In the intricate dance of global finance, staying ahead requires understanding the key indicators that drive market sentiment. For investors, analysts, and anyone with a vested interest in the European economy, one index stands out as a crucial bellwether: the FRA40 Index. But what is the FRA40 Index, what does it truly signify, and why should it command your attention in the vast landscape of financial instruments? Simply put, the FRA40 Index serves as the definitive benchmark for the French stock market. It meticulously tracks the performance of the 40 largest and most actively traded companies listed on the prestigious Euronext Paris exchange.

Think of it as a high-resolution snapshot of the health and vitality of the French economy, a vital compass for navigating the complexities of European investment. Understanding the nuances of the FRA40 Index is akin to having a finger on the pulse of French commerce, providing invaluable insights into the performance of its leading businesses. Whether you’re an experienced trader or exploring opportunities through a regulated forex broker, this comprehensive guide will equip you with the knowledge and insights necessary to decipher its signals and understand its profound significance in the financial world. Prepare to unravel the mysteries of the FRA40 Index and gain a powerful, actionable understanding of its role in shaping global markets.

Understanding the FRA40 Index Meaning

To truly grasp the essence of the FRA40 index meaning, we must first decipher its name. The seemingly simple acronym FRA40 holds the key to understanding its origin and purpose. “FRA” is the universally recognized and standardized country code assigned to France, a designation that immediately anchors the index within the French economic sphere. This immediately establishes the index’s geographical focus, making it clear that its movements are intrinsically linked to the performance of the French economy.

The “40” is equally straightforward, directly indicating the precise number of companies whose performance is aggregated to calculate the index’s value. This fixed number allows for consistent tracking and comparison over time. Therefore, FRA40 index meaning is intrinsically linked to its composition: it represents the collective performance of the top 40 companies in France, as determined by their market capitalization and the volume of their shares traded on the Euronext Paris exchange.

This fundamental connection to the French stock market is paramount to understanding the index’s function as a representative gauge of the nation’s leading businesses and overall economic climate. It’s a carefully curated selection designed to reflect the pulse of French commerce, offering a concentrated view of the nation’s economic heavyweights.

FRA40 Index Components: What Companies Make Up the Index?

