Chasing quick wins in the forex market? The GBP/USD pair, known for its lively movements, can be your arena for rapid, intraday trading gains. Imagine pinpointing market entries and exits with precision, seizing profit opportunities in mere minutes. This guide reveals the power of the GBPUSD 15 min strategy, a favored technique for traders who aim to harness intraday volatility. We’re breaking down a complete approach to trading GBP/USD using a 15-minute chart, giving you the insights to sharpen your trading edge. To effectively implement this strategy, choosing the right forex trading broker is paramount. Continue reading to discover how to potentially maximize your trading outcomes and select a suitable platform.

Understanding GBP/USD

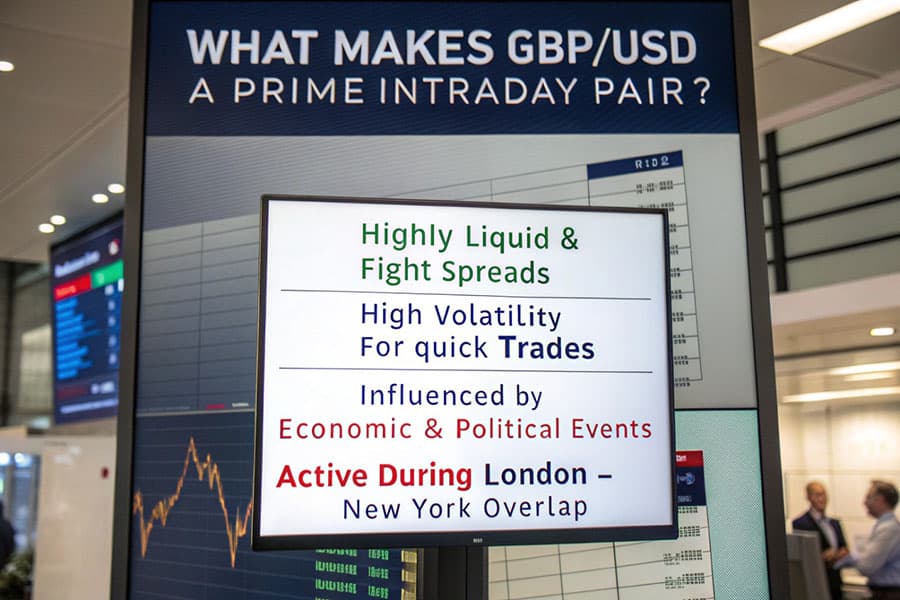

Before diving into the strategy, it’s vital to understand the instrument itself. The GBP/USD pair, often nicknamed “Cable”, is a cornerstone of the forex market. It pits the British Pound against the US Dollar, creating a dynamic exchange rate heavily influenced by economic and political tides. Its popularity stems from high liquidity and tight spreads, making it a prime choice for day traders. However, this allure is matched by significant volatility, driven by economic releases and geopolitical shifts.

Characteristics and Behavior

GBP/USD is notorious for its energetic price action. This stems from the inherent strengths and occasional clashes of the UK and US economies. Expect rapid fluctuations, especially when key economic data surfaces, such as inflation reports, employment figures, and GDP announcements from either nation.

Factors Influencing Volatility

Numerous factors can ignite GBP/USD volatility. Economic indicators are front and center, but don’t underestimate geopolitical events. Brexit aftermath, changes in central bank policies (Bank of England and Federal Reserve), and global risk sentiment all play a role. Unforeseen events can trigger dramatic price swings, demanding nimble strategy and robust risk management.

Optimal Trading Sessions

For a gbpusd 15 minute strategy, timing is everything. Liquidity and volatility peak when the London and New York trading sessions overlap. This window, roughly from 8:00 AM to 12:00 PM EST, presents the most fertile ground for trading opportunities. During these hours, expect tighter spreads and more pronounced price movements, ideal for intraday strategies.

Read More: Gbpusd scalping strategy

Key Strategy Components

A successful gbpusd 15 minute strategy is built upon several core technical elements. These components work in harmony to identify high-probability trading setups and manage risk effectively within the fast-paced 15-minute timeframe.

