Have you ever wondered why some traders seem to predict market moves with uncanny accuracy while others struggle to make sense of price fluctuations? The answer lies in a proven, systematic approach to market analysis that many overlook: the wyckoff method. This article provides an in-depth exploration of the wyckoff method explained, a time-tested trading strategy that deciphers market behavior through the interplay of supply, demand, and volume dynamics. In today’s fast-paced trading world—whether you’re trading stocks, cryptocurrencies, or working with a regulated forex broker—the wyckoff method offers clear signals that can transform your trading results.

In the sections that follow, we will cover the origins and evolution of the wyckoff method, its core principles, essential key concepts, a five-step approach for market analysis, modern applications across various asset classes, and expert tips for advanced traders. We’ll also introduce the advanced trading services offered by opofinance. Get ready for a comprehensive guide that not only explains the wyckoff method in detail but also shows you how to integrate it into your trading strategy for smarter, more disciplined decisions.

The Legacy of the wyckoff method

Understanding the history behind the wyckoff method is key to appreciating its enduring relevance. This section provides context on its origins, evolution, and why it remains a cornerstone of technical analysis even today.

Before diving into the subtopics, it is essential to recognize that the wyckoff method was developed in the early 20th century by Richard D. Wyckoff—a pioneer who revolutionized market analysis by focusing on price and volume patterns. His insights laid the foundation for modern technical analysis, and the wyckoff method explained remains highly respected among traders globally.

History and Background

Richard D. Wyckoff began his career on Wall Street at a very young age and quickly developed a deep understanding of market mechanics. His work centered on the observation that market trends are not random but result from the deliberate actions of large, institutional investors. The method he developed, now known as the wyckoff method, was designed to decode these actions by examining the dynamics of supply and demand.

Wyckoff’s teachings were disseminated through articles, books, and educational seminars, making the concepts accessible to a wide audience. The method’s focus on volume analysis as a confirmation tool set it apart from many contemporaneous techniques. Today, the term “wyckoff method explained” is used to help new traders understand these complex ideas and apply them effectively.

Evolution of the Method

Over the decades, the wyckoff method has evolved from simple chart reading into a sophisticated strategy that incorporates modern tools and multi-timeframe analysis. While the fundamental principles remain intact, modern adaptations have expanded its applicability across various asset classes—from traditional stocks to the highly volatile cryptocurrency market.

The evolution of the wyckoff method explained demonstrates its flexibility; as market conditions and technologies have advanced, so too have the techniques used to apply the method. This transformation ensures that even though the strategy was conceived over a century ago, it remains a critical tool for today’s traders.

Read More: Mastering ICT Market Structure

Core Principles of the wyckoff method

A trading strategy is only as good as the principles upon which it is built. The wyckoff method is underpinned by three core laws that provide a systematic approach to market analysis. This section introduces these fundamental principles and explains how they form the backbone of the wyckoff method explained.

Before delving into the details, it is important to note that these core principles are what enable traders to objectively analyze market conditions, regardless of whether they are trading stocks, forex, or cryptocurrencies.

The Law of Supply and Demand

The most basic yet powerful principle of the wyckoff method is that market prices are governed by the balance between supply and demand. This law asserts that:

- When demand exceeds supply: Prices tend to rise.

- When supply exceeds demand: Prices tend to fall.

The wyckoff method explained uses volume analysis in conjunction with price movements to identify key turning points. By monitoring these dynamics, traders can detect shifts in market sentiment, which often indicate upcoming breakouts or reversals. This principle forms the foundation of the method, allowing for the identification of critical support and resistance zones that are essential for timing trades.

The Law of Cause and Effect

Every significant price movement in the market is preceded by a period of consolidation—either accumulation or distribution. This principle, known as the Law of Cause and Effect, is central to the wyckoff method. It posits that:

- Accumulation (the cause): Occurs when smart money builds positions, setting the stage for a bullish breakout.

- Distribution (the cause): Happens when institutional investors offload their positions, often signaling an impending downtrend.

The wyckoff method explained uses various analytical tools, such as point and figure charts, to measure the magnitude of the “cause” and predict the subsequent “effect”—the price move. This systematic measurement allows traders to assess whether a trade meets their profit objectives and risk parameters before entering the market.

