In today’s digital trading landscape, the demand for efficient, time-saving solutions has never been higher. For many traders facing the challenges of market analysis, emotional discipline, and round-the-clock monitoring, automated trading systems offer a compelling alternative. As an online forex broker industry evolves, two prominent options have emerged: copy trading vs bot trading.

Both are powerful tools for traders but operate on fundamentally different principles and cater to distinct trader profiles. Copy trading allows investors to automatically mirror the trades of experienced professionals, while bot trading employs pre-programmed algorithms to execute trades based on specific rules. This comprehensive comparison will help you understand the key differences between copy trading or bot trading, allowing you to make an informed decision based on your goals, experience level, and preferences.

Understanding Copy Trading

Before diving into the specifics of copy trading, it’s important to understand its core concept. Copy trading offers a unique approach to participate in the financial markets by leveraging the expertise of seasoned traders. It essentially allows you to automate your trading by mirroring the actions of successful individuals.

What Is Copy Trading?

Copy trading represents a revolutionary approach to market participation that connects investors with experienced traders through automated replication. By definition, copy trading is a method where you automatically copy the trades of another professional trader into your account. When a professional trader opens a position, an identical position is simultaneously opened in your account at the same rate. This creates a mirroring effect that allows you to benefit from the expertise of seasoned traders without directly executing trades yourself.

The process typically works through specialized platforms that connect “lead traders” (whose trades are being copied) and “followers” (those replicating the trades). These platforms provide comprehensive analytics about lead traders’ performance history, risk metrics, and trading styles, enabling followers to make informed decisions about whom to copy. Most platforms allow customization options such as allocating specific amounts of capital to different traders and setting risk parameters.

Copy trading has gained significant popularity across various financial markets, including forex, stocks, commodities, and cryptocurrencies. It provides an elegant bridge between completely manual trading and fully automated systems.

Advantages of Copy Trading

Copy trading’s appeal stems from a range of benefits that cater to both novice and experienced traders. These advantages make it a particularly attractive option for those seeking a less hands-on approach to trading while still potentially benefiting from market movements.

Ease of Use: One of the most significant advantages of copy trading is its accessibility. You don’t need deep knowledge of technical or fundamental analysis to participate in markets. The platform handles trade execution automatically, making it ideal for beginners or those without extensive trading experience.

Learning from Professionals: Copy trading creates a unique educational opportunity by allowing you to observe the trades, timing, and strategies of successful traders. This practical learning experience often proves more valuable than theoretical knowledge alone.

Portfolio Diversification: Most copy trading platforms allow users to follow multiple traders simultaneously, effectively diversifying their trading approach. This diversification helps mitigate risk by spreading investments across different trading styles, markets, and strategies.

Time Efficiency: Once you’ve selected traders to copy, the system operates automatically without requiring constant monitoring. This hands-off approach is perfect for busy individuals who cannot dedicate substantial time to market analysis and trade execution.

Disadvantages of Copy Trading

Despite its benefits, copy trading is not without its drawbacks. It’s crucial to understand these limitations to make an informed decision and manage expectations when considering this automated strategy.

Dependence on Others: Your success is directly tied to the performance of the traders you choose to copy. If they experience a losing streak or change their strategy unexpectedly, your portfolio will be similarly affected.

Lack of Control: When you opt for copy trading, you relinquish significant control over individual trade decisions. While many platforms allow for some customization (like setting stop-loss limits), the fundamental trading decisions remain with the lead trader.

Potential Fees: Some platforms may include fees for the copy trading service, which can reduce your overall profitability. These may include subscription costs, performance-based fees, or widened spreads.

Market Lag: Sometimes, there may be slight delays between when a lead trader executes a trade and when it’s replicated in your account. In fast-moving markets, these delays could impact performance.

Exploring Bot Trading

Shifting gears to bot trading, it’s essential to understand that this approach relies on technology and algorithms rather than human expertise. Bot trading offers a different form of automation, driven by pre-programmed rules and strategies.