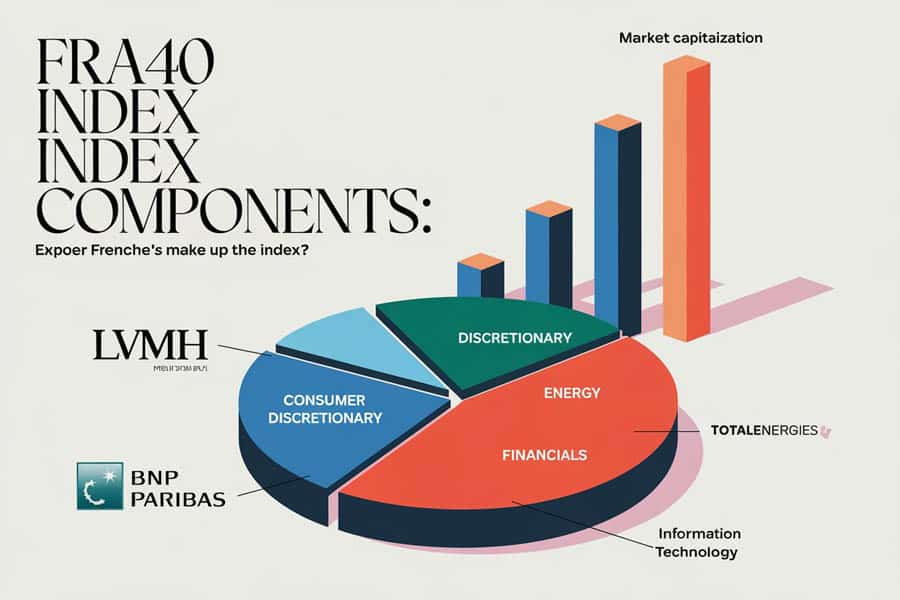

The FRA40 index isn’t a random assortment of French companies. It’s a carefully selected group representing the titans of French industry, spanning a diverse spectrum of economic sectors. These are the powerhouse companies that not only drive the French economy but also exert significant influence on the global stage, shaping industries and impacting markets worldwide. While the precise composition of the FRA40 index can undergo periodic adjustments based on evolving market dynamics, ensuring the index remains representative of the current economic landscape, certain names consistently dominate its ranks. These are the blue-chip giants that form the bedrock of the French business landscape, companies with established reputations and significant market presence.

Think of iconic brands and industry leaders such as LVMH (Moët Hennessy Louis Vuitton), the undisputed global leader in luxury goods, a symbol of French elegance and craftsmanship; TotalEnergies, a multinational energy behemoth involved in the entire energy value chain, from exploration and production to refining and distribution; Sanofi, a global pharmaceutical and healthcare giant dedicated to improving health outcomes through innovative research and development; L’Oréal, the world’s foremost cosmetics company, a symbol of French beauty expertise and a global leader in the beauty industry; and BNP Paribas, a leading European banking institution providing crucial financial services to individuals, businesses, and institutions across the globe. These companies represent the pinnacle of French business acumen and innovation.

Read More: Analysis of International Markets in Forex

How are Companies Selected for the FRA40?

The selection process for inclusion in the FRA40 index is rigorous and meticulously defined to ensure it accurately reflects the leading companies that contribute significantly to the French economy. Euronext, the operator of the Paris stock exchange, conducts a quarterly review of the index’s constituents, ensuring the index remains dynamic and representative.

To qualify, companies must meet stringent criteria related to market capitalization, ensuring only the largest firms by market value, reflecting their overall size and influence, are considered. Furthermore, free-float market capitalization is a key factor, focusing on the value of shares available for public trading, excluding those held by insiders, governments, or other entities that restrict trading. This ensures the index reflects the performance of shares readily available to investors. Finally, a high trading volume is essential, ensuring the index reflects actively traded stocks with sufficient liquidity, making it easier for investors to buy and sell shares without significantly impacting the price.

This demanding selection process guarantees that the FRA40 index accurately mirrors the performance of the most significant, influential, and actively traded companies within the French market, providing a reliable benchmark for investors.

Calculating the FRA40 Index: Understanding the Formula

Understanding the mechanics behind FRA40 index calculation is essential for interpreting its movements and appreciating its significance as a barometer of the French economy. The index employs a market capitalization-weighted methodology. This fundamental principle dictates that companies with larger market capitalizations, reflecting their greater overall value, exert a greater influence on the index’s overall value. Think of it as a voting system where the larger companies have more votes, their performance having a more significant impact on the final index value.

The calculation of the FRA40 index can be represented by the following formula, which provides a clear and concise way to understand how the index value is derived:

FRA40 Index = (∑ (Pi * Si * FFi)) / Divisor

Where:

- ∑ represents the summation across all 40 companies in the index, meaning the values for each company are added together.

- Pi is the current market price of the shares of company i, reflecting the latest trading value of its stock.

- Si is the number of outstanding shares of company i, representing the total number of shares the company has issued.

- FFi is the free-float factor of company i (representing the proportion of shares available for public trading), a crucial adjustment to reflect actual market availability.

- Divisor is a value used to scale the index and is adjusted over time to account for corporate actions and ensure the index’s continuity, preventing distortions from events like stock splits or mergers.

The calculation begins with determining the market capitalization of each constituent company (Pi * Si), representing the total market value of the company’s outstanding shares. This value is then adjusted using the free-float factor (FFi) to reflect only the shares available for public trading.

An index divisor is used to scale the index to a manageable level and ensure continuity over time, adjusting for corporate actions like stock splits or mergers that could otherwise skew the index’s value.

