The 200 EMA scalping strategy is a powerful forex trading technique that combines the stability of a long-term moving average with the excitement of fast-paced trading. This strategy allows traders to capitalize on short-term price movements while maintaining a broader market perspective, making it an invaluable tool for forex enthusiasts seeking quick gains in the dynamic currency markets. By using the 200-period Exponential Moving Average (EMA) as a key indicator, traders can identify potential entry and exit points for scalping trades, potentially boosting their profits in a matter of minutes. Whether you’re a seasoned trader or just starting your forex journey with an online forex broker, mastering the 200 EMA scalping strategy could be your ticket to more consistent and profitable trades.

This comprehensive guide will walk you through every aspect of the 200 EMA scalping strategy, from its fundamental principles to advanced techniques and real-world applications. By the end of this article, you’ll have a solid understanding of how to implement this strategy effectively and potentially enhance your forex trading performance.

What is the 200 EMA Scalping Strategy?

The 200 EMA scalping strategy is a trading approach that utilizes the 200-period Exponential Moving Average (EMA) as a key indicator for identifying potential entry and exit points in the forex market. This strategy combines the reliability of a long-term trend indicator with the agility of scalping, allowing traders to make quick profits from small price movements while staying aligned with the overall market direction.

Understanding the 200 EMA

The 200 EMA is a popular technical indicator that calculates the average price of a currency pair over the last 200 periods, giving more weight to recent prices. It’s widely regarded as a significant trend indicator, often used to determine the overall market direction. The 200 EMA is particularly valuable because it:

- Smooths out price fluctuations to reveal the underlying trend

- Adapts more quickly to recent price changes than a simple moving average

- Provides a clear visual representation of long-term market sentiment

Read More: Unveiling the 9 EMA Scalping Strategy

The Scalping Component

Scalping is a trading style that aims to profit from small price changes, often holding positions for just a few minutes. By combining scalping with the 200 EMA, traders can:

- Identify the overall trend direction

- Spot potential reversal points

- Execute quick trades with a higher probability of success

- Minimize exposure to market risk by closing positions quickly

This combination of long-term trend analysis and short-term execution makes the 200 EMA scalping strategy a versatile and potentially profitable approach to forex trading.

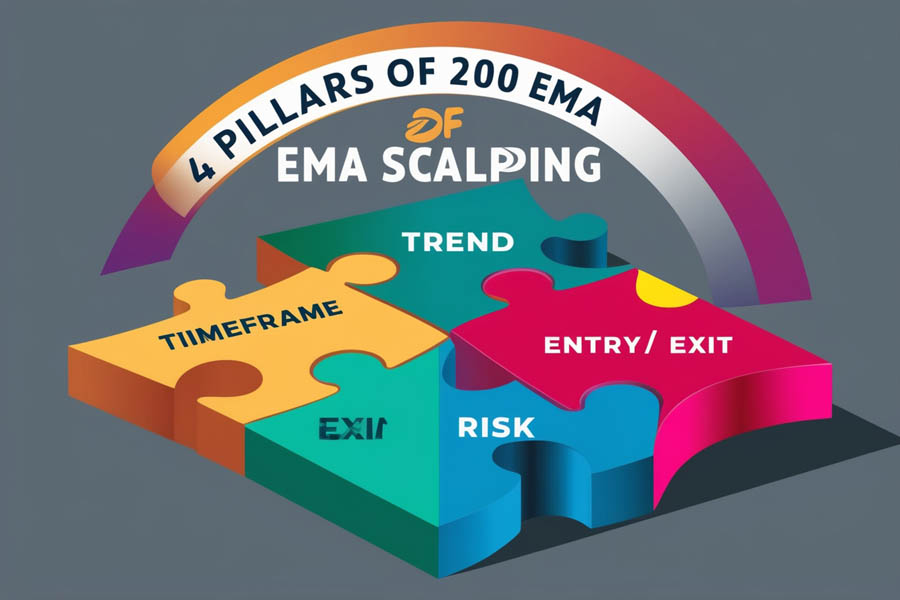

Key Components of the 200 EMA Scalping Strategy

To effectively implement this strategy, you need to understand and master several key components. Each element plays a crucial role in the success of your 200 EMA scalping approach, and mastering them will significantly improve your trading performance.

1. Timeframe Selection

The 200 EMA scalping strategy typically works best on shorter timeframes, such as the 5-minute or 15-minute charts. These timeframes provide enough volatility for scalping while still allowing the 200 EMA to act as a reliable trend indicator. When selecting your timeframe, consider:

- Your personal trading style and availability

- The volatility of the currency pair you’re trading

- The typical spread and transaction costs for your chosen pair

Remember that lower timeframes may offer more trading opportunities but can also be more prone to noise and false signals.

