Are you ready to supercharge your trading game and capture quick profits in the blink of an eye? Look no further than the powerful 1-minute scalping strategy using 50 EMA and 200 EMA. This lightning-fast approach combines the precision of exponential moving averages with split-second decision-making to help you capitalize on rapid market movements. By partnering with a regulated forex broker, you can ensure a secure and reliable trading environment while executing this high-speed strategy.

In this comprehensive guide, we’ll reveal exactly how to implement the 1-minute scalping strategy using 50 EMA and 200 EMA for maximum profit potential. You’ll learn to identify high-probability trade setups, manage risk effectively, and execute trades with confidence in the fast-paced world of forex and cryptocurrency markets.

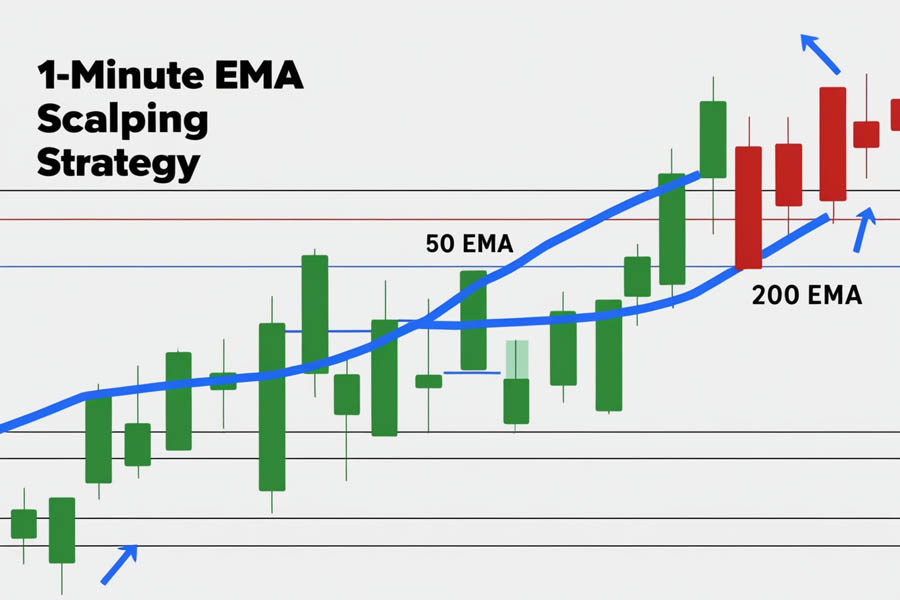

Here’s the direct answer you’re looking for: The 1-minute scalping strategy using 50 EMA and 200 EMA involves entering trades when the 50 EMA crosses the 200 EMA on a 1-minute chart, with price action confirming the move. You’ll aim to capture 10-15 pips per trade, using tight stop losses of 5-7 pips, and exiting positions within 3-5 minutes if your profit target isn’t reached.

Whether you’re a seasoned trader looking to diversify your strategies or a newcomer eager to dive into the thrilling world of scalping, this guide will equip you with the knowledge and tools to potentially boost your trading performance. Get ready to unlock the secrets of 1-minute scalping and take your trading to new heights!

What is 1-Minute Scalping?

Before we delve into the specifics of using 50 EMA and 200 EMA, let’s first understand what 1-minute scalping entails. Scalping is a trading style that aims to profit from small price changes, typically holding positions for very short periods – often just minutes or even seconds. The 1-minute scalping strategy takes this concept to the extreme, focusing on ultra-short-term trades based on 1-minute chart timeframes.

Key benefits of 1-minute scalping:

- Frequent trading opportunities

- Potential for quick profits

- Reduced exposure to long-term market risks

- Ability to capitalize on small price movements

Understanding EMA: The Foundation of Our Strategy

Exponential Moving Averages (EMAs) are crucial tools in technical analysis, offering traders insights into trend direction and potential reversal points. Unlike simple moving averages, EMAs give more weight to recent price data, making them more responsive to current market conditions.

Why EMAs Excel in Fast-Paced Markets

- Faster response to price changes: EMAs adapt quickly to new information, making them ideal for short-term trading strategies like 1-minute scalping.

- Reduced lag: The emphasis on recent data means EMAs have less lag than simple moving averages, allowing for more timely entry and exit signals.

- Trend identification: EMAs help traders identify the overall trend direction, even in rapidly changing market conditions.

