The best forex brokers with a $5 minimum deposit give you the ability to start live trading without needing a large amount of money. Top choices like XM and Exness offer regulated platforms where new traders can test their strategies on real accounts with very low financial risk. This article provides a detailed review of the top 7 low deposit forex brokers for 2025, explains how to choose the right one, covers the benefits of starting with a small deposit, and identifies the best account types for trading with low capital.

Top 7 Forex Brokers with $5 Minimum Deposit

Finding a reliable broker that allows you to start small is a significant first step. The firms that offer low entry requirements give new traders a chance to experience real market conditions without a large financial commitment. These $5 minimum deposit forex brokers are not just about accessibility; they also provide tools specifically for managing small accounts. This review focuses on some of the best forex brokers for small deposit accounts available in 2025.

The Best Forex Brokers with $5 Minimum Deposit are:

- Exness

- XM

- RoboForex

- FBS

- FXTM

- OctaFX

- HotForex (HFM)

Next, we will look at what each of these low deposit forex brokers offers to traders starting with a small amount of capital.

Exness – Flexible leverage and $1 minimum deposit

Exness allows traders to start with a minimum deposit of just $1 on its Standard Cent account, making it one of the most accessible forex brokers with low minimum deposit 2025. What makes Exness a frequent choice is its unlimited leverage feature on certain accounts, which requires careful risk management but offers significant flexibility. Their system for instant withdrawals is a practical benefit that traders appreciate. For someone transitioning from a demo account, using a cent account broker like Exness feels like a natural next step, as it keeps the real financial risk extremely low. This makes it a top choice among forex brokers with $5 minimum deposit options.

XM – $5 deposit with micro accounts for beginners

XM is widely considered one of the most beginner-friendly brokers, offering a Micro account that can be opened with a $5 minimum deposit. This account type is built for new traders, as it uses micro lots, which drastically reduces the risk associated with each trade. XM’s regulation by multiple authorities like CySEC and ASIC provides traders with a sense of security. The educational material XM provides is genuinely useful, which is why it’s often recommended for those new to the markets. This combination of a low minimum deposit requirement, solid regulation, and trader support makes XM a leading choice among $5 forex trading account brokers.

RoboForex – Best for automated and copy trading

RoboForex requires a $10 minimum deposit for its ProCent and Pro accounts, placing it firmly in the category of low deposit forex brokers. The broker’s strength lies in its support for automated trading and its CopyFX platform, which allows users to copy the trades of successful traders. This makes it a great fit for individuals interested in algorithmic trading or social trading. The ProCent account is particularly useful for testing Expert Advisors (EAs) with real money but minimal risk. Its support for various platforms, including MT4, MT5, and cTrader, adds to its appeal as a versatile minimum deposit forex broker.

FBS – $1 minimum deposit with Cent Accounts

FBS is another excellent option among the best brokers for beginners with small deposit needs, offering a Cent Account that can be started with just $1. This positions it as one of the most accessible forex brokers with $5 minimum deposit options available. The Cent Account displays the balance in cents, so a $10 deposit shows as 1,000 cents. This can be psychologically helpful for beginners learning position sizing. FBS is also known for offering high leverage, sometimes up to 1:3000. While this increases risk, it offers flexibility for traders who understand how to use it properly. This makes FBS one of the popular low deposit brokers with high leverage.

FXTM – Trusted broker with $5 Micro Account

ForexTime (FXTM) is a well-regulated broker, which is a crucial factor for many traders. Their Micro account has a minimum deposit of $10, fitting the criteria for traders looking for low deposit forex brokers. FXTM is regulated by the UK’s FCA, among others, which adds a layer of trust. The Micro account facilitates trading in smaller lot sizes, which is fundamental for risk management when trading with low capital. The market analysis and educational content provided by FXTM are practical resources for new traders. It stands as a reliable broker for forex trading that balances accessibility with strong oversight.

OctaFX – Commission-free trading and fast withdrawal

OctaFX is known for its simple platform and competitive conditions, with a typical starting deposit of around $25. It remains a popular choice for traders searching for $5 minimum deposit forex brokers because most of its accounts are commission-free. The spreads are generally tight, which is a clear advantage for small accounts where every pip matters. OctaFX also provides a popular copy trading service. Fast and straightforward withdrawals are a key feature of their service, building trader confidence. It is a solid choice for those seeking one of the best forex brokers for small deposit accounts without complex fee structures.

