Ever wished you could predict market downturns before they happen? The Three Black Crows Candlestick Pattern might be your key to staying ahead in volatile markets. This powerful bearish reversal signal is a favorite among traders and analysts alike. But to truly harness its potential, you need more than just a basic understanding—you need to master it.

Whether you’re a seasoned trader or just starting out, understanding the Three Black Crows Candlestick Pattern meaning can significantly enhance your trading strategies. In today’s fast-paced trading environment, having reliable tools at your disposal is crucial. Especially when trading forex through a trusted forex trading broker, recognizing patterns like the Three Black Crows can make a substantial difference in your profitability.

In this comprehensive guide, we’ll delve deep into the Three Black Crows Candlestick Pattern, exploring its meaning, how to identify it on charts, and how to incorporate it into your trading strategy. We’ll also discuss how this pattern fits into broader Three Black Crows Technical Analysis and how you can leverage it for better trading outcomes.

Understanding the Three Black Crows Candlestick Pattern

Decode the signals and structure of the Three Black Crows candlestick pattern.

Read More: Harami Candlestick Pattern

Three Black Crows Candlestick Pattern Meaning

The Three Black Crows Candlestick Pattern meaning lies in its ability to signal a strong shift in market sentiment from bullish to bearish. This pattern typically appears after a sustained uptrend and suggests that the bulls are losing control while the bears are gaining momentum. For traders, recognizing this pattern is crucial as it can indicate the beginning of a potential downtrend.

This pattern is a visual representation of a market reversal. Each of the three candles reflects increasing selling pressure, with each closing lower than the previous one. The formation of this pattern indicates that sellers have taken control of the market, and a decline in price may continue.

Understanding the Three Black Crows Candlestick Pattern allows traders to anticipate market movements and adjust their positions accordingly. It’s a critical component of Three Black Crows Technical Analysis, providing insights into market psychology and potential future price action.

Structure and Description of the Three Black Crows Chart Pattern

The Three Black Crows Chart Pattern consists of:

- Three Consecutive Bearish Candlesticks: Each candle opens within the previous candle’s real body and closes lower.

- Long Real Bodies: The bodies of the candles are relatively large, indicating strong selling pressure throughout the trading sessions.

- Minimal Wicks or Shadows: Little to no upper or lower shadows suggest that sellers dominated the market from open to close.

Understanding the structure of the 3 black crows candlestick pattern is essential for accurate identification and application in your trading strategy. By recognizing these specific characteristics, traders can make more informed decisions and potentially capitalize on upcoming market reversals.

Key Points:

- First Candle: Marks the end of the uptrend, opening near the previous high and closing lower.

- Second Candle: Continues the bearish momentum, opening within the first candle’s body and closing even lower.

- Third Candle: Confirms the bearish reversal, opening within the second candle’s body and closing at a new low.

Historical Background and Origin

Originating from Japanese candlestick charting techniques developed in the 18th century, the Three Black Crows Candlestick Pattern has been used by traders for centuries to predict market movements. The name is derived from the imagery of three black crows, which in some cultures symbolize bad omens or impending misfortune. In financial markets, this aligns with the bearish implications of the pattern, signaling a potential decline in asset prices.

The widespread adoption of candlestick charts in modern trading has made the Three Black Crows Candlestick Pattern a fundamental component of Three Black Crows Technical Analysis. Traders across the globe rely on this pattern to gauge market sentiment and anticipate reversals, making it a valuable tool in both traditional and online trading environments.

The historical significance of this pattern underscores its enduring relevance in today’s markets, providing a bridge between traditional charting methods and modern technical analysis.

Identifying the Three Black Crows Candlestick Pattern

Quickly identify the Three Black Crows pattern to stay ahead in trading.

Key Characteristics of the 3 Black Crows Candlestick Pattern

To accurately identify a valid 3 black crows candlestick pattern, it’s important to look for these key characteristics:

- Three Consecutive Bearish Candles: Each candle must be bearish, meaning it closes lower than it opens.

- Consistent Decline: Each subsequent candle should close at a lower price than the previous candle’s closing price.

