Are you prepared to safeguard your forex trading account against unexpected losses? Discover how effective drawdown management can secure your trading future.

Introduction to Drawdown Management in Forex Trading

Imagine watching your hard-earned trading account dwindle overnight. Drawdown management in forex is your shield against such scenarios, ensuring that temporary setbacks don’t derail your long-term trading success. Drawdown refers to the decline in your trading account after a series of losing trades, making its management crucial for preserving capital and maintaining confidence in the volatile forex market.

Whether you’re partnering with a regulated forex broker or trading independently, mastering drawdown management is essential. This guide unpacks the essentials of managing drawdowns, debunks common myths, and equips you with actionable strategies to navigate forex trading with resilience and confidence. By the end of this article, you’ll understand how to protect your investments and achieve sustainable trading success through effective drawdown management in forex.

Understanding, Measuring, and Controlling Drawdowns in Forex

Drawdown Types for Effective Forex Drawdown Control

Drawdown management in forex involves understanding different types of drawdowns and measuring them accurately to control risks effectively. There are three primary types of drawdown to consider: absolute drawdown, maximum drawdown, and relative drawdown.

Understand the different types of drawdowns to control risks and optimize trading.

Absolute Drawdown

Absolute drawdown measures the drop from your initial deposit to the lowest account balance during a trading period. For instance, starting with $10,000 and dropping to $8,000 results in an absolute drawdown of $2,000. This metric helps traders evaluate the maximum loss their strategy can incur, highlighting the need for robust risk management.

Maximum Drawdown

Maximum drawdown captures the largest peak-to-trough decline in your account balance. If your account peaks at $12,000 and falls to $8,000, the maximum drawdown is 33.33%. This measure is vital for understanding the historical risk and volatility of your trading strategy, guiding you to make informed adjustments. Forex Drawdown Control relies heavily on monitoring maximum drawdown to ensure that your trading strategies remain within acceptable risk levels.

Relative Drawdown

Relative drawdown expresses drawdown as a percentage of your current account equity. Using the previous example, a $2,000 drawdown on an $8,000 balance equates to a 25% relative drawdown. This context-sensitive metric aids in assessing the proportional impact of losses, helping you adjust position sizes and risk exposure accordingly. Managing Drawdowns in Forex Trading becomes more precise with relative drawdown metrics, allowing for dynamic risk management.

Calculation Techniques

Accurately measuring drawdown is essential for assessing trading strategy risks and implementing effective forex risk management techniques. Here are the formulas for each type:

- Absolute Drawdown:

AbsoluteDrawdown=InitialDeposit-LowestEquityPoint

- Maximum Drawdown:

MaximumDrawdown=(Peak Equity - Trough Equity) / Peak Equity ×100%

- Relative Drawdown:

RelativeDrawdown=Maximum Drawdown / Account Equity ×100%

Step-by-Step Example

Starting with $10,000, your account grows to $12,000 but drops to $8,000:

- Absolute Drawdown: $2,000

- Maximum Drawdown: 33.33%

- Relative Drawdown: 25%

These calculations help traders understand the extent of their losses and the effectiveness of their risk management strategies. High drawdown figures indicate greater risk, prompting the need for strategy reassessment. Conversely, lower drawdowns suggest a more controlled trading approach, conducive to long-term success. Effective Forex Drawdown Control relies on interpreting these metrics to adjust trading strategies accordingly.

Read More: best trading platform for forex

Causes and Triggers of Drawdowns in Forex

Drawdowns can stem from various factors, often intertwined with trading practices. Understanding these causes is the first step toward effective drawdown management.

Identify key factors behind drawdowns to prevent potential trading losses.

Risky Trading Behavior

Overleveraging and aggressive risk exposure amplify both profits and losses. For example, using high leverage can lead to substantial drawdowns if the market moves against your positions. Forex Risk Management Techniques emphasize the importance of controlled leverage to mitigate such risks.

Market Volatility

Forex markets are highly sensitive to economic indicators and geopolitical events. Sudden price swings can trigger stop-loss orders or cause slippage, resulting in unexpected losses. Traders must stay informed and adaptable to navigate these turbulent periods effectively.

Lack of Strategy Discipline

Emotional trading, revenge trading, and panic responses disrupt disciplined trading plans, leading to poor decision-making and increased drawdowns. Maintaining discipline and adhering to a structured trading plan is essential for minimizing the psychological impact of drawdowns and ensuring consistent performance.

