Stop hunting is a phenomenon that often leaves traders asking, “what is stop hunt in forex?” In essence, it is the triggering of stop-loss orders—either deliberately by large players or as a consequence of market noise—that forces positions out of the market. This article dives deep into the mechanics of stop hunts, exploring key concepts such as what is stop loss hunting in forex, stop hunting in forex trading, and the best forex stop hunt strategy to protect your trades.

Whether you’re a beginner or an intermediate trader working with a trusted and regulated forex broker, understanding what is stop hunt in forex is crucial for safeguarding your investments. In the paragraphs that follow, we not only answer the pressing question, “what is stop hunt in forex?” but also share valuable data, actionable tips, and insights on how to avoid stop hunting in forex while maximizing your trading potential.

What Exactly is a Stop Hunt?

At its core, the question “what is stop hunt in forex?” refers to a market behavior where price movements intentionally—or sometimes unintentionally—trigger stop-loss orders. In the context of stop hunting in forex trading, large institutional players or market makers push prices towards levels where many traders have set their stop-losses. This phenomenon is sometimes labeled as what is stop loss hunting in forex, highlighting the focus on stop-loss orders rather than other market elements. Whether you are evaluating the phenomenon from the perspective of a forex stop hunt strategy or trying to determine how to avoid stop hunting in forex, grasping the definition is your first step toward effective risk management.

The Mechanics: Step-by-Step Breakdown

Understanding the mechanics behind what is stop hunt in forex is essential. Here’s how it typically unfolds:

- Identification of Key Price Levels:

In forex trading, large players often identify key levels—round numbers, historical highs/lows, or technical support/resistance zones—where many stop-loss orders cluster. These are prime targets for what is stop hunt in forex. - Initiation of Price Movement:

Once these levels are identified, a calculated push in price begins. Whether intentional or a result of market volatility, this movement is designed to trigger stop-loss orders. - Cascade Effect on Stop-Loss Orders:

As the price nears these crucial levels, the cascade of orders—referred to as what is stop loss hunting in forex—begins. This triggers multiple stop-loss orders almost simultaneously, resulting in sharp price movements. - Exploitation and Market Reaction:

After triggering the stops, large players can then exploit the sudden liquidity influx. This sequence of events forms the backbone of stop hunting in forex trading and is often used as a forex stop hunt strategy by institutional traders.

Key Areas Prone to Stop Hunts

Stop hunts are more likely to occur at specific price points. Understanding where these occur can help you develop a robust forex stop hunt strategy:

- Round Numbers: Psychological barriers often lead traders to set stop-loss orders at these levels.

- Support and Resistance Zones: High interest areas where stop-loss orders tend to accumulate.

- Historical Price Levels: Areas where past market reversals occurred, now acting as magnets for stop orders.

In essence, by knowing what is stop hunt in forex and where it is most likely to happen, you can refine your trading approach and learn how to avoid stop hunting in forex effectively.

