Picture this: You’re on vacation, enjoying a serene beach, when suddenly you receive an alert that one of your trades has reached its profit target. No frantic monitoring, no stress—just pure relaxation as your investment works for you. This scenario isn’t a far-fetched dream; it can be your reality by mastering how to set take profit orders. In the dynamic world of trading, especially when dealing with a regulated forex broker, understanding and effectively implementing take profit orders can be the catalyst that transforms your trading strategy from mediocre to exceptional.

In this comprehensive guide, we’ll delve deep into the art of setting take profit orders in trading. Whether you’re a novice trader eager to protect your investments or a seasoned trader looking to optimize your profit-taking strategies, this article is designed to equip you with the essential knowledge and actionable insights. From foundational concepts to advanced strategies and pro tips, we’ll cover everything you need to know about how to place a take profit order and integrate it seamlessly into your trading plan. Let’s embark on this journey to elevate your trading game and secure consistent profits.

Understanding Take Profit Orders

Gain a clear understanding of take profit orders and how they can enhance your trading strategy through automated profit-taking.

What Is a Take Profit Order?

A Take Profit Order is a predefined instruction set by a trader to automatically close a trade once the asset reaches a specified profit level. Imagine having a personal assistant who ensures you capitalize on every profitable opportunity without you having to be glued to your screen. This automated mechanism ensures that profits are locked in without the need for constant market monitoring.

Why is this crucial? In the volatile landscape of trading, prices can fluctuate rapidly. Without a take profit order, traders might miss out on optimal profit-taking opportunities or fail to react swiftly to market changes, potentially eroding their gains. By setting a take profit order, you establish clear profit targets that help in maintaining discipline and avoiding emotional trading decisions.

How Take Profit Orders Work

Take profit orders are seamlessly integrated into your trading platform, allowing for automated execution when the market price hits your target level. For example, if you set a take profit order at $1.2000 for a currency pair you purchased at $1.1800, your trade will automatically close once the price reaches $1.2000, securing a profit of 200 pips. This automation is especially beneficial in volatile markets where price changes can occur in the blink of an eye.

Key distinction: While a stop loss order is designed to limit potential losses by closing a trade at a predetermined loss level, a take profit order focuses solely on securing profits. Together, they form a comprehensive risk management strategy, balancing potential rewards against possible risks. This synergy not only protects your investments but also ensures that your trading strategy is both disciplined and profitable.

Read More: Risk management principles for traders

Setting Take Profit Orders: Key Considerations

Explore the essential factors to consider when setting take profit orders to optimize your trading outcomes.

1. Utilize Technical Analysis

Technical analysis is the backbone of effective take profit order placement. By analyzing support and resistance levels, trendlines, chart patterns, and technical indicators like moving averages and Fibonacci retracements, traders can identify optimal price points for taking profits. These tools help in predicting potential price movements based on historical data, enabling informed decision-making.

Pro Tip: Incorporate multiple technical indicators to confirm potential take profit levels, enhancing the accuracy of your predictions. For instance, combining Fibonacci retracements with moving averages can provide stronger signals for setting your take profit orders.

2. Account for Market Volatility

Market volatility significantly impacts the effectiveness of take profit orders. High volatility can lead to rapid price swings, while low volatility results in more stable price movements. Adjust your take profit levels accordingly by considering volatility metrics such as the Average True Range (ATR). This ensures that your profit targets are realistic and achievable within the current market conditions.

Emotional Trigger: Don’t let unpredictable markets derail your trading plans—adapt your strategies to stay ahead. For example, during periods of high volatility, you might set wider take profit levels to accommodate larger price swings, thereby increasing the likelihood of reaching your profit targets.

3. Align with Personal Goals and Risk Tolerance

Every trader has unique financial objectives and risk appetites. Your take profit levels should align with your personal trading goals, whether they aim for short-term gains or long-term growth. Additionally, consider your risk tolerance—the degree of variability in returns you can withstand. By tailoring your take profit orders to match your individual preferences, you create a personalized trading strategy that supports your financial aspirations.

