Are you seeking a profitable approach to capitalize on gold price movements without the intensity of day trading? A well-structured XAUUSD swing trading strategy can offer the ideal balance between short-term gains and less screen time, allowing you to hold positions typically for 2 days to 2 weeks. This strategy enables traders to capture significant price movements in the forex market, particularly in gold trading. Swing trading gold (XAUUSD) is an effective way to harness market trends while minimizing stress.

As a regulated forex broker with a focus on precious metals trading, we have observed the effectiveness of swing trading when executed correctly. In this guide, you’ll discover seven proven strategies, key technical indicators, and essential tips that will empower you to master gold swing trading. Whether you’re just starting or have experience, these strategies will help you identify profitable opportunities while managing risk efficiently. For more insights, you can also explore Opofinance’s article on the best XAUUSD trading strategy to further enhance your trading approach.

Understanding XAUUSD Swing Trading Basics

What is Swing Trading Gold?

XAUUSD swing trading strategy involves holding positions for several days to weeks, aiming to profit from ‘swings’ in gold prices. This strategic approach differs significantly from both day trading and long-term investing, offering a balanced middle ground. Unlike day trading, which requires constant market monitoring and can be stressful, or long-term investing, which may tie up capital for extended periods, swing trading provides:

- Opportunity to capture larger price movements than day trading

- Reduced screen time, allowing for a better work-life balance

- Lower stress levels due to decreased need for split-second decisions

- Ability to take advantage of both bullish and bearish trends

- Time to thoroughly analyze setups and manage positions effectively

Statistics show that swing traders often achieve a higher success rate compared to day traders, with some studies indicating up to 40% higher profitability rates for experienced swing traders.

Read More: 7 Proven Support & Resistance Swing Trading Strategies

Why Choose Gold for Swing Trading?

Gold offers unique advantages for swing traders that make it an exceptionally attractive instrument:

- High liquidity: The gold market sees daily trading volumes exceeding $183 billion, ensuring:

- Easy entry and exit of positions

- Tighter spreads during major market hours

- Reduced slippage on larger positions

- Predictable patterns: Gold often follows technical indicators reliably due to:

- Strong adherence to technical analysis principles

- Well-established market participants following similar strategies

- Historical data showing consistent pattern repetition

- Global market influence: Gold prices are affected by various factors, creating numerous trading opportunities:

- Geopolitical events and tensions

- Central bank policies and interest rates

- Currency fluctuations, particularly in the US dollar

- Inflation concerns and economic uncertainty

- 24-hour market: The continuous nature of gold trading provides:

- Flexibility in trading times to suit different schedules

- Opportunity to capitalize on various market sessions

- Ability to react to global events as they unfold

Essential Tools for XAUUSD Swing Trading Strategy

Technical Indicators

- Moving Averages:

- EMA (10, 20, 50, 200)

- 10 EMA for short-term trend direction

- 20 EMA for medium-term trend confirmation

- 50 EMA as a significant support/resistance level

- 200 EMA for long-term trend identification

- Simple MA for trend identification

- Less responsive to price changes

- Useful for identifying major trend changes

- Moving Average Crossover Strategies

- Death Cross (50 MA crossing below 200 MA)

- Golden Cross (50 MA crossing above 200 MA)

- EMA (10, 20, 50, 200)

- Momentum Indicators:

- RSI (Relative Strength Index)

- Traditional settings (14 periods)

- Overbought levels (typically 70)

- Oversold levels (typically 30)

- Divergence identification techniques

- MACD (Moving Average Convergence Divergence)

- Signal line crossovers

- Histogram analysis

- Divergence identification

- Additional considerations:

- Stochastic oscillator for confirmation

- Rate of Change (ROC) for momentum measurement

- RSI (Relative Strength Index)

- Volatility Indicators:

- Bollinger Bands

- Standard settings (20 periods, 2 standard deviations)

- Band contraction and expansion analysis

- Walking the bands concept

- Average True Range (ATR)

