In today’s dynamic financial markets, gaining a competitive edge is crucial. A trading strategy with ChatGPT offers a revolutionary approach, empowering traders to leverage cutting-edge Artificial Intelligence (AI) to automate processes and enhance decision-making. This guide delves into how to implement a robust trading strategy using ChatGPT, providing actionable insights and real-time data analysis for traders of all levels. Whether you are trading with a regulated forex broker or exploring opportunities with an online forex broker, discover how ChatGPT can transform your trading journey with practical, step-by-step strategies designed to navigate today’s complex markets.

Understanding ChatGPT’s Role in Trading

Before implementing a trading strategy with ChatGPT, it’s vital to understand its capabilities and how it can be a game-changer in the trading world. This section breaks down the core concepts of ChatGPT and its potential to revolutionize market analysis.

What Exactly is ChatGPT?

ChatGPT is a state-of-the-art language model created by OpenAI. It’s designed to understand and generate human-like text by processing massive datasets. This remarkable ability makes it exceptionally effective for deciphering intricate market trends and news. For traders, this means developing a trading strategy with ChatGPT that is not only intelligent but also highly adaptable to market fluctuations.

How ChatGPT Powers Your Trading Strategy

ChatGPT’s effectiveness in trading comes from its sophisticated two-phase operational process:

- Extensive Pre-training: ChatGPT is initially trained on a colossal amount of text data. This phase allows it to learn fundamental aspects of language, including grammar, factual knowledge, and the ability to understand context. In trading, this pre-training enables ChatGPT to comprehend diverse financial texts, from news articles and company reports to social media sentiment and economic data releases.

- Targeted Fine-tuning: After pre-training, ChatGPT undergoes fine-tuning using specialized datasets and human feedback. This crucial step hones its accuracy and relevance for specific applications, such as trading. Fine-tuning for trading involves training ChatGPT on financial datasets, historical market data, and trading-specific language. This process ensures that when you implement a trading strategy using ChatGPT, the model is adept at interpreting and responding to trading-related queries with high precision.

By understanding these phases, traders can fully appreciate how a trading strategy with ChatGPT leverages AI’s power for real-time analysis, informed decision-making, and potentially, a more profitable trading experience.

Read More: How to trade forex using ai

Key Benefits of a Trading strategy with ChatGPT

Adopting a trading strategy with ChatGPT offers numerous advantages that can significantly improve your market approach. Let’s explore the main benefits and tangible outcomes of integrating ChatGPT into your trading routine:

- Unmatched Speed and Efficiency: In the fast-paced trading environment, time is of the essence. ChatGPT excels at rapidly processing vast quantities of financial information – from breaking market news and analyst reports to intricate technical indicators. This speed allows you to execute trades swiftly and with greater precision. For anyone employing a trading strategy with ChatGPT, this real-time insight and rapid analysis can be the difference between seizing an opportunity and missing out. Imagine receiving a summarized report of overnight global market activity just as you start your trading day, allowing for immediate strategic adjustments.

- Advanced Data Analysis & Enhanced Decision-Making: ChatGPT’s strength lies in its ability to analyze complex datasets and extract meaningful, actionable insights. By intelligently synthesizing diverse data points, including market sentiment from social media, critical economic indicators, and historical price trends, a trading strategy using ChatGPT empowers you to make profoundly informed trading decisions. This leads to more strategic trade entries and exits, boosting your confidence in navigating market complexities. For example, you can ask ChatGPT to analyze the correlation between specific economic announcements and historical price movements of a currency pair to refine your entry points.

- Improved Accessibility and Scalability for All Traders: One of the most appealing aspects of ChatGPT is its easy integration with existing trading platforms and workflows. Whether you’re an individual trader managing your portfolio or part of a large financial institution, a trading strategy with ChatGPT can be scaled to match your specific trading volume and objectives. This scalability ensures that the advantages of AI-driven insights are democratized, making advanced analytical tools accessible at every level of trading expertise. Small retail traders can access the same level of analytical power previously only available to large institutions.

Step-by-Step Guide: Getting Started with Your ChatGPT Trading Strategy

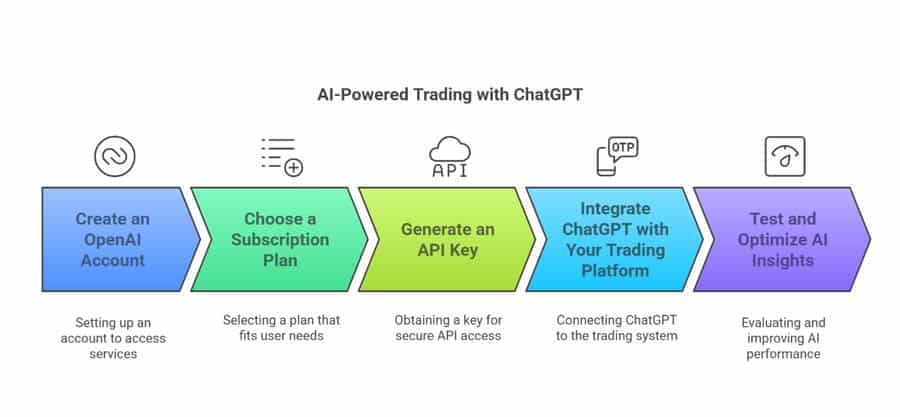

A structured, step-by-step approach is crucial for successfully implementing a trading strategy with ChatGPT. This section outlines the initial steps to effectively integrate AI into your trading operations.

