Looking to maximize your forex trading profits without being glued to your screen all day? The 1-hour forex trading strategy could be your solution. This approach, often supported by a reliable forex broker, allows traders to capitalize on market movements within a compact timeframe, ideal for those with busy schedules or a preference for quick, decisive action.

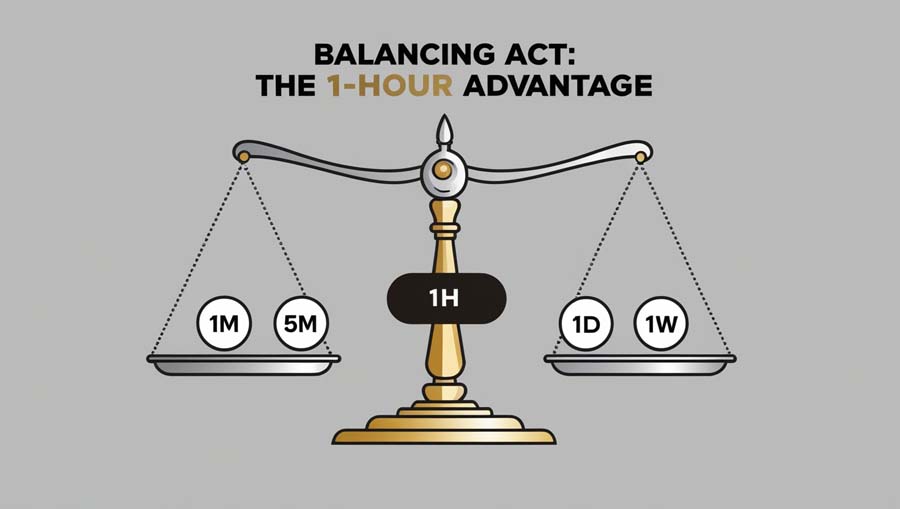

A 1-hour forex trading strategy focuses on analyzing and executing trades within 60-minute timeframes. It combines the benefits of intraday trading with a more manageable time commitment, enabling informed decisions based on hourly price movements and technical indicators. This method offers a balanced approach between high-frequency scalping and longer-term daily trading, allowing you to capture significant market moves while avoiding extreme volatility.

By mastering this strategy, you can potentially increase your trading efficiency and capitalize on market opportunities without constant monitoring. In this guide, we’ll explore the key components of a successful 1-hour forex trading strategy, including technical analysis, price action patterns, and risk management techniques. Whether you’re a novice or experienced trader, this article will equip you with the knowledge to enhance your trading performance and potentially boost your profits using the 1-hour timeframe.

What is the 1-Hour Forex Trading Strategy?

The 1-hour forex trading strategy is a disciplined approach that centers on analyzing and trading based on 60-minute price charts. This method bridges the gap between high-frequency scalping and longer-term daily trading, offering a balanced perspective on market movements. Key aspects of this strategy include:

- Timeframe: Primarily utilizing 1-hour candlestick charts for analysis and decision-making.

- Analysis Techniques: Incorporating a blend of technical analysis, price action patterns, and sometimes fundamental factors.

- Trade Duration: Positions are typically held for several hours, rarely extending beyond a single trading day.

- Frequency: Allows for multiple trading opportunities throughout the day, but with a focus on quality setups rather than quantity.

- Risk Management: Emphasizes strict risk control measures due to the shorter timeframe compared to daily or weekly trading.

The 1-hour strategy provides traders with a unique set of advantages, including reduced market noise compared to shorter timeframes, more trading opportunities than longer-term strategies, and suitability for traders with limited time availability. By focusing on the hourly timeframe, traders can capture significant market moves while avoiding the extreme volatility and stress often associated with shorter-term trading styles.

Read More: forex gap trading strategy

Why Choose the 1-Hour Timeframe?

The 1-hour timeframe offers a distinctive set of benefits that make it an attractive choice for many forex traders:

- Balanced Market Perspective: The hourly chart provides a clear view of the market, filtering out much of the noise present in shorter timeframes while still capturing intraday trends and movements. This balance allows traders to identify clearer trends and patterns, reduce false signals, and maintain a broader market context compared to scalping.

