Ever feel like you’re riding a rollercoaster when trading just one currency pair? You watch EUR/USD like a hawk, but one unexpected headline sends it tumbling, taking your trade with it. It’s frustrating, right? Relying on a single pair means all your eggs are truly in one basket, making you vulnerable to sudden market shocks and amplifying trading stress. But what if you could smooth out those bumps and approach the market with a bit more stability? That’s where a forex basket trading strategy comes in. It’s about trading a group of currency pairs together, aiming to diversify risk. By working with a savvy online forex broker, you can get the tools to manage these multi-pair positions effectively. Let’s dive into what forex basket trading involves and how you might apply this approach.

Why Consider a Basket Strategy?

Moving away from the intense focus on single pairs towards trading baskets opens up some attractive possibilities. It’s about broadening your view and leveraging the power of diversification, aiming for a potentially smoother trading journey using a forex basket trading approach.

Better Risk Management Through Diversification

This is the big one. Instead of putting all your focus (and risk) on how EUR/USD performs, a forex basket trading strategy spreads your exposure across several pairs. If one pair makes an unexpected move against you, the performance of others in the basket can help cushion the blow. Imagine you’re betting on broad USD weakness; a sudden USD rally against the Euro might be partly offset if the USD continues to weaken against the Yen within the same basket. It helps dilute the specific risk tied to any single currency, a core benefit of forex basket trading.

Less Drama Over Single Trade Outcomes

Because you’re looking at the basket’s overall result, you become less fixated on whether every single trade is a winner. In traditional trading, a loss is a loss. With forex basket trading, the goal is for the total outcome of all trades in the basket to be positive. It’s okay if some pairs lose, as long as the winners make up for it (and then some!). This portfolio view inherent in the forex basket trading strategy can take some pressure off individual trade performance.

Aiming for a Smoother Ride

By combining multiple pairs, the overall value of your basket position might fluctuate less wildly than a single volatile pair. While individual pairs can zip up and down, a well-chosen mix (especially with varied correlations) can lead to a more gradual change in your overall equity. It doesn’t remove risk, but it can make the performance feel less choppy when using forex basket trading.

Potentially More Efficient Management

While setting up needs thought, managing one overall basket position can sometimes be simpler than juggling lots of separate trades. Instead of constantly checking individual stops and targets for ten different positions, you might manage the basket based on its combined profit or loss level, focusing on the big picture driving your strategy. This efficiency is a practical advantage of the forex basket trading strategy.

Flexible by Design

Basket trading is adaptable. You can build baskets around a strong feeling about one currency, link them to commodity trends, play interest rate differences (carry trades), or even set up hedges. Plus, they aren’t set in stone – you can tweak them by adding/removing pairs or changing sizes as your market view evolves. This flexibility makes forex basket trading quite versatile.

Read More: Forex Diversification Strategies

How Forex Basket Trading Works: The Nuts & Bolts

Getting how forex basket trading functions means understanding how currency pairs relate to each other (correlation), spreading your bets (diversification), and aiming for the whole group of trades to end up positive. Think of it like conducting an orchestra – getting multiple instruments to play together harmoniously within your overall forex basket trading strategy.

The Importance of Currency Correlation

Correlation tells us how closely two currency pairs move together. It’s key for building smart baskets.

- Moving Together (Positive Correlation): Pairs like EUR/USD and GBP/USD often move in the same direction relative to the USD. If you think the Dollar will weaken, including both in a basket makes sense. But beware: if you’re wrong about the Dollar, both might lose together, amplifying the loss.

- Moving Oppositely (Negative Correlation): Pairs like EUR/USD and USD/CHF tend to move in opposite directions. You might use negatively correlated pairs for hedging or to express a specific view (e.g., Euro strength relative to the Swiss Franc).

Knowing these relationships helps you pick pairs that fit your overall goal when setting up your forex basket trading plan.

Spreading Exposure for Diversification

In forex basket trading, diversification means choosing different pairs that align with your market view but aren’t exactly the same. If you think the Japanese Yen (JPY) will weaken, you might buy EUR/JPY, GBP/JPY, and AUD/JPY. While all benefit from JPY weakness, you’re exposed to Euro, Pound, and Aussie Dollar factors too, spreading the risk beyond just one economy versus Japan.

