Ever paused to consider how the stock market and the forex market are intertwined? It’s a question on many traders’ and investors’ minds! Understanding the dynamic relationship between the stock market and forex can seriously sharpen your financial instincts. The connection, or more precisely, the stock market and forex correlation, can be complex, but cracking this code is crucial for smarter investing. This guide dives deep into the stock market and forex relationship, offering practical insights and real-world strategies. Whether you’re using an online forex trading broker or managing a diverse portfolio, we’ll equip you to navigate both these exciting markets with greater confidence.

Decoding Correlation: A Simple Explanation

Let’s get down to basics. Correlation, simply put, is about how two things move together. Think of it as observing if when one wiggles, the other wiggles in a predictable way too. In finance, when we talk about stock market and forex correlation, we’re measuring if a stock index and a currency pair tend to rise and fall in sync, opposite to each other, or just waltz to their own beat. We use a handy number called a correlation coefficient, ranging from -1 to +1, to describe this dance. Let’s unpack what those numbers really mean:

- Positive Correlation (+1 to 0): Imagine two friends strolling down the same path, side-by-side. When one heads uphill, the other tends to follow. For example, if the stock market climbs by a percent, a particular currency might also nudge upwards.

- Negative Correlation (0 to -1): Think of a seesaw in motion. As one side rises, the other descends. If stock prices take a tumble, you might see a currency gain strength.

- No Correlation (~0): Picture two dancers on a vast stage, each lost in their own routine, oblivious to the other. Their movements are completely unrelated – no predictable pattern between these assets.

Here’s a quick visual breakdown to make it crystal clear:

| Correlation Value | Meaning | Example |

| +1 | Perfect positive correlation | Stocks and currency ascend in perfect harmony |

| +0.5 | Moderate positive correlation | Stocks gain, currency often tags along |

| 0 | No correlation | Movements? Unrelated. |

| -0.5 | Moderate negative correlation | Stocks dip, currency often perks up |

| -1 | Perfect negative correlation | Stocks plunge precisely as currency soars |

Why should you care? Understanding stock market and forex correlation is like having a secret weapon for any investor. It’s a vital tool for risk management and smart portfolio construction. If you recognize how assets are linked, you’re better prepared to manage your exposure. Assets that move in opposite directions are like portfolio bodyguards – if one stumbles, the other might step up, cushioning your overall portfolio from a hard fall. That’s the essence of diversification and crafting a solid hedge.

Unraveling the Mechanisms Behind Stock Market and Forex Correlation

The stock market and forex relationship isn’t just happenstance; it’s a result of economic forces, investor psychology, and the ever-present global backdrop. Let’s explore the key drivers that shape how these markets correlate:

Economic Indicators: The Core Drivers

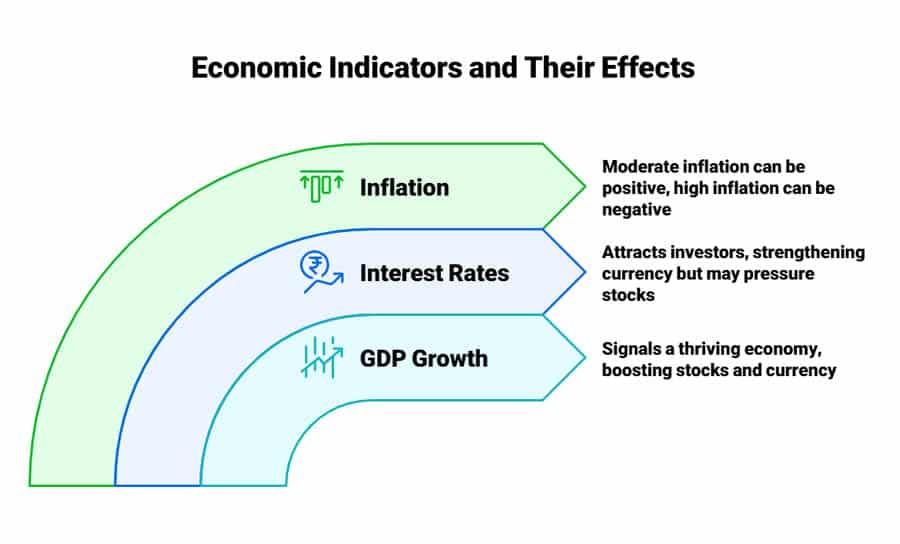

Economic indicators are essentially the vital stats of an economy, and they exert significant influence over both stock and currency valuations. Let’s see how:

- GDP Growth: Think of robust GDP growth as an economic engine roaring to life. It signals a thriving economy, which tends to fuel corporate earnings (a boon for stocks) and attract international capital, ramping up demand for the local currency (boosting its value).