Read More: Trading bots pros and cons

What Are Trading Bots?

Trading bots represent the intersection of finance and technology—computer programs that automatically execute trades based on pre-defined rules. These sophisticated algorithms analyze market data, identify trading opportunities based on specific parameters, and execute orders without human intervention, all at speeds impossible for manual traders to match.

At their core, trading bots operate on algorithmic logic. Traders or developers program these systems with specific conditions that trigger buy or sell actions. These conditions can range from simple price thresholds to complex combinations of technical indicators, chart patterns, and even sentiment analysis. Once deployed, the bot continuously monitors markets, waiting for conditions that match its programmed criteria before executing trades.

Trading bots can operate across multiple markets simultaneously and function 24/7, providing continuous market participation even when human traders are sleeping or otherwise occupied. They come in various forms, from simple programs that follow basic rules to sophisticated systems employing advanced statistical methods to adapt their strategies based on changing market conditions.

Advantages of Trading Bots

Trading bots offer a compelling set of advantages, particularly for those who value speed, consistency, and customization in their trading approach. These benefits highlight why bot trading is a popular choice for algorithmic traders.

Automated Trading: Bots allow you to trade markets 24/7 without having to constantly monitor price movements. This continuous operation can capture opportunities that would be missed during periods when you’re unable to actively trade.

Execution Speed: Bots can execute trades very quickly, reducing the risk of slippage—the difference between expected and actual execution prices. This speed can be crucial in capturing fleeting market opportunities.

Customization: Trading bots can be tailored to implement specific strategies aligned with your trading preferences and risk tolerance. You can adjust parameters to match your individual goals and market outlook.

Emotional Discipline: Bots operate based on predefined rules and don’t suffer from human emotions like fear or greed. This emotional detachment can lead to more consistent trading outcomes by eliminating common psychological biases.

Simultaneous Market Monitoring: Bots can track multiple markets, assets, and indicators simultaneously, a task that would overwhelm even the most experienced human trader.

Disadvantages of Trading Bots

Despite their powerful capabilities, trading bots also come with significant limitations. Understanding these disadvantages is critical for anyone considering bot trading as their automated strategy.

Complexity: Programming bots requires technical knowledge that many traders lack. Developing effective algorithms demands understanding both programming principles and trading strategies.

Risk of Crashes: Software crashes or technical failures may affect the performance of the bot. These technical issues can lead to missed trading opportunities or, worse, unintended positions during volatile market conditions.

Development Costs: Developing or purchasing sophisticated trading bots can involve high costs. Additionally, ongoing maintenance, updates, and optimizations add to the total cost of ownership.

Market Adaptability Challenges: Markets constantly evolve, and strategies that worked well in the past may become ineffective. Without regular updates and adjustments, trading bots may continue executing outdated strategies in changed market conditions.

Security Concerns: Trading bots often require access to your trading account, creating potential security vulnerabilities if not properly protected.

Similarities Between Copy trading and bot trading

While copy trading and bot trading operate differently, they share some fundamental similarities as automated trading methods. Recognizing these commonalities can help traders appreciate the broader landscape of automated strategies.