Market Structure & Trend Analysis

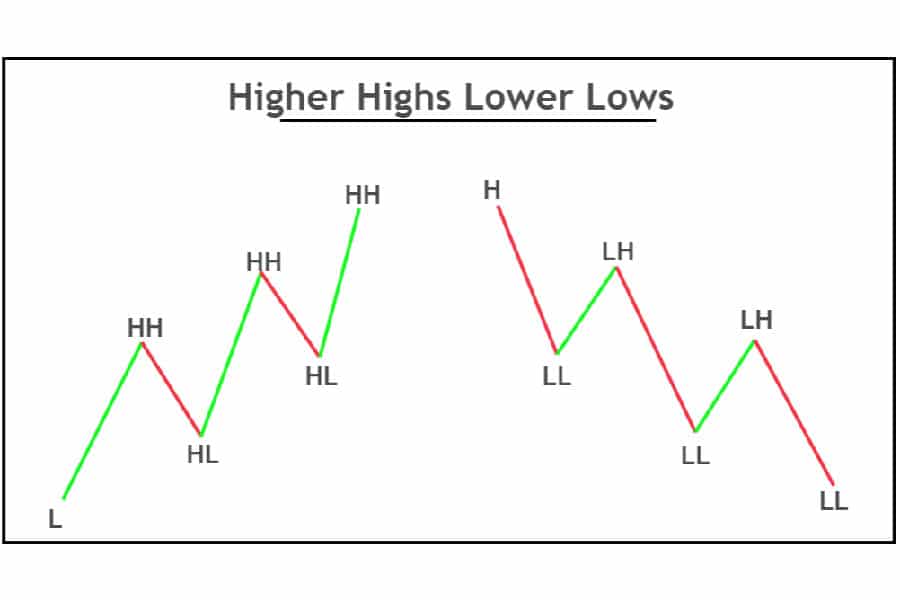

Trend identification is your compass in the gbpusd 15 minute strategy. On the 15-minute chart, discern the immediate, intraday trend. Are prices carving higher highs and lows (uptrend) or lower highs and lows (downtrend)? While the 15-minute view is your trading canvas, always zoom out to higher timeframes like the 1-hour or 4-hour charts. Confirming the overarching trend direction on these higher timeframes adds a layer of robustness to your 15-minute setups. Aligning your intraday trades with the dominant trend significantly boosts your odds of success. For example, if a 4-hour chart reveals a clear uptrend, prioritize long trades on your 15-minute chart.

Support and Resistance Zones

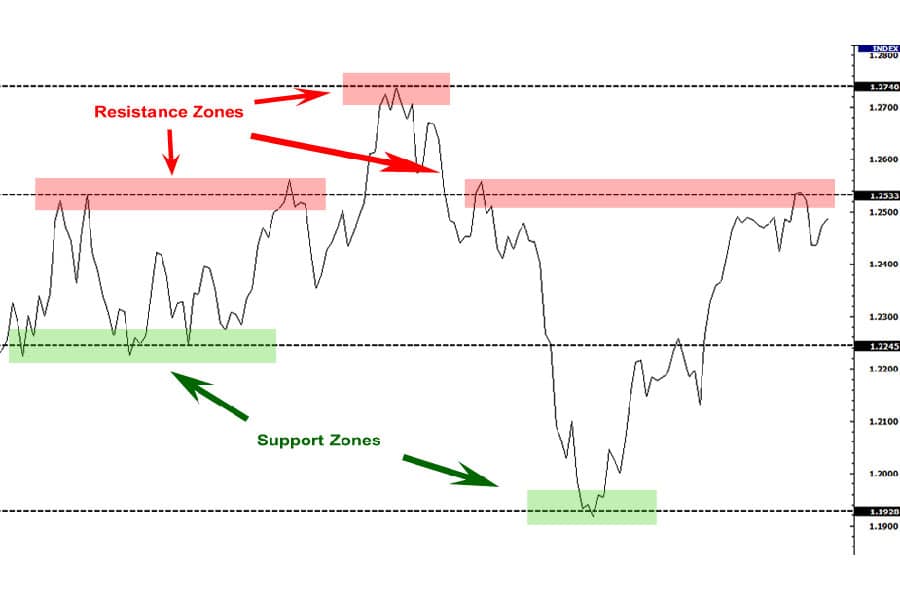

Support and resistance are the cornerstones of technical analysis and are crucial for any gbpusd 15 minute strategy. These levels are price zones where buying or selling interest is expected to intensify, potentially halting or reversing price movements. On a 15-minute chart, pinpoint intraday support and resistance by observing prior price peaks, troughs, and congestion areas. These zones become critical decision points for intraday traders. Anticipate price reactions when approaching these levels. For instance, a vigorous bounce from a support level, corroborated by other indicators, can signal a compelling long entry point.

