Imagine having a trading platform that not only meets your needs but exceeds your expectations, providing every tool and feature necessary to optimize your trading strategy. cTrader is precisely that platform—a game-changer in the realm of Forex trading. As a premier online forex broker tool, cTrader offers an unparalleled multi-asset trading environment tailored for both Forex and CFD trading. Developed by Spotware Systems, cTrader stands out with its intuitive interface, advanced charting tools, and seamless accessibility across desktop, web, and mobile devices.

In an industry where milliseconds can make the difference between profit and loss, cTrader’s robust infrastructure ensures that your trades are executed swiftly and accurately. This comprehensive guide delves into what cTrader is, explores its standout cTrader features, compares it with the widely-used MetaTrader, and provides valuable insights to help you make an informed decision. Whether you’re a seasoned trader or just starting, understanding cTrader’s capabilities will significantly enhance your trading experience and performance. Let’s embark on this journey to uncover why cTrader is the preferred choice for so many traders worldwide.

Key Features of cTrader

Understanding the core features of cTrader is essential to appreciating why it has become a favored platform among Forex and CFD traders. Each feature is meticulously designed to provide traders with the tools they need to succeed in a competitive market.

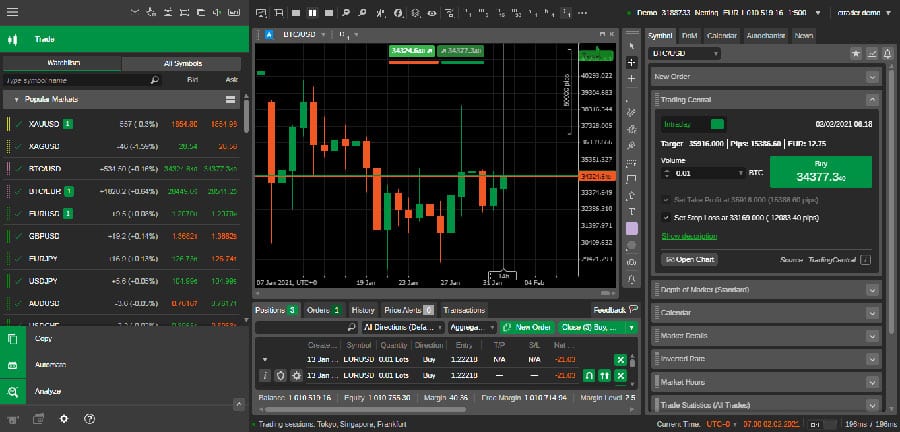

User-Friendly Interface with Advanced Charting Tools

cTrader’s interface is meticulously designed to cater to traders of all experience levels.

One of the most compelling cTrader features is its user-friendly interface. The platform’s sleek, modern design ensures that users can navigate effortlessly, accessing a wealth of features without feeling overwhelmed. The intuitive layout allows traders to focus on what truly matters—making informed trading decisions.

Advanced charting tools are at the heart of cTrader. The platform offers a variety of technical indicators, drawing tools, and customizable chart types, enabling traders to analyze market trends with precision. Features like Fibonacci retracements, pivot points, and moving averages are readily available, providing the tools necessary to perform detailed market analysis. Additionally, cTrader supports multiple chart layouts and the ability to save personalized chart templates, allowing traders to tailor their analysis environment to their specific needs.

Diverse Order Types and Execution Options

Flexibility in order execution is crucial for effective trading, and cTrader excels in this area.

cTrader supports a wide array of order types, including market orders, limit orders, stop orders, and stop-limit orders. This flexibility allows traders to execute their trading strategies efficiently, whether they are executing quick trades or setting up more complex orders. Moreover, cTrader offers ECN (Electronic Communication Network) execution, ensuring that trades are executed with minimal slippage and competitive spreads. This is particularly beneficial for high-frequency traders who rely on precise and fast order execution to maximize their trading performance.

