Looking to change your account leverage on Opofinance? You’ve come to the right place. While the process itself is incredibly simple—just a few clicks in your client portal—the decision behind it is one of the most critical you’ll make as a trader. Leverage can be your best friend, amplifying your profits, or your worst enemy, leading to serious losses. This guide will walk you through the exact steps to change your leverage safely and, more importantly, help you understand how to choose the right level for your trading style. Let’s get you in full control of your trading.

First Things First: What Exactly Is Leverage?

Before we jump into the “how-to,” let’s make sure we’re on the same page about what leverage is, without any confusing jargon.

Think of leverage as a financial “power-up” that your broker, Opofinance, offers you. It lets you control a large amount of money in the market using only a small amount of your own capital.

- A Simple Analogy: Imagine you want to buy a house worth $100,000. You don’t need the full $100,000 in cash. Instead, you might put down a $10,000 deposit (your “margin”), and the bank loans you the rest. In this scenario, you are leveraging your $10,000 to control a $100,000 asset. This is a 10:1 leverage.

In Forex, it works the same way. If you have a leverage of 1:100, it means for every $1 you have in your account, you can control $100 in the market. With a $500 account, you could open a trade worth up to $50,000!

The Double-Edged Sword

This sounds amazing, right? It can be. If that $50,000 trade moves in your favor, your profits are based on the full $50,000, not just your initial $500. This is how traders can make significant returns from small price movements.

But here’s the crucial part: losses are also amplified. A small move against you is also calculated on the full $50,000. This means a small misstep can lead to substantial losses, and even wipe out your entire account balance far more quickly than if you were trading without leverage.

That’s why understanding and controlling your leverage isn’t just a feature; it’s the core of responsible risk management.

Step-by-Step Tutorial: How to Change Leverage in the Opofinance App

Opofinance has made the leverage-adjustment process remarkably simple and user-friendly. You can do it directly from your mobile app, without any need to contact support or submit complicated requests. Below, follow each step closely and visually.