Read More: Mastering ICT Stop Runs

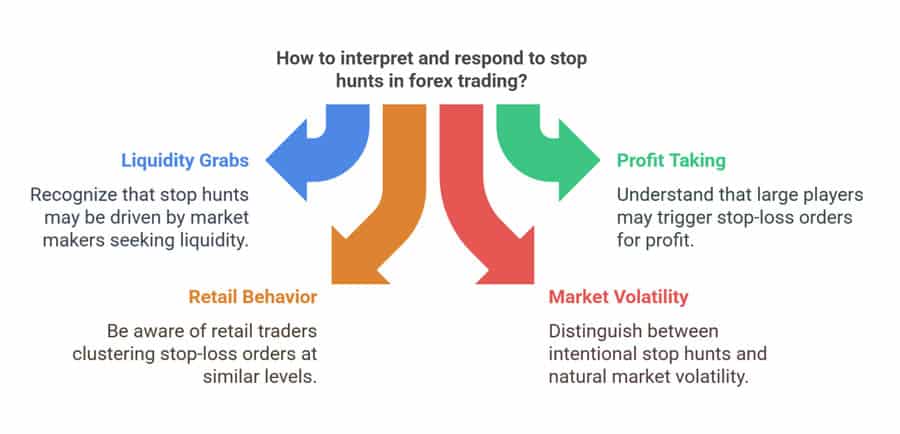

Why Do Stop Hunts Happen? Motivations and Market Dynamics

Liquidity Grabs: The Underlying Motivation

Stop hunts in forex trading are frequently driven by the need for liquidity. Market makers, who provide essential liquidity to the market, may trigger stop-loss orders to capture liquidity, thereby filling orders at better prices. This liquidity grab is a key component of many forex stop hunt strategies. When many traders place their stops at predictable levels, it creates a target-rich environment for liquidity grabs.

Profit Taking by Large Players: Institutions and Whales

Another significant motivator behind what is stop hunt in forex is the profit potential for large institutions and “whales.” These major players can move the market with their large orders. By deliberately triggering stop-loss orders through a carefully orchestrated push, they can generate additional trading opportunities. For many traders wondering how to avoid stop hunting in forex, recognizing that these moves are sometimes a deliberate tactic used by big players is critical. This awareness can lead to better stop placement and risk management practices.

Retail Trader Behavior and Stop-Loss Clustering

Retail traders, by nature, tend to cluster their stop-loss orders at similar price levels. This clustering creates a vulnerability that is often exploited in what is stop hunt in forex. Whether you are a novice trader or an experienced one trying to refine your forex stop hunt strategy, understanding the psychology behind stop-loss clustering is essential. Recognizing that your stop might be in a common area can prompt you to adjust its placement, thus learning how to avoid stop hunting in forex.

Natural Market Volatility vs. Intentional Manipulation

A critical debate in forex trading is whether what is stop hunt in forex is always a result of deliberate manipulation or if it is sometimes just a byproduct of natural market volatility. In many cases, what appears as stop loss hunting in forex might simply be the result of high volatility in the market. Distinguishing between these two can help you develop a more effective forex stop hunt strategy. Advanced traders often use technical analysis tools to differentiate between random price spikes and deliberate stop hunts.

Recognizing Stop Hunts: Signs and Indicators

Chart Patterns and Sudden Price Movements

One of the most visible signs of what is stop hunt in forex is the sudden price spike or reversal on the charts. These abrupt movements, often in the form of a quick dip followed by a sharp rebound (or vice versa), are classic indicators of stop hunting in forex trading. When many traders ask, “what is stop hunt in forex?” the answer often involves these telltale chart patterns that signal a cascade of stop-loss orders being triggered.

Increased Volatility Around Key Levels

Volatility is a significant clue when examining what is stop hunt in forex. As prices approach common stop-loss clusters—whether at round numbers or historical price levels—volatility can increase dramatically. For traders focused on developing a forex stop hunt strategy, monitoring indicators such as the Average True Range (ATR) or Bollinger Bands can provide early warnings. A sudden spike in volatility is often a precursor to a stop hunt, giving you a chance to re-evaluate your stop placements and learn how to avoid stop hunting in forex.

Unusual Order Book Activity

For traders with access to real-time market data, the order book can provide insights into potential stop hunts. Unusual activity, such as a sudden surge in orders at specific levels, can be an early indicator of what is stop hunt in forex. By closely monitoring order flow and liquidity, you can identify when stop hunting in forex trading might be imminent and adjust your trading strategy accordingly.

Data and Statistics: Valuable Insights into Stop Hunting in Forex

Recent Market Analyses and Trader Surveys

Recent market research provides valuable insights into what is stop hunt in forex and its impact on traders. Studies suggest that up to 40% of retail forex traders experience some form of stop loss hunting in forex at least once a year. This statistic underlines the importance of understanding the dynamics of stop hunts and refining your forex stop hunt strategy.

A survey of traders revealed:

- Approximately 38% of respondents reported being unexpectedly stopped out of positions due to sudden market moves.