Candlestick Patterns for Entries & Exits

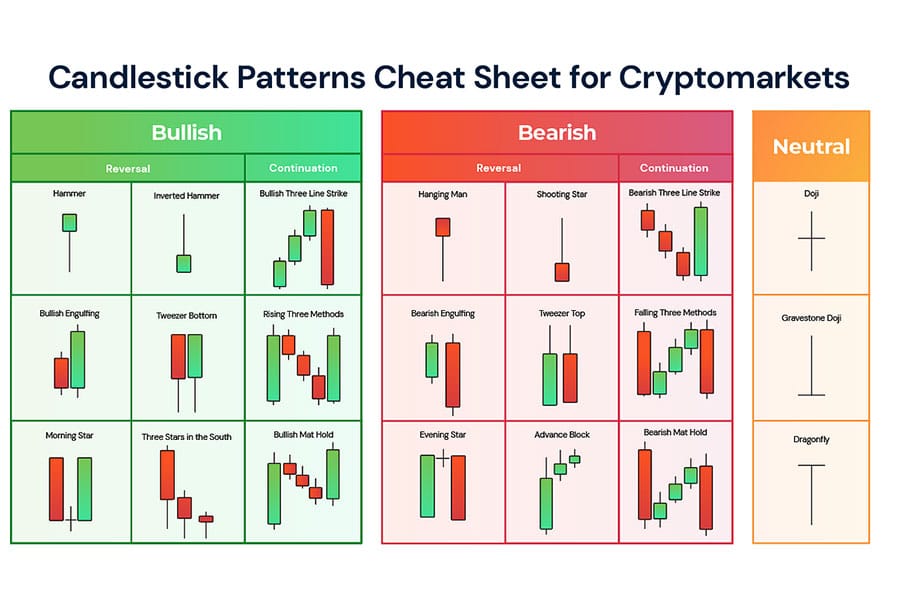

Candlestick patterns are visual whispers of market sentiment and potential price reversals, invaluable for precise trade timing in a gbpusd 15 minute strategy. Focus on potent patterns like pin bars (indicating price level rejection), engulfing candles (suggesting trend shifts), and inside bars (signaling consolidation before breakouts). For trade entries, seek these patterns forming at or near established support and resistance zones. A bullish engulfing candle emerging at a support level, for example, can be a high-confidence buy signal. Conversely, bearish patterns appearing near resistance can highlight shorting opportunities. Use candlestick patterns for both refined entry and exit points to maximize trade efficiency.

Time-Based Strategy: 7-9 AM EST Breakout

Time-based strategies leverage the rhythm of market activity throughout the trading day. The 7:00 AM to 9:00 AM EST timeframe often witnesses heightened volatility in GBP/USD as European markets fully engage. A favored gbpusd 15 minute strategy exploits range breakouts during this period. Identify the price range established in the early market hours, specifically from 7:00 AM EST. Strategically place buy stop orders just above the range high and sell stop orders just below the range low. A decisive breakout from this initial range can trigger your orders, potentially initiating profitable trades as market momentum accelerates with the unfolding session.