Power Word: Personalization is key to sustainable trading success. For instance, a conservative trader might set modest take profit levels to ensure frequent, smaller gains, while an aggressive trader might aim for higher profit targets, accepting greater risk in pursuit of larger rewards.

Read More: Stop Loss in Forex

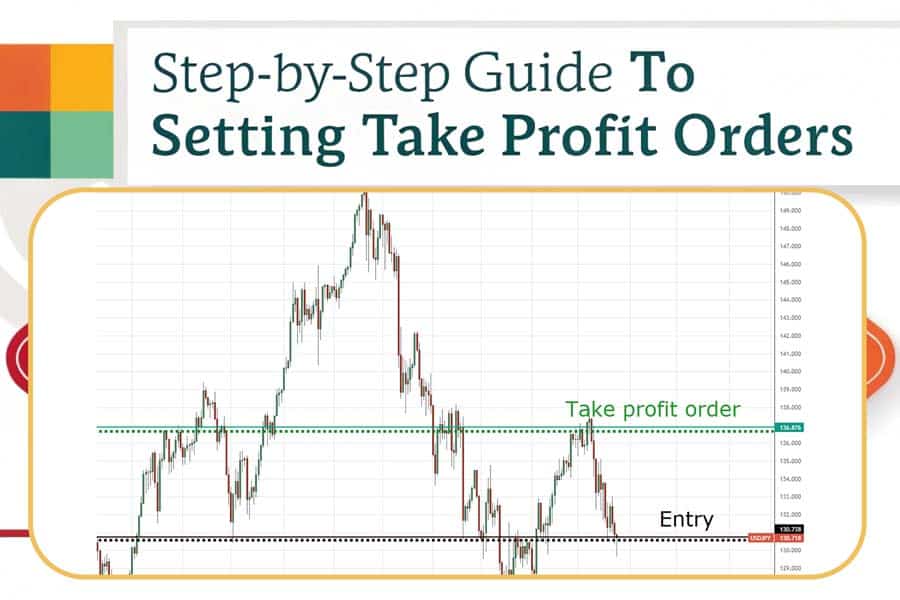

Step-by-Step Guide to Setting Take Profit Orders

Follow our detailed step-by-step guide to effectively set take profit orders and enhance your trading strategy.

1. Define Your Trading Strategy

Before setting any take profit orders, it’s imperative to clarify your trading goals. Are you seeking quick, short-term gains or aiming for substantial, long-term profits? Determine the time frame of your trades and your risk appetite. This foundational step ensures that your take profit orders are in harmony with your overall trading strategy.

Actionable Tip: Write down your trading objectives and refer to them regularly to stay focused. For example, if your goal is to achieve steady growth, your take profit orders should reflect consistent, achievable profit targets aligned with your strategy.

2. Perform Technical and Fundamental Analysis

- Technical Analysis: Delve into charts to identify key price levels using tools like Fibonacci retracements, moving averages, and trendlines. These indicators can help pinpoint potential take profit levels based on historical price movements and patterns.

- Fundamental Analysis: Stay abreast of economic indicators, news events, and other factors that could influence the price of your asset. Understanding the broader market context enhances your ability to set realistic and effective take profit levels.

Emotional Trigger: Empower yourself with knowledge to make informed trading decisions. For instance, if a major economic report is due, you might adjust your take profit levels to account for potential volatility.

3. Determine Your Risk-Reward Ratio

A favorable risk-reward ratio ensures that your potential profits justify the risks you are taking. A common ratio is 1:2, meaning for every unit of risk, you aim for twice the reward. For example, if your stop-loss is set at 50 pips, your take profit should be at least 100 pips. This balance helps in achieving profitability even if only a portion of your trades are successful.

Pro Tip: Regularly review and adjust your risk-reward ratios based on your trading performance and market conditions. If you find that your current ratio isn’t yielding the desired results, consider tweaking it to better match your trading style and market behavior.

4. Choose the Appropriate Order Type

Deciding between different order types is crucial for implementing your take profit strategy effectively.

