Imagine spotting a clear signal that a bearish trend is about to reverse, offering you a prime opportunity to enter a bullish trade. The Three Inside Up Candlestick Pattern does exactly that, serving as a powerful tool in the arsenal of savvy traders. Whether you’re a seasoned investor or just stepping into the world of trading, understanding this pattern can significantly enhance your trading strategy and boost your profitability. This comprehensive guide delves deep into the three inside up candlestick pattern meaning, provides real-world examples, and outlines actionable trading strategies to help you harness its full potential. Partnering with a regulated forex broker like Opofinance can further amplify your trading success by providing the necessary tools and support to implement these strategies effectively.

What is the Three Inside Up Candlestick Pattern?

Understand the basics of the Three Inside Up pattern and its significance in trading.

Three Inside Up Candlestick Pattern Meaning

The Three Inside Up Candlestick Pattern is a quintessential bullish reversal pattern in technical analysis, signaling a potential end to a downtrend and the commencement of an upward movement. This pattern is highly regarded for its reliability in predicting market sentiment shifts, making it an invaluable tool for traders aiming to capitalize on trend reversals.

Components of the Pattern:

- First Candlestick: A large bearish candle that signifies strong selling pressure.

- Second Candlestick: A smaller bullish candle that nests within the body of the first, indicating a temporary pause or hesitation in the bearish momentum.

- Third Candlestick: A bullish candle that closes above the high of the second, confirming the reversal and signaling a potential buy opportunity.

Role in Technical Analysis

Candlestick patterns like the Three Inside Up Pattern simplify complex price movements, allowing traders to make informed decisions based on visual cues. By interpreting these patterns, traders can anticipate future price movements, manage risks effectively, and optimize their entry and exit points in the market.

Pro Tip: Always corroborate the Three Inside Up pattern with other technical indicators such as Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to enhance the accuracy of your trading signals.

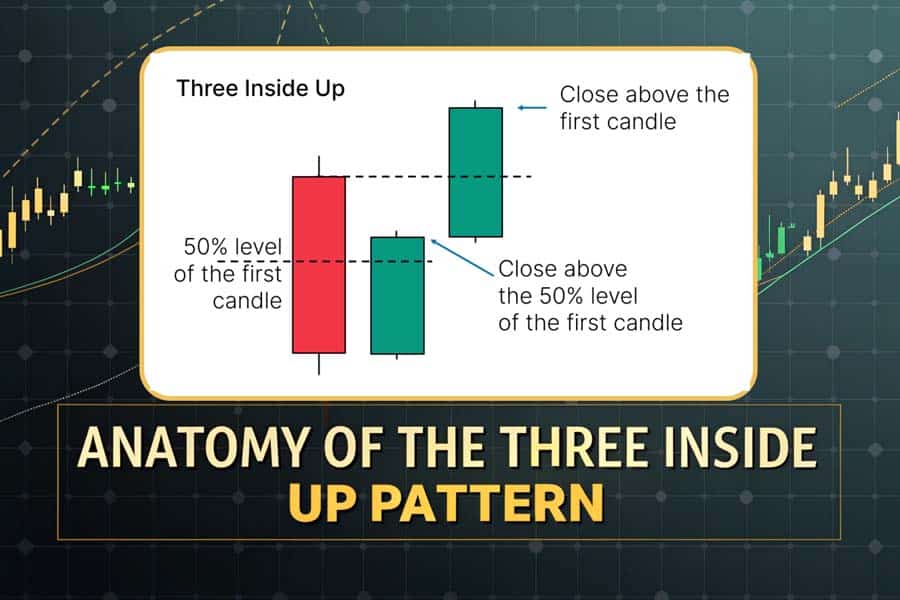

Anatomy of the Three Inside Up Candlestick Pattern

Break down the components of the Three Inside Up pattern for a deeper understanding.

