Seeking rapid-fire action in forex trading? The USD/JPY 1 min strategy delivers a high-octane approach, targeting swift profits from minor price shifts within a single minute. Known as scalping, this method is favored by traders who want fast results. But is the usdjpy 1 minute strategy truly your path to forex riches? Yes, it can be, for traders equipped with the right skills and mindset.

This article dives deep into the usdjpy 1 min trading strategy, revealing its secrets and risks. You’ll discover if this electrifying, yet demanding, method aligns with your trading style. Selecting a reliable regulated forex broker is crucial for navigating the speed and volatility of scalping. Prepare for an in-depth exploration that will equip you to master the fast lane of forex, but remember, informed strategy and caution are your allies.

Decoding the 1-Minute Scalping Phenomenon

Imagine forex trading as a race. If swing trading is a marathon and day trading is a sprint, then usdjpy 1 min strategy is a lightning-fast dash. It’s a hyper-active trading style where the goal is to capture profits from the smallest price movements, often just a few pips, all within a single minute timeframe. Picture executing numerous trades in rapid succession, each aimed at securing tiny gains that accumulate throughout your trading session. This encapsulates the core of scalping.

Unlike day traders who hold positions for hours, or swing traders with positions lasting days or weeks, the usdjpy 1 min chart strategy is all about speed and precision. Scalpers thrive on market volatility and high liquidity, which is why currency pairs like USD/JPY, known for tight spreads and active trading sessions, are particularly appealing. Choosing the right broker for forex trading is paramount to ensure low transaction costs and fast execution.

However, be warned: this strategy is not for everyone. It demands intense focus, split-second decision-making, and a temperament that thrives under pressure. Successful 1-minute scalpers are disciplined individuals, capable of dedicating concentrated screen time and adhering strictly to their well-defined trading plans. If you are drawn to immediate feedback, enjoy a dynamic and demanding trading style, and are prepared for the intensity, then the usdjpy 1 min strategy could be your niche in the forex market.

Why USD/JPY is a Scalper’s Darling: Unveiling the Pair’s Appeal

The USD/JPY currency pair, pitting the US Dollar against the Japanese Yen, holds a unique attraction for scalpers. Several key characteristics make USD/JPY a prime candidate for implementing a usdjpy 1 min trading strategy:

- Volatility: USD/JPY is famous for its volatility, especially during the overlap of the Tokyo, London, and New York trading sessions. This inherent price fluctuation provides abundant opportunities for scalpers to profit from short-term market movements.

- Liquidity: As one of the most traded currency pairs globally, USD/JPY boasts exceptional liquidity. This deep liquidity ensures tight spreads, which are essential for minimizing transaction costs. Tight spreads are a critical factor for high-frequency trading strategies like scalping, where even fractions of a pip can impact profitability. A good online forex broker will offer tight spreads on this pair.

- Tight Spreads: Reputable forex trading brokers frequently offer highly competitive spreads on USD/JPY. These tight spreads make it a cost-effective choice for high-frequency trading strategies like scalping, where every pip secured contributes significantly to the bottom line.

However, traders employing a usdjpy 1 minute strategy must be aware of specific USD/JPY behaviors:

- News Sensitivity: USD/JPY reacts strongly to economic news releases from both the United States and Japan. Major economic announcements can trigger rapid and unpredictable price swings, demanding robust and adaptable risk management protocols.

- Whip-saws: Due to its volatile nature, USD/JPY can experience frequent “whip-saws”—sudden and sharp price reversals. These reversals can quickly trigger stop-loss orders if they are not placed with strategic precision.

Read More: 1 minute forex trading strategy

Optimal Trading Times for USD/JPY Scalping

The optimal window for scalping USD/JPY is typically during the overlap of the London and New York trading sessions, roughly from 8:00 AM to 12:00 PM EST. This period generally exhibits the highest levels of volatility and liquidity, presenting the most favorable market conditions for a usdjpy 1 min strategy to thrive.

Arming Yourself: Essential Technical Indicators for USD/JPY 1-Minute Scalping

Technical indicators serve as a scalper’s essential toolkit, filtering out market noise and providing actionable trading signals. When implementing a usdjpy 1 min chart strategy, certain indicators prove particularly effective in this fast-paced environment:

Momentum Indicators: Gauge the Market’s Pulse

- Moving Average Convergence Divergence (MACD): The MACD is a powerful momentum indicator that highlights shifts in momentum and potential trend reversals. Scalpers often utilize MACD signal line crossovers on the 1-minute chart to pinpoint precise entry and exit points. A buy signal may emerge when the MACD line crosses above the signal line, indicating bullish momentum, while a sell signal may occur when it crosses below, suggesting bearish momentum.