- Over 50% believed that stop hunts were at least partly driven by deliberate actions from large players.

- Nearly 45% of traders adjusted their stop-loss orders after encountering what is stop hunt in forex, emphasizing the need for strategic stop placement.

These statistics underscore the need for a comprehensive understanding of what is stop hunt in forex and offer concrete evidence on why developing a robust forex stop hunt strategy is critical.

Historical Data and Market Trends

Historical data in forex markets also sheds light on the prevalence of stop hunts. For instance, during periods of heightened market volatility—such as during major economic announcements or geopolitical events—the frequency of what is stop hunt in forex events tends to spike. An analysis of past market movements indicates that stop hunting in forex trading is more common during these volatile times. For traders aiming to learn how to avoid stop hunting in forex, being aware of such trends can be invaluable.

Read More: Identify liquidity in forex

How to Avoid Stop Hunting in Forex: Risk Management and Strategic Adjustments

Wider Stop-Loss Placement for Breathing Room

A key component of any effective forex stop hunt strategy is adjusting your stop-loss placements. Instead of setting stops too close to market noise, give your trades more room to breathe. This simple yet effective method can reduce the likelihood of being caught in what is stop hunt in forex or experiencing stop loss hunting in forex. Wider stops allow for natural price fluctuations without triggering an early exit, helping you learn how to avoid stop hunting in forex while protecting your capital.

Diversifying Trading Pairs and Instruments

Diversification is another powerful tool in your arsenal. Trading less liquid pairs can sometimes reduce the frequency of stop hunts, though it comes with its own risks such as wider spreads. Balancing your portfolio by including both high and low liquidity pairs can be part of a broader forex stop hunt strategy. This approach not only mitigates risk but also ensures that you are not overly exposed to markets where what is stop hunt in forex occurs more frequently.

Multi-Timeframe Analysis and Confirmation

Relying on confirmation from multiple timeframes is a proven method to counteract the effects of stop hunting in forex trading. By analyzing charts on both short-term and long-term scales, you can better understand market trends and identify potential stop hunt scenarios before they occur. Tools like moving averages, RSI, and volume indicators across different timeframes can form a robust forex stop hunt strategy, helping you discern when and how to avoid stop hunting in forex.

Strategic Stop Placement and Market Structure Analysis

A deep understanding of market structure is essential when developing a forex stop hunt strategy. Instead of placing stops at obvious levels, consider areas that are less likely to attract mass stop-loss orders. This means studying historical price movements, identifying less obvious support and resistance zones, and using technical analysis to your advantage. By refining your approach and learning how to avoid stop hunting in forex, you can make more informed decisions that enhance your overall risk management.

Advanced Tools and Techniques to Counter Stop Hunts

Leveraging Technology for Real-Time Insights

Advanced trading platforms now offer sophisticated tools that can help detect what is stop hunt in forex before it fully develops. With real-time data, order flow analysis, and algorithmic trading, you can set up alerts that warn you of unusual market activity indicative of stop hunting in forex trading. These technological advancements are integral to a comprehensive forex stop hunt strategy.

- Order Flow Analysis: Track unusual patterns in the order book that may signal incoming stop hunts.

- Algorithmic Trading Systems: Deploy algorithms that automatically adjust stop-loss placements based on volatility and market conditions.

- Advanced Charting Tools: Use indicators such as the ATR, Bollinger Bands, and volume-based signals to monitor price action and learn how to avoid stop hunting in forex.

Utilizing Historical Data and Machine Learning

Incorporating machine learning models into your trading strategy can also provide a significant edge. By analyzing vast amounts of historical data, these models can predict potential stop hunting events with a high degree of accuracy. This integration of technology into your forex stop hunt strategy allows for proactive adjustments, ensuring that you are better prepared for what is stop hunt in forex.