HotForex (HFM) – Best regulated low deposit broker

HotForex, now operating as HFM, is a globally recognized brand known for strong regulation and a variety of account options. The HFM Micro account can be opened with a $5 minimum deposit, making it an excellent choice for new traders. HFM holds licenses from multiple regulators, including the FCA and CySEC, ensuring a secure trading environment. The Micro account offers leverage up to 1:1000 and the ability to trade micro lots, creating a suitable environment for learning risk management with real funds. HFM’s provision of useful trading tools makes it a valuable online forex broker for anyone starting out. For traders seeking a regulated forex broker with a low entry barrier, HFM is a top contender.

How to Select a Low Minimum Deposit Broker

Choosing the right low deposit forex broker goes beyond just the initial deposit amount. A trader needs to look at several key elements to ensure the broker is a good fit for their goals and provides a safe trading platform. A methodical evaluation of regulation, account features, trading costs, and support is necessary. Ignoring these aspects, even when starting with a small amount, often leads to problems later on. Selecting a suitable forex trading broker from the start is crucial for a positive experience.

Checking Regulation and Licensing

Regulation is the single most important factor when choosing any forex broker. A regulated firm must follow strict rules, including keeping client money in separate bank accounts. This protects your funds if the broker faces financial trouble. Look for brokers regulated by major financial authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). While some minimum deposit forex brokers are regulated by offshore bodies like the IFSC, brokers with top-tier regulation offer better protection. Always confirm a broker’s license on the regulator’s official website before depositing funds.

Account Type (Micro, Cent, Standard)

The account type is critical when trading with low capital. Forex brokers with micro or cent accounts are the best options. A Cent account shows your balance in cents (a $5 deposit appears as 500 cents), which lets you place trades with standard-looking numbers while risking very little. A Micro account allows you to trade in micro lots (0.01 of a standard lot), which is also ideal for managing risk on a small balance. Standard accounts are not suitable for a $5 deposit, as the risk per trade is too high. Selecting the right account from a regulated forex broker is a fundamental step.

Spreads, Commissions, and Leverage

Trading costs, composed of spreads and commissions, directly affect the profitability of a small account. Seek out low deposit forex brokers that offer tight spreads on major currency pairs. Some brokers may offer accounts with zero spreads but charge a commission per trade. It’s important to compare the total cost to find the most affordable option. Leverage is another key element. While low deposit brokers with high leverage can increase potential profits, they also increase potential losses. Beginners should use leverage cautiously. Proper leverage management is essential for protecting your capital.

Funding Methods (Card, Crypto, E-wallets)

The convenience and cost of deposit methods are practical issues to consider. Most $5 minimum deposit forex brokers offer various options, including credit/debit cards, bank transfers, e-wallets like Skrill and Neteller, and cryptocurrency. Check for any fees on deposits or withdrawals, as these can reduce your trading capital. Also, look at the processing times. Instant deposits and quick withdrawals are signs of an efficient broker for forex trading. The variety of funding methods is important for traders globally.

Customer Support and Service Language

Good customer support is vital, especially for new traders who might have questions. Before funding an account, it’s a good idea to test the broker’s support. A reliable broker should offer live chat, email, and phone support with helpful staff. Support available in your own language can also be a major plus. Issues can happen unexpectedly, and knowing you can get quick and effective help provides confidence and lets you focus on trading. This is a characteristic of the best forex brokers for small deposit accounts.

Why Choose a Broker with a Low Minimum Deposit?

Starting with a forex broker with a $5 minimum deposit offers clear benefits, especially for traders new to the markets or those wanting to test new methods without a large financial outlay. This low barrier to entry makes the foreign exchange market accessible to more people. This approach encourages learning and practice in a live setting rather than high-risk speculation. Many successful traders began their careers with a low deposit forex broker.