1. Setting Up Your OpenAI Account:

- Create an Account: Begin by signing up on the OpenAI platform. Visit the OpenAI website and follow the account creation process.

- Choose a Subscription Plan: OpenAI offers various subscription plans. Select one that aligns with your anticipated usage volume and trading objectives. Consider starting with a lower-tier plan and scaling up as your integration becomes more sophisticated.

- Generate an API Key: Once subscribed, generate an API key from your OpenAI account dashboard. This key is essential for connecting ChatGPT to your trading platforms and systems. Keep this key secure and do not share it publicly.

2. Integrating ChatGPT into Your Trading Platform:

- API Compatibility Check: Ensure your chosen trading platform supports API integration. Most modern platforms like MetaTrader 4/5, cTrader, and TradingView offer API functionalities. Check your platform’s documentation for API support details.

- Programming Interface: Utilize programming languages like Python, JavaScript, or other languages supported by your trading platform to build the integration. Python is particularly popular in the trading community due to its extensive libraries for data analysis and API interactions.

- Establish Connection: Use your API key to establish a secure connection between your trading software and the ChatGPT API. Libraries like

openaiin Python simplify this process. - Preliminary Data Tests: Before live trading, conduct thorough tests to ensure ChatGPT accurately processes real-time market data from your platform. Verify data feeds for accuracy and latency, which are crucial for a successful trading strategy using ChatGPT. Start with simple data retrieval and analysis tasks before moving to complex strategy implementations.

3. Customizing Your AI Trading Integration:

- Define Clear Trading Objectives: Clearly outline what you aim to achieve with your trading strategy with ChatGPT. Are you focused on enhancing risk management, improving market analysis, automating trade execution, or a combination? Specific objectives will guide your customization process.

- Develop Detailed Prompts: Craft precise and effective prompts for ChatGPT. These prompts should address specific market conditions, trading scenarios, and analytical tasks. For example, prompts could include:

- “Analyze current market sentiment for EUR/USD based on the last hour of news headlines and social media.”

- “Identify potential breakout stocks in the tech sector based on technical indicators like RSI and MACD.”

- “Summarize the key points from the latest FOMC meeting minutes and their potential impact on the USD.”

- Iterative Refinement: Continuously refine your prompts based on ChatGPT’s responses and your trading outcomes. Experiment with different phrasing and contexts to optimize the AI’s analytical precision and ensure your trading strategy with ChatGPT is highly responsive and practical.

Leveraging ChatGPT for In-Depth Market Analysis

Effective market analysis is the cornerstone of any profitable trading strategy. This section explores how to utilize ChatGPT to gather, interpret, and act on market data, transforming raw information into actionable trading signals.

- Real-Time Data and Comprehensive Sentiment Analysis:

- Live Data Feeds: Connect ChatGPT to live data feeds from your broker or financial data providers. This allows the AI to access real-time market quotes, price charts, and economic indicators as they are released.

- Sentiment Aggregation: ChatGPT can analyze sentiment by aggregating and processing data from diverse sources, including financial news websites, social media platforms (like Twitter and financial forums), and sentiment analysis tools.

- Opportunity Identification: By combining live data and sentiment analysis, a trading strategy using ChatGPT can rapidly identify potential trading opportunities. For example, ChatGPT can flag a stock showing positive sentiment spikes alongside technical breakout patterns, suggesting a potential long trade.

- Adaptive Response: ChatGPT’s real-time analysis capabilities enable your trading strategy to quickly adapt to changing market conditions. If sentiment shifts or new economic data emerges, ChatGPT can re-evaluate positions and suggest adjustments to your trading plan.

- Automating Market Reporting for Efficiency:

- Regular Updates and Summaries: Automate the generation of regular market updates and summaries using ChatGPT. You can schedule daily, intraday, or even hourly reports, depending on your trading style.

- Performance Tracking: ChatGPT can simplify tracking market performance by generating reports on key indicators, portfolio performance, and the effectiveness of your trading strategy with ChatGPT.

- Informed Adjustments: Automated reporting keeps you consistently informed, enabling rapid adjustments to your trading strategy based on the latest data and AI-driven insights. For example, receive a daily report highlighting the best and worst performing sectors, coupled with ChatGPT’s analysis of why these movements occurred, directly informing your next trading decisions.