- Minimal Wicks or Shadows: The candles should have small or non-existent upper and lower shadows, indicating that sellers controlled the price action throughout the trading sessions.

- Opens Within the Previous Candle’s Real Body: Each candle opens within the real body of the previous candle, showing a continuation of bearish sentiment.

Identifying these characteristics on your charts is essential for implementing an effective Three Black Crows Trading Strategy. By recognizing the Three Black Crows Chart Pattern accurately, traders can position themselves to take advantage of potential market downturns.

Additional Tips:

- Volume Confirmation: Higher trading volumes during the formation of the pattern strengthen its validity.

- Timeframe Consideration: The pattern is more significant on higher timeframes, such as daily or weekly charts.

Criteria for a Valid Formation

For the Three Black Crows Candlestick Pattern to be considered valid, the following criteria should be met:

- Preceding Uptrend: The pattern must occur after a clear and sustained uptrend. This ensures that the pattern represents a genuine reversal rather than a continuation of a downtrend.

- Candlestick Sizes: All three bearish candles should have relatively large bodies, reflecting strong selling pressure. Small-bodied candles may indicate indecision rather than a true shift in sentiment.

- Volume Confirmation: Increased trading volume during the formation of the pattern enhances its reliability. Higher volume suggests that more participants are involved in the selling, reinforcing the bearish signal.

- Lack of Significant Gaps: There should be no significant gaps between the candles. Each candle should open within the real body of the previous candle.

Importance of Meeting These Criteria:

- Avoid False Signals: Ensures that the pattern is not a random occurrence.

- Enhance Trading Decisions: Provides a stronger basis for entering or exiting trades.

Read More: Piercing Line Candlestick Pattern

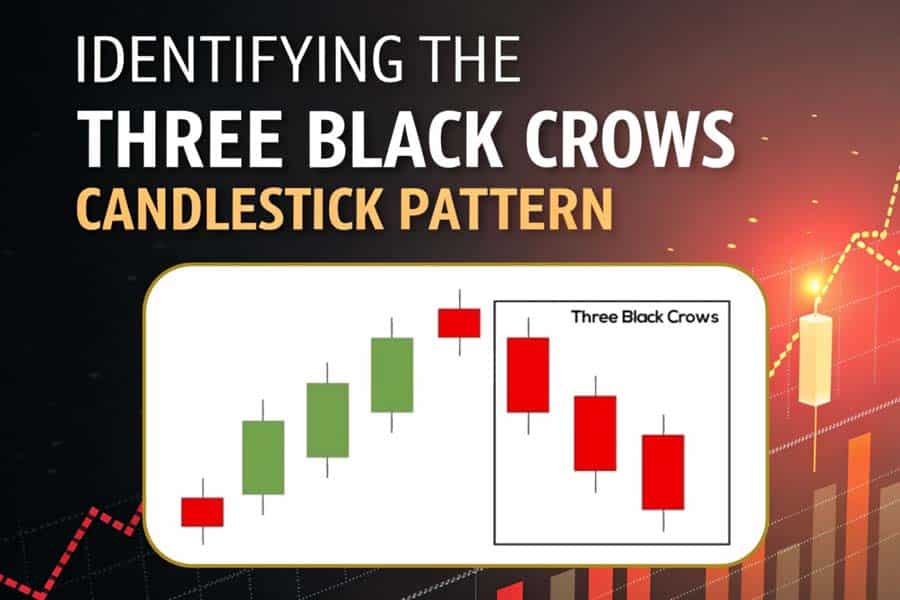

Visual Representation with Annotated Chart

Understanding the Three Black Crows Chart Pattern is easier with a visual representation.

In the above chart, you can see the Three Black Crows Candlestick Pattern forming after an uptrend. Each of the three bearish candles opens within the body of the previous candle and closes lower, with minimal shadows. This pattern signals a potential bearish reversal.

By familiarizing yourself with the visual aspects of the Three Black Crows Candlestick Pattern, you can more readily identify it in real-time trading situations, whether you’re trading stocks, commodities, or forex through an online forex broker.

Practical Application:

- Chart Analysis: Use charting software to zoom in on price action and spot the pattern.

