Imagine having a powerful tool that signals a potential market reversal before it happens, giving you the upper hand in your trading strategy. Enter the Three Inside Down Candlestick Pattern, a revered bearish reversal indicator that can transform your trading approach. Whether you’re a seasoned trader or just starting, understanding this pattern can significantly enhance your ability to anticipate market movements and make informed decisions.

In the fast-paced world of trading, timing is everything. The Three Inside Down Candlestick Pattern serves as a crucial signal in technical analysis, helping traders identify shifts from bullish to bearish momentum with precision. This comprehensive guide delves deep into the meaning, formation, and strategic application of this pattern, ensuring you’re equipped with the knowledge to leverage it effectively across various markets, including stocks, forex, and cryptocurrencies.

For those navigating the complexities of forex trading, partnering with a regulated forex broker like Opofinance can amplify the benefits of mastering this pattern. By integrating this strategy into your trading arsenal, you can unlock new levels of profitability and risk management. Let’s embark on a detailed exploration of the Three Inside Down Candlestick Pattern, uncovering its intricacies and practical applications to elevate your trading game.

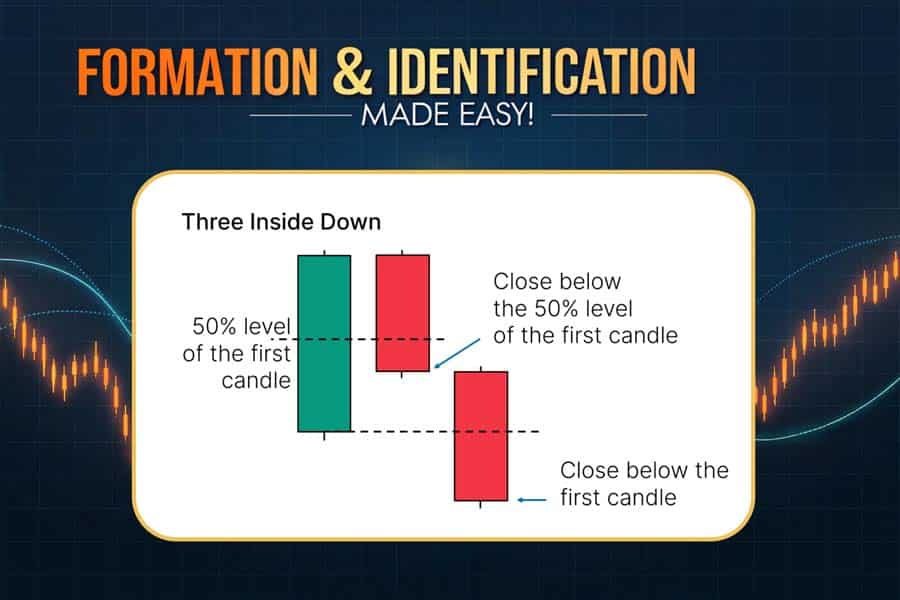

Formation and Identification of the Three Inside Down Candlestick Pattern

Learn to recognize the Three Inside Down Pattern for precise market analysis.

Breaking Down the Structure of the Three Inside Down Candlestick Pattern

To harness the full potential of the Three Inside Down Candlestick Pattern, it’s essential to understand its distinct formation. This pattern consists of three consecutive candlesticks that collectively signal a bearish reversal, indicating a shift in market sentiment from bullish to bearish. Here’s a detailed breakdown:

- First Candle: A Dominant Bullish Momentum

- The pattern begins with a large bullish (up) candle, representing strong upward momentum and buyer dominance.

- Significance: This candle establishes the existing uptrend, setting the stage for the potential reversal.

- Second Candle: A Contraction Within the First Candle

- The second candle is a smaller bearish (down) candle that is entirely contained within the body of the first candle.

- Significance: This contraction indicates a pause or hesitation in the uptrend, suggesting that buyers are losing their grip.

- Third Candle: Confirmation of the Bearish Reversal

- The third candle is a bearish candle that closes below the second candle’s close, solidifying the reversal signal.

- Significance: This final candle confirms the shift in momentum, signaling traders to prepare for a downward move.

Key Tip: Visualizing this pattern on a chart provides a clear view of the market’s transition from bullish enthusiasm to bearish caution.