Breaking Down the Three Candlesticks

Understanding the structural components of the Three Inside Up Candlestick Pattern is crucial for accurate identification and application in trading strategies.

- First Candlestick: The Bearish Climax

- Description: A large bearish candle indicating strong selling pressure and continuation of the downtrend.

- Significance: Demonstrates the dominance of sellers in the market, setting the stage for a potential reversal.

- Second Candlestick: The Bullish Signal Within the Bearish Context

- Description: A smaller bullish candle that forms entirely within the body of the first bearish candle.

- Significance: Reflects a temporary pause in selling, suggesting that buyers are beginning to gain strength.

- Third Candlestick: Confirmation of the Reversal

- Description: A bullish candle that closes above the high of the second candlestick.

- Significance: Confirms the shift in market sentiment from bearish to bullish, signaling a strong buy opportunity.

Visual Representation

Imagine a descending slope marking a downtrend, followed by a small consolidation phase, and then an upward surge indicating a reversal. This visual sequence is what the Three Inside Up Pattern embodies, making it intuitive for traders to recognize and act upon.

Key Insight: Pay close attention to the shadows (wicks) of the second candlestick. Short shadows often indicate stronger reversal potential as they suggest minimal selling pressure within the consolidation phase.

How to Identify the Three Inside Up Pattern on Charts

Key Characteristics to Look For

Identifying the Three Inside Up Candlestick Pattern requires keen observation of specific characteristics that distinguish it from other candlestick formations. Here are the key attributes to watch for:

- Sequential Structure: The pattern comprises three consecutive candlesticks, each playing a distinct role in signaling a reversal.

- Bearish Initiation: The first candlestick must be a substantial bearish candle, indicating a strong downtrend.

- Contained Second Candle: The second candlestick is a smaller bullish candle that fits entirely within the body of the first bearish candle.

- Bullish Confirmation: The third candlestick is a bullish candle that closes above the high of the second candle, confirming the reversal.

- Volume Consideration: Higher trading volumes during the third candle can add validity to the pattern, reinforcing the strength of the bullish reversal.

Common Scenarios and Market Conditions Where the Pattern Appears

The Three Inside Up Candlestick Pattern typically emerges in specific market conditions that favor trend reversals. Understanding these scenarios can enhance your ability to spot the pattern effectively:

- After a Prolonged Downtrend: The pattern often appears after an extended period of declining prices, indicating potential exhaustion of the bearish momentum.

- Near Support Levels: When the pattern forms near established support levels, it gains additional significance, as these levels can act as a catalyst for reversals.

- In Volatile Markets: Highly volatile markets, where price swings are frequent, provide fertile ground for the formation of the Three Inside Up pattern, as rapid shifts in sentiment are more likely.

- Economic Announcements: Significant economic news or events can trigger sudden changes in market sentiment, leading to the formation of the pattern as traders react to new information.

Pro Tip: Monitor market conditions and key support levels to increase the likelihood of accurately identifying the Three Inside Up Candlestick Pattern. Combining this with news events can provide a more comprehensive trading strategy.

Three Inside Up Candlestick Pattern Trading Strategy

Maximize your trades with effective strategies using the Three Inside Up pattern.

Entry and Exit Points for Traders

Implementing the Three Inside Up Candlestick Pattern within your trading strategy involves precise identification of optimal entry and exit points to maximize profitability and minimize risks.

- Entry Point:

- Signal Confirmation: Enter a long position once the third candlestick closes above the high of the second candle. This confirmation is crucial to ensure the validity of the reversal signal.

- Additional Confirmation: Utilize other technical indicators such as Moving Averages or RSI to corroborate the bullish reversal before entering the trade.

- Exit Point:

- Profit Target: Set your profit target at the next significant resistance level or a predetermined price range based on your trading plan.

- Trailing Stop: Implement trailing stops to lock in profits as the price moves in your favor, allowing for flexibility and protection against sudden reversals.