Remember Q3 2021 in the US? Strong GDP growth was a tailwind, propelling both a stock market rally (S&P 500 on the rise) and a stronger US Dollar as investors braced for tighter monetary policy.

Correlation Impact: Typically positive – both stocks and currency tend to thrive when the economy is expanding.

- Interest Rates: Interest rates are a central bank’s lever to steer inflation and economic momentum. Elevated interest rates can make a country’s assets more appealing to global investors chasing higher returns. This increased allure strengthens the local currency. However, for stocks, higher rates can translate to pricier borrowing for companies, potentially dampening stock market enthusiasm.

Back in late 2018, when the Federal Reserve hiked interest rates, the US Dollar gained ground, but the stock market experienced a dip as investors grew wary about the impact of increased borrowing costs on economic expansion.

Correlation Impact: Often negative – rising rates can boost the currency while potentially putting pressure on stocks.

Nuance: It’s not always black and white. In the initial phases of interest rate hikes, if the economy remains robust, stocks and the currency might actually climb together.

- Inflation: A touch of inflation can be a sign of a healthy, growing economy – a bit like a gentle simmer. However, runaway inflation is like a raging fire – it erodes purchasing power and breeds economic instability. Moderate inflation can be supportive for both stocks and currencies. But high inflation often compels central banks to aggressively hike interest rates, which can be a headwind for stocks while possibly bolstering the currency.

In 2022, when US inflation surged dramatically, the Federal Reserve responded with forceful rate increases. The US Dollar surged, while the stock market took a significant hit as recession worries intensified.

Correlation Impact: Can lean negative, particularly when high inflation ignites risk-averse sentiment.

Investor Sentiment: Gauging Market Mood

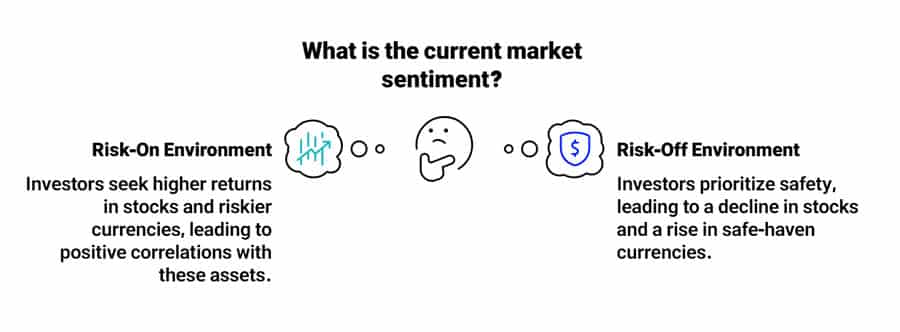

Market psychology is a powerful force. Are investors feeling upbeat and adventurous, or jittery and cautious? This overall “risk appetite” can significantly shape the stock market and forex correlation.

- Risk-On Environment: When optimism prevails, investors tend to hunt for juicier returns, often flocking to stocks and currencies considered riskier but potentially more rewarding (think Australian or Canadian Dollars). In a “risk-on” mood, safe-haven currencies like the US Dollar or Japanese Yen might lose some luster as investors seek growth elsewhere.

After the initial jolt of the COVID-19 pandemic in 2020, massive government stimulus and brightening economic prospects sparked a “risk-on” surge. Stock markets soared, and currencies like the Aussie Dollar gained ground against the US Dollar.

Correlation Impact: Positive correlation between stocks and risk-sensitive currencies; negative correlation with safe-haven currencies.

