Are you ready to master the art of commodity trading and boost your investment portfolio? Look no further! This comprehensive guide will unveil the most effective trading strategies for commodities, empowering you to navigate this dynamic market with confidence. Whether you’re a novice trader or a seasoned pro, understanding the best trading strategy for commodities is crucial for maximizing your returns and minimizing risks. To further enhance your trading journey, partnering with a reliable forex trading broker can provide the tools and insights you need to succeed in global markets.

Commodity trading involves buying and selling raw materials or primary agricultural products, such as gold, oil, wheat, or coffee. These assets play a vital role in the global economy, making them attractive investment options for traders seeking diversification and potential high returns. However, the commodity market can be volatile and complex, requiring a solid understanding of various trading strategies to succeed.

In this article, we’ll explore seven proven commodity trading strategies that can help you unlock profitable opportunities and stay ahead of the competition. From fundamental analysis to technical indicators, we’ll cover everything you need to know to develop a winning approach in the commodities market.

1. Fundamental Analysis: The Foundation of Smart Commodity Trading

Fundamental analysis is the cornerstone of successful commodity trading. This strategy involves evaluating the intrinsic value of a commodity by analyzing various economic, political, and environmental factors that influence supply and demand. Here’s how to implement this strategy effectively:

Research Supply and Demand Dynamics

- Study production levels, inventory reports, and consumption patterns

- Monitor weather conditions that may affect crop yields or energy production

- Analyze geopolitical events that could disrupt supply chains

Track Economic Indicators

- Keep an eye on GDP growth, inflation rates, and employment data

- Monitor currency fluctuations, especially for commodities priced in US dollars

- Assess interest rate changes and their impact on commodity prices

Follow Industry-Specific News

- Stay updated on technological advancements that may affect commodity production

- Watch for regulatory changes that could impact supply or demand

- Monitor mergers, acquisitions, and other corporate events in related industries

By mastering fundamental analysis, you’ll gain a deeper understanding of the forces driving commodity prices, allowing you to make more informed trading decisions.

Read More: forex intermarket analysis

2. Technical Analysis: Charting Your Path to Success

While fundamental analysis provides the big picture, technical analysis focuses on price patterns and market trends. This strategy uses historical price data and statistical indicators to predict future price movements. Here’s how to leverage technical analysis in your commodity trading:

Identify Key Chart Patterns

- Learn to recognize common patterns like head and shoulders, double tops, and triangles

- Use trendlines to identify support and resistance levels

- Spot breakouts and breakdowns to time your entries and exits

Utilize Moving Averages

- Implement simple and exponential moving averages to smooth out price data

- Use moving average crossovers as potential buy or sell signals

- Combine multiple time frames for more accurate trend identification

Harness the Power of Oscillators

- Employ the Relative Strength Index (RSI) to identify overbought or oversold conditions

- Use the Moving Average Convergence Divergence (MACD) to spot trend changes

- Incorporate the Stochastic Oscillator to gauge momentum

By combining technical analysis with fundamental insights, you’ll be better equipped to time your trades and capitalize on short-term price movements in the commodity market.

3. Trend Following: Ride the Wave to Profits

Trend following is a popular strategy among commodity traders, as it allows you to capitalize on sustained price movements. This approach is based on the principle that prices tend to move in trends, and by identifying and following these trends, you can generate substantial profits. Here’s how to implement a trend-following strategy:

Identify the Trend

- Use long-term moving averages to determine the overall trend direction

- Look for higher highs and higher lows in an uptrend, or lower lows and lower highs in a downtrend

- Confirm trends using multiple time frames

Enter and Exit Trades

- Wait for pullbacks or consolidations to enter trades in the direction of the trend

- Use trailing stop-losses to protect your profits as the trend continues

- Exit trades when there are clear signs of trend reversal or exhaustion

Manage Risk

- Implement proper position sizing based on your risk tolerance

- Use stop-loss orders to limit potential losses if the trend reverses

- Consider using options or futures contracts to manage downside risk

Trend following can be a powerful strategy for commodity trading, especially in markets with strong directional movements. However, it’s essential to remain disciplined and stick to your trading plan, even during periods of consolidation or choppy price action.