- Volatility measurement

- Stop-loss placement guide

- Position sizing calculations

- Bollinger Bands

Read More: The Highest Win Rate Swing Trading Strategy Revealed

Risk Management Techniques for XAUUSD Swing Trading Strategy

Effective risk management is essential for long-term success in XAUUSD swing trading strategy. By employing proven techniques, traders can protect their capital while maximizing potential profits. Here are key strategies to manage risk effectively:

Position Sizing

One of the most critical aspects of risk management in gold swing trading strategy is proper position sizing. Never risk more than 1-2% of your account balance on a single trade to ensure longevity in the market. Consider the following factors when determining your position size:

- Account balance: Ensure that the size of each trade aligns with your available capital.

- Stop-loss distance: Calculate how far your stop-loss is from your entry point to gauge how much capital is at risk.

- Current gold price: Factor in the price of gold (XAUUSD) when calculating your position size. Fluctuations in price can impact your trade’s risk.

- Use position sizing calculators to ensure precision and avoid unnecessary risks.

Stop-Loss Placement

Accurate stop-loss placement is key to minimizing losses in XAUUSD swing trading strategy. It’s essential to set stop-losses based on both technical analysis and market volatility. Here are some common approaches:

- Technical levels: Place stop-losses below key support levels or above resistance levels to limit downside risk.

- Average True Range (ATR): Use ATR to measure market volatility and set your stop-loss at 1.5-2 times the ATR. This helps account for price fluctuations and prevents premature stop-outs.

- Moving averages: You can also place stop-losses beyond significant moving averages (e.g., 50-day or 200-day moving averages) to ensure your trade has room to develop.

Take Profit Levels

Maximizing your profits while managing risk is crucial in gold swing trading strategy. Establish clear take-profit levels using a risk-to-reward ratio of at least 1:2 to ensure that your potential gains outweigh your risks. Consider these strategies:

- Multiple targets: Take partial profits at the first target and use a trailing stop for the remaining position to capture additional gains if the price continues to move in your favor.

- Fibonacci extension levels: Use Fibonacci extension tools to identify potential profit targets and resistance levels where price reversals may occur.

Summary of Key Risk Management Techniques

| Technique | Description |

| Position Sizing | Never risk more than 1-2% of your account per trade; use calculators for accuracy. |

| Stop-Loss Placement | Set stop-losses at key technical levels, using ATR for adjustments to prevent premature exits. |

| Take Profit Levels | Establish clear take-profit levels with a risk-to-reward ratio of at least 1:2 for effective exits. |

Implementing a well-thought-out risk management strategy will not only protect your capital but also allow you to take advantage of profitable opportunities in XAUUSD swing trading strategy. With disciplined execution, you can minimize losses and optimize gains in the gold market.

Top 7 XAUUSD Swing Trading Strategies

Implementing the right XAUUSD swing trading strategy can be the key to capturing profitable opportunities in the gold market. Below, we outline seven powerful strategies that blend technical analysis, price action, and risk management to help you succeed in gold swing trading strategy.