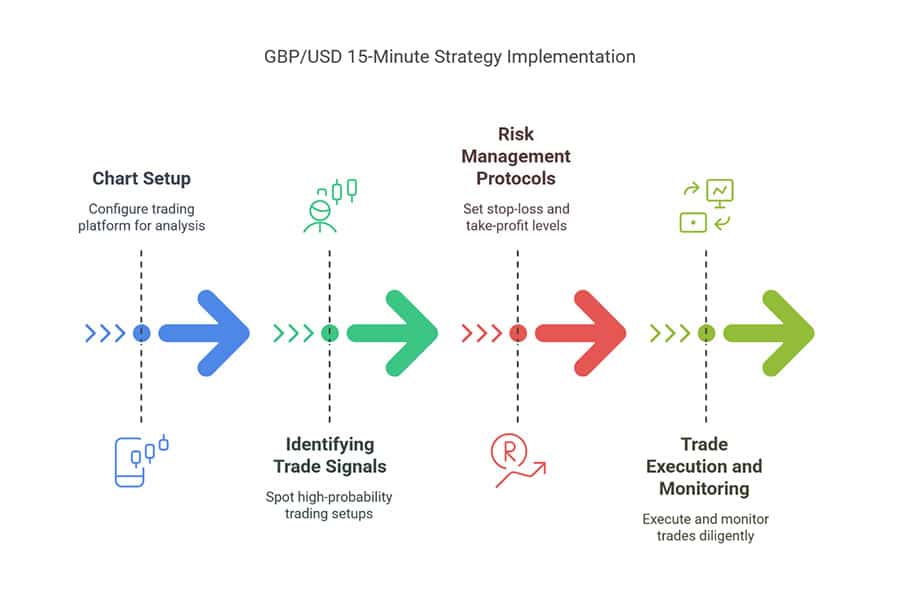

Step-by-Step Strategy Implementation

Putting the gbpusd 15 minute strategy into action requires a structured approach. Follow these steps to set up your charts, identify trading signals, manage risk, and execute your trades with precision and discipline.

Chart Setup

Begin by configuring your trading platform to display 15-minute charts for the GBP/USD pair. Clean, uncluttered charts are essential for swift analysis and decision-making in a gbpusd 15 minute strategy. Apply these core technical tools:

- Trendlines: Draw trendlines to visually delineate the prevailing intraday trend direction.

- Support & Resistance Levels: Mark significant support and resistance zones based on recent price action, focusing on key swing highs and lows.

- Moving Averages (Optional): Consider adding a 20-period or 50-period moving average to your chart. These can act as dynamic support and resistance and aid in visualizing the immediate trend.

Identifying Trade Signals

With your chart ready, focus on spotting high-probability trading setups. Analyze price behavior around your identified support and resistance levels, especially during peak trading hours (7:00 AM – 12:00 PM EST). Seek confluence – the convergence of multiple signals to strengthen your trade conviction. For example, price rebounding from a support level, reinforced by a bullish candlestick pattern and a surge in volume, constitutes a more robust buy signal than any single indicator in isolation.

Risk Management Protocols

Unwavering risk management is absolutely critical for consistent success with any gbpusd 15 minute strategy. Always pre-determine your stop-loss and take-profit levels before initiating any trade.

- Stop-Loss Placement: Strategically position your stop-loss order. For long positions, place it just below a recent swing low. For short positions, position it just above a recent swing high. A common technique is to use a multiple of the Average True Range (ATR) to calculate stop-loss distance, effectively accounting for GBP/USD’s inherent volatility.

- Take-Profit Targets: Establish realistic take-profit targets based on nearby resistance levels (for long trades) or support levels (for short trades). Aim for a risk-reward ratio of at least 1:2. This means targeting potential profits that are at least twice the size of your potential loss.

- Position Sizing Strategy: Adhere to a strict position sizing rule. Never risk more than 1% to 2% of your total trading capital on any single trade. Adjust your position size to comply with this rule, regardless of where your stop-loss is placed. This protects your capital from excessive drawdowns.

Trade Execution and Monitoring

Execute your trades with precision, only when your pre-defined strategy criteria are definitively met. Resist the urge to enter trades impulsively based on fleeting emotions. Once a trade is active, diligently monitor price action. Be prepared to proactively manage your position. Consider adjusting your stop-loss to breakeven or trailing it upwards as the trade progresses favorably to secure profits. However, avoid the pitfall of premature trade closure. Allow your take-profit target to be reached unless compelling market shifts invalidate your initial trade premise.

Read More: Best 15 minute forex trading strategy

Alternative 15-Minute Strategies

Beyond the core strategy, several alternative approaches can be effective for trading GBP/USD on the 15-minute chart. These strategies offer different perspectives and may suit varying trading styles and market conditions.

Moving Average Crossover System

Moving average crossovers are time-tested trend-following signals adaptable for a gbpusd 15 minute strategy. Employ two Simple Moving Averages (SMAs): a faster SMA (e.g., 25-period) and a slower SMA (e.g., 50-period).

- Long Signal: A bullish signal emerges when the 25-period SMA crosses above the 50-period SMA, potentially indicating the start of an uptrend. Initiate a long position.

