High volatility news in forex can be a game-changer for traders seeking to maximize their profits. These market-moving events create significant price swings, offering lucrative opportunities for those who know how to navigate them. But what exactly is high volatility news in forex? Simply put, it refers to economic releases, geopolitical events, or central bank decisions that cause rapid and substantial currency price movements. To make the most of these opportunities, it’s crucial to trade with a regulated forex broker, ensuring a secure and reliable trading environment. Understanding and capitalizing on these volatile moments can be the key to unlocking your trading potential.

In this comprehensive guide, we’ll explore the most volatile forex news events, their impact on the market, and seven powerful strategies to help you master high volatility trading. Whether you’re a seasoned trader or just starting, this article will equip you with the knowledge and tools to thrive in the fast-paced world of forex news trading.

1. Identifying High Volatility News Events

To successfully trade during periods of high volatility, you must first recognize the events that typically cause significant market movements. Here are some of the most volatile forex news events to watch:

- Central Bank Interest Rate Decisions

- Non-Farm Payroll (NFP) Reports

- Gross Domestic Product (GDP) Releases

- Consumer Price Index (CPI) Data

- Retail Sales Figures

- Geopolitical Events and Elections

- Trade Balance Reports

These events often lead to rapid price fluctuations, creating both opportunities and risks for forex traders. By staying informed about upcoming news releases and their potential impact, you can position yourself to capitalize on market volatility.

Read More: how to trade cpi news in forex

2. Understanding the Impact of High Volatility News

High volatility news in forex can significantly affect currency pairs in several ways:

- Increased Price Movement: News events can cause currencies to move hundreds of pips in a matter of minutes.

- Widened Spreads: Brokers often widen spreads during volatile periods to protect themselves from rapid price changes.

- Reduced Liquidity: High volatility can lead to temporary reductions in market liquidity, making it harder to execute trades at desired prices.

- Stop-Loss Hunting: Rapid price movements may trigger stop-loss orders, potentially leading to cascading market effects.

Understanding these impacts is crucial for developing effective trading strategies during volatile periods.

3. Causes of High Volatility News Events

High volatility in the forex market is often triggered by specific events or circumstances. Understanding these causes can help traders anticipate and prepare for periods of increased market turbulence. Here are the primary factors that lead to high volatility news events:

- Economic Data Releases: Significant economic indicators such as GDP, employment figures, inflation rates, and retail sales can cause rapid price movements when they deviate from market expectations.

- Central Bank Decisions: Interest rate changes, quantitative easing announcements, or shifts in monetary policy can dramatically impact currency values and create volatility.

- Geopolitical Events: Elections, referendums, trade agreements, conflicts, or diplomatic tensions between countries can lead to uncertainty and volatility in the forex market.

- Natural Disasters: Unexpected events like earthquakes, hurricanes, or pandemics can disrupt economies and cause volatility in affected countries’ currencies.

- Market Sentiment Shifts: Sudden changes in risk appetite or investor confidence can lead to rapid currency movements, especially in safe-haven currencies like the USD, JPY, or CHF.

- Commodity Price Fluctuations: For commodity-dependent currencies (like AUD, CAD, or NOK), significant changes in commodity prices (e.g., oil, gold) can trigger high volatility.

- Technical Breakouts: While not a news event per se, the breaking of key technical levels can lead to increased volatility as traders rush to enter or exit positions.

- Unexpected Corporate News: Major corporate announcements, especially those affecting large multinationals, can sometimes impact national currencies.

By monitoring these potential causes of high volatility, forex traders can better anticipate market movements and adjust their strategies accordingly.

4. Preparing for High Volatility News Trading

Successful trading during volatile news events requires careful preparation. Here are some essential steps to take:

- Create an Economic Calendar: Use a reliable forex economic calendar to track upcoming high-impact news events.

- Analyze Historical Data: Study how similar news events have affected currency pairs in the past.

- Set Realistic Profit Targets: Determine your risk tolerance and set appropriate profit targets for volatile conditions.

- Check Your Broker’s Policies: Understand your broker’s trading conditions during high volatility periods, including margin requirements and execution speeds.

- Test Your Strategy: Practice trading volatile news events on a demo account before risking real capital.

By taking these preparatory steps, you’ll be better equipped to handle the challenges of high volatility news trading.