- Example:

- Scenario: Suppose the EUR/USD pair has been in a downtrend. You identify the Three Inside Up Candlestick Pattern forming near a key support level. After the third bullish candle confirms the reversal, you enter a long position. You set your profit target at the next resistance level and place a trailing stop to secure gains as the price rises.

Read More: Falling Three Methods Candlestick Pattern

Risk Management and Setting Stop-Loss Orders

Effective risk management is paramount to successful trading. When employing the Three Inside Up Candlestick Pattern, consider the following strategies:

- Stop-Loss Placement:

- Below the First Candlestick: Position your stop-loss order below the low of the first bearish candlestick to protect against unexpected market reversals.

- Percentage Risk: Limit your risk to 1-2% of your trading account on any single trade, ensuring that no single loss can significantly impact your overall portfolio.

- Risk-Reward Ratio:

- Optimal Ratio: Aim for a risk-reward ratio of at least 1:2, meaning your potential reward should be twice the amount you’re willing to risk. This balance ensures that even with a lower win rate, your overall profitability remains positive.

- Example:

- Scenario: After identifying the Three Inside Up Candlestick Pattern, you enter a trade with a target of 100 pips and set your stop-loss at 50 pips below the first candlestick. This provides a 2:1 reward-to-risk ratio, aligning with sound trading principles.

Combining with Other Technical Indicators for Confirmation

To enhance the reliability of the Three Inside Up Candlestick Pattern, integrate it with other technical indicators that provide additional confirmation:

- Relative Strength Index (RSI):

- Oversold Conditions: Use RSI to identify oversold conditions (typically below 30). If the pattern forms when RSI is oversold, it strengthens the likelihood of a bullish reversal.

- Moving Averages:

- Trend Confirmation: Employ Moving Averages (e.g., 50-day or 200-day) to confirm the overall trend direction. A Three Inside Up pattern forming above a key Moving Average suggests strong bullish momentum.

- MACD (Moving Average Convergence Divergence):

- Momentum Confirmation: Use MACD to assess momentum changes. A bullish crossover in MACD alongside the pattern can provide robust confirmation of the reversal signal.

- Example:

- Scenario: You spot the Three Inside Up Candlestick Pattern on a stock chart. Simultaneously, the RSI indicates oversold conditions, and the MACD shows a bullish crossover. These combined signals provide a strong case for entering a long position.

Pro Tip: Avoid relying solely on the Three Inside Up Candlestick Pattern. Combining it with multiple indicators increases the probability of successful trades and reduces the risk of false signals.

Three Inside Up vs. Three Inside Down: A Comparative Analysis

Three Inside Up Candlestick Pattern

- Signals: Bullish reversals indicating a potential shift from a downtrend to an uptrend.

- Occurrence: Typically forms after a sustained downtrend.

- Implications: Suggests increasing buying pressure and the possibility of higher price movements.

Three Inside Down Candlestick Pattern

- Signals: Bearish reversals indicating a potential shift from an uptrend to a downtrend.

- Occurrence: Typically forms after a sustained uptrend.

- Implications: Suggests increasing selling pressure and the possibility of lower price movements.

Important Note: While both patterns serve as reversal indicators, they operate in opposite market conditions. Recognizing the differences between them is crucial for implementing appropriate trading strategies.

Read More: Rising three methods candlestick pattern

Real-World Examples and Case Studies

Historical Instances Where the Pattern Indicated Market Reversals

- Forex Markets: EUR/USD Pair

- Scenario: During a prolonged downtrend, the EUR/USD pair exhibited the Three Inside Up Pattern, leading to a significant bullish reversal.

- Outcome: Traders who identified the pattern and entered long positions experienced substantial gains as the price moved upward, reversing the downtrend.

- Stock Markets: Apple Inc. (AAPL)

- Scenario: Apple’s stock showcased the Three Inside Up Pattern after a steady decline, signaling a potential upward movement.

