Are you struggling to find consistency in your forex trading journey? The “50 pips a week” strategy might be the game-changer you’ve been searching for. This approach is a methodical forex trading technique designed to generate steady profits by targeting a modest, achievable goal of 50 pips per week. By focusing on this realistic objective, traders can potentially earn 200 pips per month or 2,400 pips annually, leading to significant account growth while managing risk effectively.

The 50 pips a week strategy is particularly beneficial for both novice and experienced traders who want to:

- Develop a disciplined trading routine

- Minimize emotional decision-making

- Achieve consistent, long-term profitability

- Reduce the risk of blowing up their trading accounts

Whether you’re working with a regulated forex broker or exploring online forex trading platforms, this strategy offers a structured approach to navigate the volatile forex markets. In this comprehensive guide, we’ll break down the 50 pips a week strategy, providing you with actionable insights and practical tips to implement this powerful trading method effectively.

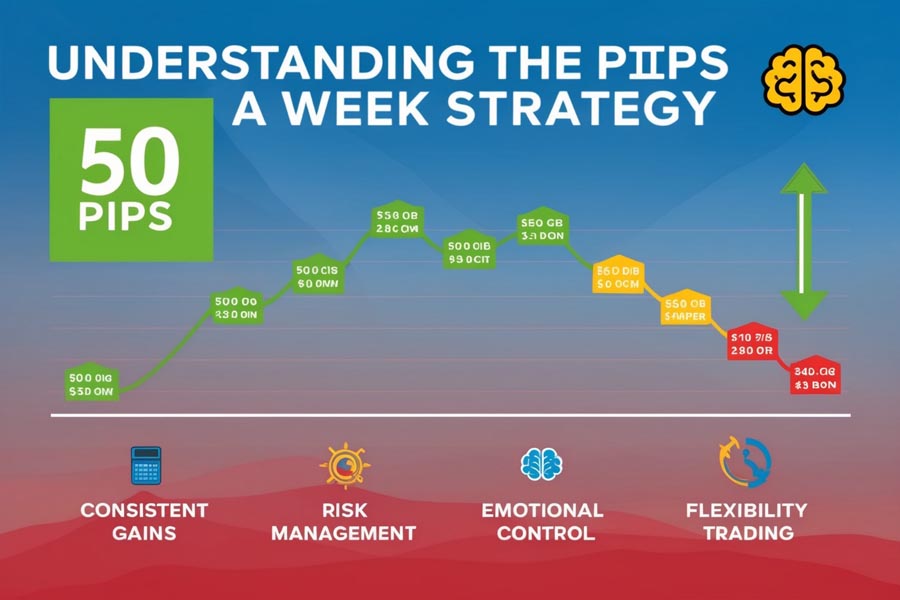

Understanding the 50 Pips a Week Strategy

What Are Pips?

Before diving deeper into the strategy, it’s crucial to have a solid understanding of pips. In forex trading, a pip (percentage in point) represents the smallest price move that a currency pair can make. For most currency pairs, one pip is equal to 0.0001 of the quoted price. For example, if the EUR/USD moves from 1.1000 to 1.1001, that’s a one-pip movement.

However, it’s worth noting that some currency pairs, particularly those involving the Japanese yen, have a different pip value. For these pairs, one pip is typically 0.01. Understanding pip values is crucial for calculating potential profits and losses accurately.

The Concept Behind 50 Pips a Week

The 50 pips a week strategy is built on the principle of consistent, modest gains over time. Instead of aiming for large, risky trades, traders focus on accumulating smaller profits that add up to 50 pips by the end of the week. This approach offers several advantages:

- Risk Management: By limiting your weekly goal, you reduce the temptation to overleverage or take unnecessary risks. This disciplined approach helps protect your capital and ensures longevity in the forex market.

- Emotional Control: A modest target helps prevent the emotional highs and lows that often lead to poor decision-making. By focusing on a achievable weekly goal, traders can maintain a more level-headed approach to their trading activities.

- Consistency: Regular small wins can lead to significant account growth over time. The compounding effect of consistent profits can result in substantial gains in the long run.

- Flexibility: This strategy can be adapted to various trading styles and time frames, making it suitable for day traders, swing traders, and even those who can only dedicate a few hours a week to trading.

- Improved Focus: With a clear weekly target, traders can better concentrate on executing their strategy rather than getting distracted by market noise or chasing unrealistic profits.

- Scalability: As traders become more proficient with the strategy, they can scale up their position sizes to increase profits while maintaining the same disciplined approach.

Implementing the 50 Pips a Week Strategy

Step 1: Choose Your Currency Pairs

Selecting the right currency pairs is crucial for the success of the 50 pips a week strategy. Not all currency pairs are created equal, and some are more suitable for this approach than others. Consider these factors when choosing your pairs:

- Volatility: Choose pairs with enough movement to reach your target without excessive risk. Pairs like EUR/USD, GBP/USD, and USD/JPY often provide a good balance of volatility and stability.

- Spread: Lower spread pairs can help maximize your profits. The spread is the difference between the bid and ask price, and tighter spreads mean you start your trade closer to profitability.