- Relative Strength Index (RSI): The RSI measures the velocity and magnitude of recent price changes to evaluate overbought or oversold conditions in the market. For usdjpy 1 minute strategy, a shorter period RSI, such as 9 or 14 periods, is commonly used. Scalpers monitor overbought levels (RSI readings above 70) and oversold levels (RSI readings below 30) to anticipate potential short-term price reversals.

- Stochastic Oscillator: Similar to the RSI, the Stochastic Oscillator is designed to identify overbought and oversold conditions. However, it focuses on price momentum by comparing a currency pair’s closing price to its price range over a defined period. Standard settings, such as (14, 1, 3), can be effective for capturing short-term momentum shifts critical for a successful usdjpy 1 min trading strategy.

Volatility Indicators: Navigating Price Swings

- Bollinger Bands: Bollinger Bands are volatility indicators that dynamically adjust to market conditions. They widen during periods of high volatility and contract during periods of low volatility. For 1-minute charts, a common setting involves a 20-period Simple Moving Average (SMA) with 2 standard deviations. Scalpers use Bollinger Bands to identify potential breakout opportunities or reversals when the price approaches or breaches the outer bands.

Trend and Support/Resistance Indicators: Mapping the Market Landscape

- Moving Averages (EMA & SMA): Exponential Moving Averages (EMA), which emphasize recent prices, and Simple Moving Averages (SMA) are invaluable for identifying short-term trends on the 1-minute chart. Scalpers often employ multiple moving averages, such as the 20-EMA and 50-EMA, to confirm the prevailing trend direction and identify potential pullback entry points in their usdjpy 1 min trading strategy.

- Volume Weighted Average Price (VWAP): VWAP represents the average price a currency pair has traded at throughout the trading day, weighted by volume. Scalpers frequently use VWAP as a dynamic support or resistance level. Prices trading above VWAP suggest prevailing bullish sentiment, while prices below VWAP indicate bearish pressure.

- Average Length Moving Average (ALMA): ALMA is designed to minimize noise and smooth out price data, potentially offering clearer signals on the highly sensitive 1-minute chart. Scalpers may use ALMA to identify potential trend changes or continuation patterns with greater clarity.

- Support and Resistance Levels: Identifying key support and resistance levels is paramount for any usdjpy 1 min trading strategy. Scalpers use horizontal lines drawn at previous day’s highs and lows, pivot points, and visually discernible levels to anticipate potential price reversals or breakouts. These levels act as crucial reference points for entry and exit decisions.

Read More: elliott wave and macd

Mastering the Minute: Effective 1-Minute Scalping Strategies for USD/JPY

With the right technical indicators in your arsenal, you can effectively deploy various usdjpy 1 min trading strategy approaches to capitalize on short-term market fluctuations:

1. Momentum Scalping: Riding the Price Wave

Momentum scalping is designed to profit from strong, short-lived bursts of price movement.

- Identifying Momentum: Utilize momentum indicators like the RSI and MACD to pinpoint periods of heightened buying or selling pressure. Look for RSI readings approaching overbought or oversold territory or MACD lines exhibiting strong divergence, signaling potential shifts in momentum.

- Entry and Exit Rules: Execute trades when momentum indicators confirm a significant price surge in a specific direction. For instance, initiate a buy order when the RSI crosses above 50 and the MACD displays bullish divergence. Conversely, close positions swiftly as momentum begins to diminish or when your predetermined profit target, typically just a few pips, is achieved.

- Example Scenario: Imagine the USD/JPY price experiencing a sudden upward spike following a minor positive economic release. The RSI surges above 60, and the MACD reinforces the bullish momentum. In such a scenario, a scalper might swiftly enter a buy trade, aiming for a quick 5-10 pip profit before the upward momentum dissipates.

2. Range Scalping: Trading Within Boundaries

Range scalping is most effective in sideways or range-bound markets where the price oscillates predictably between well-defined support and resistance levels.

- Identifying Ranges: Visually identify clear support and resistance levels on the usdjpy 1 min chart. Bollinger Bands can also be valuable in defining potential range boundaries. Look for periods where price action is contained within a relatively horizontal channel.

- Entry Points: Strategically place buy orders near the identified support level and corresponding sell orders near the resistance level. The expectation is that the price will continue to bounce between these established boundaries.

