Are you looking for the ultimate broker for forex to pair with the best 15-minute forex trading strategy and supercharge your profits? Look no further! In this comprehensive guide, we’ll unveil a powerful 15-minute forex strategy that can revolutionize your trading approach. By mastering this technique, you’ll be able to capitalize on short-term market movements and potentially boost your returns.

The best 15-minute forex trading strategy combines price action analysis, market sentiment, and risk management to identify high-probability trading opportunities within a 15-minute timeframe. This approach allows traders to make quick decisions and execute trades efficiently, making it ideal for those with limited time or who prefer fast-paced trading environments.

Let’s dive into the details of this strategy and discover how you can implement it in your own trading routine.

Understanding the 15-Minute Forex Trading Strategy

What Makes It Effective?

The 15-minute forex trading strategy is highly effective due to its ability to capture short-term price movements while minimizing exposure to market volatility. Here’s why it works:

- Optimal timeframe: 15-minute charts provide a balance between noise reduction and timely entry/exit points.

- Increased trading opportunities: More frequent price action allows for multiple trades throughout the day.

- Reduced emotional stress: Shorter holding periods can help minimize anxiety associated with longer-term positions.

- Quick feedback loop: Traders can quickly assess and adjust their approach based on results.

Key Components of the Strategy

To implement the best 15-minute forex trading strategy, you’ll need to focus on these essential elements:

- Price action analysis

- Support and resistance levels

- Trend identification

- Candlestick patterns

- Risk management techniques

Read More: forex gap trading strategy

15 Minute Forex Trading Strategies

The 15-minute timeframe offers a perfect balance between short-term volatility and meaningful price movements. It provides traders with numerous opportunities throughout the trading day while allowing for more in-depth analysis compared to lower timeframes. Here are some effective 15-minute forex trading strategies that focus on price action:

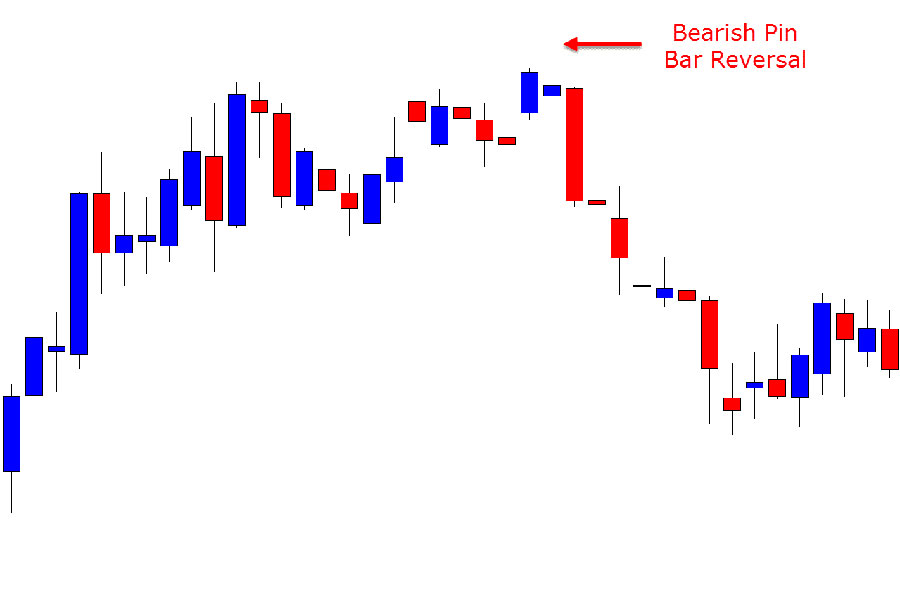

1. Pin Bar Reversal Strategy

This strategy capitalizes on potential trend reversals or continuations by identifying pin bar candlestick formations. Pin bars are powerful price action signals that indicate rejection of certain price levels. When trading pin bars on the 15-minute chart:

- Focus on pin bars forming at significant support or resistance levels

- Consider the overall trend and market structure

- Pay attention to the size and positioning of the pin bar’s wick

- Confirm the signal with the surrounding price action

- Use tight stop losses and aim for higher reward-to-risk ratios

2. Inside Bar Breakout Strategy

The inside bar breakout strategy is designed to capture potential trend continuations or the start of new trends. Inside bars represent periods of consolidation and often precede strong price movements. When implementing this strategy:

