Imagine having the ability to foresee when a bearish market is about to shift into a bullish trend, allowing you to seize opportunities before others catch on. The Three White Soldiers Candlestick Pattern offers precisely this strategic advantage. Renowned as one of the most reliable bullish reversal patterns in technical analysis, it signals that buyers are taking control of the market, paving the way for sustained upward movements.

Historically, the Three White Soldiers pattern has been a favorite among traders for its simplicity and high success rate in predicting market reversals. Whether you’re trading forex, stocks, or commodities, mastering the Three White Soldiers Candlestick Pattern can significantly enhance your trading strategies and outcomes. By pairing this pattern with advanced tools from a regulated forex broker like Opofinance, you can gain a competitive edge and maximize your trading potential.

In this comprehensive guide, we’ll delve into the intricacies of the Three White Soldiers Candlestick Pattern, explore its significance across different markets, provide detailed examples, and offer actionable strategies to leverage it effectively. By the end of this article, you’ll be equipped to identify this pattern, understand its meaning, and use it to your trading advantage confidently.

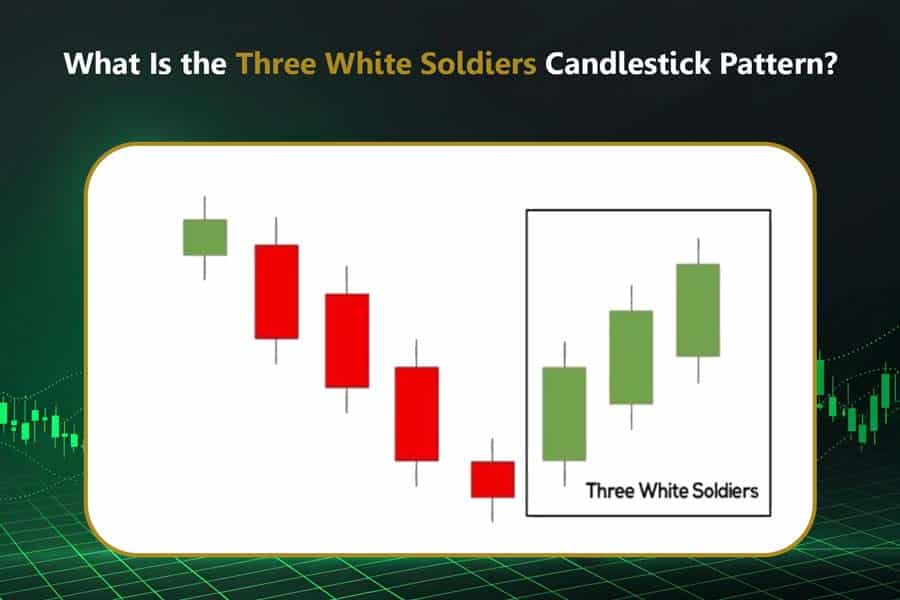

What Is the Three White Soldiers Candlestick Pattern?

The Three White Soldiers Candlestick Pattern is a classic bullish reversal indicator in technical analysis. It is characterized by three consecutive long-bodied green or white candles that appear after a significant downtrend. Each candle closes higher than the previous one with minimal or no upper shadows, signaling strong and sustained buying pressure.

Discover the structure of the Three White Soldiers candlestick pattern and its role in market analysis.

Key Features of the Three White Soldiers Pattern

- Three Consecutive Bullish Candles: Represents increasing bullish momentum, with each candle closing higher than the last. This sequence shows that buyers are consistently entering the market, pushing prices upwards.

- Minimal Shadows: Small or no upper wicks indicate that buyers maintained control throughout the trading session. The absence of upper shadows suggests that the price did not retract significantly after the initial surge, reinforcing the strength of the buying pressure.

- Progressive Gains: Each candle opens within or near the previous candle’s body and closes at a higher price point. This consistent upward movement underscores the strengthening buying pressure and the waning influence of sellers.

- Location After a Downtrend: Enhances the pattern’s role as a reversal signal from bearish to bullish sentiment. The pattern gains significance when it forms after a prolonged downtrend, highlighting a potential shift in market dynamics.

