The 3 EMA scalping strategy is a powerful forex trading technique that uses three exponential moving averages to identify short-term trends and generate quick profit opportunities. This strategy combines the 5, 9, and 21-period EMAs to provide traders with clear entry and exit signals in fast-moving markets. By mastering this strategy, you’ll be equipped to make quick, informed decisions and capitalize on short-term price movements in the forex market. Whether you’re a seasoned trader looking to refine your skills or a newcomer seeking a reliable entry point, the 3 EMA scalping strategy offers a versatile approach that can be adapted to various market conditions. In this comprehensive guide, we’ll dive deep into the intricacies of this strategy, explore its implementation with a regulated forex broker, and provide you with the tools you need to elevate your trading game.

Understanding the 3 EMA Scalping Strategy

The Three EMAs Explained

- Fast EMA (5-period): This EMA reacts quickly to price changes and helps identify immediate trends.

- Medium EMA (9-period): Provides a balance between responsiveness and smoothing, confirming short-term trends.

- Slow EMA (21-period): Offers a broader view of the trend, acting as a dynamic support or resistance level.

What is the 3 EMA Scalping Strategy?

The 3 EMA scalping strategy is a popular trading technique that utilizes three exponential moving averages (EMAs) to identify short-term trends and potential entry and exit points. This method is particularly effective for scalping, a trading style that aims to profit from small price movements over very short time frames.

Why Choose the 3 EMA Strategy?

- Simplicity: Easy to understand and implement, even for beginners.

- Versatility: Can be applied to various currency pairs and timeframes.

- Quick signals: Generates frequent trading opportunities.

- Trend confirmation: Multiple EMAs provide stronger trend confirmation.

Read More: Unveiling the 9 EMA Scalping Strategy

Implementing the 3 EMA Scalping Strategy

Step 1: Setting Up Your Charts

- Choose a forex trading platform that supports custom indicators.

- Select your preferred currency pair (e.g., EUR/USD, GBP/JPY).

- Set the chart timeframe to 5 minutes or 15 minutes for optimal scalping.

- Add the following EMAs to your chart:

- 5-period EMA (Fast)

- 9-period EMA (Medium)

- 21-period EMA (Slow)

Step 2: Identifying Trading Opportunities

Bullish Setup:

- The 5 EMA crosses above the 9 EMA

- Both the 5 EMA and 9 EMA are above the 21 EMA

- Price is above all three EMAs

Bearish Setup:

- The 5 EMA crosses below the 9 EMA

- Both the 5 EMA and 9 EMA are below the 21 EMA

- Price is below all three EMAs

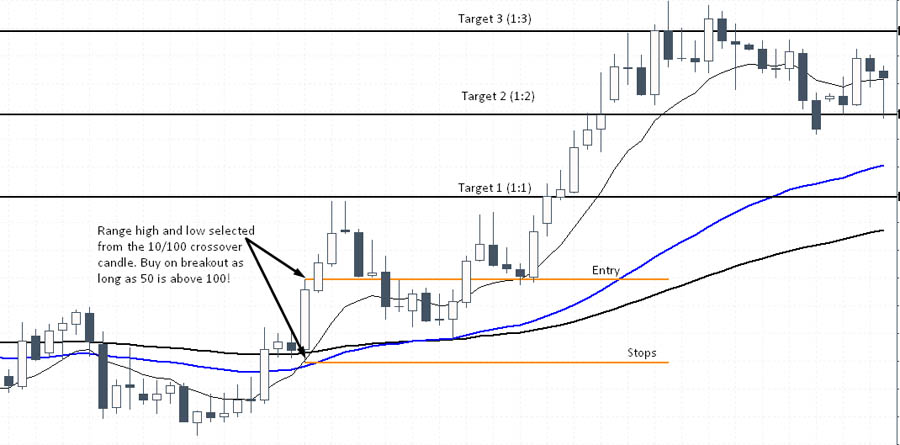

Step 3: Entry and Exit Rules

Entry:

- For long trades: Enter when the price pulls back to the 9 EMA and shows signs of bouncing.

- For short trades: Enter when the price pulls back to the 9 EMA and shows signs of rejection.

Exit:

- Set a tight stop loss just below the 21 EMA for long trades or above it for short trades.

- Take profit when the price reaches a predetermined risk-reward ratio (e.g., 1:2 or 1:3).

- Alternatively, exit when the price crosses back below (for longs) or above (for shorts) the 9 EMA.

Read More: Master the 20 EMA Scalping Strategy

Real-World Example: EUR/USD 3 EMA Scalping Trade

Let’s walk through a practical example of a 3 EMA scalping trade on the EUR/USD pair:

- Chart Setup: 5-minute EUR/USD chart with 5, 9, and 21 EMAs applied.

- Scenario: The EUR/USD is in an uptrend, with the 5 EMA above the 9 EMA, and both above the 21 EMA.

- Entry Trigger: Price pulls back to the 9 EMA and forms a bullish engulfing candle.

- Entry Point: Enter a long position at 1.1850.