Poor Money Management

Inadequate stop-loss settings and improper position sizing leave traders vulnerable to significant losses, making effective money management a cornerstone of drawdown control. Implementing sound money management techniques, including setting appropriate stop-loss levels and adjusting trade sizes based on account balance, is crucial for mitigating potential losses and maintaining account health.

Psychological Impact of Drawdowns and How to Recover

Controlling the emotional toll of drawdowns is essential for resilient trading performance.

Drawdowns aren’t just financial setbacks; they can significantly impact your mental state:

- Emotional Stress: Anxiety and frustration can cloud judgment.

- Decision Fatigue: Overthinking trades leads to exhaustion.

- Overtrading: Attempting to recover losses with excessive trades worsens drawdowns.

- Trading Paralysis: Fear of losing more can prevent profitable trades.

Building mental resilience is crucial. Maintaining discipline and adhering to your trading plan helps navigate drawdowns without compromising your strategy. Managing Drawdowns in Forex Trading effectively also involves addressing these psychological challenges to ensure sustained trading performance.

How to Recover from a Major Drawdown

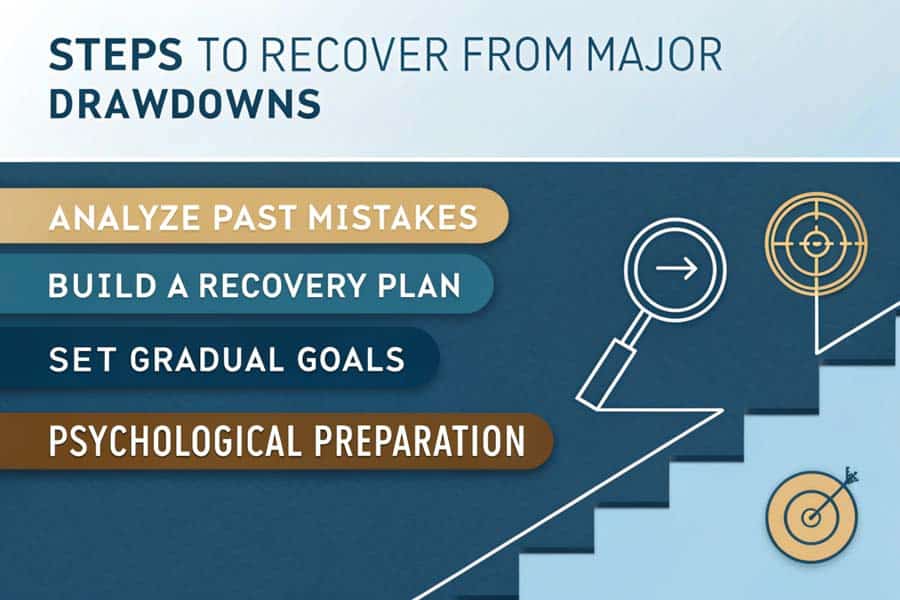

Follow these structured steps to effectively recover from major drawdowns in forex trading.

Recovering from significant drawdowns requires a structured approach:

Analyzing Past Mistakes

Review your trade logs to identify the causes of drawdowns. Understanding these errors is crucial for avoiding them in the future. For example, identifying patterns of overleveraging or emotional trading can inform better risk management practices.

Building a Recovery Plan

Develop a step-by-step plan to regain lost capital. This plan should include strict adherence to risk management rules and gradual position size increases as your account recovers. A structured recovery plan ensures that you approach rebuilding your account systematically and sustainably.

Setting Gradual Goals

Establish realistic, incremental targets to rebuild your account. Gradual goal setting maintains motivation and ensures a sustainable recovery process. Instead of aiming for rapid recovery, focus on achieving consistent, small gains that collectively restore your account balance.

Psychological Preparation for Recovery

Manage your mindset by staying positive and focused. Building emotional control helps you navigate the recovery process without succumbing to stress or panic. Maintaining a resilient mental state is essential for executing your recovery plan effectively.

Read More: Seasonal Patterns in Forex

Importance of Drawdown Management in Forex Success

Effective drawdown management is pivotal for sustainable trading:

Preserving Capital

Controlling drawdowns protects your trading capital, ensuring you remain in the market even after losses. This preservation of capital is crucial for maintaining the ability to withstand market fluctuations and recover from losses over time.