Focusing on the Net Result

This is crucial: manage the basket as one unit. Don’t obsess if one or two pairs are down. What matters is the total profit or loss of all pairs combined. Your target might be a $500 net profit for the basket, even if that means some pairs made $300 each and others lost $100 each. Your stop-loss should also be based on the basket’s total performance, a key principle of forex basket trading.

Related Ideas: Currency Strength & Indexes

Basket trading often goes hand-in-hand with analysing currency strength. Tools can show which currencies are broadly strong or weak. You might build a basket by buying the strongest currency against the weakest one via several pairs. Similarly, analysing an index like the US Dollar Index (DXY) can inform a basket designed to trade an expected move in the Dollar. These inputs are valuable for refining a forex basket trading strategy.

Read More: Most Correlated Forex Pairs

Building Your Forex Basket Trading Strategy

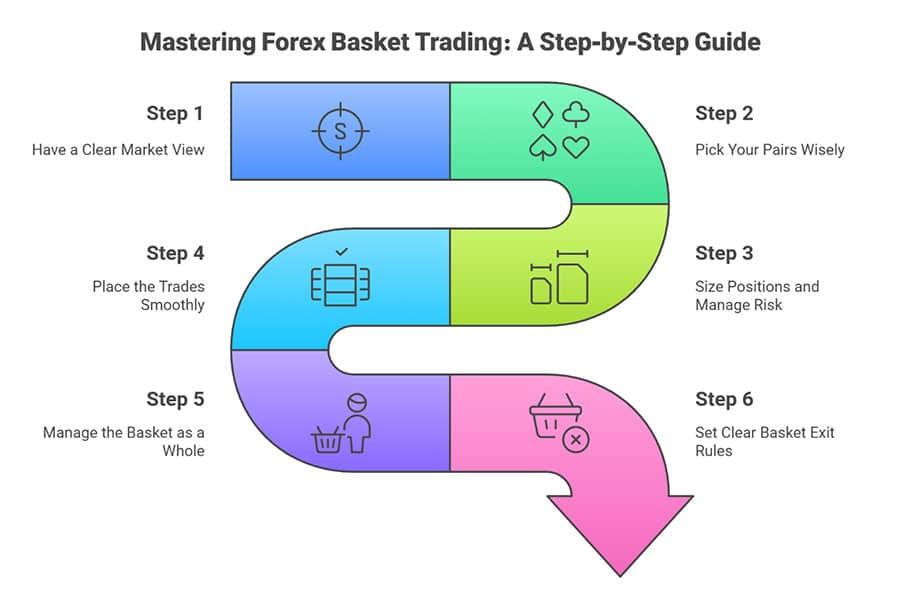

Putting together a solid forex basket trading strategy is a step-by-step affair. It’s more than just throwing pairs together; it needs a clear vision, careful selection, and disciplined handling. Here’s how you might approach developing your own forex basket trading system:

Step 1: Have a Clear Market View

It all begins with an idea about where you think a currency or the market is heading. For example:

- “I think the Canadian Dollar (CAD) will strengthen because oil prices are rising.”

- “Based on central bank talk, I expect the Euro (EUR) to weaken against most other majors.”

- “Increased global uncertainty makes me think the Swiss Franc (CHF) will gain as a safe haven.”

This core idea is your starting point for any forex basket trading.

Step 2: Pick Your Pairs Wisely

Choose currency pairs that reflect your market view. Remember correlation:

- Expecting CAD strength? Maybe LONG CAD/JPY, SHORT EUR/CAD, LONG AUD/CAD (if you think CAD will outperform AUD too).

- Expecting EUR weakness? Maybe SHORT EUR/USD, SHORT EUR/GBP, SHORT EUR/AUD, SHORT EUR/JPY.

Mix it up to get diversification while staying true to your main idea. Don’t load up only on pairs that move identically unless you’re extremely confident.

Step 3: Size Positions and Manage Risk

This part is vital. Decide:

- Total Basket Risk: How much of your account are you willing to risk on this whole basket idea? (e.g., 1.5% of equity).

- Risk Per Pair: How do you split that risk?