Step 1: Accessing the “Accounts” Management Section

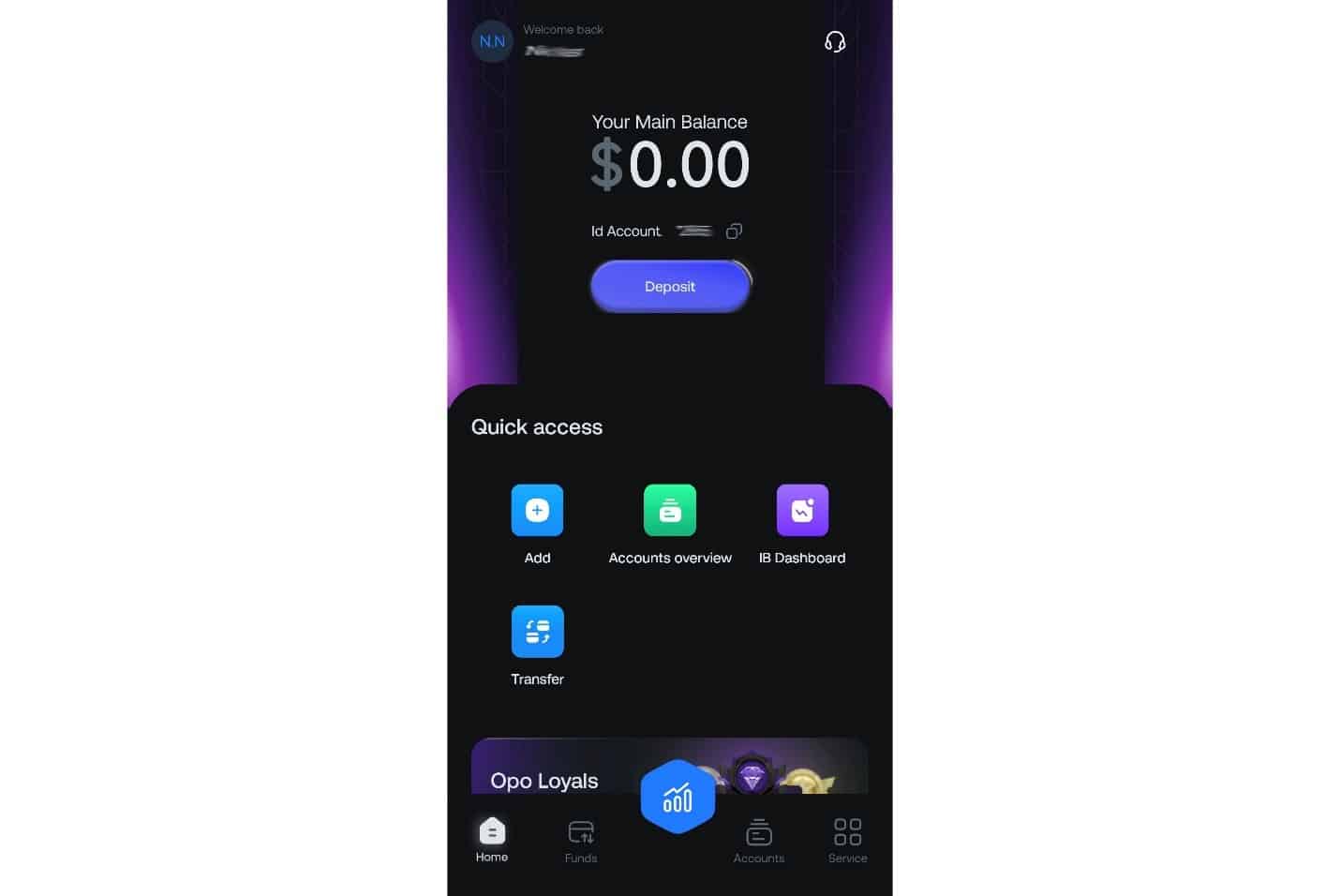

Open the Opofinance app on your mobile device and log in with your username and password. After logging in, you land on your home screen or dashboard. Here, you’ll find quick-access shortcuts such as “Add”, “Accounts overview”, and “IB Dashboard”. Select “Accounts” from the bottom menu to access your trading accounts.