Extending Trading Life

With managed drawdowns, your trading career can endure market fluctuations, allowing strategies to mature and generate consistent profits. This longevity is essential for achieving long-term success, as it enables traders to capitalize on multiple market cycles and benefit from compounding gains.

Enhancing Consistency

Traders who manage drawdowns effectively achieve more stable and predictable outcomes, fostering long-term success. Forex Risk Management Techniques that prioritize drawdown control over short-term gains help maintain a steady growth trajectory.

Prioritizing drawdown management over short-term gains sets successful traders apart from those who falter under pressure.

Strategies and Advanced Techniques for Managing Drawdowns Effectively

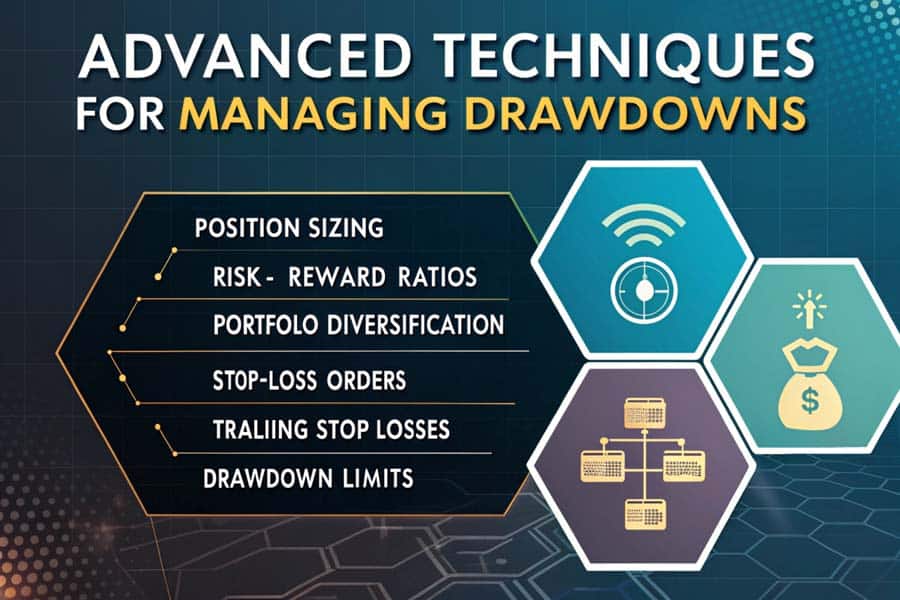

Implementing robust strategies can mitigate potential losses and maintain account stability. Here are some proven techniques to help you manage drawdowns effectively:

Discover advanced strategies to control drawdowns and optimize forex trading performance.

Position Sizing and Capital Allocation

Determine the optimal trade size based on your account balance to control drawdowns. Limit each trade to 1-2% of your account balance. Adjust position sizes based on market volatility and trade confidence to maintain consistent risk levels. For instance, during periods of high volatility, reducing position sizes can prevent large drawdowns, while increasing sizes in more stable conditions can enhance potential profits without excessively increasing risk.

Setting Realistic Risk-Reward Ratios

Aim for a risk-reward ratio of at least 1:2. This balance ensures that your potential rewards justify the risks taken, supporting overall account growth even with some losses. Consistently applying this ratio across all trades helps maintain a balanced approach to trading that supports long-term success.

Diversifying Trading Portfolio

Spread your risk across multiple forex pairs and asset classes. Diversification reduces the impact of adverse movements in any single market, stabilizing your account balance. For example, if one currency pair experiences a downturn, gains in other pairs or assets can help offset those losses, maintaining overall account stability.

Implementing Stop-Loss Orders

Set stop-loss orders at strategic levels based on technical analysis. Regularly review and adjust these levels to align with changing market conditions, ensuring losses remain contained. Effective stop-loss placement can prevent significant drawdowns by limiting potential losses on each trade.

Trailing Stop-Losses

Use trailing stops to lock in profits as trades move favorably. This technique protects gains while allowing trades to capitalize on further price movements. Trailing stop-losses adjust automatically, providing flexibility and protection without constant monitoring.