The Law of Effort versus Result

The third core principle of the wyckoff method examines the relationship between effort (as indicated by trading volume) and the resulting price movement. Ideally, a strong volume surge should result in a proportionate price change. However, if there is a divergence between volume and price, it may signal that the current trend is weakening, potentially indicating a reversal.

This concept is critical in the wyckoff method explained, as it enables traders to verify the strength of a trend. For instance, if volume increases but the price does not move significantly, it may be an early sign that the market is losing momentum. Recognizing these discrepancies is vital for effective risk management and timely trade exits.

Key Concepts in the wyckoff method explained

Beyond the core principles, several key concepts add layers of sophistication to the wyckoff method. These concepts help traders further refine their analysis and improve decision-making. In this section, we delve into these critical components to provide a deeper understanding of the method.

Before proceeding, it is essential to recognize that these concepts bridge the gap between theoretical understanding and practical application, making the wyckoff method explained a versatile tool in any trader’s arsenal.

The Composite Man Concept

One of the most unique ideas in the wyckoff method is the Composite Man concept. This concept suggests that the market behaves as if it were controlled by a single, all-knowing trader—an amalgamation of institutional investors whose actions drive price movements. By studying the behavior of this “Composite Man,” traders can infer the underlying intentions behind market moves.

The wyckoff method explained encourages traders to adopt this mindset to predict market trends. Understanding that every price move is part of a larger, coordinated plan helps reduce emotional trading and provides a clearer, more objective view of market behavior.

The Wyckoff Price Cycle

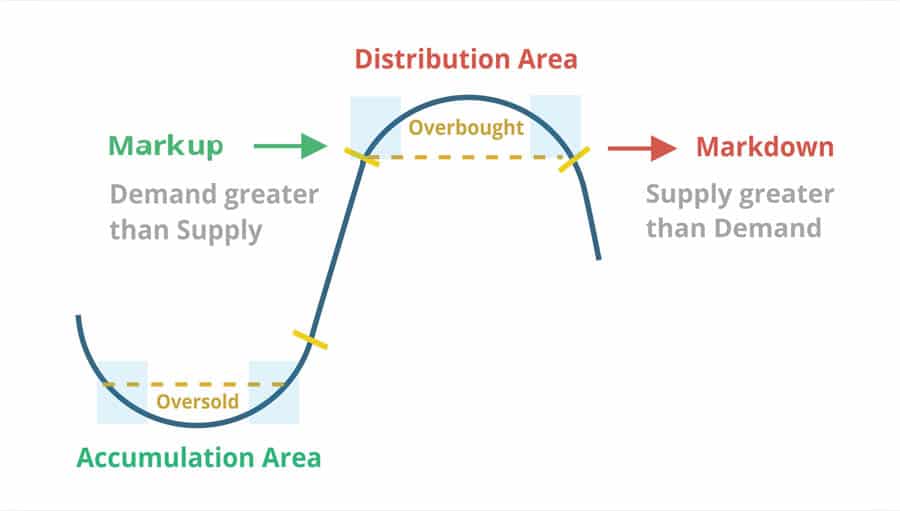

The cyclical nature of the market is another cornerstone of the wyckoff method. The price cycle is typically divided into four distinct phases, each offering unique opportunities and challenges:

- Accumulation Phase: After a downtrend, prices consolidate as smart money accumulates positions.

- Markup Phase: Prices break out of the accumulation phase and move upward as buying pressure increases.

- Distribution Phase: Following an uptrend, institutions begin selling their positions, leading to a period of consolidation.

- Markdown Phase: Prices decline sharply as the excess supply drives the market downward.

The wyckoff method explained uses these phases to help traders identify optimal entry and exit points. By understanding where the market is in its cycle, you can better time your trades and enhance your risk-reward ratio.

Accumulation Phase

- Context: Occurs after a prolonged downtrend; marked by low volatility and a narrow trading range.

- Key Characteristics: Diminishing selling pressure, increased buying interest, and the emergence of support levels.

- Trader’s Edge: Recognizing this phase early allows you to enter positions before the market shifts into a bullish trend.

Markup Phase

- Context: Follows accumulation, characterized by a clear breakout as demand overtakes supply.

- Key Characteristics: Rising prices, higher highs and higher lows, and robust volume on upward moves.

- Trader’s Edge: Capitalizing on pullbacks within this phase can maximize profit potential as the market gains momentum.