- Risk-Off Environment: When fear takes hold – perhaps due to economic clouds, geopolitical storms, or unforeseen crises – investors rush for safety. This “flight to safety” often involves selling off stocks and piling into safe-haven assets, including currencies like the US Dollar, Swiss Franc, or Japanese Yen.

At the height of the COVID-19 market meltdown in March 2020, as stock markets plummeted, the US Dollar spiked as investors scrambled for the security and liquidity of the greenback.

Correlation Impact: Negative correlation – stocks typically decline while safe-haven currencies strengthen.

Time Horizon: Short-Term Jitters vs. Long-Term Trends

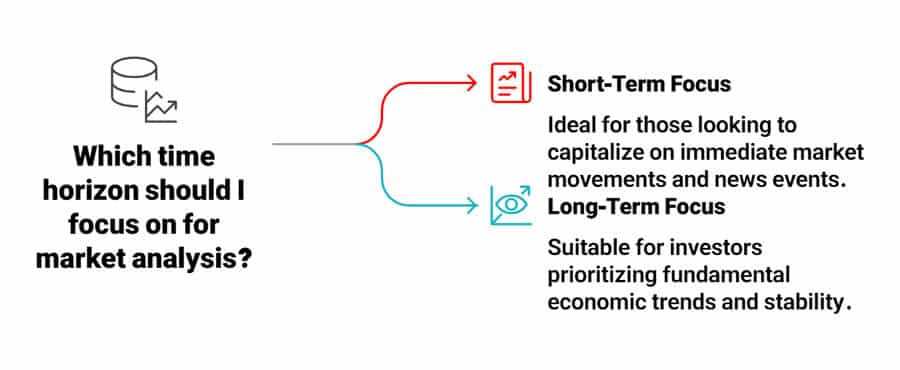

The stock market and forex correlation can paint a different picture depending on whether you’re focused on short-term blips (days or weeks) or long-term narratives (months or years).

- Short-Term (Days to Weeks): In the short run, news headlines and immediate events reign supreme. Surprise economic data drops, company earnings announcements, or sudden policy tweaks can trigger rapid shifts in both stock and currency markets, creating fleeting correlations that might not endure over longer stretches.

Imagine a surprisingly stellar US jobs report hits the wires. This could energize the stock market and simultaneously bolster the US Dollar in a single trading day, showcasing a short-lived negative correlation between stocks and EUR/USD (as a dollar surge weakens EUR/USD).

Application: Day traders often keep a close eye on short-term correlations, sometimes using stock index futures as potential clues for upcoming forex moves.

- Long-Term (Months to Years): Over the long haul, broader economic tides and fundamental shifts in economies take center stage. Short-term noise fades into the background, and underlying economic currents steer the stock market and forex relationship.

In the decade following the 2008 financial crisis (2010-2019), the US economy embarked on a prolonged recovery. The stock market experienced a phenomenal climb, but the US Dollar Index was relatively stable, indicating a weaker long-term correlation compared to the more volatile short-term dance.

Application: Long-term investors often prioritize fundamental economic factors, paying less attention to fleeting short-term correlations.