Read More: Create forex trading robot

Developing and Automating Your Trading strategy with ChatGPT: A Practical Guide

This section provides a practical roadmap for creating, refining, and automating a trading strategy using ChatGPT, ensuring you can effectively apply these techniques in real-world trading scenarios.

1. Formulating Your Core Strategy with AI Assistance:

- Brainstorming with ChatGPT: Initiate strategy development by engaging ChatGPT in brainstorming sessions. Ask the AI to suggest various trading approaches, such as:

- Momentum Trading: “Suggest momentum trading strategies applicable to the NASDAQ 100, considering daily price movements and volume.”

- Mean Reversion: “Outline a mean reversion strategy for EUR/GBP, focusing on identifying overbought and oversold conditions using Bollinger Bands and RSI.”

- Arbitrage Opportunities: “Identify potential arbitrage opportunities in cryptocurrency markets, considering price discrepancies across major exchanges.”

- Defining Specific Parameters: Once you’ve identified a promising strategy type, collaborate with ChatGPT to define precise trading rules and parameters:

- Entry and Exit Points: “Based on a mean reversion strategy for EUR/GBP, what are specific entry and exit points using Bollinger Bands and RSI indicators?”

- Stop-Loss and Take-Profit Levels: “For a momentum trading strategy on NASDAQ 100, suggest optimal stop-loss and take-profit levels based on historical volatility.”

- Position Sizing Rules: “Recommend position sizing strategies for a $50,000 account, applying a 2% risk rule per trade for a momentum strategy.”

- Actionable Rules: Ensure your trading strategy with ChatGPT is built upon clear, actionable rules that the AI can interpret and execute. This involves converting conceptual strategies into algorithmic logic.

2. Automating Trade Execution and Rigorous Backtesting:

- Automation Scripts: Translate ChatGPT’s strategic insights into automation scripts. Use programming languages and trading platform APIs to create algorithms that automatically execute trades based on your predefined criteria. Platforms like MetaTrader and TradingView support automated trading through Expert Advisors (EAs) and Pine Script, respectively.

- Backtesting with Historical Data: Implement robust backtesting using historical market data to rigorously evaluate your strategy’s performance across different market conditions. This process is crucial for validating your trading strategy using ChatGPT.

- Performance Metrics: Analyze backtesting results using key metrics such as win rate, drawdown, Sharpe ratio, and profit factor to assess the strategy’s robustness and risk-adjusted returns.

- Scenario Testing: Test your strategy under various market scenarios, including bull markets, bear markets, and periods of high volatility, to understand its strengths and weaknesses.

- Continuous Improvement and Real-Time Adjustments: Backtesting not only validates your trading strategy using ChatGPT but also provides insights for continuous improvement. Use ChatGPT to analyze backtesting results and suggest optimizations. Furthermore, set up mechanisms for real-time adjustments to your automated strategy based on ongoing market dynamics and AI-driven signals.

Pro Tips for Advanced AI-Driven Trading

Experienced traders can further refine their trading strategy with ChatGPT by incorporating advanced techniques and customizations. Here’s expert advice to elevate your AI-driven trading process:

- Advanced Prompt Engineering for Deeper Insights:

- Nuanced Prompts: Continuously refine your prompts to extract more granular and nuanced market insights from ChatGPT. Instead of generic queries, use specific, context-rich prompts. For example, instead of “Analyze EUR/USD,” ask: “Analyze EUR/USD, focusing on the impact of recent ECB policy announcements and US inflation data on its short-term volatility and direction.”

- Experiment with Phrasing: Vary your phrasing and prompt structure to maximize ChatGPT’s analytical precision. Experiment with question types, formats, and levels of detail to see what yields the most actionable responses.

- Integrate Multiple and Diverse Data Sources:

- Holistic Market View: Combine technical analysis data (price charts, indicators), fundamental data (economic reports, company financials), and sentiment analysis for a more comprehensive market view.

- Diverse Data Feeds: Utilize a variety of data feeds to ensure your trading strategy using ChatGPT is robust and adaptable to different market conditions. Consider incorporating alternative data sources like options market data, commodities indices, and global economic calendars.

- Real-Time Monitoring and Dynamic Parameter Adjustments:

- Dynamic Algorithms: Develop dynamic algorithms that automatically adjust trading parameters (like stop-loss levels, position sizes, and entry criteria) based on real-time market shifts and ChatGPT’s analysis.

- Constant Vigilance: Ensure continuous monitoring of your automated strategies and ChatGPT’s outputs to prevent over-reliance on automated recommendations. AI is a tool, and human oversight remains crucial for navigating unexpected market events and ensuring alignment with your overall trading objectives.

