Understanding the maze of forex tax in India can feel more challenging than predicting market movements. As a trader, your primary focus is on strategy and profits, but ignoring tax compliance can wipe out your gains. The core question is: how are forex profits taxed? In India, profits from legal, exchange-traded currency pairs are treated as business income, taxed at your applicable slab rate (5% to 30%). This guide will walk you through everything from legality and tax calculation to finding a compliant online forex broker, helping you navigate the complexities of forex trading tax in India for 2025.

Key Takeaways

- Legality is Key: Only trade INR-based pairs (USD-INR, EUR-INR, GBP-INR, JPY-INR) on SEBI-regulated exchanges like NSE, BSE, and MCX-SX. Trading on offshore platforms or in non-INR pairs violates FEMA rules.

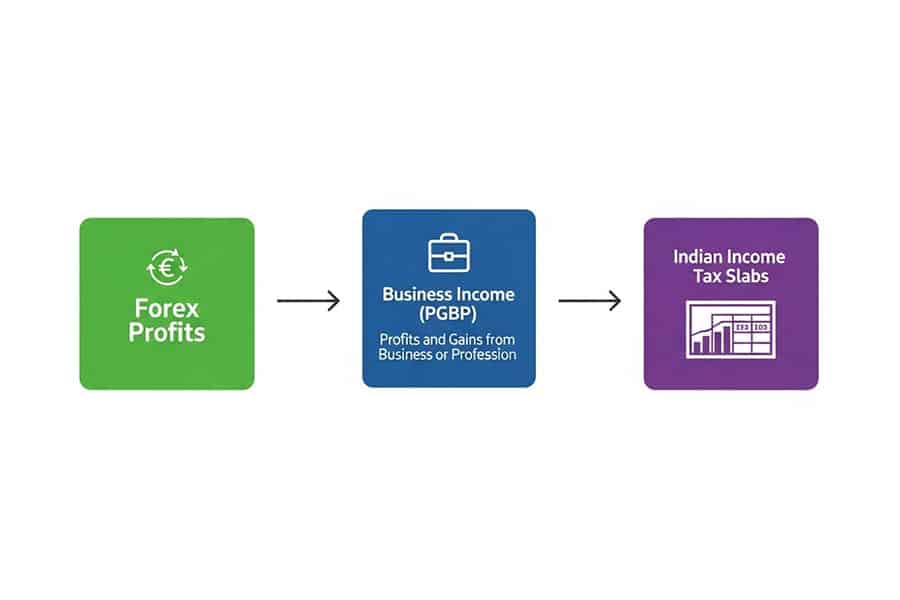

- Taxation Method: Forex trading profits are typically classified as “Profits and Gains from Business or Profession” (PGBP). They are added to your total income and taxed according to your individual income tax slab rates.

- Turnover Calculation: Turnover isn’t the total value of your trades. It’s the sum of absolute profits and losses from each transaction. This figure is crucial for determining if a tax audit is necessary.