Step 2: Selecting the Target Trading Account

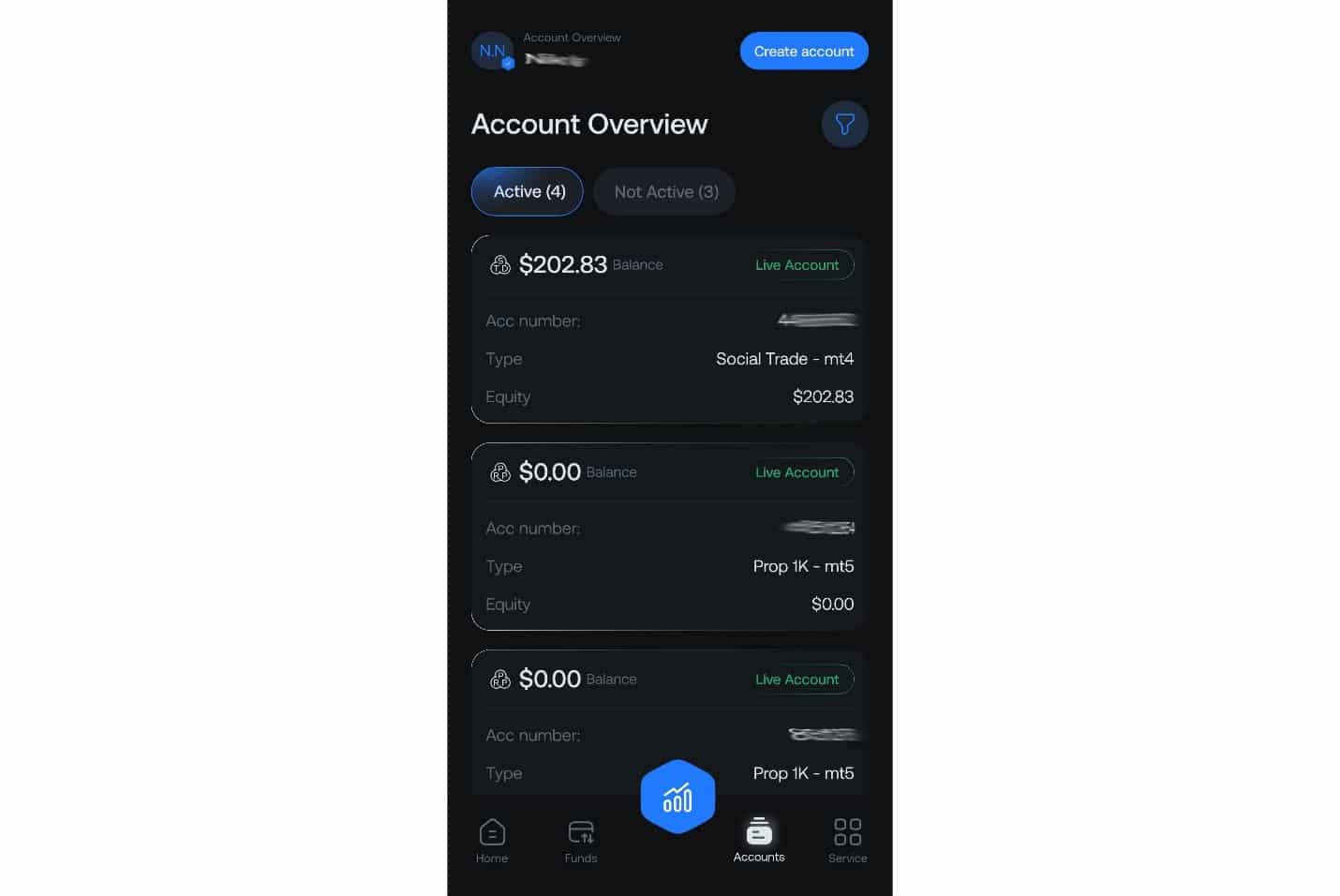

On the “Account Overview” page, you’ll see a list of all your trading accounts, both active and inactive. Locate the account whose leverage you want to change and tap it to enter its details.