Continuous Learning and Adaptation

The forex market is dynamic, and what is stop hunt in forex today may evolve tomorrow. Continuous education and staying updated with the latest market trends are essential. Many experienced traders subscribe to advanced analytics platforms and participate in trading communities where insights about stop hunting in forex trading are shared regularly. By keeping abreast of the latest developments, you can refine your forex stop hunt strategy and consistently learn how to avoid stop hunting in forex.

Real-World Examples and Case Studies

Case Study 1: A Retail Trader’s Encounter

Consider the case of a retail trader who experienced what is stop hunt in forex during a volatile market session. The trader had placed a stop-loss order near a major support level. Suddenly, a surge in market activity triggered multiple stop-loss orders, resulting in a rapid price drop. Although this event seemed like deliberate stop loss hunting in forex, further analysis revealed that natural volatility also played a role. The trader, having learned from this experience, adjusted their stop placement and now uses a forex stop hunt strategy that incorporates wider stops and multiple confirmation signals. This real-world example underscores the importance of understanding what is stop hunt in forex and learning how to avoid stop hunting in forex effectively.

Case Study 2: Institutional Tactics Unveiled

In another instance, an institutional trader executed a calculated move that many interpreted as stop hunting in forex trading. By targeting a concentration of stop-loss orders around a well-known round number, the institution was able to trigger a cascade effect. This deliberate action allowed them to secure better entry prices and profit from the ensuing volatility. Such cases highlight the dual nature of what is stop hunt in forex—whether it is an intentional strategy or a byproduct of market dynamics—and emphasize the need for a well-thought-out forex stop hunt strategy.

Learning from Data: Statistical Trends in Stop Hunts

Recent studies have shown that periods of high volatility see a marked increase in stop hunting in forex trading. For example, during major economic announcements, instances of what is stop hunt in forex rise by approximately 30-40% compared to calmer market conditions. These statistics suggest that traders should be particularly cautious during such times and adopt strategies on how to avoid stop hunting in forex. By analyzing these trends, traders can better anticipate market conditions and adjust their forex stop hunt strategy accordingly.

Read More: Identify Inducement in Forex

How to Avoid Stop Hunting in Forex: Actionable Strategies

Emphasizing Risk Management

An effective forex stop hunt strategy begins with robust risk management. Here are some actionable tips on how to avoid stop hunting in forex:

- Wider Stop-Loss Orders: Instead of setting tight stops, give your trades ample room to accommodate natural market fluctuations.

- Position Sizing: Adjust your trade size to limit the impact of any single stop hunt event on your overall portfolio.

- Use of Hedging Strategies: Hedge your positions where applicable to mitigate potential losses during stop hunts.

- Continuous Monitoring: Regularly monitor market conditions, especially around key levels where what is stop hunt in forex tends to occur.

Adapting to Market Volatility

Since volatility is a primary catalyst for what is stop hunt in forex, adapting your trading strategy during high-volatility periods is crucial. Utilize real-time volatility indicators and set alerts to notify you when the market is nearing levels of heightened activity. By doing so, you can preemptively adjust your stop-loss orders and execute trades with a forex stop hunt strategy designed to reduce risk.

Diversification and Multi-Asset Trading

Another strategy on how to avoid stop hunting in forex is to diversify your trading portfolio. By trading multiple asset classes and currency pairs, you reduce the concentration risk associated with stop-loss clustering. This diversified approach is an essential part of any robust forex stop hunt strategy and helps you learn how to avoid stop hunting in forex by not overexposing yourself to a single market.

Pro Tips for Advanced Traders

For advanced traders aiming to refine their approach to what is stop hunt in forex, here are some exclusive strategies:

- Dynamic Stop Adjustment: Continuously adjust your stop-loss orders based on real-time market data. Use trailing stops and volatility-based stops to better capture natural market movements.

- Algorithmic Trading: Consider integrating algorithmic trading systems that can analyze market data in real time and automatically adjust your positions, offering an advanced forex stop hunt strategy.

- Machine Learning Models: Leverage historical data with machine learning to predict potential stop hunting events. This technological edge can drastically improve your ability to learn how to avoid stop hunting in forex.