- Look for inside bar formations on the 15-minute chart

- Consider the positioning of the inside bar within the overall trend

- Assess the size of the inside bar relative to surrounding candles

- Wait for a clear breakout before entering the trade

- Use the inside bar’s range to determine stop loss placement

- Set take profit targets based on recent swing points or key levels

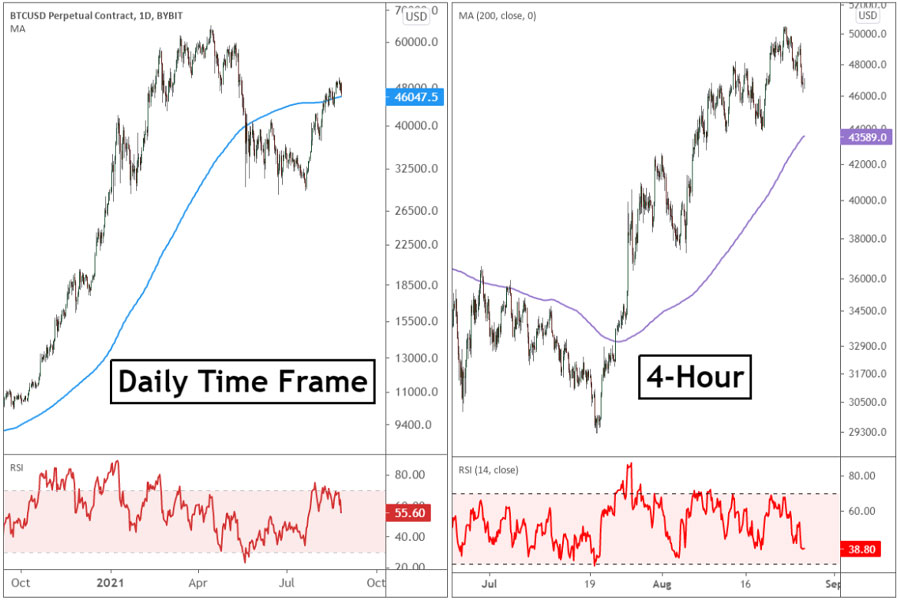

3. Multiple Time Frame Momentum Strategy

This strategy combines analysis from higher timeframes with execution on the 15-minute chart to align trades with the broader market trend. By incorporating multiple time frames, traders can improve their accuracy and reduce false signals. Key aspects include:

- Analyzing higher timeframes (e.g., 1-hour, 4-hour) to determine the overall trend

- Identifying strong momentum moves on the 15-minute chart

- Ensuring alignment between the higher timeframe trend and 15-minute price action

- Looking for pullbacks or consolidations as potential entry points

- Using momentum candles to time entries and set stop losses

- Targeting key levels identified on higher timeframes

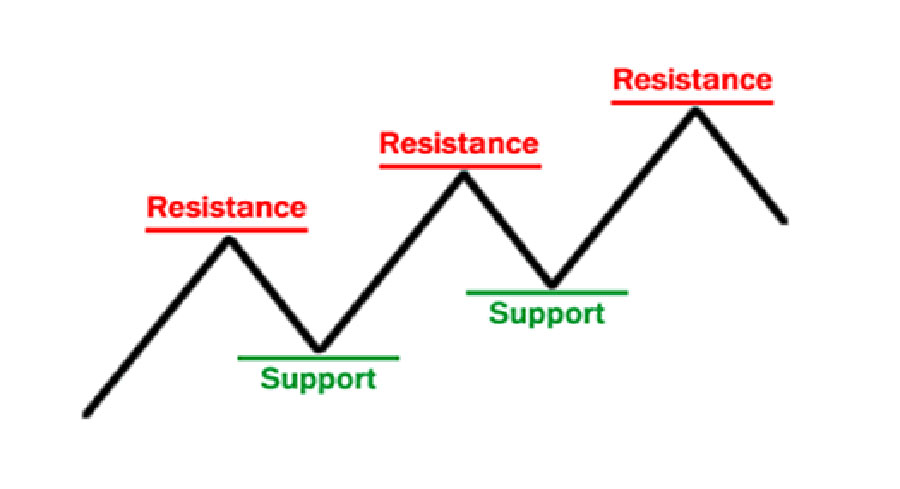

4. Support and Resistance Bounce Strategy

This strategy focuses on trading bounces off key support and resistance levels. It capitalizes on the tendency of price to react at these significant areas. When employing this strategy:

- Identify major support and resistance levels on higher timeframes

- Monitor price approach to these levels on the 15-minute chart

- Look for confirming price action signals at the key levels

- Consider the overall market context and trend

- Use tight stop losses beyond the support or resistance level

- Set take profit targets at the next major level in the opposite direction

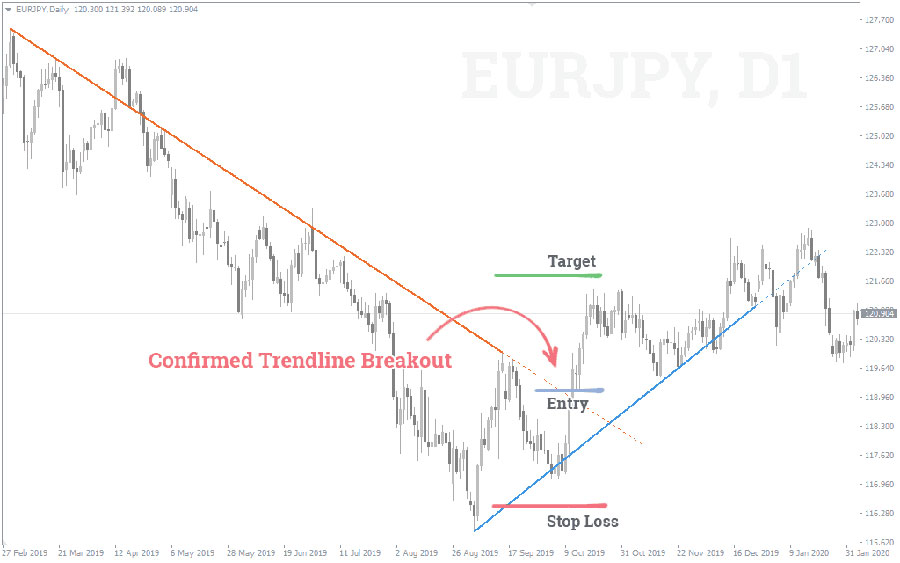

5. Trendline Break Strategy

The trendline break strategy aims to capture new trend movements or strong continuations. It involves drawing trendlines and trading breakouts from these lines. Key considerations include:

- Drawing accurate trendlines connecting recent swing highs or lows

- Waiting for a clear and decisive break of the trendline

- Assessing the strength of the breakout move

- Considering the overall market structure and potential obstacles

- Using the last swing point before the break for stop loss placement

- Targeting the next significant support or resistance level

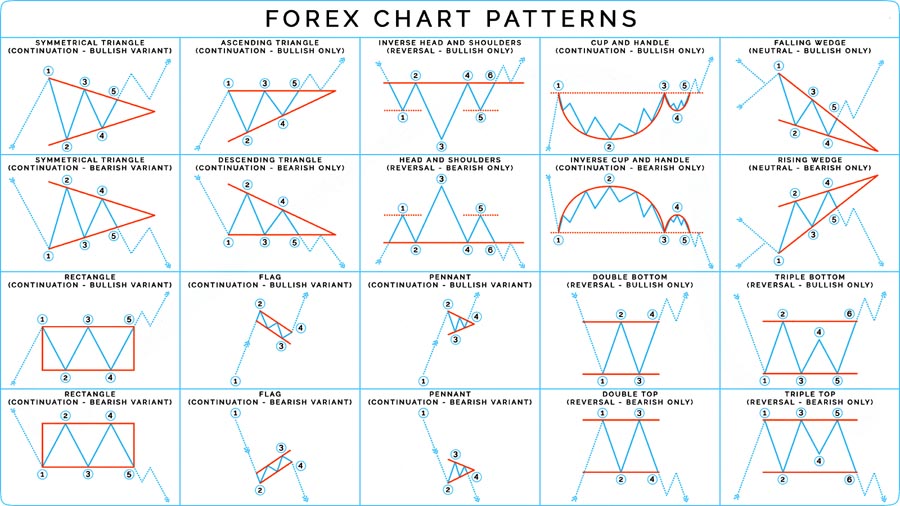

6. Candlestick Pattern Recognition Strategy

This strategy relies on identifying and trading specific candlestick patterns that form within the 15-minute timeframe. It requires a deep understanding of various candlestick formations and their implications. Important aspects include:

- Developing proficiency in recognizing key candlestick patterns

- Understanding the context in which these patterns form

- Considering the size and positioning of the pattern within the trend

- Confirming signals with surrounding price action

- Implementing strict risk management based on pattern structure

- Setting realistic profit targets based on the pattern’s potential

7. Range Trading Strategy

Range trading can be particularly effective on the 15-minute timeframe, especially during periods of low volatility or consolidation. This strategy involves:

- Identifying clear upper and lower boundaries of the range

- Trading bounces off support and resistance within the range

- Looking for breakout opportunities when the range eventually ends

- Using oscillators or other indicators to confirm overbought/oversold conditions

- Implementing tight stop losses to manage risk in case of false breakouts

- Adjusting profit targets based on the range’s size and market conditions

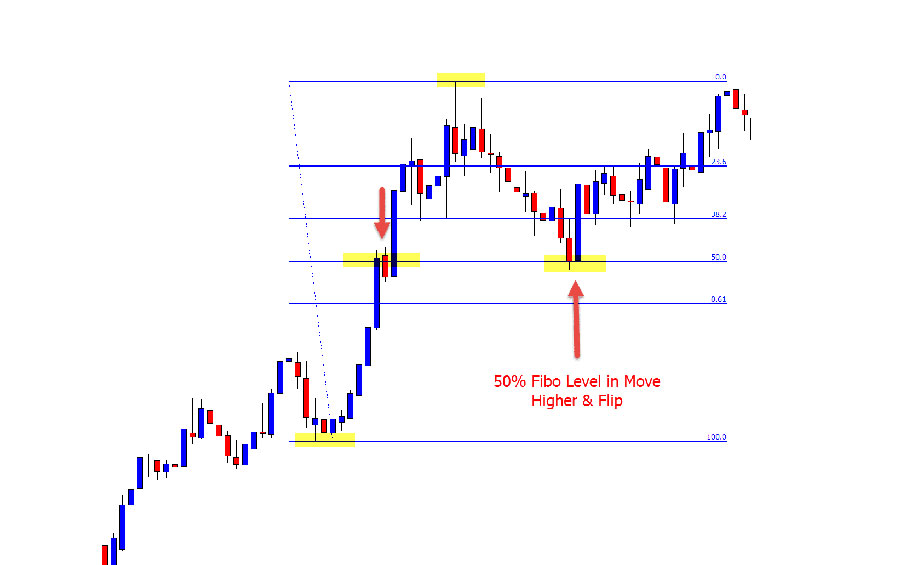

8. Fibonacci Retracement Strategy

Incorporating Fibonacci retracements into 15-minute forex trading can help identify potential reversal points and entry opportunities. This strategy involves:

- Drawing Fibonacci retracement levels on higher timeframes

- Monitoring price reactions at key Fibonacci levels on the 15-minute chart

- Combining Fibonacci analysis with other price action signals

- Using Fibonacci extension levels for potential take profit targets

- Adjusting entry and exit points based on how price interacts with Fibonacci levels

- Considering the overall trend and market structure when applying Fibonacci analysis

Each of these strategies offers a unique approach to trading the 15-minute forex charts. Traders should thoroughly backtest and practice these methods before implementing them in live trading. It’s also crucial to adapt these strategies to individual trading styles, risk tolerance, and market conditions. Remember, successful trading is not just about the strategy itself, but also about consistent application, strong risk management, and continuous learning and adaptation.

Read More: 1 minute forex trading strategy

The Step-by-Step Guide to Implementing the Strategy

Step 1: Choose Your Currency Pairs

Start by selecting 2-3 major currency pairs to focus on. Popular choices include:

- EUR/USD

- GBP/USD

- USD/JPY

These pairs typically offer high liquidity and tight spreads, making them ideal for short-term trading.

Step 2: Set Up Your Charts

Configure your trading platform to display 15-minute candlestick charts for your chosen pairs. Keep your charts clean, focusing primarily on price action.

Step 3: Identify the Trend

Use price action to determine the overall trend:

- Bullish trend: Higher highs and higher lows

- Bearish trend: Lower highs and lower lows

- Sideways trend: No clear direction, price moving in a range

Step 4: Look for Entry Signals

Watch for these high-probability entry signals:

- Price action patterns (e.g., pin bars, inside bars, engulfing candles)

- Breakouts from key levels or chart patterns

- Reactions at support and resistance levels

- Trendline breaks or bounces

Step 5: Confirm with Market Structure

Before entering a trade, confirm the signal with overall market structure:

- Alignment with the higher time frame trend

- Proximity to key support and resistance levels

- Presence of significant swing highs or lows

Step 6: Set Your Entry, Stop Loss, and Take Profit

Once you’ve identified a potential trade:

- Place your entry order based on the specific strategy rules

- Set a stop loss at a logical level (e.g., beyond a key swing point or support/resistance level)

- Target a take profit of 1.5 to 2 times your risk, or at the next major support/resistance level

Step 7: Manage Your Risk

Adhere to strict risk management rules:

- Risk no more than 1-2% of your account balance per trade

- Use a risk-reward ratio of at least 1:1.5

- Implement trailing stops to protect profits

Step 8: Monitor and Exit

Closely monitor your open positions and be prepared to exit based on:

- Your predetermined take profit level

- A trailing stop being hit

- New price action signals suggesting a reversal

Read More: 1-hour forex trading strategy

Advanced Techniques to Enhance Your Strategy

Incorporating Multiple Timeframes

To improve your accuracy, consider using multiple timeframes:

- Use the 1-hour chart to confirm the overall trend

- Trade on the 15-minute chart for entries and exits

- Refer to the 5-minute chart for fine-tuning entry points

Utilizing Fibonacci Retracements

Fibonacci retracements can help identify potential reversal points:

- Draw Fibonacci levels on the 1-hour chart

- Look for trade opportunities on the 15-minute chart near key Fibonacci levels

Implementing News Trading

Stay informed about major economic events:

- Use an economic calendar to track upcoming news releases

- Avoid trading 15 minutes before and after high-impact news

- Look for potential breakout opportunities following news announcements

Common Pitfalls to Avoid

- Overtrading: Stick to your strategy and avoid the temptation to trade every 15-minute candle.

- Ignoring the bigger picture: Always consider the broader market context when making trading decisions.

- Neglecting risk management: Consistently apply your risk management rules to protect your capital.

- Emotional trading: Stay disciplined and avoid making impulsive decisions based on fear or greed.

Optimizing Your Trading Performance

Keep a Trading Journal

Maintain a detailed record of your trades, including:

- Entry and exit points

- Reasons for entering the trade

- Market conditions

- Outcome and lessons learned

Regular Strategy Review

Periodically assess your trading performance:

- Analyze your win rate and average risk-reward ratio

- Identify patterns in your successful and unsuccessful trades

- Make data-driven adjustments to your strategy

Continuous Learning

Stay updated on market trends and trading techniques:

- Follow reputable forex trading blogs and forums

- Attend webinars and trading seminars

- Practice new strategies in a demo account before implementing them with real money

OpoFinance Services: Your Partner in Forex Success

Are you ready to take your forex trading to the next level? Look no further than OpoFinance! As a leading online trading platform, OpoFinance offers a comprehensive suite of tools and resources designed to help traders of all levels succeed in the dynamic world of forex.

With OpoFinance, you’ll enjoy:

- Advanced charting tools for precise price action analysis

- Real-time market data and news feeds

- Educational resources and webinars on price action trading

- Competitive spreads and fast execution

- Dedicated customer support

Whether you’re just starting out or looking to refine your 15-minute forex trading strategy, OpoFinance has everything you need to thrive in the markets. Sign up today and experience the OpoFinance difference!

Conclusion

Mastering the best 15-minute forex trading strategy based on price action can significantly enhance your trading performance and potentially boost your profits. By focusing on candlestick patterns, support and resistance levels, and overall market structure, you can capitalize on short-term market movements with confidence.

Remember, success in forex trading requires discipline, patience, and continuous learning. Implement the strategies outlined in this guide, stay informed about market developments, and always prioritize risk management. With practice and persistence, you’ll be well on your way to becoming a skilled 15-minute forex trader.

Are you ready to put this powerful strategy into action? Start by paper trading to refine your skills, then gradually transition to live trading as you build confidence. Happy trading!

How many trades can I expect to take per day using this 15-minute forex strategy?

The number of trades you take per day can vary depending on market conditions and your specific criteria. On average, you might find 2-5 high-quality trading opportunities per currency pair during active market hours. However, it’s essential to focus on the quality of trades rather than quantity. Remember, overtrading can lead to poor decision-making and increased risk.

Can I use this 15-minute price action strategy for cryptocurrency trading as well?

While this strategy is primarily designed for forex trading, it can be adapted for cryptocurrency markets with some modifications. Keep in mind that crypto markets tend to be more volatile and less liquid than forex, which may affect the reliability of price action patterns and increase the potential for false signals. If you decide to apply this strategy to crypto trading, start with a demo account and adjust your risk management accordingly.

Is it necessary to use any indicators with this 15-minute price action forex strategy?

No, it’s not necessary to use indicators with this price action-based strategy. The beauty of price action trading is that it relies solely on the information provided by the candlesticks and chart patterns. However, some traders may choose to add one or two carefully selected indicators to complement their price action analysis. If you do decide to use indicators, make sure they don’t clutter your charts or override your price action signals. Always prioritize what the price is telling you over indicator readings.