Distribution Phase

- Context: Occurs after an extended uptrend; marked by a consolidation phase where institutions begin offloading their positions.

- Key Characteristics: Range-bound trading, increased selling pressure, and weakened buying enthusiasm.

- Trader’s Edge: Early identification of this phase helps secure profits before a market downturn.

Markdown Phase

- Context: Follows distribution; characterized by rapid price declines as supply overwhelms demand.

- Key Characteristics: Lower lows, spikes in selling volume, and strong bearish sentiment.

- Trader’s Edge: Recognizing this phase can help you avoid losses or even create short-selling opportunities.

Read More: How to Identify Market Cycles

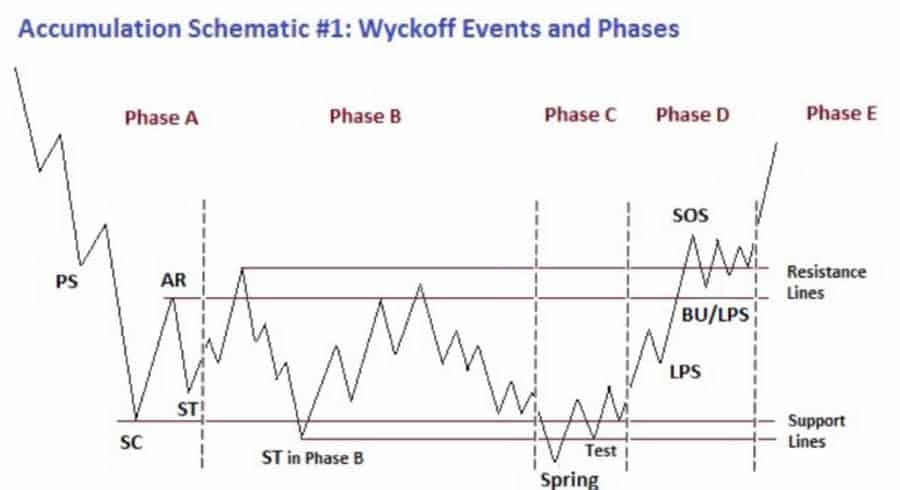

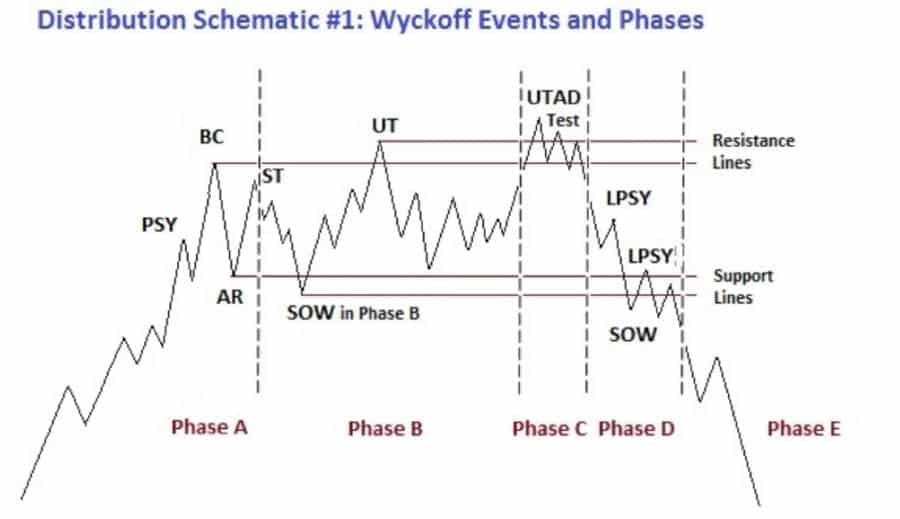

Wyckoff Schematics

To further assist traders, the wyckoff method explained includes detailed schematics that visually represent the phases of accumulation and distribution. These schematics serve as roadmaps that highlight key market events and transitions.

Accumulation Schematic

- Preliminary Support (PS): The initial slowing of a downtrend as buying interest begins.

- Selling Climax (SC): A burst of heavy selling that creates an oversold condition.

- Automatic Rally (AR): A rebound following the SC, indicating the beginning of recovery.

- Secondary Test (ST): A re-test of the SC low to confirm that selling pressure is subsiding.

