Chasing consistent profits in the volatile gold market can feel like searching for a hidden treasure. Are you struggling to pinpoint the optimal entry and exit points for your gold trades? The answer lies in mastering the Exponential Moving Average (EMA). This article unveils the best EMA settings for gold, providing a clear roadmap to navigate market fluctuations and enhance your trading strategy. We’ll explore how to leverage this powerful indicator, specifically focusing on finding the best EMA settings for gold trading, and discuss optimal EMA settings for gold to help both beginners and experienced traders refine their approach. If you’re looking for a regulated forex broker to implement these strategies, keep reading.

Intro to EMA for Gold Trading

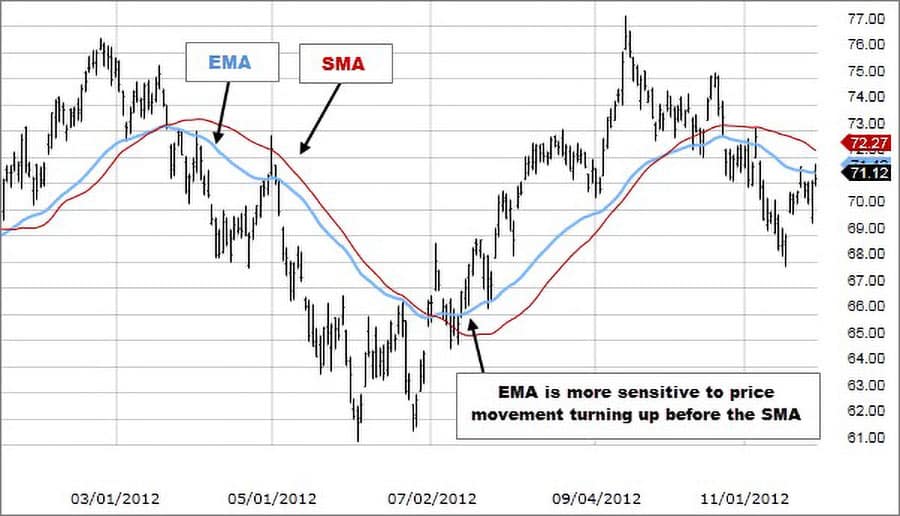

The Exponential Moving Average (EMA) is a cornerstone of technical analysis, offering traders a smoothed view of price action that emphasizes recent data. Unlike its simple counterpart, the Simple Moving Average (SMA), the EMA gives more weight to the latest price movements. This responsiveness makes it particularly valuable in the fast-paced gold market, where prices can shift dramatically in short periods. For anyone serious about gold trading, understanding and effectively utilizing EMA is paramount.

Why EMA Beats SMA for Gold

In the dynamic world of gold trading, timeliness is everything. The EMA’s sensitivity to recent price changes provides a crucial edge over the SMA. Imagine a sudden surge in gold prices due to geopolitical events. An EMA will react more quickly to this shift, providing an earlier signal for potential entry or exit points compared to an SMA, which lags due to its equal weighting of all data points. This responsiveness can translate directly into more profitable trading decisions, allowing you to capitalize on emerging trends with greater precision. For traders seeking the best moving average setting for gold, the EMA’s responsiveness is a compelling advantage.

Understanding Gold Market

Before diving into specific EMA settings, grasping the inherent nature of the gold market is crucial. Gold, often considered a safe-haven asset, exhibits unique price movements influenced by a multitude of factors. These include global economic conditions, interest rates, inflation expectations, geopolitical events, and even currency fluctuations. Understanding these dynamics is the bedrock upon which effective EMA strategies are built.

Gold Price Movements & Volatility

Gold prices are notorious for their volatility. News of unexpected inflation figures, central bank announcements, or international crises can trigger rapid and significant price swings. This inherent volatility necessitates trading tools that can adapt quickly to changing market conditions. While this volatility presents opportunities for profit, it also carries significant risk. Therefore, employing indicators like the EMA, which react swiftly to price changes, becomes essential for navigating these turbulent waters. Successfully identifying trends and potential reversals is key to profitable gold trading.

