Traders seeking to maximize their profits in the forex market often wonder about the best time to trade GBP/JPY. This currency pair, combining the British pound and Japanese yen, offers significant opportunities for those who understand its nuances. Consulting a reliable forex broker can further enhance a trader’s ability to identify the optimal trading window, which typically occurs when the London and Tokyo markets overlap, between 8:00 AM and 9:00 AM GMT (3:00 AM to 4:00 AM EST). During this period, liquidity is high, and price movements can be substantial, creating ideal conditions for traders to capitalize on market fluctuations.

In this comprehensive guide, we’ll explore the factors that influence the best time to trade GBP/JPY, strategies to optimize your trading schedule, and expert insights to help you make informed decisions. Whether you’re a seasoned trader or just starting, understanding the temporal dynamics of this popular currency pair can significantly impact your trading success.

Understanding GBP/JPY Market Dynamics

The Importance of Market Hours

The forex market operates 24 hours a day, five days a week, but not all hours are created equal when it comes to trading GBP/JPY. The most active periods coincide with the opening hours of major financial centers:

- Tokyo (Asian Session): 12:00 AM – 9:00 AM GMT

- London (European Session): 8:00 AM – 5:00 PM GMT

- New York (North American Session): 1:00 PM – 10:00 PM GMT

Read More: Best Currency Pairs to Trade in London Session

The Golden Hour: London-Tokyo Overlap

The overlap between the London and Tokyo sessions, occurring from 8:00 AM to 9:00 AM GMT (3:00 AM to 4:00 AM EST), is widely considered the best time to trade GBP/JPY. This one-hour window offers:

- Increased liquidity

- Higher trading volumes

- Potential for significant price movements

During this time, both British and Japanese markets are active, leading to enhanced volatility and trading opportunities.

Optimal Trading Times for GBP/JPY

Understanding the optimal trading times for GBP/JPY is crucial for maximizing potential profits and minimizing risks. Let’s explore the key periods that traders should consider when planning their GBP/JPY trading activities.

Overlapping Trading Sessions: London and Tokyo

The most advantageous time to trade GBP/JPY often occurs during the overlap between the London and Tokyo trading sessions. This overlap happens from 8:00 AM to 9:00 AM GMT (3:00 AM to 4:00 AM EST). During this hour:

- Both British and Japanese markets are active

- Liquidity reaches its peak for this currency pair

- Price action tends to be more volatile, offering numerous trading opportunities

Traders can capitalize on this period by:

- Preparing their strategies before the overlap begins

- Monitoring key support and resistance levels

- Being ready to execute trades quickly as opportunities arise

High Volatility Periods

While the London-Tokyo overlap is crucial, other high volatility periods can also provide excellent trading opportunities for GBP/JPY:

- London Session Opening: 8:00 AM GMT

- Often sees increased activity as European traders enter the market

- Can lead to significant price movements and potential breakouts

- New York Session Opening: 1:00 PM GMT

- Brings in North American traders, potentially increasing volatility

- Important US economic data releases can impact the yen as a safe-haven currency

- Economic Data Releases:

- UK data typically released around 9:30 AM GMT

- Japanese data often released around 11:50 PM GMT or early morning Tokyo time

- These releases can cause sharp moves in GBP/JPY, offering opportunities for news traders

Quiet Trading Hours

While active periods offer numerous opportunities, being aware of quieter trading hours is equally important:

- Mid-Asian Session: 2:00 AM to 4:00 AM GMT

- Lower liquidity can lead to wider spreads

- Price movements may be less predictable

- Pre-New York Lunch Hour: 11:00 AM to 12:00 PM GMT

- Often sees reduced activity as London traders take lunch breaks

- Can result in ranging markets or sudden, unpredictable moves

- Late New York Session: 9:00 PM to 12:00 AM GMT

- Liquidity begins to thin as North American traders end their day

- Can lead to erratic price movements, especially if unexpected news breaks

Understanding these quieter periods is crucial for:

- Avoiding times of potential slippage due to low liquidity

- Setting realistic profit targets and stop-loss levels

- Planning trade exits before liquidity decreases

By aligning your trading activities with these optimal times and being aware of quieter periods, you can enhance your GBP/JPY trading strategy. Remember that while these time frames provide general guidance, it’s essential to adapt to daily market conditions and stay informed about events that might affect usual trading patterns.

