Are you chasing the thrill of the Forex market, eager to seize profits in the blink of an eye? The gbp usd 1 minute strategy could be your high-speed entry into the world of Forex trading. For traders seeking rapid action, the GBP/USD pair, known for its dynamic movements and tight spreads when trading with a reputable forex broker, presents a compelling arena for scalping.

This article is your in-depth guide to mastering the GBP USD 1 min strategy. We will unpack the GBP/USD pair’s unique characteristics, equip you with essential technical tools, and reveal potent scalping techniques. If you’re ready to dive into an intense trading style and discover if the GBP USD 1 Minute Forex Strategy aligns with your ambitions, keep reading to learn how to navigate the one-minute charts and potentially capture swift gains.

Understanding GBP/USD Dynamics for Scalping: Riding the Wave of Volatility

Before diving into the heart-pounding action of 1-minute scalping, it’s crucial to understand why the GBP/USD currency pair is a favorite among scalpers. The ‘Cable’, as it’s affectionately known, is renowned for its:

- Volatility: GBP/USD exhibits significant price swings, especially during peak trading sessions. This inherent volatility presents numerous short-term trading opportunities, which are the lifeblood of scalping strategies.

- Liquidity: As one of the most traded currency pairs globally, GBP/USD boasts exceptional liquidity. This ensures tight spreads and easier order execution, essential for minimizing costs and maximizing profits in scalping.

Decoding GBP/USD Volatility and Spreads

For scalpers, every pip counts, and understanding the nuances of GBP/USD’s behavior is paramount:

- Volatility Characteristics: The pair’s volatility tends to spike during the London and New York trading session overlap (approximately 8:00 AM to 12:00 PM GMT). This period sees the highest trading volume and the most significant price movements, offering prime scalping conditions for your GBP USD 1 Minute Forex Strategy.

- Typical Spread Ranges: Tight spreads are crucial for scalping. With reputable online forex broker platforms, you can typically expect spreads on GBP/USD to range from 0.8 to 2 pips during liquid hours. Be mindful that spreads can widen during news events or less liquid trading hours, impacting profitability when implementing a gbp usd 1 minute strategy.

Optimal Trading Sessions and News Events

Timing is everything in 1-minute scalping, especially with GBP/USD:

- Optimal Trading Sessions: Focus your scalping efforts during the London/New York overlap. This is when market participation is highest, leading to tighter spreads and increased volatility – the ideal environment for the GBP USD 1 min strategy.

- Impact of News Events: Economic announcements from the UK and the US can trigger violent price reactions in GBP/USD. While news events can create opportunities, they also amplify risk due to increased volatility and potential spread widening. Be aware of the economic calendar and consider avoiding trading immediately before and after high-impact news releases unless you are employing specific news trading strategies. Key news to watch includes GDP figures, inflation reports, employment data, and central bank announcements from both countries, all crucial for traders using a GBP USD 1 Minute Forex Strategy.

Read More: 1 minute forex trading strategy

Key Technical Indicators for GBP/USD 1-Minute Scalping: Your Scalping Toolkit

To effectively navigate the rapid price movements of the GBP USD 1 Minute Trading Strategy, you need the right technical indicators in your arsenal. These tools help you identify fleeting opportunities and make split-second decisions.

Momentum Indicators: Gauging Short-Term Price Thrust

Momentum indicators are invaluable for scalping, helping you pinpoint the strength and direction of short-term price movements when employing a gbp usd 1 minute strategy:

- Moving Average Convergence Divergence (MACD): On a 1-minute chart, the MACD is used to detect short-term momentum shifts. Look for quick crossovers of the MACD line and the signal line to identify potential entry and exit points. A bullish crossover (MACD line crossing above the signal line) suggests upward momentum, while a bearish crossover indicates downward momentum when trading the GBP USD 1 min strategy.