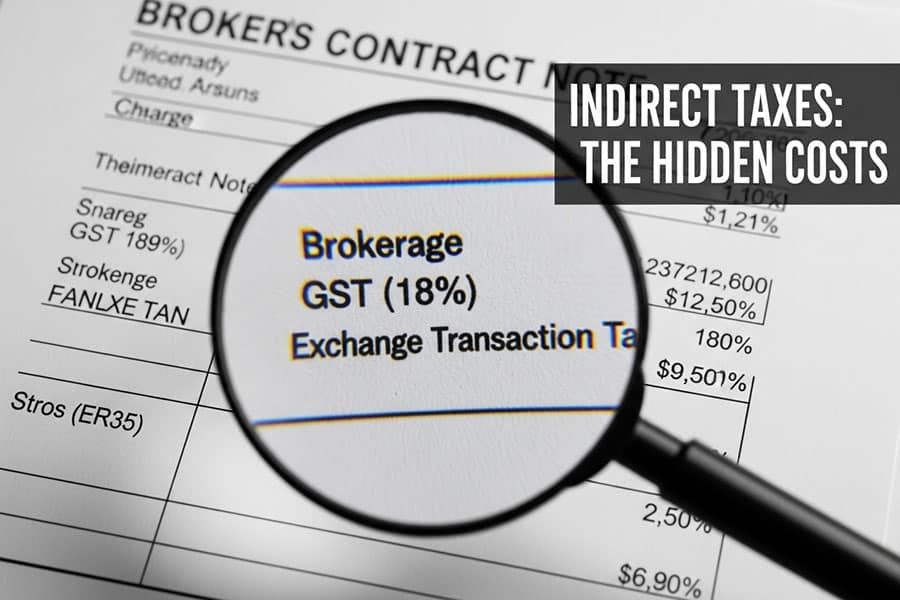

- Indirect Taxes Apply: You’ll encounter a Goods and Services Tax (GST) of 18% on brokerage fees and currency conversion charges. Furthermore, a Tax Collected at Source (TCS) of 20% applies to foreign remittances over ₹7 lakh under the Liberalised Remittance Scheme (LRS), though this is claimable as a tax credit.

- Presumptive Taxation: If your total turnover is below ₹2 crore, you might be eligible for the presumptive taxation scheme under Section 44AD, which simplifies tax filing by assuming a profit of 6% of your turnover, bypassing the need for extensive bookkeeping.

- Loss Set-Off is Permitted: Losses from non-speculative forex trading (treated as business income) can be set off against any other income source except salary. These losses can also be carried forward for up to eight assessment years.

- Filing is Mandatory: You must file your returns using ITR-3, the form designated for individuals with income from a business or profession. Accurate record-keeping is non-negotiable.

Disclaimer: Tax laws are subject to frequent changes. The information in this article is for educational purposes only. Please consult a qualified Chartered Accountant (CA) or tax lawyer before making any financial decisions.

Quick-Answer Box: How Much Tax Do I Pay?

For traders who need the bottom line fast, here’s the essential information. The amount of forex tax in India you pay depends directly on your profit, treated as business income. This means your net forex profit is added to your other income (like salary or rent) and taxed at your personal slab rate.

| Net Taxable Income (including Forex Profits) | Tax Rate (New Regime – FY 2024-25) | Advance Tax Due Dates |

| Up to ₹3,00,000 | 0% | 15% by June 15 45% by Sep 15 75% by Dec 15 100% by Mar 15 |

| ₹3,00,001 to ₹6,00,000 | 5% | |

| ₹6,00,001 to ₹9,00,000 | 10% | |

| ₹9,00,001 to ₹12,00,000 | 15% | |

| ₹12,00,001 to ₹15,00,000 | 20% | |

| Above ₹15,00,000 | 30% |

A one-liner on indirect taxes: Remember to factor in 18% GST on currency conversion charges and brokerage. Also, any foreign remittance above ₹10 lakh for trading purposes could trigger a 20% TCS on forex transactions, which you can claim back later.

Is Forex Trading Income Legal & Taxable in India?

This is the first and most critical question every Indian trader asks. The answer is nuanced. Yes, forex trading is legal and the income is taxable, but only under stringent conditions set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). From my years of experience, I’ve seen many new traders fall into the trap of illegal platforms, facing severe consequences.

The primary regulation governing this space is the Foreign Exchange Management Act (FEMA), 1999. The FEMA rules for forex trading are crystal clear: Indian residents can only legally trade currency derivatives that have the Indian Rupee (INR) as the base or quote currency. Currently, this limits you to four pairs:

- USD-INR (US Dollar – Indian Rupee)

- EUR-INR (Euro – Indian Rupee)

- GBP-INR (British Pound – Indian Rupee)

- JPY-INR (Japanese Yen – Indian Rupee)

Furthermore, these trades must be executed on recognized Indian stock exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or the Metropolitan Stock Exchange (MCX-SX). Any platform offering to trade major pairs like EUR-USD or GBP-JPY directly is operating outside these Indian regulations. Engaging with such offshore brokers, often advertising heavily on social media, constitutes a violation of FEMA. The penalties can be severe, including financial penalties up to three times the amount involved and, in some cases, even imprisonment. The RBI frequently issues press releases cautioning the public against these unauthorized platforms.