Algorithmic Trading with cTrader Automate

Harness the power of automation with cTrader’s robust algorithmic trading capabilities.

For traders interested in automating their strategies, cTrader provides cTrader Automate (formerly known as cAlgo). This feature allows users to develop and deploy automated trading strategies using the C# programming language. With cTrader Automate, traders can create custom indicators, automated trading bots, and backtest their strategies against historical data to refine their approaches. This capability empowers traders to harness the power of automation, enhancing efficiency and consistency in their trading activities. The seamless integration of cTrader Automate ensures that even those with limited programming experience can develop effective automated strategies, making it accessible to a broader range of traders.

cTrader Copy: Embrace Social Trading

Leverage the collective wisdom of the trading community with cTrader Copy.

Social trading is revolutionizing the trading landscape, and cTrader integrates this seamlessly through cTrader Copy. This service enables users to follow and replicate strategies from other successful traders, democratizing access to expert trading techniques. By leveraging the collective wisdom of the trading community, even novice traders can benefit from seasoned professionals’ insights. cTrader Copy fosters a collaborative and supportive trading environment, allowing users to diversify their trading strategies by copying multiple traders simultaneously, thereby spreading risk and enhancing potential returns.

Depth of Market (DOM) Insights

Gain a deeper understanding of market dynamics with Depth of Market insights.

Understanding market liquidity and pricing is essential for making strategic trading decisions. cTrader provides Depth of Market (DOM) data, offering a transparent view of market liquidity and real-time pricing information. This feature allows traders to gauge supply and demand dynamics, identify potential support and resistance levels, and make more informed decisions based on comprehensive market data. The DOM feature visualizes the order book, showing the number of buy and sell orders at various price levels, which is invaluable for traders looking to understand market sentiment and anticipate price movements.

Cross-Platform Accessibility

Trade seamlessly across all your devices with cTrader’s cross-platform accessibility.

In today’s fast-paced world, the ability to trade on the go is invaluable. cTrader ensures cross-platform accessibility, allowing traders to seamlessly switch between desktop, web, and mobile applications. Whether you’re at your desk, in a café, or traveling, cTrader provides a consistent and reliable trading experience. The mobile app retains all the essential features of the desktop version, including advanced charting tools, order types, and real-time market data, ensuring that you never miss an opportunity, regardless of where you are.

Read More: Top 10 Forex Trading Platforms

cTrader vs. MetaTrader: A Comprehensive Comparison

cTrader vs. MetaTrader is a common consideration for traders evaluating their platform options. Both platforms have their strengths, but cTrader distinguishes itself in several key areas:

User Interface and Design

cTrader offers a modern, intuitive design with a focus on user experience. Its interface is clean, customizable, and designed to facilitate efficient trading. In contrast, MetaTrader has a more traditional layout, which some users may find less visually appealing or user-friendly. cTrader’s interface allows for greater flexibility in arranging windows and tools, enabling traders to create a personalized workspace that enhances their trading efficiency.

Additionally, cTrader’s interface is optimized for both touch and non-touch devices, providing a seamless experience across all platforms. The platform’s design emphasizes ease of use without compromising on functionality, making it accessible to traders of all skill levels.

Charting Capabilities

While both platforms provide robust charting tools, cTrader offers a greater variety of chart types, timeframes, and built-in technical indicators. This allows for more detailed and nuanced market analysis, giving traders an edge in identifying trends and making strategic decisions. MetaTrader, while powerful, typically offers fewer charting options and less flexibility in customizing charts, which can limit the depth of analysis for some traders.

cTrader also supports multi-timeframe analysis, allowing traders to view multiple timeframes on a single chart. This feature enhances the trader’s ability to perform comprehensive technical analysis without the need to switch between different charts.

Programming Languages for Algorithmic Trading

cTrader utilizes C# for its automated trading scripts, offering a powerful and flexible programming environment. On the other hand, MetaTrader relies on MQL5, which, while effective, may have a steeper learning curve for those unfamiliar with its syntax. The choice of programming language can significantly impact the ease and efficiency of developing automated trading strategies. C# is widely used and supported, making it easier for developers to create complex and efficient trading algorithms.