Read More: What is Forex Trading Robot

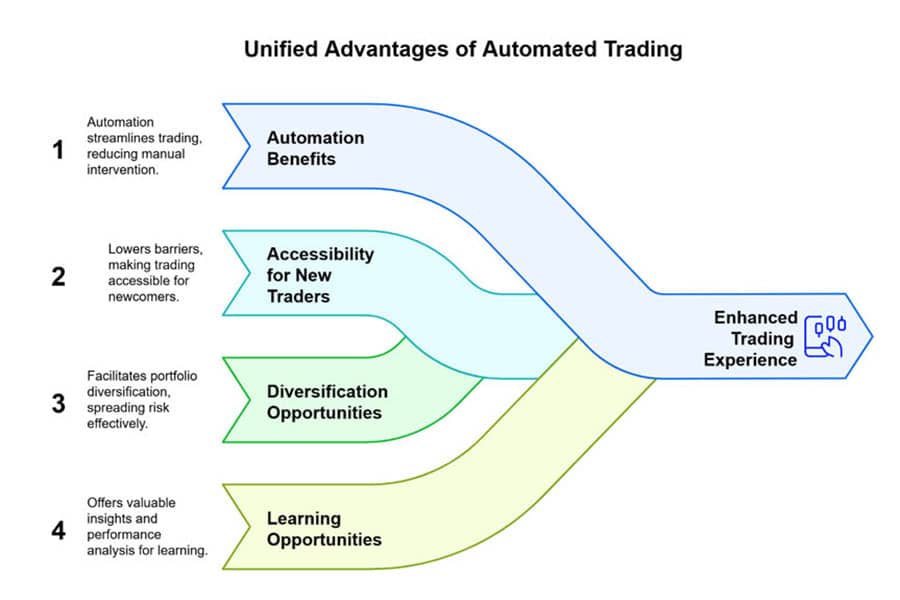

Automation Benefits

Both copy trading and bot trading are rooted in automation, aiming to streamline the trading process and reduce manual intervention. This shared reliance on automation leads to several parallel advantages for users.

Time Efficiency: Both approaches free traders from the need to constantly monitor markets and manually execute trades. Once properly set up, both systems can operate with minimal day-to-day intervention.

Continuous Market Participation: Whether you’re copying human traders or deploying algorithmic bots, both methods enable around-the-clock trading activity, allowing you to capitalize on opportunities even when you’re not actively monitoring markets.

Reduced Emotional Trading: By delegating trading decisions either to lead traders or predetermined algorithms, both methods help mitigate the emotional biases that often plague manual traders, potentially leading to more consistent results.

Accessibility for New Traders

Both copy trading and bot trading, in different ways, contribute to making financial markets more accessible to newcomers. They lower certain barriers to entry, making it easier for individuals to participate in trading.

Lower Knowledge Barriers: Both approaches allow relative newcomers to participate in sophisticated trading strategies that would otherwise require years of experience and learning to develop independently.

Simplified Entry Process: Compared to traditional manual trading, both methods offer streamlined ways to begin trading with reduced learning curves, though to different degrees.

Diversification Opportunities

Diversification is a key principle in risk management, and both copy trading or bot trading can facilitate portfolio diversification in unique ways, helping to spread risk and potentially enhance returns.

Strategy Diversification: Copy trading achieves this by following multiple traders with different approaches, while bot trading can employ various algorithms targeting different markets or conditions.

Asset Exposure: Both methods can provide exposure to a wider range of markets and assets than most individual traders could manage manually.

Learning Opportunities

While automation might seem to remove the learning aspect of trading, both copy trading vs bot trading can still offer valuable learning experiences, albeit in different forms, contributing to trader education.

Practical Insights: Copy trading provides visibility into successful traders’ decisions, while bot trading encourages understanding of systematic strategy development.

Performance Analysis: Both methods generate detailed performance data that can be analyzed to improve future trading decisions.

