The 1-hour swing trading strategy is a powerful technique that allows traders to capitalize on short-term market fluctuations within a single hour, potentially unlocking significant profits while minimizing risk exposure. This approach is perfect for those seeking to maximize their trading efficiency without being tied to their screens all day. By mastering this strategy, you can enhance your ability to identify and exploit market trends, leading to more consistent and profitable trades in the forex market.

Swing trading, traditionally a method for capturing gains over a period of days to weeks, takes on a new dimension with the 1-hour timeframe. This condensed approach combines the best elements of day trading and traditional swing trading, offering a unique blend of opportunity and risk management. The 1-hour swing trading strategy involves analyzing market movements, identifying potential entry and exit points, and executing trades within a 60-minute window.

For those new to forex trading or looking to refine their skills, finding a reliable forex broker is crucial. A reputable online forex broker can provide the necessary tools, resources, and market access to implement this strategy effectively. When selecting a broker for forex trading, it’s essential to consider factors such as regulation, platform capabilities, and execution speed, all of which play vital roles in the success of a 1-hour swing trading approach.

What is 1-Hour Swing Trading?

Swing trading is a popular trading style that aims to capture short to medium-term gains in a stock or financial instrument over a period of a few days to several weeks. The 1-hour swing trading strategy takes this concept and condenses it into a more focused timeframe, allowing traders to open and close positions within a single hour.

This approach combines elements of both day trading and traditional swing trading, creating a unique hybrid strategy that can be particularly effective in the forex market. The 1-hour timeframe provides enough volatility for meaningful price movements while still allowing for thorough analysis and strategic decision-making.

Read More: Mastering the 4-Hour Swing Trading Strategy

Key Benefits of 1-Hour Swing Trading

- Time Efficiency: Perfect for busy professionals who can’t monitor markets all day. This strategy allows you to concentrate your trading efforts into a single hour, freeing up the rest of your day for other activities or responsibilities.

- Reduced Overnight Risk: Positions are closed before major news events can impact the market. This minimizes the risk of unexpected gaps or adverse price movements that can occur during off-market hours.

- Frequent Opportunities: Multiple trading setups can occur within a single day. The 1-hour timeframe often presents several high-probability trade opportunities, allowing for a more active trading approach.

- Lower Stress: Shorter holding periods mean less emotional investment in each trade. This can lead to more objective decision-making and better overall trading performance.

- Improved Focus: Concentrating on a specific timeframe helps develop expertise in reading that particular market rhythm, potentially leading to more accurate predictions and profitable trades.

- Balanced Risk-Reward: The 1-hour timeframe often provides a good balance between potential profit and manageable risk, making it suitable for traders with various risk tolerances.

Essential Components of a Successful 1-Hour Swing Trading Strategy

To effectively implement a 1-hour swing trading strategy, you need to focus on several crucial elements:

1. Technical Analysis

Mastering technical analysis is the cornerstone of successful 1-hour swing trading. Key tools include:

- Moving Averages: Use 5, 10, and 20-period MAs to identify trends.

- Relative Strength Index (RSI): Spot overbought and oversold conditions.

- Bollinger Bands: Determine volatility and potential reversal points.

2. Price Action

Understanding candlestick patterns and chart formations is vital. Look for:

- Engulfing patterns

- Doji candles

- Pin bars

These can signal potential trend reversals or continuations within your 1-hour timeframe.

3. Support and Resistance Levels

Identifying key support and resistance levels helps in:

- Setting precise entry points

- Placing stop-loss orders

- Determining profit targets

4. Risk Management

Proper risk management is crucial in 1-hour swing trading. Implement these rules:

- Never risk more than 1-2% of your account on a single trade

- Use a risk-reward ratio of at least 1:2

- Always set stop-loss orders

Before we dive into the strategies, you might want to review our Master the 1 Hour Forex Trading Strategy for additional context and ideas.