Moreover, cTrader’s integration with Visual Studio provides a robust development environment with advanced debugging and testing tools, enhancing the overall development experience for traders looking to create sophisticated automated strategies.

Order Execution and Policies

cTrader’s ECN execution ensures minimal slippage and competitive spreads, which is particularly beneficial for high-frequency traders. MetaTrader offers various execution models, but cTrader’s transparent pricing and Level II market data provide a clearer view of the market, enhancing execution quality. This transparency allows traders to execute trades with greater confidence, knowing that they are getting the best possible prices.

Additionally, cTrader supports instant execution, market execution, and pending orders, providing traders with the flexibility to choose the execution type that best suits their trading strategy. The platform’s robust execution engine ensures that orders are processed swiftly and accurately, reducing the risk of slippage and ensuring that trades are executed at the desired price levels.

Community Support and Custom Tools

Both platforms have active communities, but cTrader’s ecosystem is rapidly growing, with a wealth of custom tools and indicators available. The platform’s developer support and regular updates ensure that traders have access to the latest features and innovations. MetaTrader also has a large community, but cTrader’s focus on modern development practices and continuous improvement provides a more dynamic and supportive environment for traders seeking custom solutions.

Furthermore, cTrader offers a dedicated Marketplace where traders can access a wide range of custom indicators, automated strategies, and trading tools developed by the community. This marketplace fosters innovation and allows traders to enhance their trading experience by integrating advanced tools tailored to their specific needs.

Read More: MetaTrader 4 vs MetaTrader 5

Advantages of Using cTrader

Transparent Pricing with Level II Market Data

cTrader provides transparent pricing, including Level II market data, which offers deep insights into market liquidity and order flow. This transparency allows traders to make more informed decisions and execute trades with greater confidence. Level II data shows the volume of buy and sell orders at different price levels, helping traders understand market depth and anticipate potential price movements.

Advanced Risk Management Tools

Effective risk management is crucial for long-term trading success. cTrader offers advanced risk management tools, including customizable stop-loss and take-profit orders, ensuring that traders can protect their investments and manage risk effectively. These tools allow traders to set precise exit points, reducing the emotional impact of trading decisions and helping maintain a disciplined approach to trading.

High Level of Customization

cTrader’s high level of customization allows traders to tailor the platform to their specific needs and preferences. From customizable layouts and chart configurations to personalized trading strategies, cTrader empowers users to create a trading environment that suits their individual style. This level of personalization enhances the trading experience, making it more efficient and enjoyable.

Regular Updates and Developer Support

Spotware Systems, the developer behind cTrader, is committed to providing regular updates and support, ensuring that the platform remains cutting-edge and responsive to traders’ evolving needs. This dedication to continuous improvement enhances the platform’s reliability and functionality, providing traders with the latest tools and features to stay competitive in the fast-paced Forex market.

Getting Started with cTrader

Starting with cTrader is a straightforward process designed to get you up and running quickly. Whether you’re new to Forex trading or an experienced trader looking to switch platforms, cTrader provides the resources and support you need to begin your trading journey with confidence.

Download and Install cTrader

To get started, visit the official cTrader website or your chosen broker’s platform to download and install cTrader on your preferred device. The platform is compatible with desktop, web, and mobile applications, ensuring seamless access across all devices. The installation process is user-friendly, with clear instructions provided to help you set up the platform without any hassle.

For desktop users, cTrader offers both a standalone application and a web-based version, providing flexibility in how you choose to access the platform. The mobile app is available for both iOS and Android devices, allowing you to trade on the go with the same comprehensive features found on the desktop version.