So, if you are trading legally within the RBI’s framework, your income is fully taxable. The Income Tax Act, 1961, does not distinguish between legal and illegal income for taxation purposes—it taxes all income. However, by trading on illegal platforms, you expose yourself not just to income tax scrutiny but also to harsh FEMA penalties. It’s a risk that simply isn’t worth taking.

Read More: Is forex legal?

Direct Taxes on Forex Profits

Once you’ve ensured your trading is legal, the next step is understanding how your profits are taxed directly. This is the core of managing your forex tax in India. Unlike stock market gains, which can be capital gains, forex trading income is almost always classified as business income. This has significant implications for tax rates, expense deductions, and ITR filing.

Business vs. Speculative Classification

The Income Tax Act classifies business income into two main categories: speculative and non-speculative. The category your forex trading falls into determines how you can treat your losses.

- Non-Speculative Business Income: This is the default and most common classification for forex derivatives trading on recognized exchanges. A non-speculative transaction is one where the contract is for actual delivery of goods or commodities. While forex futures and options are cash-settled and don’t involve physical currency delivery, they are specifically excluded from the definition of “speculative transaction” under Section 43(5) of the Income Tax Act, provided the trades are done on a recognized exchange. This is a huge advantage. Income is taxed at your slab rate, and you can deduct a wide range of expenses.

- Speculative Business Income: A transaction is speculative if it’s settled without the actual transfer of the commodity or scrip. If you were to trade forex through an illegal, non-recognized platform, your income would likely be treated as speculative. While the profit is still taxed at the slab rate, the rules for setting off losses are much stricter. A speculative loss can only be set off against speculative gains, making it far less flexible.

In my experience, as long as you stick to SEBI-approved exchanges, you can confidently declare your forex trading tax in India under non-speculative business income. This allows for better tax planning and loss management.

Tax Slabs 2025 (with table)

As business income, your net forex profit is added to your total income for the financial year. The tax is then calculated based on the slab rates applicable to you. For the Financial Year 2024-25 (Assessment Year 2025-26), individuals can choose between the Old and New Tax Regimes. The New Tax Regime is the default, and generally more beneficial if you don’t have significant deductions to claim.

Here’s a table for the New Tax Regime to help you calculate your liability:

| Income Tax Slabs (New Regime – FY 2024-25) | |

| Income Slab | Tax Rate |

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹6,00,000 | 5% on income above ₹3,00,000 |

| ₹6,00,001 – ₹9,00,000 | ₹15,000 + 10% on income above ₹6,00,000 |

| ₹9,00,001 – ₹12,00,000 | ₹45,000 + 15% on income above ₹9,00,000 |

| ₹12,00,001 – ₹15,00,000 | ₹90,000 + 20% on income above ₹12,00,000 |

| Above ₹15,00,000 | ₹1,50,000 + 30% on income above ₹15,00,000 |

Note: A Health and Education Cess of 4% is applicable on the calculated income tax. Surcharge may also apply for high-income earners.

Audit & Presumptive Schemes (Sec 44AB & 44AD)

This is where things get technical, but understanding these sections can save you from a lot of compliance headaches. The requirement for a tax audit is linked to your turnover.

Calculating Turnover: For forex trading, turnover is not your total contract value. It’s the aggregate of absolute profits and absolute losses. For example, if you made a ₹50,000 profit on one trade and a ₹20,000 loss on another, your turnover is ₹50,000 + ₹20,000 = ₹70,000.