- Stop-Loss and Take-Profit: Implement tight stop-loss orders just below the support level for buy orders and just above the resistance level for sell orders. Set take-profit targets conservatively within the range, aiming for small, consistent gains with each successful trade.

3. News Scalping: Navigating the Volatility Storm

News scalping is a high-risk, high-reward strategy that seeks to capitalize on the extreme volatility often triggered by high-impact economic news releases.

- Trading News Events: Diligently monitor economic calendars for scheduled high-impact news events, such as US Non-Farm Payroll or Japanese GDP announcements. These events are known catalysts for significant market volatility in USD/JPY.

- Capitalizing on Volatility: Be prepared for rapid and often erratic price swings and wider spreads immediately following major news releases. Some scalpers attempt to predict the news direction beforehand, while others prefer to wait for the initial surge of volatility to subside before trading the emerging trend. Both approaches are inherently risky.

- Risk Management is Paramount: News scalping is exceptionally risky and should only be attempted by experienced traders with robust risk management strategies. Expect wider spreads, potential slippage (orders being filled at less favorable prices than intended), and unpredictable price action. Employ significantly smaller position sizes and extremely tight stop-loss orders to mitigate the substantial risks involved.

4. Trend-Following Scalping: Joining the Prevailing Tide

Trend-following scalping aims to align your short-term trades with the broader, prevailing market trend, seeking quick profits during brief pullbacks.

- Identifying Trends: Begin by analyzing higher timeframe charts, such as 15-minute or 1-hour charts, to accurately determine the dominant trend direction in USD/JPY. Establishing the overall trend is crucial for aligning your scalping efforts.

- Pullback Entries: Once the trend is identified, switch to the 1-minute chart and patiently await price pullbacks or minor corrections that move against the established trend. These pullbacks offer lower-risk entry opportunities.

- Entry Signals: Enter buy trades during pullbacks within an uptrend and conversely, initiate sell trades during pullbacks within a downtrend. Look for confirmation signals that the price action is resuming in the direction of the primary trend before entering. Moving averages can be valuable tools for confirming trend resumption after a pullback.

5. Breakout Scalping: Catching the Surge

Breakout scalping is designed to capture rapid price movements that occur when the price decisively breaks through established support or resistance levels.

- Identifying Breakout Levels: Carefully pinpoint robust support and resistance levels on the usdjpy 1 min chart. These levels represent key price barriers that, once breached, can trigger significant momentum.

- Entry on Breakouts: Enter buy orders immediately when the price breaks decisively above a resistance level with strong upward momentum. Conversely, enter sell orders when the price breaks firmly below a support level with strong downward momentum. Confirmation of momentum is crucial to avoid false breakouts.

- Quick Profit Taking: Be mindful that breakouts can sometimes be followed by retracements or pullbacks. Therefore, aim to secure quick profits and consider employing trailing stop-loss orders to proactively lock in gains as the price moves favorably after the breakout.

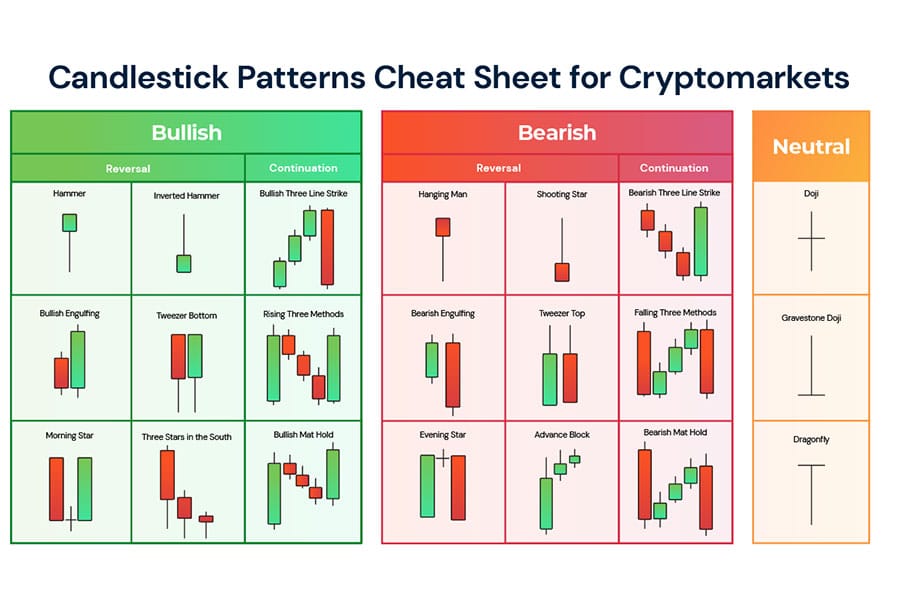

6. Candlestick and Chart Patterns: Visual Clues for Scalping

- Candlestick Patterns: Develop the ability to recognize key reversal candlestick patterns, such as Doji, Hammer, Engulfing patterns, and Pin Bars, directly on the usdjpy 1 min chart. These patterns can provide early signals of potential short-term shifts in price direction, offering valuable entry and exit cues for scalpers.