- Practice Identification: Review historical charts to practice identifying the pattern in different market conditions.

Significance of the Three Black Crows Pattern in Trading

Interpretation as a Bearish Reversal Signal

The Three Black Crows Candlestick Pattern is widely regarded as one of the most reliable bearish reversal signals in technical analysis. When this pattern appears after an uptrend, it indicates that the bullish momentum is waning, and sellers are gaining control. This shift in market sentiment suggests that a downtrend may be imminent.

By recognizing the Three Black Crows Candlestick Pattern meaning, traders can anticipate potential price declines and adjust their positions accordingly. For example, they might consider exiting long positions to protect profits or entering short positions to capitalize on the expected downturn.

Implications for Trading:

- Risk Management: Allows traders to mitigate potential losses from holding long positions during a reversal.

- Profit Opportunities: Presents opportunities to profit from declining prices through short selling or derivative instruments.

Implications for Market Sentiment

The formation of the Three Black Crows Candlestick Pattern has several implications for market sentiment:

- Shift from Bullish to Bearish: The pattern signifies a transition in control from buyers to sellers.

- Decreasing Buying Pressure: Buyers are becoming less willing to purchase at higher prices.

- Increasing Selling Pressure: Sellers are becoming more aggressive, pushing prices lower.

- Potential Panic Selling: As the pattern becomes evident, more traders may join the selling, accelerating the price decline.

Understanding these implications helps traders gauge the overall mood of the market and make informed decisions based on the likely direction of future price movements.

Market Psychology:

- Fear and Greed: The pattern reflects changing emotions among market participants.

- Herd Behavior: Awareness of the pattern can lead to collective selling.

Comparison with Similar Patterns

The Three Black Crows Candlestick Pattern has a bullish counterpart known as the Three White Soldiers pattern, which signals a potential bullish reversal after a downtrend. Both patterns are important in technical analysis and provide valuable insights into market dynamics.

Comparing these patterns can enhance a trader’s understanding of market reversals:

- Three Black Crows: Indicates a bearish reversal after an uptrend.

- Three White Soldiers: Indicates a bullish reversal after a downtrend.

By being familiar with both patterns, traders can recognize shifts in market sentiment in both directions, improving their ability to anticipate and respond to market changes.

Other Related Patterns:

- Evening Star: Another bearish reversal pattern to be aware of.

- Bearish Engulfing: Can also signal a potential reversal.

Developing a Three Black Crows Trading Strategy

Craft an effective trading strategy using the Three Black Crows pattern.

Entry and Exit Points

An effective Three Black Crows Trading Strategy involves careful planning of entry and exit points to maximize profits and minimize risks.

Entry Point:

- Short Position: Consider entering a short position at the close of the third bearish candle in the Three Black Crows Candlestick Pattern. This timing ensures that the pattern has fully formed and confirms the bearish reversal signal.

- Confirmation: For added confidence, wait for additional confirmation from other technical indicators, such as moving averages crossing over or a break below a key support level.

Stop-Loss Placement:

- Above the High of the First Candle: Place a stop-loss order just above the high of the first candle in the pattern. This protects against potential false signals and limits potential losses if the market reverses unexpectedly.

- Risk-Reward Ratio: Ensure that your stop-loss and take-profit levels align with a favorable risk-reward ratio, such as 1:2 or 1:3.

Exit Point:

- Profit Target: Set a profit target at the next significant support level or based on a specific percentage gain.

- Trailing Stop: Alternatively, use a trailing stop to lock in profits as the price moves in your favor.

Tips for Effective Implementation:

- Plan Ahead: Define your entry and exit criteria before entering the trade.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

Read More: Engulfing Candlestick Pattern

Risk Management Techniques

Effective risk management is crucial when implementing a Three Black Crows Trading Strategy:

- Position Sizing: Determine the appropriate size of your position based on your overall risk tolerance and the size of your trading account.

- Diversification: Avoid overexposure to a single asset or market. Diversify your portfolio to spread risk across different instruments.

- Use of Leverage: Be cautious when using leverage, especially in forex trading through a regulated forex broker. While leverage can amplify gains, it can also magnify losses.