Tax Audit under Section 44AB: A tax audit by a Chartered Accountant becomes mandatory under certain conditions:

- If your total business turnover exceeds ₹1 crore in a financial year.

- This limit is extended to ₹10 crore if your cash receipts and payments are less than 5% of total receipts and payments, respectively (which is common for online traders).

- An audit is also required if you opt out of the presumptive scheme (Section 44AD) and your income is below the basic exemption limit.

Presumptive Taxation under Section 44AD: This is a godsend for small to medium-sized traders. If your total turnover from the business is less than ₹2 crore, you can opt for this scheme. Under Section 44AD, you can declare your profit as 6% of your total turnover (if transactions are digital) or 8% (if cash-based). By doing so, you are not required to maintain detailed books of accounts or get them audited. For most forex traders, where all transactions are digital, the 6% rule applies. This is a powerful tool for simplifying your forex tax in India compliance.

However, if your actual profit is higher than 6%, you must declare the higher profit. If your actual profit is lower than 6% and you choose to declare this lower profit, you cannot use Section 44AD and must get your accounts audited if your total income exceeds the basic exemption limit.

Read More: Tax Implications of Forex Trading

Indirect Taxes You Can’t Ignore

Your tax liability doesn’t end with direct income tax. Several indirect taxes chip away at your capital and profits. Ignoring them means you’re miscalculating your true net returns. These are costs of doing business and are critical for a complete picture of your forex tax in India obligations.

GST on Conversion & Brokerage

The Goods and Services Tax (GST) is levied on the services you use for trading. It’s not a tax on your profit, but on the transaction costs. The standard rate for financial services, including brokerage, is 18%. This means for every ₹100 your broker charges you as a fee, you’ll pay an additional ₹18 in GST.

The GST on currency conversion is slightly more complex and is levied on a slab basis when you are dealing with actual currency conversion (less common for derivative traders but relevant for international transactions):

| GST on Currency Conversion Slabs | |

| Transaction Value | GST Applicable |

| Up to ₹1,00,000 | 1% of the gross amount of currency exchanged (Min. ₹250) |

| ₹1,00,001 to ₹10,00,000 | ₹1000 + 0.5% of the gross amount of currency exchanged |

| Above ₹10,00,000 | ₹5500 + 0.1% of the gross amount of currency exchanged (Max. ₹60,000) |

For most derivative traders, the key takeaway is the 18% GST on brokerage and other transaction charges like exchange transaction tax.

New TCS Rules from 1 Apr 2025

Tax Collected at Source (TCS) has become a major point of discussion. The rules primarily apply to foreign remittances under the Liberalised Remittance Scheme (LRS). While you shouldn’t be using LRS to fund illegal offshore forex accounts, TCS can still be relevant.

Under the new rules effective from the Finance Bill, any aggregate foreign remittance above a threshold of ₹7 lakh in a financial year will attract TCS. For most purposes, the rate is 20%. So, if you are remitting funds abroad that could be linked to your trading activities (e.g., paying for a legitimate international trading tool or service), you need to be aware of the TCS on forex transactions.

The crucial thing to remember is that TCS is not an extra tax. It is an advance tax collected on behalf of the government, which you can claim back as a credit against your final income tax liability when you file your returns. It’s a cash flow issue, not a permanent tax, but you must account for it in your capital management.

Stamp Duty & SEBI Charges Snapshot

These are smaller transaction costs, but they add up over thousands of trades.

- Stamp Duty: A small duty is levied by the government on currency derivative contracts. It’s typically around 0.0001% on the buy-side of futures and 0.001% on options premium.

- SEBI Charges: The market regulator, SEBI, also charges a very small fee per crore of transaction value to cover its regulatory costs.

- Exchange Transaction Tax (CTT/ETT): The exchange (like NSE) will charge a fee for facilitating the trade. For currency futures, it’s around 0.0009% of the turnover, and for options, it’s around 0.035% of the premium.

