In the dynamic world of forex trading, staying ahead of economic indicators is crucial for success. One such indicator that savvy traders, often guided by a trusted broker for forex, keep a close eye on is the Producer Price Index (PPI). But how exactly do you trade PPI news in forex? This comprehensive guide will walk you through the intricacies of PPI trading, providing you with actionable strategies to capitalize on these market-moving events..

Trading PPI news in forex involves analyzing the economic data release, understanding its impact on currency pairs, and executing well-timed trades based on market reactions. By mastering PPI news trading, you can potentially profit from the volatility that often follows these important economic announcements. Let’s dive into the essential strategies and techniques that will help you navigate the forex market during PPI releases with confidence.

Read More: how to trade nfp news in forex

Understanding PPI and Its Impact on Forex Markets

Before we delve into trading strategies, it’s crucial to understand what PPI is and why it matters to forex traders.

What is PPI?

The Producer Price Index (PPI) is a key economic indicator that measures the average change in selling prices received by domestic producers for their output. It’s essentially a measure of inflation at the wholesale level. The PPI tracks price changes in three areas:

- Crude goods (raw materials)

- Intermediate goods (components used in production)

- Finished goods (final products)

Why PPI Matters in Forex

PPI data is significant because:

- It’s an early indicator of consumer inflation trends

- It can influence central bank monetary policy decisions

- It affects currency valuations and exchange rates

When PPI data is released, it can cause immediate and sometimes significant movements in currency pairs, creating opportunities for traders.

The Relationship Between PPI and CPI

While PPI measures inflation at the producer level, the Consumer Price Index (CPI) measures inflation at the consumer level. PPI often serves as a leading indicator for CPI, as increases in production costs are often passed on to consumers. Forex traders watch both indicators closely, but PPI can provide earlier signals of inflationary pressures.

Read More: how to trade cpi news in forex

7 Proven Strategies for Trading PPI News in Forex

Now that we understand the importance of PPI, let’s explore seven effective strategies for trading this news event.

1. Pre-Release Analysis

Before the PPI data is released, conduct thorough research:

- Review economic calendars to confirm the release date and time

- Analyze previous PPI data and market reactions

- Study forecasts and market expectations

- Examine related economic indicators for context

This preparation will help you anticipate potential market movements and plan your trades accordingly.

Example of Pre-Release Analysis:

Let’s say the upcoming U.S. PPI release is forecasted at 0.3% month-over-month growth. You’d want to:

- Check the previous month’s figure (e.g., 0.2%)

- Look at recent trends in commodity prices

- Consider other inflationary indicators like CPI

- Assess the current monetary policy stance of the Federal Reserve

This comprehensive analysis will give you a solid foundation for interpreting the PPI release.

2. Straddle Strategy

The straddle strategy involves placing two pending orders:

- A buy stop order above the current market price

- A sell stop order below the current market price

This strategy allows you to capitalize on the market’s direction once it becomes clear after the PPI release.

Implementing the Straddle Strategy:

- Determine a reasonable range for market movement (e.g., 30 pips on either side of the current price)

- Place a buy stop order 30 pips above the current price

- Place a sell stop order 30 pips below the current price

- Set stop-loss and take-profit levels for both orders

- Cancel the non-triggered order once the market moves decisively in one direction

3. News Spike Trading

This aggressive strategy involves:

- Waiting for the initial market spike following the PPI release

- Entering a trade in the direction of the spike

- Setting a tight stop-loss to manage risk

News spike trading requires quick decision-making and precise execution.

Tips for Successful News Spike Trading:

- Use a fast execution platform to minimize slippage

- Practice with a demo account to improve your reaction time

- Be prepared for potential reversals and have an exit strategy ready

4. Fade the Move

Sometimes, the initial market reaction to PPI news is exaggerated. The fade strategy involves:

- Waiting for the initial market move

- Entering a trade in the opposite direction, anticipating a reversal

This strategy requires patience and a good understanding of market psychology.