2. Price Action Analysis

Understanding price action is crucial for successful scalping with the 200 EMA. Look for candlestick patterns, support and resistance levels, and price bounces off the 200 EMA line to identify potential entry points. Key price action elements to watch for include:

- Bullish and bearish engulfing patterns

- Doji candles near the 200 EMA

- Pin bars or hammer candles rejecting the 200 EMA level

- Clear breaks and retests of the 200 EMA line

Developing a keen eye for these patterns will help you make more informed trading decisions and improve your entry timing.

3. Entry and Exit Rules

Develop clear rules for entering and exiting trades. Having a well-defined set of entry and exit rules is essential for maintaining discipline and consistency in your 200 EMA scalping strategy. Common entry signals include:

- Price bouncing off the 200 EMA in the direction of the overall trend

- Bullish or bearish candlestick patterns forming near the 200 EMA

- Price breaking above or below the 200 EMA with strong momentum

- Convergence of multiple technical indicators with the 200 EMA signal

Exit rules should include both profit targets and stop-loss levels to manage risk effectively. Consider using:

- Fixed pip targets based on the average true range (ATR) of the currency pair

- Trailing stops to lock in profits as the trade moves in your favor

- Time-based exits to limit your exposure in the market

4. Risk Management

Proper risk management is essential when scalping. Implementing robust risk management practices is crucial for long-term success in forex trading, especially when using a high-frequency strategy like 200 EMA scalping. Set strict stop-loss orders and adhere to a consistent risk-per-trade rule, typically risking no more than 1-2% of your account balance on any single trade. Additionally:

- Use a positive risk-to-reward ratio, aiming for at least 1:1.5 or higher

- Adjust your position size based on the distance to your stop-loss

- Consider using a drawdown limit for your daily or weekly trading activities

- Regularly review and adjust your risk management approach based on your trading performance

Read More: Master the 20 EMA Scalping Strategy

Implementing the 200 EMA Scalping Strategy

Now that we understand the key components, let’s dive into how to implement this strategy step-by-step. Following a structured approach to implementing the 200 EMA scalping strategy will help you maintain consistency and improve your chances of success.

Step 1: Set Up Your Chart

- Open your preferred forex trading platform

- Select a currency pair with high liquidity (e.g., EUR/USD, GBP/USD)

- Choose a 5-minute or 15-minute timeframe

- Add the 200 EMA indicator to your chart

- Consider adding complementary indicators like RSI or Stochastic Oscillator

Ensure your chart is clean and easy to read, with clear color coding for bullish and bearish candles.

Step 2: Identify the Overall Trend

Observe the direction of the 200 EMA:

- If the price is above the 200 EMA, the overall trend is bullish

- If the price is below the 200 EMA, the overall trend is bearish

Understanding the overall trend is crucial for aligning your scalping trades with the broader market direction, potentially increasing your win rate.

Step 3: Look for Entry Signals

Wait for the price to approach the 200 EMA and look for:

- Bullish candlestick patterns in an uptrend

- Bearish candlestick patterns in a downtrend

- Strong bounces off the 200 EMA line

- Convergence with other technical indicators

Be patient and wait for clear, high-probability setups rather than forcing trades.

Step 4: Enter the Trade

When you identify a valid entry signal:

- Place a market or limit order in the direction of the overall trend

- Set a stop-loss order just beyond the recent swing high/low or a fixed number of pips

- Determine your profit target (usually 1.5 to 2 times your risk)

- Consider scaling into the position if your broker allows partial lot sizes

Executing your trades with precision and adhering to your predetermined rules is essential for consistent performance in 200 EMA scalping.

Step 5: Manage the Trade

Monitor the trade closely and be prepared to:

- Move your stop-loss to breakeven once the trade moves in your favor

- Trail your stop-loss to lock in profits

- Exit the trade if it reaches your profit target or if market conditions change

- Close the trade manually if you observe strong reversal signals

Remember that scalping requires quick decision-making and active trade management.

Step 6: Analyze and Improve

After each trading session:

- Review your trades

- Identify what worked well and what didn’t

- Adjust your strategy as needed to improve performance

- Keep a detailed trading journal to track your progress

Continuous analysis and improvement are key to refining your 200 EMA scalping strategy and achieving long-term success in forex trading.

Read More: Unlock Forex Success

Advanced Techniques for 200 EMA Scalping

To take your 200 EMA scalping to the next level, consider incorporating these advanced techniques. Mastering these advanced techniques can help you refine your strategy and potentially improve your trading results.