Your broker’s contract note will provide a detailed breakdown of all these charges. It’s good practice to review it to understand your total trading cost.

Special Situations

The world of finance is rarely straightforward. Many traders face unique circumstances, from being an NRI to dealing with losses or unconventional payout methods. Understanding the rules for these scenarios is vital for maintaining compliance with forex trading tax in India regulations.

NRI Forex-Fluctuation Relief (Clause 72)

Non-Resident Indians (NRIs) face a unique challenge: currency fluctuation can create gains or losses on their investments, even if the underlying asset’s value doesn’t change. The proposed new income tax bill includes provisions to address this, particularly for unlisted shares. While not directly for active forex trading, Clause 72 offers a mechanism to adjust the cost of acquisition and sale consideration of certain assets for currency fluctuations between the date of investment and the date of sale. This helps in calculating a more accurate capital gain, preventing NRIs from being taxed on gains that are purely due to forex rate changes. This is a specific relief and it’s important to consult a CA to see how it might apply to any India-based investments you hold as an NRI.

Crypto/USDT Payout vs Bank Transfer

Some illegal offshore brokers offer payouts in cryptocurrencies like USDT (Tether) to circumvent the banking system and FEMA. This is a massive red flag. Accepting payments this way creates two major tax problems. First, you’re dealing with an illegal trading platform. Second, you now have a crypto transaction to account for. Under Indian tax law, crypto assets are subject to a flat 30% tax on gains, with no deductions allowed for expenses other than the cost of acquisition. You also cannot set off any losses from crypto against any other income. By accepting a crypto payout, you are converting a potential business income (taxable at slab rates with deductions) into a crypto gain (taxable at a flat 30% with no deductions), likely resulting in a much higher tax bill and significant legal risk. Always insist on bank transfers from your SEBI-regulated broker.

Loss Set-off & Carry-Forward Matrix

Losses are an inevitable part of trading. The good news is that the tax laws allow you to use these losses to reduce your tax burden.

Here’s how it works for non-speculative business losses (the standard for legal forex trading):

- Intra-head Set-off: You can set off your forex trading loss against any other business income you might have in the same year.

- Inter-head Set-off: If the loss still remains, you can set it off against any other head of income in the same year, such as rental income or interest income. However, you cannot set off a business loss against salary income.

- Carry Forward: If you still have a net loss after these adjustments, you can carry it forward for up to eight assessment years. In subsequent years, this carried-forward loss can only be set off against non-speculative business income.

To claim this benefit, you must file your income tax return by the due date. Failing to do so will result in you losing the ability to carry forward your business losses.

Compliance Playbook (Actionable Steps)

Knowing the rules of forex tax in India is one thing; implementing them is another. Here’s a practical, step-by-step playbook I’ve refined over the years to stay compliant and stress-free during tax season. This is your action plan for handling forex trading tax in India like a professional.

Daily P&L Log Template

Meticulous record-keeping is the foundation of tax compliance. Don’t wait until the end of the year. Your broker provides daily contract notes and a P&L statement, but maintaining your own log helps in cross-verification and gives you a real-time view of your tax situation. A simple spreadsheet is all you need.

Your log should have columns for:

- Date: The date of the trade.

- Contract Details: e.g., USDINR Jan Futures.

- Buy Value: Total cost of entering the position.

- Sell Value: Total proceeds from exiting the position.

- Gross Profit/Loss: (Sell Value – Buy Value).

- Brokerage & Charges: All transaction costs (including GST).

- Net Profit/Loss: (Gross P/L – Charges).

At the end of the year, you can simply sum up the Net P&L column to get your total trading profit or loss. Also, sum the absolute values in the Gross P/L column to calculate your turnover for the audit check.

Choosing Correct ITR Form (ITR-3 vs ITR-2)

Using the wrong Income Tax Return (ITR) form is a common mistake that leads to a defective return notice.