Read More: Forex versus Other Markets

Geopolitical Shocks and Policy Surprises: Curveballs in the Mix

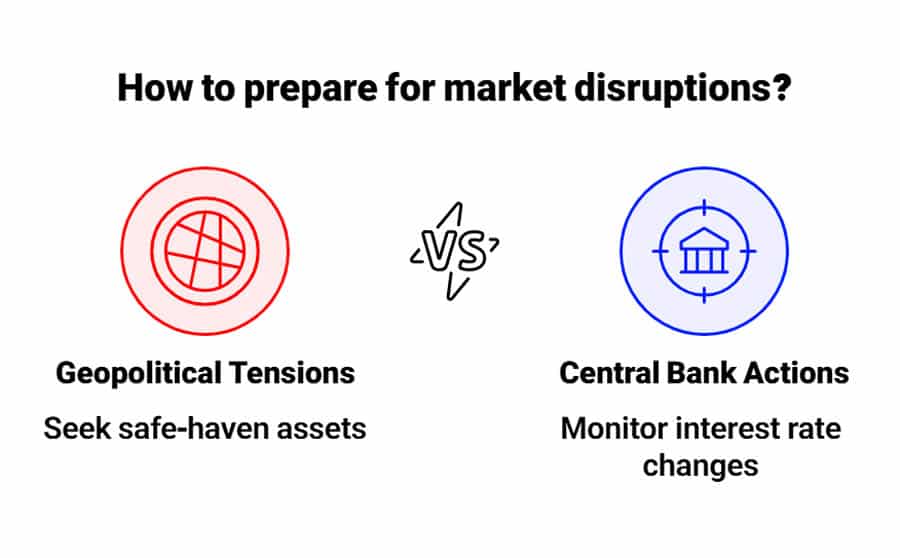

Global events and policy decisions can throw established correlation patterns off course, leading to unexpected market reactions.

- Geopolitical Tensions: Political instability, international conflicts, or trade spats inject uncertainty into the markets. In periods of geopolitical turbulence, investors often seek refuge in safe-haven assets, impacting stocks and currencies in distinct ways.

Russia’s invasion of Ukraine in 2022 triggered a sharp downturn in global stock markets and a surge in the US Dollar as investors sought safety amid the unfolding crisis.

Application: Staying plugged into global news is paramount, as geopolitical events can trigger sudden shifts in established correlations.

- Central Bank Actions: Central banks can sometimes unleash surprise moves that disrupt market norms. Unforeseen interest rate adjustments or currency market interventions can rapidly decouple typical stock market and forex correlation dynamics.

In 2015, when the Swiss National Bank unexpectedly abandoned the peg on the Swiss Franc against the Euro, the Franc skyrocketed, while Swiss stocks plunged. This policy bombshell created an instant and strong negative correlation.

Correlation Impact: Often negative, especially when policy shocks trigger a surge in risk aversion.

Real-World Scenarios: Stock Market and Forex Correlation in Action

Let’s explore some concrete examples to see how the stock market and forex correlation unfolds in various regions and situations.

United States: S&P 500 and U.S. Dollar Index (DXY)

Typical Pattern: Frequently a negative correlation. The US Dollar often plays the role of a safe-haven currency, gaining strength when risk aversion escalates, which often coincides with stock market downturns. This inverse stock market and forex correlation is a common observation.

2008 Financial Crisis

- Timeline: October 2007 (S&P 500 peak) to March 2009 (market bottom).

- S&P 500: Nosedived by 56% amid the collapse of financial giants and widespread recession fears.

- DXY: Soared by 22% as investors globally stampeded towards the safety of the US Dollar.

- Driver: Intense risk-off sentiment and a global flight to safety.

- Correlation Coefficient: Estimated to be strongly negative, hovering around -0.8 during the crisis’s peak.

- Practical Insight: Forex traders might consider adopting a long position on USD pairs (like USD/JPY) during US stock market slides, anticipating dollar strength based on this stock market and forex correlation.

Japan: Nikkei 225 and Japanese Yen

Typical Pattern: The stock market and forex correlation here can be more nuanced. Initially, expansionary monetary policy might weaken the Yen while giving stocks a lift. However, at times, especially when driven by international investment, a positive correlation can emerge as foreign investors snap up both Japanese stocks and the Yen to facilitate those investments. The stock market and forex relationship in Japan can shift.

Abenomics (2013-2015)

- Timeline: Period of aggressive monetary easing under Prime Minister Shinzo Abe starting in late 2012.

- Nikkei 225: Doubled in value, surging from approximately 10,000 to 20,000 by mid-2015.

- Yen: Initially weakened significantly (USD/JPY shot up) due to the monetary easing. However, as foreign capital poured into Japanese stocks, demand for Yen picked up in later phases.

- Driver: Initially, monetary easing weakened the Yen and boosted stocks. Later, stock market gains lured foreign capital, creating Yen demand and altering the stock market and forex correlation.

- Correlation: Shifted from negative in the early phase of easing to sporadically positive as foreign investment gained momentum.

- Practical Insight: Keep a close watch on Japanese policy announcements. A robust rally in the Nikkei might sometimes present Yen buying opportunities as international investors move in, based on this evolving stock market and forex relationship.