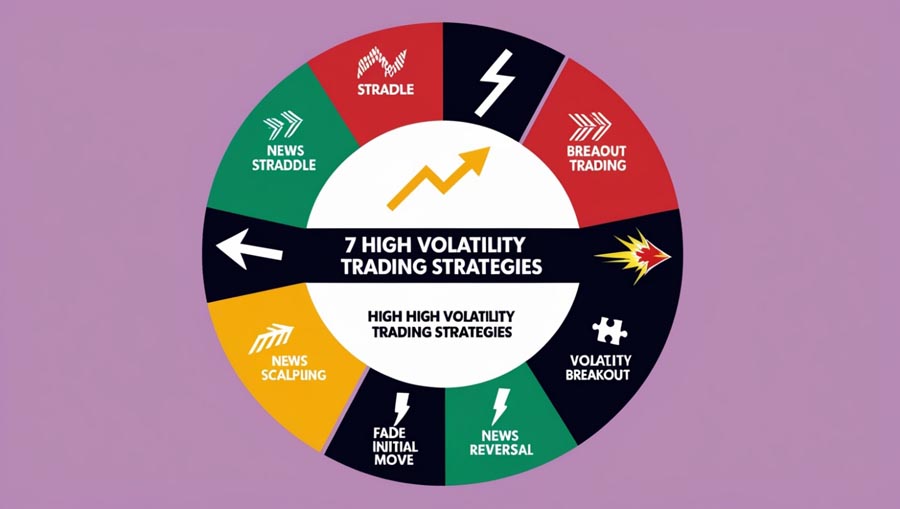

5. Seven Powerful Strategies for Trading High Volatility News

Now that we’ve covered the basics, let’s dive into seven explosive strategies to help you master high volatility news in forex:

Strategy 1: News Straddle

The news straddle strategy involves placing two pending orders – a buy stop and a sell stop – just above and below the current market price before a news release. This allows you to potentially profit regardless of the direction the market moves.

How to implement:

- Identify a high-impact news event.

- Place a buy stop order 20-30 pips above the current price.

- Place a sell stop order 20-30 pips below the current price.

- Set stop-loss and take-profit levels for both orders.

- Wait for the news release to trigger one of your orders.

Strategy 2: Breakout Trading

Breakout trading capitalizes on the strong momentum that often follows high volatility news releases. This strategy involves identifying key support and resistance levels and entering trades when prices break through these levels.

Steps to follow:

- Identify significant support and resistance levels before the news release.

- Wait for the price to break through one of these levels after the news.

- Enter a trade in the direction of the breakout.

- Set a stop-loss just beyond the breakout level.

- Use a trailing stop or set a take-profit based on the average daily range.

Strategy 3: Fade the Initial Move

This contrarian strategy involves trading against the initial price movement following a news release, based on the assumption that the market may overreact initially.

Implementation:

- Wait for the initial price surge or drop after the news release.

- Look for signs of price exhaustion or reversal.

- Enter a trade in the opposite direction of the initial move.

- Set a tight stop-loss to manage risk.

- Target a return to pre-news levels or key support/resistance areas.

Strategy 4: News Scalping

News scalping involves making quick, small profits during the heightened volatility immediately following a news release.

How to scalp news events:

- Enter the market as soon as the news is released.

- Look for small, rapid price movements in the direction of the news impact.

- Use tight stop-losses and take-profit levels (5-10 pips).

- Exit trades quickly, typically within minutes of entry.

- Be prepared to make multiple trades in quick succession.

Strategy 5: Volatility Breakout

This strategy capitalizes on the increased range of price movements during high volatility news events.

Steps for volatility breakout trading:

- Calculate the average true range (ATR) before the news release.

- Place buy and sell stop orders at 1.5-2 times the ATR above and below the current price.

- Set stop-losses at 1-1.5 times the ATR from your entry point.

- Use a trailing stop or set take-profit levels at 2-3 times the ATR.

- Allow only one order to be triggered and cancel the other.

Strategy 6: News Reversal Trading

This strategy aims to capitalize on potential price reversals that occur after the initial market reaction to high volatility news.

Implementing news reversal trades:

- Wait for the initial market reaction to the news.

- Look for signs of price exhaustion or overextension.

- Identify key support or resistance levels where reversals might occur.

- Enter a trade in the opposite direction of the initial move when reversal signals appear.