Set Up a Demo Account

Before diving into live trading, it’s advisable to set up a demo account. This allows you to familiarize yourself with cTrader’s features, explore its interface, and practice trading strategies without risking real money. A demo account is an invaluable tool for honing your skills and gaining confidence, providing a risk-free environment to test and refine your trading approach.

Creating a demo account is simple and can be done directly through the cTrader platform. The demo account typically comes with virtual funds, enabling you to execute trades and experiment with different strategies without any financial risk. This hands-on experience is crucial for understanding the platform’s functionalities and developing effective trading strategies.

Choose a Supported Broker

Selecting the right broker is a critical step in your trading journey. Ensure that the broker you choose supports cTrader and aligns with your trading needs. Consider factors such as regulatory compliance, available trading instruments, customer support, and fee structures to make an informed decision. Reputable brokers like Opofinance offer robust support for cTrader, providing a reliable and secure trading environment.

When evaluating brokers, pay attention to their regulatory status, as this ensures that your funds are protected and that the broker adheres to strict financial standards. Additionally, consider the range of trading instruments offered, including Forex pairs, commodities, indices, and cryptocurrencies, to ensure that the broker meets your trading requirements.

Read More: Best forex trading platform for beginners

Pro Tips for Advanced Traders

Maximize your trading potential with these expert strategies tailored for cTrader users.

Enhancing your trading strategy with advanced techniques can significantly improve your trading performance.

- Leverage cTrader Automate: Dive deep into automated trading by creating sophisticated algorithms using C#. Backtest your strategies extensively to refine and optimize performance before deploying them in live markets. Automated trading can help eliminate emotional biases and ensure consistent execution of your trading strategies.

- Utilize Advanced Charting Tools: Take full advantage of cTrader’s advanced charting capabilities. Experiment with different technical indicators and chart types to uncover unique market patterns and enhance your analytical precision. Combining multiple indicators can provide a more comprehensive view of market trends and potential trading opportunities.

- Engage in Social Trading with cTrader Copy: Expand your trading horizons by following and replicating strategies from top-performing traders. Analyze their approaches, learn from their successes, and integrate their insights into your own trading methodology. Social trading can provide valuable learning opportunities and help diversify your trading strategies.

- Monitor Market Depth: Use the Depth of Market (DOM) feature to gain real-time insights into market liquidity and order flow. This information can be pivotal in making timely and strategic trading decisions, especially in volatile markets. Understanding market depth can help you anticipate price movements and identify optimal entry and exit points.

- Customize Your Trading Environment: Tailor cTrader’s interface to your preferences. Customize layouts, save personalized workspace configurations, and set up hotkeys to streamline your trading process and enhance efficiency. A well-organized trading environment can improve your workflow and help you respond more quickly to market changes.

- Implement Advanced Risk Management Techniques: Beyond basic stop-loss and take-profit orders, explore advanced risk management strategies such as trailing stops, hedging, and position sizing based on volatility. Effective risk management can protect your capital and ensure long-term trading success.

Opofinance Services: Your Trusted Trading Partner

Partner with Opofinance for a secure and enhanced trading experience.

When it comes to choosing a reliable and regulated broker, Opofinance stands out as a premier choice. Opofinance not only supports the cTrader platform but also offers a suite of services designed to enhance your trading experience. Here’s why Opofinance should be your go-to broker:

- ASIC Regulated: Ensuring your investments are secure with top-tier regulatory oversight. ASIC regulation guarantees that Opofinance adheres to stringent financial standards, providing traders with a safe and trustworthy trading environment.

- Social Trading Services: Connect and trade alongside successful traders through our integrated social trading platform. With Opofinance’s social trading services, you can replicate the strategies of top-performing traders, diversifying your portfolio and potentially increasing your returns.

- Featured on the MT5 Brokers List: Recognized officially, enhancing trust and credibility. Being featured on the MT5 Brokers List signifies Opofinance’s commitment to excellence and reliability in the trading industry.