Emerging Markets: Brazil’s Bovespa and Real

Typical Pattern: Often a positive stock market and forex correlation, especially in commodity-exporting nations. Commodity cycles exert a strong influence on both stock markets and currencies in these economies. The stock market and forex relationship is heavily tied to commodities.

Commodity Boom (2003-2011)

- Timeline: Period of soaring global demand for commodities, particularly from China.

- Bovespa Index: Experienced a massive bull market, climbing from around 10,000 in 2003 to a peak near 70,000 by 2010.

- Brazilian Real: Appreciated significantly against the US Dollar, from roughly 3.5 to 1.6.

- Driver: Massive influx of foreign capital into Brazil, fueled by elevated commodity prices and strong export revenues, propelled both the stock market and the currency, solidifying the positive stock market and forex correlation.

- Correlation Coefficient: Estimated to be strongly positive, around +0.7 during the boom years.

- Practical Insight: Surges in commodity prices (like oil or metals) can signal potential trading opportunities in both the stocks and currencies of resource-rich countries, leveraging this stock market and forex relationship.

Currency Pairs and Global Stocks

- EUR/USD and S&P 500:

Pattern: Often a positive stock market and forex correlation. A rising S&P 500, reflecting global risk appetite, can sometimes weaken the US Dollar, leading to a climb in EUR/USD. The stock market and forex relationship here is worth noting.

In Q1 2021, as the S&P 500 gained ground, EUR/USD generally trended upwards as well.

Application: Some traders utilize the S&P 500 as a potential early indicator for EUR/USD movements, watching the stock market and forex correlation for clues.

- USD/JPY and S&P 500:

Pattern: Typically a negative stock market and forex correlation. The Japanese Yen tends to strengthen during risk-off periods, often when the US stock market is in decline. This inverse stock market and forex relationship is frequently observed.

During the stock market sell-off in October 2018, as the S&P 500 dipped, USD/JPY also declined as the Yen gained strength.

Application: Shorting USD/JPY might be considered during periods of US equity market weakness, anticipating Yen strength based on the established stock market and forex correlation.

Read More: Analysis of International Markets in Forex

Practical Uses: Turning Correlation Knowledge into Action

Simply understanding stock market and forex correlation is a good start, but the real advantage comes from putting this knowledge to work in your investment and trading strategies. Here’s how you can leverage stock market and forex correlation to enhance your financial decisions:

Portfolio Diversification: Creating Balance

Minimize overall portfolio risk by strategically combining assets that don’t move in perfect step. The aim is to incorporate assets with low or even negative stock market and forex correlation.

Step-by-Step:

- Assess Your Current Holdings: Let’s say your portfolio leans heavily towards US stocks, perhaps through an S&P 500 ETF (like SPY).

- Analyze the Stock Market and Forex Correlation: Recognize that the S&P 500 and the US Dollar often exhibit a negative correlation historically.

- Add Counterbalancing Assets: To diversify and manage risk based on stock market and forex correlation, consider adding assets that tend to behave differently from US stocks. Eurozone stocks (like those in the STOXX 50 index) or EUR/USD forex positions could be smart additions, as they might benefit if the dollar weakens while US stocks are under pressure.

- Monitor and Rebalance Regularly: Stock market and forex correlation is not static. Re-evaluate and rebalance your portfolio periodically (e.g., quarterly) as market conditions and correlations evolve.

Example Outcome: In a year where the S&P 500 experiences a significant drop, a portion of your portfolio allocated to EUR/USD or Eurozone stocks (which might rise if the dollar weakens during risk-off periods, due to stock market and forex correlation) could help cushion some of the losses from your US stock holdings.

Hedging Strategies: Building a Safety Net

Employ one market to act as a shield against potential downturns in another, effectively using stock market and forex correlation to your advantage.

For Traders:

- Scenario: You hold a sizable portfolio of US stocks and anticipate a possible market correction or pullback.

- Action: To hedge against a stock market decline, you might consider buying USD/JPY (going long on the dollar and shorting the Yen). The rationale here leverages the stock market and forex correlation: if stocks fall due to risk aversion, the US Dollar is likely to gain strength as a safe-haven, while the Yen might also strengthen, but potentially less so than the dollar in certain global risk-off scenarios.