- Evenly: If risking $300 total on 6 pairs, assign $50 risk to each. Adjust the trade size for each pair based on its volatility and where you’d place its individual (mental) stop to equate to $50 risk.

- Weighted: Put a bit more risk on pairs you feel stronger about, less on others.

Good sizing ensures that even if the whole basket goes wrong and hits your overall stop-loss, the damage stays within your comfort zone. This is critical risk management within a forex basket trading strategy.

Step 4: Place the Trades Smoothly

Get all the orders for the basket pairs placed. Doing this manually requires quick action. Using scripts or automated tools (Expert Advisors) can help execute them almost simultaneously, which is ideal for maintaining the intended structure right from the start.

Step 5: Manage the Basket as a Whole

Shift your focus: track the combined profit or loss of all pairs in the basket. Keep an eye on individual pairs, but resist tweaking them constantly based on their solo performance. Your decisions should be based on the basket’s overall progress towards its goal.

Step 6: Set Clear Basket Exit Rules

Know exactly when you’ll close the entire basket – for profit or loss.

- Profit Goal: A specific net profit level for the whole basket (e.g., close all trades when total P&L hits +$800).

- Stop-Loss: A maximum net loss level for the basket (e.g., close all if total P&L drops to -$400). This protects your capital.

- Time Exit: Maybe close the basket by Friday afternoon, regardless of P&L, if your view was week-dependent.

- View Changes: If the reason you built the basket no longer holds true (e.g., surprise central bank announcement), close it, even if targets aren’t met.

Sticking to these basket-level rules is key for making any forex basket trading strategy work consistently.

Examples of Forex Basket Strategies

The beauty of the forex basket trading strategy approach is its flexibility. You can tailor baskets for different market conditions and goals. Let’s look at a few common examples of forex basket trading in action:

Single Currency Focus Basket

This popular type banks on a strong feeling about one currency’s direction against several others.

- Example: “Strong Aussie” Basket

- View: Expecting the Australian Dollar (AUD) to rally broadly due to strong domestic data and rising commodity prices.

- Pairs: LONG AUD/USD, LONG AUD/JPY, LONG AUD/NZD, LONG AUD/CAD, maybe SHORT EUR/AUD.

- Logic: Capture potential AUD strength against various counterparts, diversifying the risk slightly compared to just trading AUD/USD.

- Management: Track the combined P&L. Exit based on a total profit goal or stop-loss, or if the reasons for AUD strength fade.

Commodity Currency Basket

Groups currencies linked to commodity prices like the Australian (AUD), Canadian (CAD), and New Zealand Dollars (NZD).

- Example: “Weak Commodity Bloc” Basket

- View: Expecting falling oil and metal prices to hurt commodity-linked currencies.

- Pairs: SHORT AUD/USD, SHORT CAD/JPY, SHORT NZD/USD.

- Logic: Aims to profit from a downturn in the commodity complex affecting these currencies simultaneously.

- Management: Monitor commodity price trends alongside the basket’s performance. This is a thematic forex basket trading approach.

Carry Trade Basket

Tries to earn interest rate differentials (swaps) by holding high-interest-rate currencies against low-interest-rate ones, across multiple pairs.

- Example: Diversified Carry Basket

- View: Markets are calm, and interest rate differences are likely to persist.

- Pairs: Identify high-yielders (e.g., MXN, TRY historically) and low-yielders (JPY, CHF). Create pairs like LONG USD/JPY (if US rates > Japan rates), LONG AUD/JPY, maybe SHORT EUR/MXN.

- Logic: Collect net positive interest daily from multiple positions, spreading the risk compared to a single carry pair. Works best when currency values aren’t swinging wildly. Implementing this as a form of forex basket trading helps manage the risk exposure.

- Management: Watch interest rate policies and market volatility. Big currency moves can wipe out interest gains quickly.

Hedging Basket Strategy

Baskets can also be used defensively to manage risk on other positions.

- Example: Portfolio Risk Adjustment

- Scenario: You have several unrelated long JPY positions (e.g., LONG USD/JPY, LONG CAD/JPY) but worry about sudden, broad JPY strength hurting them all.

- Pairs: Add a smaller, offsetting position, perhaps SHORT NZD/JPY (if NZD looks particularly weak) or even a small LONG EUR/JPY position if EUR looks strong, to slightly counterbalance the overall JPY exposure.