Visual Representation of the Pattern

Understanding the Three Inside Down Candlestick Pattern is greatly enhanced by visual aids. Below is a graphical representation:

- First Candle: Large bullish candle.

- Second Candle: Smaller bearish candle within the first.

- Third Candle: Bearish candle closing below the second.

Key Characteristics to Identify the Pattern on Charts

- Location in Trend: Typically appears at the top of an uptrend, signaling a potential reversal.

- Candle Size: The first candle is significantly larger than the second, demonstrating strong initial momentum.

- Containment: The second candle’s body must be entirely within the first candle’s body.

- Confirmation: The third candle must close below the second candle’s close to confirm the pattern.

These characteristics differentiate the Three Inside Down Candlestick Pattern from other bearish reversal patterns, such as the Bearish Harami, by requiring a clear three-candle formation with confirmation.

Read More: Three Inside Up Candlestick Pattern

Significance and Interpretation of the Three Inside Down Candlestick Pattern

Understand the sentiment shifts highlighted by the Three Inside Down Pattern.

Understanding Market Sentiment Through the Pattern

The Three Inside Down Candlestick Pattern is more than just a visual formation; it encapsulates a profound shift in market sentiment. Here’s what it signifies:

- Shift in Momentum: The pattern highlights a weakening uptrend, where buyers begin to lose control, and sellers start to gain influence.

- Bearish Dominance: The emergence of the third bearish candle confirms that sellers are taking over, signaling a strong potential for a downward movement.

- Psychological Barrier: This pattern often forms near significant resistance levels, where traders are more likely to take profits or initiate short positions.

Quick Insight: Unlike other reversal patterns, the Three Inside Down provides early indications, making it a preferred choice among experienced traders.

How It Signals a Potential Bearish Reversal

The Three Inside Down Candlestick Pattern serves as a reliable indicator of a bearish reversal through the following mechanisms:

- Initial Strength: The first bullish candle shows that buyers are in control, driving the price upward.

- Consolidation: The second bearish candle within the first indicates indecision among traders, as buying pressure wanes.

- Confirmation: The third bearish candle breaking below the second’s close confirms that sellers have taken control, increasing the likelihood of a sustained downtrend.

Emotional Trigger: Feel the shift as the market transitions from optimism to caution, providing a strategic opportunity to align your trades with the emerging bearish trend.

Comparison with Similar Patterns

While the Three Inside Down Candlestick Pattern shares similarities with other bearish reversal patterns like the Bearish Harami, it stands out due to its three-candle confirmation requirement. The Bearish Harami involves only two candles and may not provide the same level of confirmation, making the Three Inside Down Pattern a more robust indicator for bearish reversals.

Trading Strategies Using the Three Inside Down Pattern

Leverage actionable strategies to maximize your trading potential.

Effective Entry and Exit Points for Maximum Profit

Implementing the Three Inside Down Pattern Trading Strategy involves precise timing and strategic planning. Here’s how to optimize your entries and exits:

- Entry Point:

- Enter a short position immediately after the third candle closes below the second candle’s close.

- Confirmation: Ensure the pattern appears at a significant resistance level or within a well-established uptrend.

- Stop-Loss Placement:

- Place a stop-loss order above the high of the first bullish candle to protect against false signals and excessive losses.

- Risk Management: This approach minimizes potential losses if the market reverses unexpectedly.

- Take Profit Targets:

- Utilize support levels, Fibonacci retracements, or previous lows to determine optimal exit points.

- Profit Maximization: Setting realistic targets based on technical analysis ensures disciplined profit-taking.

Actionable Insight: Precise entry and exit strategies are crucial. Utilize charting tools provided by a regulated forex broker to execute trades with accuracy.

Risk Management Considerations

Effective risk management is paramount when trading the Three Inside Down Candlestick Pattern. Here are key considerations:

- Confirmation is Key:

- Avoid entering trades without the confirmation provided by the third bearish candle. This reduces the likelihood of acting on false signals.

- Combine with Other Indicators:

- Enhance the pattern’s reliability by integrating indicators like the Relative Strength Index (RSI), Moving Averages, or Bollinger Bands.

- Diversified Strategy: Combining multiple indicators provides a more comprehensive view of market conditions.