Read More: Create forex trading robot

Opofinance Services: Enhance Your AI Trading Experience

For traders looking for a reliable partner to complement their AI-enhanced trading strategy with ChatGPT, consider Opofinance, an ASIC-regulated broker. Opofinance offers a suite of robust services designed to elevate your trading, seamlessly integrating with your AI-driven approaches.

- Advanced Trading Platforms: Trade on industry-leading platforms including MT4, MT5, cTrader, and their proprietary OpoTrade platform, ensuring compatibility and advanced charting tools needed for AI-driven strategies.

- Innovative AI Tools: Leverage Opofinance’s AI Market Analyzer, AI Coach, and AI Support to further enhance your analytical and decision-making processes, complementing your trading strategy with ChatGPT.

- Social & Prop Trading Options: Benefit from social trading features for collaborative insights and explore prop trading opportunities to potentially scale your capital and trading activities.

- Secure & Flexible Transactions: Enjoy secure and convenient deposit and withdrawal methods, including zero-fee crypto payments, ensuring smooth financial operations for your trading endeavors.

Explore Opofinance services further at opofinance.com and discover how they can amplify your trading strategy with ChatGPT, taking your trading performance to new heights.

Conclusion: The Future of Trading with AI

A trading strategy with ChatGPT signifies a groundbreaking convergence of advanced AI and practical trading methodologies. By integrating ChatGPT into your daily trading routine, you gain the power to automate complex data analysis, make more informed and timely decisions, and adapt swiftly to the ever-changing dynamics of the market. Whether you are just starting out in trading or are a seasoned professional seeking a significant competitive advantage, a trading strategy using ChatGPT equips you with the sophisticated tools needed to navigate today’s volatile markets with greater confidence and precision. Embrace the future of trading and unlock the potential of AI in your investment journey.

Key Takeaways

- A trading strategy with ChatGPT harnesses the power of AI to boost trading speed, efficiency, and the quality of decision-making.

- Integrating ChatGPT is a straightforward process, from setting up an OpenAI account to customizing real-time, strategy-specific prompts.

- ChatGPT delivers robust market analysis by intelligently combining live data feeds with sentiment and technical analysis, providing actionable insights.

- Advanced traders can significantly optimize their trading outcomes through refined prompt engineering, integration of diverse data sources, and dynamic strategy adjustments.

- Partnering with reputable brokers like Opofinance can further enhance your trading experience by providing advanced platforms and complementary AI-driven tools.

What is the main benefit of using AI, like ChatGPT, in developing trading strategies?

AI offers the ability to analyze vast amounts of historical data quickly, identify patterns that humans might miss, and generate trading ideas or refine existing strategies. It can also automate code generation for indicators and backtesting on platforms like TradingView, enabling traders to prototype and evaluate strategies more efficiently. Moreover, AI can interpret complex risk indicators, like the VIX, providing context and implications for market sentiment.

Can ChatGPT create profitable trading strategies on its own?

While ChatGPT can generate trading strategies, indicators, and code for backtesting, it is not a guaranteed path to profit. Strategies provided by AI often need tweaking and human oversight to be effective. The AI is a tool to assist in the process, not a replacement for understanding market dynamics, risk management, and adapting to changing conditions. Rigorous backtesting and forward testing are essential to evaluate any AI-generated strategy.

What are some common technical indicators that can be used with AI-generated trading strategies?

Several technical indicators are frequently used in conjunction with AI in trading, such as Moving Averages (SMA, EMA), Relative Strength Index (RSI), Bollinger Bands, Moving Average Convergence Divergence (MACD), and Stochastic Oscillators. AI can assist in calculating these indicators, identifying crossovers, divergences, and overbought/oversold conditions, and combining them to generate potential trading signals. These indicators can be implemented using Pine Script code on TradingView, often generated with the help of AI.

How can I use ChatGPT to backtest a trading strategy?

First, use ChatGPT to generate Pine Script code for your trading strategy (or an indicator turned into a strategy). Then, in TradingView, open the Pine Editor, paste the code, and save it as a strategy. Add the strategy to your chart. TradingView’s Strategy Tester will then display the backtesting results, including profit factor, total profit, and a list of trades. You can customize the backtesting parameters, such as initial capital, contract size, stop-loss, and take-profit levels, to simulate different trading scenarios.

What is ‘prompt engineering’ and why is it important when using ChatGPT for trading?

Prompt engineering is the process of crafting specific and clear instructions (prompts) to guide ChatGPT’s responses. This is critical because ChatGPT, while powerful, is not a human and needs precise direction to produce relevant and useful outputs. For example, instead of asking “What is a good trading strategy?” a better prompt would be “Create a Pine Script code that is an indicator of two moving averages that are user-defined, 10 and 100 period as default. Please make labels for buy and sell at the key crossovers.” The quality of the prompts directly impacts the quality and relevance of the AI’s output.