Read More: 7 Powerful Secrets to Master Ichimoku Cloud Swing Trading Strategy

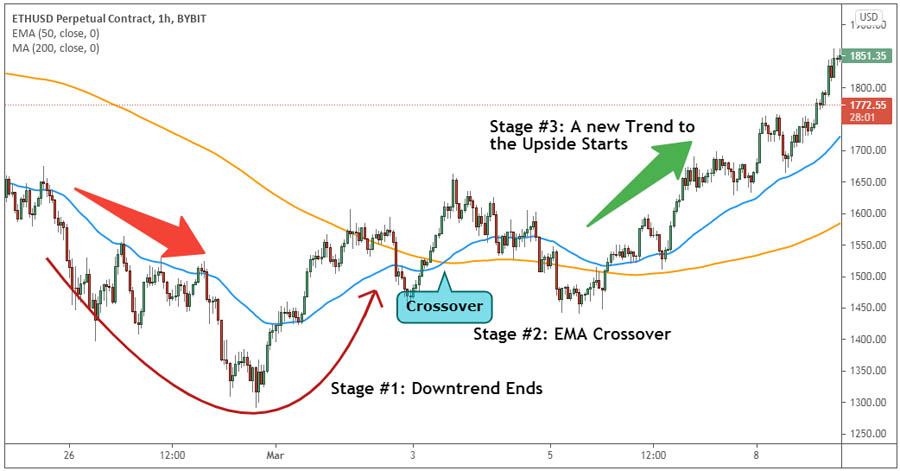

1. The Golden Cross Strategy

The Golden Cross strategy is a trend-following technique that relies on moving averages to identify potential opportunities in XAUUSD swing trading strategy. This method signals when the short-term moving average crosses above a long-term moving average, indicating a potential bullish trend.

Key Components:

- 50-day moving average (MA)

- 200-day moving average (MA)

- Volume indicators for confirmation

Implementation Steps:

- Wait for the 50-day MA to cross above the 200-day MA (Golden Cross).

- Confirm the move with increasing volume to validate the trend.

- Enter long positions when the price pulls back to the 50-day MA.

- Set a stop-loss below the 200-day MA to protect your trade.

- Target profit at 2-3 times your risk for a favorable risk/reward ratio.

Historical success rate: Approximately 68% of Golden Cross signals in gold result in profitable trades.

2. Support and Resistance Channel Strategy

Support and resistance levels are crucial in gold swing trading strategy as they represent areas where the price has historically reversed. This strategy focuses on identifying these levels and trading reversals.

Steps to Implement:

- Identify key support and resistance levels using historical price data.

- Wait for confirmation at these levels, such as candlestick patterns.

- Set a stop-loss just beyond the support or resistance level to minimize risk.

Advanced Techniques:

- Use multiple timeframes to confirm support and resistance levels.

- Look for price action patterns at key levels for additional validation.

- Consider volume to confirm the strength of these levels.

3. Fibonacci Retracement Strategy

Fibonacci retracement levels are a popular tool for identifying potential reversal points during a trend in XAUUSD swing trading strategy.

How to Use It:

- Draw Fibonacci retracement levels between significant highs and lows on the chart.

- Look for price reactions at the 38.2%, 50%, and 61.8% levels.

- Combine with trend analysis and price action for higher probability trades.

Best Practices:

- Confirm retracement levels with candlestick patterns for more reliable entries.

- Wait for price action confirmation before entering a trade.

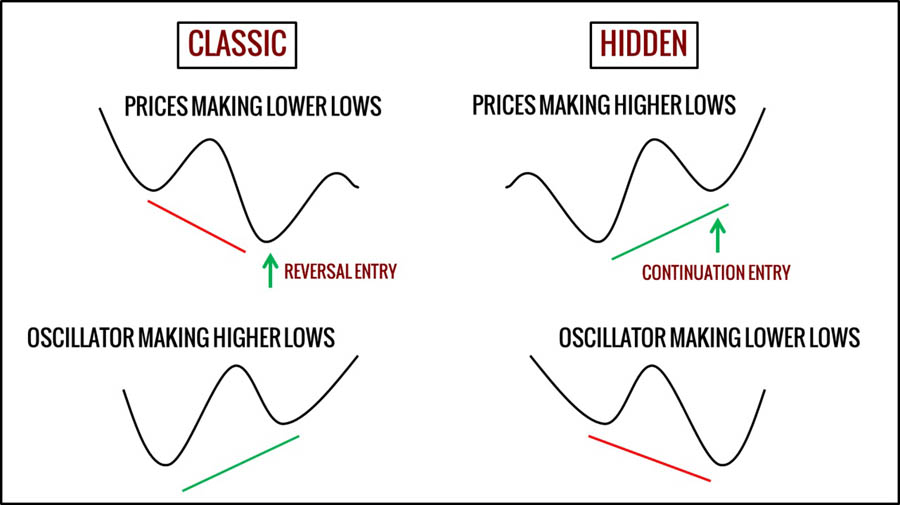

4. RSI Divergence Strategy

The RSI divergence strategy identifies potential trend reversals by comparing price action with the Relative Strength Index (RSI) indicator.