1. Multiple Timeframe Analysis

Use higher timeframes (e.g., 1-hour or 4-hour charts) to confirm the overall trend before scalping on lower timeframes. This can help improve your trade selection and increase your win rate. Consider:

- Aligning your scalping trades with the trend on higher timeframes

- Using higher timeframe support and resistance levels to identify key price areas

- Looking for confluences between multiple timeframes for stronger trade signals

2. Combining with Other Indicators

Enhance your strategy by adding complementary indicators such as:

- Relative Strength Index (RSI) for overbought/oversold conditions

- Stochastic Oscillator for momentum confirmation

- Bollinger Bands for volatility assessment

- Moving Average Convergence Divergence (MACD) for trend strength

Combining the 200 EMA with other technical indicators can provide additional confirmation and help filter out false signals.

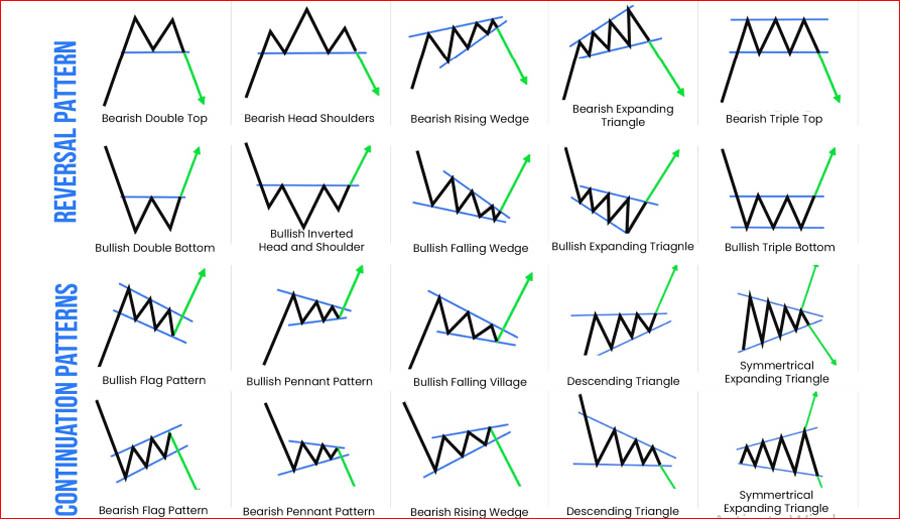

3. Price Action Patterns

Develop your skills in recognizing advanced price action patterns like:

- Pin bars

- Engulfing patterns

- Inside bars

- Three-bar reversal patterns

- Head and shoulders formations

These patterns can provide strong confirmation signals when used in conjunction with the 200 EMA, potentially improving your entry timing and trade accuracy.

4. News Trading Integration

Stay informed about major economic news releases and adjust your scalping strategy accordingly. Be cautious about scalping during high-impact news events, as increased volatility can lead to wider spreads and potential slippage. Consider:

- Using an economic calendar to plan your trading around major news events

- Adjusting your stop-loss and take-profit levels during volatile market conditions

- Implementing a news-based filter to avoid trading during high-impact releases

5. Scaling In and Out of Positions

Instead of entering and exiting trades with your full position size, consider scaling in and out of trades. This technique can help you:

- Reduce risk by starting with a smaller position size

- Lock in partial profits as the trade moves in your favor

- Maximize potential gains on strong trend moves

- Average in at better prices if the market retraces slightly

Scaling techniques can add flexibility to your 200 EMA scalping strategy and help you manage risk more effectively in volatile market conditions.

Common Pitfalls and How to Avoid Them

Even with a solid strategy, traders can fall into common traps. Being aware of these pitfalls and actively working to avoid them is crucial for maintaining consistent performance with the 200 EMA scalping strategy. Here are some pitfalls to watch out for:

1. Overtrading

Problem: Scalping can be exciting, leading to excessive trading and increased transaction costs.

Solution: Set a maximum number of trades per day and stick to it. Focus on quality setups rather than quantity. Consider implementing a “cooling-off” period after a series of losses to prevent emotional trading.

2. Ignoring the Bigger Picture

Problem: Focusing too much on short-term price movements and neglecting the overall market context.

Solution: Regularly zoom out to higher timeframes to ensure your scalps align with the broader market trend. Incorporate fundamental analysis and stay informed about major market events that could impact your trades.

3. Neglecting Risk Management

Problem: Taking on too much risk per trade or not using stop-loss orders consistently.

Solution: Always use stop-loss orders and adhere to a strict risk management plan. Never risk more than 1-2% of your account on a single trade. Regularly review and adjust your position sizing based on your account balance and recent performance.

4. Emotional Trading

Problem: Letting emotions like fear and greed dictate trading decisions.