- Spring: A brief dip below support to shake out weak holders, followed by a quick recovery.

- Sign of Strength (SOS): A strong upward movement that confirms the start of the markup phase.

- Last Point of Support (LPS): The final test of support before prices embark on a sustained uptrend.

Distribution Schematic

- Preliminary Supply (PSY): The early phase where upward momentum begins to weaken.

- Buying Climax (BC): A surge in buying that eventually exhausts, leading to an overbought condition.

- Automatic Reaction (AR): A downward move following the BC as the market corrects itself.

- Secondary Test (ST): A re-test of the BC high to verify that the buying enthusiasm is fading.

- Upthrust (UT): A false breakout above resistance designed to lure in buyers before a reversal.

- Sign of Weakness (SOW): A decisive breakdown that indicates the onset of the markdown phase.

- Last Point of Supply (LPSY): The final rally before the market begins a significant decline.

These schematics provide clear visual cues and a structured way to interpret market dynamics, making the complex principles of the wyckoff method explained easier to apply in real-world trading.

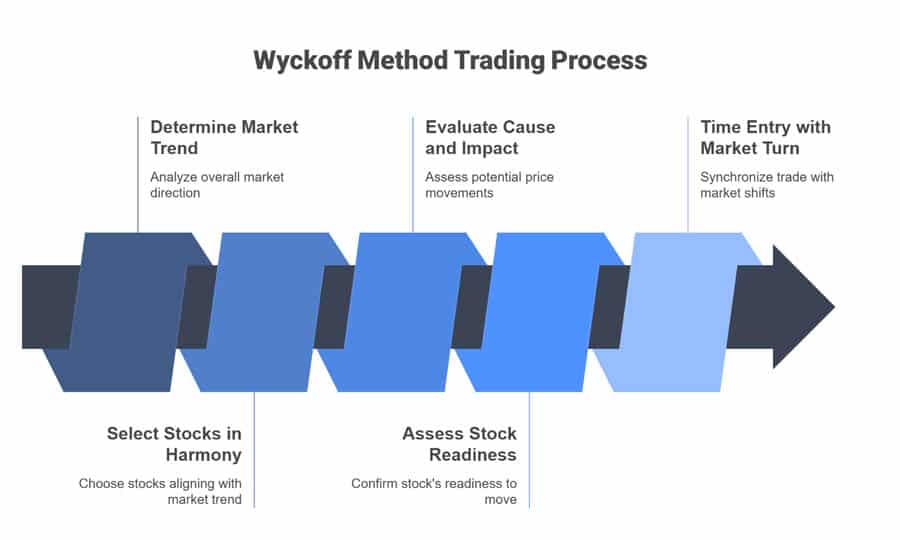

The Five-Step Approach to the Market Using the wyckoff method explained

The wyckoff method is not just theoretical; it provides a practical, step-by-step process for making informed trading decisions. This section outlines the five-step approach that traders can use to apply the wyckoff method explained effectively.

Before detailing each step, it is important to understand that this approach is designed to minimize emotional decision-making and streamline the analysis process, ensuring that every trade is backed by solid evidence.

Step 1: Determine the Market Trend

Start by analyzing the overall market to identify whether it is in an accumulation, markup, distribution, or markdown phase. The wyckoff method explained stresses the importance of understanding the broader market context before selecting individual trades.

How to Analyze Trends

- Study major market indices and sector performance.

- Use volume indicators and trend lines to spot significant movements.

- Compare current patterns with historical data to identify recurring trends.

Step 2: Select Stocks in Harmony with the Market

Once you’ve determined the overall trend, choose stocks or assets that align with that market direction. The wyckoff method explained advises selecting securities that are in sync with the prevailing market sentiment, which enhances the likelihood of a successful trade.

Criteria for Stock Selection

- Evaluate price and volume patterns to identify signs of accumulation or distribution.

- Compare the performance of similar stocks within the same sector.

- Choose stocks that demonstrate clear technical signals indicating a strong trend.

Step 3: Evaluate the Cause and Its Potential Impact

This step involves measuring the “cause” built during the accumulation or distribution phase. By using tools such as point and figure charts, the wyckoff method explained helps traders estimate the potential price move resulting from the built-up cause.

How to Measure the Cause

- Determine the width and duration of the trading range.