- Position Sizing:

- Determine appropriate position sizes based on your risk tolerance and account size to manage potential losses effectively.

Pro Tip: For advanced traders, aligning this pattern with broader market trends and using multiple confirmation tools can significantly increase its reliability and trading success.

Examples of Successful Trades Utilizing This Pattern

Consider a scenario in the forex market where the Three Inside Down Pattern appears in the EUR/USD pair:

- Identification:

- A large bullish candle drives EUR/USD upwards.

- A smaller bearish candle forms within the first candle’s body.

- A third bearish candle closes below the second, confirming the pattern.

- Execution:

- Enter a short position after the third candle closes.

- Set a stop-loss above the first candle’s high.

- Target a take profit level based on support zones or Fibonacci levels.

- Outcome:

- The EUR/USD pair declines by 150 pips, resulting in a profitable trade.

Key Insight: By recognizing and acting on the Three Inside Down Pattern, traders can capitalize on significant market moves with confidence.

Read More: Falling Three Methods Candlestick Pattern

Statistical Performance and Reliability of the Three Inside Down Pattern

Evaluating the Reliability of the Three Inside Down Pattern

The Three Inside Down Candlestick Pattern has proven to be a reliable indicator in various markets. Here’s a look at its statistical performance:

- Success Rate:

- Historical data indicates that this pattern successfully predicts bearish reversals in approximately 65-70% of cases.

- High Reliability: This success rate makes it a trustworthy tool for traders seeking consistent results.

- Enhanced Accuracy with Confirmation:

- The pattern’s reliability improves when combined with confirmation signals, such as increased trading volume or alignment with other technical indicators.

- Strategic Advantage: Utilizing multiple confirmation tools can enhance the pattern’s predictive power.

Factors Affecting Reliability

Several factors influence the Three Inside Down Pattern’s reliability:

- Market Conditions:

- Volatile Markets: Higher volatility can lead to more pronounced and reliable patterns.

- Stable Markets: In less volatile conditions, the pattern may produce fewer false signals.

- Timeframes:

- Higher Timeframes (Daily, Weekly): These tend to provide more reliable signals due to the broader market context.

- Lower Timeframes (Hourly, 15-Minute): These may generate more noise and false signals, requiring additional confirmation.

Did You Know? The Three Inside Down Candlestick Pattern works exceptionally well in forex markets, especially with an online forex broker providing real-time charting tools and analytics.

Reliability Across Different Markets

- Forex: Highly effective due to the 24-hour nature of the market and significant liquidity.

- Stocks: Works well in highly liquid stocks, particularly around earnings reports or major news events.

- Cryptocurrencies: Effective but requires additional confirmation due to higher volatility and market sentiment influences.

Advantages and Limitations of the Three Inside Down Candlestick Pattern

Understand the strengths and weaknesses of this key trading pattern.

Advantages of Incorporating the Pattern into Trading Strategies

- Early Reversal Indicator:

- Provides early signals of bearish reversals, allowing traders to position themselves ahead of the market move.

- Simplicity and Clarity:

- Easy to identify on charts, making it accessible even for novice traders.

- High Success Rate:

- Demonstrates a consistent ability to predict bearish reversals when used correctly.

- Versatility:

- Applicable across various markets, including forex, stocks, and cryptocurrencies.

- Complementary Use:

- Enhances trading strategies when combined with other technical indicators and analysis tools.

Emotional Trigger: Feel empowered knowing you have a reliable tool to anticipate market downturns and protect your investments.

Limitations and Potential Drawbacks

- False Signals:

- May produce false signals in low-volume or highly volatile markets without proper confirmation.

- Requires Confirmation:

- The pattern’s accuracy improves with additional indicators, necessitating a multi-faceted analysis approach.

- Market Conditions Dependency:

- Less effective in trending markets where reversals are rare or delayed.

- Timeframe Sensitivity:

- Effectiveness varies across different timeframes, with higher timeframes generally being more reliable.

Situations Where the Pattern May Provide False Signals

- Consolidation Phases: During periods of market consolidation, the pattern may appear frequently without leading to significant trend reversals.

- News Events: Sudden market-moving news can disrupt the pattern’s reliability by introducing unexpected volatility.

