The end-of-day forex trading strategy is a powerful approach that focuses on analyzing and executing trades based on daily price movements, typically at the close of major forex sessions. Working with a regulated forex broker, this method allows traders to capitalize on significant market shifts while minimizing the time commitment required for constant monitoring. By concentrating on daily charts and end-of-day data, traders can identify key trends, support and resistance levels, and potential entry and exit points with greater clarity and less noise than shorter timeframes.

In this comprehensive guide, we’ll explore seven proven techniques to enhance your end of day forex trading strategy, providing you with the tools and knowledge to potentially boost your profits and streamline your trading routine. Whether you’re a beginner looking to establish a solid foundation or an experienced trader seeking to refine your approach, this article will offer valuable insights into maximizing the effectiveness of your end of day forex trading strategy.

1. Understanding the Fundamentals of End of Day Forex Trading

End of day forex trading is a strategy that focuses on analyzing and executing trades based on daily price movements, typically at the close of major forex sessions. This approach offers several advantages:

- Reduced time commitment: By focusing on daily charts, traders can make informed decisions without constantly monitoring the market.

- Clearer market perspective: Daily charts provide a broader view of market trends and patterns, reducing noise from short-term fluctuations.

- Better work-life balance: End of day trading allows for a more structured routine, ideal for those balancing trading with other commitments.

- Reduced emotional impact: Less frequent trading can lead to more objective decision-making and reduced emotional stress.

Key Elements of End of Day Forex Trading

To implement an effective end of day forex trading strategy, consider the following key elements:

- Timing: Focus on the daily close of major forex sessions, such as London, New York, or Tokyo. These times often provide the most reliable signals and liquidity.

- Chart analysis: Utilize daily charts to identify trends, support and resistance levels, and potential entry and exit points. Pay attention to key price action patterns and chart formations.

- Risk management: Implement strict stop-loss and take-profit levels to protect your capital. This is crucial for long-term success in forex trading.

- Patience: Avoid overtrading and wait for high-probability setups to present themselves. Quality trades are more important than quantity.

Read More: ICT Killzone Times

Choosing the Right Currency Pairs

When implementing an end of day forex trading strategy, it’s essential to select the right currency pairs. Consider the following factors:

- Volatility: Choose pairs with sufficient daily range to provide trading opportunities.

- Liquidity: Focus on major pairs that offer tight spreads and reliable execution.

- Correlation: Understand how different pairs relate to each other to avoid overexposure to similar market movements.

Some popular pairs for end of day trading include EUR/USD, GBP/USD, USD/JPY, and AUD/USD. However, the best pairs for you will depend on your specific strategy and risk tolerance.

2. The Power of Daily Candlestick Patterns

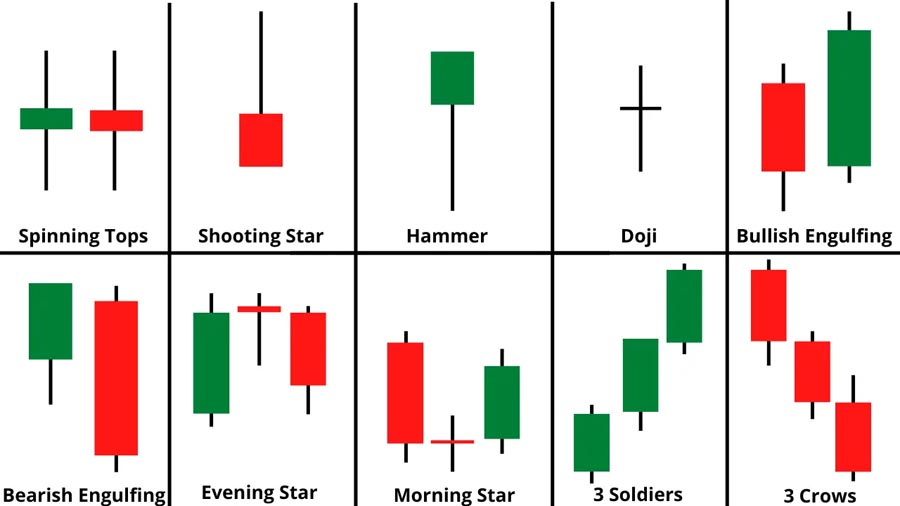

Candlestick patterns are essential tools for end of day forex traders. These visual representations of price action can provide valuable insights into market sentiment and potential trend reversals. Some key patterns to watch for include:

- Doji

- Engulfing patterns

- Pin bars

- Inside bars

Implementing Candlestick Patterns in Your Strategy

To effectively use candlestick patterns in your end of day forex trading strategy:

- Study and practice identifying these patterns on daily charts.

- Combine pattern analysis with other technical indicators for confirmation.

- Consider the overall market context when interpreting candlestick signals.

- Use patterns as part of a comprehensive trading plan, not in isolation.

Read More: ICT Midnight Open Strategy

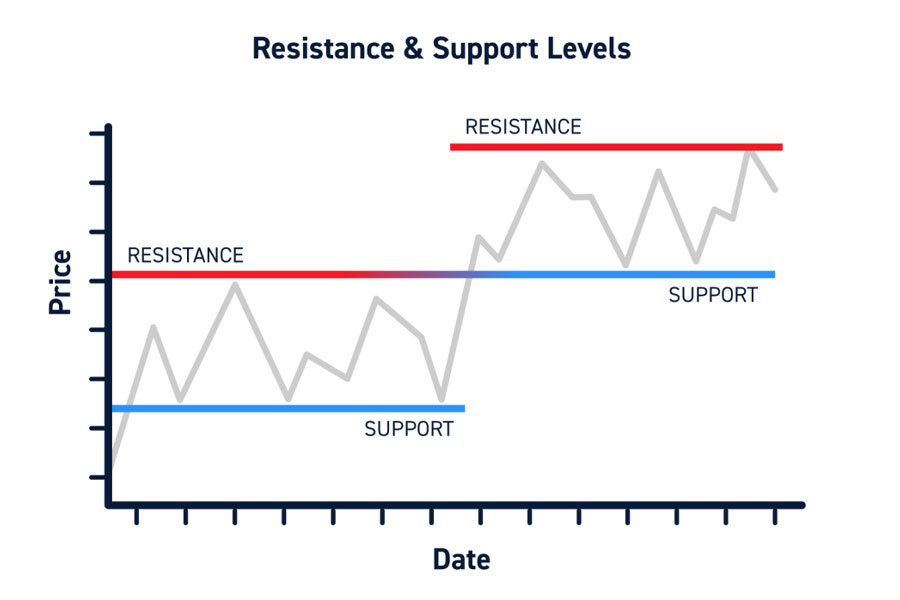

3. Leveraging Support and Resistance Levels

Support and resistance levels are crucial components of any end of day forex trading strategy. These price points represent areas where buying or selling pressure is likely to be strong, potentially leading to trend reversals or continuations.

Identifying and Using Support and Resistance

To effectively use support and resistance in your trading:

- Identify key levels using daily charts and historical price data. Look for areas where price has repeatedly reversed or stalled.

- Look for multiple touches of a level to confirm its significance. The more times a level has been tested, the more important it becomes.

- Consider using horizontal lines, trendlines, and Fibonacci retracements to identify potential support and resistance areas. These tools can help you spot less obvious levels.

- Be aware that support can become resistance (and vice versa) once broken. This role reversal is a key concept in technical analysis.

Implementing Support and Resistance in Your Strategy

- Use these levels to set entry points for trades. Look for bounces off support or rejections from resistance as potential trade signals.

- Place stop-loss orders just beyond support or resistance levels to manage risk. This helps protect your capital if the level is breached.

- Look for breakouts or bounces from these levels as potential trading opportunities. Confirmed breakouts can lead to significant price movements.

- Combine support and resistance analysis with other technical indicators for confirmation. This multi-faceted approach can increase the reliability of your trade setups.

