Imagine navigating a bustling trading floor where every trader’s next move is uncertain. This scene perfectly encapsulates the essence of the Spinning Top Candlestick Pattern in financial markets. This pivotal candlestick formation signals a moment of indecision between buyers and sellers, often preceding significant market shifts. Whether you’re delving into forex trading with a regulated forex broker like Opofinance or analyzing stock movements, understanding the Spinning Top Candlestick Pattern is crucial for making informed and strategic trading decisions.

In this comprehensive guide, we’ll explore the Spinning Top Candlestick Pattern meaning, dissect its distinctive characteristics, and examine its formation. We’ll also compare it to similar patterns like the doji candlestick, delve into effective Spinning Top Candlestick Trading Strategies, and present real-world examples to solidify your understanding. Additionally, we’ll address common misconceptions and provide advanced insights to enhance your trading prowess. By the end of this article, you’ll be equipped with the knowledge to incorporate the Spinning Top Candlestick Pattern into your trading arsenal, ensuring you stay ahead in the ever-evolving markets.

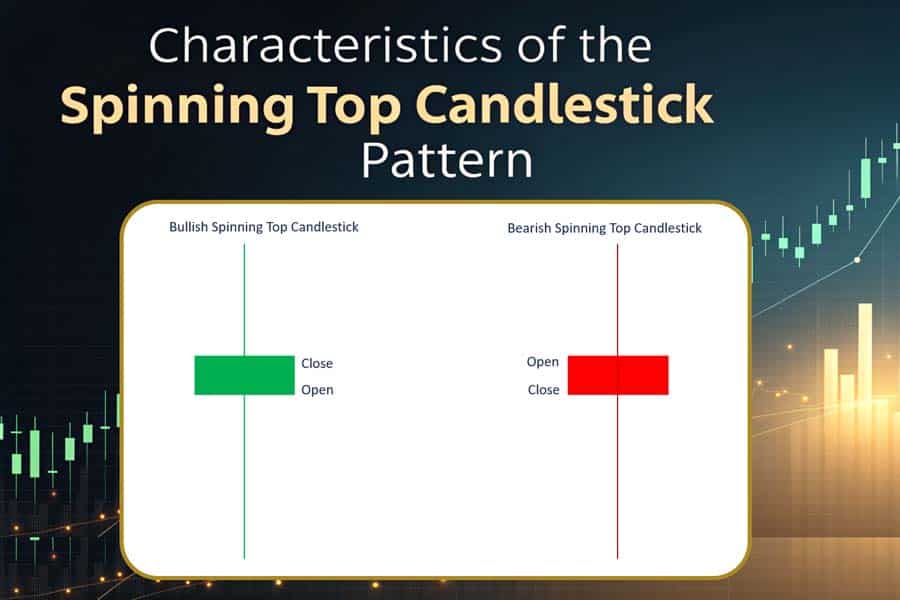

Characteristics of the Spinning Top Candlestick Pattern

Learn the distinctive characteristics of spinning tops for better trading insights.

Appearance of the Spinning Top Candlestick

The Spinning Top Candlestick Pattern is a visually distinct formation that serves as a crucial indicator of market sentiment. It is characterized by:

- Small Real Body: The difference between the opening and closing prices is minimal, indicating a balance between buyers and sellers.

- Long Upper and Lower Shadows: These wicks demonstrate that the price moved significantly during the trading period but ultimately settled near the opening price.

The spinning top’s delicate balance between the real body and the shadows visually encapsulates the market’s indecision.

Explanation of the Small Real Body and Long Upper and Lower Shadows

The small real body of the spinning top suggests that neither bulls nor bears have taken control, resulting in minimal net movement from open to close. Meanwhile, the long upper and lower shadows reflect significant volatility within the trading session. This duality showcases a tug-of-war scenario where prices fluctuate widely but end up closing close to the opening price, highlighting the struggle between buying and selling pressures.

- Small Real Body: Indicates that the opening and closing prices are close, showing a lack of strong momentum in either direction.

- Long Shadows: Represent the extremes of price movement within the session, signaling that both buyers and sellers exerted considerable influence.

Significance of the Pattern’s Formation

The formation of a spinning top candlestick is significant as it often marks a turning point in the market. It indicates that the prevailing trend may be losing momentum, and a reversal or consolidation could be imminent. Traders pay close attention to this pattern as it provides insights into potential market direction changes, allowing them to make more informed trading decisions.