Steps to Follow:

- Identify when the price makes higher highs or lower lows while the RSI shows the opposite (divergence).

- Confirm the divergence with candlestick patterns.

- Enter the trade when the price begins to reverse.

Key Considerations:

- Use a 14-period RSI for standard analysis.

- Look for divergence across multiple timeframes to strengthen your trade setup.

- Combine with support and resistance levels for better confirmation.

5. Multiple Timeframe Analysis

Using different timeframes in gold swing trading strategy helps traders gain a better understanding of overall market trends and fine-tune their entries.

Recommended Timeframe Combinations:

- Weekly, Daily, and 4-hour timeframes for a comprehensive view.

- Daily, 4-hour, and 1-hour timeframes for swing trade setups.

- 4-hour, 1-hour, and 15-minute timeframes for short-term precision.

By analyzing multiple timeframes, you can confirm larger trends, identify swing points, and execute precise entries with greater confidence.

6. Price Action Swing Strategy

This strategy relies solely on reading price movements without the use of indicators, focusing on patterns like swing highs and lows.

Key Components:

- Identify significant peaks and troughs to determine market direction.

- Look for higher highs and higher lows in uptrends, and lower highs and lower lows in downtrends.

Candlestick Patterns to Watch:

- Engulfing patterns, pin bars, and inside bars are excellent signals for entry.

Entry Rules:

- Wait for the pattern to complete before entering the trade.

- Confirm with the market structure.

- Use tight stop-losses based on the size of the candlestick pattern.

7. Volatility Breakout Strategy

This strategy focuses on capitalizing on gold’s volatility using tools like Bollinger Bands and the Average True Range (ATR).

Key Components:

- Bollinger Bands (20-period, 2 standard deviations) to measure volatility.

- ATR to gauge market volatility.

- Volume indicators for breakout confirmation.

Implementation Steps:

- Wait for the price to touch or break through the Bollinger Bands.

- Confirm the breakout with increased volume.

- Enter in the direction of the breakout.

- Set your stop-loss at 1.5 times the ATR for proper risk management.

- Target profit at 2-3 times the ATR for optimal returns.

Success Factors:

- This strategy works best during periods of high volatility, such as major market sessions.

- Combining the volatility breakout strategy with trend analysis enhances the success rate.

By applying these XAUUSD swing trading strategies, traders can improve their ability to capture profitable opportunities in the gold market while managing risk effectively. Whether you’re a beginner or an experienced trader, these approaches provide a solid foundation for navigating the dynamic world of gold swing trading.

Best Practices for Gold Swing Trading

1. Understand Gold Market Fundamentals

Familiarize yourself with key factors influencing gold prices, including:

- Interest Rates: Lower rates often increase gold prices as investors seek safe-haven assets.

- Inflation: Rising inflation typically boosts demand for gold as a hedge.

- Geopolitical Tensions: Global uncertainties drive demand for gold.

Staying informed about these factors helps time your entries and exits.

2. Use Multiple Timeframe Analysis

Combine different timeframes to gain a comprehensive view of the market:

- Weekly Chart: Identify long-term trends.

- Daily Chart: Pinpoint primary trade setups.

- 4-Hour Chart: Fine-tune entry and exit points.

This layered approach allows for more informed decision-making.

3. Follow a Defined Risk Management Plan

Implement effective risk management techniques:

- Position Sizing: Risk no more than 1-2% of your account per trade.

- Stop-Loss Placement: Use key technical levels for placing stops.

- Take Profit Levels: Aim for a risk-to-reward ratio of at least 1:2.

Proper risk management helps safeguard your capital.

4. Master Technical Indicators

Familiarize yourself with key technical indicators:

- Moving Averages: Identify trends and dynamic support/resistance.

- RSI: Spot overbought/oversold conditions and divergences.

- Fibonacci Retracement: Identify potential reversal zones.

Using these indicators enhances your trade setups.