- Time Efficiency: For traders juggling other commitments, the 1-hour strategy offers an efficient use of time. It requires less constant monitoring than shorter timeframes and allows for analysis and trade execution during specific times of day, providing flexibility to fit trading around work or personal schedules.

- Psychological Advantages: Trading on the 1-hour timeframe can offer significant psychological benefits. It reduces stress compared to faster-paced trading styles, provides more time for thoughtful analysis and decision-making, and results in fewer trades, which means less emotional strain from constant entries and exits.

- Diverse Trading Opportunities: The 1-hour chart captures a wide range of market movements, including intraday trends and reversals, key support and resistance levels, and pattern formations that may be unclear on shorter or longer timeframes.

- Effective Risk Management: The 1-hour timeframe allows for more effective risk management. It permits wider stop-losses compared to shorter timeframes, reducing the impact of market noise. Traders can also achieve better risk-reward ratios than many shorter-term strategies and have time to implement and adjust risk management tactics as market conditions evolve.

By choosing the 1-hour timeframe, traders can potentially benefit from a more balanced, flexible, and psychologically manageable approach to forex trading.

Read More: 1 minute forex trading strategy

Key Components of a Successful 1-Hour Forex Trading Strategy

To implement an effective 1-hour forex trading strategy, it’s crucial to understand and incorporate several key components. These elements work together to create a robust framework for analysis, decision-making, and execution:

- Technical Analysis Tools: While the focus is on price action, certain technical indicators can enhance analysis on the 1-hour timeframe. Moving averages, the Relative Strength Index (RSI), Bollinger Bands, and the Moving Average Convergence Divergence (MACD) can provide valuable insights when used judiciously.

- Price Action Analysis: Developing skills in reading price action on 1-hour charts is crucial. This includes recognizing candlestick patterns, chart formations, and understanding the significance of support and resistance levels.

- Trend Identification: Mastering techniques for identifying and trading with the trend on the 1-hour timeframe is essential. This involves recognizing higher highs and higher lows for uptrends, and lower lows and lower highs for downtrends.

- Entry and Exit Strategies: Developing clear rules for entering and exiting trades based on your 1-hour analysis is vital. This includes defining specific entry triggers, setting predetermined take-profit levels, and implementing trailing stops to protect profits.

- Risk Management: Incorporating robust risk management practices is non-negotiable. This includes limiting risk to 1-2% of your account balance per trade, using appropriate position sizing, and always setting stop-loss orders.

- Market Session Awareness: Understanding how different forex market sessions impact your chosen currency pairs is crucial. Focus on pairs most active during your trading hours and be aware of increased volatility during session overlaps.

- Fundamental Analysis Integration: While primarily technical, your 1-hour strategy should consider fundamental factors. Stay informed about major economic events and news releases, and be prepared to adjust your trading plan during high-impact news periods.

- Psychological Preparedness: Developing the right mindset for 1-hour trading is essential. This includes practicing patience and discipline in waiting for ideal setups, managing emotions to avoid impulsive trading decisions, and maintaining a trading journal to track and improve performance.

Mastering Price Action in 1-Hour Forex Trading

Price action trading is particularly effective on the 1-hour timeframe, offering clear signals without the noise of shorter intervals. Here’s a deep dive into mastering price action for your 1-hour forex trading strategy:

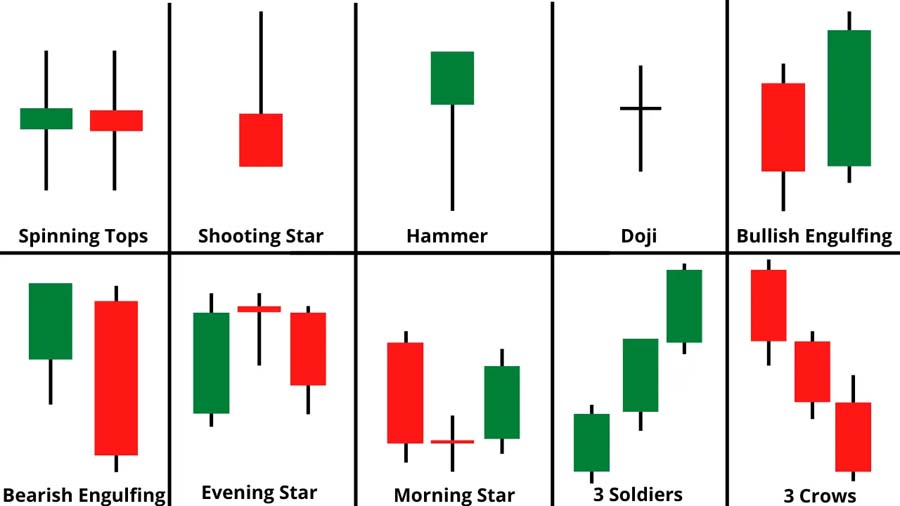

Understanding Candlestick Patterns

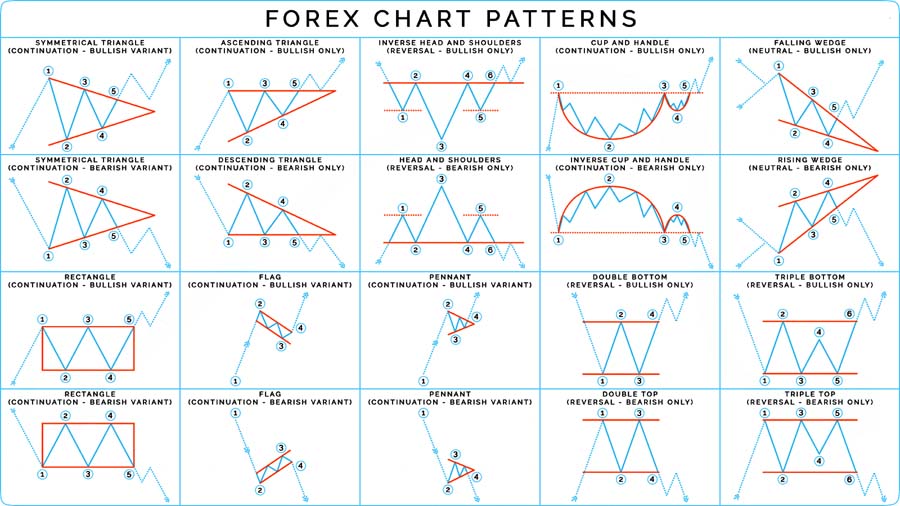

Candlestick patterns provide valuable insights into market psychology and potential price movements. On the 1-hour chart, focus on recognizing and interpreting key patterns such as dojis, hammers, shooting stars, engulfing patterns, and morning/evening stars. Each pattern tells a story about the battle between buyers and sellers, offering clues about potential trend continuations or reversals.

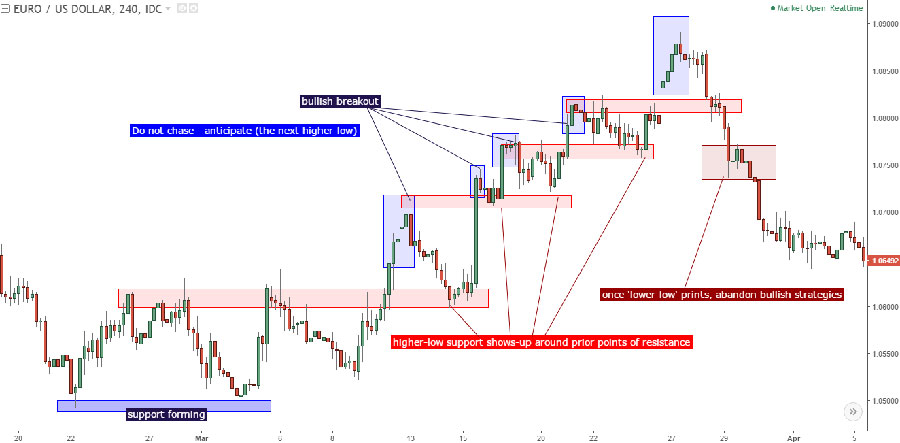

Trend Analysis Using Price Action

Identifying trends without relying heavily on indicators is a crucial skill in price action trading. On the 1-hour chart, look for a series of higher highs and higher lows to confirm an uptrend, or lower lows and lower highs for a downtrend. Pay attention to the strength and consistency of these moves, as well as any signs of weakening momentum that could signal a potential reversal.