Read More: Best Currency Pairs to Trade in New York Session

Factors Influencing GBP/JPY Trading Times

Economic Indicators and News Releases

Key economic indicators and news releases can cause substantial price movements in the GBP/JPY pair. Important events to watch for include:

- Bank of England (BoE) interest rate decisions

- Bank of Japan (BoJ) monetary policy statements

- UK and Japanese GDP reports

- Employment data from both countries

Traders should be aware of these scheduled releases and adjust their trading strategies accordingly.

Seasonal Patterns

GBP/JPY trading can also be influenced by seasonal patterns:

- Summer months often see reduced liquidity due to holidays

- End-of-year trading may be affected by position squaring and profit-taking

- Japanese fiscal year-end (March 31) can lead to increased volatility

Understanding these patterns can help traders identify optimal trading periods throughout the year.

Strategies for Trading GBP/JPY at the Right Time

1. Breakout Trading During London Open

The London market opening at 8:00 AM GMT often leads to significant price movements. Traders can capitalize on this by:

- Identifying key support and resistance levels before the market opens

- Setting up entry orders above and below these levels

- Using stop-loss orders to manage risk

2. News Trading During Economic Releases

Major economic announcements can create volatile trading conditions. To trade GBP/JPY effectively during these times:

- Stay informed about upcoming economic releases

- Use a news calendar to track important events

- Implement a straddle strategy around the news release time

3. Trend Following During Sustained Market Moves

When strong trends develop in the GBP/JPY pair:

- Use moving averages to identify trend direction

- Look for pullbacks to enter in the direction of the trend

- Trail stop-losses to protect profits as the trend progresses

Read More: Forex Market Hours

Best Practices for GBP/JPY Trading

Risk Management

Proper risk management is crucial when trading GBP/JPY:

- Never risk more than 1-2% of your trading capital on a single trade

- Use appropriate position sizing based on your risk tolerance

- Always use stop-loss orders to limit potential losses

Technical Analysis

Incorporate technical analysis tools to improve your timing:

- Use candlestick patterns to identify potential reversals

- Implement Fibonacci retracements to find optimal entry points

- Utilize momentum indicators like RSI or MACD to gauge market strength

Fundamental Analysis

Stay informed about fundamental factors affecting both currencies:

- Monitor economic calendars for upcoming events

- Analyze long-term economic trends in the UK and Japan

- Consider geopolitical events that may impact currency values

Adapting to Market Conditions

Volatility Considerations

GBP/JPY is known for its volatility, which can be both an opportunity and a risk:

- During high volatility periods, consider widening your stop-loss orders

- In low volatility conditions, look for range-bound trading opportunities

- Adjust your position size based on current market volatility

Liquidity Awareness

Understanding liquidity patterns is essential for effective GBP/JPY trading:

- Avoid trading during major holidays when liquidity is low

- Be cautious of wide spreads during off-peak hours

- Consider using limit orders to get better fill prices in less liquid markets

Advanced Techniques for Timing GBP/JPY Trades

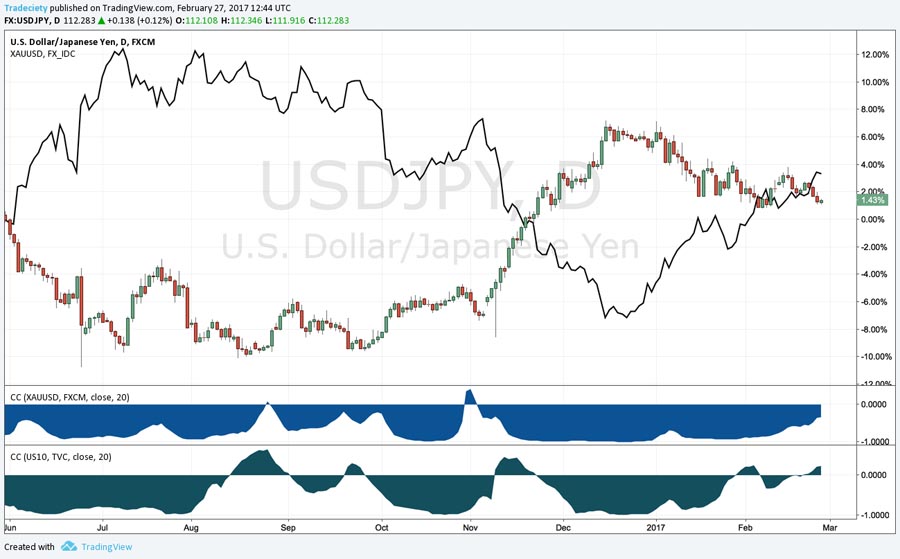

Correlation Analysis

GBP/JPY often correlates with other currency pairs and financial instruments:

- Monitor correlations with pairs like EUR/GBP and USD/JPY

- Consider the impact of stock market movements on the yen as a safe-haven currency

- Use correlation data to confirm trade ideas or identify potential divergences

Multi-Timeframe Analysis

Combining multiple timeframes can provide a more comprehensive view of the market:

- Use longer timeframes to identify overall trends

- Switch to shorter timeframes for precise entry and exit points

- Ensure consistency across timeframes before entering a trade

Sentiment Analysis

Gauge market sentiment to improve your trading decisions:

- Utilize Commitment of Traders (COT) reports to understand institutional positioning

- Monitor retail sentiment indicators provided by brokers

- Consider contrarian strategies when sentiment reaches extreme levels

Technology and Tools for Optimal GBP/JPY Trading

Trading Platforms and Software

Leverage technology to enhance your trading experience:

- Choose a reliable trading platform with advanced charting capabilities

- Utilize trading journals to track and analyze your performance

- Consider automated trading systems for executing strategies consistently

Economic Calendars and News Feeds

Stay informed with real-time information:

- Use economic calendars to plan your trading around important events

- Subscribe to reputable news feeds for instant updates on market-moving news

- Set up alerts for significant price movements or economic releases

Experience the Future of Trading with Oppofinance Today!

Oppofinance is a powerful, secure, and leading broker in the financial industry. As part of Opo Group LTD, it is not just a broker but a trusted partner in your trading journey. Leveraging advanced technology and outstanding services, Oppofinance delivers a unique trading experience.

Oppofinance proudly holds the regulatory license from ASIC Australia. This achievement places Oppofinance among onshore brokers, ensuring the credibility and security of your trades. This license reflects Oppofinance’s commitment to high regulatory standards and operational transparency, allowing you to trade with peace of mind and full confidence. At Oppofinance, security and transparency are paramount.

Oppofinance offers a wide range of services, including:

- Advanced Trading Platforms: Oppofinance provides traders with MetaTrader 4 and 5 platforms, as well as cTrader, to meet their diverse needs.

- 24/7 Support: The specialized Oppofinance team is available around the clock to address customer needs.

- Precise and Fast Trade Execution: With low spreads close to zero pips and no commissions, Oppofinance offers the best trading conditions for traders.

- Investment Security: In addition to the ASIC license, Oppofinance is regulated by the Seychelles Financial Services Authority (FSA) and offers insurance up to 20,000 euros.

- Continuous Innovation: Oppofinance constantly improves its services by leveraging new technologies.

Oppofinance focuses on transparency, efficiency, and innovation, positioning itself as a reliable trading partner ready to support you on your path to success.

Conclusion

Mastering the art of timing in GBP/JPY trading can significantly enhance your profitability and trading success. By focusing on the optimal trading window during the London-Tokyo overlap (8:00 AM to 9:00 AM GMT or 3:00 AM to 4:00 AM EST), and incorporating the strategies and insights discussed in this guide, traders can position themselves for better outcomes in the dynamic forex market.

Remember that successful trading requires a combination of knowledge, discipline, and continuous learning. Stay informed about market conditions, maintain strict risk management practices, and always be prepared to adapt your strategies as market dynamics evolve. With patience and persistence, you can develop the skills necessary to capitalize on the best times to trade GBP/JPY and work towards achieving your financial goals in the forex market.

How does daylight saving time affect the best time to trade GBP/JPY?

Daylight saving time (DST) can shift the optimal trading window for GBP/JPY. When the UK observes DST (typically from late March to late October), the best trading time may shift by an hour. Traders should adjust their schedules accordingly and stay aware of DST changes in both the UK and Japan to ensure they’re active during the most advantageous hours.

Can I effectively trade GBP/JPY outside of the recommended 8:00 AM to 9:00 AM GMT window?

While the 8:00 AM to 9:00 AM GMT window is often considered optimal, successful trading can occur at other times. The New York session (1:00 PM to 10:00 PM GMT) can also offer good opportunities, especially when significant economic data is released. However, traders should be aware that liquidity and volatility may vary outside peak hours, potentially affecting spreads and execution quality.

How do global events like elections or natural disasters impact the best time to trade GBP/JPY?

Global events can significantly alter typical trading patterns for GBP/JPY. During major events like elections, referendums, or natural disasters, market volatility can increase dramatically, and normal time-based patterns may be disrupted. In these situations, traders should exercise caution, potentially reduce position sizes, and be prepared for unexpected market movements at any time of day. Staying informed about global events and their potential impact on both currencies is crucial for adapting your trading strategy effectively.

One Response

I am impressed with this website , real I am a fan.