5. Stay Disciplined with Entries and Exits

Maintain discipline in your trading:

- Wait for Confirmation: Don’t rush trades; wait for patterns or signals.

- Avoid Chasing Trades: If you miss an opportunity, wait for the next one.

- Set Clear Exit Strategies: Define stop-losses and take-profit levels in advance.

Having a structured approach minimizes emotional decision-making.

6. Be Aware of Market Volatility

Recognize and manage periods of high volatility:

- Avoid Trading During Key Events: Major announcements can lead to unpredictable price movements.

- Use ATR (Average True Range): Measure volatility to set appropriate stop-loss distances.

Understanding volatility helps manage risks effectively.

7. Keep a Trading Journal

Maintain a detailed trading journal to track your performance:

- Record Entry and Exit Points: Note the price levels of your trades.

- Document Trade Rationale: Include the reasons for each trade.

- Analyze Outcomes: Review whether trades were profitable and why.

- Reflect on Emotions: Understand how your emotions affect decision-making.

A trading journal helps identify strengths and weaknesses, guiding future improvements.

Opofinance Services

When it comes to executing your XAUUSD swing trading strategy, choosing the right broker is crucial. Opofinance, an ASIC-regulated forex broker, offers traders a comprehensive platform for gold trading. Their advanced social trading service allows you to learn from and copy successful gold traders, accelerating your learning curve and potentially improving your results.

Key benefits of trading with Opofinance:

- Featured on the official MT5 brokers list

- Safe and convenient deposits and withdrawals

- Competitive spreads on XAUUSD

- Advanced trading platforms and tools

- Educational resources for gold traders

Conclusion

Mastering the XAUUSD swing trading strategy requires patience, discipline, and a solid framework. By implementing the seven proven techniques and best practices outlined in this guide, you can develop a robust approach to trading gold effectively.

To achieve long-term success in the gold market, it’s crucial to:

- Start Small: Begin with manageable position sizes to mitigate risks as you develop your skills and gain experience in XAUUSD swing trading.

- Focus on Risk Management: Always prioritize risk management strategies in your gold swing trading strategy. This includes setting appropriate stop-loss levels, using position sizing effectively, and adhering to a risk-reward ratio that aligns with your trading objectives.

- Continuously Refine Your Strategy: The market is dynamic, and conditions can change rapidly. Regularly review and adjust your trading strategies based on market trends, technical analysis, and personal performance metrics related to your XAUUSD swing trading strategy.

- Identify High-Probability Setups: Instead of attempting to catch every market movement, focus on high-probability setups that offer favorable risk-reward ratios. This approach allows you to trade confidently, knowing that you are aligning your trades with market conditions that support your gold swing trading strategy.

- Execute with Precision and Patience: Successful XAUUSD swing trading is about executing your strategies with discipline. Resist the urge to make impulsive decisions based on short-term market fluctuations. Maintain your focus on long-term goals and adhere to your trading plan.

By embracing these principles, you will enhance your ability to navigate the complexities of the XAUUSD swing trading strategy, leading to more consistent and profitable outcomes. Remember, trading is not merely about financial gains; it’s also about learning and evolving as a trader. Stay committed to your growth, and over time, you will cultivate the skills necessary to thrive in the gold market while effectively utilizing gold swing trading strategies.

How does the USD/CNY exchange rate affect gold swing trading?

The USD/CNY exchange rate can significantly impact gold prices as China is one of the largest gold consumers globally. When the Chinese yuan weakens against the dollar, gold becomes more expensive for Chinese buyers, potentially affecting demand and price movements in the gold market.

Can weather conditions influence gold swing trading strategies?

Yes, extreme weather conditions in major gold-producing regions can affect mining operations and subsequently impact gold supply. Traders should be aware of potential supply disruptions due to severe weather events, as these can create swing trading opportunities.

How do central bank gold purchases affect swing trading decisions?

Central bank gold purchases can create significant price movements in the gold market. Large-scale acquisitions by central banks often signal long-term bullish sentiment and can provide opportunities for swing traders to capitalize on extended upward price movements.