Read More: 5-3-1 trading strategy

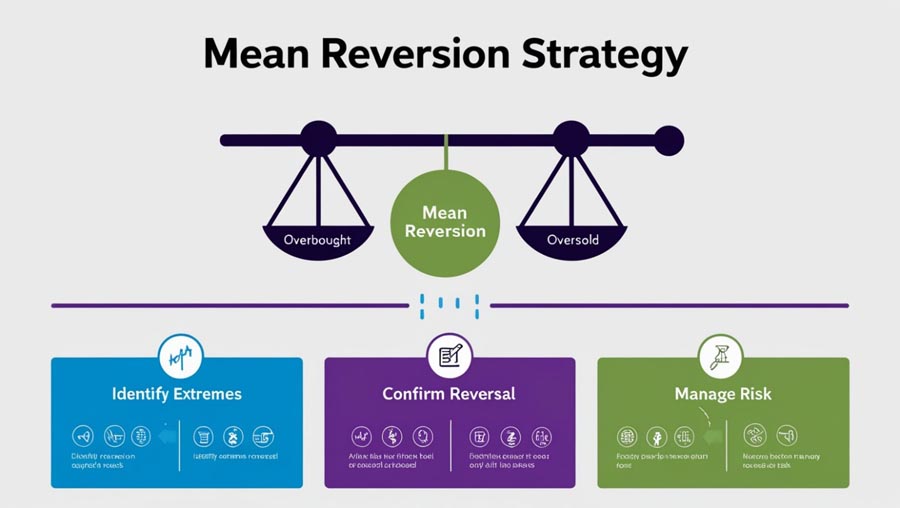

4. Mean Reversion: Capitalizing on Market Overreactions

Mean reversion is based on the idea that prices tend to fluctuate around an average or “mean” value over time. This strategy involves identifying extreme price movements and betting on a return to the average. Here’s how to apply mean reversion in commodity trading:

Identify Overbought and Oversold Conditions

- Use technical indicators like RSI or Bollinger Bands to spot extreme price levels

- Look for divergences between price and momentum indicators

- Consider fundamental factors that may justify extreme price movements

Wait for Confirmation

- Look for signs of price reversal, such as candlestick patterns or volume spikes

- Use multiple time frames to confirm potential mean reversion opportunities

- Consider combining mean reversion with other strategies for added confirmation

Implement Proper Risk Management

- Set clear profit targets based on historical price ranges or support/resistance levels

- Use tight stop-losses to protect against continued price extremes

- Consider scaling into positions to reduce risk and improve average entry price

Mean reversion can be an effective strategy in range-bound markets or during periods of high volatility. However, it’s crucial to be patient and wait for clear signs of reversal before entering trades.

5. Spread Trading: Profiting from Price Relationships

Spread trading involves simultaneously buying one commodity and selling another related commodity to profit from the changing price relationship between the two. This strategy can help reduce overall market risk while still providing opportunities for profit. Here’s how to implement spread trading:

Identify Correlated Commodities

- Look for commodities with historical price relationships, such as gold and silver

- Consider seasonal spreads, like heating oil in winter vs. gasoline in summer

- Explore inter-market spreads, such as crude oil vs. natural gas

Analyze Spread Dynamics

- Study historical spread ratios and identify normal ranges

- Look for divergences or anomalies in the spread relationship

- Consider fundamental factors that may affect the spread

Execute Spread Trades

- Use futures contracts or ETFs to create spread positions

- Implement proper position sizing based on the volatility of the spread

- Monitor and adjust positions as the spread relationship changes

Spread trading can provide more stable returns compared to outright directional trades, but it requires careful analysis and execution to be successful.

Read More: Best Trading Strategy for GBPJPY

6. Options Strategies: Leveraging Volatility for Profit

Options trading offers unique opportunities for commodity traders to profit from price movements while limiting risk. Here are some popular options strategies for commodity trading:

Covered Calls

- Sell call options against long commodity positions to generate additional income

- Use this strategy in sideways or slightly bullish markets

- Manage risk by choosing appropriate strike prices and expiration dates

Straddles and Strangles

- Profit from significant price movements in either direction

- Implement these strategies when you expect high volatility but are unsure of the direction

- Manage costs by timing entries around major economic releases or events

Bull Call Spreads

- Profit from moderate upward price movements with limited risk

- Use this strategy when you’re moderately bullish on a commodity

- Adjust the spread width based on your risk tolerance and profit objectives

Options strategies can provide flexibility and risk management benefits, but they require a solid understanding of options mechanics and pricing. Consider seeking additional education or guidance before implementing complex options strategies.