- Logic: This isn’t a pure directional bet but an attempt to fine-tune the overall portfolio’s sensitivity to JPY moves using a mini-basket. This sophisticated use of forex basket trading requires careful position sizing.

- Management: Adjust the hedge basket components based on evolving risks and correlations.

Read More: The GBPUSD Illusion of Easy Money

Handling Risk in Basket Trading

While diversifying is great, the forex basket trading strategy isn’t risk-free. Knowing the specific challenges and how to address them is crucial for success when engaging in forex basket trading.

Correlation Risk: When Diversification Fails

This is a big one. If your main market prediction is wrong, the very correlations you used to build the basket can cause all pairs to move against you at once.

- Example: You build a “Weak Euro” basket (Short EUR/USD, EUR/GBP, EUR/JPY) anticipating bad news from Europe. Instead, surprise positive news sends the Euro soaring against all majors.

- Result: All your positions lose simultaneously. The diversification didn’t help because the core assumption was incorrect.

Solution: Do your homework! Thorough analysis is key. Keep an eye on correlations, as they can change. And always, always respect your overall basket stop-loss.

Keeping Track: Complexity

Juggling multiple positions, their individual results, and the net outcome requires good organization.

- Problem: It’s easy to get lost in the details and lose sight of the basket’s total performance or margin usage.

- Solution: Use platform features that group trades or calculate net P&L easily. Spreadsheets can help. Automation (scripts/EAs) can be a lifesaver for managing exits based on total P&L, reducing manual errors in your forex basket trading.

Need for Good Analysis

Successful basket trading relies on understanding the bigger picture – market trends, currency relationships, economic factors.

- Problem: Being great at finding short-term patterns on one chart doesn’t automatically translate to predicting broad currency strength or weakness needed for baskets.

- Solution: Study macroeconomics, central bank actions, and global events. Learn about correlation and currency strength indicators. Start with simple baskets based on clear ideas before getting too complex with your forex basket trading strategy.

Margin and Leverage Watch

Opening many trades at once, even small ones, adds up in terms of margin used.

- Problem: A basket moving against you can tie up significant margin, risking margin calls if you’re overleveraged.

- Solution: Calculate the total margin needed before trading. Keep leverage modest. Ensure your basket-level stop-loss limits the total risk to a manageable percentage of your capital. Know your broker’s margin rules.

Helpful Tools for Basket Trading

Using the right tools can make implementing your forex basket trading strategy much smoother and more effective. Here’s what can help:

Trading Platforms Ready for Multi-Tasking

You need a platform that handles multiple trades well.

- MetaTrader 4/5 (MT4/MT5): The go-to for many. They easily handle multiple positions, and crucially, have a huge library of custom tools (indicators, scripts, EAs) specifically for tasks like managing baskets based on net profit/loss.

- cTrader: Another solid choice, known for good analysis tools and supporting automated trading (cBots) for basket management.

- Broker Platforms: Some brokers offer their own platforms that might have built-in features for grouping trades or placing basket orders.

Look for ease of viewing combined P&L and options for automation when selecting a platform for forex basket trading.

Analytical Aids: Strength & Correlation

Understanding how currencies stack up is vital.

- Currency Strength Meters: These tools (often MT4/5 indicators or web-based) rank currencies (USD, EUR, JPY, etc.) based on their recent performance against others. Great for spotting potentially strong or weak currencies for focus baskets.

- Correlation Matrices: Show how closely different pairs move together. Essential for picking pairs that provide real diversification or understanding potential risks in your chosen basket. Find these as indicators or on financial sites.

- News & Calendars: Basket strategies often rely on fundamental views, so staying updated on economic news is non-negotiable.

Automation: Scripts & Expert Advisors (EAs)

Automation can take the heavy lifting out of execution and management.

- Order Scripts: Simple code (like MQL4/5 for MetaTrader) can place all your basket orders instantly with the correct sizing.

- Basket Management EAs: These are powerful. They can watch the total profit/loss of your basket trades and automatically close everything when your overall target or stop-loss is hit. This enforces discipline and saves you from manual calculations under pressure. Critical for efficient forex basket trading.

Finding or developing good automated tools can be a game-changer for your forex basket trading.

