In the world of technical analysis, traders are constantly searching for an edge. Two of the most profound methodologies are the Wyckoff Method and Smart Money Concepts (SMC). For many, the link between them is murky. Is SMC simply Wyckoff in a new package? The answer is that their relationship is one of direct lineage and evolution. Understanding the connection between Wyckoff and SMC is a game-changer for any serious trader using a top-tier online forex broker. This comprehensive guide will break down their core principles and show you how to merge them into one powerful strategy.

What is the Wyckoff Method?

The Wyckoff Method is a pillar of technical analysis, developed over a century ago by Richard D. Wyckoff. It’s not just a set of rules but a complete philosophy for understanding market dynamics. Wyckoff’s core insight was to track the activity of the market’s largest and most informed players—what he called the “Composite Man.” His entire approach is designed to help retail traders figure out what this dominant force is doing and trade alongside them, rather than becoming their liquidity.

The Composite Man Theory

At the heart of the Wyckoff Method is the “Composite Man.” Wyckoff urged traders to view all market action as the result of a single, intelligent entity’s operations. This Composite Man represents the collective force of institutional capital—major banks, funds, and financial syndicates. He plans and executes long-term campaigns to accumulate assets at low prices and then distribute them to the public at high prices. Every market swing and consolidation period is seen as a deliberate part of his plan to mislead the uninformed retail crowd, creating opportunities for those who can read the signs.

The Four Phases of the Wyckoff Price Cycle

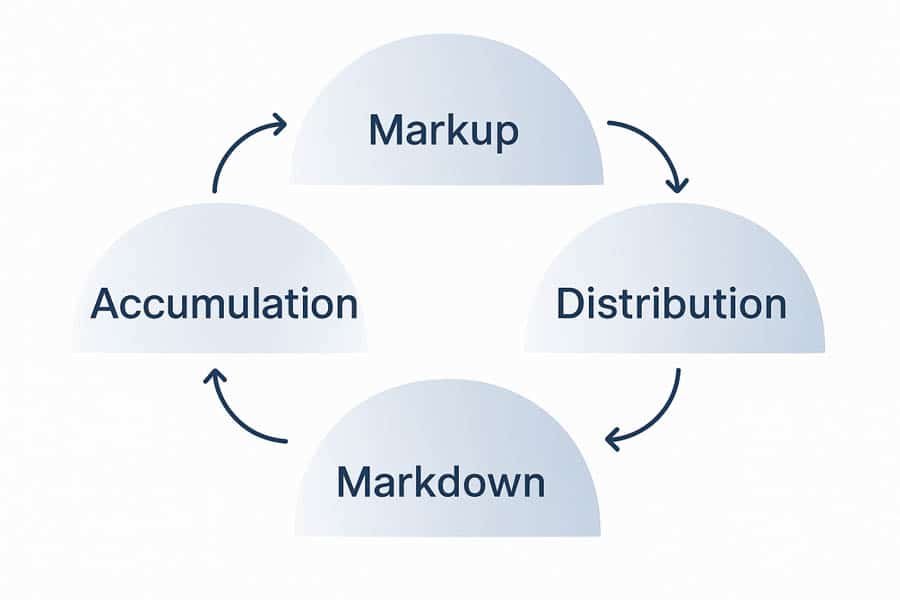

The Composite Man’s campaign unfolds across four distinct and continuous phases. Recognizing which phase the market is in gives a Wyckoffian trader immense contextual awareness and helps them anticipate the market’s next major move.

- Accumulation: Following a major downtrend, this is a sideways range where the Composite Man quietly buys assets from sellers who are panicking or giving up. The goal is to build a large position without alerting the public by causing a sharp price rise.

- Markup: Once the buying is complete and selling pressure is exhausted, the path of least resistance is upward. The Markup is a sustained uptrend, characterized by higher highs and higher lows. This is where the public starts to take notice and join the trend.

- Distribution: At the peak of the trend, the Composite Man begins to sell his holdings. This phase looks like another sideways range, but here, the institutions are offloading their positions to enthusiastic but uninformed buyers who are experiencing FOMO.