- Familiarity: Stick to pairs you understand and have experience trading. Each currency pair has its own characteristics and is influenced by specific economic factors.

- Correlation: Consider trading uncorrelated or negatively correlated pairs to diversify your risk. For example, if you’re trading EUR/USD, you might want to avoid or be cautious with pairs like GBP/USD, which often move in a similar direction.

- Liquidity: Major currency pairs typically offer better liquidity, which can result in faster execution and less slippage.

Read More: 100 Pips a Week

Here’s a list of popular currency pairs often used in the 50 pips a week strategy:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

- USD/CHF (US Dollar/Swiss Franc)

Remember, it’s often better to master trading a few pairs rather than spreading yourself too thin across many different currencies.

Step 2: Determine Your Trading Schedule

Consistency is key in the 50 pips a week strategy. Establishing a trading schedule that fits your lifestyle and aligns with the market’s most active hours is crucial for success. Here are some options to consider:

- Daily Trading: Aim for 10 pips per day over a 5-day trading week. This approach requires daily commitment but allows for smaller, more manageable trades.

- Several Sessions Per Week: Trade 2-3 times a week, targeting larger moves. This option is suitable for those who can’t commit to daily trading but can dedicate larger blocks of time on specific days.

- End-of-Week Trading: Focus on weekly trends and aim for all 50 pips in one or two trades. This approach requires patience and the ability to identify and capitalize on larger market movements.

When creating your schedule, consider these factors:

- Market Hours: The forex market is open 24 hours a day, five days a week, but certain times are more active than others. The most volatile periods often occur when multiple major markets overlap, such as the London-New York overlap (8:00 AM – 12:00 PM EST).

- Economic Releases: Be aware of major economic data releases and central bank announcements that can cause significant market movements.

- Your Time Zone: Choose trading hours that align with your most alert and focused times of day.

- Work and Personal Commitments: Ensure your trading schedule doesn’t conflict with your job or important personal responsibilities.

- Rest and Recovery: Include time for rest and analysis in your schedule. Continuous trading without breaks can lead to burnout and poor decision-making.

Here’s a sample weekly schedule for a trader aiming for 50 pips:

- Monday: Analysis and preparation, no trading

- Tuesday: Trade during London open, aim for 20 pips

- Wednesday: Trade during US open, aim for 15 pips

- Thursday: Trade during Asian session, aim for 15 pips

- Friday: Wrap up any open positions, aim for remaining pips if needed

Remember, flexibility is important. Be prepared to adjust your schedule based on market conditions and your performance.

Step 3: Set Up Your Charts and Indicators

While the 50 pips a week strategy can work with various technical analysis tools, having a well-organized chart setup is crucial for effective decision-making. Here’s a comprehensive guide to setting up your charts and indicators:

- Time Frames: Use a combination of time frames for a more comprehensive market view:

- 4-hour chart: For identifying overall trends and key support/resistance levels

- 1-hour chart: For fine-tuning entry and exit points

- 15-minute chart: For precise trade management and spotting short-term patterns

- Moving Averages: Apply these to identify trends and potential support/resistance areas:

- 50-period Exponential Moving Average (EMA): For short to medium-term trend identification

- 200-period EMA: For long-term trend identification

- Consider using different colors for each MA for easy visual distinction

- RSI (Relative Strength Index): Use the RSI to spot overbought or oversold conditions:

- Set the RSI period to 14 (standard setting)

- Look for overbought conditions above 70 and oversold conditions below 30

- Pay attention to RSI divergences for potential trend reversals

- Bollinger Bands: These can help identify volatility and potential breakouts:

- Standard settings: 20-period with 2 standard deviations

- Look for price approaching or touching the bands for potential reversal or continuation signals

- MACD (Moving Average Convergence Divergence): Use MACD for trend confirmation and momentum analysis:

- Standard settings: 12, 26, 9

- Look for MACD line crossovers with the signal line for potential entry signals

- Support and Resistance Levels: Mark key levels to identify potential entry and exit points:

- Use horizontal lines to mark significant price levels from the past

- Pay attention to psychological round numbers (e.g., 1.3000, 1.3500)

- Consider using Fibonacci retracement tools for dynamic support and resistance levels

- Candlestick Patterns: Familiarize yourself with key candlestick patterns for additional confirmation:

- Doji: Indicates indecision and potential reversal

- Engulfing patterns: Strong reversal signals

- Pin bars: Potential reversal or continuation signals

- Volume Indicator: While not always available for forex, if your broker provides it, volume can offer valuable insights:

- Look for volume confirmation of price moves

- High volume on breakouts can indicate stronger moves

- Currency Strength Meter: This tool can help you identify strong and weak currencies across multiple pairs:

- Use it to confirm your analysis on individual pairs

- Look for opportunities where a strong currency is paired against a weak one

- Economic Calendar: While not a chart indicator, keep an economic calendar visible or easily accessible:

- Mark important economic releases that could impact your traded pairs

- Be cautious or avoid trading around high-impact news events

Remember, while indicators can provide valuable insights, they should not be relied upon exclusively. Always use multiple confirmations and combine technical analysis with fundamental awareness for the best results.