Dynamic Support and Resistance

In addition to static levels, consider incorporating dynamic support and resistance into your analysis:

- Moving averages: Popular indicators like the 50-day and 200-day moving averages often act as dynamic support and resistance.

- Pivot points: These calculated levels can provide additional insight into potential turning points in the market.

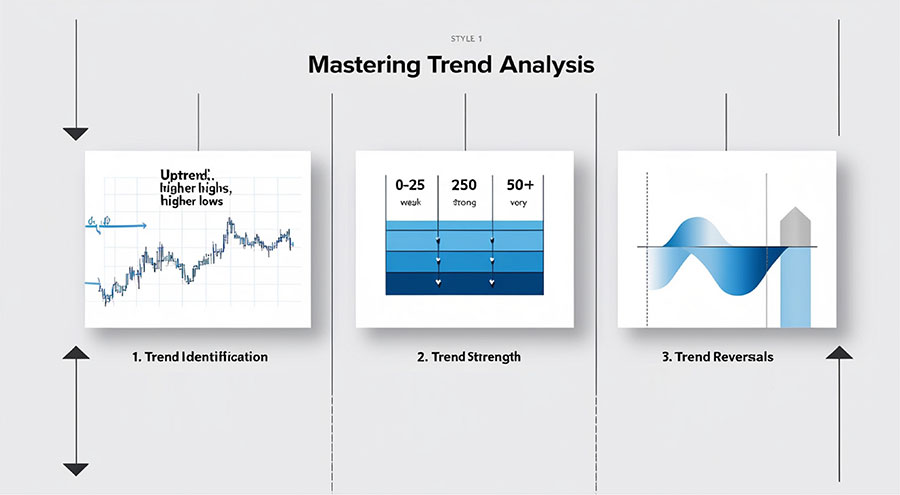

4. Mastering Trend Analysis for End of Day Trading

Trend analysis is a cornerstone of successful end of day forex trading. By identifying and trading with the prevailing market trend, you can increase your chances of profitable trades.

Key Aspects of Trend Analysis

- Trend identification: Use tools like moving averages, trendlines, and higher highs/lower lows to determine the overall market direction.

- Trend strength: Utilize indicators such as the Average Directional Index (ADX) to gauge trend strength. This can help you avoid trading in choppy or ranging markets.

- Trend reversals: Look for potential reversal signals using candlestick patterns, divergences, and other technical indicators. Being able to spot trend changes early can provide significant trading opportunities.

Implementing Trend Analysis in Your Strategy

- Trade in the direction of the prevailing trend for higher probability setups. This aligns you with the overall market momentum.

- Use pullbacks to the mean (e.g., a retracement to a moving average) as potential entry points. This allows you to enter trades at more favorable prices.

- Be cautious of trading against strong trends unless there are clear reversal signals. Counter-trend trading can be risky and should only be attempted with strong confirmation.

- Regularly reassess the market trend to avoid being caught in unexpected reversals. Markets can change direction quickly, so stay vigilant.

Advanced Trend Analysis Techniques

To further refine your trend analysis skills, consider these advanced techniques:

- Multiple timeframe analysis: Confirm trends across different timeframes for more reliable signals.

- Trend channel trading: Identify and trade within established trend channels for potential entries and exits.

- Momentum indicators: Use tools like the Relative Strength Index (RSI) or Stochastic Oscillator to gauge trend strength and potential reversals.

5. Implementing Effective Risk Management Techniques

Risk management is crucial for long-term success in forex trading, especially when using an end of day strategy.

Key Risk Management Techniques

- Position sizing: Determine the appropriate trade size based on your account balance and risk tolerance.

- Stop-loss orders: Always use stop-loss orders to limit potential losses on each trade.

- Risk-reward ratio: Aim for a favorable risk-reward ratio, typically 1:2 or higher.

- Diversification: Spread your risk across different currency pairs and avoid overexposure to a single trade or market.