Read More: What is Copy Trading in Forex

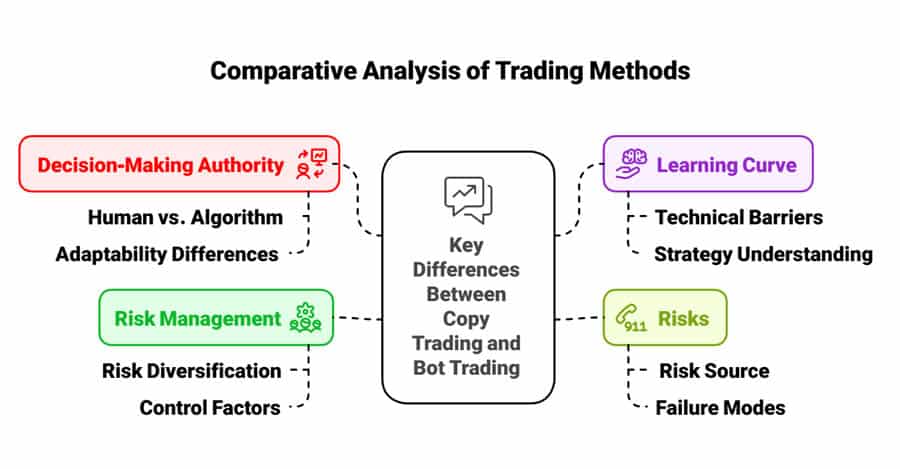

Key Differences Between Copy trading and bot trading

Despite their similarities, the distinctions between copy trading and bot trading are significant and define which approach might be more suitable for a given trader. These key differences lie in the decision-making process, required skills, and risk profiles.

Decision-Making Authority

The most fundamental difference between copy trading vs bot trading is who or what is actually making the trading decisions. This distinction shapes the entire trading experience and outcomes.

Human vs. Algorithm: Copy trading relies on human traders making discretionary decisions based on their analysis and judgment, while bot trading depends entirely on pre-programmed rules and algorithms.

Adaptability Differences: Human traders can quickly adapt to changing market narratives and unprecedented events in ways that most trading bots cannot without reprogramming.

Learning Curve

The level of knowledge and skills needed to effectively utilize copy trading or bot trading differs significantly, impacting the accessibility and ease of implementation for various traders.

Technical Barriers: Bot trading generally demands programming knowledge or at least familiarity with strategy coding platforms, while copy trading requires only the ability to evaluate trader performance metrics.

Strategy Understanding: To effectively develop trading bots, users need a deep understanding of market dynamics and how to encode them into rules. Copy trading requires primarily the ability to identify successful traders.

Risks

The nature of risks associated with copy trading vs bot trading is distinct, stemming from different sources and manifesting in different ways. Understanding these risk profiles is crucial for risk management.

Risk Source: In copy trading, risk comes primarily from the human trader’s decisions and psychology. In bot trading, risk stems from the algorithm’s design and its interaction with unexpected market conditions.

Failure Modes: Copy trading systems might fail when lead traders experience psychological pressure or deviate from their established strategies. Bot trading systems typically fail due to technical issues or encountering market conditions not accounted for in their programming.

Risk Management

Approaches to risk management in copy trading and bot trading also differ, reflecting the fundamental differences in how trades are executed and decisions are made. Effective risk management is paramount in both automated strategies.

Risk Diversification: Copy trading allows followers to diversify by selecting multiple lead traders, while bot trading allows for diversification by choosing various assets and implementing different algorithmic strategies.

Control Factors: In copy trading, risk management depends largely on the copied trader’s approach, though followers can often set maximum loss limits. In bot trading, risk parameters are explicitly programmed into the algorithm itself.

How to Choose Between Copy trading and bot trading

Deciding between copy trading or bot trading requires careful consideration of your personal circumstances, trading experience, technical skills, and investment goals. There’s no one-size-fits-all answer, and the best choice depends on individual factors.

Assessing Your Trading Experience

Your current level of trading knowledge and experience is a primary factor in determining whether copy trading vs bot trading is a better fit for you. Beginners and experienced traders might lean towards different options.

For Beginners: Copy trading generally offers a more accessible entry point for those with limited trading knowledge. It allows newcomers to benefit from experienced traders’ decisions while gradually learning market dynamics.

For Experienced Traders: Those with established trading knowledge might find bot trading more appealing, as it allows them to automate their own proven strategies rather than following others’.

Considering Your Time Commitment

The amount of time you can dedicate to trading activities plays a significant role in deciding between copy trading vs bot trading. Time availability impacts both setup and ongoing management.