- Markdown: After the distribution is complete, the market is heavy with weak hands and lacks institutional support. The path of least resistance is now downward, leading to a sustained downtrend that sets the stage for the next accumulation.

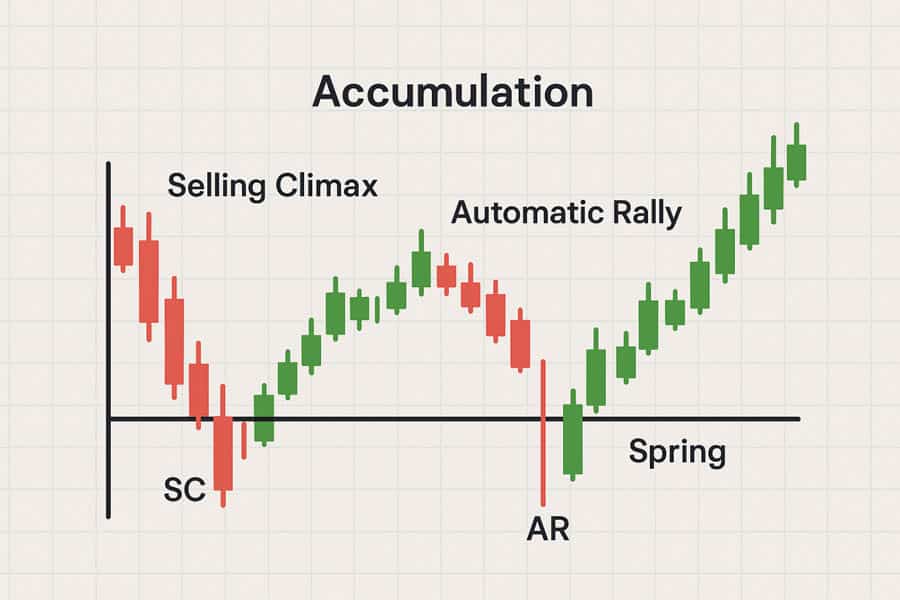

Understanding Wyckoff Schematics

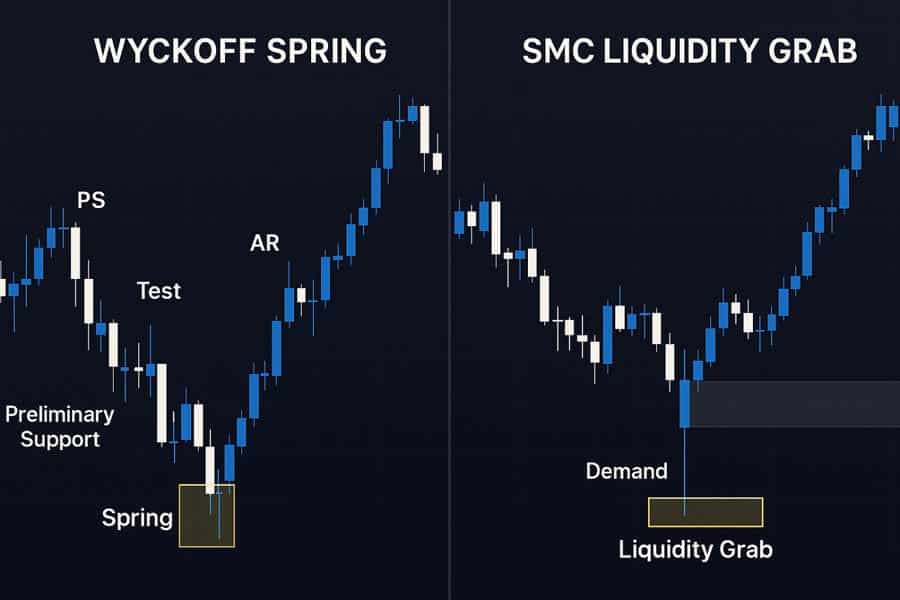

Wyckoff created detailed schematics to map out the key events within the Accumulation and Distribution ranges. These are not rigid blueprints but flexible guides to price action. For instance, an Accumulation Schematic includes events like the Selling Climax (SC), where panic selling peaks; the Automatic Rally (AR), which defines the top of the new range; and the crucial Spring—a final shakeout below the range’s support level designed to trap sellers right before the Markup begins. This structure provides a narrative for what’s happening “behind the scenes.”