- High Volume Confirmation: Increased trading volume during the pattern formation validates the strength of the bullish reversal. Higher volume signifies greater participation and conviction among traders, reinforcing the reliability of the pattern.

Read More: Dark Cloud Cover Candlestick Pattern

Three White Soldiers Candlestick Pattern Example

Consider a scenario in the EUR/USD forex pair. After a prolonged downtrend, three consecutive green candles form, each closing higher than the last. The absence of significant upper shadows and increasing volume confirms the pattern, suggesting a potential bullish reversal. Traders who recognize this Three White Soldiers Candlestick Pattern example can position themselves to benefit from the ensuing upward movement.

Historical Example:

In early 2021, the EUR/USD pair experienced a significant downtrend due to various economic uncertainties. On March 1st, three consecutive green candles formed, each closing higher than the previous one, accompanied by a surge in trading volume. This formation signaled a bullish reversal, leading to a sustained upward movement in the EUR/USD pair over the following weeks. Traders who identified this pattern early were able to capitalize on the bullish trend, resulting in substantial profits.

Why Is the Three White Soldiers Candlestick Pattern Important?

The Three White Soldiers Candlestick Pattern offers profound insights into market psychology. It signifies that buyers have regained confidence and are systematically overpowering sellers, leading to sustained upward movements. Understanding and recognizing this pattern is crucial for traders aiming to identify and act on bullish reversals with precision.

Understand the significance of the Three White Soldiers pattern in forecasting market reversals.

Significance in Forex, Stocks, and Commodities Trading

- Forex Trading: Indicates potential upward momentum in currency pairs. For example, a Three White Soldiers Candlestick Pattern Example in the EUR/USD pair after a downtrend may signal a bullish rally, allowing traders to enter long positions ahead of the market movement.

- Stock Market: Signals recovery in individual stocks or indices. A stock like Apple Inc. (AAPL) showing this pattern after a decline could indicate an upcoming bullish run, prompting traders to initiate long positions to benefit from the anticipated price increase.

- Commodities Trading: Reflects increasing demand and bullish sentiment in commodities like gold or oil, often preceding sustained price hikes. For instance, if crude oil prices display the Three White Soldiers pattern after a period of decline, it may suggest a rebound in oil prices, offering traders a strategic entry point to capitalize on the upward trend.

Three White Soldiers Pattern Success Rate

The Three White Soldiers Pattern Success Rate is notably high, especially when the pattern is confirmed with additional technical indicators and high trading volume. Studies and historical data suggest that when this pattern forms under optimal conditions, it has a success rate of approximately 70-80% in predicting bullish reversals. However, it’s essential to combine the pattern with other indicators and perform thorough market analysis to maximize its reliability and effectiveness.

Advanced Insights

Market Conditions: Impact of Volatility and Economic Indicators

The effectiveness of the Three White Soldiers Candlestick Pattern can be influenced by various market conditions:

- Volatility: High volatility can lead to false signals, making the pattern less reliable. In highly volatile markets, sudden price swings can disrupt the pattern, causing premature or incorrect trading signals. Conversely, low volatility environments enhance the pattern’s reliability by reducing the likelihood of sudden reversals, allowing the sustained buying pressure to drive the price upwards more predictably.

- Economic Indicators: Strong economic data (e.g., GDP growth, low unemployment) can bolster the bullish signals of the pattern, as positive economic performance tends to increase investor confidence and attract more buyers into the market. On the other hand, negative economic indicators may undermine the pattern’s effectiveness by introducing uncertainty and selling pressure, even if the pattern appears.

- Market Sentiment: Positive market sentiment reinforces the pattern’s signals, as a collective shift towards optimism among traders and investors supports sustained upward movements. Monitoring sentiment through tools like the Fear & Greed Index can provide additional context, ensuring that the pattern aligns with the prevailing market mood.