Step 3: Finding the “Change Leverage” Option

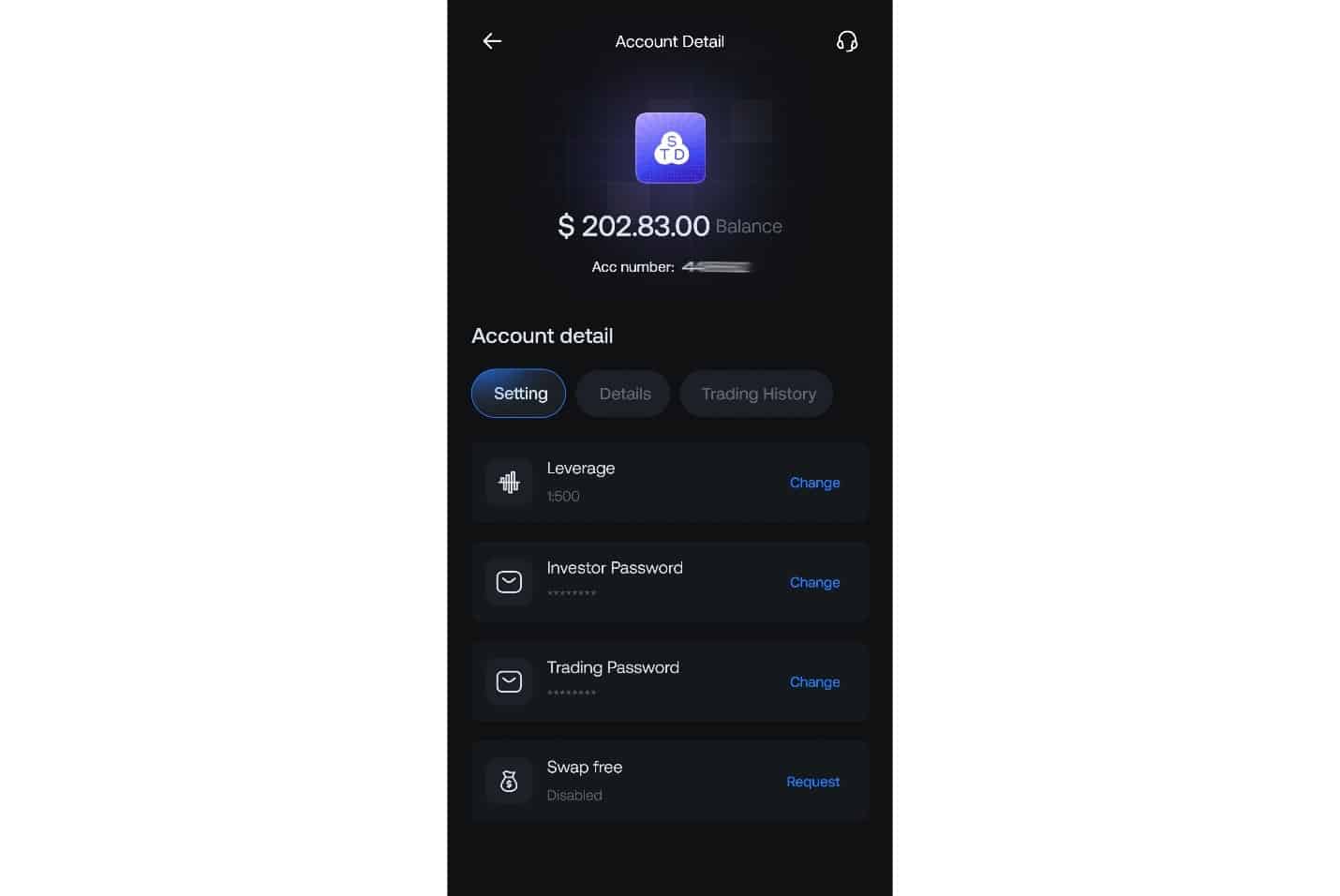

After selecting your account, you’ll enter the “Account Detail” page, which displays detailed information about that account. At the top, you’ll see three tabs: “Setting”, “Details”, and “Trading History”. Make sure you’re in the “Setting” tab. Here, you’ll find various settings, including “Investor Password” and “Trading Password”. Look for the line labeled “Leverage”, which shows your current leverage. You’ll see a blue “Change” button next to it. Tap this button to begin the leverage adjustment process.