Solution: Develop and follow a detailed trading plan. Use a trading journal to track your emotions and identify patterns in your decision-making. Consider implementing a mechanical trading system to reduce the impact of emotions on your trades.

5. Chasing the Market

Problem: Entering trades late after missing initial entry signals.

Solution: Be patient and wait for valid setups. If you miss a trade, let it go and focus on the next opportunity. Develop a watchlist of currency pairs to monitor for potential setups, rather than fixating on a single missed trade.

Opofinance Services

When implementing the 200 EMA scalping strategy or any forex trading technique, choosing the right broker is crucial. Opofinance, an ASIC-regulated forex broker, offers a range of services that can enhance your trading experience:

- Reliable Regulation: As an ASIC-regulated broker, Opofinance provides a secure trading environment, ensuring your funds are protected and trades are executed fairly.

- Advanced Trading Platforms: Access state-of-the-art trading platforms, including MetaTrader 5, which is perfect for implementing the 200 EMA scalping strategy with its advanced charting tools and indicators.

- Social Trading: Opofinance’s social trading service allows you to connect with and learn from experienced traders, potentially improving your scalping skills through observation and collaboration.

- Competitive Spreads: Enjoy tight spreads on major currency pairs, which is essential for successful scalping strategies.

- Safe and Convenient Deposits and Withdrawals: Opofinance offers secure and efficient methods for funding your account and withdrawing profits, ensuring you can focus on your trading without worrying about financial transactions.

- Educational Resources: Benefit from a wealth of educational materials to help you master the 200 EMA scalping strategy and other forex trading techniques.

With its official listing on the MT5 brokers list and commitment to trader success, Opofinance stands out as a reliable partner for both novice and experienced forex traders looking to implement advanced strategies like 200 EMA scalping.

Conclusion

The 200 EMA scalping strategy offers a powerful approach to forex trading, combining the stability of a long-term trend indicator with the excitement and profit potential of short-term price movements. By mastering this strategy, you can potentially enhance your trading performance and achieve more consistent results in the fast-paced world of forex.

Throughout this guide, we’ve covered the essential components of the 200 EMA scalping strategy, including:

- Understanding the fundamental principles of the 200 EMA and scalping

- Identifying key components such as timeframe selection and price action analysis

- Implementing the strategy step-by-step, from chart setup to trade management

- Exploring advanced techniques to refine your approach

- Recognizing and avoiding common pitfalls that can derail your trading success

Remember, success in forex trading requires dedication, continuous learning, and disciplined risk management. As you implement the 200 EMA scalping strategy, stay patient, follow your trading plan, and always be prepared to adapt to changing market conditions.

Whether you’re just starting out or looking to refine your existing trading approach, the 200 EMA scalping strategy provides a solid foundation for navigating the forex markets. With practice and persistence, you can develop the skills needed to capitalize on short-term price movements while maintaining a broader market perspective.

As you continue your journey in forex trading, consider leveraging the services of a reputable broker like Opofinance to support your trading endeavors. Their advanced platforms, educational resources, and commitment to trader success can provide the tools and environment you need to thrive with the 200 EMA scalping strategy.

How does the 200 EMA scalping strategy differ from other scalping methods?

The 200 EMA scalping strategy stands out from other scalping methods by incorporating a long-term trend indicator (the 200 EMA) into a short-term trading approach. This unique combination allows traders to align their quick trades with the overall market direction, potentially increasing the probability of successful trades. Unlike pure price action scalping or strategies that rely solely on short-term indicators, the 200 EMA strategy provides a broader context for each trade, helping to filter out false signals and improve trade selection.

Can the 200 EMA scalping strategy be applied to other financial markets besides forex?

Yes, the 200 EMA scalping strategy can be adapted for use in other financial markets, such as stocks, commodities, or cryptocurrencies. However, it’s important to note that the effectiveness may vary depending on the market’s characteristics. Forex markets are particularly well-suited for this strategy due to their high liquidity and 24-hour nature, which provides ample opportunities for scalping. When applying this strategy to other markets, traders should consider factors like trading hours, liquidity, and typical price volatility to adjust their approach accordingly.

How long does it typically take to become proficient in the 200 EMA scalping strategy?

The time required to become proficient in the 200 EMA scalping strategy can vary significantly depending on the individual trader’s experience, dedication, and learning curve. For most traders, it may take several months of consistent practice and study to develop a solid understanding of the strategy and to implement it effectively. This period typically involves:

Learning to read and interpret the 200 EMA accurately

Developing quick decision-making skills for entry and exit points

Mastering risk management techniques specific to scalping

Building emotional discipline to handle the fast-paced nature of scalping

Traders should expect to spend time in a demo account perfecting their technique before transitioning to live trading. Continuous learning and adaptation are key to long-term success with this strategy.