- Support and resistance levels: EMAs often act as dynamic support and resistance levels, providing valuable information for trade entry and exit points.

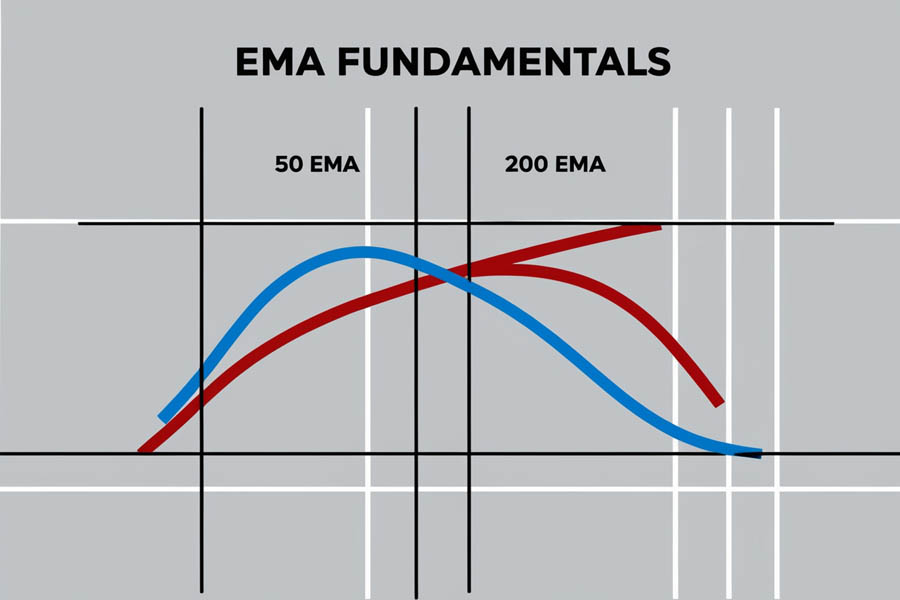

The Power of 50 EMA and 200 EMA

In our 1-minute scalping strategy, we’ll be focusing on two specific EMAs:

- 50 EMA: A short-term indicator that responds quickly to price changes

- Helps identify short-term trends and potential reversal points

- Often used by day traders and scalpers for its sensitivity to recent price action

- 200 EMA: A long-term indicator that helps identify overall trend direction

- Provides a broader perspective on market trends

- Commonly used to determine the overall market sentiment (bullish above, bearish below)

By combining these two EMAs, we create a powerful system for identifying potential entry and exit points in the fast-paced world of 1-minute scalping.

EMA Crossovers: A Key Signal

One of the most powerful signals in our strategy comes from EMA crossovers. When the 50 EMA crosses above the 200 EMA, it’s known as a “Golden Cross” and is considered a bullish signal. Conversely, when the 50 EMA crosses below the 200 EMA, it’s called a “Death Cross” and is seen as a bearish signal.

These crossovers can provide valuable insights:

- Trend confirmation: A crossover can confirm that a new trend is establishing itself.

- Potential reversal points: Crossovers often occur near important market turning points.

- Trading signals: Many traders use these crossovers as entry or exit triggers for their positions.

Read more: Mastering the 1 Minute Forex Trading Strategy

Setting Up Your Chart for 1-Minute Scalping

To implement this strategy effectively, you’ll need to set up your trading chart correctly. Here’s a step-by-step guide:

- Select a 1-minute timeframe on your preferred trading platform

- Add a 50-period EMA (typically colored blue or green)

- Add a 200-period EMA (typically colored red or orange)

- Ensure your chart displays clear price action (candlesticks or bars)

With this setup, you’re ready to start identifying potential trading opportunities.

The 1-Minute Scalping Strategy: Using 50 EMA and 200 EMA

Now that we have our chart set up, let’s dive into the core of our strategy. The 1-minute scalping approach using 50 EMA and 200 EMA is based on identifying key moments when these moving averages interact with price action and each other.