What are Smart Money Concepts (SMC)?

Smart Money Concepts (SMC) is a newer, highly popular trading methodology that gained widespread attention through online trading communities. It builds on the idea of institutional trading but uses a more modern and specific vocabulary. The central thesis of SMC is that price moves with a dual purpose: to hunt for liquidity and to rebalance price inefficiencies left behind by large orders. The interaction between smc and wyckoff is a fascinating study in how old principles get refined over time.

Read More: The Smart Money Concept

The Core Idea of Institutional Order Flow

SMC operates on the premise that markets are not random but are highly engineered. Large institutions can’t execute massive orders without impacting the price, so they must be clever. They strategically guide price toward areas where a high volume of orders—liquidity—is clustered. This is typically above old highs and below old lows, where retail stop-losses and breakout orders sit. The entire SMC framework is designed to identify these institutional footprints and anticipate how “smart money” will manipulate price to its advantage, making the link between Wyckoff and SMC quite clear.

Key SMC Tools and Terminology

SMC traders use a very specific lexicon to describe these market mechanics. Understanding these terms is key to applying the strategy.

- Order Block (OB): This refers to a specific candle that initiated a significant market move. A bullish Order Block is the last down-candle before a strong impulsive move up. These are viewed as zones where institutions placed large orders, and price is likely to return to “mitigate” or re-test these levels.

- Liquidity (BSL/SSL): SMC redefines support and resistance as liquidity pools. Buy-side Liquidity (BSL) exists above swing highs, and Sell-side Liquidity (SSL) sits below swing lows. These aren’t barriers; they are targets for smart money to “sweep” or “grab” to fuel their campaigns.

- Imbalance / Fair Value Gap (FVG): This is an area of inefficient price action, typically a large, fast-moving candle that leaves a gap between its wick and the wicks of the candles before and after it. SMC theory suggests that the market will often return to fill this “imbalance.”

- Change of Character (CHoCH) & Break of Structure (BOS): These terms define shifts in market structure. A BOS confirms a trend is continuing. A CHoCH, however, is the first signal that a trend might be reversing after a liquidity grab.

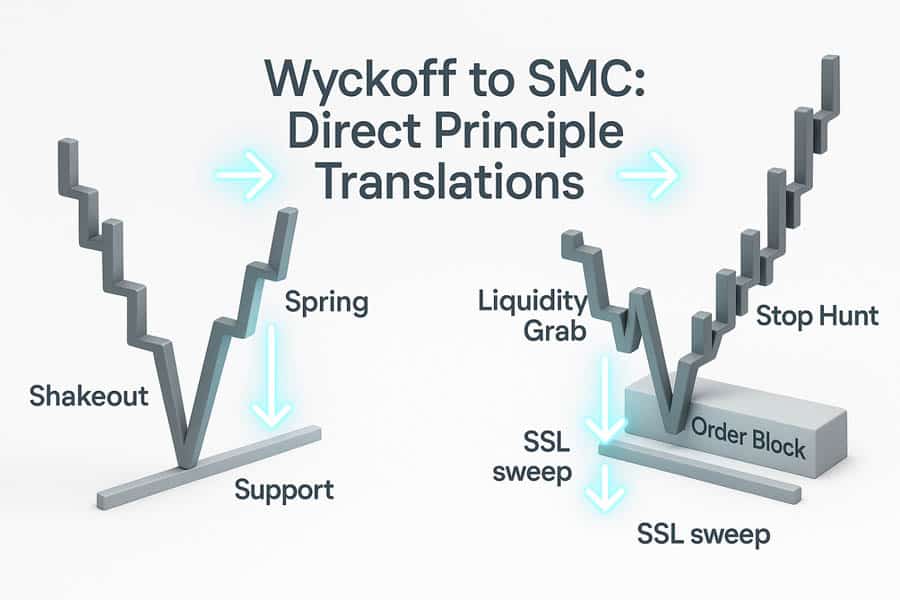

Connecting Wyckoff to SMC: The Direct Links

When you put the concepts of Wyckoff and SMC next to each other, the family resemblance is undeniable. SMC acts as a high-resolution microscope, examining the very same institutional behaviors Wyckoff described a century ago. It’s an evolution of language, where foundational principles are given new, more precise terminology.