- Stop Loss: Place a stop loss 5 pips below the 21 EMA at 1.1840.

- Take Profit: Set a take profit at 1.1870, giving a 1:2 risk-reward ratio.

- Trade Outcome: Price moves up to 1.1870, hitting the take profit for a 20-pip gain.

This example demonstrates how the 3 EMA strategy can be applied in real-time to identify and execute profitable trades.

Advanced Techniques for 3 EMA Scalping

Incorporating Support and Resistance

Combine the 3 EMA strategy with key support and resistance levels to increase the probability of successful trades. Look for setups where the EMAs align with these critical price levels for stronger entry and exit signals.

Practical Tip: Use horizontal line tools on your chart to mark significant price levels from the past few days. When the 9 EMA aligns with these levels, it can provide an extra layer of confirmation for your trades.

Using Multiple Timeframes

Enhance your analysis by using multiple timeframes:

- Higher timeframe (e.g., 1-hour): Identify the overall trend

- Trading timeframe (e.g., 5 or 15 minutes): Apply the 3 EMA strategy

- Lower timeframe (e.g., 1-minute): Fine-tune entries and exits

Practical Application: Before entering a 5-minute chart trade, check the 1-hour chart to ensure you’re trading in the direction of the larger trend. This can significantly improve your win rate.

Adding Volume Analysis

Incorporate volume indicators to confirm the strength of trends and potential reversals. High volume during EMA crossovers can signal stronger momentum and more reliable trading opportunities.

Volume-Based Entry Refinement: Look for increasing volume as the 5 EMA crosses the 9 EMA. Higher volume during these crossovers often indicates stronger trend moves and can lead to more profitable trades.

Risk Management in 3 EMA Scalping

Position Sizing

Proper position sizing is crucial for long-term success in scalping. Never risk more than 1-2% of your trading capital on a single trade. Use a position size calculator to determine the appropriate lot size based on your account balance and risk tolerance.

Practical Example: If you have a $10,000 account and want to risk 1% per trade, your maximum risk per trade would be $100. If your stop loss is 10 pips, you would trade 1 mini lot (10,000 units) to stay within your risk parameters.

Setting Stop Losses

Always use stop losses to protect your capital. Place your stop loss just beyond the 21 EMA to allow for minor price fluctuations while still limiting potential losses.

Dynamic Stop Loss Technique: As the trade moves in your favor, consider moving your stop loss to break-even once you’ve achieved a 1:1 risk-reward ratio. This ensures you won’t lose money on a winning trade if the market suddenly reverses.

Managing Drawdowns

Be prepared for losing streaks and drawdowns. Implement a maximum daily loss limit and stick to it religiously to preserve your trading capital during unfavorable market conditions.

Daily Loss Limit Strategy: Set a daily loss limit of 3% of your account balance. If you reach this limit, stop trading for the day and use the time to review your trades and identify areas for improvement.

Read More: Unlock Forex Success

Common Pitfalls and How to Avoid Them

- Overtrading: Stick to your trading plan and avoid the temptation to take every possible setup. Solution: Define specific criteria for your ideal trade setup and only enter trades that meet all your criteria.

- Ignoring market conditions: Be aware of major news events and avoid trading during highly volatile periods. Action Step: Keep an economic calendar handy and avoid trading 15 minutes before and after major news releases.

- Emotional trading: Maintain discipline and avoid revenge trading after losses. Practical Tip: Take a 15-minute break after any losing trade to reset your emotions before re-entering the market.

- Neglecting risk management: Always prioritize capital preservation over potential profits. Risk Management Hack: Use a trade management tool that automatically sets your stop loss and take profit levels based on your predefined risk parameters.

Optimizing Your 3 EMA Scalping Strategy

Backtesting and Forward Testing

Before trading live, thoroughly backtest your strategy using historical data. Once satisfied with the results, conduct forward testing on a demo account to simulate real market conditions.

Backtesting Workflow:

- Collect historical data for your chosen currency pair.

- Apply the 3 EMA strategy to at least 100 trades.

- Record entry, exit, and profit/loss for each trade.

- Calculate win rate, average win, average loss, and overall profitability.

- Adjust strategy parameters if necessary and repeat the process.

Keeping a Trading Journal

Maintain a detailed trading journal to track your performance, identify patterns, and continuously improve your strategy. Record key information such as:

- Entry and exit points

- Reasons for taking the trade

- Market conditions

- Emotional state

- Outcome and lessons learned

Digital Trading Journal Template:

| Date | Pair | Direction | Entry | Exit | Profit/Loss | Setup Quality (1-10) | Emotions | Notes |

| 9/27 | EUR/USD | Long | 1.1850 | 1.1870 | +20 pips | 8 | Confident | Strong trend, clean EMA crossover |

Adapting to Market Conditions

The 3 EMA scalping strategy works best in trending markets. Be prepared to adjust your approach or sit on the sidelines during ranging or choppy market conditions.

Market Type Identification:

- Trending Market: EMAs are well-spaced and moving in the same direction.

- Ranging Market: EMAs are close together and frequently crossing each other.