Read More: 7 Best Time Frames for Scalping

Top Powerful Price Action-Based 1-Hour Swing Trading Strategies

These strategies are designed to capitalize on the dynamic nature of the 1-hour timeframe in forex trading. They combine the precision of short-term analysis with the robustness of swing trading principles

1. The Support and Resistance Breakout Strategy

This strategy capitalizes on price breaking through key levels within the 1-hour timeframe:

- Identify: Mark clear support and resistance levels on your 1-hour chart. Look for areas where price has repeatedly bounced off or failed to penetrate.

- Entry: Enter a long position when price breaks and closes above resistance, or a short position when price breaks and closes below support. Ensure the breakout candle closes convincingly beyond the level.

- Confirmation: Look for increased volume on the breakout candle. In the forex market, you can use tick volume or range expansion as a proxy for volume.

- Stop-loss: Place your stop-loss just below the broken resistance for longs, or above the broken support for shorts. A good rule of thumb is to place it 5-10 pips beyond the level to avoid getting stopped out by market noise.

- Take-profit: Target the next major support or resistance level, or use a risk-reward ratio of at least 1:2. In fast-moving markets, consider using a trailing stop to maximize profits.

2. The Double Top/Bottom Reversal Strategy

This strategy focuses on classic reversal patterns within the 1-hour chart:

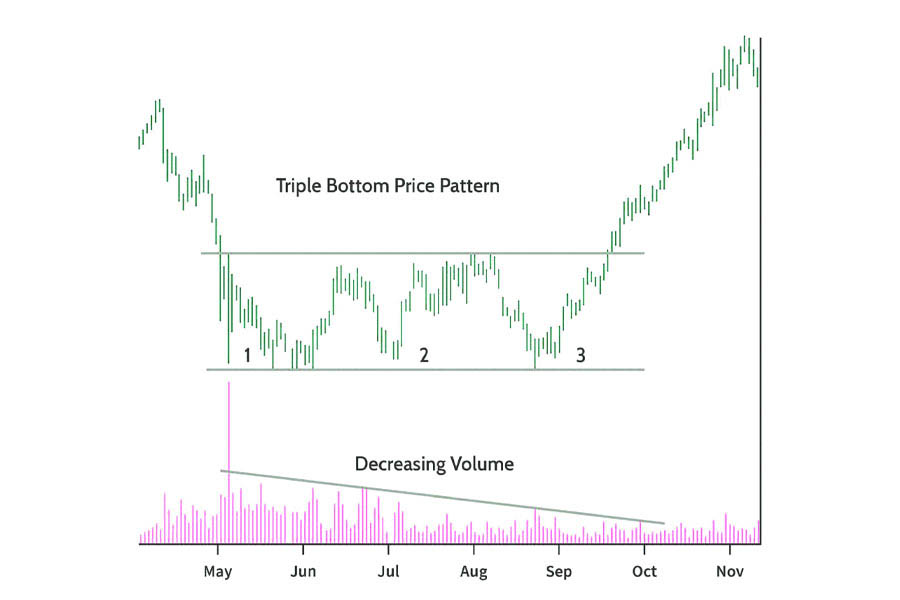

- Identify: Look for a double top (for shorts) or double bottom (for longs) pattern on the 1-hour chart. The two peaks or troughs should be at approximately the same level.

- Entry: Enter a short position when price breaks below the neckline of a double top, or a long position when price breaks above the neckline of a double bottom.

- Confirmation: Wait for a retest of the broken neckline before entering. This retest often provides a high-probability entry point with a tight stop-loss.

- Stop-loss: Place your stop-loss above the highest point of the double top for shorts, or below the lowest point of the double bottom for longs.

- Take-profit: Measure the height of the pattern (from the neckline to the peak/trough) and project it from the breakout point. This gives you a minimum target for your trade.

3. The Inside Bar Breakout Strategy

This strategy takes advantage of periods of consolidation followed by breakouts on the 1-hour chart:

- Identify: Look for an inside bar on the 1-hour chart (a bar completely contained within the range of the previous bar). This signifies a period of consolidation and potential energy build-up.

- Entry: Enter a long position if price breaks above the high of the mother bar, or a short position if price breaks below the low of the mother bar.

- Confirmation: Ensure the breakout occurs with conviction, preferably with increased volume or a strong momentum candle.