In essence, the spinning top serves as a visual cue of the market’s hesitation, offering a glimpse into possible future movements.

Read More: Three White Soldiers Candlestick Pattern

Formation and Interpretation of the Spinning Top Candlestick Pattern

Understand the formation and implications of the spinning top candlestick pattern.

Market Conditions Leading to the Formation of a Spinning Top

The Spinning Top Candlestick Pattern typically forms under specific market conditions:

- Balance of Power: Both buyers and sellers are exerting similar levels of control, leading to a stalemate.

- High Volatility: Significant price swings during the trading period indicate uncertainty and fluctuating sentiment.

- Trend Exhaustion: The pattern often appears after a sustained trend, suggesting that the trend may be nearing its end.

These conditions collectively create an environment where the spinning top can emerge, signaling a potential shift in market dynamics.

Indications of Market Indecision and Potential Trend Reversal

A spinning top candlestick signifies market indecision, where neither bulls nor bears can assert dominance. This uncertainty can be a precursor to a trend reversal or a period of consolidation. For instance:

- After an Uptrend: A spinning top may indicate that buying momentum is waning, potentially signaling a reversal to a downtrend.

- After a Downtrend: It could suggest that selling pressure is diminishing, hinting at a possible upward reversal.

Traders view spinning tops as signals to reassess their positions and prepare for possible changes in trend direction.

Differences Between Bullish and Bearish Spinning Tops

Understanding the nuances between bullish and bearish spinning tops enhances their interpretative value:

- Bullish Spinning Top: Forms during a downtrend, suggesting that selling pressure is fading and a reversal to the upside may occur.

- Bearish Spinning Top: Appears in an uptrend, indicating that buying momentum is weakening and a potential downward reversal could follow.

These distinctions help traders determine the likely direction of the next market move based on the context of the spinning top’s appearance.

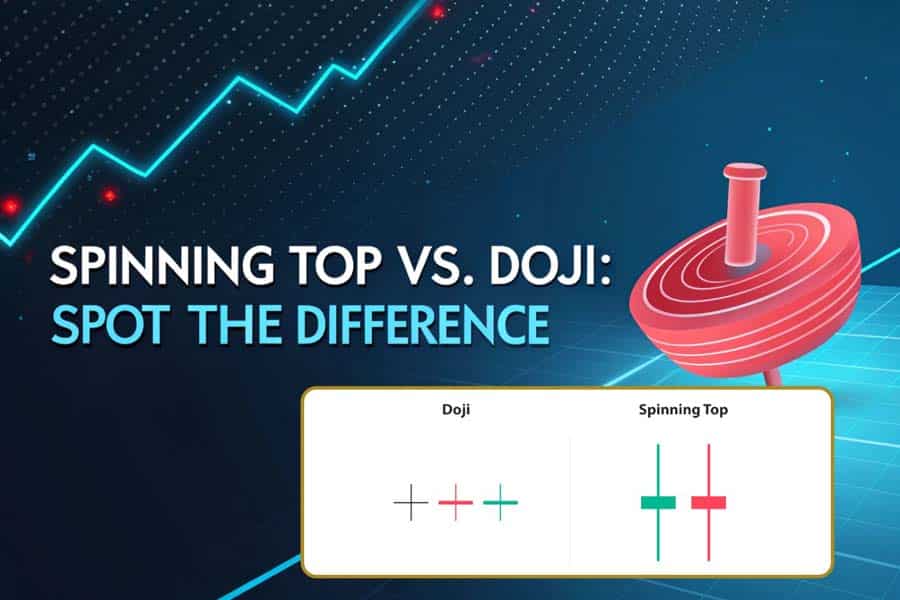

Spinning Top vs. Doji Candlestick: Understanding the Differences

Visualize the critical differences between spinning top and doji candlestick patterns.

Comparison of Their Appearances and Formations

While both spinning tops and doji candlesticks indicate market indecision, they have distinct appearances:

- Spinning Top:

- Small Real Body: The difference between open and close is noticeable but small.

- Long Upper and Lower Shadows: Significant price movement above and below the real body.

- Doji:

- No Real Body: The open and close prices are virtually identical, forming a cross-like shape.

- Long or Short Shadows: Can vary, but the defining feature is the lack of a substantial real body.

