Welcome to the world of the ICT Judas Swing, a trading strategy that has made waves in the financial markets. Developed by Michael Huddleston, this strategy integrates advanced market structure analysis, order flow concepts, and precise entry techniques to pinpoint high-probability trading opportunities. In this comprehensive guide, we’ll explore the depths of the ICT Judas Swing, arming you with the knowledge and tools to potentially transform your trading performance.

The ICT Judas Swing strategy is particularly effective in forex markets but can be adapted to various financial instruments. Its primary goal is to help traders align their positions with institutional money movements, capitalizing on market inefficiencies and liquidity flows. By mastering this strategy, you’ll gain a deeper understanding of market dynamics, potentially improving your trade timing and risk management.

Throughout this article, we’ll break down the key components of the ICT Judas Swing, including market structure analysis, order flow concepts, and advanced entry techniques. We’ll also discuss common pitfalls to avoid and provide practical tips for integrating this strategy into your trading routine. Whether you’re a seasoned trader looking to refine your approach or a novice eager to learn a cutting-edge strategy, this guide will provide valuable insights to enhance your trading journey.

What is the ICT Judas Swing?

The ICT Judas Swing is an advanced trading strategy developed by Michael Huddleston, also known as the Inner Circle Trader (ICT). This strategy combines elements of price action, market structure, and order flow to identify high-probability trading opportunities. While it is particularly effective in forex markets, it can also be applied to other financial instruments such as stocks, commodities, and indices.

Key Components of the ICT Judas Swing

- Market Structure Analysis

- Order Flow Concepts

- Price Action Patterns

- Time Frame Correlation

- Entry and Exit Techniques

The Foundations of ICT Judas Swing

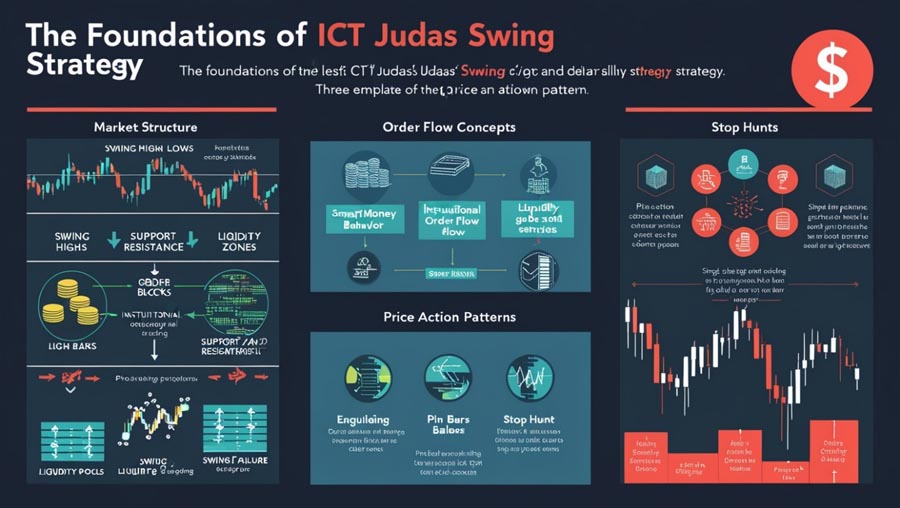

Market Structure Analysis

At the heart of the ICT Judas Swing strategy is a deep understanding of market structure. Traders must identify key levels, such as:

- Swing Highs and Lows: These are the points where the price changes direction, indicating potential areas of support and resistance.

- Support and Resistance Zones: These are levels where the price tends to find support as it falls or resistance as it rises.

- Order Blocks: These are areas where institutional traders have placed large orders, often leading to significant price movements.

- Liquidity Pools: These are areas where there is a high concentration of stop-loss orders, which can lead to sudden price movements when triggered.

By recognizing these structural elements, traders can anticipate potential price movements and plan their trades accordingly.

Order Flow Concepts

The ICT Judas Swing strategy incorporates order flow analysis to gain insights into institutional trading activity. Key concepts include:

- Smart Money Concepts: Understanding how institutional traders operate and how their actions influence market movements.

- Institutional Order Flow: Tracking the flow of large orders placed by institutions to predict future price movements.

