In today’s rapidly evolving financial landscape, you might often wonder, what is prop firm in forex? Quite simply, a prop firm in forex trading is a proprietary trading company that funds skilled traders with significant capital, enabling them to execute trades without risking their own money. This innovative model not only provides enhanced trading opportunities but also mirrors the support and tools you would expect from a top forex trading broker or a regulated forex broker.

The core idea behind what is prop firm in forex is to unlock a trader’s potential by mitigating personal financial risk and empowering them with advanced trading platforms, robust risk management, and profit-sharing structures. Whether you are a novice trader seeking to break into the market or an experienced trader looking to elevate your strategies, this comprehensive guide will address your questions on what is prop firm in forex trading, provide practical insights, and outline actionable strategies that can transform your trading career.

In this article, we will explore:

- A clear explanation of what is prop firm in forex and its role in the modern trading environment.

- How prop firm in forex trading operates differently from traditional trading methods.

- The significant benefits and potential risks associated with this funding model.

- Effective strategies and pro tips to thrive in a prop firm setting.

- An exclusive look at advanced trading platforms and innovative tools provided by an ASIC regulated broker.

As you read on, you will naturally discover the answers to your burning questions about what is prop firm in forex and what is prop firm in forex trading. Get ready to embark on a journey that could redefine your approach to forex trading, all while learning from the experts and leveraging cutting-edge technology.

Understanding Prop Firms in Forex Trading

At its essence, a prop firm is designed to answer the question, what is prop firm in forex? It is a company that uses its own capital to trade in financial markets, particularly in the forex sector, and shares a portion of the profits with the trader. Unlike traditional retail trading, where you risk your own funds, prop firm in forex trading allows you to trade with significant capital provided by the firm.

The evolution of prop firms is a fascinating journey. Initially, proprietary trading was more common in the equity markets, but as global markets expanded and forex trading became increasingly dynamic, many prop firms shifted their focus to the forex market. Today, the question what is prop firm in forex resonates with many traders who are looking to leverage institutional funding and advanced technology to maximize their trading performance.

In a typical prop firm in forex trading setup, traders are given access to substantial capital, which allows them to explore new strategies and execute larger trades than they might be able to with personal funds. This model not only increases the trading potential but also helps in better risk management as the firm absorbs much of the financial risk.

Moreover, prop firms provide comprehensive support similar to that of a dedicated online forex broker. This support includes advanced trading platforms, detailed market analytics, and sometimes even personal mentorship, which helps traders understand the intricacies of the market better. This holistic approach makes the concept of what is prop firm in forex trading an attractive proposition for many.

How Prop Firms Operate in Forex Trading

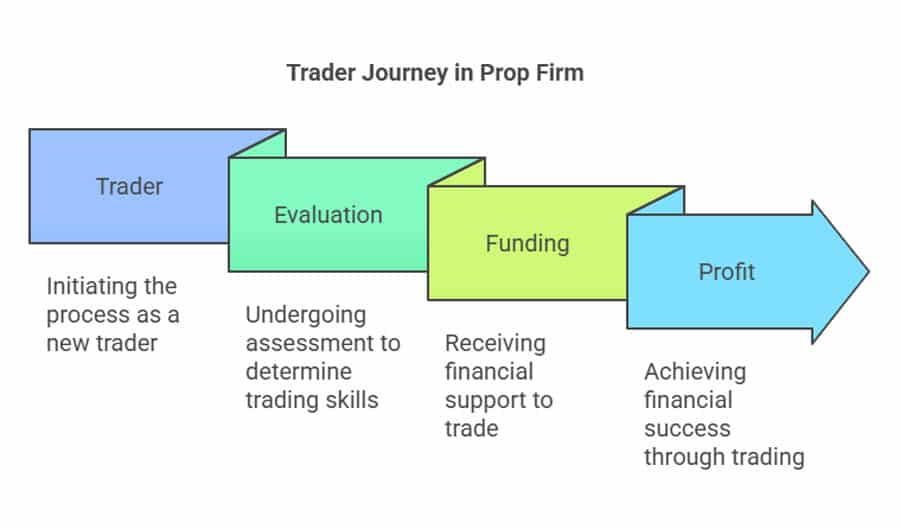

To fully grasp what is prop firm in forex, it is essential to understand the operational mechanics behind prop firm in forex trading. The process begins with an evaluation phase, where traders demonstrate their skills and trading strategies in a simulated or limited live environment.