The primary visual difference lies in the presence of a small real body in spinning tops versus the almost nonexistent real body in dojis.

Differences in Market Implications

The subtle distinctions between spinning tops and dojis lead to different market implications:

- Spinning Top:

- Suggests slight hesitation with some directional bias.

- Indicates that while there is indecision, there is still some price movement within the session.

- Doji:

- Represents a higher level of uncertainty with no clear directional bias.

- Often considered a stronger signal of potential reversal when combined with other indicators.

These differences influence how traders interpret the signals and incorporate them into their trading strategies.

Examples Illustrating Each Pattern

- Spinning Top Example:

- A stock opens at $100, rises to $105, drops to $95, and closes at $102. The small real body between $100 and $102, combined with long shadows, forms a spinning top.

- Doji Example:

- A stock opens at $100, rises to $104, falls to $96, and closes exactly at $100. The open and close being identical creates a doji candlestick.

By examining these examples, traders can visually distinguish between the two patterns and understand their implications in real-world scenarios.

Read More: Doji Candlestick Pattern

Spinning Top Candlestick Trading Strategies

Enhance your trades with actionable spinning top candlestick strategies.

Identifying Spinning Tops in Various Market Contexts

To effectively utilize spinning tops in your trading strategy, it’s essential to recognize them across different market contexts:

- Uptrends: Look for spinning tops near resistance levels as potential reversal signals.

- Downtrends: Identify spinning tops near support levels, indicating possible trend reversals.

- Consolidation Phases: Use spinning tops to gauge the strength of the consolidation and anticipate breakout directions.

Accurate identification within these contexts allows for more strategic decision-making and better trade setups.

Utilizing Technical Indicators for Confirmation

Relying solely on spinning tops can lead to false signals. Combining them with other technical indicators enhances their reliability:

- Moving Averages: Confirm trend direction and strength. A spinning top near a moving average crossover can be a stronger signal.

- Relative Strength Index (RSI): Identify overbought or oversold conditions to validate potential reversals indicated by spinning tops.

- Volume Analysis: Higher volume during the formation of a spinning top adds credibility to the pattern, suggesting genuine indecision.

- MACD (Moving Average Convergence Divergence): Helps identify changes in momentum that can confirm the signals from spinning tops.

- Bollinger Bands: Assess volatility and determine if the spinning top is forming near the upper or lower bands, indicating potential reversals.

These indicators work synergistically with spinning tops to provide a more comprehensive view of market conditions.

Advanced Spinning Top Trading Strategies

For traders looking to deepen their strategies, consider the following advanced approaches:

- Pattern Confluence: Combine spinning tops with other candlestick patterns like engulfing candles or hammer patterns to strengthen trade signals.

- Timeframe Analysis: Use multiple timeframes to confirm spinning top signals. A spinning top on a daily chart supported by signals on a weekly chart can increase reliability.

- Trend Line Breaks: Incorporate trend line breaks alongside spinning tops to confirm potential reversals.

- Divergence Analysis: Look for divergences between spinning tops and indicators like RSI or MACD to identify stronger reversal signals.

- Fibonacci Retracements: Align spinning tops with key Fibonacci levels to identify optimal entry and exit points.

These advanced strategies enhance the effectiveness of spinning tops, providing more precise and reliable trading opportunities.

Risk Management Considerations When Trading Based on Spinning Tops

Effective risk management is crucial when trading based on spinning top patterns:

- Stop-Loss Orders: Place stop-loss orders just below the low of a bullish spinning top or above the high of a bearish spinning top to limit potential losses.

- Risk-Reward Ratios: Ensure that the potential reward justifies the risk taken. A common ratio is 2:1, meaning the potential profit is twice the potential loss.

- Position Sizing: Adjust the size of your trades based on your risk tolerance and the reliability of the spinning top signal.

- Diversification: Avoid placing all your capital into a single spinning top trade. Spread your risk across multiple trades and instruments.

- Trailing Stops: Use trailing stops to lock in profits as the trade moves in your favor, allowing for maximum gains while minimizing losses.

Implementing these risk management strategies helps protect your capital and ensures sustainable trading practices.

Example Trading Strategy: Spinning Top Reversal Setup

- Identify the Pattern: Spot a spinning top at the top of an uptrend or the bottom of a downtrend.