- Execution: If the S&P 500 does indeed decline by 5%, and USD/JPY rises (or falls less than other pairs as USD strengthens more broadly, reflecting stock market and forex correlation), your forex position could generate a profit that partially offsets the losses in your stock portfolio.

For Companies:

- Scenario: A US company generates a substantial portion of its revenue in Euros (€10 million) and is concerned that a strengthening US Dollar could diminish the dollar value of these Euro earnings when converted back to USD.

- Action: The company could utilize a forward contract to hedge its currency risk, taking advantage of predictable stock market and forex correlation patterns to manage exposure. For instance, they could lock in an exchange rate for EUR/USD at 1.10 for a future date.

- Outcome: If, over the contract period, EUR/USD weakens to 1.05, the hedge ensures the company still converts its Euro earnings at the more favorable rate of 1.10, preserving their profit margin in USD terms and providing greater stability to their stock price, thanks to proactive management of stock market and forex correlation.

Trading Strategies: Capitalizing on Correlation

Actively trade based on observed stock market and forex correlation patterns to potentially generate profits.

Pairs Trading (Example with EUR/USD and S&P 500):

- Setup: Observe that EUR/USD and the S&P 500 often exhibit a positive stock market and forex correlation. You notice the S&P 500 is rallying, but EUR/USD seems to be lagging behind the upward momentum.

- Action: You might decide to buy EUR/USD, anticipating that it will eventually catch up to the S&P 500’s upward trajectory, based on the historical stock market and forex relationship. Let’s say you buy EUR/USD at 1.18, expecting it to climb towards 1.20 as the S&P 500 continues its ascent.

- Result: If your analysis proves correct, and EUR/USD rises to 1.20, you would realize a profit on your forex trade, effectively profiting from the stock market and forex correlation.

Macro Trading (Example with Nikkei and USD/JPY):

- Setup: You believe that a declining Nikkei 225 is signaling heightened risk aversion in the market, which could translate to Yen strength, leveraging the typical stock market and forex correlation.

- Action: You decide to short USD/JPY, anticipating a downward move, based on your understanding of the stock market and forex relationship. For example, you short USD/JPY at 150.00, targeting a move down to 145.00 if the Nikkei continues its descent.

- Result: If the Nikkei indeed falls, and USD/JPY drops towards your target of 145.00 as the Yen strengthens, you would realize a profit on your short USD/JPY trade, successfully trading based on stock market and forex correlation.

Risk Management: Mitigating Unexpected Losses

Utilize your understanding of stock market and forex correlation to better manage risk and avoid taking on excessive exposure.

Volatility Adjustment:

- You’re aware that the Brazilian Bovespa stock index and the Brazilian Real currency are positively correlated. However, you also observe that the Real tends to exhibit higher volatility than the Bovespa.

- Action: When trading both, you might opt to size your forex positions in the Real smaller than your stock positions in the Bovespa to compensate for the Real’s greater volatility and maintain a more balanced risk profile across both markets, informed by the stock market and forex relationship.

Correlation Monitoring:

- Tool: Employ financial platforms like TradingView or Bloomberg to track rolling correlations (e.g., 30-day correlation) between assets you’re actively trading, keeping tabs on the evolving stock market and forex correlation.

- Action: If you notice that the historically negative stock market and forex correlation between the S&P 500 and the DXY has suddenly strengthened significantly (e.g., moving from -0.2 to -0.8), you might adjust your USD-related trades to reflect this intensified inverse relationship. For instance, you might increase the size of your USD hedges if you hold US equities, adapting to the changing stock market and forex relationship.

Read More: Forex vs Stock

Pro Tips for Advanced Traders

- Dynamic Correlation Analysis: Steer clear of relying on static correlation figures. Embrace rolling correlation metrics to grasp how the stock market and forex relationship between assets is shifting over time. Correlations are fluid, not fixed, and change with market tides.

- Conditional Correlation: Delve into how stock market and forex correlation behaves under varying market climates – for example, during periods of high versus low volatility, or during bull versus bear markets. The stock market and forex relationship can transform in stressful scenarios.

- Lagged Correlation: Sometimes, one market might lead the other in the stock market and forex relationship. Investigate if there’s a lagged correlation where stock market moves today might foreshadow forex movements tomorrow (or vice versa). This could unveil predictive trading opportunities.