Step 4: Selecting Your New Leverage Level and Saving Changes

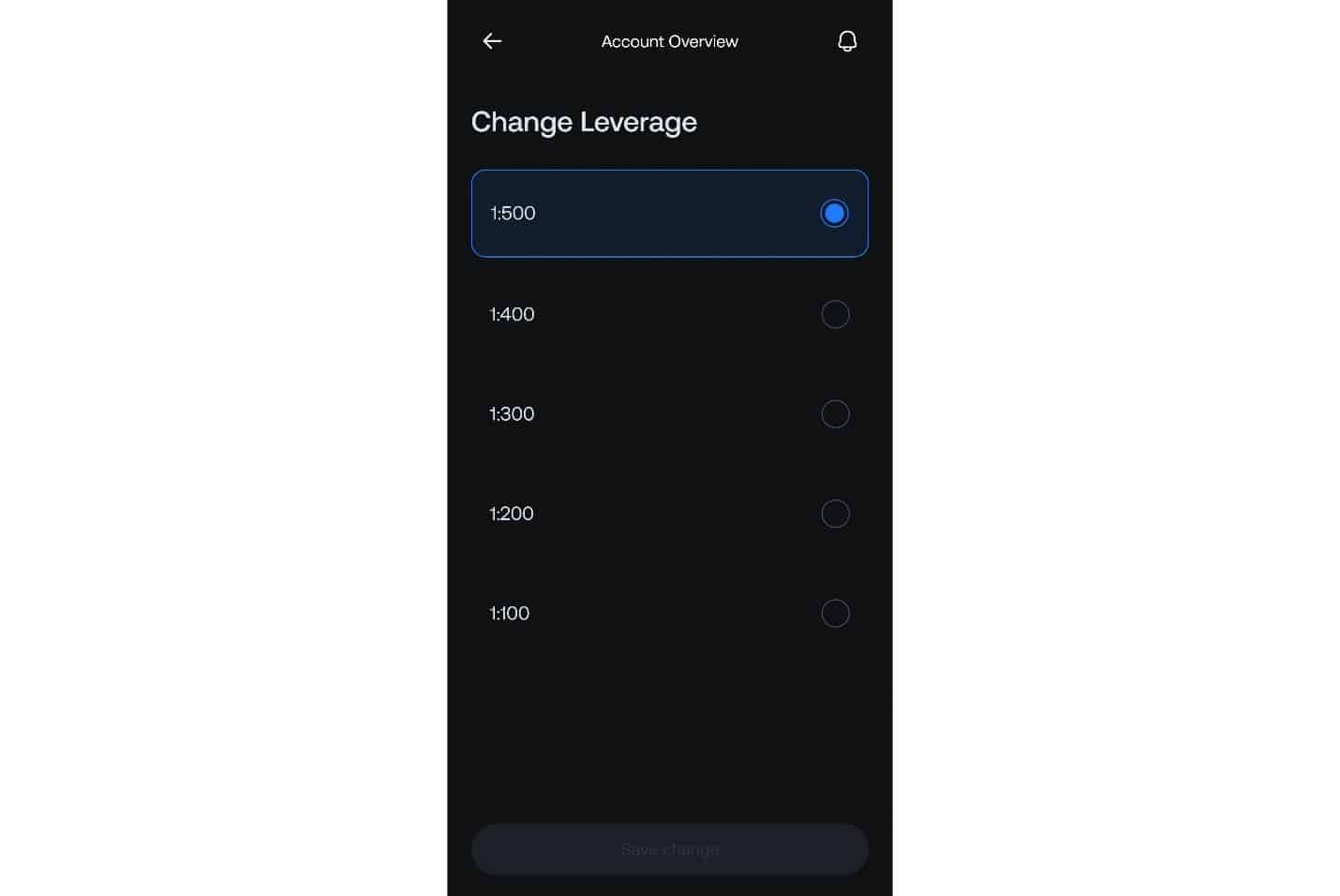

Tapping the “Change” button takes you to the “Change Leverage” page. Here, you’ll see a list of all available leverage levels offered for your account type—typically 1:500, 1:400, 1:300, 1:200, and 1:100. Select the leverage level that matches your risk tolerance and trading strategy. As you select an option, a blue circle will appear next to it.

Once you’ve chosen your new leverage level, the “Save change” button at the bottom of the page will become active. Tap this button to finalize your selection. The change is usually applied instantly. From this point onward, all new trades you open will use the new leverage setting.

Read More: OpoFinance Deposit and Withdrawal Tutorial

The Most Important Rule: Read This Before You Click “Confirm”!

The steps above are easy. The decision to change leverage is hard. And there is one golden rule you must never, ever break.

ALWAYS CLOSE ALL OF YOUR OPEN TRADES BEFORE CHANGING YOUR LEVERAGE.