- Relative Strength Index (RSI): The RSI is excellent for identifying overbought and oversold conditions in the ultra-short term. In GBP USD 1 Minute Forex Strategy, consider RSI readings above 70 as overbought and below 30 as oversold, signaling potential reversals. However, in strong trending markets, these levels can be breached, so use RSI in conjunction with other indicators for your gbp usd 1 minute strategy.

- Stochastic Oscillator: Similar to RSI, the Stochastic Oscillator is a momentum indicator that compares a security’s closing price to its price range over a given period. It’s particularly sensitive to price changes, making it useful for capturing short-term momentum changes in GBP/USD scalping. Look for crossovers of the %K and %D lines in overbought or oversold territory for potential trade signals in your GBP USD 1 Minute Forex Strategy.

Volatility & Range Indicators: Measuring Market Swings

Understanding volatility and price ranges is critical for setting realistic profit targets and stop-loss levels in scalping, especially when using a gbp usd 1 minute strategy:

- Bollinger Bands: These bands dynamically adjust to volatility, widening as volatility increases and contracting as it decreases. In gbp usd 1 minute strategy, Bollinger Bands can help identify potential breakout or reversal points. Price breaking above the upper band might suggest overextension and a potential pullback, while price breaking below the lower band could indicate overselling and a possible bounce when trading the GBP USD 1 min strategy.

- Average True Range (ATR): The ATR measures the average price movement of GBP/USD over a specified period. On a 1-minute chart, the ATR helps you understand the pair’s typical price fluctuation within that minute. This is vital for setting appropriate stop-loss and take-profit levels that are proportional to the current market volatility when implementing a GBP USD 1 Minute Forex Strategy.

Support and Resistance Tools: Pinpointing Key Price Levels

Identifying key support and resistance levels is essential for determining strategic entry and exit points when using a gbp usd 1 minute strategy:

- Pivot Points: Pivot points are intraday support and resistance levels calculated from the previous day’s high, low, and closing prices. They are widely used by day traders and scalpers to identify potential areas where price may react. In GBP USD 1 min strategy, pivot points can serve as dynamic levels for placing orders or anticipating price reversals.

- Fibonacci Retracements: Fibonacci retracement levels are horizontal lines that indicate potential areas of support or resistance. They are derived from Fibonacci ratios (e.g., 23.6%, 38.2%, 50%, 61.8%) and applied to identify potential reaction areas in GBP/USD charts. Scalpers often watch for price reactions at these levels for quick trades in their GBP USD 1 Minute Forex Strategy.

- Prior Day’s High/Low: The previous day’s high and low prices often act as significant intraday support and resistance levels. Many scalpers monitor these levels in Gbp usd 1 minute strategy to anticipate potential breakouts or reversals at these price extremes.

Effective 1-Minute GBP/USD Scalping Strategies: Actionable Techniques

Now, let’s delve into specific, actionable scalping strategies you can employ with the GBP/USD pair, leveraging the indicators discussed for your GBP USD 1 Minute Forex Strategy.

London Breakout Scalping: Capitalizing on the London Open

The London session open is renowned for injecting significant volatility into the Forex market, especially for GBP pairs. The London Breakout strategy aims to capture the initial surge in volatility and momentum, and can be very effective with a gbp usd 1 minute strategy:

- Capitalizing on London Session Volatility: The strategy focuses on the first few hours of the London trading session when GBP/USD typically experiences a surge in trading volume and price movement, ideal for implementing a GBP USD 1 Minute Forex Strategy.

- Identifying Breakout Opportunities: Look for range breakouts that occur at the beginning of the London session. Often, the price will consolidate in a tight range during the Asian session and then break out as London traders enter the market, presenting opportunities for your gbp usd 1 minute strategy.

- Entry and Exit Techniques:

- Entry: Place buy stop orders above the Asian session range high and sell stop orders below the Asian session range low when using a GBP USD 1 Minute Forex Strategy.