- Safe and Convenient Deposit and Withdrawal Methods: Enjoy hassle-free transactions with a variety of secure payment options. Opofinance offers multiple deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets, ensuring that your transactions are both secure and convenient.

Additionally, Opofinance provides:

- 24/7 Customer Support: Dedicated support team available around the clock to assist you with any queries or issues you may encounter.

- Comprehensive Educational Resources: Access to tutorials, webinars, and guides to help you improve your trading skills and make informed trading decisions.

- Competitive Spreads and Low Commissions: Benefit from tight spreads and low commissions, maximizing your trading profitability.

Conclusion

cTrader is a powerful and versatile trading platform that caters to the diverse needs of Forex and CFD traders. Its advanced cTrader features, user-friendly interface, and robust customization options make it a standout choice in the crowded trading platform market. Whether you’re a beginner looking to explore the world of Forex trading or an experienced trader seeking sophisticated tools and automation capabilities, cTrader offers the resources and support you need to succeed.

The platform’s commitment to transparency, advanced risk management, and continuous improvement ensures that traders have access to the best tools and features available. By leveraging cTrader’s comprehensive features and integrating expert strategies, you can enhance your trading performance and achieve your financial goals. Embrace the future of trading with cTrader and transform your trading experience today.

Key Takeaways

- cTrader is a leading multi-asset trading platform designed for Forex and CFD trading, developed by Spotware Systems.

- The platform offers advanced charting tools, diverse order types, and algorithmic trading through cTrader Automate.

- Compared to MetaTrader, cTrader provides a more modern interface, superior charting capabilities, and transparent pricing with Level II market data.

- Advantages of using cTrader include transparent pricing, advanced risk management tools, high customization, and regular updates.

- Getting started with cTrader is easy with downloadable applications, demo accounts, and support from reputable brokers like Opofinance.

- Pro Tips: Utilize cTrader Automate, advanced charting tools, social trading with cTrader Copy, monitor market depth, customize your trading environment, implement advanced risk management techniques, utilize cTrader’s API, and engage with the cTrader community for optimal performance.

Can cTrader handle multiple trading accounts simultaneously?

Yes, cTrader allows you to manage multiple trading accounts simultaneously. This feature is particularly useful for traders who manage different strategies or portfolios, providing a seamless and efficient way to switch between accounts without logging out and back in. The platform’s intuitive account management system ensures that you can monitor and trade across various accounts with ease, enhancing your overall trading efficiency.

Additionally, cTrader supports multi-account analysis, enabling you to view the performance of each account side-by-side. This comprehensive overview helps in assessing the effectiveness of different trading strategies and making informed decisions about resource allocation.

Does cTrader offer educational resources for new traders?

Absolutely. cTrader provides a wealth of educational resources, including tutorials, webinars, and comprehensive guides. These resources are designed to help new traders understand the platform’s features, develop effective trading strategies, and enhance their overall trading knowledge. Additionally, many brokers that support cTrader, such as Opofinance, offer dedicated customer support and educational materials to further assist traders in their learning journey.

The platform’s cTrader University is an excellent resource for beginners, offering step-by-step tutorials and video lessons that cover everything from basic navigation to advanced trading techniques. Moreover, regular webinars hosted by experienced traders provide insights into market trends, trading strategies, and platform updates, ensuring that traders are always informed and well-prepared.

How secure is cTrader for online trading?

Security is a top priority for cTrader. The platform employs advanced encryption technologies to protect user data and transactions. Additionally, when used with regulated brokers like Opofinance, traders benefit from stringent regulatory standards that ensure the safety and integrity of their investments. cTrader’s commitment to security, combined with the regulatory oversight of reputable brokers, provides traders with a secure and trustworthy trading environment.

cTrader also offers two-factor authentication (2FA), adding an extra layer of security to your trading accounts. Regular security audits and compliance with international security standards further reinforce the platform’s dedication to safeguarding trader information and funds. With cTrader, traders can focus on their strategies without worrying about the security of their trading activities.