Ideal for Beginner Traders

For beginners, the main objective is education, not immediate profit. Beginner-friendly brokers with low deposit requirements offer the perfect environment for learning. Trading with a real $5 or $10 provides a different psychological experience than using a demo account. It teaches you to manage real emotions like fear and greed. A $5 forex trading account broker helps a novice understand how the market works with very little financial risk. It is the most effective way to move from theory to practical application.

Testing Strategies with Low Risk

Even seasoned traders find value in accounts with a low minimum deposit requirement. When developing a new trading strategy or testing an automated system, it is crucial to see how it performs in a live market. Demo accounts are useful, but they don’t fully replicate real trading conditions like slippage. Using a micro account forex setup with a small deposit allows a trader to test a strategy with real money but with controlled risk. This gives more accurate feedback before applying the strategy with more significant capital.

Practicing Real Trading with Small Capital

Practicing on a live account, regardless of its size, builds discipline and reinforces good risk management habits. When your own money is at stake, you are more likely to treat each trade seriously and follow your plan. Trading with low capital on a cent or micro account teaches you how to size your positions correctly relative to your account balance. This hands-on experience is invaluable for future success. Many $5 minimum deposit forex brokers, such as XM or FBS, are structured to support this learning process.

Comparison Table of $5 Minimum Deposit Brokers

To help you make an informed decision, the table below compares the essential features of the top low deposit forex brokers. This comparison allows you to quickly see which broker for forex trading might be the best fit for your needs, based on regulation, account details, and trading costs. Creating a simple checklist like this helps to cut through marketing language and focus on what is truly important for a trader starting with a small deposit.

| Broker Name | Country of Registration | Regulation | Minimum Deposit | Account Type | Spread (EUR/USD) | Leverage | Key Advantage |

| Exness | Cyprus, UK, Seychelles | CySEC, FCA, FSA | $1 | Standard Cent | From 0.3 pips | Up to 1:Unlimited | Instant withdrawals, flexible leverage |

| XM | Cyprus, Australia, Belize | CySEC, ASIC, IFSC | $5 | Micro | From 1.6 pips | Up to 1:1000 | Excellent for beginners, strong regulation |

| RoboForex | Belize | IFSC | $10 | ProCent | From 1.3 pips | Up to 1:2000 | Great for automated and copy trading |

| FBS | Belize, Cyprus | IFSC, CySEC | $1 | Cent | From 1 pip | Up to 1:3000 | Very high leverage, accessible cent account |

| FXTM | Cyprus, UK, Mauritius | CySEC, FCA, FSC | $10 | Micro | From 1.5 pips | Up to 1:1000 | Trusted brand with strong regulation |

| OctaFX | St. Vincent & Grenadines | (Unregulated) | $25 | MT4 Micro | From 0.6 pips | Up to 1:500 | Commission-free, copy trading |

| HotForex (HFM) | Cyprus, UK, Dubai | CySEC, FCA, DFSA | $5 | Micro | From 1 pip | Up to 1:1000 | Strong regulation, wide range of tools |