When to Consider Fading the Move:

- The initial move seems disproportionate to the actual PPI data

- Technical indicators suggest the currency pair is overbought or oversold

- Other economic factors contradict the direction of the initial move

5. Breakout Trading

PPI releases can sometimes lead to breakouts from established trading ranges. To implement this strategy:

- Identify key support and resistance levels before the release

- Place pending orders above and below these levels

- Enter the trade if the price breaks through either level post-release

Enhancing Your Breakout Strategy:

- Use multiple timeframes to confirm the breakout

- Look for increased volume to validate the strength of the move

- Consider using trailing stops to protect profits if the breakout continues

6. Currency Correlation Trading

Different currencies often react differently to PPI data. To use this strategy:

- Study how various currency pairs typically respond to PPI news

- Identify correlations between pairs

- Trade correlated pairs to potentially amplify profits or hedge risks

Example of Correlation Trading:

If you expect a strong U.S. PPI figure, you might:

- Go long on USD/JPY (positive correlation with USD strength)

- Simultaneously go short on EUR/USD (negative correlation with USD strength)

This approach can potentially increase your overall profit or provide a hedge if one trade moves against you.

7. Long-Term Trend Trading

For traders with a longer time horizon:

- Analyze how PPI data fits into the broader economic picture

- Use PPI releases to confirm or challenge existing long-term trends

- Adjust your position sizes or enter new trades based on this analysis

Incorporating PPI in Long-Term Trading:

- Use PPI data as part of a broader fundamental analysis

- Look for consistent trends in PPI over several months

- Consider how PPI trends might influence central bank policies in the long run

Read More: how to trade FOMC news in forex

Essential Tools for PPI News Trading

To effectively trade PPI news in forex, you’ll need the right tools:

- Economic Calendar: Keep track of upcoming PPI releases and other important economic events. Popular options include ForexFactory and Investing.com.

- News Feed: Access real-time economic news and analysis. Bloomberg Terminal and Reuters are industry standards, but many brokers offer news feeds as part of their platforms.

- Charting Software: Analyze price movements and identify key levels. MetaTrader 4/5 and TradingView are widely used options.

- Risk Management Tools: Use stop-loss and take-profit orders to manage your exposure. Most trading platforms offer these features built-in.

- Fast Execution Platform: Ensure your trades are executed quickly during volatile market conditions. Look for platforms with low latency and reliable connections.

- Economic Indicator Analysis Tools: Some platforms offer tools to analyze historical PPI data and its impact on currency pairs.

- Correlation Matrix: To implement the currency correlation strategy, use a tool that shows real-time correlations between different pairs.

Risk Management in PPI News Trading

Trading PPI news can be highly profitable, but it also comes with significant risks. Here are some risk management tips:

- Set appropriate position sizes based on your risk tolerance

- Use stop-loss orders to limit potential losses

- Consider using guaranteed stop-loss orders during highly volatile periods

- Never risk more than 1-2% of your trading capital on a single trade

- Be prepared for slippage during fast-moving markets

- Use trailing stops to protect profits in trending markets

- Diversify your trades across different currency pairs to spread risk

- Always have an exit strategy before entering a trade

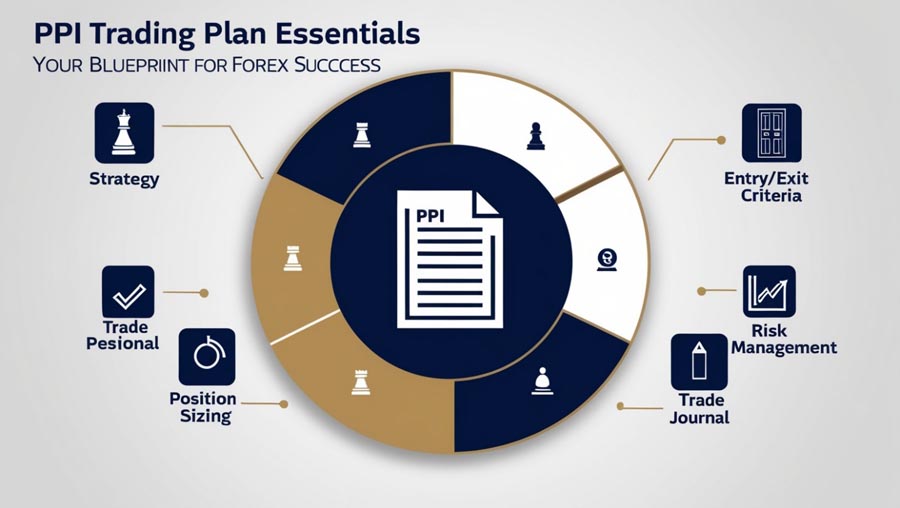

Developing Your PPI Trading Plan

A well-structured trading plan is essential for consistent success. Your PPI trading plan should include:

- Your chosen trading strategy (or strategies)

- Entry and exit criteria

- Risk management rules

- Position sizing guidelines

- A journal to track and analyze your trades

Remember, successful PPI news trading requires discipline and adherence to your plan.

Sample PPI Trading Plan:

- Strategy: News Spike Trading

- Entry Criteria:

- Enter long if PPI is significantly above forecast and price spikes upward

- Enter short if PPI is significantly below forecast and price spikes downward

- Exit Criteria:

- Take profit at 2:1 reward-to-risk ratio

- Use trailing stop after 1:1 reward-to-risk is achieved

- Risk Management:

- Risk no more than 1% of account balance per trade

- Use stop-loss at 30 pips from entry

- Position Sizing:

- Calculate position size based on account balance and stop-loss distance

- Trade Journal:

- Record entry/exit prices, reasons for trade, and lessons learned

Backtesting and Forward Testing Your PPI Strategy

Before risking real capital, it’s crucial to test your PPI trading strategy:

- Backtesting: Analyze historical PPI releases and how they affected currency pairs. This can help you identify patterns and refine your strategy.

- Forward Testing: Use a demo account to practice your strategy in real-time market conditions without risking real money.

- Review and Adjust: Regularly review your test results and make necessary adjustments to your strategy.

The Psychology of News Trading

Trading PPI news can be emotionally challenging due to the rapid market movements. To succeed:

- Stay calm and stick to your plan

- Avoid impulsive decisions based on fear or greed

- Accept that not every trade will be profitable

- Learn from both winning and losing trades

- Develop mental resilience to handle the stress of fast-paced trading

Conclusion

Trading PPI news in forex can be a lucrative strategy for those who understand the market dynamics and implement effective trading techniques. By mastering the seven strategies outlined in this guide, developing a solid trading plan, and employing robust risk management, you can potentially capitalize on the volatility that PPI releases bring to the forex market.

Remember, successful PPI news trading requires continuous learning and adaptation. Stay informed about economic trends, practice your strategies in a demo account, and always be prepared for the unexpected. With dedication and discipline, you can turn PPI releases into profitable trading opportunities in the forex market.

Whether you’re a novice trader looking to understand the impact of economic indicators or an experienced forex professional seeking to refine your news trading strategies, mastering PPI trading can significantly enhance your forex trading toolkit. Start implementing these strategies today, and take your forex trading to the next level!

By staying informed, prepared, and disciplined, you can navigate the challenges of PPI news trading and potentially reap significant rewards in the forex market. Remember that consistency and continuous improvement are key to long-term success in forex trading. Good luck, and may your PPI trades be profitable!

How soon after the PPI release should I enter a trade?

The timing of your entry depends on your chosen strategy. For news spike trading, you might enter within seconds of the release. For fade strategies or breakout trades, you might wait several minutes to allow the initial volatility to settle. Always wait for a clear signal based on your strategy before entering a trade.

Can I use technical analysis when trading PPI news?

Yes, technical analysis can be valuable when trading PPI news. Key support and resistance levels, trend lines, and chart patterns can help you identify potential entry and exit points. However, be aware that fundamental factors often override technical indicators during major news releases.

Is it better to trade major or minor currency pairs during PPI releases?

Both major and minor pairs can offer opportunities during PPI releases. Major pairs like EUR/USD or USD/JPY typically see the most liquidity and tightest spreads, making them suitable for short-term strategies. Minor pairs might offer larger moves but can be more volatile and have wider spreads. Choose pairs that align with your trading style and risk tolerance.