We can’t stress this enough. It should be a habit burned into your trading brain. Why? It all comes down to a concept called “Margin.”

What is Margin and Why Does it Matter Here?

Margin isn’t a fee; it’s a good-faith deposit. It’s the amount of your money the broker holds onto to keep your leveraged trade open. This amount is directly tied to your leverage.

- High Leverage = Low Margin Deposit

- Low Leverage = High Margin Deposit

Let’s see what happens if you ignore the golden rule:

Scenario 1: You DECREASE your leverage with an open trade (e.g., from 1:500 to 1:100).

This is the most dangerous scenario. When you decrease your leverage, the broker suddenly needs a much bigger deposit (Required Margin) for that same open trade.

- Example: Imagine you have a trade open that required a $200 margin deposit with 1:500 leverage. If you suddenly switch to 1:100 leverage, that same trade might now require a $1,000 margin deposit.

If you don’t have that extra $800 of “free” cash in your account, the broker’s system has a safety switch. It will automatically close your trade (this is called a “Stop Out”) to protect itself and prevent your account from going into negative balance. This can lock in a huge, unexpected loss for you.

Scenario 2: You INCREASE your leverage with an open trade (e.g., from 1:100 to 1:500).

This is less immediately dangerous but can lead to bad habits. Increasing your leverage lowers the margin deposit needed for your open trade. This frees up more of your cash, which might make you think, “Great, I have more money to trade with!”

This can tempt you to open more trades or use bigger position sizes than you planned, which secretly ramps up your overall risk to a level you’re not prepared for.

The Bottom Line: To be safe, always have a clean slate. Close your trades, change your leverage, and then start fresh.

Finding Your Perfect Match: Which Leverage is Right for You?

So, what’s the magic number? 1:50? 1:100? 1:500?

The truth is, there is no single “best” leverage. The right leverage depends entirely on your personality, your strategy, and how long you plan to hold your trades. Let’s find your trading style.

The Scalper (The Quick-Action Trader)

- Who you are: You’re in and out of the market in minutes, sometimes seconds. You love fast action and aim to stack up lots of small, quick wins.

- Leverage temptation: High leverage (like 1:400 or 1:500) looks very attractive to you because it can turn tiny price movements into meaningful profits.

- The reality check: This is the equivalent of driving a Formula 1 car in city traffic. It’s exhilarating, but the risk is immense. You need razor-sharp focus and extremely tight stop-losses. A small unexpected news event can wipe you out in an instant. Use high leverage only if you are an experienced, highly disciplined trader.

The Day Trader (The 9-to-5 Market Player)

- Who you are: You open your trades in the morning and close them all before you go to bed. You don’t hold positions overnight. You work within the day’s market waves.

- Your leverage sweet spot: Moderate leverage, typically in the range of 1:50 to 1:100, is often ideal.

- Why it works: It gives you enough power to make a decent profit from the day’s price swings, but it also gives you some breathing room. You won’t get knocked out of a good trade by a single, sudden price spike. It’s a balance between opportunity and safety.

The Swing Trader (The Patient Strategist)

- Who you are: You’re looking to capture bigger market moves that take several days or even weeks to develop. You identify a trend and ride it.

- Your leverage sweet spot: Lower leverage, like 1:10 to 1:50, is your best friend.

- Why it works: Your trades need to survive the daily ups and downs of the market. If you use high leverage, a normal daily pullback could easily stop you out before the real, larger move happens. Low leverage ensures your account can handle this volatility, giving your strategy the time it needs to prove itself.

The Position Trader (The Long-Term Investor)

- Who you are: You think in terms of months and years. You’re investing based on long-term fundamental economic factors.

- Your leverage sweet spot: Very low leverage (less than 1:10) or, ideally, no leverage at all (1:1).