- Calculate the potential price target based on the cause and the subsequent effect.

- Ensure that the potential move justifies the risk, aligning with your profit objectives.

Step 4: Assess the Stock’s Readiness to Move

Before committing to a trade, it’s crucial to confirm that the stock is prepared to break out or break down from its current trading range. The wyckoff method explained emphasizes the importance of monitoring recent price and volume trends for confirmation signals.

Indicators of Readiness

- Look for consolidation patterns that culminate in a surge of volume.

- Verify that key support or resistance levels are being retested.

- Watch for breakout patterns that match the overall market trend.

Step 5: Time Your Entry with a Market Turn

The final step is to synchronize your trade with a broader market shift. Timing is essential, and even a well-prepared trade can falter if the overall market sentiment is off. The wyckoff method explained advises waiting for confirmation from both the specific asset and the general market before entering a trade.

Timing Considerations

- Use multi-timeframe analysis to confirm market turns.

- Establish clear stop-loss and take-profit levels based on market structure.

- Exercise patience to avoid premature entries that could expose you to unnecessary risk.

Read More: Price Action in Forex Trading

Modern Applications of the wyckoff method

In today’s dynamic trading environment, the principles behind the wyckoff method continue to be highly relevant. Modern technology and analytical tools have enhanced the traditional techniques, making the wyckoff method explained adaptable across a variety of asset classes.

Before examining the specific applications, it’s worth noting that the method’s enduring strength lies in its focus on universal market dynamics—making it applicable to stocks, forex, and cryptocurrencies alike.

Application in Stock Markets

In equity trading, the wyckoff method explained is used to identify key phases of accumulation and distribution in high-volume stocks. By analyzing volume spikes and price patterns, traders can detect when smart money is entering or exiting a position, which provides a significant edge in forecasting market moves.

Benefits in Stock Trading

- Early detection of accumulation phases can signal upcoming bullish trends.

- Clear distribution indicators help in locking in profits before a downturn.

- Structured analysis improves risk management and entry timing.

Application in Forex Trading

The foreign exchange market is known for its rapid fluctuations, and applying the wyckoff method explained can bring structure to the chaos. When trading with a regulated forex broker, the method helps in analyzing currency pairs by focusing on supply and demand dynamics—even when volume is represented by tick data.

Forex Trading Insights

- Detect accumulation in currency pairs, indicating potential rallies.

- Avoid false breakouts by confirming signals with volume and trend analysis.

- Enhance risk management by integrating the method with other technical indicators.

Application in Cryptocurrency Markets

Cryptocurrencies are notorious for their volatility, which makes them ideal candidates for the systematic approach offered by the wyckoff method explained. By identifying key phases in the crypto market, traders can better navigate sharp reversals and explosive upward moves.

Crypto Trading Advantages

- Pinpointing accumulation zones during market dips can lead to better entry points.

- Early detection of distribution phases enables timely profit-taking.

- Combining the wyckoff method with on-chain analytics provides a comprehensive market view.

Integrating with Advanced Technology

Modern trading platforms have embraced the wyckoff method explained, offering automated tools and multi-timeframe charting that simplify its application. Advanced analytics, algorithmic trading, and AI-powered indicators all contribute to making this century-old method even more effective.

Technological Enhancements

- Set automated alerts for key events such as the Selling Climax or Sign of Strength.

- Utilize multi-timeframe analysis to verify signals across different time intervals.

- Integrate additional volume-based indicators and AI tools for enhanced decision-making.

Pro Tips for Advanced Traders

For experienced traders looking to fine-tune their strategy, the following pro tips offer advanced strategies to maximize the effectiveness of the wyckoff method explained. These tips build on the foundational principles and encourage continuous refinement of your trading approach.

Before implementing these strategies, remember that continuous learning and adaptation are crucial in today’s ever-changing market landscape.

Advanced Strategies

- Combine Multiple Indicators: Enhance the reliability of wyckoff signals by cross-verifying with indicators like RSI, MACD, and Bollinger Bands.

- Monitor Divergences: Pay close attention to divergences between volume and price movements; these can signal upcoming reversals.

- Develop Custom Patterns: Create a personal library of chart patterns that consistently align with the wyckoff method explained, tailoring them to your trading style.

Utilizing Technology

- Automated Alerts: Set up alerts on your trading platform for specific wyckoff events such as the Secondary Test or Upthrust.