Read More: 500 Pips a Week

Step 4: Develop Your Entry and Exit Rules

Clear, predefined rules are crucial for successful implementation of the 50 pips a week strategy. Here’s a sample ruleset:

Entry Rules:

- Identify the overall trend using the 200 EMA on the 4-hour chart.

- Look for pullbacks to the 50 EMA on the 1-hour chart.

- Confirm the entry with RSI (oversold in an uptrend, overbought in a downtrend).

- Enter the trade when price action confirms the trend resumption (e.g., a bullish engulfing candle in an uptrend).

Exit Rules:

- Set a take-profit order at 50 pips from your entry point.

- Place a stop-loss order at 25 pips to maintain a 1:2 risk-reward ratio.

- If the trade moves 25 pips in your favor, move the stop-loss to breakeven.

- Consider trailing your stop-loss to lock in profits as the trade progresses.

Step 5: Manage Your Risk

Proper risk management is crucial for long-term success with the 50 pips a week strategy. Follow these guidelines:

- Position Sizing: Risk no more than 1-2% of your account on any single trade.

- Weekly Stop: If you hit your 50-pip target early in the week, consider stopping trading to protect your gains.

- Monthly Goals: Aim for 200 pips per month (50 pips × 4 weeks) as a realistic, achievable target.

Advanced Techniques for 50 Pips a Week

Scaling In and Out of Trades

As you become more comfortable with the strategy, consider scaling techniques to maximize profits:

- Scaling In: Enter a trade with half your planned position size, then add to the position if it moves in your favor.

- Scaling Out: Take partial profits at predetermined levels (e.g., 25 pips) and let the remainder run to 50 pips or beyond.

Incorporating Fundamental Analysis

While the 50 pips a week strategy primarily relies on technical analysis, incorporating fundamental factors can improve your success rate:

- Economic Calendar: Be aware of major economic releases that could impact your chosen currency pairs.

- Central Bank Decisions: Monitor central bank policies and statements for potential trend shifts.

- Geopolitical Events: Stay informed about global events that could cause market volatility.

Adapting to Market Conditions

The forex market is dynamic, and your strategy should be flexible enough to adapt:

- Ranging Markets: In low-volatility periods, consider reducing your pip target or focusing on range-bound trading strategies.

- Trending Markets: During strong trends, you might achieve your weekly goal in fewer trades, allowing you to be more selective.

- High-Impact News: Be cautious around major news events, as increased volatility can lead to slippage and unexpected moves.

Read More: 300 pips a week

OpoFinance: Your Trusted Partner in Forex Trading

When implementing the 50 pips a week strategy, having a reliable and regulated forex broker is crucial. OpoFinance stands out as an ASIC-regulated broker, offering traders a secure and professional trading environment. With its cutting-edge platforms, competitive spreads, and a wide range of tradable instruments, OpoFinance provides the tools you need to execute your 50 pips a week strategy effectively.

One of OpoFinance’s standout features is its social trading service, which allows you to connect with and learn from experienced traders. This can be particularly beneficial for those new to the 50 pips a week strategy, as you can observe how successful traders implement similar approaches. By combining OpoFinance’s robust trading infrastructure with the disciplined 50 pips a week strategy, you’re well-positioned to achieve consistent growth in your forex trading journey.

Conclusion

The 50 pips a week strategy offers a structured, disciplined approach to forex trading that can lead to consistent profits and steady account growth. By focusing on achievable weekly targets, managing risk effectively, and maintaining emotional control, traders can navigate the volatile forex markets with greater confidence and success.

Remember, the key to mastering this strategy lies in patience, discipline, and continuous improvement. Start small, stay consistent, and don’t be afraid to adjust your approach as you gain experience. With dedication and the right mindset, the 50 pips a week strategy could be your pathway to long-term forex trading success.

Can I use the 50 pips a week strategy with a small account?

Absolutely! The 50 pips a week strategy is particularly well-suited for smaller accounts. By focusing on achievable, consistent gains, you can grow your account steadily without taking on excessive risk. The key is to adjust your position sizes accordingly to ensure you’re risking an appropriate percentage of your account on each trade. Start with micro or mini lots if necessary, and gradually increase your position sizes as your account grows.

How long does it typically take to become proficient in the 50 pips a week strategy?

The time it takes to become proficient in the 50 pips a week strategy can vary depending on your trading experience, dedication, and market conditions. Generally, traders should expect to spend at least 3-6 months practicing and refining their approach before seeing consistent results. It’s crucial to use a demo account initially to test your strategy without risking real capital. Once you’ve achieved consistent success in demo trading for several weeks, you can consider transitioning to a live account with small position sizes.

Is the 50 pips a week strategy suitable for day trading or swing trading?

The 50 pips a week strategy is versatile and can be adapted to both day trading and swing trading styles. For day traders, it might involve taking multiple smaller trades throughout the week, aiming for 10-15 pips per trade. Swing traders, on the other hand, might prefer to hold positions for several days, targeting larger moves that can potentially exceed the 50-pip weekly goal. The key is to adapt the strategy to your preferred trading style and time availability while maintaining the core principles of consistent gains and disciplined risk management.