- Why it works: Your number one priority is preserving your capital over the long run. The risk of being kicked out of a multi-month position because of short-term noise is something you want to avoid at all costs. For you, leverage is an unnecessary risk.

A Deeper Look: The Key Terms That Protect Your Account

To truly master leverage, you need to understand the “health stats” of your account. Think of this like the dashboard of your car.

- Required Margin: We’ve touched on this. It’s the “security deposit” for an open trade.

- Equity: This is the real-time value of your account. It’s your account balance plus or minus the profit/loss of your open positions.

- Free Margin: This is the money you have available to open new trades or to absorb losses from your current trades. The formula is simple:

Free Margin = Equity - Required Margin. - Margin Level (%): This is the most important health meter for your account! It tells you how healthy your account is relative to the margin you’re using.

- The Formula:

Margin Level = (Equity / Required Margin) x 100

- A high Margin Level (e.g., 1000%) is very healthy. A low Margin Level (e.g., 150%) is a danger sign.

- The Formula:

- Margin Call: This is a warning from your broker. Opofinance has a set Margin Call level (you can find this in your account details). If your Margin Level percentage drops to this point, it’s a notification that you are in danger of having your trades automatically closed. It’s a “call” to either deposit more funds or close some positions to free up margin.

- Stop Out Level: This is the kill switch. If your Margin Level continues to fall and hits the Stop Out Level (e.g., 50%), the system will automatically start closing your trades, starting with the least profitable one, until your Margin Level is back above the Stop Out level. This is not a punishment; it’s a built-in safety feature to ensure you cannot lose more money than you have in your account.

Using high leverage means your Margin Level can drop from healthy to the Stop Out level with alarming speed.

Read More: Margin in Forex: A Comprehensive Guide

Final Thoughts: Be the Master of Your Tools

The power to change your leverage at Opofinance is a fantastic tool for a thinking trader. It gives you the power to be aggressive when you have high confidence and a solid plan, and the power to be defensive when the market is uncertain or your strategy requires patience.

But a powerful tool in untrained hands is dangerous. Don’t treat leverage like a lottery ticket. Treat it like a scalpel—a precision instrument to be used carefully and deliberately.

Your key takeaways:

- Start Low: If you’re new, use low leverage. There’s no shame in it. Profitable trading is a marathon, not a sprint.

- The Golden Rule: Always, always, always close your trades before you change your leverage.

- Have a Plan: Choose your leverage based on your trading style (Scalper, Swing Trader, etc.), not on greed or fear.

- Watch Your Health Meter: Keep an eye on your Margin Level. It’s the best indicator of your account’s real-time risk.

By respecting the power of leverage and using it wisely, you put yourself on the path to becoming a more consistent, controlled, and ultimately more successful trader.

So, how do I actually change my leverage in Opofinance?

It’s simple! Log in, go to “Accounts overview,” click the “More” button next to your account, choose “Setting,” and then click the “Change Leverage” link. Select your new level and hit “Confirm.”

Is it really that bad to change leverage when I have a trade open?

Yes, it is. It’s very risky. If you decrease your leverage, your broker will demand a bigger margin deposit for your open trade, which can cause it to be closed automatically at a loss (a “Stop Out”). Just close your trades first—it’s the professional way to do it.

What’s the highest leverage I can get on Opofinance?

This depends on your account type, but standard accounts often go up to 1:500. Some professional accounts might offer more. The best way to know for sure is to check the options available in the “Change Leverage” pop-up in your own client portal.

Why can’t I just change the leverage from inside my MetaTrader (MT4/MT5) platform?

Leverage is a core account setting that lives on the broker’s server, not on your trading software. You can only change it from your official account dashboard on the Opofinance website.

In simple terms, how does changing leverage change my risk?

Think of it like this: Higher leverage is like adding a turbocharger to your car. It makes you go much faster (more potential profit) but also makes any crash much more severe (more potential loss). Lower leverage is like driving a safe family car—less speed, but much more control and lower risk.