- Short Signal: A bearish signal occurs when the 25-period SMA crosses below the 50-period SMA, possibly signaling a downtrend. Initiate a short position.

Implement robust risk management. Position stop-loss orders below the most recent swing low for long trades and above the latest swing high for short trades. Aim to secure profits at a multiple of your initial risk or at the next discernible support or resistance level.

Bollinger Band Breakout System

Bollinger Bands are volatility indicators that can be leveraged in a gbpusd 15 minute strategy to capitalize on volatility expansions after periods of market consolidation. Bollinger Bands consist of a middle band (typically a Simple Moving Average) and upper and lower bands set at standard deviations away from the middle band.

- Long Breakout Trade: When the price decisively breaks above the upper Bollinger Band following a period of constricted band width (signifying low volatility), it can signal the beginning of a strong upward price surge. Enter a long position on such breakouts.

- Short Breakout Trade: Conversely, when the price breaches below the lower Bollinger Band after a period of narrow band width, it may indicate the onset of a sharp downward price move. Initiate a short position on these breakdowns.

Manage risk by placing stop-loss orders just inside the Bollinger Bands. Target profit-taking at a multiple of your risk or at the opposing Bollinger Band.

Fibonacci Retracement System

Fibonacci retracement levels are widely used to identify potential pullback zones within established trends, making them valuable for a gbpusd 15 minute strategy. In an uptrend, after a strong upward price movement, prices often retrace to key Fibonacci levels before resuming the upward trajectory. Key Fibonacci retracement levels to watch are 38.2%, 50%, and 61.8%.

- Long Entry Setup: In an uptrending market, patiently await a price pullback towards a Fibonacci retracement level that aligns with a pre-identified support zone. Seek bullish candlestick patterns forming at these confluent levels to confirm your long entry.

- Short Entry Setup: In a downtrending market, anticipate price rallies towards Fibonacci retracement levels that coincide with resistance zones. Look for bearish candlestick patterns emerging at these levels to validate your short entry.

Protect your capital by placing stop-loss orders just below relevant Fibonacci levels for long trades and just above for short trades. Set profit targets at the prior swing high (for long positions) or swing low (for short positions).

Read More: What is gbpusd in forex

Common Trading Errors

Even with a well-defined gbpusd 15 minute strategy, certain common pitfalls can undermine your trading performance. Be vigilant and actively avoid these frequent mistakes:

- Overtrading Tendency: The rapid pace of the 15-minute chart can create the illusion of abundant trading opportunities, leading to overtrading. Adhere strictly to your strategy’s defined entry criteria. Not every minor price fluctuation constitutes a valid trade setup. Cultivate patience and unwavering discipline.

- Ignoring Economic Announcements: Major economic news releases, particularly from the UK and the US, can inject extreme volatility into GBP/USD, rendering technical setups temporarily unreliable. Always consult the economic calendar and refrain from trading during high-impact news events, or proactively tighten your risk parameters.

- Insufficient Risk Management: Improper stop-loss placement or excessively large position sizes can rapidly erode your trading capital, especially in the volatile GBP/USD market. Always prioritize meticulous risk management above the allure of potential profit on any individual trade. Capital preservation is paramount.

Pro Tip for Advanced Traders

Strategy Fusion & Confluence Mastery: For experienced traders seeking to refine their gbpusd 15 minute strategy, consider integrating elements from multiple strategies to amplify signal robustness. For example, seek moving average crossovers that occur in close proximity to Fibonacci retracement levels and Bollinger Band breakouts that are validated by strong candlestick patterns. The greater the convergence of independent trading signals (confluence), the higher the probability of a successful trade outcome. Furthermore, incorporate volume analysis to strengthen confirmation of breakouts and reversals. A surge in trading volume accompanying breakouts or reversals lends significant credence to your trading signals, enhancing their reliability.

Trade GBP/USD with Opofinance: Your ASIC-Regulated Advantage

Supercharge your gbpusd 15 minute strategy by trading with Opofinance, a premier ASIC-regulated broker. Unlock superior trading conditions and access cutting-edge tools meticulously engineered to maximize your potential within the dynamic forex market.