- Stop-loss: Place your stop-loss at the opposite side of the mother bar. This clearly defines your risk for each trade.

- Take-profit: Use a minimum risk-reward ratio of 1:2, or target the next significant support or resistance level visible on the 1-hour chart.

4. The Swing High/Low Failure Strategy

This strategy aims to catch the beginning of new trends within the 1-hour timeframe:

- Identify: Look for a failed attempt to make a new higher high in an uptrend, or a new lower low in a downtrend on the 1-hour chart.

- Entry: Enter a short position when price fails to make a new higher high and breaks below the previous swing low. Enter a long position when price fails to make a new lower low and breaks above the previous swing high.

- Confirmation: Look for a strong closure beyond the previous swing point. A momentum candle (a large-bodied candle in the direction of the new potential trend) can serve as good confirmation.

- Stop-loss: Place your stop-loss above the recent swing high for shorts, or below the recent swing low for longs.

- Take-profit: Target the next major support or resistance level visible on the 1-hour chart, or use a trailing stop to maximize profits in case of a strong trend development.

5. The Three-Push Pattern Strategy

This strategy identifies potential reversals after strong trends within the 1-hour chart:

- Identify: Look for three consecutive pushes in the direction of the trend on the 1-hour chart, with each push showing less momentum (smaller candles or longer wicks).

- Entry: Enter a counter-trend position after the third push shows clear signs of exhaustion (such as a reversal candlestick pattern like a pin bar or engulfing candle).

- Confirmation: Wait for a break of the trendline connecting the three pushes. This often signifies that the trend is losing steam and a reversal may be imminent.

- Stop-loss: Place your stop-loss beyond the extreme of the third push. This allows some room for market volatility while clearly defining your risk.

- Take-profit: Target the origin of the three-push move, or use a risk-reward ratio of at least 1:2. In strong reversals, you might see price retrace the entire three-push move quite quickly.

Remember, these price action strategies require practice and a deep understanding of market structure. Always combine them with proper risk management and be aware of key fundamental factors that might influence the market.

Read More: Comprehensive Guide to Multi-Timeframe Scalping Strategy

When using these strategies for 1-hour swing trading, pay extra attention to the timing of your trades. The 1-hour chart can be particularly sensitive to market opens, closes, and major economic news releases. Consider using an economic calendar to avoid trading during potentially volatile news events unless that’s part of your specific strategy.

Implementing Your 1-Hour Swing Trading Strategy

Follow these steps to execute your strategy effectively:

- Market Selection: Choose liquid markets with consistent volatility. Major forex pairs like EUR/USD, GBP/USD, and USD/JPY often provide good opportunities for 1-hour swing trading.

- Time Frame Setup: Use 1-hour charts as your primary view, with 15-minute charts for entry precision. Consider also glancing at 4-hour charts to understand the broader trend.

- Pre-Market Analysis: Identify potential trade setups before the hour begins. Look for key support and resistance levels, ongoing trends, and any significant news events that might impact the market.

- Entry Triggers: Wait for confirmation signals before entering a trade. This could be a candlestick pattern, a break of a key level, or a combination of technical indicators aligning.

- Position Sizing: Calculate your position size based on your risk tolerance. Use a position size calculator to ensure you’re risking the appropriate amount per trade.

- Trade Management: Monitor your trade actively, adjusting stop-loss and take-profit levels as needed. Consider using a trailing stop to lock in profits as the trade moves in your favor.

- Exit Strategy: Have a clear plan for exiting trades, whether at your profit target or stop-loss. Don’t be afraid to take partial profits if the trade is moving strongly in your favor.

- Record and Review: Keep a detailed trading journal to track your trades, including entry and exit points, reasons for the trade, and the outcome. Regularly review this journal to identify areas for improvement.

Common Pitfalls to Avoid

Even with a solid strategy, traders can fall into traps. Here are some to watch out for:

- Overtrading: Stick to your plan and don’t force trades.

- Emotional Decision-Making: Use data and analysis, not feelings.