Setup Time: Bot trading typically requires significant upfront time investment for development and testing, while copy trading can be implemented relatively quickly.

Ongoing Management: Copy trading generally requires less day-to-day management, making it suitable for those with limited time. Bot trading systems need regular monitoring and occasional adjustments to remain effective.

Evaluating Your Technical Skills

Your comfort level with technology and technical skills is another crucial factor when choosing between copy trading or bot trading. Technical proficiency can heavily influence the ease of implementing and managing each strategy.

Programming Knowledge: Bot trading often requires at least basic programming skills or familiarity with strategy builders. Copy trading demands minimal technical expertise beyond platform navigation.

Data Analysis Capabilities: Effective bot trading relies on the ability to analyze performance data and optimize parameters accordingly. Copy trading requires primarily the ability to interpret trader performance metrics.

Analyzing Your Trading Goals

Your specific trading objectives and investment goals should ultimately guide your decision between copy trading vs bot trading. Understanding what you aim to achieve with automated trading is key.

Control Preference: Assess how much direct control you want over individual trading decisions. Bot trading allows you to define exact parameters, while copy trading delegates decision-making to others.

Education vs. Results: Determine whether your primary goal is learning about markets or simply achieving returns. Copy trading can provide educational insights into successful traders’ methods, while bot trading focuses more on systematic execution.

Opofinance Services: Advanced Solutions for Automated Trading

For traders seeking a comprehensive platform that supports both copy trading and bot trading strategies, ASIC-regulated Opofinance offers a robust ecosystem of tools and services designed to enhance your trading experience. Opofinance provides advanced solutions to cater to diverse automated trading needs.

- Advanced Trading Platforms – Access multiple trading environments including MT4, MT5, cTrader, and the proprietary OpoTrade platform, providing flexible options for both copy trading and bot implementation.

- Innovative AI Trading Tools – Leverage cutting-edge technology with AI Market Analyzer for pattern recognition, AI Coach for strategy optimization, and AI Support for round-the-clock assistance.

- Comprehensive Social & Prop Trading Features – Engage with copy trading through Opofinance’s social trading network, connecting followers with experienced lead traders across global markets.

- Secure & Flexible Transactions – Enjoy safe and convenient deposits and withdrawals through multiple methods, including cryptocurrency payments, all with zero fees from Opofinance.

- Advanced Bot Integration Capabilities – Implement and manage trading bots seamlessly through Opofinance’s compatible platforms, with resources for both beginners and advanced algorithm developers.

Ready to elevate your automated trading journey with professional tools and support? Visit Opofinance today to learn more about their integrated solutions for modern traders.

Conclusion: Making Your Decision

The final decision between copy trading vs bot trading rests on a careful evaluation of your individual needs and preferences. Both offer compelling pathways to automate your trading, but cater to different skill sets and trading styles. Understanding the nuances of copy trading or bot trading is crucial for making the right choice.

Copy trading provides an accessible entry point for beginners, requiring minimal technical knowledge while offering valuable learning opportunities through observation of professional traders. It’s particularly well-suited for those with limited time for market analysis or those who recognize the value of human adaptability in changing market conditions. However, this approach means placing significant trust in the decision-making abilities of others and accepting a certain loss of control over individual trade decisions.

Bot trading, conversely, offers precise execution of predetermined strategies without emotional interference. For those with technical skills and well-defined trading rules, bots can provide consistent implementation of strategies across multiple markets simultaneously. The trade-off comes in the form of higher technical barriers to entry, ongoing maintenance requirements, and potential difficulties adapting to unprecedented market scenarios.

Many successful traders find value in both approaches, either at different stages of their trading journey or simultaneously as complementary systems. The trading landscape continues to evolve, with increasingly sophisticated hybrid options emerging that combine elements of both human and algorithmic decision-making.