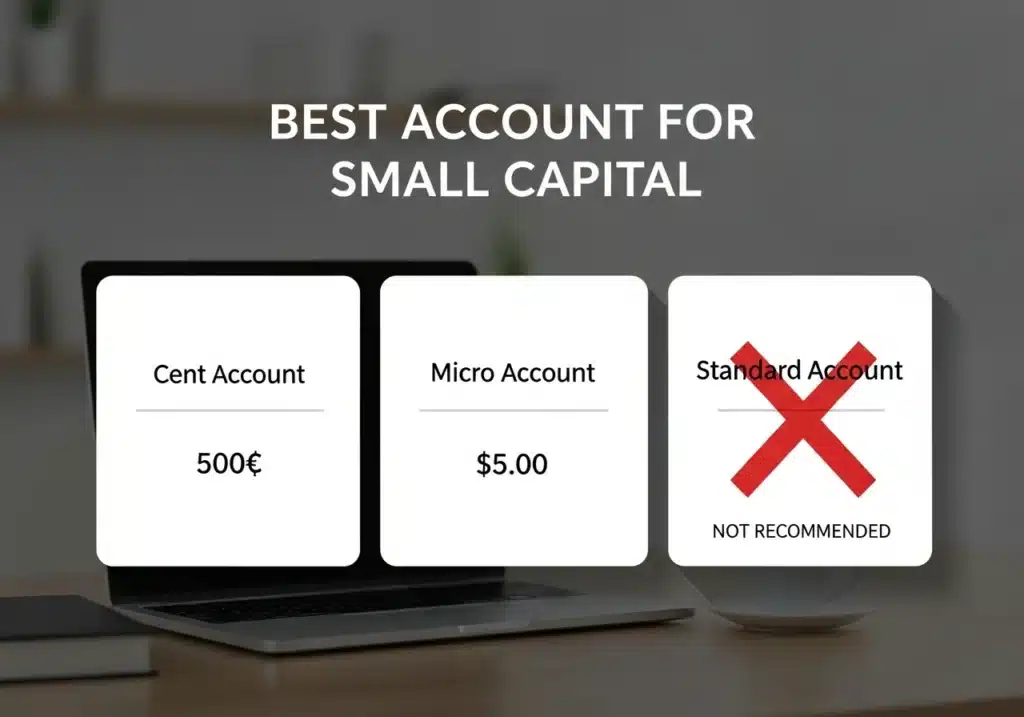

Best Account Type for Starting with Small Capital

Choosing the right account type is just as important as selecting a regulated forex broker. For traders with limited funds, the account choice directly affects risk management and the overall trading experience. The account structure defines the trade size, the value of each pip, and how the balance is shown. Understanding these details is key for anyone starting with a $5 minimum deposit forex broker who hopes to grow their capital.

Cent Account vs. Micro vs. Standard Account

The main difference between these accounts is the trade volume unit. A Standard Account uses standard lots (100,000 currency units), where one pip is worth about $10—too high for a small deposit. A Micro Account uses micro lots (1,000 units), where a pip is worth about $0.10, which is much more manageable. A Cent Account, offered by cent account brokers like Exness and FBS, takes it a step further. The account balance is shown in cents, and trade sizes are also measured in cents. This means a $10 deposit is displayed as 1,000 cents, which makes position sizing feel more intuitive for beginners.

Which Account is Best Suited for Beginners?

For someone completely new to trading, a Cent Account is often the best choice. It reduces risk to the absolute minimum while providing the experience of live trading. The psychological effect of seeing a balance of “1000” instead of “$10” can also help build confidence. For traders with a bit more familiarity, a Micro Account is an excellent option. It is an industry standard offered by many of the best forex brokers for small deposit accounts, including XM and HFM. It provides a clear understanding of risk in dollar terms ($0.10 per pip), which is an important lesson in money management.

Professional Recommendation for Account Selection

The practical recommendation is to begin with either a Cent or Micro account from a reputable forex broker. The decision between them often depends on personal preference. If the main goal is to get used to the psychology of trading with real money, a Cent account is better. If the goal is to practice precise risk management with standard dollar values from the start, a Micro account is more suitable. Standard accounts should be avoided until your capital has grown and you have a proven, profitable strategy. The path to consistent trading is long, and these accounts are the right place to start.

Advantages and Limitations of Low-Deposit Accounts

While forex brokers with a $5 minimum deposit provide a great starting point, it is important to have a realistic view. These accounts offer clear advantages for new and cautious traders, but they also come with limitations that you need to be aware of. Understanding this balance helps in managing expectations and using a small account effectively. It is a tool for learning, not a quick path to wealth.

Advantages

The main benefits of using a low deposit forex broker are straightforward. They offer a low-risk learning environment, easy market access, and a great way to test new trading ideas.

- Low Financial Risk: The most significant benefit is that you risk very little money. A loss of $5 or $10 is a small price to pay for live trading experience.

- Accessibility: It allows more people to participate in forex trading, even if they don’t have thousands of dollars to invest.

- Strategy Testing: These accounts are ideal for testing trading strategies or automated systems in a live market without risking significant capital.

- Psychological Training: It helps traders move from a demo account mentality to a live trading one, where real emotions are involved.

Limitations

Despite the benefits, traders need to be aware of the limitations of trading with low capital. These constraints can affect profits and the overall trading experience.