Finally, the sum of the free-float adjusted market capitalizations of all 40 companies is divided by the divisor to arrive at the final FRA40 index value. This meticulous methodology ensures accuracy and responsiveness to market dynamics, providing a reliable and consistent measure of the French stock market’s performance.

Read More: what is china 50

History of the FRA40 Index: Key Milestones

While the FRA40 index has been known by its current moniker since 1999, its historical lineage extends further back, reflecting the evolution of the French stock market. It effectively succeeded the CAC 40 (Cotation Assistée en Continu), which was initially introduced in 1987, marking a significant step in the modernization of the French financial markets. This transition in 1999 marked a significant evolution in the index’s management and calculation methodology, aligning it more closely with international standards and best practices, enhancing its comparability and appeal to global investors.

Key Historical Moments in Bullet Points

- 1987: The CAC 40 (Cotation Assistée en Continu) is launched as the benchmark index for the Paris Bourse, representing a pivotal moment in the formalization of the French stock market.

- 1999: The CAC 40 is rebranded as the FRA40 index, adopting a continuous calculation methodology and aligning with international standards, making it more accessible and understandable to global investors.

- Early 2000s: The FRA40 index experiences significant volatility during the Dot-com Bubble, reflecting the rapid rise and fall of technology stocks and the speculative fervor of the era.

- 2008-2009: The Global Financial Crisis leads to a sharp decline in the FRA40 index, mirroring the global economic downturn and the interconnectedness of financial markets worldwide.

- Early 2010s: The European Sovereign Debt Crisis creates uncertainty and volatility for the FRA40 index as concerns about Eurozone stability rise, highlighting the impact of macroeconomic factors on the index.

- 2020 onwards: The COVID-19 Pandemic triggers a significant market downturn, impacting the FRA40 index before a subsequent recovery, demonstrating the index’s sensitivity to global health and economic crises.

Understanding the historical trajectory and evolution of the FRA40 index provides invaluable context for interpreting its current performance and anticipating potential future trends, allowing investors to make more informed decisions based on past market behavior and economic cycles.

FRA40 vs. Other Indices: How Does it Compare?

The FRA40 index is a vital component of the global stock market ecosystem, serving as a key indicator of the health of the French economy. Gaining a broader understanding requires comparing it to other prominent international indices, providing a global perspective on market performance. This comparative analysis provides valuable insights into its unique characteristics and its relative performance, highlighting the strengths and weaknesses of different regional markets.

Comparing the FRA40 index to Germany’s DAX reveals similarities as key indicators of major European economies, both representing the performance of their respective leading companies, though sector compositions can differ, with the DAX often having a stronger industrial and automotive focus, reflecting Germany’s manufacturing prowess.

The UK’s FTSE 100 often has a greater weighting towards resource and financial companies, reflecting the UK’s historical strengths in these sectors and its global financial hub status. The US S&P 500, a broad market index representing 500 of the largest US companies, is often seen as a global benchmark for overall market health, reflecting the size and influence of the American economy. The distinctive characteristics of the FRA40 index stem from its specific focus on the French economy and the particular weighting of its constituent sectors, such as luxury goods and consumer staples, where France holds a leading global position, showcasing its expertise in these areas.

Read More: What is DAX 40 Index

Trading the FRA40 Index: Opportunities and Strategies

For individuals and institutions seeking to participate in the performance of the French stock market, understanding the intricacies of FRA40 index trading offers several accessible avenues to engage with this important benchmark. Understanding these different trading instruments is key to formulating effective investment strategies and managing risk appropriately.

Methods for Trading the FRA40

Common methods for FRA40 index trading include trading Contracts for Difference (CFDs), which allow speculation on price movements with leverage, amplifying both potential gains and losses, making them a higher-risk, higher-reward instrument. Exchange-Traded Funds (ETFs) that track the index offer a diversified and often lower-cost investment option, providing a convenient way to gain exposure to the entire index with a single transaction. Futures contracts involve agreements to buy or sell the index at a predetermined future date and price, often used by more sophisticated traders for hedging or speculation, requiring a deeper understanding of market dynamics and risk management.