- Backtesting: Regularly backtest your strategy using historical data to ensure that your interpretations of the wyckoff method explained hold up across different market conditions.

- Multi-Timeframe Analysis: Use both long-term and short-term charts to confirm trends and refine entry and exit points.

Backtesting and Adaptation

- Maintain a Trading Journal: Document every trade, noting the signals from the wyckoff method explained and the outcomes. This will help you identify patterns and refine your approach over time.

- Regular Reviews: Periodically review your trading strategy and adjust parameters based on market feedback and evolving trends.

- Stay Educated: Join trading communities and forums where experienced practitioners of the wyckoff method explained share insights and advanced techniques.

Opofinance Services Section

Before wrapping up our discussion on the wyckoff method, it’s important to mention a trading partner that aligns perfectly with this systematic approach. ASIC regulated opofinance broker provides an exceptional suite of tools designed for traders who demand reliability and advanced technology. Here’s why opofinance stands out:

- Advanced Trading Platforms: Trade effortlessly on MT4, MT5, cTrader, and OpoTrade, ensuring a seamless experience while applying the wyckoff method explained.

- Innovative AI Tools: Benefit from AI Market Analyzer, AI Coach, and AI Support to accelerate your decision-making process.

- Social & Prop Trading: Access a community of experienced traders and proprietary strategies that enhance your market insights.

- Secure & Flexible Transactions: Enjoy safe transactions with flexible options, including crypto payments—with zero fees.

- Safe Deposits and Withdrawals: Experience hassle-free, secure deposit and withdrawal methods that ensure your funds remain accessible.

Take your trading to the next level with these advanced features. Visit opofinance.com now and start trading smarter with opofinance!

Conclusion

In conclusion, the wyckoff method provides a comprehensive framework for understanding market behavior and making disciplined trading decisions. The wyckoff method explained throughout this article empowers traders to identify key market phases—accumulation, markup, distribution, and markdown—and to decode the actions of institutional investors. Whether you are trading stocks, forex with a regulated forex broker, or cryptocurrencies, this method’s structured approach helps reduce emotional decision-making and enhances risk management.

By integrating the three core principles—supply and demand, cause and effect, and effort versus result—with a systematic five-step process, the wyckoff method explained enables traders to make informed entries and exits. Modern technological enhancements further amplify its effectiveness, proving that even century-old principles can thrive in today’s digital markets.

Ultimately, mastering the wyckoff method not only equips you with the skills to interpret market signals accurately but also builds a foundation for sustainable trading success. Embrace these time-tested strategies, continually adapt to market changes, and unlock the secrets of market dynamics with confidence.

Key Takeaways

- The wyckoff method is a time-tested trading strategy based on analyzing supply, demand, and volume dynamics.

- The wyckoff method explained encompasses three core laws: supply and demand, cause and effect, and effort versus result.

- Understanding the market cycle phases—accumulation, markup, distribution, and markdown—is crucial for effective trading.

- A systematic five-step approach helps traders determine trends, select suitable assets, measure potential price moves, assess readiness, and time entries.

- Modern applications extend the method’s relevance to stocks, forex, and cryptocurrencies.

- Advanced traders can enhance the method with additional technical indicators, multi-timeframe analysis, and automated tools.

- ASIC regulated opofinance broker offers advanced trading platforms, innovative AI tools, and secure transaction methods to support the implementation of the wyckoff method explained.

References: +

How does the wyckoff method explained help traders adapt to sudden market reversals?

The wyckoff method explained helps traders recognize early signs of market reversals through discrepancies between volume and price movements, as well as clear signals in the accumulation and distribution phases. This enables timely exits or short-selling opportunities, reducing overall risk.

What makes the wyckoff method explained suitable for both beginner and advanced traders?

Its structured, systematic approach—combined with detailed schematics and a five-step process—makes the method accessible to beginners. Advanced traders can further refine the method by integrating additional technical indicators and automated alerts, ensuring it remains robust across different market conditions.

Can the wyckoff method explained be successfully combined with automated trading systems?

Yes, many modern trading platforms allow traders to integrate the wyckoff method explained into automated systems. This includes setting up alerts for key events such as the Selling Climax or Secondary Test, which can then trigger algorithmic trade entries and exits, further enhancing efficiency.