- Chart Patterns: Learn to identify short-term chart patterns, including Double Tops and Bottoms, Head and Shoulders formations, and Flags and Pennants, on the 1-minute chart. These patterns can suggest potential trend reversals or continuations, providing scalpers with higher-probability trading opportunities.

- Trend Lines: Master the technique of drawing trend lines on the 1-minute chart to identify dynamic support and resistance levels. Breakouts beyond or bounces off established trend lines can offer precise entry and exit signals for scalping trades.

Read More: What is USDJPY in Forex

Risk Management: The Bedrock of 1-Minute Scalping Success

Within the intense environment of usdjpy 1 min strategy, risk management is not merely important—it is absolutely fundamental to survival and sustained profitability. The sheer volume of trades executed in scalping amplifies both potential gains and losses. Implementing strict risk management protocols is the essential shield that safeguards your trading capital:

- Tight Stop-Loss Orders: Employ tight stop-loss orders on every single trade you execute. A commonly accepted range for usdjpy 1 minute strategy is a very tight 2-5 pips. This practice is crucial for rigorously limiting your potential loss on any individual trade and preventing significant capital erosion from a series of adverse trades.

- Risk Per Trade Limits: Adhere to a strict rule of never risking more than 1-2% of your total trading account balance on any single trade. This conservative approach is vital for preventing a string of losing trades from critically damaging your capital base. Consistent risk control is key to longevity in scalping.

- Risk-Reward Ratio: Strive to maintain a minimum risk-reward ratio of 1:1.5 on all scalping trades. This means that for every pip you risk on a trade, aim to target at least 1.5 pips in potential profit. Maintaining this positive risk-reward ratio is essential for achieving long-term profitability and offsetting inevitable losing trades in scalping.

- Daily Stop-Loss Limits: Implement a daily stop-loss limit as a critical safeguard. Once you reach your predetermined daily loss threshold, immediately cease trading for the remainder of the day, regardless of any perceived trading opportunities. This disciplined approach is essential to prevent emotional trading, curb impulsive revenge trading, and protect your capital from runaway losses.

- Emotional Control: Scalping is an exceptionally emotionally demanding trading style. Mastering your emotions is non-negotiable for success. Consciously avoid impulsive decisions driven by fear of missing out or excessive greed. Rigorously adhere to your pre-defined trading strategy and trading plan, even during periods of consecutive losses. Emotional discipline is the cornerstone of consistent scalping performance.

Pro Tips for Advanced USD/JPY 1-Minute Scalpers

For seasoned traders aiming to further refine their usdjpy 1 min trading strategy and gain a competitive edge:

- Advanced Order Types: Explore and strategically utilize advanced order types, such as “one-cancels-the-other” (OCO) orders. OCO orders can significantly enhance your efficiency in managing both trade entries and exits, particularly in the highly volatile and fast-moving scalping environment.

- Correlation Analysis: Incorporate correlation analysis into your trading routine. Analyze the correlation relationships between USD/JPY and other relevant currency pairs or market indices. Identifying strong correlations can provide valuable confluence, improve the precision of your trade timing, and potentially increase your win rate.

- Automated Trading (Expert Advisors): Consider the development or utilization of automated trading systems, commonly known as Expert Advisors (EAs), to execute your scalping strategy. EAs offer the potential to automate trade execution with speed and precision, eliminating emotional biases and capitalizing on fleeting market opportunities. However, rigorous testing, continuous monitoring, and careful optimization of EAs are absolutely crucial before deploying them in live trading.

- Level 2 Data: For a more granular and in-depth understanding of market microstructure, explore the use of Level 2 data. Level 2 data provides real-time order book information, revealing insights into short-term supply and demand imbalances and potentially offering an edge in identifying fleeting scalping opportunities.