Factors Influencing FRA40 Trading

Several key factors can exert influence over the price movements of FRA40 index trading. These include releases of key French and Eurozone economic data, such as GDP growth and inflation figures, which can significantly impact market sentiment and investor confidence. The company earnings reports of constituent companies are crucial indicators of their financial health and profitability, often driving significant stock price movements. Significant political events and policy changes in France and the Eurozone can also influence investor confidence and market stability. Finally, broader global market trends and international economic developments, such as global growth forecasts or international trade tensions, can have a ripple effect on the FRA40 index, highlighting the interconnectedness of global financial markets.

Trader’s Edge: Mastering FRA40 Trading

To navigate the complexities of FRA40 index trading effectively, it’s crucial to stay informed about market news, economic indicators, and geopolitical events that could impact the French market. Utilizing technical analysis, such as chart patterns, trend lines, and technical indicators, can help identify potential trading opportunities and assess market momentum. Conducting thorough fundamental analysis of the underlying companies and the French economy provides a deeper understanding of intrinsic value and long-term investment potential. Implementing robust risk management strategies, including setting stop-loss orders and managing position sizes, is essential to protect capital and mitigate potential losses. Finally, considering portfolio diversification across different asset classes and geographical regions can help mitigate risk and enhance overall portfolio stability.

Benefits of Investing in the FRA40 Index

Investing in FRA40 index offers a range of compelling advantages for investors seeking exposure to the French equity market, making it a potentially valuable component of a diversified investment portfolio. These benefits make it an attractive option for both novice and experienced investors looking to participate in the growth of the French economy.

Key benefits include the inherent diversification gained by investing in a basket of 40 leading French companies across various sectors, effectively reducing the risk associated with investing in individual stocks and providing a more stable investment. It provides direct exposure to the French and European economy, allowing participation in their growth potential and benefiting from the economic success of the region. The high liquidity of the index and related investment products facilitates easy buying and selling of shares, allowing investors to enter and exit positions quickly and efficiently. Finally, the transparency of the index’s composition and calculation provides investors with clear insights into its performance drivers, fostering trust and understanding of the investment.

Risks Associated with the FRA40 Index

While the FRA40 index presents significant investment opportunities, it’s crucial to acknowledge and understand the inherent risks involved in investing in any stock market index, allowing investors to make informed decisions and manage their risk effectively.

Potential risks include market volatility, which can lead to unpredictable and sometimes significant price swings, impacting investment value in the short term. Economic risks, such as a recession in France or the Eurozone, can negatively impact company performance and the index value, reflecting the sensitivity of the stock market to economic conditions. The impact of global events, including geopolitical instability, international trade tensions, and unforeseen global crises, can create market uncertainty and negatively affect investor sentiment. Finally, currency risk is a factor for international investors whose base currency is not the Euro, as fluctuations in exchange rates can affect the returns on their investments when converted back to their home currency.

Future Outlook for the FRA40 Index

Forecasting the future performance of any stock market index, including the FRA40 index, is inherently complex and subject to numerous uncertainties, making precise predictions challenging. However, we can consider some potential trends and influential factors that may shape its trajectory in the years to come, providing a framework for understanding potential future developments.

Factors that may shape the future include the pace of technological innovation and the adoption of new technologies by French companies, potentially leading to growth in certain sectors and disruption in others. The increasing global focus on sustainability and ESG investing may favor companies with strong environmental, social, and governance practices, attracting more investment and potentially impacting valuations. The evolving geopolitical landscape and international trade relations will continue to influence market sentiment and global economic conditions, impacting the FRA40 index‘s performance. Finally, the progress of European economic integration and the overall health of the Eurozone economy will be key determinants of the FRA40 index‘s future performance, as a strong and stable European economy generally benefits French businesses.