- ITR-3: This is the correct form for you. Since forex trading income is classified as “Profits and Gains from Business or Profession,” you must use ITR-3. This form allows you to report business income, calculate turnover, and claim eligible expenses. It’s more detailed than other forms, requiring a profit and loss statement and a balance sheet (though simplified if you opt for presumptive taxation).

- ITR-2: This form is for individuals with capital gains income but no business income. Do not use this form for your forex trading profits, as it will lead to incorrect reporting.

Filing ITR-3 might seem daunting, but it’s manageable. If you find it overwhelming, hiring a CA is a wise investment.

Sec 1256 Election? (Explain why India doesn’t allow)

You might read on international forums about a “Section 1256 election,” which is a provision in the US tax code. It allows traders to treat 60% of their futures trading gains as long-term capital gains (taxed at a lower rate) and 40% as short-term capital gains. This is a very favorable tax treatment for US traders.

It’s crucial to understand that this does not apply to India. The Indian Income Tax Act has its own distinct set of rules. There is no equivalent of a Section 1256 election in India. All profits from forex derivatives trading are treated as 100% business income and taxed at your applicable slab rate. Applying US tax concepts to your Indian filings is a recipe for disaster. Stick to the Indian Income Tax Act and the guidance provided here.

Read More: Forex Tax in Dubai

5 Tax-Saving Strategies (Legit)

Paying your fair share of tax is a duty, but there’s no reason to pay more than you’re legally required to. Here are five legitimate strategies to optimize your forex tax in India liability. These are not loopholes but smart applications of the existing tax laws.

1. Deductible Expenses List

Since your trading is a business, you can deduct expenses incurred wholly and exclusively for that business. This directly reduces your net taxable profit. I maintain a separate bank account for trading to make tracking these expenses easier. Common deductible expenses include:

- Brokerage and transaction charges (CTT, Stamp Duty, SEBI fees).

- GST paid on these charges.

- Salary paid to any staff helping with your trading business.

- Internet and telephone bills (pro-rated if used for personal use too).

- Depreciation on your computer or office equipment used for trading.

- Subscription fees for trading software, data analysis tools, or financial news services.

- Fees paid to a tax consultant or CA for filing your returns.

- Rent for the premises if you have a dedicated office for trading.

2. Presumptive 44AD if Eligible

As discussed earlier, if your turnover is below ₹2 crore, Section 44AD can be a powerful tax-saving and simplification tool. If your actual profit margin is, say, 10%, you can opt for this scheme and declare a profit of only 6% of your turnover. This legally reduces your taxable income. For example, on a turnover of ₹50 lakh, your actual profit might be ₹5 lakh. But under 44AD, you can declare a profit of just ₹3 lakh (6% of ₹50 lakh), saving tax on the ₹2 lakh difference. Remember, this comes with the trade-off of not being able to claim individual expenses.

3. Adjust TCS as Advance Tax Credit

If you’ve had Tax Collected at Source (TCS) deducted on any foreign remittances, do not forget to claim it. The 20% TCS on forex transactions over the LRS threshold might seem like a big hit, but it’s essentially an advance tax payment. When you file your ITR, this amount is credited against your total tax liability. If the TCS paid is more than your final tax liability, you will receive a refund. You can view your total TCS paid in your Form 26AS on the income tax portal.

4. Use RFC Account When Returning NRI

This is a specific strategy for NRIs who are returning to India for good (becoming a Resident and Ordinarily Resident). Before you return, you can convert your foreign currency funds into a Resident Foreign Currency (RFC) account in India. The interest earned on an RFC account is tax-exempt in India until you maintain your Resident but Not Ordinarily Resident (RNOR) status. This allows you to legally shield your foreign currency assets from Indian tax for a period, which can be beneficial for managing capital intended for trading.