Psychological Factors: Buyer Dominance and Sustained Upward Movements

The Three White Soldiers Candlestick Pattern embodies buyer dominance, where traders and investors regain confidence, systematically overcoming selling pressure. This shift in sentiment creates momentum that sustains upward price movements, reinforcing the bullish trend signaled by the pattern.

- Confidence and Commitment: The pattern signifies a strong commitment from buyers who are confident in the asset’s future performance. This collective buying behavior overcomes previous selling resistance, leading to sustained price increases.

- Overcoming Doubts: Following a downtrend, buyers stepping in with consistent buying activity indicate that market sentiment has shifted from pessimism to optimism. This psychological shift is crucial for the formation and effectiveness of the pattern.

- Momentum Building: As each bullish candle closes higher than the previous one, it builds momentum, attracting more buyers and creating a self-reinforcing cycle of price appreciation. This momentum is critical for sustaining the upward trend initiated by the pattern.

Understanding these psychological drivers helps traders interpret the pattern’s signals beyond mere technical formations, enabling more informed and strategic trading decisions.

Read More: Morning Star Candlestick Pattern

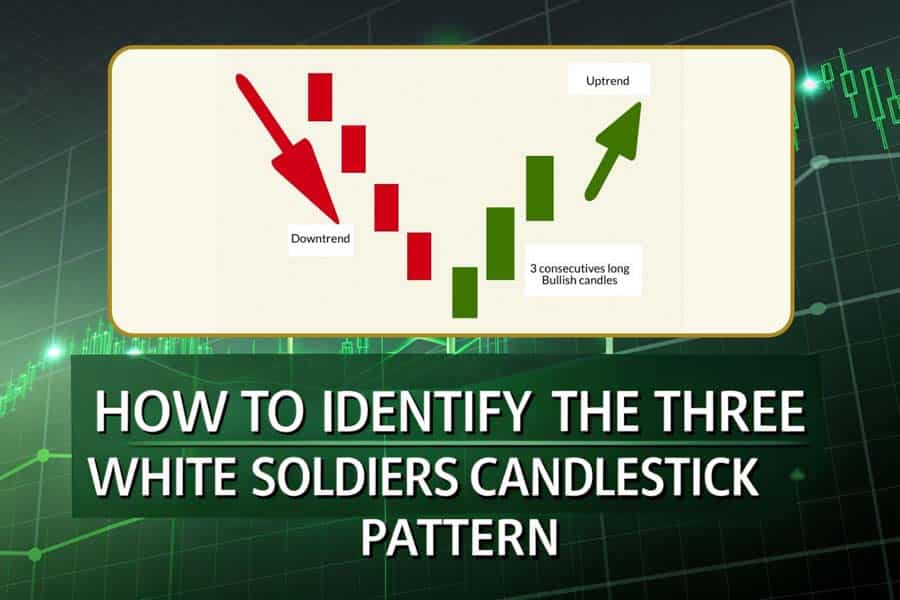

How to Identify the Three White Soldiers Candlestick Pattern

Learn the steps to identify the Three White Soldiers pattern and spot bullish reversals confidently

Step-by-Step Guide to Spotting the Pattern

Identifying the Three White Soldiers Candlestick Pattern is a straightforward process, yet it demands meticulous attention to detail and a comprehensive understanding of the market context. Follow this step-by-step guide to accurately spot the pattern and harness its predictive power in your trading endeavors.

- Locate a Downtrend: Ensure the pattern appears after a clear and prolonged bearish trend. The preceding downtrend establishes the foundation for the bullish reversal signal. Use trend lines or moving averages to confirm the downtrend’s strength and duration.

- Identify Three Bullish Candles:

- Long Bodies: Each of the three candles should have a substantial body, indicating significant price movement during the trading session. The length of the candle bodies reflects the intensity of buying pressure.

- Minimal or No Upper Shadows: The absence of substantial upper wicks (shadows) signifies that buyers maintained control throughout the session, preventing the price from retreating after the initial surge.

- Progressive Closes: Each candle opens within or near the body of the preceding candle and closes at a higher price point, demonstrating a consistent upward trajectory.