- Advanced Platform Suite: Execute trades with unparalleled efficiency on industry-leading platforms: MT4, MT5, cTrader, and the groundbreaking OpoTrade platform. Benefit from advanced charting tools and seamless order execution.

- AI-Powered Trading Tools: Gain a competitive edge with Opofinance’s innovative AI-driven toolset:

- AI Market Analyzer: Harness data-driven insights to pinpoint high-probability trading opportunities with speed and accuracy.

- AI Trading Coach: Elevate your trading skills and receive personalized guidance from an AI-powered coach, tailored to your individual trading style and goals.

- Intelligent AI Support: Access instant, intelligent support and receive immediate answers to your trading queries via our AI-powered assistance system.

- Social & Prop Trading Network: Become part of a vibrant trading community. Connect with fellow traders, exchange strategy insights, and explore lucrative proprietary trading opportunities to potentially amplify your trading capital and network.

- Secure and Streamlined Transactions: Experience secure and convenient deposit and withdrawal processes, featuring diverse methods including crypto-currency payments, all processed with zero fees imposed by Opofinance, ensuring optimal transaction efficiency.

Ready to revolutionize your GBP/USD trading? Begin trading with Opofinance now!

Conclusion

Mastering the gbpusd 15 minute strategy provides a powerful means to tap into intraday profit potential within the dynamic forex arena. However, sustained success demands unwavering discipline, consistent strategy application, and robust risk management protocols. Rigorously backtest any strategy using historical market data and refine your approach through diligent practice on demo accounts before committing real capital. Continuously adapt and optimize your strategy based on ongoing performance analysis and evolving market dynamics. With a meticulously crafted trading plan and steadfast discipline, achieving consistent profitability in GBP/USD trading on the 15-minute timeframe becomes a realistic and attainable objective.

Key Takeaways

- The GBPUSD 15 min strategy is specifically tailored for intraday trading, designed to capitalize on short-term price fluctuations.

- A deep understanding of GBP/USD volatility catalysts and optimal trading session timings is paramount for effective strategy implementation.

- Core strategy components encompass trend analysis, support/resistance identification, candlestick pattern recognition, and time-based trading tactics.

- Stringent risk management practices, including the consistent use of stop-loss orders and appropriate position sizing, are indispensable for safeguarding trading capital.

- Actively avoid prevalent trading errors such as overtrading, neglecting critical economic news releases, and inadequate risk management procedures.

- Commit to continuous backtesting and iterative refinement of your chosen strategy to foster long-term trading success.

Is the GBPUSD 15-minute strategy suitable for beginner forex traders?

While the allure of rapid gains with a GBPUSD 15 min strategy is undeniable, it necessitates a strong foundation in technical analysis and disciplined risk management. If you are new to forex trading, it is strongly recommended to first acquire practical experience on a demo trading account and thoroughly learn the essential principles of forex trading before deploying this or any intraday strategy with live funds. Consider commencing with longer timeframes to develop a solid understanding of market dynamics and price behavior before venturing into faster-paced strategies.

How often can I expect to identify viable trading opportunities using the GBPUSD 15-minute strategy?

The Gbpusd 15 minute strategy, especially when actively traded during peak market hours aligning with the London and New York session overlap, can present numerous potential trading opportunities on a daily basis. However, the precise frequency of opportunities will fluctuate depending on prevailing market volatility levels and the stringency of your adherence to your strategy’s specific entry criteria. Prioritize trade quality over quantity. Exercising patience and waiting for high-conviction setups is considerably more crucial than impulsively forcing trades. Some trading days will naturally offer more valid setups than others due to varying market conditions.

Beyond those already mentioned, what are some supplementary indicators that could enhance a GBPUSD 15-minute strategy?

While trendlines, support and resistance zones, candlestick patterns, and moving averages form a robust strategy core, you might explore supplementary indicators to further refine your approach. The Relative Strength Index (RSI) can be valuable for gauging market momentum and identifying potential overbought or oversold conditions. Similarly, the Moving Average Convergence Divergence (MACD) indicator can assist in confirming trend strength and spotting potential trend reversals. Volume indicators can also prove beneficial in validating the robustness of price movements and breakout events. Experiment cautiously with incorporating these supplementary indicators to assess if they demonstrably improve your strategy’s overall performance. However, avoid excessive indicator use – often, a simpler, uncluttered chart approach proves most effective for intraday trading.