During this phase, traders are assessed on several key performance indicators:

- Consistency: Demonstrating the ability to generate steady returns over a given period is crucial. Consistency is a vital factor in what is prop firm in forex trading.

- Risk Management: Traders must show that they can control losses and adhere to strict risk parameters. This is fundamental in understanding what is prop firm in forex as it minimizes the firm’s exposure.

- Strategy Execution: Your ability to implement a well-defined trading plan under real market conditions is another critical component.

Once a trader successfully navigates the evaluation phase, they are allocated a funded account with capital that can range from tens of thousands to millions of dollars. This funding enables you to execute larger trades, diversify your trading strategies, and benefit from the advanced tools provided by the firm.

What distinguishes prop firm in forex trading from other trading models is the comprehensive infrastructure it provides. Advanced risk management tools, automated trading systems, and real-time market data are integral components. Additionally, profit-sharing structures ensure that both the trader and the firm benefit when the trading strategies succeed. In many ways, this system mirrors the operational excellence of a high-caliber forex trading broker.

In summary, understanding what is prop firm in forex requires an appreciation of both the funding model and the technological support that underpins it. The system is designed to create a win-win situation, where skilled traders can leverage significant capital without exposing personal funds to excessive risk.

Read More:Prop firm vs hedge fund

Benefits of Prop Firm in Forex Trading

Many traders ask, what is prop firm in forex and why should they consider this model? The benefits are numerous and can significantly enhance your trading career. Here are some of the most compelling advantages:

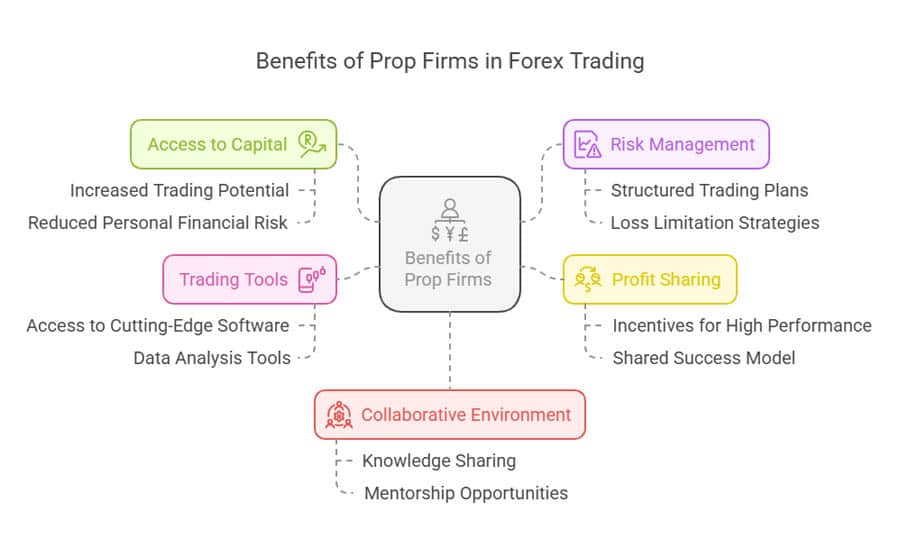

Access to Significant Capital

One of the foremost benefits of what is prop firm in forex trading is the access to large amounts of capital. With a funded account, you have the opportunity to take advantage of market opportunities that would be out of reach if you were trading with limited personal funds. This increased capital can lead to larger profit potential and the ability to diversify your trading portfolio.

Enhanced Risk Management

When you engage in prop firm in forex trading, you benefit from rigorous risk management protocols. The firm typically sets strict guidelines, such as daily loss limits and position size restrictions, which help minimize risk. By sharing the risk, the model of what is prop firm in forex allows you to trade with confidence, knowing that your personal funds are not fully exposed to market volatility.

Performance-Driven Profit Sharing

Instead of earning a fixed salary, traders in a prop firm in forex trading environment are rewarded through a profit-sharing model. This means that the more successful your trading strategy, the higher your earnings will be. This performance-driven structure aligns your interests with those of the firm and encourages continuous improvement and discipline.

Access to Advanced Trading Tools and Platforms

What sets prop firm in forex trading apart from traditional trading methods is the state-of-the-art technological infrastructure provided to traders. You gain access to premier trading platforms such as MT4, MT5, cTrader, and even proprietary systems that offer real-time analytics, automated trading features, and advanced charting capabilities. This is similar to the level of service you might expect from a top online forex broker or a regulated forex broker.