- Limited Profit Potential: With a very small deposit, the potential for significant profit is naturally low. A few dollars in profit is a good percentage return on a $10 account, but it is not a large sum of money.

- Trading Volume Restrictions: A small balance limits the number of trades you can have open at once and the size of those trades.

- Risk of Over-Leveraging: There is a strong temptation to use high leverage to try to make larger profits, which is a major risk. On a small account, one or two losing trades with high leverage can wipe out the balance.

- Access to Premium Features: Some online forex brokers may reserve their best tools, lowest spreads, or dedicated support for clients with larger deposits.

Funding and Withdrawal Methods for Low-Deposit Brokers

The ease of depositing and withdrawing money is a critical part of a forex broker’s service. For traders using $5 minimum deposit forex brokers, this is especially important because transaction fees can be a large percentage of a small deposit. Fortunately, most modern brokers offer a wide range of convenient and low-cost funding options.

Bank Cards and Cryptocurrency

Credit and debit cards like Visa and Mastercard are the most common deposit methods. Deposits are usually instant and free. In recent years, cryptocurrencies such as Bitcoin, Ethereum, and Tether have become popular for both deposits and withdrawals. Crypto transactions offer privacy and can be faster than bank wires, though they have network fees. Many minimum deposit forex brokers now accept crypto to provide more flexibility.

Perfect Money and WebMoney

E-wallets are another popular choice for funding trading accounts. Services like Skrill, Neteller, Perfect Money, and WebMoney are known for their speed and ease of use. Deposits are often instant, and withdrawals are typically processed within a few hours. These services act as a middleman between your bank and the broker, which some traders prefer. It is always a good idea to check if the broker charges fees for using these deposit methods.

Transaction Processing Times

Processing times vary by method. As a rule, deposits via cards, e-wallets, and crypto are credited almost instantly. Withdrawals usually take longer because of security checks. E-wallet withdrawals are often the fastest, typically processed within 24 hours. Withdrawals to bank cards can take 2-5 business days, and bank wires can take even longer. A broker’s speed in processing withdrawals is a good sign of its reliability.

Opofinance: Your Regulated Trading Partner

For traders looking for a secure and advanced trading platform, Opofinance is a strong choice. As an ASIC-regulated broker, it ensures a high standard of safety and reliability, which is essential for any trader.

- Advanced Trading Platforms: Access top platforms like MT4, MT5, cTrader, and the unique OpoTrade platform.

- Innovative AI Tools: Use an AI Market Analyzer, a personal AI Coach, and 24/7 AI-driven Support to improve your trading decisions.

- Flexible Trading Options: Explore Social & Prop Trading to diversify your strategies and learn from other traders.

- Secure & Flexible Transactions: Benefit from secure deposits and withdrawals, including crypto payments with zero fees, for easy access to your funds.

Conclusion

Beginning your trading journey with a forex broker with a $5 minimum deposit is a smart and practical choice. Brokers such as Exness, XM, and HFM have made the market more accessible, offering a low-risk setting for beginners to learn and for experienced traders to test new ideas. When selecting a low deposit forex broker, always focus on regulation, suitable account types like Micro or Cent, and clear trading conditions. This approach helps build a strong foundation for developing your trading skills and growing your capital.

Frequently Asked Questions

Which forex brokers accept $5 minimum deposit?

Some of the best-known forex brokers that accept a $5 minimum deposit are XM, HotForex (HFM), and Exness (which accepts as low as $1). These are regulated brokers that offer account types designed for new traders.

Are $5 forex accounts suitable for beginners?

Yes, a $5 forex account is very suitable for beginners. It allows them to trade in a live environment, learn risk management, and handle trading psychology with very little financial risk, making it a great step up from a demo account.

Can I withdraw profits from a $5 forex account?

Yes, all regulated brokers allow you to withdraw your profits, no matter the size of your initial deposit. Just be aware of any minimum withdrawal limits or fees that the broker or payment service might have.

What are the risks of trading with low deposit brokers?

The main risk is the temptation to use too much leverage to make up for the small account size, which can cause you to lose your deposit quickly. Also, some unregulated brokers use low deposit offers to attract clients, so it’s critical to choose a well-regulated broker.