- Confirm with Volume: Increased trading volume during the formation of each bullish candle amplifies the reliability of the pattern. Elevated volume levels suggest strong buyer participation and conviction, reinforcing the likelihood of a sustained uptrend.

- Check Market Context: Align the pattern with broader market trends and confirm with technical indicators like moving averages, Relative Strength Index (RSI), or MACD (Moving Average Convergence Divergence). This confirmation enhances the pattern’s predictive power, ensuring that the signal aligns with overall market dynamics.

Three White Soldiers Candlestick Pattern Meaning

The Three White Soldiers Candlestick Pattern Meaning revolves around the interpretation of sustained buying pressure and the psychological shift from bearish to bullish sentiment. Each candle in the pattern represents a day of strong buyer activity, with the cumulative effect signaling a robust reversal in the market trend.

- First Soldier: Marks the beginning of the reversal, indicating that buyers have started to gain strength after a downtrend.

- Second Soldier: Confirms the initial buying interest, showing that buyers are continuing to push prices higher.

- Third Soldier: Solidifies the bullish reversal, demonstrating that buyers have fully regained control and are driving prices upward.

Trading Strategies Using the Three White Soldiers Pattern

To effectively leverage the Three White Soldiers Candlestick Pattern, integrate it into a well-defined trading strategy encompassing entry points, exit strategies, and robust risk management. Below, we outline comprehensive approaches to maximize the pattern’s potential in your trading activities.

Explore effective trading strategies to leverage the Three White Soldiers pattern for market success.

1. Entry Strategies

Wait for the Pattern to Complete

Patience is paramount when utilizing the Three White Soldiers pattern. The optimal entry point is after the third bullish candle has fully formed and closed. This confirmation ensures that the bullish momentum is genuine and not a fleeting anomaly, reducing the risk of false signals.

Example: If the third candle in the Three White Soldiers pattern closes at $1.2000, you might place a buy order slightly above this level, say at $1.2010, to confirm the continuation of the upward trend.

Confirmation with Indicators

To bolster the reliability of the Three White Soldiers pattern, employ complementary technical indicators. Tools such as moving averages, RSI, or MACD can confirm the upward momentum signaled by the pattern. For instance, a rising 50-day moving average alongside the pattern can provide additional assurance of a sustained uptrend.

- Moving Averages (MA): A crossover where a short-term MA crosses above a long-term MA can confirm the bullish trend.

- Relative Strength Index (RSI): An RSI moving above 50 indicates strengthening bullish momentum.

- MACD: A bullish crossover in the MACD line relative to the signal line can validate the bullish reversal.

Ideal Entry Point

The ideal entry point is slightly above the high of the third bullish candle. Placing a buy order at this level ensures that the upward trend is continuing and not a temporary spike. This strategy helps in capturing the initial phase of the bullish movement, optimizing profit potential.

Example: If the third candle closes at $1.2000 with a high of $1.2020, placing a buy order at $1.2030 can confirm the continuation of the bullish trend.

2. Exit Strategies

Set Profit Targets

Establishing clear profit targets is essential for effective trading. Utilize Fibonacci retracement levels or identify key resistance zones to determine where to take profits. For example, if the price rises by 20% following the Three White Soldiers pattern, setting a profit target at the next Fibonacci level can help in systematically securing gains.

Example: After entering at $1.2030, you might set a profit target at $1.2436, which represents a 20% increase from the entry point.

Use Trailing Stops

Implementing trailing stops is a prudent method to protect your profits while allowing for potential further gains. As the price ascends, adjust your stop-loss order accordingly to lock in profits and minimize losses in the event of a reversal. This dynamic approach ensures that you benefit from sustained upward movement without exposing yourself to excessive risk.

Example: If the price moves from $1.2030 to $1.2300, you might adjust your trailing stop to $1.2200, locking in profits while allowing for further gains.

3. Risk Management

Stop-Loss Placement

Effective risk management begins with prudent stop-loss placement. Position your stop-loss order below the low of the first bullish candle in the pattern. This placement minimizes potential losses should the market reverse unexpectedly, providing a safety net against unfavorable price movements.