- Liquidity Grabs: Identifying areas where the market is likely to move to trigger stop-loss orders and create liquidity.

- Stop Hunts: Recognizing when the market is likely to move to trigger stop-loss orders placed by retail traders.

Understanding these dynamics helps traders align their positions with larger market forces, increasing their chances of success.

Price Action Patterns

Recognizing specific price action patterns is crucial for successfully implementing the ICT Judas Swing strategy. Some important patterns to watch for include:

- Engulfing Candles: These indicate a potential reversal when a large candle engulfs the previous smaller candle.

- Pin Bars: These are candles with long wicks that indicate a potential reversal.

- Inside Bars: These are candles that are completely contained within the range of the previous candle, indicating potential consolidation or reversal.

- Swing Failure Patterns: These occur when the price fails to break a previous swing high or low, indicating a potential reversal.

These patterns, when combined with other strategy components, can signal potential trade setups.

Read More: Mastering the ICT Turtle Soup Trading Strategy

Implementing the ICT Judas Swing Strategy

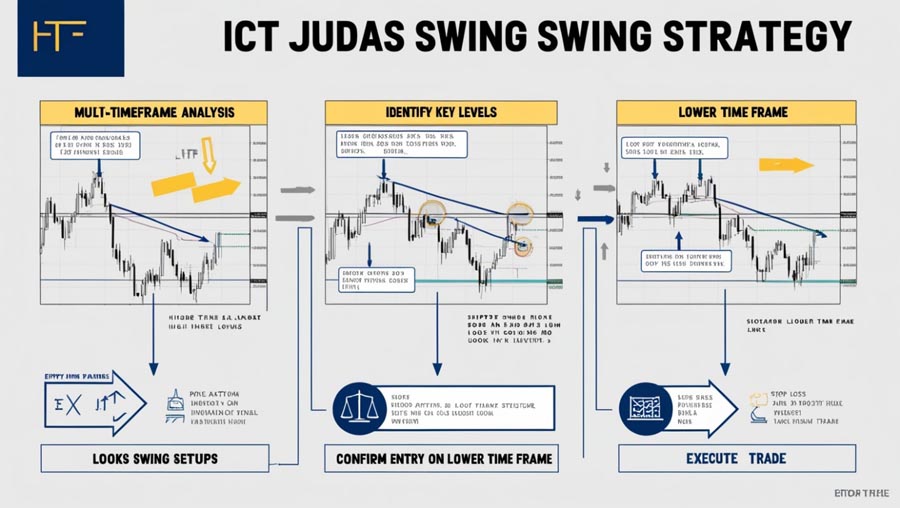

Step 1: Multi-Timeframe Analysis

Begin by analyzing multiple time frames to gain a comprehensive view of the market. Typically, traders use:

- Higher Time Frame (HTF): This is used to determine the overall trend direction.

- Intermediate Time Frame (ITF): This is used to identify swing points and potential areas of interest.

- Lower Time Frame (LTF): This is used for precise entry and exit points.

This multi-timeframe approach ensures that trades align with the broader market context, increasing the probability of success.

Step 2: Identify Key Levels

On the higher time frame, mark significant structural levels such as:

- Major Swing Highs and Lows: These are critical points where the price has previously changed direction.

- Key Support and Resistance Zones: These are areas where the price has historically found support or resistance.

- Order Blocks: These are areas where institutional traders have placed large orders.

- Liquidity Areas: These are zones with a high concentration of stop-loss orders.

These levels will serve as potential areas for trade setups, guiding your analysis and decision-making process.

Step 3: Look for Swing Setups

On the intermediate time frame, watch for potential swing setups near the identified key levels. Look for:

- Price Approaching a Significant Level: This indicates a potential trading opportunity.

- Candlestick Patterns Indicating a Potential Reversal: Patterns such as engulfing candles, pin bars, and inside bars can signal a change in direction.

- Signs of Institutional Involvement: Look for large volume spikes or other indicators of institutional activity.

Step 4: Confirm Entry on Lower Time Frame

Once a potential setup is identified, switch to the lower time frame for entry confirmation. Look for:

- Price Action Confirmation: This includes patterns such as engulfing candles, pin bars, and inside bars.