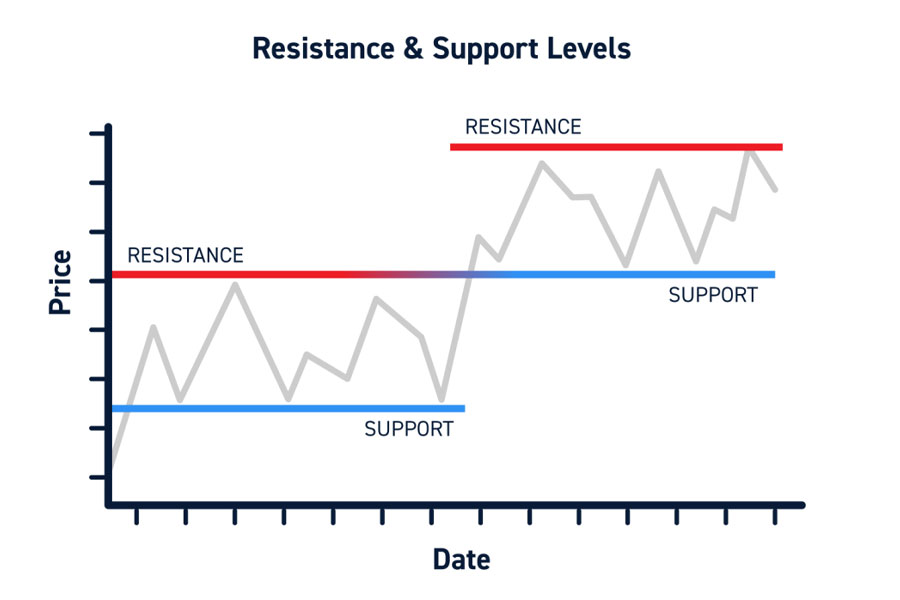

Support and Resistance Dynamics

Price action traders pay close attention to key levels where price has previously reversed. On your 1-hour chart, mark significant swing highs and lows, and watch for price reactions at these levels. Remember that support and resistance are not exact prices but zones, and the more times a level is tested, the more significant it becomes. Also, be aware of the principle of role reversal, where broken support can become resistance and vice versa.

Chart Patterns in Price Action Trading

Recognizing and trading common chart patterns is a vital aspect of price action trading on the 1-hour timeframe. Familiarize yourself with patterns such as head and shoulders, double tops and bottoms, triangles, flags, and pennants. Each pattern has its own implications for potential price movements and can offer valuable entry and exit points when traded correctly.

Breakout Trading with Price Action

Breakouts can lead to significant moves on the 1-hour chart. Learn to identify key levels or chart patterns that, when broken, could signal the start of a new trend. Look for increased volume (if available) to confirm the strength of the breakout, and be wary of false breaks, which are common in forex markets.

False Break Strategy

False breaks often lead to sharp reversals and can be highly profitable if traded correctly. On the 1-hour chart, watch for brief breaks of key levels followed by quick rejections. These scenarios can offer excellent risk-reward opportunities if you enter in the direction of the reversal.

Multiple Time Frame Confluence

While focusing on the 1-hour chart, don’t ignore the bigger picture. Use higher timeframes (like 4-hour or daily) to identify the overall trend, and lower timeframes (like 15-minute) to fine-tune entries. When signals align across multiple timeframes, the probability of a successful trade increases significantly.