- Outcome: Investors who acted on the pattern witnessed a bullish run, enhancing their portfolio performance.

- Commodity Markets: Gold Prices

- Scenario: Gold prices formed the Three Inside Up Pattern amidst market volatility, indicating a shift from bearish to bullish sentiment.

- Outcome: Traders capitalized on the reversal, securing profitable trades as gold prices surged.

Analysis of Outcomes and Effectiveness

Backtesting historical data reveals that the Three Inside Up Candlestick Pattern boasts a success rate of approximately 65-75% when confirmed with other technical indicators. This reliability underscores its value as a dependable tool for predicting market reversals and making informed trading decisions.

Key Insight: The pattern’s effectiveness increases when it occurs near key support levels or is corroborated by additional indicators, enhancing its predictive power.

Advantages and Limitations of the Three Inside Up Pattern

Advantages of Incorporating This Pattern into Trading Strategies

- Ease of Identification:

- The Three Inside Up Pattern is straightforward to recognize, making it accessible even for novice traders.

- High Reliability:

- When confirmed with other indicators, the pattern offers a reliable signal of market reversals, enhancing trading accuracy.

- Versatility Across Markets:

- Applicable to various markets, including forex, stocks, and commodities, allowing traders to utilize the pattern in multiple trading environments.

- Enhanced Decision-Making:

- Provides clear entry and exit signals, facilitating more disciplined and strategic trading decisions.

Potential Drawbacks and False Signals to Be Aware Of

- False Signals in Low-Volume Markets:

- In markets with low trading volume, the pattern may produce unreliable signals, leading to potential losses.

- Need for Confirmation:

- Reliance solely on the Three Inside Up Pattern without additional confirmation can result in false positives, reducing trading effectiveness.

- Susceptibility to Market Noise:

- In highly volatile markets, the pattern may be obscured by erratic price movements, making accurate identification challenging.

Pro Tip: Mitigate these limitations by combining the pattern with robust risk management strategies and additional technical indicators to validate trading signals.

Pro Tips for Advanced Traders: Maximizing the Three Inside Up Pattern

Advanced tips to leverage the Three Inside Up pattern for trading success.

1. Integrate Multiple Timeframes for Enhanced Analysis

Advanced traders can gain deeper insights by analyzing the Three Inside Up Candlestick Pattern across different timeframes. For instance, identifying the pattern on both daily and hourly charts can provide a more comprehensive view of market trends and improve the timing of trade entries and exits.

2. Utilize Advanced Indicators for Confirmation

Leverage sophisticated technical indicators such as Fibonacci retracements or Ichimoku Clouds alongside the Three Inside Up Pattern to strengthen trade signals. These indicators can offer additional layers of confirmation, reducing the likelihood of false signals and enhancing trade precision.

3. Implement Automated Trading Systems

Consider using algorithmic trading systems to automatically detect the Three Inside Up Pattern and execute trades based on predefined criteria. Automation can eliminate emotional biases, ensure timely trade execution, and optimize trading efficiency.

4. Analyze Volume Patterns for Deeper Insights

Incorporate volume analysis to assess the strength behind the Three Inside Up Pattern. High trading volumes accompanying the pattern can confirm the validity of the reversal signal, while low volumes may indicate a lack of conviction among traders.

5. Develop a Comprehensive Trading Plan

Create a detailed trading plan that outlines how to identify, confirm, and act upon the Three Inside Up Pattern. A well-structured plan enhances consistency, discipline, and overall trading performance.

Pro Tip: Continuously refine your trading plan based on performance reviews and evolving market conditions to maintain a competitive edge.

Read More: Three Inside Down Candlestick Pattern

Opofinance Services: Trusted ASIC-Regulated Broker

When it comes to executing trading strategies based on the Three Inside Up Candlestick Pattern, choosing the right broker is paramount. Opofinance stands out as a premier ASIC-regulated forex broker, offering a suite of services tailored to meet the needs of both novice and advanced traders. Here’s why Opofinance is the ideal choice for your trading endeavors:

- ASIC-Regulated: Ensures strict compliance with regulatory standards, providing a secure and trustworthy trading environment.