- Choppy Market: No clear EMA alignment, price moving erratically.

Adaptive Strategy: In ranging markets, consider widening your stop loss and take profit levels to accommodate larger price swings. In choppy markets, it’s often best to stay out and preserve your capital.

Choosing the Right Forex Broker for 3 EMA Scalping

Selecting the appropriate forex broker is crucial for successful scalping. Consider the following factors:

- Low spreads: Look for brokers offering tight spreads to minimize trading costs.

- Fast execution: Ensure your broker provides quick order execution to capitalize on short-term price movements.

- Regulatory compliance: Choose a regulated broker to protect your funds and ensure fair trading practices.

- Trading platform: Select a broker that supports your preferred trading platform (e.g., MetaTrader 4 or 5).

- Customer support: Opt for brokers with responsive customer service to address any issues promptly.

Broker Comparison Checklist:

- Average spread on major pairs

- Execution speed (in milliseconds)

- Regulatory bodies (e.g., ASIC, FCA, CySEC)

- Available trading platforms

- Customer support hours and methods (live chat, phone, email)

OpoFinance: Your Trusted Partner for 3 EMA Scalping

When it comes to implementing the 3 EMA scalping strategy, having a reliable and regulated forex broker is essential. OpoFinance stands out as an excellent choice for traders looking to maximize their potential with this powerful technique. As an ASIC-regulated broker, OpoFinance offers a secure and transparent trading environment, giving you peace of mind as you execute your scalping strategies.

OpoFinance provides a range of features that cater specifically to scalpers:

- Competitive spreads: Enjoy tight spreads that minimize your trading costs and maximize profit potential.

- Lightning-fast execution: Take advantage of OpoFinance’s advanced technology for quick order execution, crucial for successful scalping.

- MetaTrader 5 platform: Access the powerful MT5 platform, perfect for implementing and optimizing your 3 EMA scalping strategy.

- Social trading: Benefit from OpoFinance’s innovative social trading service, allowing you to learn from and copy successful traders.

- Safe and convenient deposits and withdrawals: Enjoy peace of mind with secure and efficient fund management options.

As an officially featured broker on the MT5 brokers list, OpoFinance demonstrates its commitment to providing top-tier services to forex traders. Whether you’re new to the 3 EMA scalping strategy or looking to refine your approach, OpoFinance offers the tools, support, and security you need to thrive in the fast-paced world of forex scalping.

Conclusion

The 3 EMA scalping strategy offers a powerful and versatile approach to forex trading, combining simplicity with effectiveness. By mastering this technique and adhering to strict risk management principles, you can potentially unlock consistent profits in the forex market. Remember that success in trading requires continuous learning, adaptation, and discipline. With dedication and practice, the 3 EMA scalping strategy can become a valuable tool in your trading arsenal, helping you navigate the dynamic world of forex with confidence and precision.

As you embark on your journey with the 3 EMA scalping strategy, consider partnering with a reputable broker like OpoFinance to ensure you have the best possible foundation for success. With the right tools, knowledge, and support, you’ll be well-equipped to tackle the challenges and seize the opportunities that the forex market presents.

The world of forex trading is constantly evolving, and staying ahead of the curve is crucial for long-term success. By continuously refining your 3 EMA scalping strategy, embracing technological advancements, and adapting to changing market conditions, you’ll be well-positioned to thrive in the exciting and rewarding world of forex trading.

Can the 3 EMA scalping strategy be applied to cryptocurrencies?

Yes, the 3 EMA scalping strategy can be adapted for cryptocurrency trading. However, it’s important to note that crypto markets can be more volatile than traditional forex pairs. When applying this strategy to cryptocurrencies, consider using wider stop losses and being more selective with your entries due to the increased volatility. Additionally, make sure your chosen crypto exchange offers low fees and fast execution to accommodate the high-frequency nature of scalping.

How does the 3 EMA strategy compare to other popular scalping methods?

The 3 EMA strategy stands out for its simplicity and effectiveness compared to other scalping methods. Unlike more complex strategies that may involve multiple indicators or complicated rules, the 3 EMA approach provides clear signals based on the relationship between three moving averages. This simplicity can lead to faster decision-making, which is crucial in scalping. However, it’s worth noting that no single strategy is perfect for all market conditions. Some traders may prefer strategies that incorporate additional elements like RSI or Stochastic oscillators for confirmation. Ultimately, the best strategy depends on your trading style, risk tolerance, and market analysis.

Is it possible to automate the 3 EMA scalping strategy?

Yes, it is possible to automate the 3 EMA scalping strategy using expert advisors (EAs) or trading bots. Automation can be particularly beneficial for this strategy due to its rule-based nature and the need for quick execution in scalping. To automate the 3 EMA strategy, you would need to code the entry and exit rules into a trading algorithm. This can help eliminate emotional decision-making and allow for 24/7 trading. However, it’s crucial to thoroughly backtest and forward test any automated system before using it with real money. Additionally, even with automation, regular monitoring and adjustment of the strategy parameters may be necessary to adapt to changing market conditions.