Opofinance Services: Empowering Your Trading Journey

Are you looking for a reliable and secure platform to explore the exciting world of trading? Look no further than Opofinance, a trusted ASIC-regulated broker dedicated to providing a seamless and efficient trading experience. Here’s why Opofinance stands out:

- Stringent ASIC Regulation: Trade with complete peace of mind, knowing that Opofinance operates under the rigorous regulatory oversight of the Australian Securities and Investments Commission (ASIC). This ensures the highest standards of security, transparency, and fairness in all transactions.

- Innovative Social Trading: Tap into the collective wisdom of the trading community with Opofinance’s cutting-edge social trading feature. Observe the strategies of seasoned traders, learn from their insights, and even replicate their trades to enhance your own trading outcomes.

- Official MT5 Platform Recognition: Opofinance is officially featured on the prestigious MT5 brokers list, granting you access to the powerful and versatile MetaTrader 5 platform. Enjoy advanced charting tools, technical indicators, and automated trading capabilities to optimize your trading strategies.

- Safe and Convenient Transactions: Experience hassle-free deposits and withdrawals with a wide array of secure and efficient payment methods. Your financial security is a top priority at Opofinance, ensuring smooth and reliable transactions every time.

Ready to unlock a world of trading possibilities? Visit Opofinance today and embark on your trading journey with a trusted partner.

Conclusion: Understanding the FRA40 Index

The FRA40 index is far more than just a numerical value; it serves as a powerful and dynamic representation of the French economy’s strength, resilience, and global influence. A thorough understanding of its composition, the methodology behind its calculation, its historical evolution, and the various factors that influence its performance is indispensable for anyone actively involved in or keenly observing the financial markets.

Whether you are an experienced investor, a seasoned trader, or simply an individual seeking to comprehend the intricacies of the global economic landscape, the FRA40 index offers invaluable insights into the workings of one of the world’s major economies. By grasping the nuances of this critical benchmark index, you gain a deeper appreciation for the forces that are shaping not only the French economy but also the broader European and global financial systems, allowing for a more informed perspective on global economic trends.

Key Takeaways

The FRA40 index is the primary benchmark stock market index for France, providing a key indicator of its economic health. It tracks the performance of the 40 largest companies on Euronext Paris and is calculated using a market capitalization-weighted methodology, ensuring larger companies have a greater influence. Trading can be done through CFDs, ETFs, and futures, each with its own risk and reward profile. Investing offers diversification and exposure to the French economy, but it’s crucial to understand the associated risks, including market volatility and economic downturns.

What is the impact of foreign exchange rate changes on international investors in the FRA40 index?

Fluctuations in foreign exchange rates can indeed have a notable impact on the returns for international investors in the FRA40 index. If an investor’s base currency strengthens against the Euro, the returns from their FRA40 index investments, when converted back to their base currency, will be reduced. Conversely, if the Euro strengthens against their base currency, their returns will be amplified. This currency risk is an important consideration for international investors.

What is the availability of ESG-focused ETFs tracking the FRA40 index?

Yes, there are an increasing number of ETFs available that track modified versions of the FRA40 index with a focus on sustainability and ESG criteria. These ETFs typically screen and select companies based on their ESG performance, excluding those with poor ESG ratings or those involved in controversial industries. This allows investors to align their investments with their sustainability values while still gaining exposure to the French equity market.

What is the typical effect of a major company’s inclusion or exclusion from the FRA40 index?

The inclusion or exclusion of a major company from the FRA40 index can have a noticeable impact on the index’s overall value and investor sentiment. When a large, well-regarded company is added to the index, it can boost investor confidence and potentially lead to an increase in the index’s value. Conversely, the exclusion of a significant company, particularly if it’s due to poor performance, can negatively impact sentiment and potentially lead to a decrease in the index’s value. These changes are closely watched by market participants.