- Exit: Aim for quick profits, targeting 5-10 pips. Use tight stop-loss orders just below the entry point to protect capital when implementing your gbp usd 1 minute strategy.

News Event Scalping (GBP/USD Focused): Trading the Headlines

Economic news releases can cause rapid and substantial price movements in GBP/USD. News event scalping seeks to profit from this volatility, and can be integrated into a GBP USD 1 Minute Forex Strategy:

- Trading Around UK and US News: Focus on high-impact economic news releases from the UK and the US, such as GDP, inflation, and employment figures. These events are known to heavily influence GBP/USD and are crucial for news event scalping with a gbp usd 1 minute strategy.

- Managing Volatility and Spread Widening: Be prepared for increased volatility and wider spreads around news releases. It’s crucial to use limit orders to manage entry prices and have robust risk management in place when applying a GBP USD 1 Minute Forex Strategy during news events.

- Specific News Indicators to Monitor: Keep a close watch on economic calendars for announcements from sources like the Bank of England, the UK Office for National Statistics, the U.S. Federal Reserve, and the U.S. Bureau of Labor Statistics, essential for successful news event scalping in your GBP USD 1 Minute Forex Strategy.

Read More: Gbpusd scalping strategy

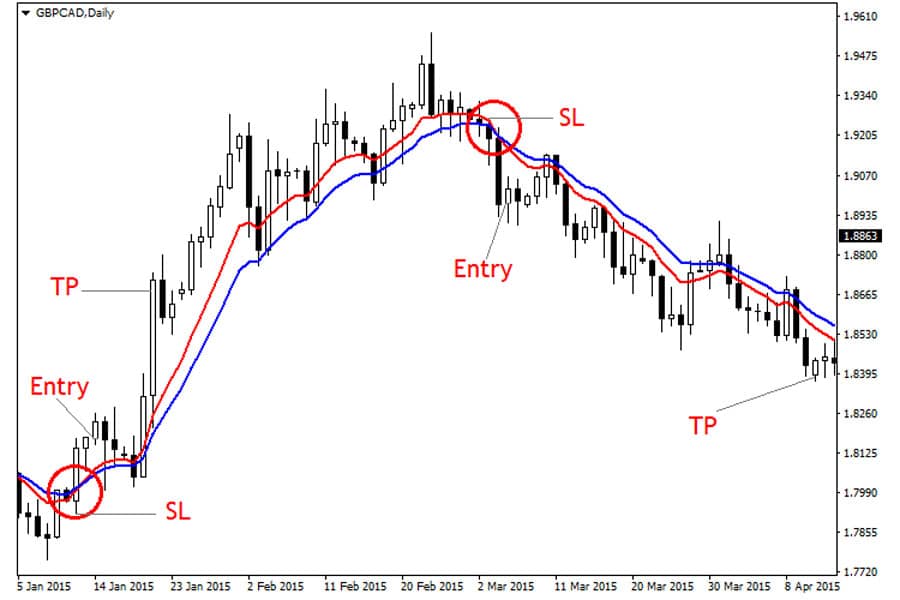

Moving Average Crossover Scalping: Riding Short-Term Trends

Moving average crossovers can signal short-term trend changes in the fast-paced 1-minute timeframe, a cornerstone of many GBP USD 1 Minute Trading Strategy approaches:

- Using Fast and Slow Moving Averages: Employ a combination of a fast moving average (e.g., 5-period EMA) and a slow moving average (e.g., 20-period EMA) as part of your gbp usd 1 minute strategy.

- Optimized Moving Average Periods: For GBP USD 1 Minute Trading Strategy, these periods are optimized for capturing very short-term trends. Experiment with slightly different periods to find what works best under various market conditions for your gbp usd 1 minute strategy.

- Entry and Exit Rules:

- Entry: Buy when the fast MA crosses above the slow MA, indicating potential upward momentum. Sell when the fast MA crosses below the slow MA, signaling potential downward momentum in your GBP USD 1 Minute Forex Strategy.