EMA for Trend & Reversal Spotting

The beauty of the EMA lies in its ability to smooth out price fluctuations, making it easier to identify the underlying trend. When the gold price is consistently above a specific EMA, it suggests an uptrend. Conversely, when the price consistently trades below the EMA, it indicates a downtrend. Furthermore, EMA crossovers – where a shorter-period EMA crosses above or below a longer-period EMA – can signal potential trend reversals. For instance, a 9-period EMA crossing above a 21-period EMA might suggest the beginning of an upward trend. Mastering the interpretation of these signals is vital for any gold trader aiming for consistent profitability. This is a core component of any effective gold moving average strategy.

Read More: Best trading strategy for xauusd

Best EMA Settings for Gold

Now, let’s delve into the heart of the matter: identifying the best EMA settings for gold trading. There’s no single “magic number,” as the optimal settings often depend on your individual trading style and timeframe. However, certain EMA periods have proven their effectiveness in the gold market time and time again.

Recommended Gold EMA Periods

Several EMA periods are widely favored by gold traders:

- 9-period EMA: This short-term EMA is highly sensitive to recent price changes, making it ideal for identifying short-term trends and potential entry/exit points for scalpers and day traders.

- 21-period EMA: A popular choice for swing traders, the 21-period EMA strikes a balance between responsiveness and reliability, helping to identify intermediate-term trends.

- 50-period EMA: This medium-term EMA provides a broader perspective on the trend and is often used to confirm signals from shorter-term EMAs. It’s favored by position traders.

- 200-period EMA: Considered a long-term trend indicator, the 200-period EMA is invaluable for understanding the overall market direction. Many investors use it to gauge the prevailing sentiment in the gold market.

Understanding the significance of each period allows you to tailor your strategy to your specific trading goals.

Choosing EMA Settings by Trading Style

The timeframe you operate on significantly influences the best EMA settings for gold.

- Scalpers: Focusing on very short-term price fluctuations, scalpers often utilize the 9-period EMA or even shorter periods to capture quick profits.

- Day Traders: Typically holding positions for a few hours, day traders might favor the 9 and 21-period EMAs to identify intraday trends.

- Swing Traders: Aiming to profit from price swings lasting several days or weeks, swing traders often find the 21 and 50-period EMAs most effective.

- Long-Term Investors: With a horizon spanning months or years, long-term investors primarily rely on the 200-period EMA to understand the overarching trend of gold prices.

Choosing the right EMA settings aligned with your trading style is paramount for success. Experimentation and backtesting are crucial to fine-tune your approach.

Gold EMA Alignment Strategy

One particularly effective strategy for gold trading involves the alignment of multiple EMAs. A popular combination is the 8, 13, and 21-period EMAs. This strategy leverages the different sensitivities of these EMAs to identify high-probability trading opportunities.

Understanding 8, 13, 21 EMA Alignment

The core principle of this strategy is to look for instances where the three EMAs are aligned in a specific order, indicating a strong trend. In an uptrend, the 8-period EMA should be above the 13-period EMA, which in turn should be above the 21-period EMA. Conversely, in a downtrend, the order is reversed. This alignment suggests that short-term, medium-term, and intermediate-term trends are all moving in the same direction, increasing the likelihood of the trend continuing. This powerful visual confirmation can significantly enhance your trading decisions.

Using EMA Crossovers & Price Rejection

Within the EMA alignment strategy, crossovers and price rejection provide specific entry and exit signals.

- Entry Signals (Uptrend): When the 8-period EMA crosses above the 13-period EMA, with both above the 21-period EMA, it can signal a potential long entry. Look for price to pull back towards the aligned EMAs and find support (price rejection) before entering.

- Entry Signals (Downtrend): When the 8-period EMA crosses below the 13-period EMA, with both below the 21-period EMA, it can signal a potential short entry. Look for price to rally towards the aligned EMAs and find resistance (price rejection) before entering.

