The 9 EMA scalping strategy is a powerful forex trading technique that combines the speed of scalping with the reliability of the 9-period Exponential Moving Average indicator. This strategy allows traders to capitalize on short-term price movements in the forex market, potentially generating quick profits through multiple small trades throughout the day. Whether you’re an experienced forex trading broker or a novice trader looking for an effective scalping method, the 9 EMA strategy offers a structured approach to navigating the fast-paced world of forex.

In this comprehensive guide, we’ll delve deep into the intricacies of the 9 EMA scalping strategy, providing you with the knowledge and tools needed to implement this technique in your own trading. From understanding the basic concepts to mastering advanced techniques, this article will serve as your ultimate resource for becoming proficient in 9 EMA scalping. By the end, you’ll have a clear roadmap for incorporating this strategy into your forex trading arsenal, potentially improving your trading outcomes and boosting your confidence in the market.

Understanding the 9 EMA Scalping Strategy

What is the 9 EMA?

The 9 EMA, or 9-period Exponential Moving Average, is a technical indicator that calculates the average price of an asset over the last 9 periods. Unlike simple moving averages, the EMA gives more weight to recent price data, making it more responsive to current market conditions. This responsiveness is what makes the 9 EMA particularly suitable for scalping strategies.

Key features of the 9 EMA:

- Reacts quickly to price changes

- Smooths out price fluctuations

- Provides a clear visual representation of short-term trends

The Basics of Scalping

Scalping is a trading style that aims to profit from small price changes, often entering and exiting trades within minutes or even seconds. Scalpers typically make numerous trades throughout the day, capitalizing on the market’s volatility. This high-frequency trading approach requires quick decision-making, discipline, and a solid understanding of market dynamics.

Characteristics of scalping:

- Short holding periods (seconds to minutes)

- High number of trades per day

- Small profit targets per trade

- Requires intense focus and quick reflexes

Read More: Unlock Profitable Trading with the 3 EMA Scalping Strategy

Combining 9 EMA and Scalping

The 9 EMA scalping strategy leverages the quick responsiveness of the 9 EMA to identify potential entry and exit points for scalp trades. Traders using this strategy look for specific setups where price action interacts with the 9 EMA line, signaling potential trade opportunities. By combining the trend-following nature of the EMA with the rapid execution of scalping, traders can potentially increase their chances of success in short-term trading.

Benefits of combining 9 EMA and scalping:

- Clear entry and exit signals

- Reduced noise in price action

- Ability to ride short-term trends

- Potential for consistent small profits

Implementing the 9 EMA Scalping Strategy

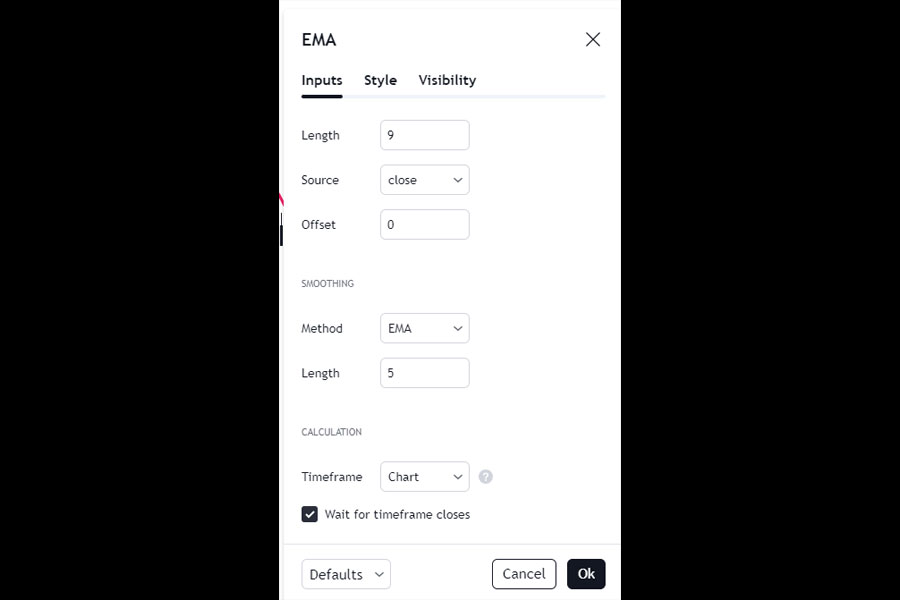

Step 1: Setting Up Your Chart

To effectively use the 9 EMA scalping strategy, you need to set up your trading chart correctly. Follow these steps to ensure you have the right foundation:

- Choose a forex pair with high liquidity (e.g., EUR/USD, GBP/USD)

- Set your chart timeframe to 1-minute or 5-minute intervals

- Apply the 9 EMA indicator to your chart

Additional chart setup tips:

- Use a clean, uncluttered chart layout

- Consider adding volume indicators for confirmation

- Ensure your broker provides fast and accurate price feeds

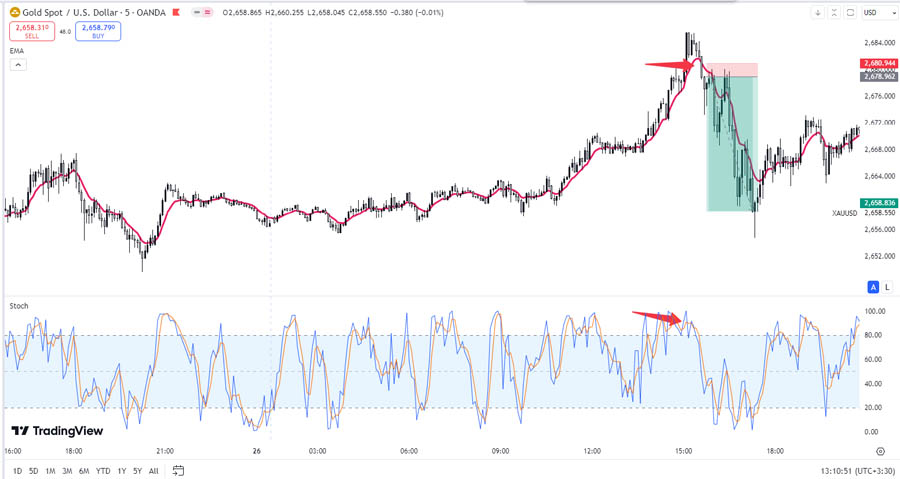

Step 2: Identifying Trade Setups

The key to success with the 9 EMA scalping strategy lies in identifying high-probability trade setups. Here’s what to look for:

Bullish Setup:

- Price action moves above the 9 EMA

- Candles begin to close above the 9 EMA line

- Look for a slight pullback to the 9 EMA before entering a long position

Bearish Setup:

- Price action moves below the 9 EMA

- Candles begin to close below the 9 EMA line

- Wait for a small retracement to the 9 EMA before entering a short position

Additional factors to consider:

- Confirm the overall trend on higher timeframes

- Look for supportive candlestick patterns

- Be aware of key support and resistance levels

Step 3: Entering Trades

Once you’ve identified a potential setup, it’s time to execute your trade. Follow these steps for optimal entry:

- Confirm the trend direction using price action and the 9 EMA

- Wait for a candle to close in the direction of the trend

- Place a market order or a limit order slightly above (for longs) or below (for shorts) the closing price

Tips for precise entries:

- Use pending orders to automate entries

- Consider using additional confirmations (e.g., RSI, MACD)

- Be prepared to act quickly as scalping opportunities can disappear rapidly

Step 4: Managing Risk

Proper risk management is crucial for long-term success in forex scalping. Implement these risk management techniques:

- Set a tight stop-loss, typically 5-10 pips away from your entry point

- Use a risk-reward ratio of at least 1:1, aiming for 5-10 pips of profit per trade

- Always adhere to proper risk management, risking no more than 1-2% of your account balance per trade

Additional risk management strategies:

- Use a trailing stop to protect profits

- Adjust position sizes based on market volatility

- Have a daily loss limit and stick to it

Step 5: Exiting Trades

Knowing when to exit your trades is just as important as knowing when to enter. Follow these guidelines for exiting your 9 EMA scalp trades:

- Take profit at your predetermined target (5-10 pips)

- Exit the trade if price action shows signs of reversal

- Consider trailing your stop-loss to lock in profits as the trade moves in your favor

Advanced exit strategies:

- Use multiple take-profit levels to maximize gains

- Monitor price action for potential trend exhaustion

- Be prepared to close trades manually if market conditions change rapidly

Read More: Unlock Forex Success

Advanced Techniques for 9 EMA Scalping

Multiple Timeframe Analysis

Enhance your 9 EMA scalping strategy by incorporating higher timeframes:

- Use 15-minute and 30-minute charts to confirm the overall trend direction

- Identify key support and resistance levels on higher timeframes

- Look for confluence between multiple timeframes before entering trades

Benefits of multiple timeframe analysis:

- Reduced false signals

- Improved trade timing

- Better understanding of market structure

Combining with Other Indicators

While the 9 EMA is powerful on its own, combining it with other indicators can provide additional confirmation and improve your trading accuracy:

- RSI (Relative Strength Index): Use to confirm overbought or oversold conditions

- Look for divergences between RSI and price

- Use extreme RSI readings as potential reversal signals

- Stochastic Oscillator: Identify potential reversals and momentum shifts

- Watch for crossovers in oversold or overbought territories

- Use slow stochastic for smoother signals

- Bollinger Bands: Gauge volatility and potential price breakouts

- Look for price to touch or break the bands for potential entry signals

- Use band width to assess market volatility

Tips for combining indicators:

- Avoid using too many indicators, which can lead to analysis paralysis

- Ensure each indicator serves a specific purpose in your strategy

- Regularly review and optimize your indicator settings

Price Action Confirmation

Incorporating price action analysis can significantly enhance your 9 EMA scalping strategy. Look for specific candlestick patterns that align with your 9 EMA signals:

- Bullish Engulfing: Strong buying pressure in an uptrend

- Bearish Engulfing: Strong selling pressure in a downtrend

- Doji: Potential trend reversal or continuation

- Pin Bars: Potential reversal signals, especially when touching the 9 EMA

Additional price action techniques:

- Identify key support and resistance levels

- Look for breakouts and fakeouts around the 9 EMA

- Use multiple candlestick patterns for stronger confirmation

Common Pitfalls and How to Avoid Them

Even experienced traders can fall into common traps when using the 9 EMA scalping strategy. Be aware of these pitfalls and learn how to avoid them:

- Overtrading: Stick to your trading plan and avoid the temptation to enter every potential setup

- Set a maximum number of trades per day

- Take breaks to avoid trading fatigue

- Ignoring Market Conditions: Be aware of major news events and market volatility that can affect your scalping strategy

- Use an economic calendar to track important announcements

- Adjust your strategy or avoid trading during high-impact news events

- Neglecting Risk Management: Always use stop-losses and maintain proper position sizing

- Never risk more than you can afford to lose

- Regularly review and adjust your risk parameters

- Emotional Trading: Stay disciplined and avoid revenge trading after losses

- Keep a trading journal to track your emotions

- Implement a rule-based system to minimize emotional decision-making

Additional tips to avoid pitfalls:

- Regularly backtest and optimize your strategy

- Seek mentorship or join a trading community for support

- Continuously educate yourself on market dynamics and trading psychology

Read More: Master the 20 EMA Scalping Strategy

Optimizing Your 9 EMA Scalping Strategy

Backtesting and Forward Testing

Thorough testing is crucial for developing a robust 9 EMA scalping strategy:

- Use historical data to backtest your strategy over different market conditions

- Perform forward testing on a demo account before risking real capital

- Analyze your results to identify areas for improvement

Key metrics to track during testing:

- Win rate

- Average profit per trade

- Maximum drawdown

- Sharpe ratio

Keeping a Trading Journal

Maintain a detailed trading journal to track your performance and refine your strategy:

- Record entry and exit points for each trade

- Note market conditions and your emotional state

- Regularly review your journal to identify patterns and areas for improvement

Benefits of keeping a trading journal:

- Improved self-awareness

- Ability to identify and correct mistakes

- Tracking of progress over time

Continuous Education

Stay updated on market trends, economic events, and new trading techniques:

- Follow reputable forex trading blogs and news sources

- Attend webinars and trading seminars

- Network with other traders to share insights and experiences

Areas to focus on for continuous improvement:

- Technical analysis techniques

- Fundamental analysis and economic indicators

- Trading psychology and mindset development

The Psychology of Successful Scalping

Developing Mental Discipline

Cultivate the mental skills necessary for successful scalping:

- Practice patience to wait for high-probability setups

- Develop emotional control during winning and losing streaks

- Build the ability to make quick decisions under pressure

Techniques for improving mental discipline:

- Meditation and mindfulness practices

- Visualization exercises

- Setting and reviewing daily trading goals

Building Confidence

Confidence is key to executing your 9 EMA scalping strategy effectively:

- Start with small position sizes to build confidence in your strategy

- Gradually increase your trade size as you become more proficient

- Celebrate small wins and learn from losses to maintain a positive mindset

Steps to build trading confidence:

- Set realistic expectations for your trading performance

- Regularly review and acknowledge your progress

- Seek feedback from experienced traders or mentors

Technological Considerations for 9 EMA Scalping

Choosing the Right Trading Platform

Select a trading platform that offers:

- Fast execution speeds

- Reliable real-time data

- Customizable charting tools

- Advanced order types (e.g., OCO orders)

Popular platforms for 9 EMA scalping:

- MetaTrader 4 and 5

- cTrader

- NinjaTrader

Ensuring a Stable Internet Connection

A stable, high-speed internet connection is crucial for successful scalping:

- Use a wired connection when possible

- Consider using a backup connection or mobile hotspot for emergencies

- Monitor your connection speed and latency regularly

Tips for optimizing your trading setup:

- Use a dedicated computer for trading

- Minimize background processes and applications

- Consider using a Virtual Private Server (VPS) for improved stability

Utilizing Trading Algorithms

Explore the possibility of automating your 9 EMA scalping strategy:

- Develop or purchase an Expert Advisor (EA) for MetaTrader platforms

- Use trading bots on other platforms that support automated trading

- Implement partial automation to assist with trade execution and management

Benefits of algorithmic trading for scalping:

- Elimination of emotional decision-making

- Ability to trade 24/7

- Backtesting and optimization capabilities

OpoFinance: Your Trusted Partner in Forex Scalping

When it comes to implementing your 9 EMA scalping strategy, choosing the right forex broker is crucial. OpoFinance stands out as an ASIC-regulated broker, offering a secure and reliable trading environment for forex enthusiasts. With its cutting-edge trading platforms, competitive spreads, and lightning-fast execution speeds, OpoFinance provides the perfect foundation for successful scalping.

One of OpoFinance’s standout features is its innovative social trading service, allowing traders to connect, share strategies, and even copy trades from successful scalpers. This unique offering can be particularly beneficial for those new to the 9 EMA scalping strategy, providing valuable insights and learning opportunities.

As an officially featured broker on the MT5 brokers list, OpoFinance demonstrates its commitment to providing top-tier trading conditions. The broker also ensures safe and convenient deposits and withdrawals, giving traders peace of mind when managing their funds. Whether you’re a seasoned scalper or just starting your forex journey, OpoFinance offers the tools, support, and security needed to thrive in the fast-paced world of 9 EMA scalping.

Conclusion

The 9 EMA scalping strategy offers forex traders a powerful tool for capitalizing on short-term market movements. By combining the responsiveness of the 9 EMA with disciplined scalping techniques, traders can potentially achieve consistent profits in the forex market. However, success with this strategy requires dedication, practice, and a thorough understanding of market dynamics.

Remember that scalping is a high-intensity trading style that may not suit everyone. It’s essential to assess your risk tolerance, time commitment, and trading goals before fully embracing this strategy. With proper education, rigorous practice, and a commitment to continuous improvement, the 9 EMA scalping strategy can become a valuable addition to your forex trading arsenal.

As you embark on your journey with the 9 EMA scalping strategy, stay focused on risk management, maintain emotional discipline, and always be open to refining your approach. With persistence and the right mindset, you’ll be well on your way to mastering this exciting and potentially profitable trading technique.

How does the 9 EMA scalping strategy perform in ranging markets?

The 9 EMA scalping strategy can be challenging in ranging markets due to the lack of clear trend direction. In such conditions, traders may experience more false signals and whipsaws. To adapt, consider:

Widening your stop-loss and take-profit levels slightly

Looking for range-bound trading opportunities between support and resistance levels

Incorporating additional indicators like the RSI to confirm overbought and oversold conditions

Being more selective with your trades and reducing your overall trading frequency

Can the 9 EMA scalping strategy be applied to cryptocurrencies?

Yes, the 9 EMA scalping strategy can be applied to cryptocurrencies, but with some considerations:

Cryptocurrency markets are often more volatile, so adjust your risk management accordingly

Choose high-liquidity crypto pairs to ensure smooth execution of trades

Be aware of the 24/7 nature of crypto markets and how it might affect your trading schedule

Consider using longer timeframes (e.g., 5-minute or 15-minute) due to increased volatility

Stay informed about regulatory news that can cause sudden market movements

How do you handle slippage when scalping with the 9 EMA strategy?

Slippage can be a significant issue for scalpers, potentially eating into profits. To minimize its impact:

Choose a broker with low latency and fast execution speeds

Use limit orders instead of market orders when possible

Avoid trading during major news releases or times of low liquidity

Consider implementing a slippage tolerance in your trading plan

Use a Virtual Private Server (VPS) to reduce latency if trading algorithmically

Monitor your execution quality regularly and switch brokers if necessary