Spring and UTAD vs. Liquidity Grab

This is the most direct and powerful link. A Wyckoff Spring is a sharp price move below the support of an accumulation range to shake out weak hands and hunt stops. A UTAD (Upthrust After Distribution) is the same concept at a market top. In SMC, this is simply called a Liquidity Grab or a Stop Hunt. The “Spring” is an engineered move to sweep the Sell-side Liquidity (SSL) below the range. The UTAD sweeps the Buy-side Liquidity (BSL). The underlying institutional purpose is identical; only the name has been modernized.

Institutional Absorption vs. Order Blocks

Wyckoff talked about absorption, a process during accumulation where large players would soak up all available sell orders at a key price level without letting the price fall further. This required immense institutional buying. The SMC Order Block is the modern footprint of this very event. That last down-candle before an explosive move up—the bullish OB—marks the final point of Wyckoffian absorption. The SMC concept of price returning to an Order Block for “mitigation” is essentially the market revisiting a key zone of institutional interest.

Sign of Strength vs. Change of Character

In a Wyckoff accumulation, after a Spring, the market rallies decisively, breaking a key resistance level within the range. Wyckoff called this a Sign of Strength (SOS). It was the first clear proof that buyers were now in control. This is exactly what an SMC trader calls a Change of Character (CHoCH) followed by a Break of Structure (BOS). The CHoCH is the initial, smaller shift in momentum, and the BOS is the larger confirmation. The principles of smc and wyckoff are describing the same shift of power from sellers to buyers.

Effort vs. Result vs. Imbalance (FVG)

One of Wyckoff’s three fundamental laws was “Effort vs. Result,” which involved analyzing volume (the effort) against the price movement it created (the result). A huge volume spike with little price change signaled opposing pressure. SMC’s Imbalance or Fair Value Gap (FVG) is a modern take on this. An FVG represents a powerful result with very little opposing effort. The rapid price move shows that one side of the market was in complete control, an idea that aligns perfectly with Wyckoff’s analysis of a successful trend with a clear path of least resistance.

Read More: Wyckoff method

Wyckoff vs. SMC: A Detailed Comparison

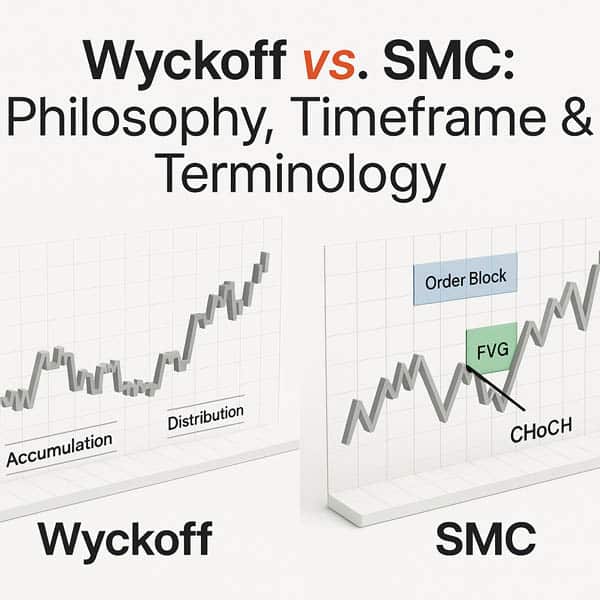

While the logic connecting Wyckoff and SMC is strong, their practical application and focus have important differences. The debate isn’t about which is superior, but rather how the complementary nature of smc and wyckoff can be used to a trader’s advantage.

