Looking to level up your trading strategy with precise timing? The Ichimoku entry and exit strategy can be a game-changer, offering clarity on when to buy and sell by combining multiple elements in a single, powerful indicator. The Ichimoku Cloud system, developed in Japan, provides insights into trend direction, market momentum, and reversal points, making it an all-in-one tool for smarter trading decisions.

In this guide, we’ll dive deep into the Ichimoku entry and exit strategy and how it can improve your approach to trading across stocks, forex, and cryptocurrencies. With practical tips, advanced techniques, risk management strategies, and even broker recommendations, you’ll learn how to apply Ichimoku Cloud entry and exit signals confidently. Plus, we’ll introduce you to Opofinance, an ASIC-regulated forex broker with features designed for Ichimoku traders.

Let’s get started on using the Ichimoku Cloud to boost your trading success.

What Is the Ichimoku Cloud? A Complete Trading System for Entry and Exit

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is more than just an indicator—it’s a complete trading system. Developed by Japanese journalist Goichi Hosoda, this system brings together trend direction, support and resistance levels, and reversal points, all in one view. By using the Ichimoku Cloud entry and exit strategy, traders can gain clear insight into when to buy, sell, and avoid potential traps.

Key Components of the Ichimoku Cloud

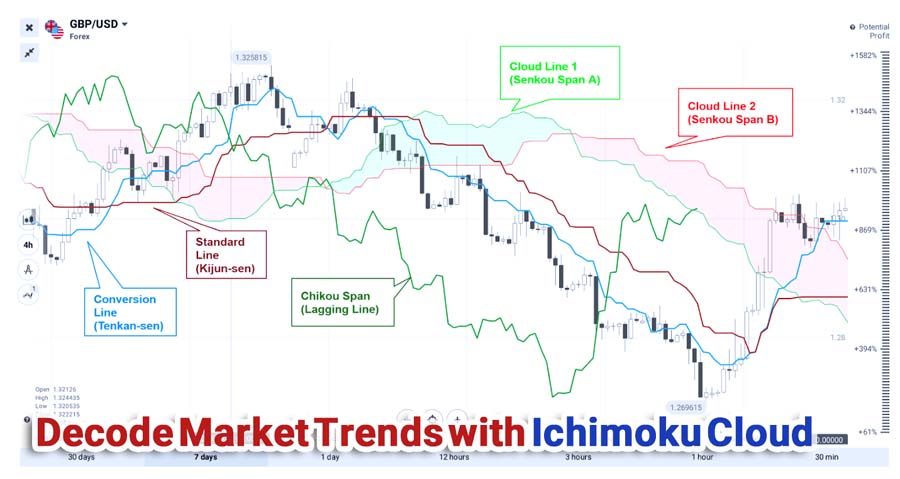

The Ichimoku Cloud consists of five key elements, each playing an essential role in shaping the Ichimoku entry and exit strategy:

- Tenkan-Sen (Conversion Line): Reflects short-term momentum by averaging the highest high and lowest low over the last 9 periods. It gives quick insight into recent price action.

- Kijun-Sen (Base Line): Represents the medium-term trend direction and is calculated by averaging the last 26 periods’ high and low. Kijun-Sen helps confirm overall trend direction.

- Senkou Span A (Leading Span A): The first boundary of the cloud, calculated by averaging Tenkan-Sen and Kijun-Sen and projecting it 26 periods forward.

- Senkou Span B (Leading Span B): The second boundary of the cloud, based on the midpoint of the last 52 periods’ high and low, also projected forward by 26 periods.

- Chikou Span (Lagging Span): Plotted 26 periods behind the current price, this line confirms trend direction and serves as a form of validation for other Ichimoku Cloud signals.

The cloud, or Kumo, is the shaded area between Senkou Span A and Senkou Span B. When prices are above the cloud, it’s considered a bullish signal; when below, it’s bearish. A thicker cloud often indicates stronger support or resistance, while thinner clouds suggest weaker levels.

Read More: Ichimoku and RSI

Why Use the Ichimoku Cloud Entry and Exit Strategy?

The Ichimoku Cloud entry and exit strategy is popular because it offers a full-market view in one tool, making it ideal for spotting trends, timing trades, and managing risk—all at a glance.

Key Benefits of Using the Ichimoku Cloud Strategy

- Complete System for Entry and Exit: The Ichimoku Cloud provides clear buy and sell signals, showing when to enter, exit, and hold based on trend strength. The layered elements—such as cloud position, line crossovers, and the Chikou Span—work together to offer strong entry/exit confirmation.

- Built-in Support and Resistance: The cloud itself acts as a dynamic support and resistance zone, adapting as the market changes. This makes it easier to set logical stop-loss levels, reducing the chance of premature exits and improving risk management.