7. Algorithmic Trading: Harnessing Technology for Consistent Results

Algorithmic trading involves using computer programs to execute trades based on predefined rules and criteria. This strategy can help remove emotional biases and ensure consistent execution of your trading plan. Here’s how to get started with algorithmic trading in commodities:

Develop a Trading System

- Define clear entry and exit rules based on your preferred strategies

- Backtest your system using historical data to assess performance

- Optimize parameters to improve risk-adjusted returns

Choose a Trading Platform

- Select a platform that supports algorithmic trading and provides necessary data feeds

- Ensure the platform offers robust risk management features

- Consider factors like latency and execution speed for high-frequency strategies

Implement and Monitor

- Start with small position sizes to test your algorithm in live market conditions

- Continuously monitor performance and make adjustments as needed

- Stay informed about market conditions that may affect your algorithm’s performance

Algorithmic trading can provide consistent execution and the ability to trade multiple markets simultaneously. However, it requires significant technical expertise and ongoing maintenance to be successful.

Conclusion

Mastering trading strategies for commodities is essential for anyone looking to thrive in this exciting and potentially lucrative market. By implementing the seven strategies outlined in this article – fundamental analysis, technical analysis, trend following, mean reversion, spread trading, options strategies, and algorithmic trading – you’ll be well-equipped to navigate the complexities of commodity trading and maximize your profit potential.

Remember, success in commodity trading requires continuous learning, adaptation, and disciplined risk management. Start by focusing on one or two strategies that align with your trading style and gradually expand your toolkit as you gain experience and confidence.

Whether you’re drawn to the stability of physical commodities or the excitement of futures and options, there’s a strategy that can help you achieve your financial goals. So, take the first step today, put these strategies into action, and unlock the full potential of commodity trading. Your journey to becoming a successful commodity trader starts now!

What are the most important factors to consider when choosing a commodity to trade?

When selecting a commodity to trade, consider the following factors:

Liquidity: Choose commodities with high trading volume to ensure ease of entry and exit.

Volatility: Look for commodities with sufficient price movement to provide profit opportunities.

Market hours: Ensure the trading hours align with your schedule and availability.

Fundamental drivers: Understand the key factors that influence the commodity’s price.

Correlation with other markets: Consider how the commodity relates to other assets in your portfolio.

Contract specifications: Be aware of contract sizes, delivery methods, and expiration dates.

Your expertise: Focus on commodities in sectors you understand or have experience with.

By carefully evaluating these factors, you can select commodities that best suit your trading style and objectives.

How can I manage risk effectively when trading commodities?

Effective risk management is crucial for success in commodity trading. Here are some key strategies to implement:

Use stop-loss orders: Set predetermined exit points to limit potential losses on each trade.

Implement proper position sizing: Never risk more than a small percentage (1-2%) of your trading capital on a single trade.

Diversify your portfolio: Trade multiple commodities or use different strategies to spread risk.

Use options for hedging: Employ options strategies to protect against adverse price movements.

Stay informed: Continuously monitor market news and economic data that may impact your positions.

Maintain a trading journal: Track your trades and analyze your performance to identify areas for improvement.

Use leverage judiciously: While leverage can amplify gains, it also increases risk. Use it carefully and within your risk tolerance.

By incorporating these risk management techniques into your trading plan, you can protect your capital and improve your long-term chances of success in the commodity markets.

How much capital do I need to start trading commodities?

The amount of capital required to start trading commodities can vary widely depending on the specific market and your chosen trading strategy. For futures contracts, you may need anywhere from $5,000 to $25,000 or more to meet minimum margin requirements. However, some brokers offer micro-futures contracts with lower capital requirements.

For options trading, you can start with as little as a few hundred dollars, but a more realistic starting capital would be around $5,000 to $10,000 to allow for proper risk management and diversification.

It’s important to note that starting with more capital can provide greater flexibility and the ability to withstand market fluctuations. Always ensure you’re trading with risk capital that you can afford to lose.