- Comprehensive Technical Analysis: Use a combination of indicators (ATR, Bollinger Bands, volume indicators) across multiple timeframes to identify potential stop hunts before they occur.

- Psychological Resilience: Build mental resilience to cope with the emotional impacts of sudden market movements. Accept that what is stop hunt in forex is part of trading, and plan your strategies accordingly.

Opofinance Services

Before wrapping up, let’s take a moment to highlight a trusted service that can help you execute a successful forex stop hunt strategy and learn how to avoid stop hunting in forex. ASIC regulated opofinance broker provides a suite of advanced tools and services designed to give traders a competitive edge.

- Advanced Trading Platforms: Trade seamlessly on MT4, MT5, cTrader, and OpoTrade.

- Innovative AI Tools: Utilize AI Market Analyzer, AI Coach, and AI Support to sharpen your forex stop hunt strategy.

- Social & Prop Trading: Benefit from expert insights and collaborative trading environments.

- Secure & Flexible Transactions: Enjoy safe and secure transaction methods with flexible options.

- Convenient Deposits and Withdrawals: Experience zero-fee crypto payments along with traditional banking methods.

Elevate your trading game by partnering with a broker that offers not only technological innovation but also a commitment to helping you understand what is stop hunt in forex and how to avoid stop hunting in forex. Learn more at opofinance.com

Conclusion: Navigating Stop Hunts with Confidence

In summary, understanding what is stop hunt in forex is crucial for any trader looking to succeed in the highly competitive forex market. Whether you view stop hunting in forex trading as deliberate market manipulation or a byproduct of natural volatility, the impact on your trading strategy is significant. Adopting a robust forex stop hunt strategy that includes wider stop-loss placements, diversified trading, and advanced analytical tools can make all the difference. By continuously refining your approach and staying informed, you not only learn how to avoid stop hunting in forex but also empower yourself to make smarter, data-driven trading decisions.

Stop hunts, or what is stop loss hunting in forex, are part of the complex dynamics of the forex market. With careful planning and a proactive approach, you can mitigate the risks and turn potential market disruptions into profitable opportunities. Embrace continuous learning and advanced risk management techniques, and you’ll be well on your way to mastering the art of navigating stop hunts in forex trading.

Key Takeaways

- Definition: What is stop hunt in forex refers to the phenomenon where stop-loss orders are triggered—either intentionally or through market volatility.

- Key Drivers: Liquidity grabs, institutional profit taking, and retail trader clustering are primary drivers.

- Detection: Sudden price movements, increased volatility, and unusual order book activity are key indicators.

- Risk Management: Strategies such as wider stop-loss placement, multi-timeframe analysis, and diversified trading are essential for mitigating risks.

- Advanced Strategies: Utilize dynamic stop adjustments, algorithmic trading, and machine learning models as part of a robust forex stop hunt strategy.

- Actionable Insights: Continuous monitoring, technical analysis, and adaptive risk management can help you learn how to avoid stop hunting in forex effectively.

What are the best methods to differentiate between a natural market move and what is stop hunt in forex?

Distinguishing between natural volatility and deliberate stop hunting in forex trading requires a close look at market context. Look for sudden spikes in volatility, clustering of stop-loss orders, and unusual order flow patterns. Advanced tools such as order book analysis and multi-timeframe confirmation can further clarify the situation.

Can a robust forex stop hunt strategy really protect my trading capital over the long term?

Yes, by incorporating wider stop-loss placements, using algorithmic trading for real-time adjustments, and diversifying your portfolio, you create a robust forex stop hunt strategy that minimizes the risk of being caught in what is stop hunt in forex and helps protect your capital over time.

How can I better prepare myself for sudden stop hunts and learn how to avoid stop hunting in forex?

Preparation comes from a combination of education, technology, and discipline. Using real-time alerts, continuous market analysis, and back-tested strategies can help you anticipate stop hunts. In addition, maintaining psychological resilience and a disciplined risk management approach is key to learning how to avoid stop hunting in forex.