A Collaborative Trading Environment

In addition to funding and technology, many prop firms foster a community environment where traders can share strategies, insights, and experiences. This collaborative culture helps in refining trading techniques and encourages ongoing learning. Understanding what is prop firm in forex trading means recognizing that success is often the result of both individual effort and collective wisdom.

In essence, the benefits of engaging in prop firm in forex trading extend far beyond access to capital. They include enhanced risk management, better technology, and a supportive environment that can help propel your trading career to new heights.

Read More: Prop firm vs personal trading accounts

Risks and Considerations in Prop Firm Forex Trading

While the advantages of what is prop firm in forex trading are significant, it is equally important to understand the risks and challenges inherent in this model. A clear-eyed view of these considerations will help you prepare and adapt your trading strategy effectively.

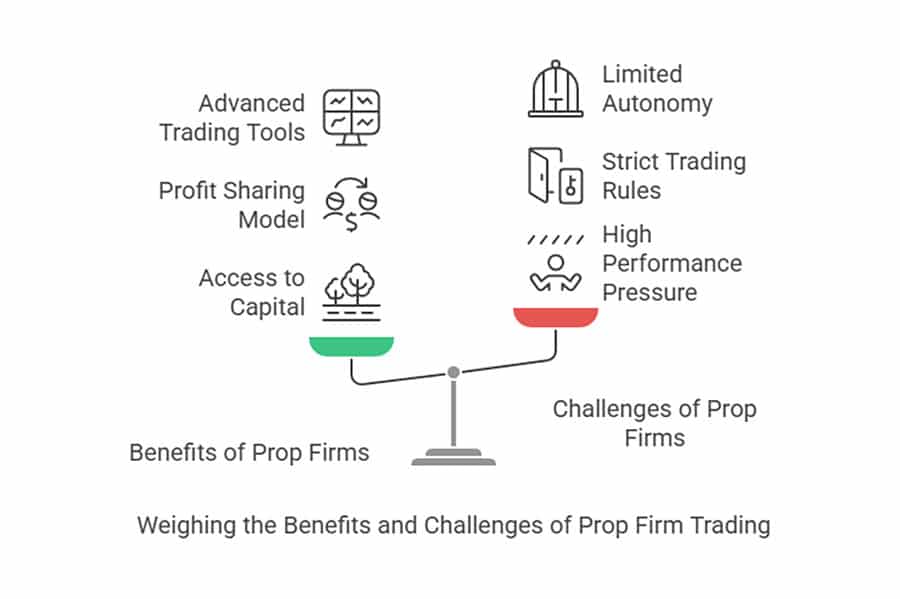

High Performance Expectations

One of the challenges associated with what is prop firm in forex trading is the high performance standard that traders are expected to meet. Firms typically set strict benchmarks, and failing to meet these can result in reduced capital allocation or even termination of your funded account. The pressure to consistently perform at a high level can be intense, especially during periods of market volatility.

Profit Sharing Trade-Offs

While the profit-sharing model is designed to reward performance, it also means that a portion of your profits will go to the firm. This trade-off is the cost of accessing significant capital and advanced trading tools. It’s important to weigh the benefits of increased funding against the percentage of profits that must be shared.

Strict Trading Rules and Limitations

Prop firms impose stringent trading rules to protect their capital. These rules include limits on daily losses, restrictions on position sizes, and sometimes even bans on certain types of trades. Although these measures are designed to minimize risk, they can sometimes feel restrictive for traders who prefer greater autonomy.

Psychological and Emotional Pressure

Trading with a prop firm can introduce a unique set of psychological pressures. The constant need to prove your trading strategy under strict guidelines, coupled with the awareness that your funded account is on the line, can lead to heightened stress levels. It is essential to maintain a balanced approach and develop strategies to manage the emotional ups and downs inherent in high-stakes trading.

Contractual and Regulatory Considerations

Before joining any prop firm, it is critical to carefully review the contractual terms and understand the regulatory framework within which the firm operates. This includes details on profit distribution, risk limits, and exit strategies. Having clarity on these aspects is key to avoiding potential disputes and ensuring that your interests are well-protected.

In summary, while what is prop firm in forex trading offers substantial benefits, it is not without its challenges. A thorough understanding of the risks involved and a disciplined approach to risk management are essential for long-term success.