- Regular Monitoring: Keep a close eye on market developments and be prepared to adjust your strategy as needed.

Best Practices:

- Risk Assessment: Only risk a small percentage of your trading capital on any single trade.

- Emotional Control: Avoid making impulsive decisions based on fear or greed.

Case Studies and Real-World Examples

Case Study 1: Forex Market Application

In the forex market, the Three Black Crows Candlestick Pattern can be particularly effective due to the market’s high liquidity and volatility.

- Scenario: After a prolonged uptrend in the EUR/USD currency pair, a Three Black Crows Candlestick Pattern forms on the daily chart.

- Action: A trader recognizes the pattern and, after confirming with the Relative Strength Index (RSI) indicating overbought conditions, decides to enter a short position.

- Outcome: The currency pair begins to decline over the next several days, allowing the trader to realize significant profits.

Case Study 2: Stock Market Example

- Scenario: A technology stock has been in a strong uptrend but then forms a Three Black Crows Chart Pattern on the weekly chart.

- Action: The trader notes increased volume during the formation of the pattern, confirming strong selling pressure. They enter a short position and set a stop-loss above the pattern’s high.

- Outcome: The stock price declines over the following weeks, and the trader exits the position at a key support level, securing a substantial gain.

Lessons Learned:

- Confirmation is Key: Both traders waited for additional confirmation before entering trades.

- Risk Management: Proper stop-loss placement protected them from potential losses.

Limitations and Considerations in Three Black Crows Technical Analysis

Avoid common pitfalls and enhance reliability in your technical analysis

Potential for False Signals

While the Three Black Crows Candlestick Pattern is a strong bearish indicator, it’s not infallible. False signals can occur, leading traders to make misguided decisions.

Factors Contributing to False Signals:

- Low Trading Volume: If the pattern forms during periods of low volume, it may not accurately reflect true market sentiment.

- Sideways Market Conditions: In a consolidating market, the pattern may not signify a genuine reversal but rather normal price fluctuations within a range.

- News and Economic Events: Unexpected news or economic data releases can override technical patterns, leading to sudden market reversals.

Avoiding False Signals:

- Wait for Confirmation: Use additional technical indicators to confirm the pattern.

- Consider Fundamental Analysis: Be aware of upcoming economic events that may impact the market.

Importance of Confirmation with Other Indicators

To enhance the reliability of the Three Black Crows Technical Analysis, it’s essential to confirm the pattern with other technical indicators:

- Moving Averages: A crossover of moving averages can support the bearish signal.

- Relative Strength Index (RSI): An RSI indicating overbought conditions can confirm that the market is ripe for a reversal.

- MACD (Moving Average Convergence Divergence): A bearish crossover in the MACD can provide additional confirmation.

- Volume Analysis: Increased volume during the formation of the pattern strengthens the signal.

Combining Indicators:

- Multiple Confirmations: Using several indicators together can reduce the likelihood of acting on false signals.

- Divergence Analysis: Look for divergences between price action and indicators to spot potential reversals.

Market Conditions Affecting Reliability

The effectiveness of the Three Black Crows Candlestick Pattern can vary depending on market conditions:

- High Volatility Markets: In highly volatile markets, price movements can be erratic, and patterns may form and fail quickly.

- Trend Strength: If the preceding uptrend was weak or short-lived, the pattern might not signal a strong reversal.

- Timeframe Considerations: Patterns on longer timeframes (e.g., daily or weekly charts) are generally more reliable than those on shorter timeframes (e.g., 5-minute charts).

Best Practices:

- Assess the Overall Market Trend: Ensure that the broader market context supports the bearish signal.

- Avoid Overtrading: Don’t rely solely on the pattern; consider other factors before making trading decisions.

- Stay Informed: Keep abreast of economic news and events that may impact the markets.

Opofinance: Your Trusted Forex Trading Broker

When it comes to executing your Three Black Crows Trading Strategy, choosing a reliable and regulated forex trading broker is paramount. Opofinance, an ASIC-regulated broker for forex trading, offers a secure and advanced trading environment to help you succeed in the financial markets.