- Exit Signals: A break of the EMA alignment, or a crossover in the opposite direction, can signal a potential exit point. For example, if in a long position, the 8-period EMA crossing below the 13-period EMA could be a signal to take profits or cut losses.

Combining EMA crossovers with price action analysis significantly improves the accuracy of your trading signals.

Read More: Moving Average Indicator in Forex

Combining EMA with Other Indicators

While EMA is a powerful tool on its own, its effectiveness can be amplified by combining it with other technical indicators. This confluence of signals can provide a more robust and reliable assessment of market conditions.

EMA with RSI, MACD, Candlesticks

Here are some popular combinations:

- EMA and RSI (Relative Strength Index): Use the RSI to identify overbought or oversold conditions. For example, if the EMA alignment suggests an uptrend, wait for the RSI to pull back from overbought levels before entering a long position.

- EMA and MACD (Moving Average Convergence Divergence): Look for confirmation of EMA signals from the MACD. A bullish EMA crossover accompanied by a bullish MACD crossover strengthens the buy signal.

- EMA and Candlestick Patterns: Combine EMA signals with candlestick patterns like engulfing patterns, pin bars, or dojis. For instance, if the price bounces off a key EMA and forms a bullish engulfing pattern, it provides a high-probability entry signal.

These combinations help filter out false signals and increase the confidence in your trading decisions.

Volume for Confirming EMA Signals

Volume plays a crucial role in confirming the strength of EMA signals. Increased volume during an EMA crossover or a price move in the direction of the trend adds credibility to the signal. Conversely, a lack of volume during a breakout or crossover might indicate a weaker signal and a higher chance of failure. Indicators like Volume or On-Balance Volume (OBV) can provide valuable insights into the conviction behind price movements, helping you to avoid entering trades based on potentially weak signals.

Backtesting EMA Strategies

Before deploying any EMA strategy with real capital, rigorous backtesting is essential. Backtesting involves applying your chosen EMA settings and trading rules to historical gold price data to assess their profitability and effectiveness.

Why Backtest EMA Settings on Gold

Backtesting allows you to objectively evaluate the performance of your EMA strategy under various market conditions. It helps you identify potential weaknesses, optimize your settings, and gain confidence in your approach. By analyzing historical trades, you can determine the win rate, average profit per trade, drawdown, and other crucial metrics that will inform your risk management and position sizing.

Tools for Backtesting EMA

Several powerful tools and platforms facilitate backtesting:

- TradingView: Offers a robust charting platform with a built-in strategy tester. You can code your EMA strategy using Pine Script and backtest it on historical gold data.

- TrendSpider: Provides advanced backtesting capabilities, allowing you to test complex trading strategies and analyze their performance with detailed metrics.

- MetaTrader 5 (MT5): A popular trading platform that allows for backtesting using its Strategy Tester feature. You can use the MQL5 language to code your EMA-based expert advisors (EAs) and backtest them.

Utilizing these tools allows for a data-driven approach to refining your EMA strategies.

Common EMA Mistakes

While EMA is a valuable tool, certain pitfalls can hinder its effectiveness. Understanding and avoiding these common mistakes is crucial for maximizing your trading success.

Over-Reliance on EMA

It’s crucial to remember that no single indicator is foolproof. Over-relying solely on EMA signals without considering the broader market context can lead to losses. Factors like major news announcements, economic data releases, and unexpected geopolitical events can significantly impact gold prices, potentially invalidating EMA signals. Always consider the fundamental backdrop and overall market sentiment before acting on EMA signals.

Ignoring Risk Management

Effective risk management is paramount in gold trading, regardless of the indicators you use. Ignoring stop-loss orders based on EMA signals or trading without a clear risk-reward ratio can lead to significant capital losses. Always define your risk tolerance and set appropriate stop-loss levels to protect your capital. Even the best EMA settings for gold cannot guarantee profits without sound risk management practices.

Successful Gold EMA Trades

Let’s examine a hypothetical example of a successful gold trade using EMA strategies.