Opofinance Services: Powering Your Basket Trading

Having the right broker partner is essential for effectively executing strategies like forex basket trading. Opofinance, regulated by ASIC, provides a feature-rich ecosystem that can really support this approach:

- Versatile Trading Platforms: Choose from MT4, MT5, cTrader, and the user-friendly OpoTrade. This selection ensures you have the tools needed to manage multiple positions, analyze correlations, and potentially utilize automated basket EAs.

- Smart AI Tools: Get an edge with unique AI features like the AI Market Analyzer for deeper insights, an AI Coach to help refine your basket strategy logic, and responsive AI Support.

- Community & Skill Development: Tap into social trading insights or challenge yourself with prop trading opportunities, broadening your market exposure.

- Hassle-Free Banking: Enjoy secure and easy deposits and withdrawals, including crypto options, with the added benefit of zero transaction fees charged by Opofinance – keeping more of your capital working for you.

Discover how Opofinance’s blend of regulation, technology, and trader-friendly conditions can elevate your forex basket trading strategy. Visit Opofinance today to explore the possibilities!

Conclusion: Wrapping Up Basket Trading

So, what’s the bottom line on the forex basket trading strategy? It’s essentially a portfolio approach applied to currencies, shifting focus from single-pair wins and losses to the overall performance of a carefully chosen group. The big draw is diversification, which can help manage risk and potentially lead to less volatile results compared to trading just one pair. It rewards traders who can accurately read broader market themes and currency relationships. However, it’s not without challenges – it demands good analysis, organized management, and awareness of correlation risks. Whether this forex basket trading strategy fits you depends on your comfort with managing multiple positions, your analytical style, and your risk appetite. It’s a sophisticated technique worth considering if you’re looking beyond single-pair trading.

- What it is: Trading a group (basket) of currency pairs together as one position – a core concept of forex basket trading.

- Why do it: To diversify risk, potentially smooth out returns, and trade broader market themes.

- How it works: Relies on understanding currency correlations and managing the net profit/loss of the entire basket.

- Building one: Start with a clear market view, select pairs carefully, size positions for risk control, and set clear basket exit rules for your forex basket trading strategy.

- Common types: Focus on one currency’s strength/weakness, commodity trends, interest rate differences (carry), or hedging.

- Watch out for: Correlation risk (if your view is wrong), complexity, needing strong analytical skills, and managing margin across multiple trades.

- Helpful tools: Good platforms (MT4/5, cTrader), correlation/strength tools, and automation (EAs/scripts).

- Who is it for?: Traders who like a top-down view, understand macro factors, and are comfortable managing a portfolio using a forex basket trading approach.

How does volatility affect forex basket trading?

Volatility impacts basket trading significantly, but in nuanced ways. High volatility can increase potential profits but also drastically increases risk, especially correlation risk – if pairs move sharply against your core assumption simultaneously. It can also rapidly increase margin usage. Conversely, some basket strategies, like carry trade baskets, thrive in low-volatility environments where interest earnings aren’t eroded by large price swings. When constructing a forex basket trading strategy, you must consider the current and expected volatility environment and adjust position sizing and risk parameters accordingly.

Can I mix different types of strategies within one basket?

While possible, mixing fundamentally different strategies (e.g., combining a short-term momentum play on one pair with a long-term carry trade element on another within the same “basket”) is generally not recommended, especially for less experienced traders. It makes the basket’s overall objective unclear and complicates management and risk assessment. A successful forex basket trading strategy usually relies on a single, coherent theme or market view driving the selection and management of all included pairs. Keeping the purpose of the basket clear makes it easier to manage and evaluate.

How often should I re-evaluate or adjust my forex basket?

The frequency depends on the strategy’s timeframe and the nature of your core market view. A short-term basket based on an upcoming news event might only last hours or days. A basket based on a longer-term macroeconomic view (e.g., expected interest rate divergence over months) might be held longer. You should constantly monitor if the underlying reason for the basket remains valid. Re-evaluate correlations periodically, as they can change. Adjustments (adding/removing pairs, changing weights) might be needed if market conditions shift significantly or if some pairs clearly diverge from the expected behaviour, but avoid constant tinkering without solid reasons when implementing your forex basket trading approach.