Opofinance: Your Premier Partner in Forex Trading

For traders seeking a dependable and innovative online forex broker to effectively implement their usdjpy 1 min strategy, Opofinance emerges as a leading choice. As an ASIC-regulated broker, Opofinance delivers a comprehensive suite of services meticulously designed to elevate your trading experience:

- Advanced Trading Platforms: Execute trades with unmatched efficiency and precision on industry-leading platforms, including the widely acclaimed MT4, MT5, and cTrader, alongside OpoTrade, Opofinance’s cutting-edge proprietary platform. These platforms provide the robust tools and ultra-fast execution speeds essential for successful scalping.

- Innovative AI Tools: Gain a significant analytical advantage by leveraging Opofinance’s suite of AI-powered trading tools. Utilize the AI Market Analyzer for in-depth market insights, benefit from personalized trading guidance with the AI Coach, and access instant support through AI Support, all designed to enhance your trading decisions.

- Social & Prop Trading: Connect with a vibrant community of fellow traders and explore potential opportunities to amplify your trading capital through Opofinance’s Social and Proprietary Trading programs, fostering a collaborative and potentially rewarding trading environment.

- Secure & Flexible Transactions: Experience complete peace of mind with Opofinance’s robust security protocols and highly convenient deposit and withdrawal methods. Opofinance supports a wide array of secure transaction options, including seamless crypto payments, all processed with zero fees imposed by Opofinance, ensuring efficient and cost-effective fund management.

Ready to elevate your trading with Opofinance?

Conclusion: Is the USD/JPY 1-Minute Strategy Right for You?

The usdjpy 1 min strategy presents an exciting and potentially lucrative avenue for forex traders who thrive on fast-paced market action and seek rapid profit opportunities. Its inherent speed and demand for precision can be exceptionally rewarding for traders possessing the requisite temperament, skills, and unwavering discipline. However, it is absolutely essential to acknowledge and fully understand the substantial risks associated with this high-frequency trading style. Scalping necessitates unwavering discipline, robust risk management protocols, and a commitment to continuous learning and adaptation.

Before embarking on your usdjpy 1 minute strategy journey, conduct a thorough and honest self-assessment of your individual trading style, risk tolerance levels, and available time commitment for focused screen time. Rigorously backtest your chosen strategies using historical data, dedicate ample time to practice execution on a demo account, and always prioritize the paramount importance of capital preservation. When approached with prudence, unwavering discipline, and the support of a reputable broker for forex, the usdjpy 1 min trading strategy can evolve into a powerful and valuable asset within your comprehensive forex trading toolkit.

Key Takeaways:

- 1-Minute Scalping: A high-frequency trading strategy centered on capturing minimal price fluctuations within extremely short timeframes.

- USD/JPY Advantages: USD/JPY’s inherent volatility, high liquidity, and tight spreads make it particularly well-suited for scalping methodologies.

- Essential Indicators: Key technical indicators for usdjpy 1 min chart strategy include MACD, RSI, Stochastic Oscillator, Bollinger Bands, Moving Averages (EMA & SMA), VWAP, ALMA, and Support & Resistance Levels.

- Key Strategies: Effective usdjpy 1 min trading strategy approaches encompass Momentum Scalping, Range Scalping, News Scalping, Trend-Following Scalping, Breakout Scalping, and Candlestick/Chart Pattern recognition.

- Risk Management is Crucial: Implementing stringent risk management measures, including tight stop-loss orders, pre-defined risk per trade limits, favorable risk-reward ratios, and robust emotional control, is absolutely paramount for long-term success.

- Backtesting is Essential: Thoroughly validate your chosen strategy through rigorous backtesting on historical data before deploying it with live capital.

- Practice and Discipline: Achieving proficiency and consistent profitability in scalping demands significant dedicated practice and unwavering trading discipline.

What are the main challenges of using a USD/JPY 1-minute strategy?

The primary challenges include the high level of market noise on the 1-minute chart, the need for extremely fast execution, and the intense emotional and mental discipline required to manage risk and avoid overtrading in such a fast-paced environment.

Can beginners successfully use a USD/JPY 1-minute strategy?

While potentially profitable, the USD/JPY 1-minute strategy is generally not recommended for beginners. Its demanding nature, rapid decision-making, and need for tight risk control are better suited for experienced traders who have a solid understanding of technical analysis and risk management. Beginners should first focus on longer timeframes to build a strong foundation.

How much capital do I need to start USD/JPY 1-minute scalping?

You can start with a relatively small capital amount, but it’s crucial to choose a broker for forex trading that offers micro-lots and high leverage (used cautiously). However, regardless of the starting capital, always prioritize risk management by only risking a small percentage of your account per trade. Focus on practicing on a demo account until you are consistently profitable before trading live funds.