5. Hedge Exposure to Cut Turnover

This is an advanced strategy related to managing your audit liability. Since turnover is the sum of absolute profits and losses, volatile trading with big swings can inflate your turnover figure quickly, even if your net profit is small. By using hedging strategies (e.g., using options to protect a futures position), you can potentially reduce the magnitude of your losses. A smaller loss in a losing trade means a lower contribution to your total turnover. This can help you stay under the ₹1 crore or ₹10 crore audit thresholds, saving you the cost and complexity of a mandatory tax audit.

“Many traders focus solely on profits, forgetting that tax compliance is an integral part of wealth preservation. The key is proactive management: classify your income correctly, maintain meticulous records, and leverage provisions like Section 44AD where applicable. Treating your trading as a professional business from day one is the best way to avoid surprises from the tax department.” – Quote from a Chartered Accountant

Key Takeaways

Navigating the landscape of forex tax in India requires diligence. Success isn’t just about profitable trades; it’s about legally retaining those profits. The most critical takeaway is to operate within the legal framework provided by RBI and SEBI. Trading only in INR pairs on recognized exchanges is non-negotiable. Classify your income as non-speculative business income, which allows you to deduct expenses and manage losses effectively. Keep a keen eye on your turnover to determine if a tax audit is required, and consider the presumptive scheme under Section 44AD for simplification. Remember the impact of indirect taxes like GST and TCS. Finally, timely filing of your ITR-3 is essential to carry forward any losses. By treating your trading as a serious business, you can build a sustainable and compliant trading career.

Disclaimer: This article provides a general overview and is not a substitute for professional tax advice. Tax laws are complex and change over time. Always consult with a qualified Chartered Accountant to address your specific financial situation.

Why Choose Opofinance?

For traders seeking a robust and technologically advanced trading environment, Opofinance stands out as an ASIC-regulated broker committed to empowering its clients. We provide a comprehensive suite of tools designed for the modern trader:

- Advanced Trading Platforms: Choose from industry-standard platforms like MT4, MT5, and cTrader, or use our proprietary OpoTrade app for a seamless mobile experience.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer, personalized AI Coach, and responsive AI Support system.

- Flexible Trading Options: Explore diverse opportunities with our Social Trading and Prop Trading programs.

- Secure & Flexible Transactions: We prioritize your convenience and security with safe deposit and withdrawal options, including crypto payments with zero fees.

Start your advanced trading journey with Opofinance today.

Conclusion

Mastering forex tax in India is a journey of continuous learning. For 2025, the principles remain clear: stay legal, maintain immaculate records, and understand how your income is classified and taxed. By viewing tax compliance not as a burden but as a core component of your trading business, you safeguard your hard-earned capital. Use the strategies outlined, from deducting expenses to leveraging presumptive schemes, to legally optimize your tax liability. Ultimately, a well-informed trader is a profitable and sustainable trader in the long run.

Can I claim my home internet bill as a trading expense?

Yes, you can claim the portion of your internet bill that is used for your trading activities. You must make a reasonable allocation between personal and business use (e.g., 50%) and claim only the business portion.

What happens if I forget to file my ITR for forex income?

Failing to file your ITR can lead to penalties, interest on the tax due, and a notice from the Income Tax Department. Most importantly, you will lose the right to carry forward any trading losses to future years.

Is tax on forex trading in India different for futures vs. options?

No, the tax treatment is the same. Profits from both currency futures and options on recognized exchanges are considered non-speculative business income and are taxed at your applicable slab rate.

Do I need a GST number for forex trading?

No, an individual forex trader is not required to register for GST. The GST on brokerage and other services is charged by your broker, who then remits it to the government. You do not have a separate GST liability on your trading profits.

How is the income from a joint trading account taxed?

The income from a joint account is typically taxed in the hands of the primary account holder. However, the income can be split between the holders if it can be proven that the capital was contributed by both, in which case it should be declared proportionately in their respective ITRs.