- Confirm with Indicators:

- RSI: Check for overbought (in uptrend) or oversold (in downtrend) conditions.

- Volume: Ensure increased volume during the formation of the spinning top.

- Determine Entry Point:

- For bearish reversal: Enter a short position below the spinning top’s low.

- For bullish reversal: Enter a long position above the spinning top’s high.

- Set Stop-Loss:

- Place a stop-loss order just above the high (for bearish) or below the low (for bullish) of the spinning top.

- Define Profit Target:

- Use Fibonacci retracement levels or previous support/resistance levels to set realistic profit targets.

- Monitor and Adjust:

- Use trailing stops to secure profits as the trade moves in your favor.

- Reassess the trade based on additional market developments and indicator signals.

This structured approach ensures that each trade based on spinning tops is methodically planned and managed for optimal outcomes.

Real-World Examples of the Spinning Top Candlestick Pattern

Case Study 1: Spinning Tops Leading to Trend Reversals

In April 2023, the EUR/USD forex pair was in a prolonged downtrend. A bullish spinning top formed after several consecutive bearish candles, signaling a potential reversal. The pattern was confirmed by an RSI divergence and increased trading volume. Following the spinning top, the EUR/USD pair reversed course, initiating a new uptrend that yielded significant profits for traders who acted on the signal.

Case Study 2: Spinning Tops Within Ongoing Trends

In the cryptocurrency market, Bitcoin was experiencing a steady uptrend in mid-2023. A bearish spinning top emerged near a major resistance level, indicating a possible pause or reversal. While the immediate response saw a slight pullback, the overall uptrend continued, demonstrating that not all spinning tops lead to reversals. This example underscores the importance of context and confirmation when interpreting spinning top signals.

Case Study 3: Spinning Top in Stock Trading

In September 2023, Apple Inc. (AAPL) was in a strong uptrend. A spinning top formed after the stock reached a new all-time high, with the candlestick showing a small real body and long shadows. Traders used this pattern in conjunction with moving averages and MACD indicators, which confirmed a potential reversal. Shortly after, AAPL experienced a pullback, validating the spinning top as a reliable reversal signal in this context.

These real-world instances highlight the versatility and reliability of the spinning top candlestick pattern when used appropriately.

Read More: Piercing Line Candlestick Pattern

Limitations and Considerations of the Spinning Top Candlestick Pattern

Understand the limitations of the spinning top candlestick pattern to avoid pitfalls.

Common Misconceptions About Spinning Tops

- Myth: A spinning top always signals a trend reversal.

- Reality: It indicates indecision and the potential for a reversal, but confirmation from other indicators is necessary.

- Myth: Spinning tops are only relevant in trending markets.

- Reality: While more significant in trending markets, spinning tops can also appear in consolidating phases, though their implications may differ.

Dispelling these misconceptions helps traders use spinning tops more effectively without overreliance on the pattern alone.

Importance of Context and Confirmation in Trading Decisions

The spinning top candlestick pattern’s reliability is highly dependent on the surrounding market context and confirmation from other indicators:

- Trend Context: The pattern’s significance varies depending on whether it appears in an uptrend, downtrend, or sideways market.

- Indicator Confirmation: Using tools like RSI, moving averages, and volume analysis can validate the signals provided by spinning tops, reducing the likelihood of false positives.

Contextual analysis ensures that trading decisions based on spinning tops are well-founded and strategically sound.

Potential Pitfalls and How to Avoid Them

- Ignoring Volume: Overlooking the role of volume can lead to misinterpretation of the spinning top signal.

- Trading in Isolation: Relying solely on spinning tops without considering other factors can result in poor trading outcomes.

- Overtrading: Acting on every spinning top signal without proper filtering can increase transaction costs and reduce profitability.

- False Signals in Low Volatility: In markets with low volatility, spinning tops may not carry significant weight, leading to potential false signals.

- Emotional Trading: Allowing emotions to drive decisions based on spinning tops can result in impulsive and unplanned trades.

Avoiding these pitfalls by adhering to a disciplined trading approach and using comprehensive analysis enhances the effectiveness of spinning top-based strategies.

Pro Tip: Always integrate spinning tops within a broader trading framework that includes multiple indicators and risk management practices.