Why Choose Opofinance as Your Forex Broker?

- ASIC Regulated Forex Broker: Opofinance is regulated by the Australian Securities and Investments Commission (ASIC), ensuring compliance with strict financial standards and providing peace of mind for traders.

- Featured on MT5 Brokers List: Officially recognized on the MetaTrader 5 (MT5) brokers list, Opofinance provides access to the industry-leading MT5 trading platform.

- Safe and Convenient Deposits and Withdrawals: Enjoy multiple deposit and withdrawal methods with enhanced security measures to protect your funds.

- Social Trading Service: Take advantage of social trading features to follow and copy the strategies of successful traders, enhancing your own trading performance.

- Advanced Trading Tools: Access a wide range of technical analysis tools, including charting software to help you identify patterns like the Three Black Crows Candlestick Pattern.

Benefits of Trading with Opofinance

- Competitive Spreads and Low Fees: Maximize your profits with tight spreads and minimal trading costs.

- Educational Resources: Benefit from comprehensive educational materials to improve your trading knowledge and skills.

- Dedicated Customer Support: Receive professional support from a team of experts ready to assist you 24/5.

- Flexible Account Types: Choose from various account options tailored to your trading style and experience level.

Opofinance is not just a broker; it’s a partner committed to your trading success.

Ready to Elevate Your Trading Experience?

Don’t miss the opportunity to trade smarter and more confidently with Opofinance, your trusted online forex broker.

Experience the difference of trading with a broker that puts your needs first.

Conclusion

The Three Black Crows Candlestick Pattern is a powerful tool in the arsenal of traders and analysts. By understanding its meaning, structure, and significance within Three Black Crows Technical Analysis, traders can gain valuable insights into potential market reversals. Implementing an effective Three Black Crows Trading Strategy involves accurate identification of the pattern, careful planning of entry and exit points, and robust risk management techniques.

However, it’s important to recognize the limitations of the pattern and the necessity of confirming signals with other technical indicators. Market conditions, trading volume, and economic events can all impact the reliability of the pattern. By staying informed and utilizing a trusted forex trading broker like Opofinance, traders can navigate the markets more effectively and enhance their trading success.

Remember, mastering the Three Black Crows Candlestick Pattern requires practice, patience, and continual learning. With dedication and the right resources, you can turn this knowledge into profitable trading opportunities.

Key Takeaways

- Understanding the Three Black Crows Candlestick Pattern: Recognize the pattern’s structure and meaning to identify potential bearish reversals.

- Implementing a Three Black Crows Trading Strategy: Plan your entry and exit points carefully, and employ risk management techniques to protect your capital.

- Importance of Technical Analysis: Use the Three Black Crows Technical Analysis in conjunction with other indicators for more reliable trading signals.

- Choosing a Regulated Forex Broker: Trading with a trusted broker like Opofinance can enhance your trading experience and provide access to advanced tools and resources.

- Continuous Learning and Adaptation: Stay informed about market conditions and continually refine your strategies for optimal trading performance.

Can the Three Black Crows Candlestick Pattern be used in Forex Trading?

Yes, the Three Black Crows Candlestick Pattern is applicable in forex trading and can be observed across various currency pairs. The forex market’s liquidity and volatility make it suitable for technical analysis patterns, including the 3 black crows candlestick pattern. Traders can leverage this pattern to anticipate potential reversals in currency pairs and adjust their trading strategies accordingly.

How Reliable is the Three Black Crows Candlestick Pattern?

While the Three Black Crows Candlestick Pattern is considered a strong bearish signal, its reliability increases when confirmed with other technical indicators and when it appears after a significant uptrend. Traders should be cautious of false signals and always consider the broader market context. Combining the pattern with volume analysis, RSI, and moving averages can enhance its reliability.

Should I Use the Three Black Crows Pattern Alone for Trading Decisions?

It’s advisable not to rely solely on the pattern. Combining the Three Black Crows Candlestick Pattern with other technical analysis tools and considering market conditions can lead to more effective trading decisions. Using additional indicators for confirmation helps reduce the risk of false signals and increases the likelihood of successful trades.