How to Choose the Right Prop Firm

Deciding to work with a prop firm is a significant step in your trading career, and choosing the right firm can make all the difference. Here are some factors to consider when evaluating what is prop firm in forex trading opportunities:

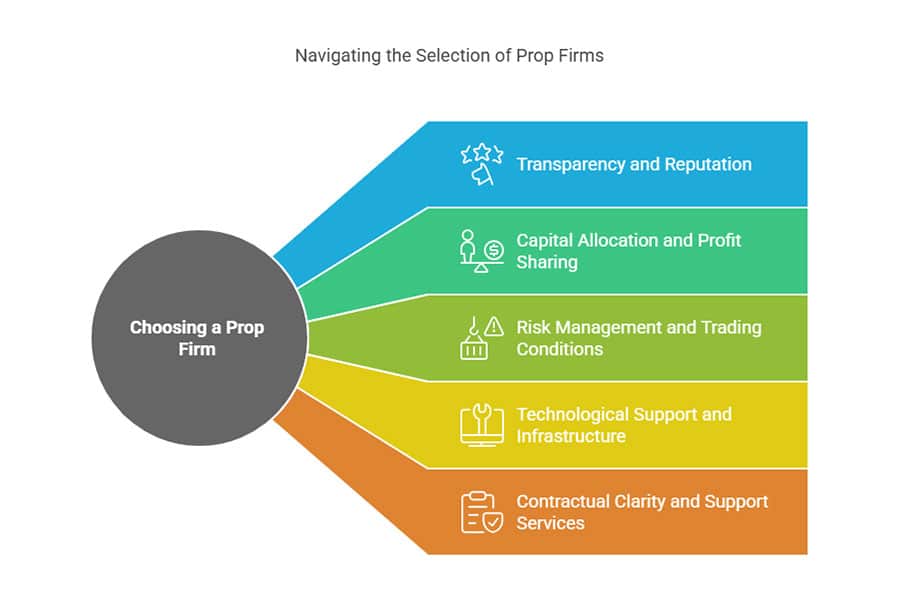

Transparency and Reputation

Start by researching the firm’s track record. Look for transparent reviews, verified testimonials, and evidence of regulatory compliance. A reputable prop firm should have a history of success and a commitment to ethical practices, much like a well-regulated forex broker.

Capital Allocation and Profit Sharing

Evaluate the funding levels and the profit-sharing model offered by the firm. Ensure that the capital provided aligns with your trading ambitions and that the profit split is competitive. Understanding what is prop firm in forex trading means knowing how much capital you will have at your disposal and how your earnings will be calculated.

Risk Management and Trading Conditions

Carefully review the firm’s risk management protocols. Look for clear guidelines on daily loss limits, position sizing, and other risk-related parameters. These rules should complement your trading style rather than restrict it unnecessarily.

Technological Support and Infrastructure

A key advantage of prop firm in forex trading is access to advanced trading platforms. Ensure that the firm provides state-of-the-art technology, including real-time data feeds, comprehensive charting tools, and automated trading systems. This technological edge is often comparable to the offerings of a top online forex broker.

Contractual Clarity and Support Services

Finally, review the contractual details thoroughly. Look for clear terms regarding funding, profit distribution, and exit strategies. Additionally, consider whether the firm offers ongoing educational resources, mentorship, or community support to help you continuously improve your trading performance.

By carefully evaluating these factors, you can choose a prop firm that not only funds your trading ambitions but also provides the supportive environment you need to succeed.

Effective Strategies for Prop Firm Forex Trading

Success in what is prop firm in forex trading demands a blend of strategic planning, disciplined execution, and continuous learning. The following strategies have been proven effective by traders who have excelled in this environment:

Develop a Comprehensive Trading Plan

A robust trading plan is the cornerstone of success. Outline clear entry and exit criteria, define your risk management parameters, and set realistic profit targets. This plan should serve as a roadmap for what is prop firm in forex trading, ensuring that every trade is executed with precision and discipline.

Utilize Data-Driven Insights

Leverage the power of data to inform your trading decisions. Use technical analysis tools to interpret chart patterns and market trends, and complement these insights with fundamental analysis of economic indicators. Many successful traders in prop firm in forex trading combine both approaches to optimize their strategies.

Implement Strict Risk Management

One of the greatest strengths of what is prop firm in forex trading is the emphasis on risk management. Always use stop-loss orders, never over-leverage, and diversify your trading positions. By limiting your exposure and adhering to predetermined risk limits, you protect both your funded account and your long-term trading potential.

Embrace Automation and Technology

With access to advanced trading platforms, consider integrating automated trading systems into your strategy. These systems can execute trades with greater speed and accuracy, minimizing human error and ensuring that your trading plan is followed consistently.