Read More: 5-Minute Trading Strategy

Volume-Price Relationship

Although forex is decentralized, many platforms offer volume indicators that can enhance price action analysis. On the 1-hour chart, look for volume spikes at key levels, use volume to confirm breakouts, and be cautious of price moves on low volume, as they may lack conviction.

Divergence in Price Action Trading

While divergence is often associated with indicators, it can also be observed in pure price action. Compare highs and lows on price to the momentum of market moves. If price makes a higher high but with less momentum (smaller candles, longer wicks), it could signal a potential reversal.

The Power of Round Numbers

Price often reacts to psychologically significant levels, particularly round numbers. On your 1-hour chart, pay attention to price behavior around these levels (e.g., 1.3000, 1.3500), as they often act as support or resistance. Combining round number analysis with other price action signals can provide high-probability trading opportunities.

By mastering these price action techniques and integrating them into your 1-hour forex trading strategy, you can develop a robust, indicator-light approach to the markets. Remember, consistent practice and continuous learning are key to success in price action trading.

Common Pitfalls to Avoid in 1-Hour Forex Trading

Even with a solid strategy, traders can fall into common traps. Here are key pitfalls to avoid in 1-hour forex trading:

- Overtrading: Don’t feel compelled to trade every hour. Wait for high-probability setups.

- Ignoring the Bigger Picture: Always consider the larger trend on higher timeframes.

- Neglecting Risk Management: Stick to your predetermined risk per trade, typically 1-2% of your account.

- Chasing the Market: Avoid entering late into a move. Wait for a proper setup.

- Emotional Trading: Don’t let fear or greed drive your decisions. Stick to your strategy.

- Failing to Adapt: Markets change. Be prepared to adjust your strategy as conditions evolve.

- Overcomplicating Analysis: Keep your approach simple and focused on price action.

- Neglecting Economic Calendar: Be aware of major news events that can impact your trades.

- Inconsistent Trade Management: Have clear rules for managing open positions and stick to them.

- Lack of Patience: The 1-hour timeframe requires patience. Don’t force trades out of boredom.

OpoFinance Services

OpoFinance offers a comprehensive suite of tools and services tailored for 1-hour forex traders. Their advanced charting platform includes customizable 1-hour charts with a wide range of technical indicators and drawing tools. OpoFinance provides competitive spreads on major currency pairs, making it ideal for short-term strategies.

Their risk management features allow traders to set precise stop-losses and take-profit levels, crucial for 1-hour trading. OpoFinance also offers educational resources, including webinars and tutorials focused on intraday trading strategies.

With 24/5 customer support and a user-friendly mobile app, OpoFinance ensures that traders can execute their 1-hour strategies efficiently, whether at home or on the go. Their demo account option allows traders to practice and refine their 1-hour strategies risk-free before transitioning to live trading.

Conclusion

The 1-hour forex trading strategy offers a balanced approach between short-term opportunism and longer-term trend following. By focusing on price action, utilizing key technical tools, and maintaining strict risk management, traders can potentially capitalize on intraday market movements while avoiding the stress of ultra-short-term trading.

Remember, success in 1-hour forex trading comes from consistent practice, continuous learning, and disciplined execution. Start by mastering one or two strategies, backtest thoroughly, and always prioritize capital preservation. With patience and dedication, the 1-hour timeframe can become a powerful tool in your forex trading arsenal.

As you embark on your 1-hour forex trading journey, stay informed, remain adaptable, and never stop refining your approach. The forex market is dynamic, but with the right strategy and mindset, you can navigate its complexities and work towards your trading goals.

How many trades should I aim for in a day using the 1-hour strategy?

While it varies, most successful traders using this strategy aim for 2-4 quality trades per day. Focus on the best setups rather than a fixed number.

Can I use the 1-hour strategy with all currency pairs?

While it can be applied to many pairs, it’s most effective with major pairs that have tighter spreads and higher liquidity. Start with pairs like EUR/USD, GBP/USD, and USD/JPY.

How does the 1-hour strategy compare to scalping?

The 1-hour strategy typically involves fewer trades, lower stress, and potentially higher profit per trade compared to scalping. It’s often more suitable for traders with other commitments.