- Low Liquidity: In markets or securities with low liquidity, price movements may not reflect true market sentiment, leading to inaccurate signals.

Power Words: While powerful, it’s crucial to recognize the limitations and apply the Three Inside Down Pattern within a broader, well-rounded trading strategy.

Real-World Examples of the Three Inside Down Candlestick Pattern

Case Study: Forex Market

Scenario: EUR/USD Daily Chart

- Pattern Formation:

- A large bullish candle drives EUR/USD to a new high.

- A smaller bearish candle forms within the body of the first candle.

- A third bearish candle closes below the second candle’s close.

- Trade Execution:

- Enter a short position after the third candle closes.

- Set a stop-loss above the first candle’s high.

- Target a support level where the price is likely to reverse.

- Outcome:

- The EUR/USD pair declines by 150 pips, resulting in a profitable trade.

Key Insight: This example underscores the importance of waiting for the third candle’s confirmation before executing trades based on the Three Inside Down Pattern.

Case Study: Stock Market

Scenario: Apple Inc. (AAPL) Weekly Chart

- Pattern Formation:

- A large bullish weekly candle marks a strong uptrend.

- A smaller bearish weekly candle forms within the first candle’s body.

- A third bearish weekly candle closes below the second candle’s close.

- Trade Execution:

- Enter a short position following the pattern confirmation.

- Set a stop-loss above the first candle’s high.

- Use previous support levels as take profit targets.

- Outcome:

- AAPL’s stock price declines by 10%, aligning with the pattern’s prediction.

Lessons Learned: Even in highly liquid stocks, the Three Inside Down Pattern can effectively signal significant reversals when confirmed properly.

Case Study: Cryptocurrency Market

Scenario: Bitcoin (BTC) 4-Hour Chart

- Pattern Formation:

- A large bullish candle propels BTC to a new high.

- A smaller bearish candle forms within the first candle’s body.

- A third bearish candle closes below the second candle’s close.

- Trade Execution:

- Enter a short position after the third candle closes.

- Set a stop-loss above the first candle’s high.

- Target support levels based on recent lows.

- Outcome:

- BTC’s price drops by 5%, providing a profitable trading opportunity.

Key Takeaway: In the volatile cryptocurrency market, the Three Inside Down Pattern can be a valuable tool, provided traders incorporate additional confirmation to mitigate risks.

Pro Tips for Advanced Traders

Enhance your trading skills with expert insights and advanced techniques.

Enhance Your Strategy with Advanced Techniques

- Integrate Multiple Technical Indicators:

- Combine the Three Inside Down Pattern Trading Strategy with indicators like the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), or Bollinger Bands to confirm signals and reduce false positives.

- Strategic Integration: This multi-indicator approach enhances the pattern’s reliability and trading accuracy.

- Conduct Multi-Timeframe Analysis:

- Validate the pattern across different timeframes (e.g., daily and weekly charts) to ensure consistency and reduce the impact of short-term market noise.

- Comprehensive Analysis: Aligning signals across multiple timeframes provides a more robust trading signal.

- Leverage Automated Trading Systems:

- Utilize algorithmic trading systems or expert advisors (EAs) that can automatically detect the Three Inside Down Candlestick Pattern and execute trades based on predefined criteria.

- Efficiency Boost: Automation reduces emotional bias and ensures timely trade execution.

- Analyze Volume and Market Sentiment:

- Incorporate volume analysis to assess the strength behind the pattern. Higher trading volumes during the pattern’s formation can indicate stronger conviction in the reversal.

- Informed Decisions: Understanding market sentiment through volume provides deeper insights into the pattern’s validity.

- Backtest and Optimize Your Strategy:

- Regularly backtest the Three Inside Down Pattern on historical data to evaluate its performance and adjust your trading parameters for optimal results.

- Continuous Improvement: Ongoing backtesting ensures your strategy remains effective under varying market conditions.

Pro Tip: For advanced traders, aligning this pattern with broader market trends and utilizing sophisticated tools available through a regulated forex broker like Opofinance can significantly enhance trading outcomes.

Opofinance Services: Why Choose This Broker?