Commit to Ongoing Learning and Adaptation

The forex market is dynamic, and so should be your strategies. Regularly review your performance, learn from both your successes and setbacks, and stay abreast of market developments. Engaging with trading communities and attending webinars can provide fresh insights and innovative techniques that keep you ahead in what is prop firm in forex trading.

By integrating these strategies, you can build a sustainable and profitable approach to prop firm in forex trading that evolves with the market.

Read More: Should i trade with a prop firm

Pro Tips for Advanced Traders

For experienced traders seeking to elevate their game in what is prop firm in forex trading, here are some advanced tips:

- Master Leverage Management: Use leverage as a tool to amplify gains while strictly controlling the associated risks.

- Refine Your Technical Analysis: Experiment with advanced indicators and oscillators to capture subtle market signals that may provide a competitive edge.

- Integrate Algorithmic Trading: Automate routine trading decisions to minimize errors and ensure faster reaction times during volatile market conditions.

- Customize Your Trading Environment: Tailor your trading platforms and dashboards to highlight the metrics most relevant to your strategy, ensuring a more efficient workflow.

- Invest in Continued Education: Regularly attend advanced seminars, subscribe to expert market analysis, and consider mentorship opportunities to refine your approach in what is prop firm in forex trading.

These pro tips can help you push beyond conventional trading strategies and harness the full potential of the funding and technology available through a prop firm.

Opofinance Services

For traders looking to elevate their trading experience even further, consider the innovative services provided by an ASIC regulated broker. This platform exemplifies what is prop firm in forex trading by offering an unmatched blend of advanced technology and comprehensive support. Here’s what you can expect:

- Advanced Trading Platforms: Enjoy seamless trading on MT4, MT5, cTrader, and OpoTrade, designed to meet the demands of high-speed forex markets.

- Innovative AI Tools: Benefit from tools such as AI Market Analyzer, AI Coach, and AI Support that help you make data-driven decisions quickly and efficiently.

- Social & Prop Trading: Engage with a community of traders and access flexible, secure trading options that foster collaboration and learning.

- Safe Deposits & Withdrawals: Experience hassle-free funding methods, including crypto payments with zero fees, ensuring that your transactions are as seamless as your trades.

Ready to transform your trading journey with a platform that understands what is prop firm in forex trading? Explore opofinance now and take your trading to the next level!

Conclusion

In conclusion, understanding what is prop firm in forex is pivotal for any trader who aspires to leverage institutional capital and advanced technological tools to achieve greater success in the forex market. The prop firm model, or prop firm in forex trading, offers a unique opportunity to trade with significant funding while minimizing personal financial risk. By embracing robust risk management protocols, accessing cutting-edge trading platforms, and continuously refining your strategies, you can transform your trading career.

Although the journey in prop firm in forex trading comes with high performance expectations and strict rules, the benefits—such as substantial capital access, profit sharing, and an enriched trading environment—can lead to a highly rewarding career. Whether you are just starting out or are an experienced trader, the prop firm model provides a powerful platform to unlock your full potential.

Remember, success in what is prop firm in forex trading is not solely about capital; it is about developing a disciplined mindset, leveraging advanced tools, and continuously learning from both successes and setbacks. With the right approach and support, the possibilities are truly endless.

Key Takeaways

- Capital Access: Prop firm in forex trading provides significant funding, enabling larger and diversified trades.

- Risk Management: Strict risk protocols protect both the trader and the firm, ensuring a disciplined trading approach.

- Advanced Tools: Access to premier trading platforms and cutting-edge analytics empowers informed decision-making.

- Profit Sharing: A performance-based compensation model aligns your interests with the firm, driving continuous improvement.

- Supportive Environment: Collaborative trading communities and ongoing education are integral to long-term success in what is prop firm in forex trading.

What are the typical qualifications for joining a prop firm in forex?

While qualifications can vary by firm, most prop firms look for a proven trading track record, robust risk management skills, and a clear understanding of what is prop firm in forex trading. Experience with advanced trading platforms and a commitment to continuous improvement are also highly valued.

How long does the evaluation process usually take in prop firm in forex trading?

The evaluation phase typically ranges from a few weeks to several months. During this period, traders must consistently demonstrate their ability to generate profits and manage risk effectively under the firm’s guidelines.

Do prop firms offer educational resources or mentorship programs?

Yes, many reputable prop firms provide comprehensive training, mentorship, and continuous educational resources to help traders excel in what is prop firm in forex trading.