- Exit: Place take-profit orders at a small pip target (e.g., 5-7 pips) and stop-loss orders just below/above the entry point when employing a gbp usd 1 minute strategy.

Range-Bound Scalping within GBP/USD: Trading Sideways Markets

When GBP/USD enters a consolidation phase, range-bound scalping can be effective, especially within a comprehensive GBP USD 1 Minute Forex Strategy:

- Identifying Tight Trading Ranges: Look for periods where GBP/USD price action is confined between clear support and resistance levels on the 1-minute chart. These ranges often occur during quieter trading sessions, creating ideal scenarios for a gbp usd 1 minute strategy.

- Buying at Support and Selling at Resistance: The core of range-bound scalping is to buy near the range’s support level and sell near the resistance level, a fundamental tactic in a GBP USD 1 Minute Forex Strategy.

- Stop-Loss and Take-Profit Placement: Place stop-loss orders just outside the range (below support or above resistance) to protect against breakouts. Set take-profit orders near the opposite end of the range when using a gbp usd 1 minute strategy.

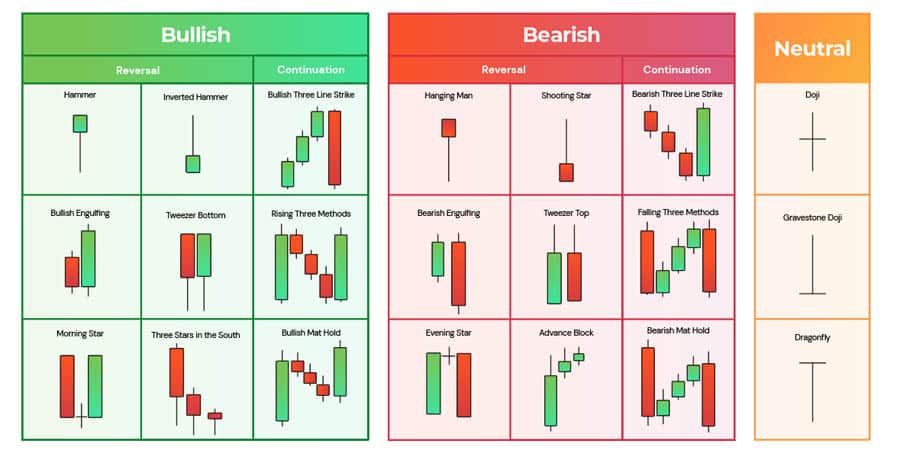

Scalping with Candlestick Patterns on GBP/USD: Price Action Signals

Candlestick patterns provide quick visual signals of potential price reversals or continuations, valuable for quick decisions in a GBP USD 1 Minute Forex Strategy:

- Recognizing High-Probability Candlestick Patterns: Focus on patterns like Engulfing Patterns, Pin Bars, and Morning/Evening Stars, which can offer strong signals on the 1-minute GBP/USD chart and enhance your gbp usd 1 minute strategy.

- Using Candlestick Signals for Entry and Confirmation: For example, a bullish engulfing pattern forming at a support level can be a strong buy signal. A bearish pin bar at resistance can signal a potential sell opportunity within your GBP USD 1 Minute Forex Strategy.

- Combining Candlestick Patterns with Other Indicators: Enhance the reliability of candlestick signals by using them in conjunction with momentum indicators like RSI or Stochastic to confirm overbought or oversold conditions at pattern formation, improving the precision of your GBP USD 1 Minute Forex Strategy.

Read More: Best stochastic settings for 1 minute

Risk Management for GBP/USD 1-Minute Scalping: Protecting Your Capital

Given the high frequency and rapid nature of Gbp usd 1 minute strategy, robust risk management is not just advisable—it’s essential for survival. Proper risk management is key to successfully deploying a GBP USD 1 Minute Forex Strategy.