- Limit Orders: These are ideal for setting precise take profit levels. A limit order specifies the exact price at which you want to close your trade, ensuring that you take profits at your desired level.

- Market Orders: Useful for executing trades instantly when your target is reached. However, they may not guarantee the exact price, especially in highly volatile markets.

Actionable Tip: Use limit orders for precision and market orders for speed, depending on your trading style and market conditions. For example, in a stable market, a limit order can secure your profit at the exact target, while in a fast-moving market, a market order can ensure your trade is closed swiftly.

5. Implement the Take Profit Order in Your Trading Platform

Most trading platforms, including MetaTrader 5 (MT5), offer straightforward methods to set take profit orders. Typically, you can set a take profit order while placing the trade or modify an existing position to include the take profit level. Here’s a general overview:

- Placing a Trade:

- Enter your desired asset.

- Specify the trade size.

- Set your take profit level in the designated field before executing the trade.

- Modifying an Existing Trade:

- Open your trade management window.

- Select the trade you want to modify.

- Input your take profit level in the appropriate section.

Emotional Trigger: Take control of your trades with ease and precision using your platform’s tools. For instance, setting a take profit order before placing the trade ensures that your profit target is secured from the outset.

6. Monitor and Adjust as Necessary

The market is dynamic, and your take profit levels should be adaptable. Regularly review your open positions and adjust your take profit orders in response to significant market changes or new information. Flexibility ensures that your trading strategy remains effective under varying market conditions.

Pro Tip: Set periodic reminders to review your trades and make necessary adjustments to your take profit levels. For example, if market volatility decreases, you might tighten your profit targets to capture gains more frequently.

Strategies for Effective Take Profit Placement

Discover multiple strategies for placing take profit orders effectively to maximize your trading profits and manage risks.

1. Utilizing Support and Resistance Levels

Support and resistance levels are critical indicators in technical analysis. Support levels are price points where an asset tends to find buying interest, preventing it from falling further. Resistance levels are points where selling interest emerges, halting upward price movements. Placing take profit orders near these levels increases the likelihood of successful execution, as price reversals often occur around these points.

Example: If a currency pair has historically bounced back at $1.2000, setting a take profit order just below this level can maximize your chances of capturing profits before a potential reversal. This strategy leverages historical price behavior to inform future trading decisions.

2. Applying Risk-Reward Ratios

Maintaining appropriate risk-reward ratios is essential for sustainable trading. By ensuring that your potential rewards significantly outweigh your risks, you create a framework where even a few successful trades can lead to overall profitability. For instance, adopting a 1:3 risk-reward ratio means that for every unit of risk, you aim for three units of reward.

Emotional Trigger: Secure your future profits by balancing your risks and rewards effectively. This approach not only enhances your chances of success but also fosters a disciplined trading mindset, crucial for long-term success.

3. Incorporating Trailing Take Profit Techniques

Trailing take profit is a dynamic strategy that adjusts your take profit level as the market moves in your favor. Unlike static take profit orders, trailing take profit orders move with the price, allowing you to lock in profits while giving your trade room to grow. This technique is particularly useful in trending markets where sustained price movements can lead to substantial gains.

Pro Tip: Combine trailing take profit with moving averages to automate adjustments based on market trends. For example, setting a trailing take profit that follows a 50-day moving average can help capture profits as the trend strengthens.

Read More: Mastering Trailing Stops in Forex

Common Mistakes to Avoid

1. Setting Unrealistic Profit Targets

One of the most common pitfalls traders face is setting unrealistic profit targets. Overly ambitious goals can lead to missed opportunities or premature trade closures. It’s essential to base your take profit levels on solid technical and fundamental analysis rather than wishful thinking.

Solution: Use historical data and realistic market expectations to set achievable profit targets. For example, if past price movements suggest a moderate increase, align your take profit order with that trend instead of aiming for an unlikely spike.

2. Ignoring Market Conditions

Market conditions are ever-changing, and failing to adapt your take profit orders accordingly can result in suboptimal outcomes. Ignoring factors such as economic news, geopolitical events, or sudden market shifts can leave your trades vulnerable.