Example: If the first candle in the Three White Soldiers pattern has a low of $1.1900, placing a stop-loss at $1.1880 ensures that you limit your downside risk.

Position Sizing

Avoid overexposure by carefully calculating your position size. Utilize tools and resources provided by trading platforms like Opofinance to determine an appropriate risk-reward ratio. Proper position sizing ensures that no single trade adversely impacts your overall trading capital, maintaining a balanced and sustainable trading approach.

Example: If you are willing to risk 1% of your trading capital on a single trade and your stop-loss is $20 below your entry point, you can determine the appropriate position size to align with your risk tolerance.

Pro Tip

Advanced traders can enhance their risk management strategies by leveraging the social trading tools available on Opofinance’s platform. Observing and replicating successful strategies from experienced traders can provide valuable insights and optimize your trading performance.

Read More: Three Black Crows Candlestick Pattern

Common Mistakes and How to Avoid Them

Identify common mistakes in using the Three White Soldiers pattern and learn strategies to avoid them.

While the Three White Soldiers Candlestick Pattern is renowned for its reliability, it is not infallible and can be susceptible to misuse. Awareness of common mistakes and strategies to avoid them is crucial for maximizing the pattern’s effectiveness and safeguarding your trading endeavors.

1. Misinterpreting the Pattern

Mistake

A prevalent mistake among traders is misidentifying the Three White Soldiers pattern by assuming that any sequence of three bullish candles qualifies as the pattern.

Solution

To accurately identify the pattern, ensure that each of the three candles has long bodies, minimal upper shadows, and appears explicitly after a sustained downtrend. The candles should open within or near the body of the preceding candle and close at progressively higher prices, reflecting genuine bullish momentum.

Example: Three consecutive bullish candles with substantial bodies and no upper wicks following a clear downtrend confirm the Three White Soldiers pattern, rather than any arbitrary sequence of bullish candles.

2. Ignoring Market Context

Mistake

Applying the Three White Soldiers pattern in a sideways or range-bound market can lead to inaccurate signals and potential losses. Using the pattern in an unsuitable market environment diminishes its predictive power and reliability.

Solution

Only employ the pattern in trending markets where clear uptrends or downtrends are evident. Assess the broader market context and validate the pattern with additional technical indicators like moving averages or RSI to ensure that the market conditions are conducive to a bullish reversal.

Example: In a strongly trending upmarket, the Three White Soldiers pattern is more likely to indicate a continuation of the trend, whereas in a sideways market, the pattern may not hold as a reliable reversal signal.

3. Failing to Manage Risk

Mistake

Neglecting risk management measures, such as trading without a stop-loss or overleveraging your position, can result in significant losses, even when the pattern signals a bullish reversal.

Solution

Implement robust risk management strategies by setting stop-loss orders below the low of the first bullish candle and carefully determining position sizes to maintain a favorable risk-reward ratio. Utilize the risk management tools offered by regulated forex brokers like Opofinance to safeguard your trading capital and minimize potential losses.

Example: Always set a stop-loss order to limit your losses if the market moves against your position, ensuring that a single trade does not significantly impact your overall capital.

4. Overreliance on the Pattern

Mistake

Relying solely on the Three White Soldiers pattern without considering other market factors and technical indicators can lead to incomplete analysis and suboptimal trading decisions.

Solution

Integrate the Three White Soldiers pattern into a comprehensive trading strategy that includes multiple technical indicators, fundamental analysis, and market sentiment assessments. This multifaceted approach enhances the accuracy and reliability of your trading signals, providing a more holistic view of the market dynamics.

Example: Combining the Three White Soldiers pattern with RSI to ensure that the market is not overbought, and using moving averages to confirm the trend direction, leads to more informed trading decisions.

Opofinance: The Trusted Broker for Forex Traders

Trading the Three White Soldiers Candlestick Pattern effectively requires advanced tools and a reliable platform. Opofinance is an ASIC-regulated broker offering everything you need for a seamless trading experience. From robust charting tools to social trading capabilities, Opofinance provides the resources necessary to maximize the potential of your trading strategies.