Core Philosophy and Market Narrative

Wyckoff: The narrative is grand and strategic, like a long-form story. It’s about the “Composite Man’s” entire campaign, playing out over weeks or months. A Wyckoff trader is trying to understand the long-term *intent* behind market phases. The question is, “Is the Composite Man accumulating or distributing?” The focus is on the psychology and overarching plan of institutional operators.

SMC: The narrative is tactical and event-based. It’s focused on the mechanical efficiency of the market on a smaller scale. The story is about price moving from a specific liquidity pool to fill a specific imbalance. An SMC trader asks, “Where is the next liquidity target, and where is the nearest FVG?” The focus is on the immediate, precise cause-and-effect of order flow. The relationship between smc and wyckoff is that SMC explains the mechanics that drive the Wyckoff cycle.

Timeframe Application

Wyckoff: This methodology excels on higher timeframes like the Daily, 4-Hour, and 1-Hour charts. Its purpose is to establish the big-picture context and directional bias. It helps a trader see “the forest” and determine if the overall environment is bullish, bearish, or consolidating. It is a top-down approach for strategic planning.

SMC: This is primarily a lower-timeframe execution model, used on charts like the 15-Minute, 5-Minute, or even 1-Minute. Its tools are designed for finding precise, low-risk entries. A trader would use Wyckoff to identify a high-probability context and then use SMC to execute the trade. This highlights the perfect partnership between Wyckoff and SMC—one for strategy, one for tactics.

Terminology and Accessibility

Wyckoff: The language is classic, originating from the early 20th century. Terms like “Spring,” “Upthrust,” “Climax,” and “Jumping the Creek” sound historical and can be a barrier for new traders. While well-documented in books, it feels less immediate than modern trading jargon.

SMC: The terminology is modern, sleek, and was born in the digital age of online forums. Acronyms like FVG, CHoCH, BSL, and SSL are designed for quick charting and communication. This makes SMC feel more accessible, though it can sometimes be less standardized than the classical Wyckoff terms. The terminological difference is a key distinction between Wyckoff and SMC.

Interpreting Highs and Lows

Wyckoff: Key swing highs and lows define the boundaries of a trading range—a field of play where the Composite Man operates. Moves outside this range (Spring/UTAD) are seen as final, decisive tests or shakeouts designed to mislead the public before the real move begins.

SMC: Key swing highs and lows are explicitly defined as liquidity pools. They are not barriers; they are magnets for price. To an SMC trader, a clean series of highs is a target that must be broken to trigger stop-loss orders, which provides the fuel for a reversal. This is a critical philosophical shift: Wyckoff sees the range edge as a test; SMC sees it as fuel. In reality, the Wyckoffian test *is* the SMC liquidity hunt.

A Practical Wyckoff and SMC Trading Strategy

The real power comes from blending these two methodologies into a unified, top-down approach. Stop seeing it as a choice between Wyckoff and SMC and start using them as a team.

Step 1: High-Timeframe Wyckoff Analysis

Begin on a higher timeframe like the Daily or 4-Hour chart. Your only job here is to identify the current market phase according to the Wyckoff cycle. Have we just come out of a long downtrend and started building a range? If so, you can hypothesize that this is Accumulation. This gives you your high-level directional bias: you should be looking for buying opportunities.

Step 2: Identifying the Wyckoff Schematic Phase

Now, zoom into the 4-Hour or 1-Hour chart to analyze the action within your identified accumulation range. Where are we in the schematic? Have you just seen a sharp, fast move below the range’s support that quickly reversed back inside? That is your Spring. This is a high-probability signal that the institutional shakeout is complete, and the markup may be about to begin. The combination of Wyckoff context and this key event gives you a powerful reason to look for an entry.

Read More: SMC Market Structure Mapping

Step 3: Low-Timeframe SMC Execution

With your bullish bias confirmed by the 4H Spring, it’s time to drill down to the 15-Minute or 5-Minute chart to find your entry. Here, you put on your SMC hat:

- Confirm the Liquidity Grab: The 4H Spring will appear as a clear sweep of Sell-side Liquidity (SSL) on your lower timeframe.

- Wait for a Change of Character (CHoCH): Don’t jump in right away. Wait for the market to prove its intent. Look for a break of the most recent minor swing high. This is your CHoCH, confirming a shift in momentum.