- Set stop-losses beyond the recent swing high/low and use a risk-reward ratio of at least 1:2.

Strategy 7: Hybrid Approach

Combine multiple strategies to create a comprehensive approach to trading high volatility news in forex.

Creating a hybrid strategy:

- Use the news straddle to capture initial movements.

- Apply breakout trading principles for sustained trends.

- Implement scalping techniques for quick profits during extreme volatility.

- Consider reversal opportunities as the market stabilizes.

- Adjust your approach based on the specific news event and market conditions.

Read More: how to trade ppi news in forex

6. Risk Management During High Volatility News Trading

Trading during periods of high volatility can be extremely risky. Implement these risk management techniques to protect your capital:

- Use Proper Position Sizing: Never risk more than 1-2% of your account on a single trade.

- Set Stop-Losses: Always use stop-loss orders to limit potential losses.

- Avoid Overleveraging: Reduce your leverage during volatile periods to minimize risk.

- Use Guaranteed Stop-Losses: If available, use guaranteed stop-losses to ensure your orders are executed at the specified price.

- Consider Reducing Trade Size: Trade smaller positions during extremely volatile events to manage risk.

By implementing these risk management strategies, you can protect your trading account while still capitalizing on the opportunities presented by high volatility news in forex.

7. Tools and Resources for High Volatility News Trading

To effectively trade high volatility news in forex, you’ll need the right tools and resources. Here are some essential ones to consider:

- Economic Calendars: Use reliable calendars like ForexFactory or Investing.com to track upcoming news events.

- News Feed Services: Subscribe to real-time news feeds for instant updates on market-moving events.

- Volatility Indicators: Implement indicators like the Average True Range (ATR) or Bollinger Bands to measure and visualize volatility.

- Trading Platforms: Use advanced platforms like MetaTrader 5 or cTrader for fast execution and advanced charting capabilities.

- VPS Services: Consider using a Virtual Private Server (VPS) to ensure uninterrupted trading during high volatility periods.

Utilizing these tools can give you a significant edge when trading high volatility news in forex.

Read More: how to trade nfp news in forex

Conclusion

Mastering high volatility news in forex can be a powerful way to boost your trading profits. By understanding the nature of volatile news events, preparing thoroughly, and implementing the seven strategies we’ve discussed, you can position yourself for success in the fast-paced world of forex news trading.

Remember, while high volatility news events offer significant profit potential, they also come with increased risk. Always prioritize risk management, continually educate yourself, and practice your strategies before committing real capital. With dedication and the right approach, you can turn the challenge of high volatility news in forex into a lucrative opportunity.

Are you ready to take your forex trading to the next level? Start implementing these strategies today and watch your trading performance soar!

How can I protect my trades during unexpected high volatility news events?

To protect your trades during unexpected high volatility news events, consider implementing these measures:

Use wider stop-losses to account for increased price swings.

Reduce your position size to limit overall risk exposure.

Utilize guaranteed stop-losses if your broker offers them.

Set up price alerts to notify you of sudden market movements.

Consider closing open positions before major unexpected events.

Remember, it’s always better to prioritize capital preservation over potential profits when dealing with unexpected volatility.

Are there any specific currency pairs that are more affected by high volatility news?

Yes, certain currency pairs are typically more sensitive to high volatility news:

EUR/USD: Highly affected by economic data from both the Eurozone and the United States.

GBP/USD: Sensitive to UK economic releases and Brexit-related news.

USD/JPY: Often reacts strongly to global risk sentiment and US economic data.

AUD/USD: Influenced by commodity prices and Chinese economic news.

USD/CAD: Sensitive to oil prices and North American economic data.

These pairs often experience larger price movements during high-impact news events, providing more trading opportunities but also increased risk.

How long do the effects of high volatility news typically last in the forex market?

: The duration of high volatility following news releases can vary depending on the significance of the event and market conditions. Generally:

Initial reaction: The most intense volatility usually occurs within the first 5-15 minutes after the news release.

Short-term impact: Heightened volatility may persist for 30 minutes to 2 hours following major news events.

Medium-term effects: Significant news can influence market trends for several hours or even days.

Long-term implications: Some high-impact events, like changes in central bank policies, can affect currency pairs for weeks or months.

It’s important to adjust your trading strategy based on the expected duration of volatility following different types of news events.