Solution: Stay informed about market developments and be prepared to adjust your take profit levels in response to significant changes. For instance, if an unexpected economic report is released, reassess your take profit strategy to accommodate potential volatility.

3. Neglecting Risk Management

Focusing solely on take profit orders without integrating proper risk management strategies can expose you to unnecessary risks. It’s crucial to balance take profit orders with stop loss orders to protect your investments from adverse market movements.

Solution: Always pair your take profit orders with stop loss orders to create a balanced and comprehensive risk management plan. This dual approach ensures that your trades are protected on both ends, securing profits while limiting potential losses.

Integrating Stop Loss and Take Profit Orders

Combining stop loss and take profit orders creates a balanced risk management strategy that safeguards your investments while allowing for profit-taking. This synergy ensures that you have predefined exit points for both potential losses and gains, reducing the need for emotional decision-making.

The Synergy Between Stop Loss and Take Profit

By setting both stop loss and take profit orders, you define the boundaries of your trade. This dual approach helps in maintaining discipline, ensuring that you exit trades at predetermined levels regardless of market emotions or pressures. For example, if you enter a trade with a stop loss set at 50 pips and a take profit at 100 pips, you are maintaining a 1:2 risk-reward ratio, which enhances your potential for profitability.

Trailing Stop Losses: Locking in Profits

Trailing stop losses are an advanced technique that allows you to lock in profits as the market moves in your favor. Unlike static stop loss orders, trailing stops adjust dynamically with the price, enabling you to maximize your gains while providing a safety net against sudden reversals.

Example: If you set a trailing stop loss at 50 pips, and the price moves 100 pips in your favor, the stop loss will adjust to 50 pips below the new price level, securing your profits. This method ensures that you capture substantial gains while protecting against unexpected market downturns.

Emotional Trigger: Let your profits grow while protecting them from unexpected downturns. Trailing stops offer peace of mind, knowing that your gains are safeguarded as the market evolves.

Pro Tips: Advanced Strategies for Experienced Traders

Unlock advanced strategies with our pro tips to optimize your take profit orders and elevate your trading performance.

For traders looking to elevate their trading strategies beyond the basics, here are some advanced pro tips to optimize your take profit orders:

1. Use Multiple Take Profit Levels

Instead of setting a single take profit level, consider implementing multiple take profit points at different price levels. This strategy allows you to secure partial profits at various stages of the trade, ensuring that you benefit from sustained price movements.

Example: Set initial take profit orders at 50 pips, 100 pips, and 150 pips. As each level is reached, a portion of your position is closed, locking in profits while allowing the remaining position to capitalize on further price increases.

2. Combine Take Profit with Technical Indicators

Enhance your take profit strategy by integrating technical indicators such as Relative Strength Index (RSI), Bollinger Bands, or Moving Average Convergence Divergence (MACD). These indicators can provide additional confirmation for setting your take profit levels, increasing the likelihood of successful trade closures.

Pro Tip: Use RSI to identify overbought conditions, signaling potential reversals where setting take profit orders can be particularly effective.

3. Implement Time-Based Take Profit Adjustments

Adjust your take profit levels based on the time frame of your trades. For short-term trades, more aggressive take profit targets might be appropriate, while long-term trades may benefit from more conservative, gradual profit-taking strategies.

Example: For day trades, set take profit orders that align with intraday support and resistance levels. For swing trades, use broader profit targets that consider weekly or monthly market trends.

4. Monitor Economic Calendars

Stay ahead of major economic events that can significantly impact market volatility and price movements. Setting take profit orders around these events can help you manage risks and capitalize on predictable price behaviors.

Actionable Tip: Before major announcements like central bank meetings or economic reports, adjust your take profit levels to account for potential market reactions.

5. Backtest Your Take Profit Strategies

Use historical data to backtest different take profit strategies and identify which approaches yield the best results for your trading style and market conditions.

Pro Tip: Backtesting allows you to refine your take profit levels based on past performance, helping you develop a more effective and reliable trading strategy.