Entry Signals

- Bullish Entry:

- Price is above both the 50 EMA and 200 EMA

- The 50 EMA crosses above the 200 EMA (Golden Cross)

- A bullish candlestick forms, closing above both EMAs

- Additional confirmation: Look for increasing volume on the bullish move

- Bearish Entry:

- Price is below both the 50 EMA and 200 EMA

- The 50 EMA crosses below the 200 EMA (Death Cross)

- A bearish candlestick forms, closing below both EMAs

- Additional confirmation: Look for increasing volume on the bearish move

Exit Signals

- Take Profit:

- For long trades: When price reaches 10-15 pips above entry

- For short trades: When price reaches 10-15 pips below entry

- Consider using a trailing stop to maximize profits in strong trends

- Stop Loss:

- Place stop loss 5-7 pips away from your entry point

- Adjust based on current market volatility

- Time-Based Exit:

- Close the trade if it hasn’t reached take profit within 3-5 minutes

- This prevents getting stuck in prolonged unfavorable positions

Refining Your Entries

To improve the accuracy of your entries, consider these additional factors:

- Trend Strength:

- Look for a clear separation between the 50 EMA and 200 EMA

- The wider the gap, the stronger the trend

- Price Action Confirmation:

- Look for strong bullish or bearish candles at potential entry points

- Avoid entering on doji or indecision candles

- Support and Resistance:

- Pay attention to key support and resistance levels

- Entries near these levels can provide additional confirmation

- Fibonacci Retracements:

- Use Fibonacci levels to identify potential reversal points

- Entries at key Fibonacci levels can increase the probability of success

Managing Open Positions

Once you’ve entered a trade, active management is crucial:

- Partial Profit Taking:

- Consider closing half of your position at the initial take profit level

- Move your stop loss to breakeven on the remaining position

- Trailing Stops:

- In strong trends, use trailing stops to lock in profits

- Set the trailing stop 5-7 pips behind the current price

- Scaling Out:

- Instead of closing the entire position at once, scale out in parts

- This allows you to capture larger moves while securing profits

Advanced Techniques for 1-Minute Scalping

To take your 1-minute scalping strategy to the next level, consider incorporating these advanced techniques:

1. Multiple Timeframe Analysis

While focusing on the 1-minute chart, it’s beneficial to keep an eye on higher timeframes (5-minute, 15-minute) to confirm the overall trend direction. This can help you avoid trading against major market movements.

Read more: Discover the Best EMA for 5 Minute Charts

2. Volume Confirmation

Incorporate volume indicators to validate your entry signals. High volume during EMA crossovers can indicate stronger trend potential.

3. Price Action Patterns

Look for classic price action patterns (such as pin bars, engulfing candles, or doji) that align with your EMA signals for added confirmation.

4. Volatility Awareness

Be mindful of market volatility. During high-volatility periods, you may need to adjust your take profit and stop loss levels to account for larger price swings.

Risk Management in 1-Minute Scalping

Effective risk management is crucial when implementing a 1-minute scalping strategy. Here are some key principles to follow:

- Limit your risk per trade to 1-2% of your total account balance

- Use a risk-reward ratio of at least 1:1.5 (preferably 1:2 or higher)

- Implement a daily stop loss to protect your account from significant drawdowns

- Avoid overtrading – stick to your strategy and don’t chase every potential setup

Psychological Aspects of 1-Minute Scalping

The fast-paced nature of 1-minute scalping can be psychologically challenging. Here are some tips to maintain a healthy trading mindset:

- Develop a solid trading plan and stick to it

- Practice emotional control – don’t let fear or greed drive your decisions

- Take regular breaks to avoid mental fatigue

- Keep a trading journal to track your progress and identify areas for improvement

Common Pitfalls to Avoid

Even experienced traders can fall into traps when employing a 1-minute scalping strategy. Be aware of these common pitfalls:

- Overtrading during slow market periods

- Ignoring the impact of spread on your profitability

- Failing to adapt to changing market conditions

- Neglecting proper risk management in pursuit of quick profits

Read more: 7 Powerful 200 Day Moving Average Trading Strategies

Backtesting and Optimization

To maximize the effectiveness of your 1-minute scalping strategy using 50 EMA and 200 EMA, it’s crucial to backtest and optimize your approach. Here’s how:

- Use historical data to simulate trades based on your strategy

- Analyze the results to identify strengths and weaknesses

- Adjust parameters (such as EMA periods or take profit levels) to optimize performance

- Continuously refine your strategy based on real-world results

OpoFinance Services: Your Trusted ASIC-Regulated Broker

When it comes to executing your 1-minute scalping strategy with precision and confidence, choosing the right broker is paramount. Look no further than OpoFinance, an ASIC-regulated broker that offers a suite of services tailored to meet the needs of discerning traders.

