies for Experienced Traders

- Volume Price Analysis (VPA) Scalping

VPA combines price action with volume data to provide deeper insights into market dynamics, allowing experienced scalpers to make more informed decisions.

Key steps:

- Analyze the relationship between price movements and volume

- Look for volume spikes or divergences that indicate potential reversals or trend continuations

- Use volume to confirm breakouts or identify false moves

- Enter trades based on price action signals confirmed by volume analysis

- Implement tight stop-losses and scale out of positions as the trade progresses

- Order Flow Scalping

Order flow analysis involves interpreting the buying and selling pressure visible in the order book and recent trades, providing advanced scalpers with a real-time view of market dynamics.

Key steps:

- Utilize advanced charting software that displays order flow data

- Identify areas of significant buying or selling pressure

- Look for imbalances in the order book that may indicate potential price movements

- Enter trades based on sudden shifts in order flow or absorption of large orders

- Use ultra-tight stop-losses and be prepared to exit quickly if order flow dynamics change

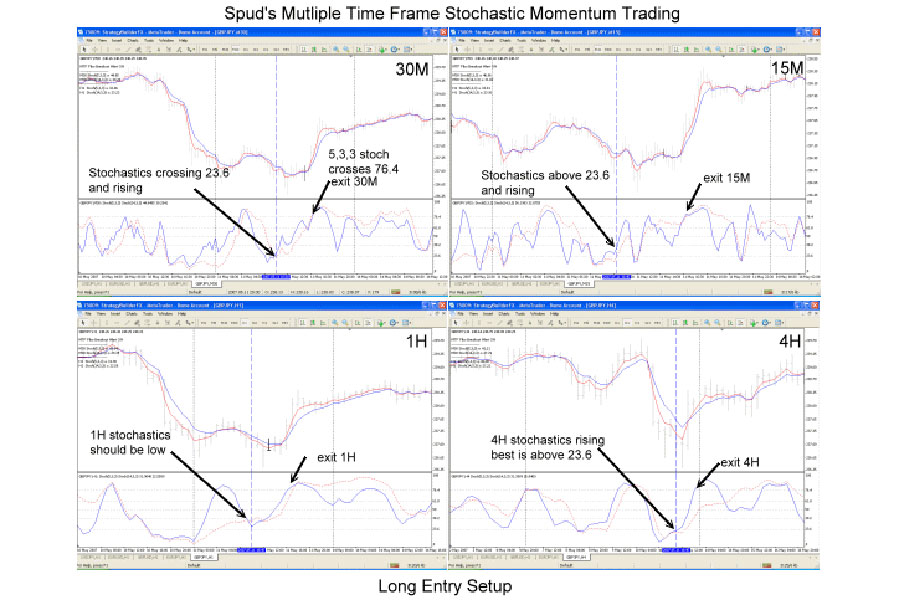

- Multi-Timeframe Price Action Scalping

Read More: eur usd scalping strategy

This advanced strategy involves analyzing price action across multiple timeframes to identify high-probability scalping opportunities with favorable risk-reward ratios.

Key steps:

- Establish the overall trend and key levels on higher timeframes (30-minute or 1-hour charts)

- Identify potential entry zones on medium timeframes (5-minute or 15-minute charts)

- Fine-tune entries using price action signals on lower timeframes (1-minute or 2-minute charts)

- Align trades with the higher timeframe trend while capitalizing on short-term price action setups

- Use a trailing stop-loss strategy to maximize profits on winning trades

- Harmonic Pattern Scalping

Experienced traders can utilize harmonic patterns to identify potential reversal points in the S&P 500, offering precise entry and exit levels for scalping.

Key steps:

- Identify harmonic patterns such as Gartley, Butterfly, or Bat patterns on short-term charts

- Validate patterns using Fibonacci retracement and extension levels

- Enter trades at the completion of the pattern when price action confirms the potential reversal

- Place stop-losses beyond the pattern’s extreme point

- Set initial profit targets at the pattern’s projected reversal zone

- Market Profile Scalping

Market Profile provides a unique view of price action by displaying volume at price, allowing advanced scalpers to identify value areas and potential breakout levels.

Key steps:

- Analyze the Market Profile structure to identify value areas, point of control, and balance areas

- Look for price acceptance or rejection at key levels within the profile

- Enter trades when price moves out of balance or tests the edges of value areas

- Use the Market Profile structure to set precise stop-loss and take-profit levels

- Combine Market Profile analysis with traditional price action signals for higher probability trades

By mastering these scalping strategies, both novice and advanced traders can enhance their ability to capitalize on short-term price movements in the S&P 500. Remember that successful scalping requires not only technical skills but also strict discipline, effective risk management, and the ability to make quick decisions under pressure.

Risk Management in S&P 500 Scalping

Effective risk management is crucial for long-term success in S&P 500 scalping. Here are some essential principles to follow:

- Set strict stop-loss orders: Always use stop-loss orders to limit potential losses on each trade.

- Maintain a favorable risk-reward ratio: Aim for a minimum risk-reward ratio of 1:2 or higher.

- Limit position sizes: Never risk more than 1-2% of your trading capital on a single trade.

- Use proper leverage: While leverage can amplify profits, it also increases risk. Use it judiciously.

- Implement a daily stop-loss: Set a maximum daily loss limit to protect your account from significant drawdowns.

Common Pitfalls to Avoid in S&P 500 Scalping

- Overtrading: Don’t feel pressured to be in the market constantly. Wait for high-probability setups.

- Ignoring transaction costs: Factor in commissions and spreads when calculating potential profits.