Implementing Risk Management in Your Strategy

- Never risk more than 1-2% of your account balance on a single trade.

- Set stop-loss orders based on technical levels rather than arbitrary pip values.

- Use trailing stops to protect profits as trades move in your favor.

- Regularly review and adjust your risk management approach based on market conditions and performance.

6. Utilizing Key Technical Indicators for End of Day Trading

While price action should be the primary focus of your end of day forex trading strategy, technical indicators can provide valuable confirmation and additional insights.

Read More: Counter Trend Trading Strategy

Useful Indicators for End of Day Trading

- Moving Averages: Use multiple timeframe moving averages to identify trends and potential support/resistance levels.

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions and potential reversals.

- MACD (Moving Average Convergence Divergence): Useful for trend identification and spotting potential trend reversals.

- Bollinger Bands: Can help identify volatility and potential breakout opportunities.

Implementing Technical Indicators in Your Strategy

- Avoid indicator overload by focusing on a select few that complement your trading style.

- Use indicators in conjunction with price action analysis, not in isolation.

- Be aware of lagging indicators and their limitations in fast-moving markets.

- Regularly assess the effectiveness of your chosen indicators and adjust as needed.

7. Developing a Comprehensive End of Day Trading Plan

A well-structured trading plan is essential for consistent success in end of day forex trading.

Key Components of a Trading Plan

- a) Trading goals: Set realistic, measurable objectives for your trading performance.

- b) Entry and exit criteria: Clearly define the conditions under which you’ll enter and exit trades.

- c) Risk management rules: Outline your position sizing, stop-loss, and risk-reward parameters.

- d) Trading schedule: Establish a routine for analyzing markets and executing trades.

- e) Journal and review process: Regularly record and analyze your trades to identify areas for improvement.

Implementing Your Trading Plan

- Write down your plan and review it regularly to ensure adherence.

- Be disciplined in following your plan, even during challenging market conditions.

- Regularly assess and refine your plan based on performance and changing market dynamics.

- Consider using a demo account to test and refine your plan before risking real capital.

Conclusion

Mastering the end of day forex trading strategy requires a combination of technical analysis skills, disciplined risk management, and a well-structured trading plan. By focusing on daily charts and end-of-day data, traders can gain a clearer perspective on market trends and make more informed decisions without the need for constant market monitoring.

The seven techniques outlined in this article provide a solid foundation for success in end of day forex trading. From understanding fundamentals and leveraging technical analysis tools to implementing robust risk management and developing a comprehensive trading plan, each element plays a crucial role in developing a robust trading approach.

Remember that consistency and discipline are key to long-term profitability in forex trading. Continuously educate yourself, practice your skills, and refine your approach based on market conditions and your own performance. With dedication and the right strategy, end of day forex trading can be a powerful tool for achieving your financial goals in the dynamic world of currency markets.

How does end of day forex trading differ from scalping or day trading strategies?

End of day forex trading focuses on longer-term price movements and typically involves holding positions overnight or for several days. This approach allows for a more relaxed trading style compared to scalping or day trading, which require constant market monitoring and quick decision-making. End of day traders can analyze markets and place trades at specific times, usually around the close of major forex sessions, rather than throughout the entire trading day.

What are the tax implications of end of day forex trading?

The tax implications of end of day forex trading can vary depending on your country of residence and specific tax laws. In some jurisdictions, forex trading profits may be subject to capital gains tax, while in others, they might be treated as regular income. It’s important to consult with a tax professional familiar with forex trading to understand your specific obligations and potential strategies for tax efficiency.

How can I automate my end of day forex trading strategy?

Automating an end of day forex trading strategy can be achieved through the use of trading algorithms or Expert Advisors (EAs). This typically involves coding your trading rules and analysis techniques into a program that can automatically execute trades based on predetermined criteria. Popular platforms for automated trading include MetaTrader 4/5 and cTrader. However, it’s crucial to thoroughly backtest and forward test any automated strategy before using it with real money, and to regularly monitor its performance to ensure it adapts to changing market conditions.