Tailoring Risk Management to GBP/USD Volatility

GBP/USD’s inherent volatility demands a tailored approach to risk management, especially when employing a gbp usd 1 minute strategy:

- Importance of Tight Stop-Loss Orders: Due to rapid price swings, tight stop-loss orders are crucial. In GBP USD 1 min strategy, stop losses should be placed strategically, often just a few pips away from your entry point, adjusted based on the ATR to accommodate GBP/USD’s typical minute-to-minute volatility.

- Position Sizing Considerations: Conservative position sizing is vital. Never risk a large percentage of your capital on a single trade. A common guideline is to risk no more than 0.5% to 1% of your trading capital per trade, especially when scalping GBP/USD using a GBP USD 1 Minute Forex Strategy.

Managing Slippage, Spread Risk, and Emotional Control

Additional risk factors specific to scalping GBP/USD and using a gbp usd 1 minute strategy include:

- Managing Slippage and Spread Risk: Slippage (the difference between your expected order price and the actual execution price) and spread widening can erode profits in scalping. Choose a broker for forex trading with tight spreads and fast execution speeds, especially during volatile periods, to mitigate these risks in your GBP USD 1 Minute Forex Strategy. Consider a regulated forex broker for enhanced security and reliability.

- Emotional Control and Disciplined Execution: The fast-paced nature of 1-minute scalping can be emotionally taxing. Fear and greed can lead to impulsive decisions that can negatively impact your GBP USD 1 Minute Forex Strategy. Strict adherence to your trading plan, disciplined entry and exit execution, and maintaining emotional detachment are crucial for consistent performance when using a gbp usd 1 minute strategy.

Pro Tips for Advanced Traders: Sharpening Your Scalping Edge

- Automate Your Strategy: Consider automating parts of your strategy using Expert Advisors (EAs) or trading bots. Automation can help execute trades with the speed and precision required for 1-minute scalping, removing emotional biases and ensuring consistent execution of your rules within your GBP USD 1 Minute Forex Strategy.

- Advanced Order Types: Explore using advanced order types like One-Cancels-the-Other (OCO) or If-Done orders to manage entries and exits more efficiently in your gbp usd 1 minute strategy. These tools can help you pre-set both profit targets and stop-loss levels, crucial for fast-moving markets.

- Correlation Analysis: GBP/USD doesn’t trade in isolation. Analyze correlations with other currency pairs or indices to gain a broader market context when implementing your GBP USD 1 Minute Forex Strategy. For instance, movements in EUR/USD or related indices can sometimes provide leading indications for GBP/USD price action.

Opofinance Services: Elevate Your GBP/USD Scalping Experience

Looking for a broker for forex that can support your Gbp usd 1 minute strategy with cutting-edge tools and reliable services? Consider Opofinance, an ASIC-regulated broker, designed to enhance your trading journey. Opofinance provides a suite of services tailored for the demands of modern Forex trading:

- Advanced Trading Platforms: Trade on industry-leading platforms including MT4, MT5, and cTrader, known for their robust charting tools and fast execution capabilities, essential for scalping. Explore OpoTrade, Opofinance’s innovative platform designed for intuitive trading, perfect for implementing your GBP USD 1 Minute Forex Strategy.

- Innovative AI Tools: Gain a trading edge with Opofinance’s AI-powered tools:

- Utilize AI Market Analyzer: Get real-time market insights and potential trading opportunities generated by AI algorithms to inform your GBP USD 1 Minute Forex Strategy.

- AI Coach: Benefit from personalized trading guidance and analytics to refine your strategies and improve your gbp usd 1 minute strategy.

- AI Support: Access instant, AI-driven customer support to resolve queries quickly, ensuring smooth execution of your GBP USD 1 Minute Forex Strategy.

- Social & Prop Trading: Engage with a community of traders, share strategies, and explore prop trading opportunities to potentially amplify your trading capital when using your GBP USD 1 Minute Forex Strategy.