- Emotional trading: Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

- Neglecting market analysis: Stay informed about broader market trends and potential catalysts that could impact the S&P 500.

- Failing to adapt: Be prepared to adjust your strategy as market conditions change.

Read More: xauusd scalping strategy

Developing Your S&P 500 Scalping Strategy

To create a successful S&P 500 scalping strategy, follow these steps:

- Define your trading style: Determine which scalping approach aligns best with your personality and risk tolerance.

- Backtest your strategy: Use historical data to test your strategy’s performance under various market conditions.

- Paper trade: Practice your strategy in a risk-free environment using a demo account.

- Start small: When transitioning to live trading, begin with small position sizes and gradually increase as you gain confidence.

- Keep a trading journal: Document your trades, including reasons for entry and exit, to identify areas for improvement.

- Continuously educate yourself: Stay updated on market trends, new trading techniques, and economic factors affecting the S&P 500.

Psychological Aspects of S&P 500 Scalping

Successful S&P 500 scalping requires not only technical skills but also strong mental discipline. Consider the following psychological factors:

- Maintain emotional control: Stay calm and focused, even during periods of market volatility.

- Develop patience: Wait for high-probability setups rather than forcing trades out of boredom or FOMO (fear of missing out).

- Accept losses: Understand that losses are part of trading and focus on long-term profitability.

- Avoid revenge trading: Don’t attempt to immediately recover losses by taking on excessive risk.

- Celebrate small wins: Recognize that consistent small profits can lead to significant gains over time.

OpoFinance Services: Empowering Your S&P 500 Scalping Journey

When it comes to executing your S&P 500 scalping strategy, choosing the right broker is paramount. OpoFinance, an ASIC-regulated forex broker, offers a comprehensive suite of services tailored to meet the needs of discerning scalpers. With its cutting-edge trading platform, lightning-fast execution speeds, and competitive spreads, OpoFinance provides the ideal environment for implementing your US500 scalping strategy.

One standout feature of OpoFinance is its innovative social trading service. This powerful tool allows you to connect with and learn from experienced S&P 500 scalpers, providing valuable insights and potentially accelerating your learning curve. By observing and even copying the trades of successful scalpers, you can refine your strategy and improve your overall performance in the fast-paced world of S&P 500 scalping.

Conclusion

Mastering the S&P 500 scalping strategy can open up a world of opportunities for traders seeking to capitalize on short-term market movements. Throughout this guide, we’ve explored the fundamental concepts, key strategies, and essential tools needed to succeed in US500 scalping. Let’s recap the main takeaways:

- S&P 500 scalping involves making numerous quick trades to profit from small price fluctuations in the US500 market.

- Success in this strategy requires a combination of technical skills, market knowledge, and psychological discipline.

- We’ve covered various price action-based strategies suitable for both novice and advanced traders, from support and resistance trading to complex order flow analysis.

- Effective risk management is crucial, including setting tight stop-losses and maintaining a favorable risk-reward ratio.

- Utilizing advanced tools and technologies can enhance your scalping performance and decision-making process.

Remember, while S&P 500 scalping can be potentially lucrative, it also comes with significant risks. It’s essential to practice extensively in a demo environment before committing real capital. Continuously educate yourself, stay updated on market trends, and be prepared to adapt your strategy as market conditions evolve.

As you embark on your S&P 500 scalping journey, focus on developing a consistent, disciplined approach. Keep a trading journal, analyze your performance regularly, and never stop learning. With dedication, practice, and the right mindset, you can work towards becoming a proficient US500 scalper.

Whether you’re just starting out or looking to refine your existing skills, the world of S&P 500 scalping offers exciting challenges and potential rewards. By applying the knowledge and strategies outlined in this guide, you’re now better equipped to navigate this fast-paced trading environment and potentially unlock new levels of trading success.

Remember, there’s no one-size-fits-all approach to scalping. Experiment with different techniques, find what works best for you, and always prioritize risk management. Happy trading, and may your S&P 500 scalping endeavors be both educational and rewarding!

How much capital do I need to start S&P 500 scalping?

The amount of capital required for S&P 500 scalping can vary depending on your broker’s requirements and your personal risk tolerance. Generally, it’s recommended to start with at least $5,000 to $10,000 to ensure you have enough capital to withstand potential losses and take advantage of multiple trading opportunities. Some brokers may offer mini or micro contracts that allow you to start with smaller amounts, but keep in mind that adequate capitalization is crucial for managing risk effectively in scalping.

Is S&P 500 scalping legal?

Yes, S&P 500 scalping is legal in most jurisdictions. However, it’s important to be aware of and comply with any specific regulations in your country or region. For example, in the United States, the Pattern Day Trader (PDT) rule requires a minimum account balance of $25,000 for frequent day trading. Always ensure you’re trading with a regulated broker and following all applicable laws and regulations in your area.

How does S&P 500 scalping differ from traditional day trading?

While both S&P 500 scalping and traditional day trading involve opening and closing positions within a single trading day, there are key differences:

Time frame: Scalping typically involves holding positions for seconds to minutes, while day trading positions can last several hours.

Frequency: Scalpers may make dozens or even hundreds of trades per day, whereas day traders usually make fewer, more carefully planned trades.

Profit targets: Scalpers aim for smaller profits per trade, often just a few ticks or points, while day traders generally seek larger price movements.

Risk management: Scalpers use tighter stop-losses and must be extremely disciplined in exiting trades quickly if they move against them.

Analysis: Scalpers focus more on short-term technical indicators and price action, while day traders may incorporate broader market analysis and fundamental factors.