- Social Trading Features: Harness the power of community-driven trading by copying strategies from successful traders, enhancing your trading performance effortlessly.

- MT5 Platform: Officially listed among top brokers for its advanced features, the MetaTrader 5 (MT5) platform offers unparalleled trading tools, customizable indicators, and automated trading capabilities.

- Flexible Transactions: Enjoy safe and convenient deposit and withdrawal methods, ensuring seamless management of your trading funds.

- Competitive Spreads: Benefit from tight spreads and low trading costs, maximizing your potential profits.

- 24/7 Customer Support: Receive round-the-clock assistance from a dedicated support team, ensuring that your trading experience is smooth and hassle-free.

- Educational Resources: Access a wealth of educational materials, webinars, and tutorials to enhance your trading knowledge and skills.

Take action now! Open an account with Opofinance today and experience unparalleled trading convenience, security, and support. Elevate your trading strategy with a trusted partner that prioritizes your success.

Conclusion

The Three Inside Up Candlestick Pattern is a potent tool in the arsenal of technical analysis, offering traders a reliable indicator of potential bullish reversals. By understanding its structure, significance, and practical applications, you can harness this pattern to make informed trading decisions, optimize your entry and exit points, and enhance your overall trading performance.

However, like all trading strategies, the effectiveness of the Three Inside Up Candlestick Pattern is maximized when combined with robust risk management practices and confirmed with additional technical indicators. Whether you’re a beginner or an advanced trader, integrating this pattern into your trading strategy can provide valuable insights into market sentiment and trend reversals.

Remember: Consistent practice, continuous learning, and disciplined trading are key to mastering any technical pattern. Utilize demo accounts to refine your skills, stay informed about market conditions, and leverage the services of a trusted regulated forex broker like Opofinance to support your trading journey.

Key Takeaways

- Reliable Indicator: The Three Inside Up Candlestick Pattern is a dependable signal for bullish reversals, providing clear entry points for long positions.

- Comprehensive Analysis: Combining this pattern with other technical indicators, such as RSI and MACD, enhances its accuracy and reduces the risk of false signals.

- Versatile Application: Applicable across various markets and timeframes, the pattern offers flexibility and adaptability in diverse trading environments.

- Risk Management: Implementing effective risk management strategies, including stop-loss orders and position sizing, is essential to protect your trading capital.

- Trusted Broker: Partnering with a reputable and ASIC-regulated forex broker like Opofinance ensures a secure and efficient trading experience, enabling you to leverage the Three Inside Up Candlestick Pattern effectively.

How Does the Three Inside Up Pattern Compare to Other Bullish Reversal Patterns?

The Three Inside Up Pattern is often compared to patterns like the Morning Star or the Hammer. While all these patterns signal bullish reversals, the Three Inside Up is distinct in its formation of three specific candlesticks within a downtrend. Its unique structure can provide clearer signals in certain market conditions, making it a valuable addition to a trader’s toolkit.

Can the Three Inside Up Pattern Be Used in All Market Conditions?

While the pattern is versatile, its effectiveness can vary across different market conditions. It tends to perform best in trending markets with clear downtrends and increased volatility. In sideways or highly volatile markets without a clear trend, the pattern may produce more false signals, necessitating additional confirmation through other indicators.

What Are Common Mistakes to Avoid When Trading the Three Inside Up Pattern?

One common mistake is entering a trade solely based on the pattern without seeking confirmation from other technical indicators. Additionally, failing to implement proper risk management strategies, such as setting stop-loss orders, can lead to significant losses. Traders should also avoid overtrading and ensure they understand the pattern’s nuances before applying it in live trading scenarios.