- Neglecting Market News: Stay informed about potential market movers.

- Inconsistent Execution: Follow your strategy consistently for best results.

Opofinance Services: Your Partner in 1-Hour Swing Trading Success

When it comes to executing your 1-hour swing trading strategy, having a reliable and regulated broker is paramount. Opofinance, an ASIC-regulated forex broker, offers a suite of services tailored to meet the needs of swing traders. With their state-of-the-art trading platform, competitive spreads, and fast execution speeds, Opofinance provides the perfect environment for implementing your 1-hour swing trading strategy.

One standout feature of Opofinance is their innovative social trading service, which allows you to learn from and copy the trades of successful swing traders. This can be especially beneficial for those new to the 1-hour strategy or looking to refine their techniques. By observing how experienced traders apply the principles of 1-hour swing trading in real-time, you can accelerate your learning curve and potentially improve your trading results.

Additionally, Opofinance is officially featured on the MT5 brokers list, ensuring you have access to one of the most powerful and popular trading platforms in the industry. MetaTrader 5 offers advanced charting capabilities, multiple timeframe analysis, and a wide range of technical indicators – all essential tools for effective 1-hour swing trading.

Safety and convenience are top priorities at Opofinance, with a wide range of secure deposit and withdrawal methods available. This means you can focus on your trading strategy without worrying about the safety of your funds or the hassle of transactions. Quick and reliable access to your capital is crucial in the fast-paced world of 1-hour swing trading, where opportunities can arise and disappear rapidly.

Conclusion

The 1-hour swing trading strategy offers a powerful way to capitalize on market movements while managing risk effectively. By mastering technical analysis, understanding price action, and implementing solid risk management practices, you can potentially achieve consistent profits in the forex market. Remember, success in 1-hour swing trading comes from discipline, continuous learning, and adapting to market conditions.

Key takeaways for successful 1-hour swing trading include:

- Develop a robust trading plan and stick to it consistently.

- Master technical analysis and price action reading skills.

- Implement strict risk management rules to protect your capital.

- Stay informed about market-moving events and news.

- Continuously educate yourself and refine your strategy based on performance.

- Choose a reliable broker like Opofinance that provides the necessary tools and support.

With the right approach and a reliable broker like Opofinance by your side, you’re well-equipped to navigate the exciting world of short-term trading. Start implementing these strategies today and watch your trading performance soar!

Remember, while 1-hour swing trading can be highly rewarding, it also comes with risks. Always trade responsibly and never risk more than you can afford to lose. With dedication, practice, and the right mindset, you can harness the power of 1-hour swing trading to potentially boost your forex trading success.

How does 1-hour swing trading differ from day trading?

While both involve short-term trading, 1-hour swing trading focuses on capturing moves within a specific 1-hour window, whereas day trading can involve multiple trades throughout the entire trading day. Swing trading generally aims for larger price movements and may hold positions for longer periods, even overnight in some cases. 1-hour swing trading offers a more structured approach, allowing traders to concentrate their efforts during specific times of day, potentially leading to better work-life balance.

Can I use 1-hour swing trading strategies on cryptocurrencies?

Yes, 1-hour swing trading strategies can be applied to cryptocurrencies. However, it’s important to note that crypto markets are often more volatile and less regulated than traditional forex markets. Traders should adjust their risk management accordingly and be prepared for potentially wider price swings. When trading cryptocurrencies, pay extra attention to liquidity, as some alt-coins may not have sufficient volume for effective 1-hour swing trading.

What’s the ideal account size for starting 1-hour swing trading?

The ideal account size depends on your risk tolerance and trading goals. However, many experts recommend starting with at least $5,000 to $10,000 for forex swing trading. This allows for proper position sizing and risk management, giving you enough capital to withstand potential losses while still having room for growth. Remember, it’s not just about the account size, but also about risking an appropriate percentage per trade. Even with a smaller account, you can practice 1-hour swing trading by using micro lots and maintaining strict risk management.

One Response

My brother recommended I might like this blog. He was once totally right. This publish actually made my day. You cann’t imagine just how much time I had spent for this info! Thanks!