- Factor-Based Analysis: Rather than solely focusing on direct stock market and forex correlation, strive to understand the underlying factors influencing both stock and forex markets (like risk sentiment, interest rate gaps, commodity prices). Trading decisions rooted in these shared factors can be more robust than solely depending on observed correlations.

- Tail Risk Awareness: Always remember that stock market and forex correlation tends to break down during extreme market events or “black swan” scenarios. Be prepared for correlations to falter precisely when you need them most for hedging. Consistently use stop-loss orders and carefully manage position sizing, regardless of typical stock market and forex correlation patterns.

Opofinance: Your Partner in Navigating Global Markets

Looking for a reliable and innovative broker to explore the dynamics of the stock market and forex relationship? Consider Opofinance, an ASIC regulated broker offering a suite of advanced tools and platforms designed to empower traders of all levels.

- ASIC Regulated Broker: Trade with confidence knowing Opofinance adheres to the stringent regulatory standards of the Australian Securities and Investments Commission (ASIC).

- Advanced Trading Platforms: Access a range of powerful platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and their proprietary OpoTrade platform, catering to diverse trading styles and preferences.

- Innovative AI Tools: Leverage cutting-edge AI-powered tools such as the AI Market Analyzer for market insights, AI Coach for personalized trading guidance, and AI Support for instant assistance.

- Social & Prop Trading: Engage with a community of traders through social trading features and explore opportunities in proprietary trading programs.

- Secure & Flexible Transactions: Enjoy safe and convenient deposit and withdrawal methods, including crypto payments, with zero fees from Opofinance, ensuring seamless transactions.

Ready to take your trading to the next level? Discover the Opofinance advantage today!

Conclusion: Mastering the Stock-Forex Dynamic

The stock market and forex relationship is a vibrant dance of economic forces, investor moods, and global events. Grasping stock market and forex correlation, whether it’s the often opposing movements in the US or the synchronized patterns in commodity-driven economies, gives you a valuable edge. By thoughtfully analyzing these patterns and their driving forces—GDP growth, interest rates, risk appetite—you can forge more informed strategies for trading, hedging, and portfolio diversification across both the stock and forex arenas. The stock market and forex correlation isn’t a rigid rule, but a powerful insight to refine your approach to global finance and the intricate stock market and forex relationship.

Key Takeaways

- The stock market and forex relationship reveals complex correlations shaped by economic indicators, investor sentiment, and global happenings.

- In the U.S., stocks and the dollar often display a negative stock market and forex correlation, while export-focused economies can showcase positive correlations.

- Understanding these stock market and forex correlation patterns is vital for diversification, hedging, and crafting effective trading strategies.

- Always keep in mind that stock market and forex correlation is not causation, and market dynamics can shift, requiring continuous analysis and adaptation to the stock market and forex relationship.

- Utilize stock market and forex correlation as a tool within a broader framework that includes fundamental and technical analysis for sound decision-making in navigating the stock market and forex relationship.

Can changes in commodity prices significantly impact the stock market and forex correlation?

Absolutely, especially for commodity-exporting nations. Surging commodity prices can energize both the stock market (particularly resource-linked stocks) and the currency of these countries due to amplified export revenues and improved economic prospects. This often forges a positive stock market and forex correlation in such economies.

How does political instability in a country affect its stock market and forex correlation with global markets?

Political instability typically cranks up uncertainty and risk aversion. In such scenarios, international investors may pull out capital, causing both the stock market and the currency to weaken. Domestically, investors might also shift funds to safer assets or currencies, potentially disrupting typical stock market and forex correlation patterns with global markets and possibly leading to a temporary positive correlation between domestic stock and currency declines.

Is it possible for the stock market and forex relationship to exhibit positive correlation during a crisis?

In specific types of crises, particularly those originating from or heavily impacting a specific country, you might witness a temporary positive stock market and forex correlation. For instance, if a country grapples with a severe economic crisis, both its stock market and its currency could decline in tandem as investors flee domestic assets for safer havens elsewhere. However, in broader global risk-off events, the typical negative stock market and forex correlation between US stocks and the US dollar often re-emerges.