OpoFinance stands out with its commitment to providing a secure and transparent trading environment. As an ASIC-regulated entity, they adhere to strict financial standards, ensuring the safety of your funds and the integrity of your trades. Their platform boasts lightning-fast execution speeds, crucial for the split-second decisions required in 1-minute scalping.

With competitive spreads, a wide range of tradable assets, and advanced trading tools, OpoFinance empowers traders to implement sophisticated strategies like the 50 EMA and 200 EMA scalping technique with ease. Their dedicated customer support team is always ready to assist, making your trading journey smoother and more rewarding.

Experience the difference of trading with a regulated, professional broker. Choose OpoFinance for your 1-minute scalping endeavors and take your trading to new heights.

Conclusion

Mastering the 1-minute scalping strategy using 50 EMA and 200 EMA can be a game-changer for traders seeking to capitalize on short-term market movements. By combining the power of these exponential moving averages with disciplined risk management and psychological preparedness, you can develop a potent approach to navigating the fast-paced world of scalping.

Remember, success in 1-minute scalping requires dedication, practice, and continuous learning. Start by paper trading to hone your skills, then gradually transition to live trading as you gain confidence and consistency. With persistence and the right strategy, you can unlock the potential of 1-minute scalping and take your trading to new heights.

References:

- Murphy, John J. 2009 “Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications” New York Institute of Finance (Book available on various platforms) This source is valuable because it provides a comprehensive overview of technical analysis, including detailed explanations of moving averages and their applications in trading strategies.

- Forex Factory 2023 “Moving Average (MA)” Forex Factory https://www.forexfactory.com/journal/500/moving-average-ma This reference is useful as it offers practical insights into the application of moving averages in forex trading, which is directly relevant to the scalping strategy discussed in the article.

- Chande, Tushar S. 2001 “Beyond Technical Analysis: How to Develop and Implement a Winning Trading System” Wiley Trading (Book available on various platforms) This source is important because it delves into the psychological aspects of trading and risk management, which are crucial components of successful scalping strategies.

How does the 1-minute scalping strategy using 50 EMA and 200 EMA perform in different market conditions?

The performance of the 1-minute scalping strategy using 50 EMA and 200 EMA can vary depending on market conditions. In trending markets, this strategy tends to perform well, as the EMAs can effectively identify the direction and strength of the trend. However, during ranging or highly volatile markets, the strategy may generate more false signals. It’s important to adapt your approach based on current market conditions. For example, you might widen your stop loss and take profit levels during high volatility, or look for additional confirmation signals in ranging markets. Always monitor market conditions and be prepared to adjust your strategy accordingly.

Can the 1-minute scalping strategy with 50 EMA and 200 EMA be applied to cryptocurrencies?

Yes, the 1-minute scalping strategy using 50 EMA and 200 EMA can be applied to cryptocurrency trading. However, there are some important considerations. Cryptocurrencies often experience higher volatility than traditional forex pairs, which can lead to more dramatic price swings in short timeframes. This increased volatility can potentially offer more profit opportunities, but it also comes with higher risk. When applying this strategy to cryptocurrencies, you may need to adjust your take profit and stop loss levels to account for the increased volatility. Additionally, ensure that your chosen cryptocurrency exchange offers low-latency trading and tight spreads to make 1-minute scalping viable.

How can I automate the 1-minute scalping strategy using 50 EMA and 200 EMA?

: Automating the 1-minute scalping strategy using 50 EMA and 200 EMA can be achieved through algorithmic trading or expert advisors (EAs). Here’s a general approach:

Develop a clear set of rules for entries, exits, and risk management based on the 50 EMA and 200 EMA crossovers and price action.

Use a programming language compatible with your trading platform (e.g., MQL4/5 for MetaTrader, Python for some other platforms).

Code your strategy, including functions to calculate EMAs, identify crossovers, and execute trades based on your defined rules.

Implement robust risk management features, including position sizing and stop loss placement.

Backtest your automated strategy extensively using historical data.

Forward test on a demo account to ensure real-time performance matches backtested results.

Gradually transition to live trading with small position sizes, monitoring performance closely.

Remember that while automation can remove emotional decision-making and allow for 24/7 trading, it requires careful development, testing, and ongoing monitoring to ensure it performs as expected in various market conditions.