- Secure & Flexible Transactions: Enjoy peace of mind with safe and convenient deposit and withdrawal methods, including crypto payments. Opofinance offers zero fees on deposits and withdrawals, maximizing your trading efficiency for your GBP USD 1 Minute Forex Strategy.

Conclusion: Is 1-Minute GBP/USD Scalping Right for You?

The GBP/USD 1 minute strategy offers a high-octane approach to Forex trading, promising rapid profit potential for those who can master its intricacies. It’s a strategy that demands focus, quick decision-making, and robust risk management. While the allure of fast gains is strong, it’s crucial to recognize the inherent risks and challenges of a GBP USD 1 Minute Forex Strategy.

Success in 1-minute GBP/USD scalping hinges on a deep understanding of the pair’s dynamics, skillful application of technical indicators, and disciplined strategy execution. It’s not a path for the faint of heart or those seeking overnight riches. However, for traders equipped with the right knowledge, tools, and mindset, the GBP USD 1 Minute Forex Strategy can be a dynamic and potentially rewarding way to engage with the Forex market. Remember to always prioritize education, practice on a demo account with a reliable forex trading broker, and manage your risk diligently as you explore the exciting world of GBP USD 1 Minute Forex Strategy.

Key Takeaways:

- GBP/USD Volatility is Key: Leverage the GBP/USD pair’s volatility and liquidity, especially during the London/New York overlap, for your GBP USD 1 Minute Forex Strategy.

- Master Essential Indicators: Utilize momentum, volatility, and support/resistance indicators to identify scalping opportunities within your gbp usd 1 minute strategy.

- Implement Effective Strategies: Choose strategies like London Breakout, News Event, Moving Average Crossover, Range-Bound, or Candlestick Pattern scalping to optimize your GBP USD 1 Minute Forex Strategy.

- Risk Management is Paramount: Employ tight stop-losses, conservative position sizing, and manage emotional discipline rigorously when using a gbp usd 1 minute strategy.

- Continuous Learning and Practice: Scalping requires constant refinement and adaptation. Practice on a demo account and continuously analyze your performance to master your GBP USD 1 Minute Forex Strategy.

Can beginners successfully use the GBP/USD 1-minute scalping strategy?

While theoretically accessible to beginners, the GBP/USD 1-minute scalping strategy is generally better suited for those with some Forex trading experience. The fast-paced nature and the need for quick decision-making can be overwhelming for novices. It’s recommended that beginners first gain a solid understanding of Forex basics, technical analysis, and risk management on longer timeframes before attempting GBP USD 1 Minute Forex Strategy. Starting with a demo account with a broker for forex trading is crucial to practice and assess if this high-pressure style aligns with their trading personality and skills.

What is the ideal capital needed to start GBP/USD 1-minute scalping?

There’s no fixed capital amount, but it’s wise to start with a capital that allows for proper risk management without undue emotional stress. A smaller account, perhaps $500 to $1000, is often sufficient for beginners to practice and learn the gbp usd 1 minute strategy. The focus should be on percentage risk per trade rather than the absolute dollar amount. As your skill and confidence grow, and if your strategy proves consistently profitable, you can consider increasing your trading capital. Always ensure you’re trading with capital you can afford to lose, especially when engaging in high-risk strategies like GBP USD 1 Minute Forex Strategy scalping.

How often should I expect to trade using a 1-minute GBP/USD scalping strategy?

One of the hallmarks of 1-minute scalping is the high frequency of trades. Depending on market conditions and your specific strategy, you could be executing dozens, or even hundreds, of trades in a single trading session when using a GBP USD 1 Minute Forex Strategy. The exact frequency will vary based on your strategy rules, the volatility of GBP/USD, and the time you dedicate to trading. It’s essential to be prepared for constant monitoring of charts and rapid execution of trades when employing this gbp usd 1 minute strategy.