When it comes to executing the Three Inside Down Candlestick Pattern Trading Strategy, partnering with a reliable and feature-rich broker is essential. Opofinance stands out as a premier choice for traders seeking excellence and security in their trading endeavors. Here’s why Opofinance should be your go-to broker:

- ASIC-Regulated Broker:

- Operates under stringent regulations, ensuring a safe and trustworthy trading environment.

- Peace of Mind: Your investments are protected by a reputable regulatory body.

- MT5 Integration:

- Officially listed on the MT5 brokers list, providing access to advanced trading platforms and tools.

- Seamless Trading: Enjoy the robust features of MetaTrader 5 for enhanced trading performance.

- Social Trading Services:

- Leverage Opofinance’s social trading features to copy strategies from experienced traders who successfully utilize patterns like the Three Inside Down.

- Collaborative Success: Benefit from the collective expertise of the trading community.

- Safe and Convenient Deposits and Withdrawals:

- Offers a variety of secure and efficient methods for depositing and withdrawing funds.

- Financial Flexibility: Manage your trading capital with ease and confidence.

- Advanced Charting Tools:

- Access comprehensive charting and technical analysis tools to identify and act on the Three Inside Down Candlestick Pattern with precision.

- Technical Excellence: Utilize cutting-edge tools to enhance your trading strategy.

- Exceptional Customer Support:

- Receive dedicated support from a knowledgeable team ready to assist with any trading-related inquiries.

- Reliable Assistance: Get the help you need, when you need it.

Open your account with Opofinance today and experience a superior trading environment designed to help you succeed!

Conclusion: Harness the Power of the Three Inside Down Candlestick Pattern

The Three Inside Down Candlestick Pattern is a cornerstone for traders aiming to capitalize on bearish reversals and navigate market downturns with confidence. By mastering its formation, significance, and strategic application, you can enhance your trading decisions and achieve superior outcomes. This pattern not only provides early indications of market sentiment shifts but also integrates seamlessly with various trading strategies and technical indicators to bolster its effectiveness.

However, like any trading tool, the Three Inside Down Pattern is most powerful when used as part of a comprehensive trading strategy that includes robust risk management and complementary analysis techniques. By combining this pattern with the advanced features and secure environment offered by a regulated forex broker like Opofinance, you can optimize your trading performance and safeguard your investments.

Empower your trading journey by mastering the Three Inside Down Candlestick Pattern and leveraging the right tools and partnerships to unlock your full trading potential.

Read More: Rising three methods candlestick pattern

Key Takeaways

- Reliable Bearish Signal: The Three Inside Down Candlestick Pattern is a trustworthy indicator of potential bearish reversals.

- Three-Candle Formation: Consists of a large bullish candle, a smaller bearish candle within the first, and a confirming bearish candle.

- Enhanced Trading Strategy: Use this pattern in conjunction with resistance levels, technical indicators, and robust risk management for maximum efficacy.

- Proven Success Rate: Historical data shows a 65-70% success rate in predicting bearish movements when properly confirmed.

- Advanced Applications: Incorporate multi-timeframe analysis, volume assessment, and automated trading systems to amplify the pattern’s effectiveness.

- Trusted Partnership: Collaborate with a regulated forex broker like Opofinance to leverage advanced trading tools and secure trading conditions.

Maximize your trading success by integrating the Three Inside Down Candlestick Pattern into your strategy and partnering with top-tier brokers.

How Can I Differentiate Between a Three Inside Down Pattern and a Regular Downtrend?

While a regular downtrend indicates a sustained bearish movement, the Three Inside Down Candlestick Pattern specifically highlights a potential reversal from an existing uptrend. This pattern provides a clear three-candle formation that signals a shift in market sentiment, unlike a general downtrend which may lack such precise indicators.

Is the Three Inside Down Pattern Effective in Low-Liquidity Markets?

The pattern can still be effective in low-liquidity markets, but its reliability may decrease due to higher susceptibility to false signals. It’s advisable to use additional confirmation tools and indicators when trading in low-liquidity environments to enhance accuracy.

Can I Use the Three Inside Down Pattern for Day Trading?

Yes, the pattern can be utilized for day trading, especially on shorter timeframes like 15-minute or hourly charts. However, due to the increased market noise in shorter timeframes, it’s essential to use additional confirmation methods and maintain strict risk management practices to ensure successful trades.