Weekly/Monthly Drawdown Limits

Establish maximum loss limits for each trading period. Cease trading once these limits are reached to prevent further losses and reassess your strategies. Setting weekly or monthly drawdown limits enforces discipline and ensures that drawdowns remain within manageable limits.

Risk Management Tools in Trading Platforms

Utilize built-in tools in platforms like MetaTrader and cTrader to monitor risk levels and manage drawdowns effectively. These platforms offer features such as risk calculators, margin level indicators, and customizable alerts that provide real-time information on your account’s risk exposure.

Trading Journals

Maintain a detailed trading journal to identify patterns and refine strategies. Regular reviews help spot recurring issues leading to drawdowns. By recording each trade, including entry and exit points, trade size, and the rationale behind each decision, you can analyze your performance over time and make necessary adjustments.

Automated Alerts and Notifications

Set up alerts for risk thresholds and drawdown limits. Timely notifications enable prompt actions to mitigate potential losses. Automated alerts ensure you stay informed about critical risk levels, allowing for swift interventions when necessary.

Regular Backtesting and Strategy Evaluation

Test your strategies against historical data to identify potential drawdown scenarios. Regular evaluations ensure your strategies remain robust under various market conditions. Backtesting helps anticipate market behaviors, refine trading tactics, and enhance the overall robustness of your trading plan.

Read More: Choosing a Forex Broker

Pro Tips for Advanced Traders

Elevate your drawdown management with these advanced strategies:

- Leverage Advanced Analytics: Utilize statistical tools to deeply analyze performance metrics, uncovering hidden risks and optimization opportunities. Advanced analytics can reveal patterns and insights that inform better risk management decisions.

- Implement Hedging Strategies: Protect positions with offsetting trades in correlated or inverse assets, reducing the impact of adverse market movements. Hedging can provide a safety net, limiting potential drawdowns even in volatile markets.

- Utilize Algorithmic Trading: Automate your strategies to eliminate emotional biases, ensuring consistent execution aligned with your risk management rules. Algorithmic trading systems can adhere strictly to predefined parameters, enhancing drawdown control.

Additional Tips for Long-Term Drawdown Prevention

Maintain account stability with these ongoing practices:

- Avoid High-Risk Trades in Volatile Conditions: Reduce position sizes or avoid high-risk trades during major news events to prevent significant drawdowns.

- Plan for Market Slowdowns: Adjust your trading tactics during low liquidity periods to maintain account stability.

- Continuous Learning: Stay educated on forex risk management techniques and market trends to handle evolving conditions effectively.

Incorporating these advanced techniques can significantly enhance your ability to manage drawdowns and boost overall profitability. Expert insights and the latest trading tools can provide an extra edge in maintaining robust Forex Drawdown Control.

Case Studies: Successful Drawdown Management in Action

Case Study 1: High-Leverage Strategy with Drawdown Control

Trader Profile: John, an experienced swing trader.

Strategy: John employed a high-leverage strategy to maximize his trading potential. Recognizing the inherent risks, he meticulously managed his drawdowns by limiting each trade to just 1% of his account equity.

Challenges: High market volatility often led to rapid price movements against his positions.

Actions Taken:

- Strict adherence to predefined stop-loss orders.

- Avoidance of overtrading by maintaining discipline.

- Regular portfolio reviews to adjust leverage based on market conditions.

Outcomes: By maintaining disciplined position sizing and stop-loss placements, John was able to sustain manageable drawdowns even in volatile markets. This approach enabled steady account growth without significant losses, demonstrating effective Forex Drawdown Control in action.

Lessons Learned: Controlled leverage and strict risk management can mitigate the risks associated with high-leverage strategies, ensuring long-term trading success.

Case Study 2: Recovery from Significant Drawdowns

Trader Profile: Sarah, a novice day trader.

Strategy: Sarah initially focused on day trading with aggressive position sizes, leading to significant drawdowns during a market downturn.

Challenges: Experienced a severe 40% drawdown due to impulsive trades and overleveraging.

Actions Taken:

- Analyzed trading behavior to identify key mistakes.

- Revamped her trading plan with a focus on disciplined risk management.

- Implemented proper position sizing and disciplined stop-loss settings.

- Focused on emotional control to avoid revenge trading.

Outcomes: Gradually, Sarah recovered her losses by adhering to her new strategy and maintaining emotional control. She achieved consistent profitability, transforming her trading approach into a sustainable model with effective Managing Drawdowns in Forex Trading.