As you evaluate copy trading vs bot trading for your investment strategy, remember that neither approach eliminates the fundamental risks inherent in financial markets. Success with either method still requires diligent research, realistic expectations, proper risk management, and ongoing education about market dynamics.

Key Takeaways:

- To summarize the key points of comparison between copy trading and bot trading, consider these essential takeaways that encapsulate the core differences and advantages of each approach.

- Automated Trading Options: Copy trading and bot trading represent two distinct approaches to automated market participation, each offering unique advantages and limitations.

- Copy Trading Strengths: Offers accessibility for beginners, learning through observation, human adaptability to changing market conditions, and minimal technical requirements.

- Bot Trading Advantages: Provides emotional discipline, precise execution, 24/7 operation, customizable parameters, and potential for simultaneous multi-market trading.

- Decision Factors: Your choice should be guided by your trading experience, technical skills, time availability, and specific trading objectives.

- Risk Awareness: Both methods carry risks and neither guarantees profits; proper research, testing, and risk management remain essential regardless of approach.

- Hybrid Potential: Consider exploring combined approaches that leverage the strengths of both human judgment and algorithmic precision.

- Ongoing Evolution: The most successful traders continuously evaluate and adjust their approach as they gain experience and as market conditions change.

How does regulatory oversight differ between copy trading and bot trading platforms?

Regulatory oversight varies significantly between these two automated trading approaches. Copy trading platforms typically fall under more defined regulatory frameworks because they involve direct intermediation between lead traders and followers, often requiring licensing as investment advisors or similar classifications depending on the jurisdiction. Most reputable copy trading services must comply with know-your-customer (KYC) and anti-money laundering (AML) regulations, and may need to disclose performance metrics according to standardized reporting requirements.

Bot trading, particularly when traders develop their own algorithms, often faces less direct regulation as the trader remains the sole decision-maker, albeit through automated means. However, when bot trading services are offered as managed products or signals, they may face similar regulatory requirements as copy trading platforms. Additionally, the deployment of certain high-frequency trading algorithms may trigger specific regulatory considerations in some jurisdictions, particularly regarding market manipulation risks.

What taxation implications should traders consider when using copy trading versus bot trading systems?

Taxation of automated trading activities presents nuanced considerations between these approaches. Copy trading may sometimes be classified as a managed investment activity in certain tax jurisdictions, potentially affecting how gains are categorized and reported. Some tax authorities might view copy trading as delegating investment decisions to another party, which could have implications for tax treatment compared to personally executed trades.

Bot trading, particularly when you design and operate your own algorithm, typically maintains clearer tax classification as direct trading activity. However, both approaches require careful record-keeping of all transactions for tax purposes. The frequency of trading can also affect tax classification, with high-frequency strategies potentially falling under different tax treatments than longer-term approaches. Traders should consult with tax professionals familiar with automated trading to ensure proper compliance with local tax regulations, as these considerations vary significantly between jurisdictions.

How are copy trading and bot trading evolving with artificial intelligence advancements?

Artificial intelligence is transforming both copy trading and bot trading in profound ways. In copy trading, AI is increasingly being employed to analyze and classify lead traders, identifying those whose performance demonstrates genuine skill rather than luck. AI systems can now detect subtle strategy shifts, risk profile changes, and even potential fraudulent activity among lead traders, helping followers make more informed selection decisions.

Bot trading is experiencing even more dramatic AI-driven evolution, moving beyond rigid rule-based systems toward adaptive learning algorithms. Modern trading bots can now employ machine learning to identify complex patterns across multiple data dimensions, adapt to changing market regimes without manual intervention, and even develop novel trading strategies through reinforcement learning techniques. Neural networks are being applied to predict market movements with increasingly sophisticated pattern recognition capabilities. As natural language processing advances, some systems can now incorporate sentiment analysis from news and social media as additional inputs. These developments are gradually blurring the line between human-directed copy trading and algorithmic bot trading, creating hybrid systems that combine aspects of both approaches.