Why Choose Opofinance?

- Regulated and Reliable: ASIC oversight ensures fund security and adherence to high standards of transparency and ethical practices. This regulation provides traders with peace of mind, knowing that their investments are protected and that the broker maintains integrity in all its operations.

- Social Trading Platform: Opofinance’s social trading platform allows traders to follow and replicate the strategies of successful traders in real time. This feature is invaluable for both novice and experienced traders, offering insights into proven trading methodologies and enabling the adoption of strategies that have demonstrated consistent profitability.

- MT5 Integration: Access MetaTrader 5 (MT5), a leading trading platform renowned for its robust charting capabilities, advanced technical tools, and user-friendly interface. MT5 integration with Opofinance provides traders with the necessary tools to perform detailed technical analysis, execute trades with precision, and implement complex trading strategies effectively.

- Secure Transactions: Enjoy the convenience of fast and secure deposits and withdrawals through multiple payment options offered by Opofinance. The broker prioritizes the safety and efficiency of financial transactions, ensuring that your funds are readily accessible when you need them, without compromising on security.

- Advanced Analytical Tools: Opofinance provides an array of advanced analytical tools that complement the Three White Soldiers pattern, enabling traders to perform comprehensive market analysis. These tools include real-time data feeds, customizable charts, and a suite of technical indicators that enhance your ability to make informed trading decisions.

Start Your Trading Journey with Opofinance

Begin your trading journey with Opofinance today and unlock a world of opportunities. Whether you’re a beginner seeking to learn the ropes or an experienced trader aiming to refine your strategies, Opofinance provides the resources, tools, and support needed to succeed in the competitive financial markets. Sign up now to experience the benefits!

Conclusion

The Three White Soldiers Candlestick Pattern is a powerful tool for identifying and capitalizing on bullish market reversals. By understanding its structure, meaning, and strategic applications, you can make more informed trading decisions. Whether you’re new to trading or looking to refine your strategies, integrating the Three White Soldiers pattern with advanced tools from a regulated forex broker like Opofinance can provide the competitive edge you need to thrive in the financial markets.

Harness the power of the Three White Soldiers Candlestick Pattern to master bullish trends and achieve your trading goals with confidence and precision.

Key Takeaways

- Three White Soldiers Candlestick Pattern: Consists of three consecutive bullish candles with progressively higher closes, signaling a strong bullish reversal.

- Three White Soldiers Candlestick Pattern Meaning: Reflects sustained buying pressure and buyer dominance, indicating potential upward momentum.

- Three White Soldiers Pattern Success Rate: Known for its high reliability, especially when confirmed with additional indicators and high trading volume.

- Versatile Applicability: Effective across forex, stocks, and commodities markets, adaptable to various timeframes.

- Strategic Integration: Combine the pattern with robust trading strategies, including clear entry and exit points and comprehensive risk management.

- Trusted Partnership: Collaborate with a reputable, regulated broker like Opofinance to enhance your trading experience with advanced tools and secure transactions.

What is the Three White Soldiers Candlestick Pattern?

The Three White Soldiers Candlestick Pattern consists of three consecutive bullish candles, each closing higher than the last. It signals a strong bullish reversal following a downtrend, indicating buyer dominance and potential upward momentum.

Can the Three White Soldiers pattern work in all timeframes?

Yes, the Three White Soldiers Candlestick Pattern can be applied across various timeframes, from daily and weekly charts to shorter intraday intervals. However, it tends to be more reliable in longer timeframes like daily or weekly charts, where the pattern is less susceptible to noise and false signals. For shorter intervals, it’s advisable to corroborate the pattern with additional technical indicators to enhance its accuracy.

Is the Three White Soldiers pattern effective for beginners?

Absolutely! The Three White Soldiers Candlestick Pattern is highly effective for beginners due to its simplicity and clear indications of bullish reversals. Its straightforward structure makes it easy to identify and understand. Additionally, leveraging the comprehensive tools and educational resources offered by a regulated forex broker like Opofinance can further enhance its effectiveness, providing beginners with the necessary support to make informed trading decisions.