- Pinpoint the Entry Zone: The strong move that caused the CHoCH will likely have left behind a clean Order Block and possibly a Fair Value Gap (FVG). This is your high-probability entry zone.

- Execute the Trade: Place a limit order at the Order Block, with your stop-loss placed safely below the low of the Spring. Your target can be a pool of Buy-side Liquidity at the top of the higher-timeframe Wyckoff range.

This integrated system uses the strengths of both Wyckoff and SMC to build a complete trading plan from concept to execution.

Opofinance: Trading with a Professional Edge

To effectively implement strategies like the Wyckoff and SMC model, a trader needs a reliable and well-equipped broker. Opofinance, an ASIC-regulated broker, provides the tools and environment necessary for advanced technical analysis.

- Powerful Trading Platforms: Access industry-standard platforms like MT4, MT5, and cTrader for in-depth charting and analysis.

- Innovative AI Tools: Gain an edge with an AI Market Analyzer to find opportunities and an AI Coach to help refine your strategies.

- Secure and Modern Transactions: Benefit from safe and convenient deposit and withdrawal methods, including crypto payments, with zero fees from Opofinance’s side.

Elevate your trading by partnering with a broker built for modern traders. Discover the advantages of trading with Opofinance.

Conclusion: Is SMC Just Modern Wyckoff?

After a thorough analysis, the conclusion is clear: SMC isn’t just a rebrand of Wyckoff, but it is its direct and logical evolution. It has taken the timeless principles of institutional behavior that Wyckoff identified and given them a modern, precise vocabulary focused on execution. The relationship between Wyckoff and SMC is one of a student surpassing the master while honoring their teachings. A strong understanding of smc and wyckoff together provides a truly holistic view of the market.

The Final Verdict on Their Relationship

Think of it this way: Wyckoff wrote the classic, foundational novel on market mechanics. SMC is the modern, high-definition film adaptation, complete with slow-motion replays of the critical action scenes. Both tell the same story, but they provide different and equally valuable perspectives. The synergy between smc and wyckoff is undeniable.

Recommendations for Developing Traders

For traders aiming to master price action, the learning path should be sequential. Begin with Wyckoff. Internalize the logic of the Composite Man and the market cycle. This provides the essential context that many purely SMC traders lack. Once you can confidently read the high-timeframe narrative, introduce SMC as your precision tool for execution. This layered approach ensures your trading is grounded in solid logic, allowing you to harness the full power of both Wyckoff and SMC.

Key Takeaways

- Shared DNA: Both Wyckoff and SMC are based on tracking institutional “smart money” footprints.

- Different Roles: Wyckoff provides the high-level strategic narrative (“the why”), while SMC offers the low-level tactical execution tools (“the how”).

- Direct Translations: A Wyckoff Spring is an SMC Liquidity Grab. Wyckoff’s Absorption is an SMC Order Block.

- Timeframe Synergy: Use Wyckoff on high timeframes (4H, Daily) for context and bias. Use SMC on low timeframes (15M, 5M) for precise entries.

- Evolutionary Path: SMC is the modern evolution of Wyckoff’s principles, refined for today’s fast-paced digital markets. The study of smc and wyckoff is the study of this evolution.

What is the main difference between Wyckoff and SMC?

The main difference is focus and timeframe. Wyckoff focuses on the long-term market cycle (accumulation/distribution) on higher timeframes to establish a directional bias. SMC focuses on precise, lower-timeframe entry mechanics like order blocks and liquidity grabs to execute trades within that bias.

Is Wyckoff or SMC better for beginners?

Beginners should start by learning the foundational principles of the Wyckoff Method first. Understanding the overall market cycle and the “why” behind price movements provides a crucial context that makes SMC concepts much easier and more effective to apply later on.

Can I combine ICT concepts with Wyckoff?

Yes, you can. ICT (Inner Circle Trader) concepts are a popular branch of Smart Money Concepts. The core ideas of ICT, such as order blocks and liquidity voids (fair value gaps), are the modern equivalents of Wyckoffian principles, making them highly compatible for a blended trading approach.