- Order Flow Indicators: Indicators such as volume divergence can confirm the presence of institutional activity.

- Break of Local Structure: This can indicate a shift in market direction, providing a signal to enter the trade.

Step 5: Execute the Trade

When all conditions align, enter the trade with a clear plan for:

- Stop Loss Placement: Typically, this is placed beyond the nearest structural level to protect against adverse price movements.

- Take Profit Targets: These are based on the next significant level or a predetermined risk-reward ratio.

- Trade Management Rules: This includes strategies such as trailing stops and partial profit-taking to maximize gains and minimize losses.

Advanced Techniques for ICT Judas Swing Trading

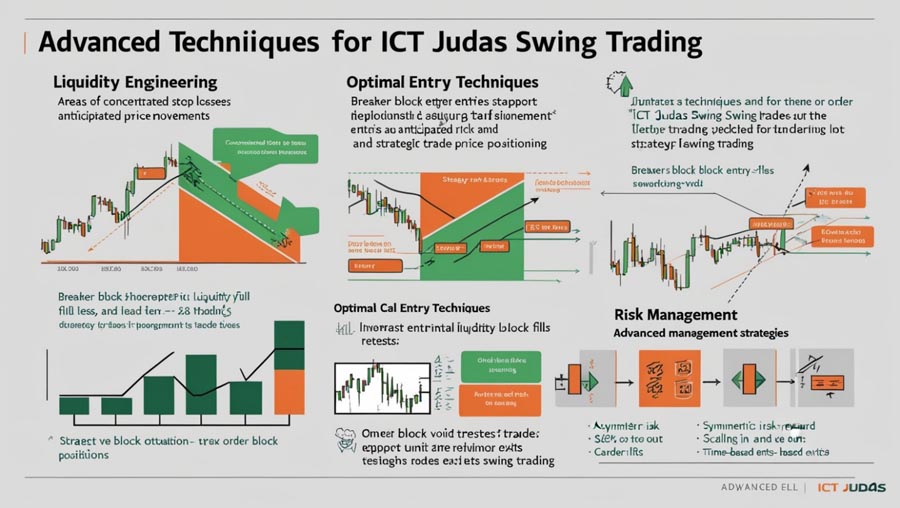

Liquidity Engineering

One of the hallmarks of the ICT Judas Swing strategy is the concept of liquidity engineering. This involves:

- Identifying Areas of Concentrated Stop Losses: These are zones where many traders have placed their stop-loss orders.

- Anticipating Price Movements Designed to Trigger These Stops: The market often moves to these areas to create liquidity.

- Positioning Trades to Benefit from the Subsequent Price Reaction: By understanding these movements, traders can position themselves to profit from the resulting price action.

Mastering liquidity engineering can provide a significant edge in trade timing and risk management.

Optimal Entry Techniques

Refining your entry technique is crucial for maximizing the potential of the ICT Judas Swing. Consider these advanced entry methods:

- Breaker Block Entries: Enter trades when the price returns to a previously broken structure level.

- Liquidity Void Fills: Capitalize on rapid price movements as markets fill areas of low liquidity.

- Order Block Retests: Look for precise entries as the price retests significant order blocks.

Risk Management Strategies

Effective risk management is paramount in ICT Judas Swing trading. Implement these strategies to protect your capital:

- Asymmetric Risk-Reward: Aim for trades with a minimum 1:3 risk-reward ratio to ensure that your potential profits outweigh your potential losses.

- Scaling In and Out: Consider entering positions in tranches and taking partial profits at key levels to manage risk and lock in gains.

- Time-Based Exits: Incorporate time stops to avoid holding positions through unfavorable market conditions.

Read More: Mastering the ICT Power of 3 (PO3)

Common Pitfalls and How to Avoid Them

Overtrading

Many traders fall into the trap of overtrading when first implementing the ICT Judas Swing strategy. To avoid this:

- Stick to your predefined trading plan and avoid deviating from it.

- Focus on quality setups rather than quantity, ensuring that each trade meets your criteria.

- Practice patience and discipline in trade selection, waiting for the best opportunities.