Opofinance Services: Empowering Your Trades

Opofinance, an ASIC-regulated broker, stands out as a premier choice for traders seeking a secure and efficient trading experience. Here’s why Opofinance is the ideal partner for your trading journey:

- Featured on the MT5 Brokers List: Experience seamless trading on one of the most advanced and reliable platforms in the industry. MetaTrader 5 offers robust tools for setting and managing take profit orders, enhancing your trading precision.

- Safe and Convenient Deposits and Withdrawals: Benefit from reliable financial transactions with multiple secure payment methods, ensuring your funds are always accessible. Opofinance prioritizes the safety of your investments, providing peace of mind as you trade.

- Social Trading Services: Leverage the power of community by copying successful traders, optimizing your strategies, and enhancing your trading performance. Social trading allows you to learn from experienced traders and implement proven take profit strategies.

- Regulated Environment: Trade with confidence knowing that Opofinance is regulated by ASIC, ensuring adherence to stringent security and compliance standards. Regulatory oversight guarantees that your trading activities are conducted in a fair and transparent manner.

- Exclusive Features: Enjoy unique tools and features tailored to enhance your trading experience, including advanced charting tools, real-time market data, and personalized support.

Enhance your trading experience with Opofinance’s advanced services, including social trading, secure transactions, and the powerful MT5 platform.

Ready to elevate your trading experience? Join Opofinance today and unlock a world of advanced trading tools, secure transactions, and unparalleled support! Take advantage of Opofinance’s social trading services and become part of a thriving trading community.

Conclusion: Mastering the Art of Take Profit Orders

Setting take profit orders is an indispensable skill for any trader committed to achieving consistent success in the markets. By understanding the mechanics, employing strategic placement, and integrating robust risk management techniques, you can significantly enhance your trading outcomes. Platforms like Opofinance, with their advanced features and secure environment, further empower you to implement your take profit strategies effectively. Embrace these practices to take control of your trading journey, secure your profits, and minimize risks. Remember, disciplined trading coupled with effective take profit strategies is the key to unlocking your full trading potential.

Key Takeaways

- Automate Profit-Taking: Take profit orders help secure gains without constant market monitoring, reducing emotional trading.

- Strategic Placement: Utilize technical and fundamental analysis to determine optimal take profit levels aligned with market conditions.

- Balanced Risk Management: Combine take profit orders with stop loss orders to create a comprehensive risk management strategy.

- Advanced Tools: Leverage platforms like Opofinance for secure, efficient, and feature-rich trading experiences.

- Continuous Adaptation: Regularly monitor and adjust your take profit orders to stay aligned with evolving market dynamics and personal trading goals.

- Personalization: Tailor your take profit strategies to match your unique trading objectives and risk tolerance for sustainable success.

Can I Adjust a Take Profit Order After Placing It?

Absolutely! Most trading platforms allow you to modify your take profit orders after they have been set. This flexibility is beneficial when market conditions change or when you reassess your trading strategy. Adjusting your take profit levels can help you capture more profits or better align with new market insights. For example, if the market trend strengthens beyond your initial target, increasing your take profit level can maximize your gains.

What Happens If the Market Doesn’t Hit My Take Profit Level?

If the market price does not reach your take profit level, your trade will remain open. This scenario can be advantageous if the market moves in your favor beyond your initial target. However, it’s essential to monitor your trades and consider adjusting your take profit levels or manually closing the trade if necessary to avoid potential reversals that could erode your gains. Additionally, in some cases, the market might oscillate around your take profit level, leading to multiple executions of take profit orders, which can either enhance profits or lead to partial closures.

Is a Take Profit Order Suitable for Beginners?

Absolutely! Take profit orders are user-friendly tools that help beginners manage their trades more effectively. By automating profit-taking, novice traders can focus on learning and developing their trading strategies without the stress of constantly monitoring the markets. This structured approach aids in disciplined trading and helps mitigate emotional decision-making. Moreover, setting take profit orders teaches beginners the importance of planning and risk management, which are crucial for long-term success.