- Effective in Trending Markets: In trending conditions, the Ichimoku Cloud shines. When prices are above or below the cloud, it indicates a clear direction, allowing traders to ride trends and avoid market noise.

- Reduces Need for Multiple Indicators: Since the Ichimoku Cloud combines trend, momentum, and support/resistance in one tool, it minimizes the need for additional indicators, keeping charts simple and insights straightforward.

By offering clarity, trend validation, and a structured approach to stop-losses, the Ichimoku Cloud entry and exit strategy helps traders make informed, confident trading decisions across various markets.

Mastering Ichimoku Cloud Entry and Exit Signals

Mastering entry and exit signals with the Ichimoku Cloud strategy involves understanding key points of confirmation that signal the start or end of a trend. Let’s break down how to identify optimal entry and exit points within the Ichimoku Cloud framework, and how to refine your timing for maximum profitability.

1. Understanding Ichimoku Entry Signals: How to Time Your Trades

Bullish and Bearish Entry Signals in the Ichimoku Cloud

Ichimoku Cloud entry signals rely on two critical factors: price breakouts above or below the cloud, and line crossovers between the Tenkan-Sen (Conversion Line) and Kijun-Sen (Base Line). These signals indicate the start of a new trend, making them essential for timely entries.

- Bullish Entry (Buy Signal): A bullish entry signal occurs when the price breaks above the cloud, which is generally a sign of strong buying interest. To confirm this signal, look for the Tenkan-Sen (Conversion Line) crossing above the Kijun-Sen (Base Line), showing that short-term momentum is overtaking the medium-term trend. Additionally, the Chikou Span (Lagging Span) should be positioned above the price line, reinforcing upward momentum. This combination suggests that the market has shifted into a bullish trend, making it a strong entry point for long trades.

- Bearish Entry (Sell Signal): A bearish entry signal is triggered when the price drops below the cloud, indicating potential downward momentum. For added strength, ensure that Tenkan-Sen crosses below Kijun-Sen, showing that downward momentum is building. The Chikou Span should also fall below the price line, confirming that the market sentiment is bearish. Together, these elements point to a downtrend, making it a suitable entry point for short positions.

These entry signals are designed to help traders position themselves early in a trend, maximizing potential returns as the market gains momentum.

Pro Tips for Entry Timing

- Wait for Clear Confirmation: For higher accuracy, wait until both the price and the Chikou Span are fully clear of the cloud in the same direction. This reduces the risk of premature entries and improves the likelihood of catching a profitable trend.

- Use Additional Indicators: To add strength to Ichimoku Cloud entry signals, pair them with other indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence). RSI can confirm that the trend has enough momentum, especially if it’s above 50 for bullish entries or below 50 for bearish entries. MACD, on the other hand, can provide added confirmation by highlighting shifts in trend strength, helping to filter out false breakouts.

2. Mastering Ichimoku Exit Signals: Knowing When to Exit a Trade

Exiting Trades with Ichimoku Cloud

Ichimoku Cloud exit signals provide clear guidance for when to close a position and secure profits before a trend reversal. Recognizing these exit points is crucial for holding profitable trades while minimizing the risk of losses during trend reversals.

- Bullish Exit (Close Long Position): For long trades, consider exiting when the price drops back below the cloud. This signals that the uptrend may be weakening. Additionally, if the Tenkan-Sen crosses below the Kijun-Sen, it’s a sign that momentum is reversing. Together, these signals suggest it may be time to close the position and lock in profits before the market reverses.

- Bearish Exit (Close Short Position): For short trades, a potential exit signal occurs when the price moves back above the cloud, suggesting the downtrend may be losing steam. Similarly, if Tenkan-Sen crosses above Kijun-Sen, it can signal a shift in market momentum. This combination often signals a weakening trend, indicating it’s time to exit and secure any profits from the downtrend.

These exit signals enable traders to stay in profitable trades for as long as the trend holds, while giving clear cues to exit before a complete reversal.

Pro Tips for Exits

- Trailing Stop-Loss with Kijun-Sen: Use Kijun-Sen as a trailing stop-loss level, especially when the trend is strong. Setting a stop-loss at Kijun-Sen or just below the cloud boundary allows traders to protect profits while giving the trend room to continue.

- Monitor the Chikou Span for Early Warnings: Chikou Span can offer early signals for exits; if it starts to move against the current trend, it may indicate a possible market reversal. This gives traders a valuable heads-up, allowing them to consider exiting before a full trend shift occurs.

Using Ichimoku Cloud’s entry and exit signals effectively provides traders with a systematic approach to capitalizing on early trend momentum and exiting trades at the right time. When combined with additional indicators and careful timing, these signals can significantly improve trading outcomes.