Opofinance Services: Your Trusted Forex Broker

When it comes to executing trades based on patterns like the Spinning Top Candlestick Pattern, having a reliable and regulated broker is paramount. Opofinance stands out as an ASIC-regulated forex broker, offering a suite of services designed to enhance your trading experience. Here’s why Opofinance is the preferred choice for traders:

- Social Trading Service: Connect with and copy the strategies of successful traders, leveraging collective expertise to boost your trading performance.

- MT5 Brokers List Recognition: Officially featured on the MT5 brokers list, Opofinance provides access to advanced trading tools and a user-friendly platform.

- Safe and Convenient Deposit and Withdrawal Methods: Enjoy seamless transactions with a variety of secure options, ensuring your funds are always accessible.

- Advanced Analytics: Utilize cutting-edge tools for technical analysis, enabling you to make informed trading decisions based on comprehensive data.

- Competitive Spreads and Low Fees: Benefit from tight spreads and minimal fees, maximizing your trading profits.

- 24/7 Customer Support: Receive prompt and professional assistance whenever you need it, ensuring a smooth trading experience.

- Exclusive Social Trading Features: Engage with a community of traders, share insights, and follow top-performing strategies to enhance your trading outcomes.

Choosing Opofinance as your broker means gaining access to top-tier services that support your trading strategies, including those involving the spinning top candlestick pattern.

Ready to elevate your trading game? Start trading with Opofinance today and unlock new possibilities!

Conclusion

The Spinning Top Candlestick Pattern is a powerful tool in the arsenal of any trader, offering valuable insights into market sentiment and potential trend shifts. By understanding its characteristics, formation, and how it compares to other patterns like the doji candlestick, traders can better navigate the complexities of the financial markets. Incorporating effective Spinning Top Candlestick Trading Strategies, supported by robust risk management and confirmation from other technical indicators, can significantly enhance your trading outcomes.

Moreover, partnering with a trusted and regulated broker like Opofinance ensures that you have the necessary resources and support to implement these strategies effectively. As you continue to refine your trading approach, the spinning top candlestick pattern will remain an essential component of your technical analysis toolkit, guiding you toward more informed and strategic trading decisions.

Key Takeaways

- Market Indecision Indicator: The spinning top candlestick pattern highlights periods of market indecision, often signaling potential trend reversals or consolidations.

- Distinct Characteristics: With a small real body and long upper and lower shadows, the spinning top visually represents the balance between buyers and sellers.

- Contextual Importance: The pattern’s significance varies based on its placement within an uptrend, downtrend, or sideways market, making context crucial for accurate interpretation.

- Comparison with Doji: Understanding the differences between spinning tops and doji candlesticks enhances pattern recognition and trading accuracy.

- Strategic Integration: Combining spinning tops with other technical indicators and robust risk management strategies leads to more reliable trading decisions.

- Advanced Strategies: Leveraging pattern confluence, multiple timeframes, and advanced indicators can amplify the effectiveness of spinning top-based strategies.

- Trusted Broker Partnership: Utilizing services from a regulated broker like Opofinance provides the necessary tools and support for effective trading based on candlestick patterns.

Implementing these takeaways can transform your trading approach, leveraging the spinning top candlestick pattern to achieve greater market success.

How does the timeframe of a spinning top candlestick affect its reliability?

The timeframe plays a significant role in the reliability of the spinning top candlestick pattern. Patterns identified on higher timeframes (e.g., daily or weekly charts) tend to carry more weight and offer more reliable signals compared to those on lower timeframes (e.g., 5-minute or 15-minute charts). Higher timeframe spinning tops indicate more substantial market indecision and are more likely to precede significant trend reversals or consolidations.

Can spinning tops be used effectively in algorithmic trading?

Yes, spinning tops can be incorporated into algorithmic trading strategies. By programming trading algorithms to recognize the specific characteristics of spinning tops—such as the small real body and long shadows—and combining them with other indicators for confirmation, traders can automate the identification and execution of trades based on this pattern. However, it’s essential to backtest and optimize the algorithms to ensure their effectiveness across different market conditions.

What role does market news play in the formation of spinning tops?

Market news and economic events can significantly influence the formation of spinning tops. Unexpected news releases or economic data can create volatility and uncertainty, leading to the price fluctuations that characterize spinning tops. In such cases, the pattern may reflect the market’s reaction to the news, indicating a temporary pause or a reassessment of the prevailing trend. Traders should be aware of scheduled news events and consider their potential impact when interpreting spinning tops.