Profitable Gold EMA Trade Examples

Imagine the price of gold has been trending upwards, with the 8, 13, and 21-period EMAs aligned bullishly on a 1-hour chart. The price pulls back slightly towards the 21-period EMA and forms a bullish pin bar candlestick pattern, indicating buying pressure. A trader using the EMA alignment strategy, combined with candlestick analysis, would identify this as a high-probability long entry. They would place a stop-loss order below the low of the pin bar and target a profit level based on previous resistance or a favorable risk-reward ratio. As the uptrend continues, the EMAs remain aligned, providing confirmation of the trade. This example illustrates how combining EMA with price action can lead to profitable trading opportunities.

Learning from Failed Trades

Even with the best strategies, losing trades are inevitable. The key is to learn from these experiences. Analyze failed trades to understand why the EMA signals might have been inaccurate in those specific instances. Did unexpected news impact the market? Was the volume weak? Did you ignore other confirming indicators? By meticulously reviewing your losing trades, you can identify patterns and refine your strategy to minimize future losses. This continuous learning process is essential for long-term success in gold trading.

Trading Gold with EMA: Beginner Tips

If you’re new to gold trading and the concept of EMA, here’s a step-by-step guide to get you started.

Setting Up EMA on Trading Platforms

Setting up EMA on most trading platforms is straightforward:

- Choose a Trading Platform: Select a reputable platform like MetaTrader 4/5, TradingView, or your broker’s platform.

- Open a Chart: Open the chart for the gold instrument you wish to trade (e.g., XAU/USD).

- Add the EMA Indicator: Look for the “Indicators” or “Studies” menu. Search for “Moving Average Exponential” or “EMA.”

- Configure the Settings: A dialogue box will appear. Enter the desired period for the EMA (e.g., 9, 21, 50). You can also customize the color and thickness of the EMA line.

- Apply the Indicator: Click “OK” or “Apply,” and the EMA line will appear on your chart.

- Experiment with Different Periods: Try adding multiple EMAs with different periods to your chart to observe how they interact with price action.

Start with a demo account to practice without risking real capital.

Resources for Learning EMA

Numerous resources can help you deepen your understanding of EMA strategies:

- Online Trading Courses: Platforms like Udemy, Coursera, and Investopedia offer courses on technical analysis, including EMA strategies.

- Trading Books: “Technical Analysis of the Financial Markets” by John J. Murphy and “Trading in the Zone” by Mark Douglas are excellent resources.

- Financial Websites and Blogs: Websites like Investopedia, BabyPips, and TradingView have articles and tutorials on EMA and other trading concepts.

- YouTube Channels: Many experienced traders share their knowledge and strategies on YouTube. Search for “EMA trading strategies” or “gold trading analysis.”

- Broker Resources: Many forex broker platforms offer educational materials, webinars, and tutorials on technical analysis.

Continuous learning is key to mastering EMA and becoming a successful gold trader.

Read More: what is xauusd in forex

Opofinance Services

Looking for a reliable partner to implement your gold trading strategies? Consider Opofinance, an ASIC-regulated broker committed to providing a secure and efficient trading environment.

- ASIC Regulated: Trade with confidence knowing Opofinance adheres to stringent regulatory standards.

- Social Trading: Leverage the wisdom of the crowd with Opofinance’s social trading features, allowing you to follow and copy the trades of experienced traders. This can be particularly beneficial when exploring new strategies like those involving EMA settings for gold.

- Featured on MT5 Brokers List: Opofinance is officially recognized on the MetaTrader 5 brokers list, offering access to a powerful and versatile trading platform.

- Safe and Convenient Deposits and Withdrawals: Enjoy peace of mind with a variety of secure and convenient methods for funding your account and withdrawing your profits.

Ready to explore the power of social trading and a regulated trading environment? Discover Opofinance today!

Conclusion

Mastering EMA settings for gold trading is a journey that demands dedication, practice, and a commitment to continuous learning. By applying the principles outlined in this guide, experimenting with different EMA configurations, and integrating EMA with other technical analysis tools, you can significantly elevate your trading performance in the gold market. Always prioritize risk management and remain adaptable to changing market conditions to achieve long-term success.