Read More: Ichimoku and Elliott Wave

Risk Management for the Ichimoku Cloud Entry and Exit Strategy

Using Risk-Reward Ratios with Ichimoku Cloud

Risk-reward ratios are essential for managing risk in any trading strategy, especially with Ichimoku entry and exit. A minimum ratio of 1:2—where the potential reward is twice the risk—is commonly used to ensure that each trade is worth the risk taken.

- Setting Stop-Losses with the Cloud: In the Ichimoku Cloud entry and exit strategy, the cloud acts as a natural boundary for stop-losses. For bullish trades, set a stop-loss below the cloud; for bearish trades, set it above the cloud.

- Using the cloud as a risk boundary allows traders to manage risk efficiently, aligning stop-losses with market structure and avoiding premature exits.

Position Sizing with Ichimoku Cloud Signals

Position sizing is critical for managing exposure, especially when using Ichimoku Cloud entry and exit strategies.

- For Stronger Signals: Consider a slightly larger position size when signals are strong (e.g., price clears a thick cloud), as these are often more reliable.

- For Weaker Signals: For weaker signals (e.g., thinner clouds), reduce position size to control risk.

- Risk-Based Sizing: Risk no more than 1-2% of your total account balance per trade to maintain steady risk control across trades.

Ideal Markets and Conditions for Ichimoku Cloud Strategies

Best Markets for Ichimoku Cloud Entry and Exit

The Ichimoku Cloud entry and exit strategy shines in trending markets, where it can clearly highlight entry and exit points. Here are some ideal markets and conditions:

- Forex Trading: Currency pairs like EUR/USD and USD/JPY often display clear, sustained trends, making them well-suited to Ichimoku Cloud strategies.

- Stocks: High-liquidity stocks, such as blue-chips or popular tech stocks, tend to work well with Ichimoku, especially in trending phases.

- Cryptocurrencies: Cryptocurrencies like Bitcoin and Ethereum, known for their high volatility and strong trending behavior, also work effectively with the Ichimoku Cloud entry and exit strategy.

Handling Range-Bound Markets with Ichimoku Cloud

Ichimoku Cloud can give false signals in range-bound markets without clear trends. Here’s how to manage Ichimoku Cloud signals in such conditions:

- Combine with Oscillators: Use indicators like RSI or Bollinger Bands to detect range-bound conditions and avoid false signals.

- Wait for Clear Breakouts: In range-bound markets, wait for price to break decisively through the cloud before entering a trade.

Customizing Ichimoku Cloud for Different Trading Styles

Using Ichimoku Cloud for Swing Trading, Day Trading, and Scalping

Each trading style benefits from specific Ichimoku settings and timeframes, making it adaptable for various strategies.

- Swing Trading: Standard Ichimoku settings (9, 26, 52) work well on daily or 4-hour charts, providing longer-term trends ideal for swing trading, where trades last days or weeks.

- Day Trading: For day trading, consider modified settings (e.g., 6, 13, 26) on shorter timeframes like 1-hour or 15-minute charts. This configuration captures intraday trends and provides quicker signals.

- Scalping: Scalping requires even shorter timeframes, such as 1-minute or 5-minute charts, with settings like 3, 6, and 12. Scalpers often pair Ichimoku Cloud with fast indicators, such as moving averages, to increase precision.

Suggested Timeframes by Trading Style

- Swing Trading: 4-hour or daily charts

- Day Trading: 15-minute or 1-hour charts

- Scalping: 1-minute or 5-minute charts

Advanced Tips for Ichimoku Cloud Entry and Exit Strategy

Using Cloud Thickness to Assess Trend Strength

The thickness of the cloud, or Kumo width, indicates the trend’s strength. Thick clouds represent stronger support or resistance, whereas thin clouds suggest weaker levels that are more easily breached.

- Thick Clouds: Indicate strong support or resistance and signify durable trends that are less likely to reverse.

- Thin Clouds: Signal weaker support or resistance, making price breakouts more likely and suggesting potential consolidation.

Multi-Timeframe Analysis with Ichimoku Cloud

Multi-timeframe analysis helps refine Ichimoku Cloud entry and exit points, providing additional trend confirmation.

- Higher Timeframes: Use daily or 4-hour charts to establish the main trend direction.

- Lower Timeframes: Confirm entry and exit signals on shorter timeframes (e.g., 15-minute charts) to improve timing accuracy and avoid false entries.

Read More: Ichimoku and MACD

Backtesting and Practice Tips for Ichimoku Cloud Strategies

Backtesting Ichimoku Cloud on Historical Data

Backtesting allows you to evaluate Ichimoku Cloud’s performance over time, providing insight into which signals work best. To backtest effectively:

- Test across various assets and timeframes to identify patterns in Ichimoku Cloud entry and exit signals.