Misinterpreting Market Structure

Accurately interpreting market structure is crucial. Common mistakes include:

- Misidentifying key levels, leading to incorrect trade decisions.

- Ignoring higher time frame context, resulting in trades that are out of sync with the broader market trend.

- Failing to adapt to changing market conditions, causing missed opportunities or unnecessary losses.

Regularly review and refine your market structure analysis to improve accuracy and effectiveness.

Neglecting Fundamental Analysis

While the ICT Judas Swing is primarily a technical strategy, ignoring fundamental factors can be detrimental. Stay informed about:

- Major economic events, such as central bank announcements and economic data releases.

- Central bank policies, which can significantly impact market movements.

- Geopolitical developments, which can create volatility and affect market sentiment.

Incorporate this information into your trading decisions for a more holistic approach, enhancing your overall strategy.

Conclusion

The ICT Judas Swing trading strategy offers a sophisticated and potentially lucrative approach to market analysis and trade execution. By combining advanced market structure analysis, order flow concepts, and precise entry techniques, traders can identify high-probability setups across various financial markets.

Throughout this guide, we’ve explored the core components of the ICT Judas Swing, from its foundational principles to advanced implementation techniques. We’ve discussed the importance of multi-timeframe analysis, liquidity engineering, and risk management strategies that are crucial for success with this approach.

As with any advanced trading strategy, mastering the ICT Judas Swing requires dedication, practice, and continuous learning. It’s essential to start with a demo account, keep a detailed trading journal, and regularly review your performance to refine your skills. Remember that while the strategy can be highly effective, it’s not without its challenges. We’ve highlighted common pitfalls to avoid and provided insights on how to overcome them.

As you embark on your journey to master the ICT Judas Swing, keep in mind that consistency and patience are key. Don’t be discouraged by initial setbacks; instead, view them as learning opportunities to refine your approach. With time and experience, you’ll develop the intuition and skill necessary to effectively apply this powerful strategy.

By thoroughly understanding and consistently applying the principles outlined in this guide, you’ll be well-equipped to harness the power of the ICT Judas Swing strategy. This approach has the potential to significantly enhance your market insights, improve your trade timing, and ultimately lead to more profitable trading outcomes.

Read More: Mastering the Opening Range Breakout Trading Strategy

Remember, successful trading is a marathon, not a sprint. Stay committed to your learning process, remain adaptable to changing market conditions, and always prioritize risk management. With dedication and perseverance, the ICT Judas Swing could become a valuable addition to your trading arsenal, potentially leading to improved market insights and more consistent profitability in your trading journey.

How does the ICT Judas Swing perform in ranging markets?

The ICT Judas Swing strategy can be effective in ranging markets, but it requires some adjustments. In range-bound conditions, focus on identifying key support and resistance levels within the range. Look for order blocks and liquidity pools near these levels, as they often provide opportunities for high-probability trades. Additionally, pay close attention to false breakouts, as these can offer excellent entry points for trades back into the range. Remember to adjust your profit targets and risk management strategies to account for the limited directional movement in ranging markets.

Can the ICT Judas Swing be combined with other trading strategies?

Yes, the ICT Judas Swing can be effectively combined with other trading strategies to create a more robust trading approach. For example, you might use traditional technical indicators like moving averages or RSI to confirm trends identified by the ICT Judas Swing analysis. Alternatively, you could incorporate elements of fundamental analysis to validate the directional bias suggested by the ICT Judas Swing. The key is to ensure that any additional strategies or indicators complement the core principles of the ICT Judas Swing, rather than contradicting them. Always test any combined approach thoroughly before implementing it in live trading.

What role does psychology play in successfully implementing the ICT Judas Swing strategy?

ychology plays a crucial role in the successful implementation of the ICT Judas Swing strategy. This approach often requires traders to take positions that may seem counterintuitive to traditional technical analysis, which can be psychologically challenging. Developing a strong mental game is essential for:

Maintaining discipline in trade selection and execution.

Managing emotions during periods of drawdown or consecutive losses.

Avoiding the temptation to overtrade or deviate from the strategy.

Building confidence in the strategy through consistent application and review.

Cultivating patience, emotional control, and a growth mindset are key psychological traits that can significantly enhance your success with the ICT Judas Swing strategy.