Lessons Learned: Identifying and correcting poor trading behaviors, coupled with disciplined risk management, can facilitate recovery from significant drawdowns and lead to long-term success.

Case Study 3: Long-Term Traders Handling Drawdowns

Trader Profile: Mike, a long-term trader with a diversified portfolio.

Strategy: Mike diversified his trading portfolio across multiple currency pairs and implemented trailing stop-loss orders to protect his profits.

Challenges: Consistently faced drawdowns during extended market downturns.

Actions Taken:

- Diversified across different forex pairs and asset classes.

- Implemented trailing stop-loss orders to lock in profits.

- Maintained a disciplined approach, sticking to his trading strategy despite market fluctuations.

Outcomes: Mike’s disciplined approach allowed him to withstand market downturns and capitalize on subsequent recoveries. Over multiple market cycles, his account experienced overall growth, showcasing the effectiveness of Forex Risk Management Techniques in managing drawdowns.

Lessons Learned: Diversification and the use of trailing stop-losses can enhance resilience against market downturns, contributing to sustained trading success.

Opofinance Services: Your Partner in Effective Drawdown Management

Choosing the right broker is vital for effective drawdown management. Opofinance, an ASIC-regulated forex broker, offers advanced tools and services to support your trading journey. As a broker for forex trading, Opofinance provides a secure and user-friendly environment tailored for both novice and experienced traders.

Opofinance’s social trading service allows you to learn from and copy strategies of successful traders, minimizing drawdowns by leveraging seasoned expertise. Featured on the MT5 brokers list, Opofinance grants access to the powerful MetaTrader 5 platform, renowned for its advanced trading capabilities.

Depositing and withdrawing funds with Opofinance is safe and convenient, thanks to a variety of trusted methods ensuring secure transactions. With Opofinance, you gain a reliable partner committed to your trading success, providing the tools and support necessary for effective drawdown management.

Conclusion

Mastering drawdown management in forex is essential for achieving sustainable trading success. By understanding the different types of drawdowns, recognizing their causes, and implementing effective management strategies, you can protect your capital and enhance your trading performance. Maintaining discipline, managing risk diligently, and committing to continuous improvement are key to thriving in the competitive forex market. With the right approach to drawdown management, you can navigate market fluctuations with confidence and build a resilient trading career.

Key Takeaways

- Understand Drawdown Types: Knowing absolute, maximum, and relative drawdowns is crucial for effective risk assessment and management.

- Implement Risk Management Strategies: Utilize position sizing, stop-loss orders, and portfolio diversification to control potential losses.

- Stay Emotionally Disciplined: Manage the psychological impacts of drawdowns to make rational and informed trading decisions.

- Choose a Reliable Broker: Partnering with a regulated forex broker like Opofinance enhances your trading capabilities and provides essential support.

- Commit to Continuous Learning: Regularly refine and adapt your strategies to stay ahead in the ever-evolving forex market.

How can I determine the optimal leverage to use in my forex trading?

Determining optimal leverage involves balancing potential returns with the risk of drawdowns. Assess your risk tolerance and trading experience, starting with lower leverage to minimize risks. Gradually increase leverage as you gain confidence and refine your trading strategies, ensuring that you maintain control over potential losses. Effective Forex Drawdown Control requires careful consideration of leverage levels to align with your overall risk management plan.

What are the best practices for setting stop-loss orders to minimize drawdowns?

Effective stop-loss orders should be placed based on technical analysis, such as support and resistance levels, or volatility measures. Avoid setting stops too tight to prevent premature exits or too loose to limit larger losses. Regularly review and adjust stop-loss levels in response to changing market conditions to align with your overall risk management strategy. Incorporating Forex Risk Management Techniques into your stop-loss strategy ensures that losses remain contained and manageable.

Can a diversified trading portfolio completely eliminate drawdowns?

While diversification significantly reduces the risk of large drawdowns by spreading exposure across different assets and currency pairs, it cannot completely eliminate drawdowns. Market conditions can affect multiple assets simultaneously, leading to correlated losses. However, a diversified portfolio enhances your ability to manage and mitigate drawdowns, contributing to more stable and consistent trading performance. Effective Managing Drawdowns in Forex Trading involves leveraging diversification as part of a comprehensive risk management strategy.