- Note successful patterns in past signals to refine future trades.

Best Platforms for Practicing Ichimoku Cloud

Platforms like TradingView and MetaTrader 5 (MT5) are excellent for backtesting and practicing Ichimoku Cloud strategies:

- TradingView: Provides a user-friendly interface and advanced charting tools for backtesting Ichimoku strategies.

- MT5: Available through brokers like Opofinance, MT5 offers powerful analysis tools for refining Ichimoku strategies in real time.

Opofinance: Optimized for Ichimoku Entry and Exit Strategies

For traders using the Ichimoku strategy, Opofinance provides a powerful, ASIC-regulated platform designed for efficient execution and advanced charting. Key features include:

- MetaTrader 5 (MT5) Support: Opofinance offers MT5 with sophisticated charting and analysis tools ideal for customizing Ichimoku settings across different trading styles—whether you’re swing trading or day trading.

- Low-Latency Execution: Precise timing is crucial for Ichimoku signals. Opofinance’s low-latency execution minimizes slippage, allowing traders to enter and exit positions exactly when signals are triggered.

- Multi-Asset Access: Trade forex, stocks, and cryptocurrencies on a single platform, taking advantage of Ichimoku’s strengths in diverse markets.

- Risk Management Tools: With customizable stop-loss and take-profit orders, traders can automate risk management directly in MT5, aligning with Ichimoku’s trend and support/resistance insights.

- Social Trading Features: Opofinance’s social trading allows users to follow successful strategies, offering valuable learning and replication opportunities, especially for refining Ichimoku techniques.

Opofinance’s platform combines security, advanced features, and real-time support, enhancing Ichimoku’s effectiveness and helping traders make informed, confident decisions.

Conclusion: Unlocking the Power of Ichimoku Cloud for Smarter Trading Decisions

The Ichimoku entry and exit strategy offers traders a comprehensive, single-view system that combines trend detection, momentum assessment, and risk management tools. By mastering each component of the Ichimoku technique—such as identifying entry signals through Tenkan-Sen and Kijun-Sen crossovers, or using Senkou Span lines for support and resistance insights—traders gain a structured and disciplined approach to timing trades more effectively. This allows for well-informed entry and exit points, giving traders the confidence to navigate various markets, from forex and stocks to high-volatility cryptocurrencies.

The Ichimoku strategy also shines in trending markets, where it can highlight long-term trends, helping traders capture gains while reducing market noise. Meanwhile, in range-bound or sideways markets, adapting the Ichimoku with additional indicators, such as RSI or Bollinger Bands, can add clarity and avoid false signals, preserving capital during periods of low momentum.

For traders focused on maximizing potential, combining the Ichimoku strategy with a reliable, feature-rich broker platform, like Opofinance, can be transformative. With tools tailored to Ichimoku’s unique needs, Opofinance provides fast execution, advanced charting, and educational support, ensuring traders have everything needed to refine their skills.

Incorporating the Ichimoku strategy into your trading toolkit can transform how you analyze markets, enhancing both decision-making and profitability. With practice and dedication, this technique becomes a powerful ally, helping you capture trends with precision and exit trades strategically. As you refine your understanding of Ichimoku and apply it across different market conditions, you’ll unlock greater potential in your trading journey, enabling smarter, more confident trading decisions.

Key Takeaways

- Ichimoku Entry Strategy: Confirm entry with price and Chikou Span breaking the cloud in the same direction for stronger signals.

- Ichimoku Exit Strategy: Use the cloud as a trailing stop, exiting when price re-enters the cloud or Tenkan-Sen crosses Kijun-Sen in the opposite direction.

- Risk Management: Use a 1:2 risk-reward ratio and set stop-losses at cloud boundaries to manage risk effectively.

- Best Markets: Works well in trending markets like forex, high-liquidity stocks, and cryptocurrencies.

- Advanced Tips: Use cloud thickness and multi-timeframe analysis for stronger trend confirmation.

What other indicators complement Ichimoku Cloud?

Ichimoku Cloud pairs well with RSI and MACD, as these indicators can confirm momentum. Volume indicators also validate breakouts above or below the cloud, enhancing confidence in Ichimoku Cloud entry and exit points.

Can I use Ichimoku Cloud for cryptocurrency trading?

Yes, Ichimoku Cloud is effective in crypto trading, particularly with trending coins like Bitcoin and Ethereum. Use the 4-hour or daily charts for broader trends and confirm entries with volume indicators.

How does Ichimoku Cloud compare to traditional moving averages?

While moving averages show general trend lines, Ichimoku Cloud provides detailed support/resistance zones and momentum signals. This additional information allows traders to assess trend strength, making Ichimoku Cloud ideal for comprehensive market analysis.