Gold trading, with its unique volatility and sensitivity to global events, requires tools that can adapt quickly to shifting trends. The EMA, with its focus on recent price action, is perfectly suited for this dynamic environment. However, success in trading goes beyond just understanding indicators—it requires a disciplined approach, a clear strategy, and the ability to learn from both wins and losses.

As you refine your EMA strategies, remember that no single indicator is foolproof. The gold market is influenced by a wide range of factors, including geopolitical events, economic data, and currency fluctuations. Combining EMA with other technical indicators, such as RSI, MACD, and candlestick patterns, can provide a more comprehensive view of the market and help filter out false signals.

Moreover, backtesting your strategies on historical data is a critical step in ensuring their effectiveness. By analyzing past performance, you can identify strengths and weaknesses in your approach, optimize your settings, and build confidence in your trading decisions.

Finally, always keep risk management at the forefront of your trading plan. Even the best EMA settings cannot guarantee profits if you fail to manage risk effectively. Set clear stop-loss levels, define your risk-reward ratios, and avoid over-leveraging your trades.

Key Takeaways

- EMA prioritizes recent price data, making it faster and more responsive than SMA for gold trading. This responsiveness is particularly valuable in the fast-moving gold market, where prices can shift dramatically in short periods.

- Optimal EMA settings vary based on your trading style—whether you’re scalping, swing trading, or investing long-term. For example, scalpers may prefer shorter EMAs like 9 or 13, while long-term investors might rely on the 200-period EMA to gauge the overall trend.

- Common EMA periods for gold include 9, 21, 50, and 200, each serving different trading objectives. These periods are widely used because they strike a balance between responsiveness and reliability, helping traders identify trends and potential reversals.

- The 8, 13, and 21 EMA alignment strategy is a powerful tool for identifying high-probability trading setups. When these EMAs align in a specific order, they provide a strong visual confirmation of the trend, increasing the likelihood of successful trades.

- Combining EMA with indicators like RSI, MACD, and candlestick patterns enhances signal accuracy and reliability. For instance, using RSI to identify overbought or oversold conditions can help you time your entries and exits more effectively.

- Backtesting EMA strategies on historical data is essential to validate their effectiveness before live trading. By analyzing past performance, you can fine-tune your settings and gain confidence in your approach.

- Avoid over-reliance on EMA—always consider broader market conditions and maintain disciplined risk management practices. Factors like major news events or economic data releases can override EMA signals, so it’s important to stay informed and adaptable.

Can I Use EMA for Trading Other Assets Besides Gold?

Yes, the Exponential Moving Average (EMA) is a versatile indicator that can be used for trading various assets, including stocks, forex, cryptocurrencies, and commodities. While the optimal EMA settings may vary depending on the asset’s volatility and trading style, the core principles of using EMA to identify trends, spot reversals, and generate entry/exit signals remain applicable across different markets. Always backtest your EMA strategy on the specific asset you plan to trade to ensure its effectiveness.

How Do I Adjust EMA Settings for Different Time Zones or Market Sessions?

The EMA settings you use may need adjustments depending on the market session or time zone you are trading in. For example, during high-volatility sessions like the London or New York market openings, shorter EMA periods (e.g., 9 or 21) may be more effective for capturing quick price movements. Conversely, during quieter sessions, longer EMA periods (e.g., 50 or 200) might provide more reliable signals. It’s important to analyze the specific market conditions of the session you’re trading and adjust your EMA settings accordingly.

What Are the Best EMA Settings for Scalping Gold on a 5-Minute Chart?

For scalping gold on a 5-minute chart, shorter EMA periods are typically more effective due to the fast-paced nature of scalping. A common setup is using a 5-period EMA for quick entry signals and a 13-period EMA for trend confirmation. These settings allow you to react swiftly to short-term price movements while filtering out some of the market noise. However, always combine EMA signals with other indicators like RSI or volume to confirm trades and manage risk effectively.